Choosing the best forex trading app for Canadians: Embark on a thrilling adventure through the wild world of online forex trading! Forget stuffy spreadsheets and cryptic charts; we’re diving headfirst into the exciting realm of apps designed to make your Canadian dollar sing. This isn’t your grandpappy’s brokerage – we’re talking sleek interfaces, lightning-fast transactions, and enough features to make your head spin (in a good way, of course!).

Get ready to navigate the regulatory waters, compare fees like a pro, and find the perfect app to match your trading style. Prepare for takeoff!

This guide will equip you with the knowledge to choose a forex trading app that fits your needs perfectly. We’ll cover everything from regulatory compliance and essential features to security, customer support, and the all-important question of fees. We’ll help you avoid hidden costs and navigate the complexities of the Canadian forex market, ensuring a smooth and profitable trading experience.

So buckle up, buttercup, it’s time to find your perfect trading partner.

Regulatory Compliance for Canadian Forex Traders

Navigating the world of forex trading in Canada requires a healthy dose of caution and a thorough understanding of the regulatory landscape. Unlike the Wild West of some unregulated markets, Canada boasts a fairly robust system designed to protect investors and maintain market integrity. Let’s delve into the specifics, because nobody wants their hard-earned loonies vanishing into thin air due to a shady broker.

The Regulatory Landscape of Forex Trading in Canada

The primary regulatory body overseeing forex trading in Canada is the Investment Industry Regulatory Organization of Canada (IIROC). Think of IIROC as the sheriff of the forex trading town, ensuring brokers play fair and adhere to strict rules. However, the regulatory picture isn’t entirely black and white. Some forex brokers operating in Canada might fall under the purview of provincial securities commissions, depending on their specific business model and the services offered.

This can add a layer of complexity, highlighting the need for due diligence before choosing a platform. It’s like choosing between a trusted sheriff and a slightly less predictable but still lawful town marshal – both protect you, but one might be more familiar to you.

Licensing Requirements for Forex Brokers Operating in Canada

To operate legally in Canada, forex brokers must obtain the necessary licenses from the relevant regulatory bodies. This isn’t a simple “fill out this form” kind of process. It involves rigorous checks on the broker’s financial stability, operational procedures, and overall compliance with Canadian securities laws. These requirements are designed to weed out the less reputable players and protect Canadian investors from potential scams.

Think of it as a tough but necessary initiation rite for any forex broker wanting to operate within Canada’s financial ecosystem. The licensing process includes background checks, capital adequacy requirements, and ongoing monitoring of the broker’s activities. Failure to comply can result in hefty fines or even a complete shutdown of operations.

Comparison of Regulatory Bodies Overseeing Forex Trading in Canada

While IIROC is the main player, provincial securities commissions also play a significant role. The differences in oversight can be subtle, but understanding them is crucial. IIROC generally focuses on the regulation of investment dealers and trading activities, while provincial commissions might have a broader mandate encompassing other financial products and services. It’s a bit like having a specialized team of financial experts working in tandem to ensure everything runs smoothly and fairly.

The overlap in regulatory responsibilities ensures that brokers are held accountable to a high standard, no matter where they operate within the country. This redundancy also serves as a safeguard against regulatory gaps, providing multiple layers of protection for Canadian investors.

Comparison of Regulated Forex Brokers in Canada

Choosing the right broker can feel like navigating a minefield, but understanding the regulatory landscape can help you steer clear of potential problems. Below is a simplified comparison of some features offered byhypothetical* regulated forex brokers in Canada. Remember, always conduct thorough research before selecting any broker. This table should be considered for illustrative purposes only and does not constitute financial advice.

| Broker Name | Minimum Deposit | Spreads | Regulation |

|---|---|---|---|

| Example Broker A | $250 | Variable, starting at 1.5 pips | IIROC |

| Example Broker B | $500 | Fixed, 2 pips | IIROC & Ontario Securities Commission |

