Is Questrade’s global FX platform suitable for beginners in Canada? That’s the burning question for many aspiring Canadian traders looking to dip their toes into the exciting (and sometimes terrifying) world of foreign exchange. This isn’t your grandpa’s piggy bank; we’re talking about global markets, fluctuating currencies, and the potential for both hefty profits and heartbreaking losses. Let’s dive into whether Questrade’s platform offers a gentle slope for newbies navigating this thrilling terrain.

This deep dive explores Questrade’s features, ease of use, educational resources, account opening process, and the crucial aspect of risk management for beginners. We’ll also examine the support system Questrade provides and uncover real user experiences to paint a comprehensive picture. Get ready to arm yourself with the knowledge you need to make an informed decision about whether Questrade is the right platform to launch your FX trading journey.

Questrade’s Global FX Platform Features for Beginners

So, you’re thinking about dipping your toes into the thrilling (and sometimes terrifying) world of foreign exchange trading? Questrade’s Global FX platform might be a good place to start, but let’s see if it’s truly beginner-friendly. We’ll navigate the platform’s features, order types, and educational resources, ensuring you’re not left feeling like a goldfish in a shark tank.

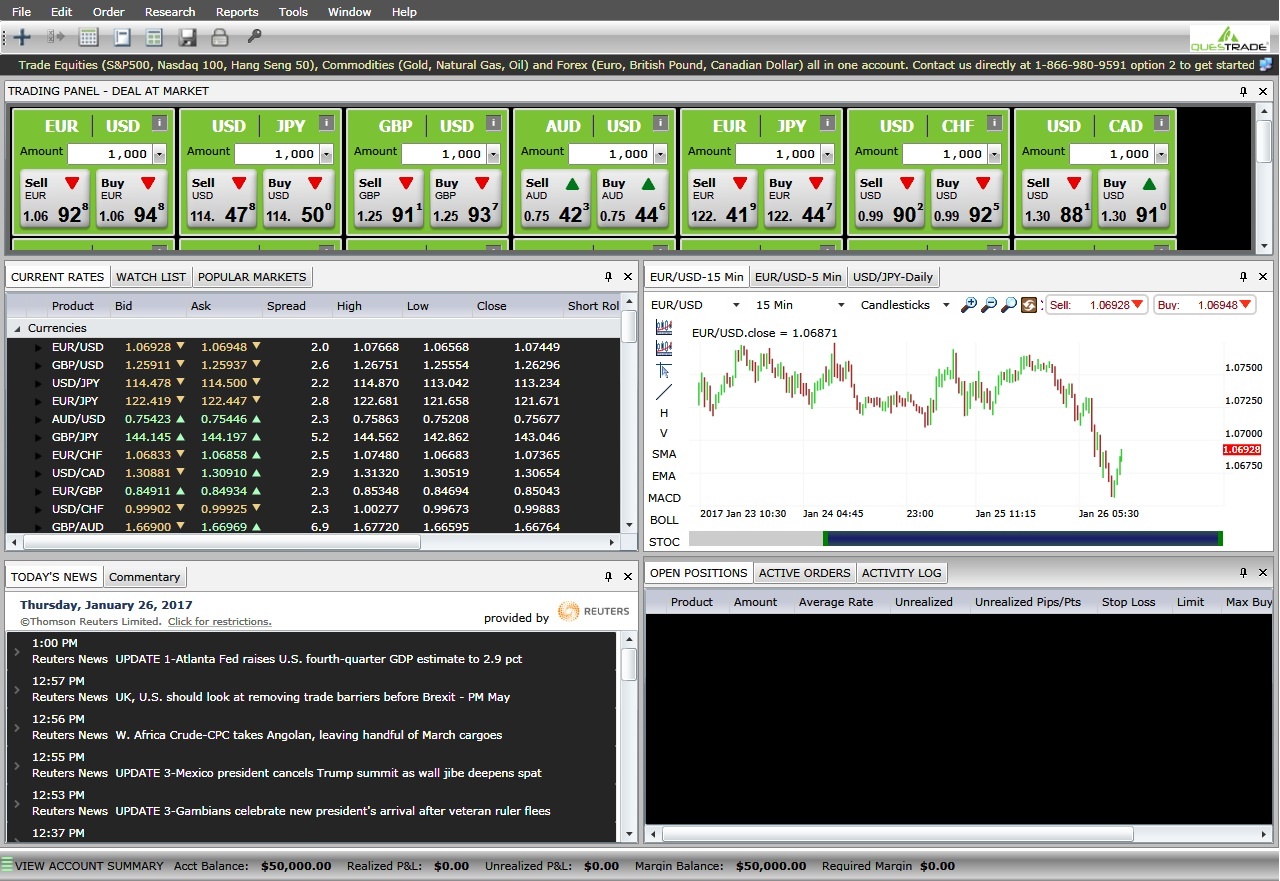

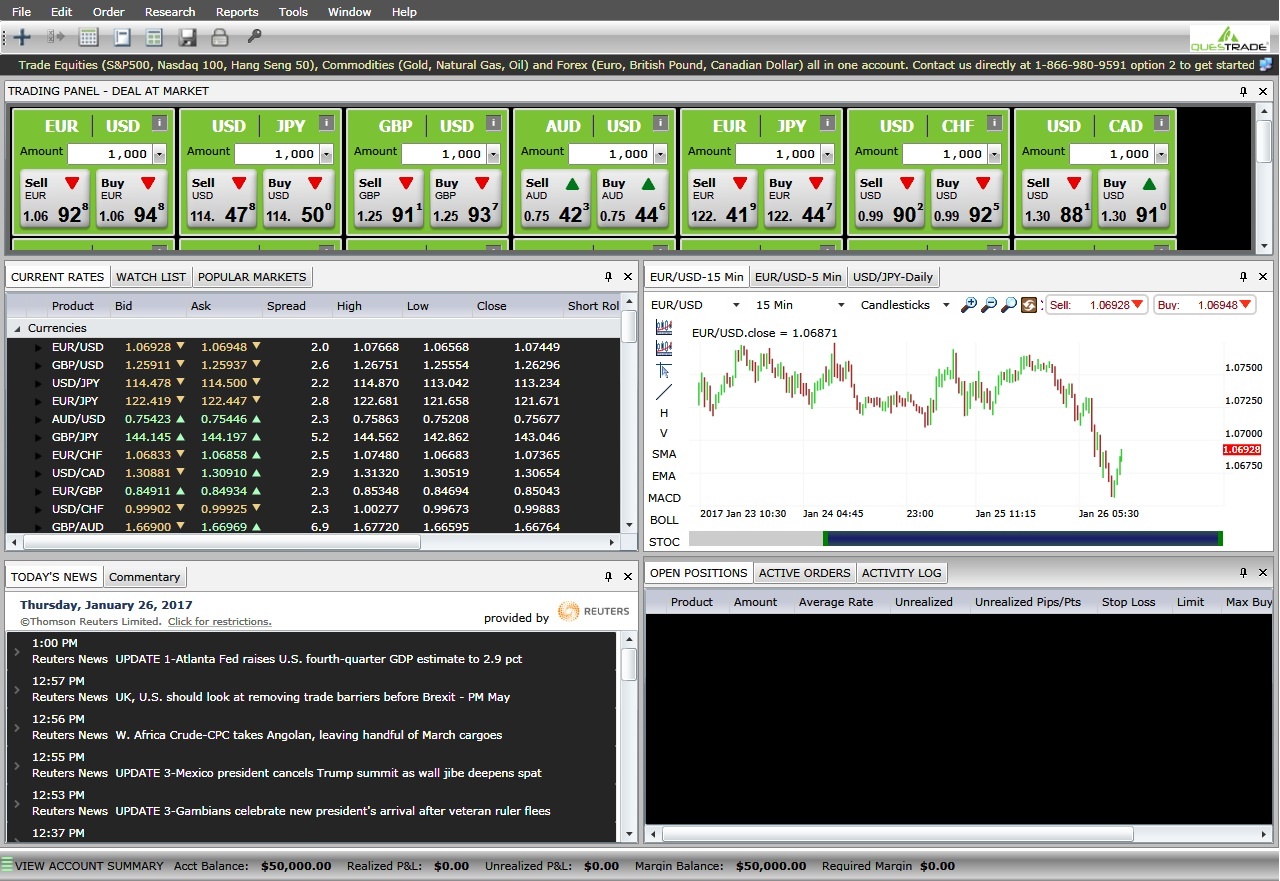

Questrade’s Global FX Platform User Interface

Navigating Questrade’s platform shouldn’t feel like deciphering hieroglyphics. For beginners, a clean, intuitive interface is crucial. While the platform offers advanced features for experienced traders, the core functionality is designed to be accessible. Think of it as a well-organized toolbox – you can easily find the tools you need, even if you’re not a seasoned carpenter. The layout is generally straightforward, with clear visual cues guiding you through the process of placing trades, monitoring your portfolio, and accessing educational resources.

Let’s compare it to a typical beginner-friendly online brokerage:

