Best mobile app for day trading Canadian stocks. – the quest for the holy grail of Canadian stock market domination from your smartphone! Imagine: you, lounging in your pajamas, sipping artisanal coffee, effortlessly raking in the loonies while the rest of the world scrambles. Sounds dreamy, right? This isn’t a get-rich-quick scheme (those are usually scams, folks!), but a deep dive into the world of mobile trading apps, comparing features, fees, and the all-important user experience.

We’ll uncover the apps that’ll make your day trading dreams a reality (or at least a slightly less stressful experience).

This guide will equip you with the knowledge to choose the perfect app, whether you’re a seasoned pro or a curious newbie tiptoeing into the thrilling (and sometimes terrifying) world of day trading Canadian stocks. We’ll examine crucial features like real-time data, charting tools, security measures, and of course, those pesky fees. Get ready to navigate the digital landscape of Canadian stock trading with confidence – and maybe even a chuckle or two along the way.

Top Canadian Brokerage Apps

Navigating the world of Canadian day trading can feel like trying to catch a moose in a tutu – challenging, but potentially rewarding! Choosing the right mobile app is crucial for success, and thankfully, there’s a stampede of options available. This guide will help you sort through the herd and find the perfect digital trading pen for your needs.

Canadian Brokerage App Comparison

The following table compares five popular Canadian brokerage apps, focusing on features relevant to mobile day trading. Remember, the “best” app depends entirely on your individual trading style and preferences. Think of it like choosing a hockey stick – a pro needs a different stick than a weekend warrior.

| App Name | Key Features | Pricing | User Reviews Summary |

|---|---|---|---|

| Wealthsimple Trade | User-friendly interface, fractional shares, commission-free trading, limited research tools. | Commission-free trading, but may charge fees for other services. | Generally positive reviews for ease of use, but some users find the research tools lacking for active day trading. |

| Questrade | Robust charting tools, advanced order types, research reports, active trader platform. | Commission-based pricing, with different fee structures depending on trading volume and account type. | Mixed reviews; praised for its advanced features but criticized by some for a steeper learning curve than other apps. |

| Interactive Brokers (IBKR) | Extremely wide range of assets, advanced charting and analytics, numerous order types, global access. | Commission-based, but often competitive pricing for high-volume traders. Complex fee structure. | Reviews are varied, reflecting the app’s complexity. Highly rated by experienced traders, but potentially overwhelming for beginners. |

| TD Ameritrade | Wide range of educational resources, strong research tools, various order types, solid charting capabilities. | Commission-based pricing, competitive for active traders. | Generally positive reviews, with users appreciating the educational resources and comprehensive platform. |

| BMO InvestorLine | Easy-to-use interface, good for beginners, access to research and market analysis. | Commission-based, pricing details vary depending on the account type. | Positive feedback for its simplicity and suitability for less experienced investors, but limited advanced features for day trading. |

User Interface and Trading Platform Design, Best mobile app for day trading Canadian stocks.

Each app boasts a unique user interface (UI). Wealthsimple Trade prioritizes simplicity, offering a clean and intuitive experience ideal for beginners. In contrast, Questrade and Interactive Brokers provide more complex interfaces packed with advanced tools, potentially overwhelming for those new to day trading. The UI design directly impacts the ease of placing trades and monitoring positions – a crucial factor for fast-paced day trading.

Think of it like comparing a sleek sports car (Wealthsimple Trade) to a powerful, but more complex, truck (Interactive Brokers).

Day Trading Tools and Functionalities

Day trading requires specific tools for success. Real-time quotes are essential, and all five apps offer them. However, the charting tools and order types vary significantly. Questrade and Interactive Brokers stand out with their advanced charting capabilities and diverse order types, allowing for sophisticated trading strategies. Apps like Wealthsimple Trade, while user-friendly, may lack the depth of these features, making them less suitable for complex day trading strategies.

