Reliable forex trading robots and automated systems for Questrade: Dive into the wild, wild west of automated forex trading! Picture this: you, sipping a margarita on a beach somewhere exotic, while your robot diligently churns out profits on the Questrade platform. Sounds dreamy, right? But before you ditch your day job and book that flight, let’s explore the thrilling (and sometimes terrifying) reality of using automated systems to conquer the forex market.

We’ll unravel the mysteries of Questrade’s API, dissect the reliability of different robot types, navigate the treacherous waters of security and risk management, and even peek into some real-world (hypothetical, of course) success and failure stories. Buckle up, it’s going to be a rollercoaster!

This comprehensive guide will walk you through the intricacies of integrating forex robots with Questrade, examining the platform’s API capabilities and limitations. We’ll compare different types of trading robots, highlighting their strengths and weaknesses, and emphasizing the crucial role of backtesting and forward testing in assessing their reliability. Security and risk management are paramount, so we’ll cover Questrade’s security measures and provide practical strategies to protect your account and investments.

Finally, we’ll delve into the legal and regulatory aspects of automated forex trading, ensuring you’re fully compliant while navigating the exciting world of algorithmic trading.

Questrade’s API and Forex Robot Compatibility: Reliable Forex Trading Robots And Automated Systems For Questrade

Navigating the world of automated forex trading with Questrade requires a keen understanding of their API. While Questrade offers a robust platform for manual trading, the intricacies of its API and its suitability for various robot functionalities deserve careful consideration. Think of it like this: your forex robot is a highly skilled chef, but Questrade’s API is the kitchen – some kitchens are fully equipped for gourmet creations, others… less so.

Questrade’s API provides access to market data and allows for order placement and management. However, the level of access isn’t as comprehensive as some other platforms, particularly regarding real-time data streaming and advanced order types. This means certain robot functionalities might be limited or require workarounds.

Questrade API Limitations and Capabilities

Questrade’s API offers a RESTful interface, which is a common standard. This is generally good news for robot developers. However, limitations exist, primarily in the speed and depth of data provided. While sufficient for many trading strategies, high-frequency trading (HFT) robots might find the latency unacceptable. The API also doesn’t support every conceivable order type, potentially hindering robots relying on sophisticated order management techniques.

On the plus side, the documentation is generally well-maintained, making integration easier than wrestling a greased pig.

Common Forex Robot Functionalities and Questrade API Compatibility

Let’s examine how common robot features fare with Questrade’s API. Remember, compatibility isn’t always a simple yes or no; it often involves compromises and clever programming.

- Market Order Execution: Generally compatible. Questrade’s API supports placing market orders, a fundamental function for most robots.

- Limit Order Execution: Generally compatible. Similar to market orders, placing limit orders is well-supported.

- Stop-Loss and Take-Profit Orders: Generally compatible. These essential risk management tools are usually supported.

- Trailing Stop Orders: Potentially challenging. Questrade’s API might require workarounds or clever logic to implement trailing stops effectively, as direct support may be limited.

- Advanced Order Types (e.g., OCO, bracket orders): Limited compatibility. The API might not directly support these more complex order types, demanding creative solutions from developers.

- Real-time Data Streaming: Limited compatibility. While data is available, the speed and frequency might not be ideal for HFT strategies.

- Backtesting Capabilities: Not directly supported by the API. Backtesting usually requires using historical data downloaded separately and then running the robot locally.

Challenges in Integrating Forex Robots with Questrade and Suggested Solutions

Integrating forex robots with Questrade can present certain hurdles. However, with careful planning and resourceful coding, these challenges are often surmountable.

Dreaming of robot-powered riches with your Questrade forex account? Before you unleash your army of automated traders, it’s crucial to understand the financial battlefield – namely, the fees! Check out this link to learn about Questrade’s forex pricing: What are the fees and commissions associated with Questrade forex trading? Knowing these costs will help you fine-tune your robot’s strategies for maximum profit (and minimum heartbreak!).

- API Rate Limits: Questrade, like most platforms, imposes rate limits on API calls. Solutions involve efficient coding to minimize requests and potentially employing queuing mechanisms.

- Data Latency: The delay between data updates and order execution can be a concern. Solutions include adjusting trading strategies to accommodate latency and employing more robust error handling.

- Lack of Certain Order Types: The absence of specific order types might require creative workarounds using combinations of supported orders. This demands sophisticated programming skills.