| Feature | Questrade Global FX | Typical Beginner Brokerage | Comparison |

|---|---|---|---|

| Ease of Navigation | Intuitive layout, clear visual cues | Generally user-friendly, but might lack advanced features | Questrade offers a good balance of simplicity and functionality. |

| Charting Tools | Provides various charting tools, customizable | Basic charting tools often included | Questrade offers more customization options for advanced analysis. |

| Order Placement | Straightforward order entry forms | Simple order entry, but may lack order types | Questrade offers a wider variety of order types. |

| Account Management | Easy access to account details, transaction history | Similar account management features | Both offer similar functionality, but Questrade might have a slightly steeper learning curve for advanced features. |

Order Types Available on Questrade’s Platform

Understanding different order types is key to managing risk and achieving your trading goals. Questrade provides a range of options, catering to both beginners and experienced traders. Don’t worry, we’ll break it down:

The various order types offered allow for different levels of control and risk management. For a beginner, understanding the basics is paramount before venturing into more complex strategies.

- Market Order: This is the simplest type. You buy or sell at the current market price. Example: You want to buy 1000 USD/CAD at the current market rate. You place a market order, and the trade executes immediately at the prevailing price.

- Limit Order: You specify the price at which you want to buy or sell. The order only executes if the market reaches your specified price. Example: You want to buy EUR/USD at 1.1000. You place a limit order; it will only execute if the price drops to 1.1000 or lower.

- Stop Order: This order is triggered when the market price reaches a certain level. It’s often used to limit losses or protect profits. Example: You’ve bought USD/CAD at 1.3500 and want to limit potential losses. You set a stop-loss order at 1.3400. If the price drops to 1.3400, your order automatically sells, limiting your losses.

