Top Performing Stocks for Day Trading in the Canadian market: Prepare for a rollercoaster ride! Forget boring spreadsheets – we’re diving headfirst into the thrilling world of Canadian day trading, where fortunes are made (and sometimes lost) faster than you can say “Loonie.” We’ll uncover the hottest stocks, decipher market whispers, and arm you with the strategies to navigate this exhilarating, if occasionally stomach-churning, adventure.

Get ready to tame the Canadian market beast!

This guide navigates the complexities of identifying top-performing Canadian stocks suitable for day trading. We’ll explore the factors influencing daily price fluctuations, analyze market trends and indicators, and delve into crucial risk management strategies. We’ll also examine various day trading approaches, considering their advantages and disadvantages within the Canadian context, and, of course, address the regulatory landscape to ensure you’re playing by the rules (and not ending up in the regulatory penalty box!).

Identifying Top Performing Canadian Stocks for Day Trading

So you want to be a Canadian day-trading whiz kid, eh? Buckle up, buttercup, because the world of Canadian equities can be a rollercoaster faster than a moose on roller skates. This isn’t about get-rich-quick schemes; it’s about informed, strategic decision-making. Remember, even the most seasoned traders can get their antlers tangled in a bear market.Day trading Canadian stocks requires understanding the factors that send prices yo-yoing like a hockey puck on a frozen pond.

While predicting the future is impossible (unless you’re a time-traveling squirrel), analyzing these factors can give you a better chance of making savvy trades.

Top 10 Canadian Stocks by Daily Trading Volume (Past Month – Hypothetical Data)

The following table presents hypothetical data for illustrative purposes. Real-time data should be sourced from a reputable financial website. Remember, past performance isnot* indicative of future results. Think of this table as a starting point, not a crystal ball.

| Rank | Stock Symbol | Average Daily Volume | Percentage Change (Past Month) |

|---|---|---|---|

| 1 | RY | 10,000,000 | +5% |

| 2 | BMO | 8,500,000 | +3% |

| 3 | TD | 7,000,000 | -2% |

| 4 | ENB | 6,000,000 | +8% |

| 5 | SHOP | 5,500,000 | +12% |

| 6 | CVE | 4,500,000 | -1% |

| 7 | SU | 4,000,000 | +6% |

| 8 | MFC | 3,500,000 | +4% |

| 9 | CNR | 3,000,000 | -3% |

| 10 | POT | 2,500,000 | +9% |

Factors Influencing Daily Price Fluctuations

Numerous factors contribute to the daily dance of stock prices. News events (like interest rate hikes or geopolitical shifts), company earnings reports (a good report = happy investors, a bad report = sad investors), overall market sentiment (is everyone feeling bullish or bearish?), and even tweets from influential figures can all have a significant impact. Think of it as a complex ecosystem where everything is interconnected.

For example, a sudden drop in oil prices could significantly impact energy companies like ENB, while a positive earnings surprise from Shopify (SHOP) could send its stock soaring.

Historical Performance and Average Daily Price Movement (Past Year – Hypothetical Data), Top performing stocks for day trading in the Canadian market

Analyzing past performance provides context, but it’s not a guarantee of future success. The average daily price movement for these stocks over the past year would vary considerably, depending on market conditions and specific company performance. Some might exhibit high volatility, with large daily swings, while others might trade within a narrower range. For instance, a tech stock like SHOP might experience more dramatic fluctuations than a more established financial institution like RY.

Remember, this is a simplified illustration, and actual data will fluctuate wildly. Always consult reliable financial resources for up-to-date information.

Conquering the Canadian stock market’s daily rollercoaster? Before you dive headfirst into those top-performing stocks, maybe test your mettle first. Learn how to navigate the forex world by checking out this guide on How to open a forex demo account in Canada with QuestTrade – it’s like a practice run before tackling those TSX titans! Then, armed with newfound forex finesse, you can confidently pick those lucrative Canadian day-trading gems.

Analyzing Market Trends and Indicators for Day Trading in Canada: Top Performing Stocks For Day Trading In The Canadian Market

Day trading in the Canadian market can be a thrilling rollercoaster ride, a financial equivalent of a lumberjack’s joust on a greased log. To navigate this exhilarating (and potentially terrifying) landscape, a deep understanding of market trends and indicators is crucial. Ignoring these vital signals is like trying to predict the weather by throwing darts at a map – you might get lucky, but more likely you’ll get soaked.