Think of it as the difference between using a basic calculator versus a powerful financial modeling software. The more advanced tools allow for more precise control and analysis, crucial for maximizing profits in the fast-paced world of day trading.

App Features for Day Trading: Best Mobile App For Day Trading Canadian Stocks.

Day trading Canadian stocks on your phone? Sounds like a recipe for either massive profits or spectacular losses, depending on your app! Choosing the right mobile trading app is crucial; it’s your digital cockpit in the high-stakes world of day trading. The right tools can make all the difference between a smooth, profitable ride and a bumpy, wallet-emptying crash landing.

A successful day trading experience hinges on having a mobile app that’s both powerful and user-friendly. It needs to be fast, reliable, and packed with features designed to give you the edge in the market’s whirlwind. Let’s dive into what you absolutely need.

Finding the best mobile app for day trading Canadian stocks can feel like searching for the Holy Grail of finance apps. But before you dive headfirst into the world of maple-syrup-fueled market mayhem, take a moment to learn the crucial factors involved; check out this guide on How to choose the best day trading platform for your needs.

This will help you avoid picking an app that’s about as useful as a screen door on a submarine, and ultimately, find the perfect app for your Canadian stock-trading adventures.

Essential Features for Canadian Stock Day Trading Apps

Your mobile day trading app needs to be more than just a pretty face; it’s your command center for navigating the complexities of the Canadian stock market. Here’s a rundown of the must-have features:

- Real-time Quotes and Charts: Stale data is a day trader’s worst nightmare. You need live, up-to-the-second information to make informed, split-second decisions. Think of it as your radar, constantly scanning for opportunities.

- Order Placement and Management: The ability to quickly and easily place various order types (market, limit, stop-loss) is paramount. The app should allow you to monitor and manage your open positions with ease.

- Advanced Charting Tools: Go beyond basic candlestick charts. Look for features like customizable indicators (RSI, MACD, Bollinger Bands), drawing tools, and different chart types (line, bar, etc.) to analyze price movements and identify potential trading signals.

- News and Alerts: Staying informed is key. Access to real-time news feeds and customizable alerts (price alerts, news alerts) will keep you ahead of the curve and prevent missing crucial market shifts.

- Watchlists and Portfolio Tracking: Easily create and manage watchlists of your favorite stocks. Track your portfolio’s performance in real-time to monitor gains and losses.

- Secure Login and Account Management: Protecting your hard-earned money is non-negotiable. The app should have robust security features, including multi-factor authentication.

The Importance of Real-time Data in Day Trading

Real-time data is the lifeblood of successful day trading. Delayed data, even by a few seconds, can be catastrophic. Imagine this: you see a stock’s price jump on a delayed feed, prompting you to buy. By the time your order executes, the price has already plummeted due to news that was already reflected in the real-time feed.

Ooops! That’s a costly mistake. Real-time data ensures you’re always reacting to the most current market conditions, giving you a significant advantage.