Educational Resources Provided by Questrade

Questrade understands that forex trading isn’t a walk in the park. They offer several educational resources to help beginners get up to speed. Think of it as a crash course in financial wizardry, without the need for a pointy hat.

These resources aim to equip beginners with the knowledge and confidence to navigate the complexities of foreign exchange trading responsibly.

- Educational Webinars: Questrade often hosts webinars covering various aspects of forex trading, from fundamental analysis to risk management. These are usually free and provide a great interactive learning experience.

- Trading Guides and Tutorials: Their website offers downloadable guides and tutorials explaining forex trading concepts in a beginner-friendly manner. These resources often cover topics like order types, technical analysis, and market dynamics.

- Glossary of Terms: Navigating the world of finance can be daunting due to the specialized jargon. Questrade provides a comprehensive glossary to help decipher the financial lingo.

Account Opening and Funding Processes

Embarking on your global FX trading journey with Questrade? Buckle up, buttercup, because opening an account and funding it might seem like navigating a maze blindfolded, but fear not! We’ll demystify the process, turning potential pitfalls into stepping stones to financial freedom (or at least, slightly less broke freedom).The process of opening a Questrade account and funding it for FX trading is surprisingly straightforward, though beginners might encounter a few hurdles.

Think of it as a slightly more complicated version of ordering pizza online – more paperwork, less deliciousness.

Account Opening Steps

Before you can start trading currencies like a seasoned pro (or even a slightly less green beginner), you’ll need to open an account. Here’s a step-by-step guide to help you navigate the process:

- Visit the Questrade Website: Head over to Questrade’s website and locate the account opening section. It’s usually prominently displayed – they want your money, after all!