| Example Broker C | $1000 | Variable, starting at 1 pip | IIROC |

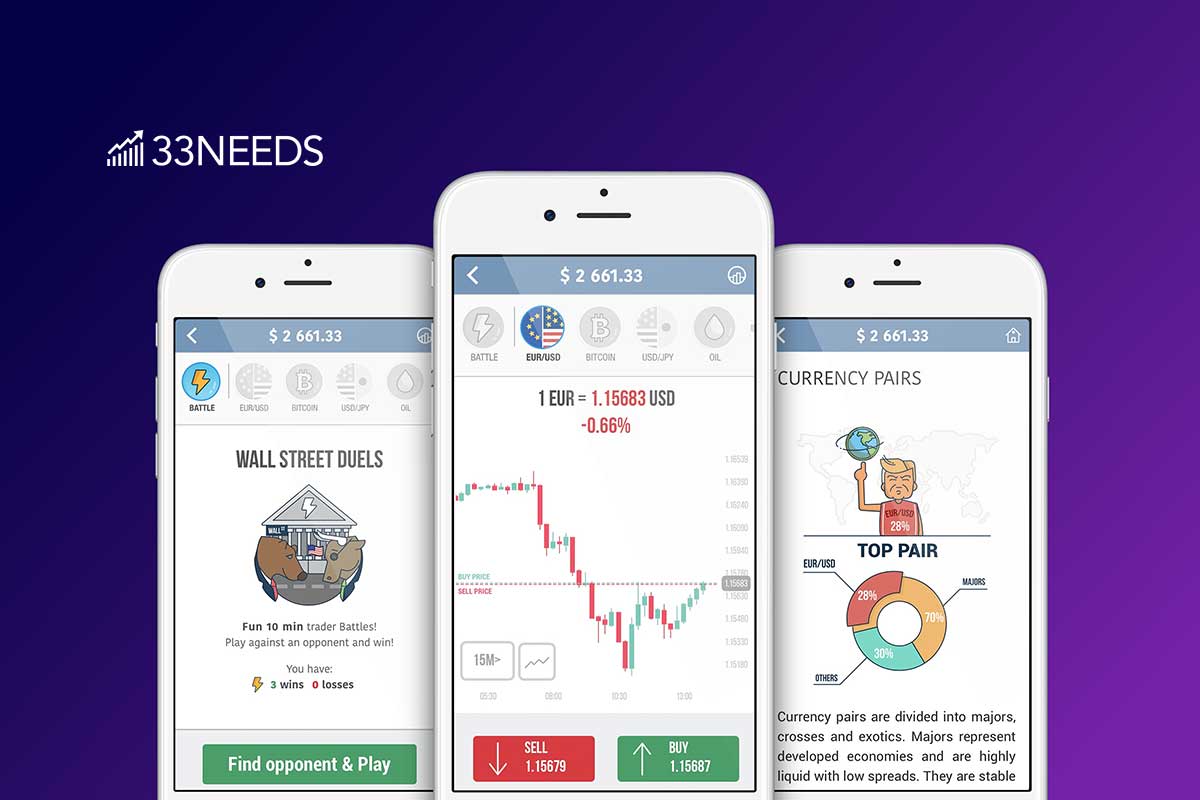

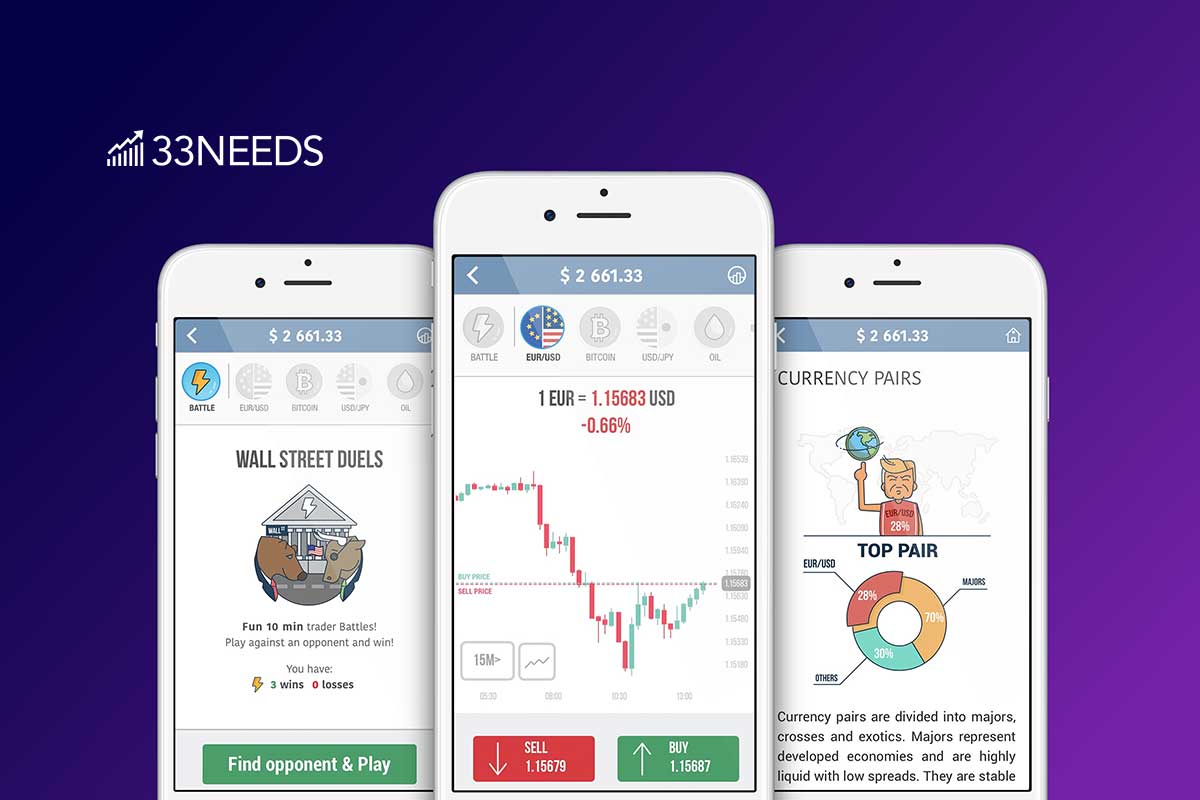

Key Features of Forex Trading Apps: Choosing The Best Forex Trading App For Canadians

Choosing the right forex trading app can feel like navigating a minefield of jargon and confusing features. But fear not, fellow Canadian trader! A well-designed app can be your secret weapon in the exciting (and sometimes terrifying) world of currency exchange. Let’s explore the essential elements that will make your trading experience smoother than a freshly-poured Tim Hortons double-double.A user-friendly forex trading app should be intuitive, efficient, and, dare we say, even enjoyable to use.

Think of it as your personalized trading cockpit – it needs to be comfortable, equipped with all the necessary tools, and easy to navigate, even during those high-pressure moments when the market is acting like a caffeinated squirrel.

Choosing the best forex trading app for Canadians requires careful consideration, but let’s be honest, sometimes the most important decision of the day is what delicious halal meal to have. Need inspiration? Check out halal culinary for some seriously mouthwatering ideas. Then, fuelled by deliciousness, you can return to conquering the forex markets with your newly chosen app!

Charting Tools and Technical Indicators

Charting tools are the bread and butter of technical analysis. A good forex app will offer a variety of chart types (candlestick, bar, line) and allow you to customize them with different timeframes (from 1-minute to monthly charts) and indicators. Technical indicators, like moving averages, RSI, and MACD, help traders identify potential trends and trading opportunities. Imagine these indicators as your trusty sidekicks, whispering helpful insights into your ear as you analyze market movements.

Picking the perfect forex trading app as a Canadian? It’s a wild goose chase without understanding the market’s quirks! Before you dive in, learn how global exchange rates – the very heart of forex – can make or break your trades by checking out this insightful article: Understanding the impact of global exchange rates on forex trading.