- Authentication and Security: Robust security measures are crucial. Solutions involve implementing secure API key management and adhering to best practices for handling sensitive information.

Comparison of Forex Trading Platforms and API Access

Here’s a hypothetical comparison of five popular platforms, illustrating the spectrum of API capabilities. Note that these scores and complexities are subjective and can vary based on individual experiences and evolving platform features.

Dreaming of forex riches with Questrade’s automated trading robots? Before you unleash your army of digital traders, consider this crucial question: Are you ready for the wild ride? Check out this article, Is Questrade’s global FX platform suitable for beginners in Canada? , to see if Questrade’s platform is beginner-friendly. Then, and only then, should you unleash those robots on the market!

| Platform Name | API Features | Compatibility Score (1-5) | Integration Complexity |

|---|---|---|---|

| MetaTrader 4 | Extensive, real-time data, advanced order types, MQL4 language | 5 | Moderate |

| cTrader | Robust, real-time data, advanced order types, cAlgo language | 5 | Moderate |

| NinjaTrader | Comprehensive, real-time data, advanced order types, customizability | 4 | High |

| TradingView | Good data access, limited order execution, primarily for charting and analysis | 3 | Low |

| Questrade | RESTful API, market and limit orders, limited advanced order types | 3 | Moderate |

Evaluating the Reliability of Forex Trading Robots

So, you’re thinking of letting a robot handle your forex trading on Questrade? That’s bold! Like trusting a Roomba to clean up after a particularly messy party – itmight* work, but there’s a chance you’ll end up with a digital mess on your hands. Let’s dissect the reliability of these automated trading marvels (or monsters, depending on your luck).

So, you’re dreaming of robot overlords managing your Questrade forex trades? Before you unleash the automated army, it’s wise to understand the platform’s strengths and weaknesses. A great resource for this is AGR Forex vs Questrade: A comprehensive comparison for Canadian traders , which helps you choose the right battlefield for your bot brigade. Then, and only then, can you confidently deploy your reliable forex trading robots and automated systems on Questrade.

Types of Forex Trading Robots

Choosing the right forex robot is like picking a superhero for your investment portfolio. Each type has its strengths and weaknesses. Ignoring these differences could be the difference between a triumphant victory and a spectacular crash-and-burn.

- Expert Advisors (EAs): These are the workhorses of automated forex trading, typically used within platforms like MetaTrader 4 or 5. Think of them as highly specialized, code-based traders following pre-programmed strategies. Their reliability hinges entirely on the quality of the code and the strategy it employs. A poorly coded EA is a recipe for disaster.

- Algorithmic Trading Systems: These are broader than EAs, encompassing a wider range of automated trading techniques. They can use more sophisticated algorithms and incorporate factors like machine learning. While potentially more powerful, they also require more technical expertise to set up and monitor effectively. They’re like the super-powered, experimental superheroes – incredibly potent but potentially unpredictable.

- Pre-built Trading Robots: These are off-the-shelf solutions, often marketed with promises of guaranteed riches (proceed with extreme caution!). They typically lack the customization of EAs or the sophistication of algorithmic systems. Consider them the sidekick – helpful, but not likely to save the day on their own.

Potential Risks of Automated Forex Trading Systems on Questrade

Even the most sophisticated robot can’t predict the unpredictable nature of the forex market. Think of it as trying to predict the weather with a crystal ball – sometimes it works, sometimes it rains cats and dogs.

So you’re thinking of unleashing the power of reliable forex trading robots and automated systems on your Questrade account? Before you do, however, it’s crucial to understand the risks involved, especially with leverage. That’s where learning about Understanding Questrade’s leverage options for forex trading in Canada comes in handy. Mastering leverage is key to successfully using those automated trading bots; otherwise, you might end up with a robot uprising of a different kind (a depleted account!).

- Unexpected Market Volatility: Sudden shifts in the market can wipe out even the best-laid plans of automated systems. A robot relying on historical data might not be equipped to handle a black swan event.

- Software Glitches: A bug in the robot’s code can lead to disastrous trades, costing you money and potentially causing significant losses. Remember, even robots need regular maintenance and updates.

- Lack of Human Oversight: While automation offers convenience, it’s crucial to monitor your robot’s performance and intervene when necessary. Blind faith in a robot can be as dangerous as reckless trading.

- Brokerage Platform Issues: Problems with Questrade’s API or platform could disrupt your robot’s operations, leading to missed opportunities or erroneous trades.