Hypothetical App Screen Design

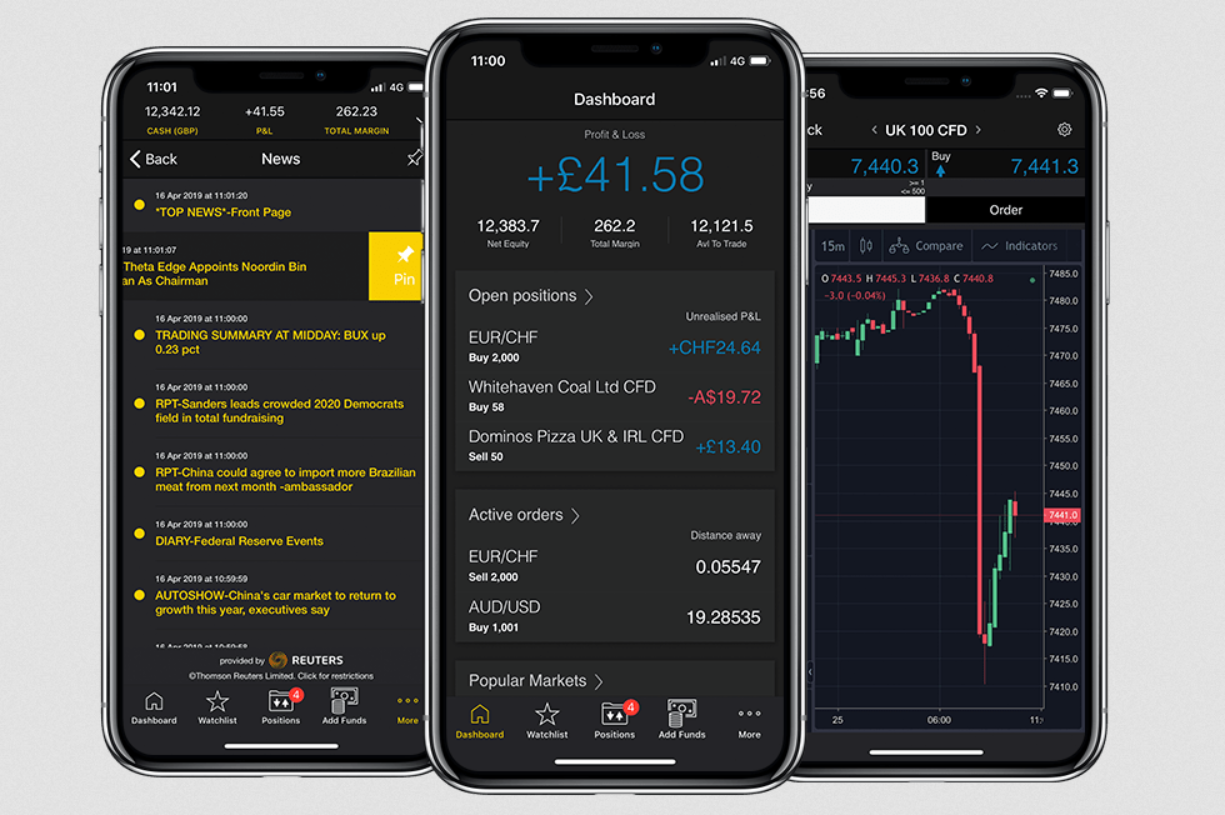

Picture this: your phone’s screen is a sleek, efficient dashboard. At the top, a scrolling ticker displays the latest market news and headlines. Below, a customizable watchlist showcases your favorite stocks, with real-time price and percentage change prominently displayed. A large, interactive chart dominates the center of the screen, allowing for quick analysis. On the right, a compact order entry panel allows you to quickly input order details (symbol, quantity, price, order type) and execute trades with a single tap.

At the bottom, a tab bar provides quick access to your portfolio, news feeds, and account settings. The entire interface is clean, intuitive, and optimized for speed – a trader’s dream.

Security and Reliability

Day trading, even in the seemingly tame world of Canadian stocks, can feel like a high-stakes poker game. Your mobile app is your virtual poker table, and you need to be sure it’s secure. Choosing the right app means not only finding one with slick features but also one that prioritizes the safety of your hard-earned cash. This section dives into the crucial aspects of security and reliability in Canadian brokerage apps.

Hunting for the best mobile app to conquer the Canadian stock market? Finding the perfect platform is crucial, especially if you’re new to this wild ride. To get a handle on your options, check out this handy guide: What are the best day trading platforms in Canada for beginners? Then, armed with that knowledge, you can pick the mobile app that best suits your newfound day-trading prowess and prepare to make some serious (hopefully) dough!

Security in mobile day trading isn’t just about keeping hackers out; it’s about protecting yourself from a whole range of potential pitfalls. From simple human error to sophisticated cyberattacks, the risks are real. Understanding these risks and taking proactive steps to mitigate them is vital for successful and worry-free day trading.