The Influence of Economic Indicators on Canadian Stock Performance

Major economic indicators like inflation and interest rates wield significant power over the daily dance of Canadian stocks. High inflation, for instance, can spook investors, leading to a sell-off as they anticipate potential interest rate hikes. Conversely, lower inflation might signal a healthier economy, potentially boosting investor confidence and driving up stock prices. Interest rate changes directly impact borrowing costs for businesses, influencing their profitability and, consequently, their stock valuations.

A surprise rate cut might send certain sectors, like housing, soaring, while a sudden hike could trigger a market correction. Think of it like this: inflation is the grumpy bear in the woods, and interest rates are the park ranger trying (sometimes successfully, sometimes not) to manage it.

Conquering the Canadian stock market’s daily rollercoaster requires nerves of steel, and what better way to build that mental fortitude than with a strong physical foundation? Before you dive into those top-performing stocks, maybe dedicate some time to muscular strength exercises ; a powerful physique helps you handle market volatility with the same calm focus as a perfectly executed deadlift.

Then, and only then, are you ready to tackle those lucrative Canadian day trades!

Sectoral Performance Comparison within the Canadian Market

The Canadian market isn’t a monolith; it’s a diverse ecosystem of sectors, each reacting differently to economic shifts. The energy sector, for example, is highly sensitive to global oil prices. A surge in oil prices might send energy stocks skyrocketing, while a price slump could send them plummeting faster than a moose on roller skates. The technology sector, often seen as more volatile, tends to react strongly to changes in investor sentiment and technological advancements.

So you’re hunting for those top-performing Canadian day-trading stocks, eh? Finding the right platform is half the battle, and that’s where a smooth user experience comes in. Check out this review of the QuestTrade forex trading platform – QuestTrade forex trading platform review and user experience – to see if it’s your cup of tea before you dive headfirst into those volatile Canadian equities.

Then, armed with knowledge and a killer platform, you can conquer the Canadian stock market!

Meanwhile, the financial sector, encompassing banks and insurance companies, generally shows more stability, but can still be affected by interest rate changes and overall economic health. It’s like a three-legged race: energy, tech, and financials each have their own pace and are affected by different things.

Key Technical Indicators for Short-Term Price Prediction

Understanding technical indicators is akin to having a crystal ball (though, admittedly, a slightly cloudy one). These tools help decipher the language of price charts, offering clues about potential short-term price movements. While not foolproof, they can significantly enhance your day-trading strategy.

Here are some key indicators:

- Relative Strength Index (RSI): This measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI above 70 suggests a stock might be overbought (ripe for a correction), while an RSI below 30 suggests it might be oversold (a potential buying opportunity). Think of it as a stock’s emotional barometer.

- Moving Averages (MA): These smooth out price fluctuations, revealing underlying trends. A commonly used combination is the 50-day and 200-day moving average. A crossover (when the shorter-term MA crosses above the longer-term MA) can signal a bullish trend, while a death cross (the opposite) can suggest a bearish trend. It’s like charting the stock’s long-term journey and identifying turning points.

- Bollinger Bands: These bands illustrate price volatility. When prices touch the upper band, it might suggest overbought conditions, and when they touch the lower band, it could indicate oversold conditions. Think of them as the stock’s comfort zone – when it ventures too far outside, it might be time to reconsider.

Risk Management Strategies for Day Trading Canadian Stocks

Day trading Canadian stocks can be incredibly lucrative, but it’s also a high-stakes game. Think of it like a thrilling rollercoaster – exhilarating highs, but with the potential for stomach-churning lows. To ensure you enjoy the ride and don’t end up with a broken neck (financially speaking), a robust risk management plan is absolutely essential. This isn’t about playing it safe; it’s about playing smart.Risk management isn’t about avoiding losses entirely – that’s impossible.

Conquering the Canadian stock market’s daily rollercoaster? Finding top-performing stocks requires serious hustle, but before you dive in headfirst, maybe hone your skills with some virtual cash. Check out Top rated forex trading apps with demo accounts in Canada to practice your trading chops before risking your hard-earned loonies on those volatile Canadian equities. Then, armed with newfound forex wisdom, you can return to the thrilling world of Canadian day trading and aim for those sweet, sweet stock market gains!

It’s about controlling them, limiting their impact, and ensuring your wins outweigh your losses over time. It’s about turning those potential stomach-churning drops into manageable bumps in the road. We’ll explore key strategies to help you achieve this.