Backtesting and Forward Testing for Assessing Robot Reliability

Before unleashing your robot into the wild, thorough testing is essential. This isn’t about letting your robot loose on your actual money – this is about a trial run in a simulated environment.Backtesting uses historical data to simulate the robot’s performance. Think of it as a practice match before the big game. Forward testing, on the other hand, involves using the robot with real money, but with a small account to minimize risk.

This is like a friendly exhibition match – still low-stakes, but with a real-world feel.

Interpreting Backtesting Results

Backtesting results provide valuable insights, but don’t take them as gospel. They’re a starting point, not a guarantee of future success.Key performance indicators (KPIs) to scrutinize include:

- Profit Factor: The ratio of gross profit to gross loss. A higher profit factor (ideally above 1) indicates better profitability.

- Maximum Drawdown: The largest peak-to-trough decline during the backtesting period. A lower drawdown is preferred, as it indicates less risk.

- Sharpe Ratio: Measures risk-adjusted return. A higher Sharpe ratio suggests better performance relative to risk.

- Win Rate: The percentage of winning trades. While a high win rate is desirable, it’s not the only factor to consider; the average profit per winning trade is just as important.

Remember, even impressive backtesting results don’t guarantee future success. The forex market is dynamic, and what worked in the past may not work in the future. Always proceed with caution and manage your risk effectively.

Security and Risk Management with Automated Forex Trading on Questrade

Letting robots loose in the wild world of forex trading on Questrade sounds exciting, but like a caffeinated squirrel on a tightrope, it needs careful management. Security and risk mitigation are paramount to avoid turning potential profits into a spectacular financial wipeout. This section will explore the safeguards Questrade offers and the steps you can take to protect your hard-earned cash (and sanity).Questrade employs robust security measures to protect against unauthorized access and fraudulent activities related to automated trading.

These include multi-factor authentication, encryption of data both in transit and at rest, and rigorous monitoring for suspicious activity. They also maintain strong firewall protection and employ intrusion detection systems to identify and respond to potential threats. Think of it as a heavily fortified digital castle, complete with moats (firewalls), drawbridges (authentication), and vigilant guards (monitoring systems).

Questrade’s Security Measures for Automated Trading

Questrade’s security infrastructure is designed to withstand various attack vectors. Their multi-factor authentication (MFA) adds an extra layer of protection beyond just a password, often requiring a code from a separate device or app. This makes it significantly harder for hackers to gain access, even if they somehow manage to steal your password. Data encryption ensures that even if intercepted, your trading data remains unreadable to unauthorized individuals.

Regular security audits and penetration testing help identify vulnerabilities before malicious actors can exploit them. This proactive approach minimizes risks and maintains a high level of security.

Securing Your Forex Robot and Questrade Account: A Step-by-Step Guide, Reliable forex trading robots and automated systems for Questrade

Protecting your automated trading setup requires a multi-pronged approach. First, choose a reputable and well-reviewed forex robot. Thoroughly research its developer and look for independent audits or verification of its trading strategies. Second, create a strong, unique password for your Questrade account and enable MFA. Avoid using easily guessable information like birthdays or pet names.

Third, keep your robot’s software updated with the latest security patches. Outdated software is vulnerable to known exploits. Fourth, use a strong and unique password for your robot’s access credentials, separate from your Questrade login. Fifth, regularly review your Questrade account activity and your robot’s trading logs for any unusual or suspicious transactions. Think of this as a regular security check-up for your automated trading system.

Potential Risks Associated with Automated Forex Trading and Mitigation Strategies

Automated trading, while offering convenience, introduces unique risks. One major risk is the potential for software bugs or errors leading to unintended trades or losses. Mitigation involves rigorous testing of the robot before live deployment and careful monitoring of its performance. Another risk is over-reliance on the robot without understanding its underlying strategies. Mitigation involves gaining a strong understanding of the robot’s logic and parameters.

A third risk is market volatility leading to unexpected losses. Mitigation involves setting appropriate stop-loss orders and diversifying your portfolio across multiple currency pairs. Finally, there’s the risk of unauthorized access to your account, which is mitigated by using strong passwords, MFA, and regularly monitoring account activity. Remember, even the best robot can’t predict the unpredictable nature of the forex market.

A Hypothetical Security Breach Scenario and its Consequences

Imagine a scenario where a hacker gains access to your Questrade account through a phishing scam, exploiting weak security practices. They could then use your robot to execute unauthorized trades, potentially draining your account. The consequences could be devastating, ranging from significant financial losses to severe reputational damage. The recovery process would involve immediately contacting Questrade support to report the breach, changing your passwords, and possibly filing a police report.