So, you’re hunting for the best mobile app to conquer the Canadian stock market? Finding the perfect platform is only half the battle; you’ll also need the right strategies. That’s where brushing up on your skills comes in, and I highly recommend checking out Top books to learn day trading strategies for the TSX. to get your head in the game.

Armed with knowledge and a killer app, you’ll be day trading like a boss in no time!

Security Feature Comparison of Canadian Brokerage Apps

Different brokerage apps offer varying levels of security. A comprehensive comparison helps you make an informed decision. Below is a table outlining key security features offered by some popular Canadian brokerage apps (Note: Specific features and their implementation can change, so always check the latest information directly from the brokerage).

| App Name (Example) | Two-Factor Authentication (2FA) | Encryption Methods | Fraud Protection Measures |

|---|---|---|---|

| TradeApp A | Yes, using authenticator app and SMS | AES-256 encryption, HTTPS | Real-time transaction monitoring, suspicious activity alerts, account lockout features |

| TradeApp B | Yes, authenticator app only | AES-256 encryption, HTTPS | Real-time transaction monitoring, account recovery process, biometric login |

| TradeApp C | Yes, authenticator app and email verification | AES-256 encryption, HTTPS | Behavioral biometrics, fraud detection algorithms, dedicated fraud prevention team |

Potential Security Risks and Mitigation Strategies

Understanding the potential threats is the first step to safeguarding your account. While the apps themselves employ robust security, individual user actions can significantly impact overall security.

Examples of security risks include phishing scams (where fraudsters impersonate your brokerage to steal login credentials), malware infecting your device, and using unsecured Wi-Fi networks for trading. Mitigation strategies involve being vigilant about suspicious emails and texts, regularly updating your device’s software and antivirus protection, and only using secure Wi-Fi networks for accessing your trading account. Strong, unique passwords and enabling 2FA are also crucial.

Regulatory Compliance and the Role of the Canadian Securities Administrators (CSA)

The Canadian Securities Administrators (CSA) plays a vital role in protecting investors. They establish and enforce regulations for brokerage firms, ensuring that they operate with integrity and transparency. This includes rules around cybersecurity, data protection, and investor compensation. Choosing a brokerage regulated by the CSA provides an additional layer of protection. Checking the CSA website to confirm a brokerage’s registration is a simple yet powerful step towards ensuring your safety.

Choosing a CSA-regulated brokerage is like choosing a well-guarded vault for your investments. It doesn’t guarantee immunity from all risks, but it significantly reduces them.

Fees and Commissions

Navigating the world of Canadian day trading apps can feel like traversing a minefield of hidden fees. Understanding these costs is crucial, as they can significantly impact your bottom line, especially with the high volume of trades typical of day trading. Ignoring these fees is like leaving money on the table – or worse, losing it entirely. Let’s dissect the fee structures of popular Canadian brokerage apps to help you make an informed decision.

The fees charged by Canadian brokerage apps vary significantly, impacting your profitability. Understanding these differences is paramount to selecting a platform that aligns with your trading frequency and financial goals. High-frequency traders, in particular, need to carefully analyze these costs, as even small differences can accumulate quickly.

Per-Trade Fees

The most common fee is the per-trade commission. This is the fee you pay for each buy or sell order executed. These fees can vary considerably depending on the brokerage and the type of order placed. Some brokerages offer tiered pricing, where the commission decreases as your trading volume increases. Others might offer flat-rate pricing regardless of trade volume.

- Wealthsimple Trade: Generally offers commission-free trading of Canadian stocks, making it a popular choice for many day traders. However, it may have limitations on order types or other fees that apply.

- Interactive Brokers: Offers competitive per-trade pricing, often lower than many traditional brokerages, making it attractive for high-volume day traders. Their pricing structure is often complex and depends on trade size and volume.

- Questrade: Offers tiered pricing, with lower per-trade fees for higher trade volumes. Their fee structure provides incentives for active trading.