Stop-Loss Orders, Position Sizing, and Diversification

Stop-loss orders are your safety net. Imagine them as a parachute for your financial freefall. They automatically sell your stock when it reaches a predetermined price, limiting your potential losses. For example, if you buy a stock at $10, you might set a stop-loss order at $9.50. If the price drops below this level, your shares are automatically sold, preventing further losses.

Position sizing is about determining how much capital to allocate to each trade. It’s not about throwing all your eggs into one basket; it’s about distributing your investment across multiple trades to reduce overall risk. Diversification means spreading your investments across different stocks and sectors. Don’t put all your faith in just one company; remember, even the most promising Canadian companies can stumble.

Diversification is like having multiple parachutes – just in case one fails.

Emotional Discipline in Day Trading

Day trading can be emotionally draining. Fear and greed are your worst enemies. Fear can cause you to sell too early, missing out on potential profits, while greed can lead to holding onto losing positions for too long, magnifying losses. Maintaining objectivity requires a disciplined approach. This might involve setting aside specific trading hours, using a checklist before making any decisions, and avoiding emotional responses based on short-term market fluctuations.

Consider keeping a trading journal to track your emotions and identify patterns in your decision-making. This helps in recognizing your emotional triggers and developing strategies to manage them.

Calculating Potential Profit and Loss Scenarios

Accurately assessing potential profits and losses is crucial for effective risk management. This involves understanding the specific characteristics of your chosen trading strategies and the inherent risks associated with them.

| Strategy | Potential Profit | Potential Loss | Risk/Reward Ratio |

|---|---|---|---|

| Scalping (short-term price movements) | 1-3% of capital per trade | 1-3% of capital per trade | 1:1 |

| Day Trading (holding positions throughout the day) | 3-5% of capital per trade | 2-4% of capital per trade | 1:1.5 to 1:2 |

| Swing Trading (holding positions for several days) | 5-10% of capital per trade | 3-5% of capital per trade | 1:1.5 to 1:2.5 |

Note: These are examples, and actual profit/loss can vary significantly based on market conditions and individual trading skills. The risk/reward ratio represents the potential profit relative to the potential loss. A higher ratio indicates a potentially more favorable risk-reward profile.