- Complete the Application: This involves providing personal information, employment details, and answering some questions about your trading experience and financial situation. Be honest; they’ll find out eventually, and it’s far less embarrassing if you’re upfront.

- Provide Identification: You’ll need to upload copies of your government-issued ID (like your driver’s license or passport) and proof of address (a recent utility bill or bank statement). Make sure these are clear and legible – blurry photos are the enemy of efficient account opening.

- Account Approval: Questrade will review your application. This can take a few business days. Patience, young Padawan!

- Funding Your Account: Once your account is approved, you can fund it using various methods, including electronic funds transfer (EFT), wire transfer, or possibly even a carrier pigeon (just kidding…probably).

Minimum Deposit and Fees

Let’s talk money – specifically, how much money you need to start trading and what Questrade might charge you. These details are crucial, as they directly impact your trading capital.

| Aspect | Details |

|---|---|

| Minimum Deposit | While there isn’t a minimum deposit specifically for the Global FX platform, Questrade may have minimum deposit requirements for specific account types. It’s best to check their website for the most up-to-date information. |

| Fees | Questrade charges commissions and spreads on FX trades. These vary depending on the currency pair and the volume traded. Be sure to thoroughly review their fee schedule before trading. |

Verification Process and Required Documents

Think of the verification process as Questrade’s way of ensuring you’re not a mischievous robot trying to steal their money (or a less mischievous human trying to do the same). It’s a necessary evil for security and regulatory compliance.To open a Questrade account in Canada, you’ll need to provide various documents for verification purposes. These typically include:

- Government-issued photo identification (passport or driver’s license).

- Proof of address (utility bill, bank statement, or other official document).

- Possibly additional documentation depending on your circumstances (e.g., proof of income).

The verification process might take a few business days. Don’t panic if you don’t see instant results; Rome wasn’t built in a day, and neither is a fully verified Questrade account.

Trading Tools and Resources

Navigating the world of foreign exchange can feel like trying to herd cats while riding a unicycle – chaotic and potentially hilarious. But fear not, aspiring forex traders! Questrade’s global FX platform, while not exactly a fluffy kitten, offers a surprisingly robust set of tools and resources to help you avoid a spectacular crash and burn. Let’s explore how these tools can help beginners chart a course to (hopefully) profitable waters.

Understanding the tools available is crucial for successful trading. A well-equipped trader is a happy trader (and a potentially richer one!). This section will dissect Questrade’s offerings and compare them to other beginner-friendly Canadian brokerages, highlighting their strengths and weaknesses. We’ll also explore key indicators and research tools to help you make informed decisions – because guess what?

Throwing darts at a board is less effective than using actual market analysis.

So, Questrade’s global FX platform for Canadian newbies? It’s a bit like trying to bench press a small car – maybe not the best starting point. You need a solid foundation first, much like finding the best strength training program before attempting Olympic lifts. Therefore, for FX beginners, a simpler, less overwhelming platform might be a wiser initial choice before tackling Questrade’s more advanced features.

Charting Tools Comparison

Choosing the right charting tools is like picking the right weapon for a battle – the wrong choice can leave you vulnerable. This table compares Questrade’s charting capabilities to those of other popular Canadian brokerages for beginners, focusing on features relevant to novice traders. Note that features and specific offerings can change, so always check the brokerage’s website for the most up-to-date information.

| Feature | Questrade | Interactive Brokers (Canada) | TD Ameritrade |

|---|---|---|---|

| Chart Types (Candlestick, Line, Bar, etc.) | Offers a standard range of popular chart types, easily customizable. | Provides a wider variety of chart types, including some more advanced options. | Similar to Questrade, with a good selection of customizable chart types. |

| Technical Indicators | Includes a solid selection of built-in technical indicators, sufficient for beginners. | Offers a significantly larger library of technical indicators, catering to more experienced traders as well. | Provides a good selection, comparable to Questrade, with easy access and customization. |

| Drawing Tools | Provides standard drawing tools (trend lines, Fibonacci retracements, etc.) | Offers a more extensive set of drawing tools, including advanced geometrical shapes and annotations. | Offers a similar range of drawing tools to Questrade, user-friendly for beginners. |

| Customization Options | Allows for reasonable customization of chart appearance and indicators. | Highly customizable, allowing for extensive personalization of charts. | Offers good customization options, allowing for adjustments to suit individual preferences. |

Key Trading Indicators and Tools

Technical indicators are like your trusty sidekick in the forex world – they help you decipher the market’s cryptic messages. Understanding and applying these indicators is crucial for making informed trading decisions, even as a beginner. Remember, even seasoned traders rely on these tools to help them navigate the market’s volatility.