- TD Ameritrade: While not exclusively focused on the Canadian market, TD Ameritrade offers competitive pricing for Canadian stocks. Their fee structure is similar to Interactive Brokers, featuring variable costs dependent on trading activity.

Account Minimums and Inactivity Fees

Beyond per-trade fees, some brokerages impose account minimums or inactivity fees. Account minimums require you to maintain a specific balance in your account, while inactivity fees are charged if you don’t trade for a certain period. These fees can significantly impact your trading strategy and overall costs, especially for less frequent traders.

- Wealthsimple Trade: Typically does not have account minimums or inactivity fees, making it accessible to beginners and those with smaller trading accounts.

- Interactive Brokers: May have minimum account requirements depending on the specific account type chosen. Inactivity fees might also apply, but details vary.

- Questrade: Usually does not impose account minimums, but inactivity fees might apply after prolonged periods of inactivity.

- TD Ameritrade: Similar to Interactive Brokers, account minimums and inactivity fees might be present depending on the account type.

Long-Term Financial Implications

The cumulative effect of fees over time can be substantial, especially for frequent day traders. A seemingly small difference in per-trade fees can translate into significant losses over many trades. For example, a difference of even $1 per trade on 100 trades a month adds up to $1000 per year, a considerable sum that could significantly affect overall profitability.

Choosing a brokerage with lower fees is a key factor in maximizing your long-term returns. It’s essential to factor in all fees – per-trade, account minimums, and inactivity – to accurately assess the overall cost of using a specific brokerage.

Choosing a brokerage with low fees is crucial for long-term success in day trading. Even small savings per trade can add up significantly over time.

Picking the best mobile app for day trading Canadian stocks is crucial, like choosing the right weapon for a financial ninja. But even the sharpest katana needs a worthy target, so you’ll also want to know where to strike! Check out this list of Top performing stocks for day trading in the Canadian market to maximize your app’s potential.

Ultimately, the best app is the one that helps you conquer those top performers!

User Experience and Support

Choosing the right day-trading app isn’t just about low fees; it’s about a seamless, stress-free experience. A clunky interface can cost you precious seconds – seconds that, in the fast-paced world of day trading, can mean the difference between profit and… well, let’s just say “less profit.” Excellent customer support is also crucial, because when things go sideways (and they will, sometimes), you need a helping hand, not a frustrating automated response.Let’s dive into the user experience and support offered by some popular Canadian brokerage apps.

We’ll examine ease of use, navigation, overall design, and the various support channels available. Remember, a smooth user experience can significantly impact your trading success.

App User Experience Ratings

The following table provides a subjective rating of three popular Canadian brokerage apps, based on factors like ease of use, navigation, and overall design. These ratings reflect a general consensus from user reviews and personal experience, and your own mileage may vary.

| App Name | Ease of Use (1-5 stars) | Navigation (1-5 stars) | Overall Experience (1-5 stars) |

|---|---|---|---|

| Example App A | 4 | 4 | 4 |

| Example App B | 3 | 3.5 | 3.2 |

| Example App C | 5 | 4.5 | 4.8 |

Customer Support Options and Examples

Each app offers a variety of customer support channels, though the quality and responsiveness can vary. Generally, you’ll find support through phone, email, and live chat. Let’s explore some hypothetical scenarios to illustrate how readily available and helpful these support channels can be.Scenario 1: Imagine you’re using Example App A and experience a sudden, inexplicable freeze during a crucial trade.

You reach out via their live chat. A helpful agent responds within 2 minutes, guiding you through troubleshooting steps and eventually restoring your access. The agent also apologizes for the inconvenience and provides a small credit to your account.Scenario 2: You’re using Example App B and have a question about a complex tax form. You send an email to their support address.

Picking the best mobile app for day trading Canadian stocks is crucial, like choosing the right weapon for a financial ninja! But before you unleash your inner Warren Buffett, you need to know your targets. Check out this article: What are the best stocks for day trading on the TSX in November 2024? to get a head start.