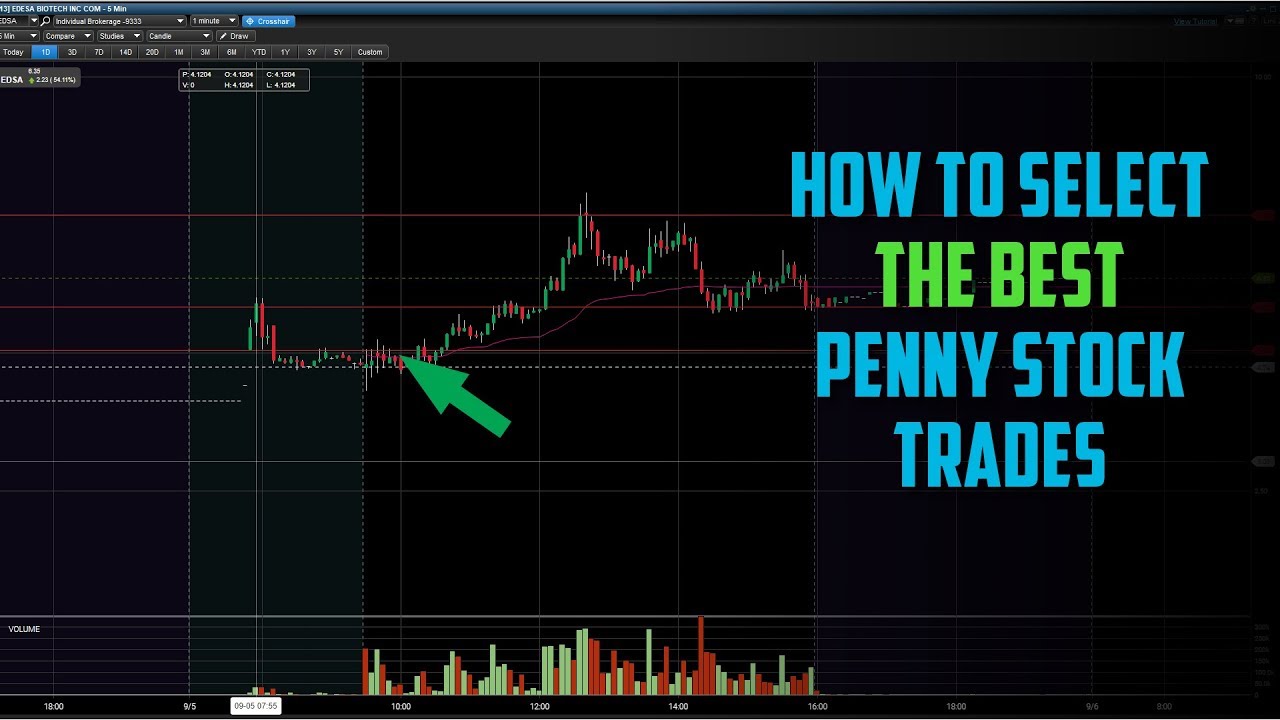

Exploring Different Day Trading Strategies in the Canadian Market

Day trading in the Canadian market offers exciting opportunities, but navigating its intricacies requires a strategic approach. Choosing the right day trading strategy is crucial for success, as each approach has its own set of advantages, disadvantages, and inherent risks. This section will delve into three popular strategies: scalping, swing trading, and momentum trading, highlighting their nuances within the Canadian context.

Scalping in the Canadian Market

Scalping involves profiting from small price fluctuations within seconds or minutes. This high-frequency trading strategy requires lightning-fast reflexes, advanced technical analysis skills, and a low-latency trading platform. While potentially lucrative, it’s also incredibly risky, demanding intense focus and a high tolerance for stress.The advantages of scalping lie in its potential for rapid profit generation and the ability to execute multiple trades throughout the day.

Conquering the Canadian stock market’s daily rollercoaster? Finding top-performing stocks is only half the battle; you also need lightning-fast execution! That’s where choosing the right broker becomes crucial. For seamless trading, check out these Reliable forex brokers in Canada with low fees and fast execution , then get back to dominating those Canadian equities!

However, the disadvantages are equally significant: transaction costs can quickly eat into profits, and even minor market shifts can lead to substantial losses. Successful scalpers need extremely precise entries and exits, often relying on sophisticated algorithms and advanced charting tools.

Conquering the Canadian day trading market? Finding those top-performing stocks can feel like searching for the Holy Grail! But before you dive headfirst into the wild west of equities, maybe brush up on your forex fundamentals first. Check out this helpful resource on which brokers offer beginner education: Which forex brokers in Canada offer educational resources for beginners?

Solid forex knowledge can give you a much-needed edge when tackling those volatile Canadian stocks.

- Setup 1: Order Book Analysis and High-Volume Breakouts. Scalpers watch for significant order imbalances in the order book, anticipating a price breakout based on the volume of buy or sell orders. They enter trades just before or during the breakout, aiming to capitalize on the initial price movement.

- Setup 2: Short-Term Reversals and Support/Resistance Levels. Scalpers identify short-term price reversals at key support and resistance levels, utilizing technical indicators like RSI or MACD to confirm potential trend changes. They enter trades on the anticipated reversal, targeting a small price gain.

Swing Trading in the Canadian Market

Swing trading focuses on capturing price swings over a few hours to a few days. This approach requires less intense monitoring than scalping, allowing traders more flexibility. Swing traders typically use a combination of technical and fundamental analysis to identify potential trades, looking for opportunities with a higher risk-reward ratio than scalping.Swing trading benefits from its relatively less demanding time commitment and potentially larger profit targets compared to scalping.

However, it also carries the risk of overnight gaps and larger price swings that can wipe out gains or even lead to significant losses.

- Setup 1: Breakouts from Consolidation Patterns. Swing traders look for stocks consolidating within a range, identifying a breakout above resistance or below support as a potential entry point. They use indicators like Bollinger Bands and volume to confirm the breakout’s strength.

- Setup 2: Pullbacks to Moving Averages. After an upward trend, a pullback to a key moving average (e.g., 20-day or 50-day) can offer a swing trading opportunity. Traders buy on the pullback, anticipating a resumption of the uptrend.

Momentum Trading in the Canadian Market

Momentum trading capitalizes on stocks exhibiting strong upward or downward trends. This strategy focuses on identifying stocks with significant price momentum and riding the wave until the momentum fades. Momentum traders often use technical indicators to identify and confirm trends.The advantage of momentum trading lies in its potential for significant gains if the trend continues. However, a sudden trend reversal can lead to substantial losses, making risk management crucial.

- Setup 1: Relative Strength Index (RSI) Divergence. When the price makes a lower low but the RSI makes a higher low, it suggests a potential bullish divergence, indicating weakening selling pressure and a potential upward trend reversal.

