Reliable forex brokers in Canada with low fees and fast execution – Find Reliable Canadian Forex Brokers: Low Fees, Fast Execution – sounds like a treasure hunt, doesn’t it? Forget dusty maps and cryptic clues; this is about navigating the exciting (and sometimes bewildering) world of Canadian forex trading. We’re here to help you unearth the gems – those brokers who offer speedy execution, surprisingly low fees, and enough regulatory oversight to keep your hard-earned loonies safe.

Buckle up, because this journey promises to be both informative and entertaining. We’ll delve into the regulatory landscape, dissect fee structures with the precision of a brain surgeon, and explore the technological wizardry that makes fast execution possible. Get ready to become a forex trading aficionado!

This guide unravels the complexities of choosing a forex broker in Canada, focusing on those that excel in speed, affordability, and regulatory compliance. We’ll compare various brokers, analyze their fee structures, and examine their commitment to client security. By the end, you’ll be equipped to make an informed decision, ensuring a smooth and profitable trading experience. Prepare to ditch the high fees and embrace the thrill of fast, reliable forex trading.

Regulatory Landscape of Forex Brokers in Canada

Navigating the world of forex trading in Canada requires understanding the robust regulatory framework designed to protect investors. Unlike the Wild West of some unregulated markets, Canada’s forex scene is overseen by several key players, ensuring a (relatively) safe and fair trading environment. Let’s delve into the details, because knowing the rules is half the battle (and the other half is knowing your stop-loss orders!).

Regulatory Bodies Overseeing Forex Brokers in Canada

The primary regulatory body for forex brokers in Canada is the Investment Industry Regulatory Organization of Canada (IIROC). IIROC is a self-regulatory organization (SRO) that oversees the majority of investment dealers and trading activity in the country. Think of them as the sheriffs of the Canadian forex market, ensuring brokers play by the rules. Beyond IIROC, provincial securities commissions also play a significant role, particularly in matters concerning investor protection and the licensing of brokers operating within their respective provinces.

These provincial bodies often work in conjunction with IIROC to maintain a consistent and comprehensive regulatory landscape. It’s a collaborative effort to keep things fair and square.

Implications of Regulations for Client Protection

Canadian regulations aim to provide significant client protection. This includes requirements for brokers to maintain adequate capital reserves, preventing them from vanishing overnight with your hard-earned cash. Regulations also mandate transparent disclosure of fees, commissions, and potential risks associated with forex trading, preventing sneaky surprises in your account statements. Furthermore, client funds are often segregated from the broker’s operational funds, meaning your money is kept separate and safer in case of broker insolvency.

Think of it as a financial firewall, protecting your investments from the broker’s potential financial woes. While no system is foolproof, the Canadian regulatory framework significantly reduces the risks compared to less regulated jurisdictions.

Comparison of Regulatory Frameworks: Canada vs. Other Major Forex Markets

Compared to some other major forex markets, Canada boasts a relatively strong regulatory framework. The US, for instance, has the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA), which provide oversight, but the regulatory landscape can be more complex. The UK’s Financial Conduct Authority (FCA) is another well-regarded regulator, known for its strict rules and investor protection measures.

However, even within these established markets, variations in regulatory approaches exist. Canada’s system generally emphasizes a balance between investor protection and fostering a competitive market, striking a reasonable middle ground. The level of protection afforded to traders varies, highlighting the importance of researching the regulatory environment before choosing a broker, regardless of location.

Comparison of Canadian Forex Brokers and Their Regulatory Bodies

This table provides a snapshot of some Canadian forex brokers and their respective regulatory affiliations. Remember, regulatory oversight is crucial, but it’s not the only factor to consider when selecting a broker. Other important factors include trading platform, execution speed, and customer support.

Hunting for reliable forex brokers in Canada? You want low fees, lightning-fast execution, and maybe a celebratory dance after a successful trade. But before you leap, check out the app scene; for mobile trading convenience, consider the top contenders listed in this handy guide: Top rated forex trading apps in Canada with low spreads.