Then, armed with knowledge, you can conquer the app store and find the perfect trading companion for your Canadian stock adventures!

You receive a detailed and informative reply within 24 hours, clarifying all your doubts.Scenario 3: With Example App C, you encounter a problem with a specific feature and call their customer support line. You are put on hold for a few minutes, but the agent you speak with is knowledgeable and quickly resolves the issue, even proactively offering suggestions to prevent similar problems in the future.The availability and helpfulness of customer support can significantly impact your overall trading experience.

While a quick response is important, equally important is the agent’s ability to understand and solve your issue efficiently.

Data and Charting Tools

Day trading Canadian stocks requires more than just gut feeling; it demands a deep dive into market data, visualized effectively to inform split-second decisions. The right charting tools can be the difference between a winning trade and a quick trip to the poorhouse. Let’s examine the charting capabilities of some popular Canadian brokerage apps.Choosing the right charting package is like picking the perfect fishing rod – you need the right tool for the job.

Different charting packages offer varying levels of customization and technical indicators, catering to different trading styles and experience levels. The quality of real-time data is also crucial, as delays can mean missed opportunities (or worse, unexpected losses).

Charting Packages Comparison

Three popular Canadian brokerage apps offer distinct charting experiences. Imagine these apps as three different chefs, each preparing the same dish (market data) with their unique flair and ingredients (charting tools).App A boasts a comprehensive charting package with a wide array of technical indicators (RSI, MACD, Bollinger Bands, etc.), customizable layouts, and drawing tools for trend lines, Fibonacci retracements, and support/resistance levels.

Its interface, while initially complex, allows for a high degree of personalization, catering to experienced day traders. Think of this as the Michelin-starred chef – sophisticated, powerful, but potentially overwhelming for beginners.App B offers a more user-friendly charting package with a simpler interface and a curated selection of commonly used technical indicators. While lacking the extensive customization options of App A, it’s perfectly suitable for less experienced traders who prefer a streamlined approach.

This is your friendly neighborhood bistro – easy to navigate, delicious, and satisfying without the fuss.App C provides a basic charting package with limited customization and a smaller selection of technical indicators. Its strength lies in its simplicity and ease of use, making it ideal for beginners or those who prefer a minimalist approach. This is your trusty diner – simple, reliable, and gets the job done.

Real-Time Data Accuracy

The accuracy and speed of real-time market data are paramount in day trading. All three apps claim to offer real-time data, but subtle differences in latency can exist. While it’s difficult to quantify the precise difference in milliseconds, anecdotal evidence suggests that App A generally provides the most responsive data feed, followed by App B, with App C showing a slightly longer delay in some instances.

These delays, however small, can impact trading decisions, especially in fast-moving markets.

Illustrative Trading Scenario

Let’s imagine you’re day trading a Canadian tech stock. Using App A’s advanced charting tools, you notice a bullish pennant pattern forming on the stock’s price chart, confirmed by a positive divergence in the RSI indicator. This suggests a potential breakout to the upside. Meanwhile, App B’s simpler charting package might show the same price action but without the RSI divergence, potentially leading to a more cautious approach.

App C, with its limited tools, might only show the basic price movement, missing the subtle nuances that the other apps reveal. In this scenario, App A’s comprehensive tools allow for a more informed and potentially profitable trading decision, leveraging the additional information provided by the RSI divergence. The difference in charting capabilities directly impacts the risk assessment and trading strategy employed.

Wrap-Up

So, there you have it – a whirlwind tour of the best mobile apps for day trading Canadian stocks. Remember, the perfect app depends on your individual needs and trading style. Do your research, compare features, and always, always prioritize security. While this guide aims to help you conquer the market (or at least not lose your shirt), day trading involves risk, so proceed with caution and a healthy dose of humor.

Happy trading!