- Moving Averages (MA): MAs smooth out price fluctuations, revealing underlying trends. Beginners can use simple moving averages (SMA) to identify potential support and resistance levels. For example, a 50-day SMA crossing above a 200-day SMA might signal a bullish trend.

- Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. A reading above 70 might suggest an asset is overbought, while a reading below 30 might suggest it’s oversold – potential signals for a price reversal.

- MACD (Moving Average Convergence Divergence): The MACD identifies momentum changes by comparing two moving averages. Crossovers of the MACD line above its signal line can indicate a bullish trend, while crossovers below can suggest a bearish trend. Beginners can use this to confirm trends suggested by other indicators.

Research and Analysis Tools

Before you dive headfirst into the forex market, thorough research is your life raft. Questrade’s platform provides various tools to help you analyze market trends and make informed decisions. Remember, informed decisions are less likely to result in regretful trading experiences.

- Economic Calendar: Stay informed about upcoming economic events (like interest rate announcements or employment reports) that can significantly impact currency prices. Understanding the potential impact of these events is crucial for anticipating market movements.

- News and Market Commentary: Access market news and analysis to understand the factors driving currency fluctuations. This can provide valuable context for your technical analysis and help you anticipate potential market shifts.

- Currency Charts and Historical Data: Analyze historical currency price movements to identify patterns and trends. This helps you understand the typical behavior of specific currency pairs and make more informed predictions about future price movements. For example, observing historical price action around significant support and resistance levels can help you anticipate potential price reactions.

Risks and Considerations for Beginners

So, you’re thinking of diving into the thrilling world of global FX trading? Buckle up, buttercup, because while the potential rewards are enticing (think sipping margaritas on a beach in Bali, funded by your savvy trading), the risks are equally significant. Let’s not sugarcoat it: losing money is a very real possibility, especially for beginners. Understanding these risks is crucial before you even think about clicking that “buy” button.Foreign exchange trading, at its core, is a game of predicting price movements.

Get it right, and you’re golden. Get it wrong, and… well, let’s just say your Bali trip might have to wait. The market is influenced by a chaotic cocktail of economic indicators, geopolitical events, and the unpredictable whims of global traders. This volatility can lead to significant losses, even if you’re following seemingly sound strategies.

Potential Losses in Foreign Exchange Trading

The potential for losses in foreign exchange trading is substantial, and beginners are particularly vulnerable. The leverage offered by many platforms can magnify both profits and losses. A small, seemingly insignificant movement against your position can quickly wipe out your initial investment. It’s not uncommon for inexperienced traders to lose more than they initially invested.

- Leverage Risk: Leverage allows you to control a larger position with a smaller investment. While this amplifies potential profits, it also dramatically increases potential losses. A small price movement against your leveraged position can result in significant losses, potentially exceeding your initial investment.

- Market Volatility Risk: FX markets are notoriously volatile. Sudden and unexpected price swings, triggered by news events or economic data releases, can quickly lead to substantial losses. Beginners often lack the experience to navigate these turbulent waters.

- Liquidity Risk: While major currency pairs are generally highly liquid, less-traded pairs can be difficult to exit quickly if the market moves against you. This can lead to forced liquidation at unfavorable prices and larger losses.

- Geopolitical Risk: Global political events, such as elections or international conflicts, can significantly impact currency values. These events are often unpredictable, making it difficult to accurately assess the risk.

- Lack of Experience Risk: Beginners often lack the knowledge and experience to effectively manage risk and make informed trading decisions. This inexperience can lead to impulsive trades and significant losses.

Risk Management Strategies for Beginners

Effective risk management is not just a good idea; it’s essential for survival in the FX market, particularly for beginners. Think of it as your financial parachute. Without it, a sudden market downturn could send you plummeting.