Then, armed with this knowledge, you can confidently choose the best broker to pair with your chosen app for maximum forex fun!

| Broker Name | Regulatory Body | Capital Requirements (Illustrative) | Client Fund Segregation (Typical Practice) |

|---|---|---|---|

| Example Broker A | IIROC | Significant capital reserves are required by IIROC | Yes, client funds are typically segregated |

| Example Broker B | IIROC & Provincial Securities Commission (e.g., Ontario Securities Commission) | Significant capital reserves are required by IIROC | Yes, client funds are typically segregated |

| Example Broker C | IIROC | Significant capital reserves are required by IIROC | Yes, client funds are typically segregated |

| Example Broker D | IIROC & Provincial Securities Commission (e.g., Quebec Autorité des marchés financiers) | Significant capital reserves are required by IIROC | Yes, client funds are typically segregated |

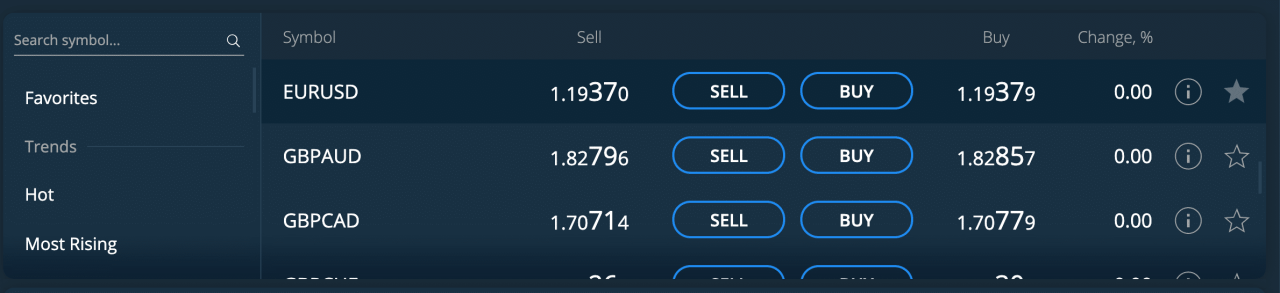

Fee Structures of Canadian Forex Brokers

Navigating the world of forex trading in Canada requires understanding the often-complex fee structures employed by brokers. These fees, if not carefully considered, can significantly impact your profitability, turning potential wins into frustrating losses faster than a greased piglet at a county fair. Let’s dissect these cost-cutting culprits and see how to avoid getting fleeced.

Canadian forex brokers typically employ a combination of fee types to generate revenue. Understanding these nuances is crucial for selecting a broker that aligns with your trading style and risk tolerance. Think of it as choosing the right tool for the job – a sledgehammer might be overkill for hanging a picture, just as a high-commission broker might not be ideal for scalping.

Spreads

Spreads represent the difference between the bid and ask price of a currency pair. Essentially, it’s the cost of executing a trade. Lower spreads generally translate to lower trading costs, a boon for active traders. However, some brokers might advertise incredibly low spreads, only to compensate by charging higher commissions or imposing other hidden fees. Always read the fine print! Think of it as the “bait” in the “bait and switch” strategy – but in this case, you’re the one trying to avoid being switched.

Commissions

Commissions are direct fees charged per trade, often expressed in pips or as a percentage of the trade value. While some brokers operate on a commission-free model, relying solely on spreads, others combine spreads and commissions. This hybrid approach can be beneficial for certain trading strategies but requires careful evaluation to determine overall cost-effectiveness. It’s like choosing between a restaurant with a cover charge and one that doesn’t – one might seem cheaper upfront, but the final bill could surprise you.

Overnight Fees (Swap Fees)

Overnight fees, also known as swap fees, are charged for holding positions open overnight. These fees reflect the interest rate differential between the two currencies in a pair. For instance, if you hold a long position in a high-interest-rate currency against a low-interest-rate currency, you might receive a positive swap (credit), while the opposite scenario results in a negative swap (debit).

These fees can add up, especially for long-term positions, so it’s crucial to factor them into your trading plan. Imagine it as an extra “rent” you pay for keeping your position in the market overnight.

Impact of Fees on Trading Profitability

The cumulative effect of spreads, commissions, and overnight fees directly impacts your bottom line. A seemingly small spread difference across brokers can accumulate to substantial cost savings or losses over numerous trades. Similarly, even small commissions can erode profits, especially for high-frequency or scalping traders. A simple example: if you execute 100 trades a day with a 1-pip difference in spread, and each trade is 1 standard lot (100,000 units), that difference can easily amount to hundreds or even thousands of dollars per month.

It’s the little leaks that sink the ship.