Armed with this knowledge, choosing the right app for your Canadian forex journey will be a breeze (or at least, less of a rollercoaster).

Without robust charting capabilities, you’re essentially trading blindfolded – not a recipe for success.

Real-Time Market Data and News Feeds

Real-time market data is crucial for making informed decisions. Delays in data can cost you money, potentially turning a profitable trade into a loss. A reliable app will provide up-to-the-second information on currency pairs, allowing you to react quickly to market changes. Integrated news feeds, providing insights into global events impacting forex markets, are an invaluable bonus. Think of it as having a 24/7 news channel dedicated solely to the economic events affecting your trades.

This real-time information is your competitive edge in the fast-paced world of forex.

Security Features

Security is paramount in the world of online trading. You wouldn’t leave your wallet lying around unattended, and you shouldn’t treat your trading account any differently. Two-factor authentication (2FA) is a must-have feature. This adds an extra layer of security, requiring a code from your phone or another device in addition to your password. Look for apps that also offer encryption of your data and robust security protocols to protect your hard-earned loonies from prying eyes.

Picking the perfect forex trading app as a Canadian can feel like choosing a maple syrup – so many options! But even the best app is only half the battle; you also need a solid strategy. Understanding the role of reliable signals is key, and you can learn more about that by checking out this article on Reliable forex trading signals and their impact on profitability.

Ultimately, the right app combined with smart signal analysis is your ticket to forex fortune (or at least, a slightly less empty wallet).

Some apps even offer features like account alerts, notifying you of suspicious activity. Consider these security features as your digital bodyguards, ensuring your trading account remains safe and sound.