You might also need to work with your robot’s developer to assess and address any potential vulnerabilities in the software itself. This highlights the importance of proactive security measures.

Legal and Regulatory Considerations for Automated Forex Trading on Questrade

Navigating the world of automated forex trading can feel like venturing into uncharted territory, especially when it comes to the legal and regulatory landscape. While the thrill of potentially profiting from algorithmic trading is undeniable, understanding the rules of the game is crucial to avoid unexpected pitfalls. This section will shed light on the legal and regulatory frameworks governing automated forex trading on Questrade, ensuring you’re not just trading, but trading – smartly*.

Relevant Legal and Regulatory Frameworks

The legal and regulatory framework governing automated forex trading on Questrade is primarily determined by the jurisdiction where the Questrade user resides. This typically involves adherence to securities laws and regulations of that specific country or region. For example, in Canada, where Questrade operates, this would involve compliance with the regulations set forth by the Ontario Securities Commission (OSC) and other relevant provincial securities commissions, as well as federal regulations.

So, you’re looking for reliable forex trading robots for Questrade? That’s serious business, demanding focus and discipline – much like sticking to a killer best strength training program. Building wealth, like building muscle, requires consistent effort. The right automated systems can give your forex trading the same boost a great workout gives your physique. Ultimately, success in both arenas hinges on a well-structured plan and dedicated execution.

These regulations cover aspects like registration requirements for advisors, anti-money laundering (AML) compliance, and the overall conduct of business. It’s crucial for users to understand the specific regulations that apply to their location to ensure complete compliance. Ignoring these regulations can lead to significant penalties, including fines and even legal action.

Tax Reporting and Compliance Implications of Automated Systems

Automated forex trading introduces unique challenges for tax reporting. The high frequency of trades generated by robots can complicate the process of accurately tracking profits and losses. Tax authorities typically require detailed records of all transactions, including dates, amounts, and currency conversions. Failure to maintain meticulous records can lead to underreporting of income and potential penalties. Tax software specifically designed for forex trading can significantly simplify this process, providing automated reporting features that help users comply with tax regulations.

It is advisable to consult with a tax professional experienced in forex trading to ensure accurate and timely filing of tax returns. Remember, even though your robot is doing the trading,

Dreaming of forex robots making you richer than Scrooge McDuck? Before unleashing those automated trading beasts on Questrade, maybe you should hone your skills first. Check out this handy guide: Can I use a practice account on Questrade to learn forex trading? Then, and only then, can you confidently unleash those algorithmic money-making machines (or maybe just learn to avoid them entirely!).

you* are ultimately responsible for the tax implications.

Trader Responsibilities Regarding Compliance and Risk Management

While automated systems handle the execution of trades, the trader retains ultimate responsibility for compliance and risk management. This includes understanding the limitations of the automated system, regularly monitoring its performance, and ensuring that its operation aligns with their risk tolerance and investment strategy. It’s not a case of “set it and forget it”; active oversight is essential.

For instance, a trader must ensure their automated system adheres to pre-defined parameters to prevent excessive losses. They should also be aware of potential malfunctions or errors in the system and have contingency plans in place. Ultimately, the responsibility for losses, even those resulting from system malfunctions, generally rests with the trader.

Regulatory Requirements: Manual vs. Automated Forex Trading

The core regulatory requirements for forex trading on Questrade remain largely consistent whether the trading is manual or automated. The fundamental principles of Know Your Client (KYC) and Anti-Money Laundering (AML) compliance, for example, apply equally to both methods. However, automated trading introduces an added layer of complexity. While manual trading involves individual decisions and a more readily auditable trail, automated systems require rigorous testing, documentation, and ongoing monitoring to ensure compliance.

Regulatory bodies might scrutinize the algorithms and parameters used in automated systems to ensure they are not manipulative or violate market rules. The increased frequency of trades generated by automated systems also necessitates more robust record-keeping and reporting mechanisms. In essence, the regulatory burden, while not fundamentally different, is significantly increased in complexity when using automated systems.

Case Studies

Let’s dive into the thrilling (and sometimes terrifying) world of real-world forex robot performance on Questrade. We’ll examine both triumphant victories and spectacular crashes, learning valuable lessons from each. Remember, these are hypothetical examples, but they reflect common scenarios traders encounter.