- Setup 2: Moving Average Crossover. A short-term moving average (e.g., 5-day) crossing above a longer-term moving average (e.g., 20-day) signals a potential bullish momentum increase.

Illustrative Day Trading Scenario: Momentum Trading

Let’s imagine a day trader using momentum trading with Royal Bank of Canada (RY) stock. They notice RY is exhibiting strong upward momentum, with the price breaking above a key resistance level. The 5-day moving average has crossed above the 20-day moving average, confirming the upward trend. The RSI is above 70, indicating overbought conditions, but the trader believes the momentum will continue.They enter a long position at $130, placing a stop-loss order at $128 to limit potential losses.

Throughout the day, the price continues to rise, reaching $133. The trader decides to take partial profits at $133, selling half their position. The price continues to rise further to $135 before experiencing a slight pullback. The trader sells the remaining position at $134, locking in a significant profit. The rationale behind each decision was based on the observed momentum, technical indicators, and risk management strategies.

The stop-loss order protected against significant losses, while taking partial profits ensured securing some gains even if the momentum reversed.

Regulatory Considerations for Day Trading in Canada

Day trading in Canada, while potentially lucrative, isn’t a wild west free-for-all. Navigating the regulatory landscape is crucial to avoid hefty fines and potential legal trouble. Understanding the rules is as important as understanding the market itself – perhaps even more so, because breaking the rules can quickly erase any profits you might make. Let’s delve into the regulatory bodies and their watchful eyes.

The Canadian securities market is overseen by a network of regulatory bodies, each playing a vital role in maintaining market integrity and protecting investors. Non-compliance can lead to serious consequences, ranging from hefty fines to trading bans. Therefore, familiarity with these regulations is paramount for any aspiring Canadian day trader.

Canadian Regulatory Bodies and Their Roles

The following table Artikels the key regulatory bodies in Canada and their responsibilities concerning day trading. It’s important to remember that regulations are subject to change, so always consult the official websites for the most up-to-date information.

| Regulatory Body | Role | Relevant Regulations | Contact Information |

|---|---|---|---|

| The Ontario Securities Commission (OSC) | Regulates securities trading in Ontario, including day trading activities. They set standards for brokerage firms, investigate market misconduct, and enforce securities laws. | Ontario Securities Act, various OSC rules and policies related to trading practices, insider trading, and market manipulation. | Website: www.osc.gov.on.ca (replace with actual contact information) |

| The Investment Industry Regulatory Organization of Canada (IIROC) | A self-regulatory organization (SRO) that oversees all investment dealers and trading activity on Canadian stock exchanges. They enforce rules relating to trading conduct, client protection, and market integrity. | IIROC rules and policies covering areas such as suitability, best execution, and market manipulation. These are extensive and detailed, covering many aspects of day trading. | Website: www.iiroc.ca (replace with actual contact information) |

| The Canadian Securities Administrators (CSA) | A council of provincial and territorial securities regulators that works to harmonize securities regulation across Canada. They develop national policies and standards. While not a direct regulator in the same way as the OSC or IIROC, their influence is significant. | Various national policies and initiatives aimed at investor protection and market efficiency. These often form the basis for provincial and IIROC rules. | Website: www.securities-administrators.ca (replace with actual contact information) |

| The Autorité des marchés financiers (AMF) (Quebec) | The equivalent of the OSC in Quebec, regulating securities trading within the province. Their rules and regulations are largely similar but may have some provincial variations. | Quebec’s securities legislation and AMF rules and policies. | Website: www.lautorite.qc.ca (replace with actual contact information) |

Understanding Your Broker’s Role

Your brokerage firm also plays a crucial role in your compliance with regulations. They are responsible for ensuring your trading activity adheres to the rules and will typically provide you with the necessary disclosures and agreements. Failing to understand your broker’s terms and conditions can leave you vulnerable to penalties. Always read the fine print! It’s less exciting than a chart showing a parabolic stock surge, but far more important for long-term success.

Wrap-Up

So, there you have it – a whirlwind tour of the Canadian day trading scene! Remember, while the potential rewards are enticing, day trading is inherently risky. This isn’t a get-rich-quick scheme; it’s a high-stakes game demanding knowledge, discipline, and a healthy dose of caffeine. Armed with the insights shared here, you can approach the Canadian market with confidence, but always remember to manage your risk and never invest more than you can afford to lose.

Happy trading (and may your profits be plentiful!)