Educational Resources and Customer Support

Choosing a forex trading app is like choosing a financial sherpa to guide you through the treacherous, yet potentially lucrative, mountains of the forex market. A good sherpa provides not only the tools but also the knowledge and support to ensure a safe and (hopefully) profitable climb. This means that the app you choose should offer more than just charts and graphs; it should offer comprehensive educational resources and readily available, effective customer support.A truly reputable forex trading app understands that not everyone starts as a seasoned trading guru.

Therefore, access to high-quality educational materials is paramount. These resources shouldn’t just be a dusty old manual; they should be engaging, up-to-date, and tailored to different skill levels. Imagine a well-stocked library dedicated to forex trading, with beginner guides, advanced strategies, and even webinars presented by experienced traders. This comprehensive approach empowers traders to learn at their own pace and confidently navigate the complexities of the market.

Types of Educational Resources Offered by Reputable Forex Trading Apps

Reputable forex trading apps typically provide a diverse range of educational resources. These can include video tutorials explaining fundamental concepts, interactive lessons covering technical analysis, eBooks detailing trading strategies, and even access to simulated trading environments where users can practice without risking real money. Some apps even offer regular webinars or live Q&A sessions with financial experts, allowing for direct interaction and personalized guidance.

Think of it as having a personal forex tutor available 24/7, albeit virtually. This layered approach to education ensures that traders of all levels can find valuable learning materials relevant to their needs and experience.

Picking the perfect forex trading app as a Canadian? It’s a wild goose chase without understanding spreads! Before you dive in, check out this Comprehensive guide to forex trading spreads and how to minimize them to avoid getting your feathers ruffled. Knowing how to minimize spreads is key to choosing an app that won’t bleed your profits dry, eh?

Importance of Accessible and Responsive Customer Support Channels

Customer support is the lifeline of any successful forex trading app. When things go wrong (and in trading, they sometimes do!), you need immediate and effective assistance. Imagine being locked out of your account during a volatile market swing – the stress would be immense. This is where readily available and responsive customer support becomes crucial. A prompt and helpful response can make all the difference between a minor setback and a major financial loss.

It’s the difference between feeling supported and feeling utterly abandoned in a sea of complex financial jargon.

Examples of Customer Support Channels

Effective customer support utilizes a multi-channel approach. This typically includes email support for non-urgent inquiries, a live chat feature for immediate assistance with pressing issues, and, ideally, telephone support for complex problems requiring a more personal touch. Some apps may even integrate a comprehensive FAQ section or a knowledge base to address common queries quickly. The aim is to offer multiple avenues for seeking help, ensuring that users can access assistance through their preferred method.

Ideal Customer Support Response Times and Effectiveness

The ideal response time for live chat support is within minutes, while email support should aim for a response within 24 hours. Telephone support response times should ideally be near-instantaneous, although wait times may vary depending on call volume. Effectiveness goes beyond just speed; it encompasses the knowledge and helpfulness of the support agents. A truly effective support team should be able to understand the user’s problem, offer clear and concise solutions, and demonstrate empathy and understanding throughout the process.

Imagine a support agent who not only solves your problem but also leaves you feeling reassured and confident in the app’s reliability. That’s the gold standard.

Security and Data Protection

Your hard-earned loonies deserve a fortress, not a flimsy shack, when it comes to online forex trading. Choosing a secure forex trading app isn’t just about protecting your profits; it’s about safeguarding your personal and financial information from the digital wolves lurking online. Think of it as choosing between a Swiss bank vault and a cardboard box – you wouldn’t leave your life savings in the latter, would you?Data encryption and robust security protocols are the cornerstones of a trustworthy forex trading app.

These act as the digital equivalent of reinforced steel and laser grids, preventing unauthorized access to your sensitive data. Without these, your trading activity, personal details, and financial information become vulnerable to cybercriminals, potentially leading to identity theft or financial loss. Imagine the headache of dealing with a data breach – not fun.

Identifying Secure Forex Trading Apps

Identifying a truly secure forex trading app requires a discerning eye. Look for apps that boast transparent security practices and readily available information about their security measures. A reputable broker will not shy away from detailing their security protocols. They should clearly Artikel how they protect user data, including the types of encryption used and the security certifications they hold.

A lack of transparency should raise a red flag bigger than a Canadian Mountie’s hat.

Security Features to Look For in a Forex Trading App

Choosing a secure forex trading app involves understanding what security features to prioritize. These features act as your digital bodyguards, protecting your account from unwelcome intrusions.