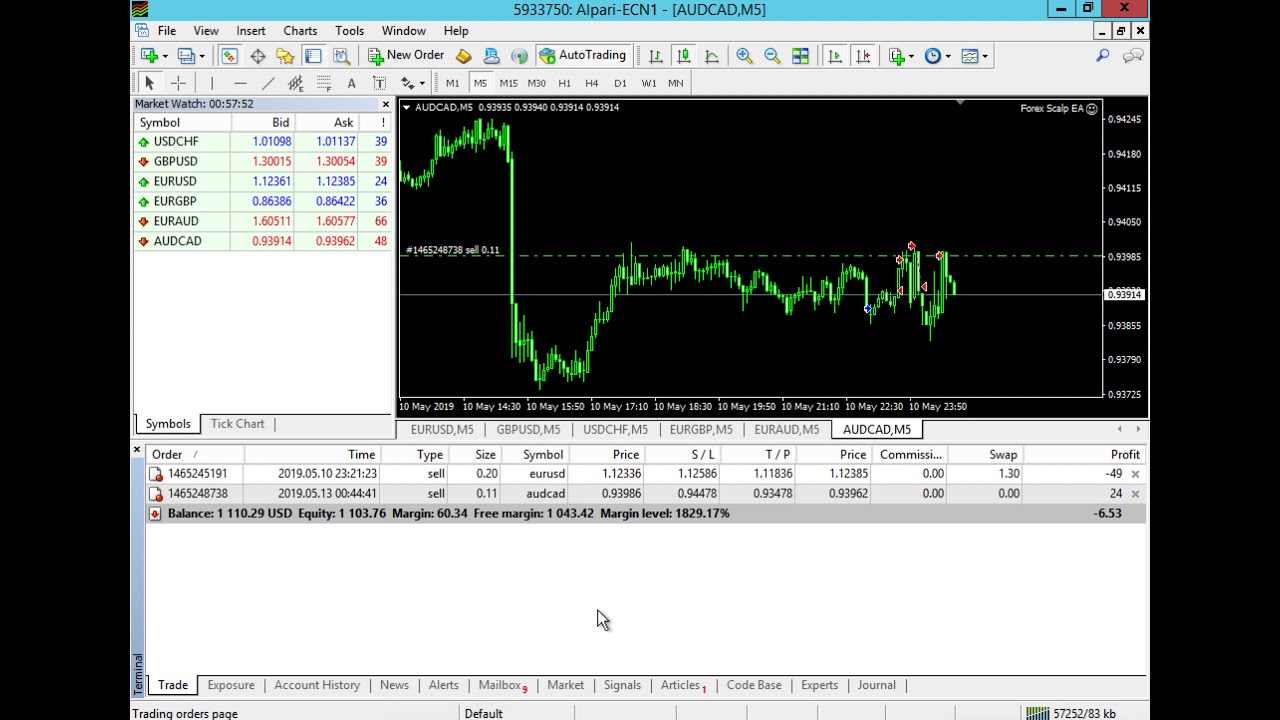

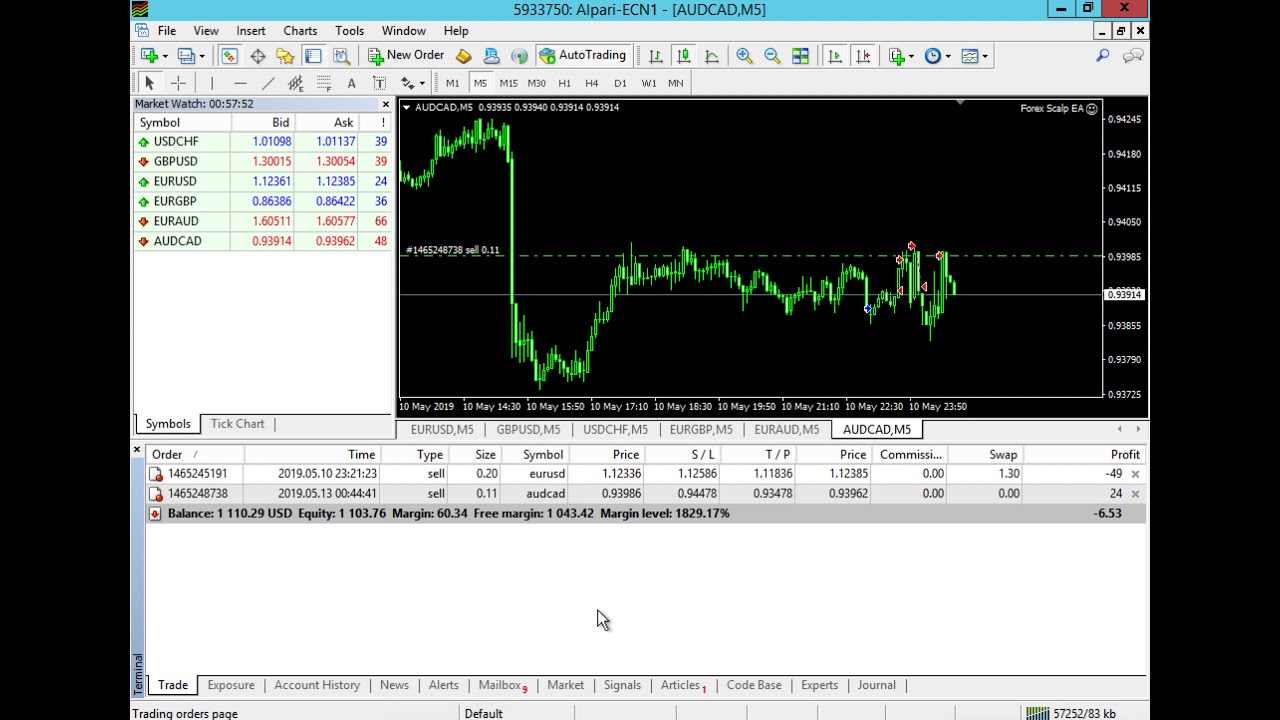

Successful Forex Robot Implementation: Project “Golden Goose”

Project “Golden Goose,” as we’ll call it, utilized a mean reversion strategy focusing on the EUR/USD pair. The robot employed a sophisticated combination of moving averages and RSI indicators to identify potential reversals. Crucially, it incorporated a robust risk management system, limiting losses per trade to a maximum of 1% of the account balance. The robot also had a built-in mechanism to adjust its trading frequency based on market volatility, becoming more conservative during periods of high uncertainty.

Over a six-month period, Project “Golden Goose” achieved a consistent average monthly return of 5%, with a maximum drawdown of only 3%.

Unsuccessful Forex Robot Implementation: Operation “Market Meltdown”

Operation “Market Meltdown,” on the other hand, serves as a cautionary tale. This robot, based on a complex neural network attempting to predict market trends, lacked a proper risk management strategy. It aggressively entered trades with large position sizes, leading to significant losses during periods of market instability. The lack of built-in safeguards and over-reliance on a complex, untested algorithm resulted in a rapid depletion of the trading account.

Within three months, the account balance had decreased by 80%, demonstrating the critical importance of risk management.

Comparison of Project “Golden Goose” and Operation “Market Meltdown”

The stark contrast between these two case studies highlights the crucial role of risk management and robust strategy design in automated forex trading. Project “Golden Goose’s” success stemmed from its carefully crafted risk management rules, adaptive trading frequency, and proven trading strategy. Operation “Market Meltdown,” conversely, failed due to its lack of risk controls, over-reliance on a complex, untested algorithm, and aggressive trading approach.