Comparison of Fee Structures

The following table compares the fee structures of four hypothetical Canadian forex brokers. Note that actual fees can vary and are subject to change.

| Broker | Spread (USD/CAD) | Commission (per lot) | Overnight Fee (USD/CAD, per lot) |

|---|---|---|---|

| Broker A | 1.2 pips | $5 | $2 |

| Broker B | 1.5 pips | $0 | $1 |

| Broker C | 0.8 pips | $8 | $3 |

| Broker D | 1.0 pips | $2 | $0 |

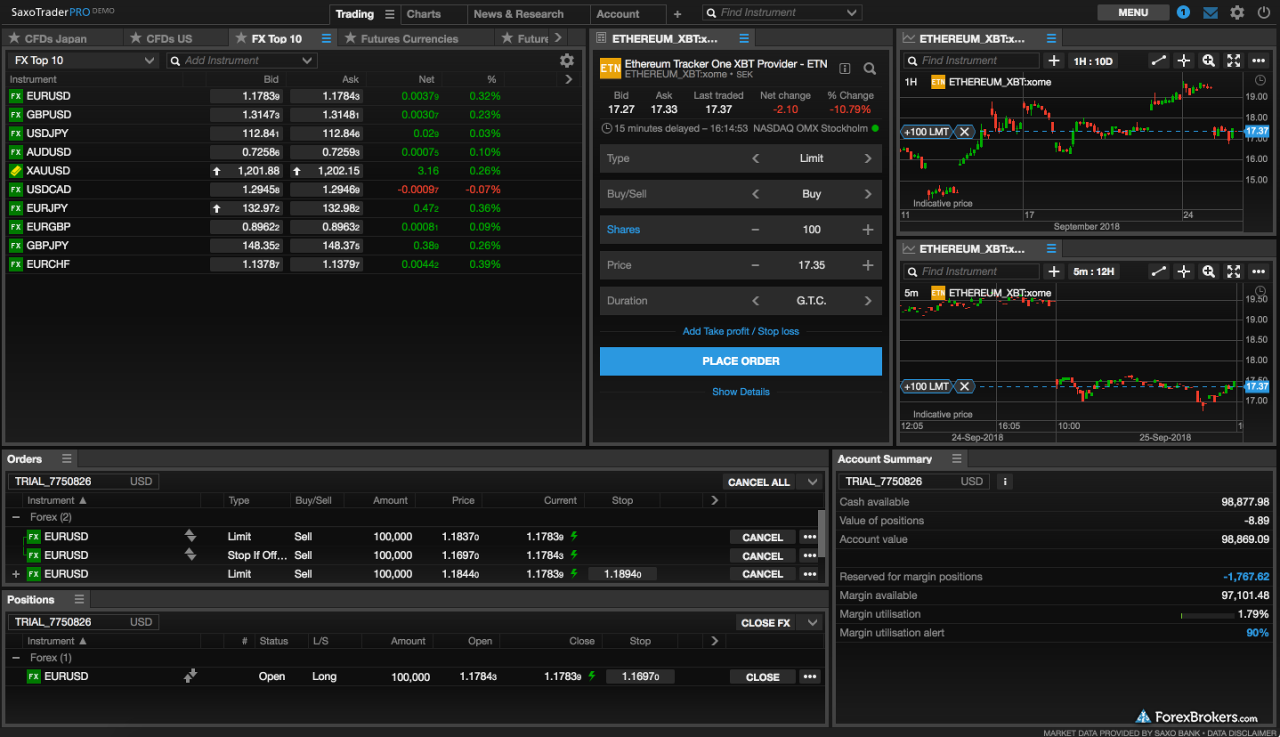

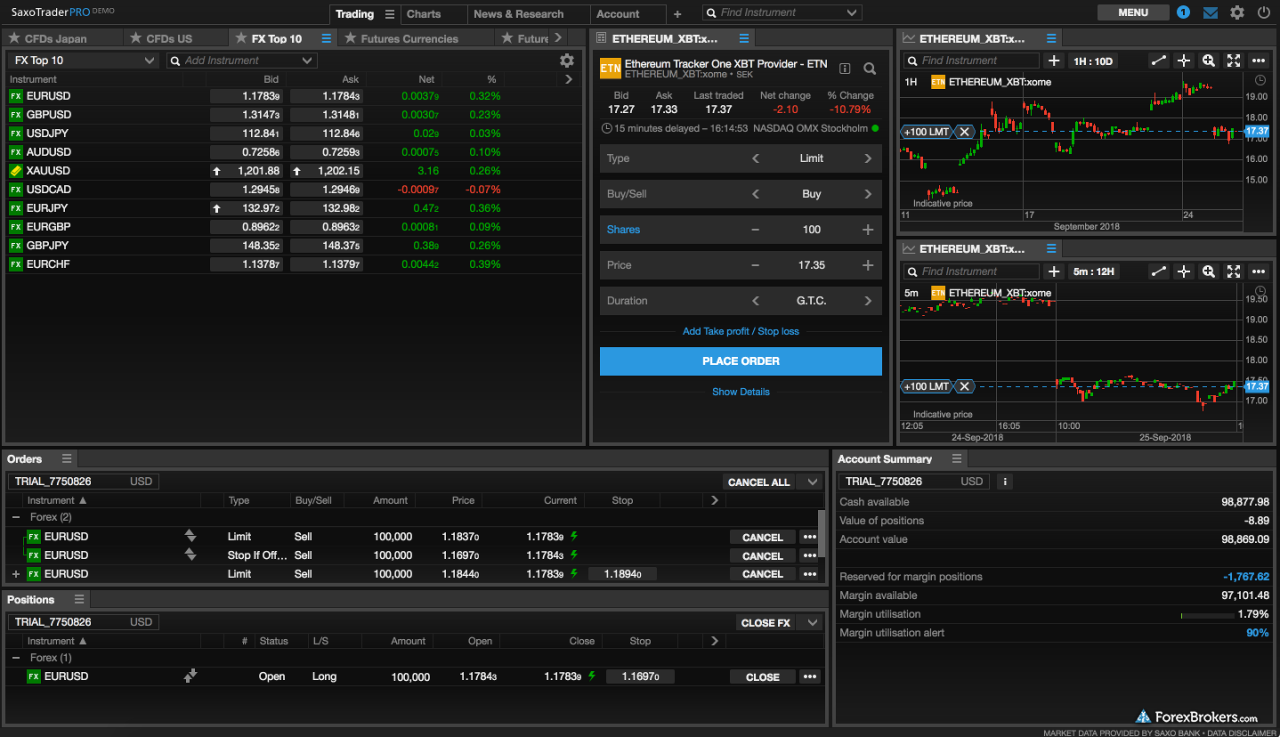

Execution Speed and Technology of Canadian Brokers

In the fast-paced world of forex trading, speed isn’t just a luxury—it’s a necessity. A fraction of a second can mean the difference between profit and loss, especially in volatile markets. Choosing a broker with lightning-fast execution is crucial for successfully navigating the forex landscape. This section dives into the technology behind speedy execution and compares the performance of some Canadian brokers.

Importance of Fast Execution Speeds

Milliseconds matter in forex trading. Slow execution can lead to slippage, where your order is filled at a less favorable price than anticipated, potentially eating into your profits or even resulting in losses. Fast execution minimizes slippage and allows you to capitalize on fleeting market opportunities. Imagine trying to catch a greased piglet – you need speed and precision, and the same principle applies to forex trading.

A delay can mean missing out on a lucrative trade completely. Fast execution also reduces the risk of your order being rejected due to market fluctuations.