- Start Small: Begin with a small trading account and only risk a small percentage of your capital on each trade (e.g., 1-2%). This limits your potential losses and allows you to gain experience without risking significant amounts of money.

- Use Stop-Loss Orders: Stop-loss orders automatically close your position when the price reaches a predetermined level, limiting your potential losses. This is a crucial risk management tool for beginners.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Spread your investments across different currency pairs to reduce the impact of any single adverse market movement.

- Develop a Trading Plan: Before you start trading, create a detailed trading plan that Artikels your goals, strategies, and risk tolerance. Stick to your plan and avoid impulsive decisions.

- Practice with a Demo Account: Most brokers offer demo accounts that allow you to practice trading with virtual money. This is a risk-free way to gain experience and test your strategies before risking real capital.

Regulatory Environment and Beginner Protection in Canada

In Canada, the regulatory landscape for FX trading is designed to protect investors, including beginners. The Investment Industry Regulatory Organization of Canada (IIROC) and provincial securities commissions oversee the activities of registered dealers, ensuring compliance with regulations designed to maintain fair and orderly markets. While regulation can’t eliminate all risks, it helps create a more transparent and trustworthy trading environment.

Choosing a regulated broker is paramount for beginners, providing a layer of security and recourse should any issues arise. Always verify that your broker is registered with the appropriate regulatory bodies before opening an account.

Customer Support and Accessibility: Is Questrade’s Global FX Platform Suitable For Beginners In Canada?

Navigating the world of foreign exchange can feel like trying to decipher ancient hieroglyphs, especially for beginners. Luckily, a responsive and accessible customer support system can be your Rosetta Stone, translating the jargon and guiding you through the process. Let’s see how Questrade measures up in this crucial area.Questrade offers a variety of ways to get help, catering to different communication styles and technological preferences.

Their support channels aim to provide assistance whenever a novice trader needs it, whether it’s a simple question or a full-blown crisis (hopefully not!).

Customer Support Channels, Is Questrade’s global FX platform suitable for beginners in Canada?

The following table summarizes Questrade’s customer support channels. While the availability of each channel might vary depending on your specific account type and the time of day, Questrade generally aims for comprehensive coverage.

| Channel | Description | Typical Response Time (Estimate) |

|---|---|---|

| Phone | Direct phone support with live agents. | Varies, but generally aims for quick resolution during business hours. Expect longer wait times during peak periods. |

| Submit a detailed query via email. | Typically within 24-48 hours, although complex issues might take longer. | |

| Online Chat | Real-time chat with a support agent. | Generally immediate or near-immediate response during business hours. |

Accessibility for Beginners with Disabilities

Questrade’s commitment to accessibility for traders with disabilities is a mixed bag. While their website offers some accessibility features, such as keyboard navigation and screen reader compatibility, the extent of these features and their effectiveness vary. For example, while alt text might be present for some images, it might be missing or insufficient for others, hindering the experience for visually impaired users.

Furthermore, the level of detail in providing accessible information regarding trading tools and resources for those with cognitive disabilities could be significantly improved. More comprehensive support materials in various formats (e.g., audio descriptions, large print) would be beneficial. Independent accessibility audits of their platform would enhance transparency and help identify areas needing improvement.

Real User Experiences

One user, a new investor with visual impairment, reported difficulty navigating certain sections of the platform using a screen reader, highlighting the need for more robust accessibility features. Conversely, another beginner trader praised the responsiveness of the live chat support, describing their experience as helpful and efficient in resolving a query about funding their account. These contrasting experiences underscore the importance of continuous improvement in both accessibility and customer service responsiveness.

A consistent positive experience across all channels is crucial for fostering confidence and trust, particularly among beginners who may be more vulnerable to frustration and uncertainty.

Final Conclusion

So, is Questrade’s global FX platform suitable for Canadian beginners? The answer, like the forex market itself, is nuanced. While Questrade offers a relatively user-friendly platform with educational resources, the inherent risks of FX trading remain significant. Beginners need to approach this with a healthy dose of caution, a solid understanding of risk management, and a commitment to learning.

If you’re prepared for the learning curve and the potential for losses, Questrade can be a viable entry point. However, thorough research and perhaps even a trial run with a smaller amount are strongly recommended before jumping headfirst into the deep end.