The key difference lies in the level of sophistication and testing involved in the development and implementation of the respective trading robots.

Visual Representation of Profit and Loss Curves

The profit and loss curve for Project “Golden Goose” would show a relatively smooth upward trend, with minor dips representing small drawdowns, always quickly recovered. The overall trajectory would be positive and consistent, reflecting the steady 5% monthly gains. In contrast, the profit and loss curve for Operation “Market Meltdown” would depict a dramatic downward spiral, with steep drops interspersed with brief periods of minor gains.

This curve would show a consistently negative trajectory, reflecting the substantial losses incurred. The initial upward trajectory, if any, would be quickly overtaken by significant drawdowns leading to a steep negative slope illustrating the devastating impact of poor risk management and an untested strategy.

Conclusive Thoughts

So, are automated forex trading robots and Questrade a match made in algorithmic heaven? The answer, as with most things in life, is a resounding “it depends.” While the potential for automated profits is undeniably alluring, the path to success requires careful planning, rigorous testing, and a healthy dose of risk management. This journey into the heart of automated forex trading has revealed the importance of understanding Questrade’s API, choosing the right robot, and prioritizing security.

Remember, even the most sophisticated robot needs a human hand on the tiller, guiding it through the stormy seas of the forex market. Happy trading (responsibly, of course)!