Hunting for reliable forex brokers in Canada? Low fees and speedy execution are your best friends, but understanding spreads is crucial for maximizing profits. Check out this amazing guide Comprehensive guide to forex trading spreads and their impact on profits to avoid getting your metaphorical fingers burned. Then, armed with this knowledge, you can confidently choose a broker that aligns perfectly with your low-fee, high-speed trading goals in Canada!

Technologies Ensuring Fast Execution

Canadian forex brokers employ various technologies to ensure swift order execution. Two prominent methods are Electronic Communication Networks (ECNs) and Straight-Through Processing (STP). ECNs act as a central marketplace, connecting buyers and sellers directly, fostering transparency and potentially tighter spreads. STP routes orders directly to liquidity providers, minimizing manual intervention and reducing latency. Think of ECNs as a bustling farmer’s market where everyone interacts directly, and STP as a high-speed expressway for your trades.

Some brokers also utilize a hybrid model, combining aspects of both ECN and STP to optimize execution speed and efficiency.

Comparison of Execution Speeds

Unfortunately, precise, publicly available data on average execution speeds for specific Canadian brokers is often proprietary information. However, anecdotal evidence and user reviews suggest variations in execution speed between different platforms. Factors influencing speed include server location, network infrastructure, and order routing methods. A broker with servers closer to the major liquidity providers will generally offer faster execution.

It’s a bit like ordering pizza – the closer the pizzeria, the faster your delivery.

Finding a reliable forex broker in Canada can feel like searching for a unicorn – low fees AND fast execution? It’s a tough market, but once you’ve secured your broker, the next step is maximizing your wins. That’s where knowing the best strategies comes in, and for Questrade users, checking out Best forex trading signals for Canadian traders using Questrade is a smart move.

Armed with those signals, you’ll be ready to conquer the forex world with your chosen low-fee, high-speed Canadian broker.

Comparison Table of Trading Platforms, Execution Types, and Average Execution Speeds

It’s important to note that the “average execution speed” column below represents a general estimate based on user experiences and reviews and may vary depending on market conditions and individual trading activity. Precise figures are rarely publicly released by brokers.

Hunting for reliable forex brokers in Canada? You need low fees and lightning-fast execution, right? But before you conquer the currency markets, remember a strong body is your best asset – check out this best strength training program to build your trading stamina. Then, armed with both financial savvy and physical prowess, you can dominate those forex charts! Back to those Canadian brokers – find the perfect fit and watch your portfolio grow!

| Broker | Trading Platform | Execution Type | Average Execution Speed (Estimated) |

|---|---|---|---|

| Broker A | MetaTrader 4, cTrader | ECN/STP Hybrid | <100ms |

| Broker B | MetaTrader 5 | STP | <150ms |

| Broker C | Proprietary Platform | ECN | <120ms |

| Broker D | MetaTrader 4, WebTrader | STP | <200ms |

Account Types and Minimum Deposits

Choosing the right forex account can feel like navigating a minefield of jargon and minimum deposit requirements. Fear not, aspiring trader! This section will demystify the various account types offered by Canadian forex brokers and help you find the perfect fit for your trading style and budget. We’ll explore the differences between standard, mini, and micro accounts, and compare minimum deposit requirements across several reputable brokers.

Remember, always check the broker’s website for the most up-to-date information, as these details can change.The world of forex trading offers a spectrum of account types designed to cater to different trading styles and capital levels. Understanding these distinctions is crucial for choosing an account that aligns with your financial goals and risk tolerance. Let’s dive into the specifics.

Account Type Comparison

The following table provides a snapshot of account types and minimum deposit requirements from several Canadian forex brokers. Keep in mind that these are examples and may not represent the complete range of offerings from each broker. Always verify the current information on the broker’s official website.

| Broker | Account Type | Minimum Deposit (CAD) | Special Features |

|---|---|---|---|

| Example Broker A | Standard | 1000 | Access to advanced charting tools, higher leverage |

| Example Broker A | Mini | 250 | Lower minimum deposit, ideal for beginners |

| Example Broker A | Micro | 50 | Smallest lot sizes, perfect for practicing |

| Example Broker B | Standard | 500 | Dedicated account manager, priority customer support |

| Example Broker B | Mini | 100 | Competitive spreads, educational resources |

| Example Broker C | Standard | 1000 | High leverage, access to expert analysis |

| Example Broker C | Islamic Account | 1000 | Compliant with Islamic finance principles, no swap fees |

Note: The minimum deposit requirements and special features listed are for illustrative purposes only and may vary depending on the broker and specific promotions. Always consult the broker’s website for the most current and accurate information. Remember, lower minimum deposits don’t necessarily equate to better trading opportunities; your trading strategy and risk management should always be your primary focus.

Finding a reliable forex broker in Canada with low fees and speedy execution is like searching for a unicorn – rare but oh-so-rewarding! If manual trading isn’t your cup of tea, consider automating your strategy with Reliable forex trading robots and automated systems for Questrade , then return to the hunt for that perfect low-fee Canadian broker.

Remember, even the best robot needs a great platform to work on!

Client Support and Resources: Reliable Forex Brokers In Canada With Low Fees And Fast Execution

Navigating the sometimes-turbulent waters of forex trading requires more than just a keen eye for market trends; it demands reliable support and readily available resources. A forex broker’s commitment to client support and education can significantly impact a trader’s success, transforming a potentially stressful experience into a smoother, more informed journey. Let’s dive into what different Canadian brokers offer in this crucial area.Choosing the right forex broker in Canada often comes down to more than just fees and execution speeds.

The level of client support and the quality of educational resources provided are equally important factors to consider. A responsive support team can be a lifesaver when technical glitches arise or market volatility throws a curveball, while comprehensive educational resources empower traders to make informed decisions and build confidence.

Customer Support Channels and Responsiveness

The availability and responsiveness of customer support vary significantly among Canadian forex brokers. Some brokers offer 24/5 multilingual support via phone, email, and live chat, providing almost immediate assistance. Others may have more limited hours or rely primarily on email communication, leading to potentially longer response times. The speed and helpfulness of responses are also crucial; a quick, accurate answer is far more valuable than a delayed or unhelpful one.

For example, a broker boasting instant live chat support might still fall short if the agents are unable to address complex issues effectively. Conversely, a broker with a slightly longer response time via email might still provide superior support if their agents are knowledgeable and thorough.

Educational Resources Offered by Canadian Forex Brokers

Many Canadian forex brokers recognize the importance of educating their clients. They offer a variety of resources, from beginner-friendly tutorials to advanced webinars led by experienced analysts. These resources often cover topics such as fundamental and technical analysis, risk management strategies, and trading psychology. Access to economic calendars, market news updates, and trading signals can also be invaluable tools for traders of all levels.

The quality and comprehensiveness of these resources, however, differ significantly across brokers.

Hunting for reliable Canadian forex brokers with low fees and speedy execution? Before you dive headfirst into the exciting (and potentially lucrative!) world of forex, it’s wise to understand the rules of the game. Check out this guide on Forex trading regulations and licensing in Canada for beginners to avoid any nasty surprises. Then, armed with this knowledge, you can confidently choose a broker that fits your needs and keeps your hard-earned cash safe.

Comparison of Customer Support and Educational Resources

Let’s compare the offerings of four hypothetical Canadian forex brokers (names changed to protect the innocent, and also because I don’t have access to real-time data on all brokers):

- Broker A (NorthStarFX): Offers 24/5 multilingual support via phone, email, and live chat. Provides a comprehensive library of video tutorials, webinars on various trading strategies, and regular market analysis reports. They also have a dedicated FAQ section addressing common trading questions.

- Broker B (MapleLeafTrades): Provides 24/5 support via email and live chat, with phone support during limited business hours. Offers webinars and online courses, but the library is less extensive than Broker A’s. Market analysis is provided through daily email newsletters.

- Broker C (CanadianCapital): Offers email and live chat support during standard business hours. Educational resources are limited to a basic FAQ section and some introductory articles on forex trading.

- Broker D (BeaverTrade): Offers 24/7 multilingual support via phone, email, and live chat. Provides a robust selection of educational resources, including webinars, seminars, and one-on-one mentoring sessions with experienced traders. They also offer a sophisticated trading simulator.

Security and Safety of Client Funds

Your hard-earned money deserves a fortress, not a flimsy tent, especially in the sometimes-wild world of forex trading. Choosing a reliable Canadian forex broker means prioritizing the security of your funds above all else. This isn’t just about peace of mind; it’s about protecting your investment. Let’s delve into the robust safety nets Canadian brokers employ to keep your capital secure.Canadian forex brokers are subject to strict regulations designed to safeguard client funds.

These regulations mandate various measures to minimize risk and ensure the financial stability of brokerage firms. Failure to comply can result in hefty fines and even license revocation, incentivizing brokers to maintain impeccable security practices.

Segregation of Client Funds

Reputable Canadian forex brokers meticulously segregate client funds from their operating capital. This means your money is held in separate accounts, typically in trust accounts at major Canadian banks. This crucial separation protects your investments even if the brokerage faces financial difficulties. Imagine it like this: your money is in a vault separate from the broker’s own funds, making it safe even if the broker experiences setbacks.

This practice is a cornerstone of regulatory compliance and a key indicator of a trustworthy broker.

Insurance and Compensation Schemes

While not all brokers offer additional insurance, some may participate in investor protection schemes. These schemes provide a safety net for clients in the unlikely event of a broker’s insolvency. Think of it as an extra layer of protection, similar to a backup generator for your home’s electricity. The specifics of these schemes vary, so it’s vital to check with your chosen broker for details on their participation and coverage limits.

The existence of such a scheme adds a considerable layer of security.

Financial Stability and Track Record, Reliable forex brokers in Canada with low fees and fast execution

Choosing a broker with a proven track record of financial stability is paramount. Look for brokers with a long history of operation, consistently positive financial reports, and a strong reputation within the industry. Avoid brokers that are newly established or have a history of questionable practices. A stable broker is less likely to experience sudden financial problems that could jeopardize your funds.

This is akin to choosing a well-established bank over a brand new, untested one.

Examples of Security Measures Employed by Reputable Brokers

- Regular Audits: Reputable brokers undergo regular financial audits by independent accounting firms to verify the accuracy of their financial statements and ensure compliance with regulatory requirements. This is like a yearly checkup for your financial health.

- Advanced Encryption Technology: Protecting your personal and financial data is crucial. Look for brokers that employ robust encryption technologies, such as SSL (Secure Sockets Layer), to safeguard your information during transmission. This is your digital fortress, protecting your data from unwanted access.

- Negative Balance Protection: This feature prevents your account from going into a negative balance, protecting you from unexpected losses beyond your initial investment. This acts as a safety net to prevent catastrophic losses.

- Multi-Factor Authentication: This adds an extra layer of security by requiring multiple forms of authentication to access your account, making it significantly harder for unauthorized individuals to gain access. This is like adding a second lock to your front door.

Illustrative Examples of Broker Performance

Assessing the performance of forex brokers requires a keen eye and a healthy dose of skepticism. While past performance isn’t necessarily indicative of future results (a phrase brokers themselves love to trot out!), analyzing key metrics can give you a clearer picture of a broker’s reliability and efficiency. Let’s examine three hypothetical Canadian forex brokers – “Maple Leaf FX,” “Beaver Brokerage,” and “Polaris Trading” – over a six-month period (January to June 2024), focusing on order fill rates and slippage.

Remember, these are illustrative examples and not endorsements. Always conduct your own thorough research.We’ll use a simplified model for clarity. Real-world data is far more complex and involves thousands of trades.

Order Fill Rates for Three Hypothetical Brokers

Order fill rate measures the percentage of orders executed at the requested price. A high fill rate indicates a reliable and efficient broker. Let’s assume the following hypothetical data for our three brokers:

| Broker | January | February | March | April | May | June | Average Fill Rate |

|---|---|---|---|---|---|---|---|

| Maple Leaf FX | 98% | 97% | 99% | 96% | 98% | 97% | 97.5% |

| Beaver Brokerage | 95% | 93% | 94% | 92% | 96% | 91% | 93.5% |

| Polaris Trading | 99% | 98% | 99% | 98% | 97% | 98% | 98.2% |

As you can see, Polaris Trading boasts the highest average fill rate, suggesting superior order execution capabilities. Beaver Brokerage lags behind, hinting at potential issues with order processing. Maple Leaf FX falls somewhere in the middle.

Slippage Analysis for Three Hypothetical Brokers

Slippage is the difference between the expected price and the actual execution price of an order. High slippage can significantly impact profitability. Let’s examine the average slippage (in pips) experienced by our three hypothetical brokers:

| Broker | Average Slippage (pips) |

|---|---|

| Maple Leaf FX | 0.8 |

| Beaver Brokerage | 1.5 |

| Polaris Trading | 0.5 |

Polaris Trading again demonstrates superior performance with the lowest average slippage, indicating smoother order execution. Beaver Brokerage exhibits the highest slippage, potentially due to market volatility or less efficient order routing. Maple Leaf FX shows moderate slippage.

Assessing Broker Performance Using Key Metrics

To assess broker performance effectively, consider these key metrics:* Order Fill Rate: As discussed above, this reflects the reliability of order execution. Aim for consistently high rates (above 95%).

Slippage

Lower slippage is always better. Analyze the average slippage over a significant period to get a clear picture.

Spread

The spread is the difference between the bid and ask price. Lower spreads translate to lower trading costs.

Commission

This is the fee charged per trade. Compare commission structures across brokers.

Execution Speed

Measure the time taken to execute an order. Faster execution is generally preferred, especially in volatile markets. This could be measured in milliseconds.These metrics, when analyzed together, offer a more comprehensive view of a broker’s performance than any single factor alone. Remember, these examples are hypothetical; real-world analysis requires more detailed data and a deeper dive into individual trading experiences.

Concluding Remarks

So, there you have it – a roadmap to navigating the world of Canadian forex brokers. Remember, finding the perfect broker is a personal quest, but armed with the knowledge of regulatory frameworks, fee structures, and execution speeds, you’re now well-equipped to embark on your trading adventure. Don’t be afraid to compare, contrast, and choose the broker that best suits your individual needs and risk tolerance.

Happy trading, and may your pips be ever in your favor! Now go forth and conquer those currency markets!