- Two-Factor Authentication (2FA): This adds an extra layer of security, requiring a second verification method (like a code sent to your phone) beyond your password. Think of it as a double-locked door for your account.

- Data Encryption (SSL/TLS): This scrambles your data during transmission, making it unreadable to anyone who intercepts it. It’s like sending your financial information in a coded message only your broker can decipher.

- Regular Security Audits: Reputable brokers undergo regular independent security audits to identify and address vulnerabilities. This is like having a professional security team regularly inspecting your fortress for weaknesses.

- Firewall Protection: Firewalls act as digital bouncers, preventing unauthorized access to your account from malicious sources. They’re like the guards at the gate, keeping out the unwanted guests.

- Secure Storage of Data: Brokers should store your data on secure servers with robust physical and digital security measures. Think of this as keeping your valuables in a high-security vault, protected by multiple layers of security.

Broker Data Protection Measures

Reputable forex brokers implement a range of measures to protect user data from unauthorized access. These range from employing advanced encryption techniques and multi-layered security systems to adhering to strict regulatory compliance standards. They also invest in robust infrastructure and employ security experts to monitor for threats and respond to potential breaches. They understand that their reputation (and your money) depends on it.

Picking the perfect forex trading app in Canada can feel like searching for the Holy Grail of finance. But once you’ve got your app, don’t stop at basic charts! Level up your game with advanced strategies by checking out this guide on Advanced forex trading strategies using TradingView indicators in Canada to truly master the market.

Then, you can confidently choose the app that best suits your now supercharged trading style!

Think of it as the broker having a dedicated team of digital ninjas guarding your data around the clock.

Payment Methods and Withdrawal Options

Choosing the right payment method for your forex trading adventures in Canada is as crucial as picking the perfect toque for a snowy day – you want something reliable, efficient, and ideally, won’t leave you shivering with excessive fees. Let’s dive into the world of Canadian forex payment options, navigating the sometimes-murky waters of processing times and fees.The variety of payment methods available to Canadian forex traders reflects the country’s diverse financial landscape.

Understanding the nuances of each method is key to a smooth and stress-free trading experience. Speed and cost are major factors to consider, but security should always be your top priority.

Picking the perfect forex trading app for Canadians can feel like navigating a minefield of fees! One major hurdle with some platforms, like Questrade, is their currency conversion charges, but thankfully, you can dodge those bullets by learning how to avoid them – check out this guide on Questrade currency conversion fees and how to avoid them for some savvy strategies.

Then, armed with this knowledge, you can confidently choose the app that’s right for your Canadian loonie-loving trading heart.

Common Payment Methods for Canadian Forex Brokers

Canadian forex brokers typically offer a range of payment options catering to different preferences and needs. These commonly include bank wire transfers, credit/debit cards (Visa, Mastercard), e-wallets (such as PayPal, Skrill, Neteller), and Interac Online. The availability of specific methods may vary depending on the broker.

Processing Times and Fees

Processing times and fees associated with each payment method differ significantly. Bank wire transfers, while secure, can take several business days to process and often incur higher fees. Credit/debit card transactions are generally faster, usually completing within a few days, but may involve smaller transaction fees or percentage-based charges. E-wallets provide swift transactions, often instant for deposits and within 1-3 business days for withdrawals, with fees varying depending on the provider and transaction amount.

Interac Online, a popular Canadian online payment system, offers relatively fast processing times and often lower fees compared to wire transfers. It’s crucial to check the specific fees and processing times with your chosen broker, as these can fluctuate.

Reliable and Secure Withdrawal Options

Security should be paramount when choosing a withdrawal method. Bank wire transfers, due to their regulated nature, offer a high level of security. E-wallets like Skrill and Neteller, while convenient, require robust security measures on the user’s end (strong passwords, two-factor authentication). Credit/debit card withdrawals are generally secure, provided you’re using a reputable broker with robust security protocols.

Always prioritize brokers with encryption and other security measures in place to protect your financial information.

Identity Verification for Withdrawals

Before you can bask in the glory of your forex winnings, most brokers require identity verification for withdrawals – a process designed to prevent fraud and maintain regulatory compliance. This typically involves providing identification documents such as a passport, driver’s license, and proof of address. Some brokers might also request additional documentation depending on the withdrawal amount or frequency.

This verification process is a standard security measure and is not meant to be a hassle; it’s simply a necessary step to ensure the safety and security of both the trader and the broker. Think of it as a digital handshake, confirming you are who you say you are.

Currency Pairs and Trading Instruments

Navigating the world of forex trading can feel like venturing into a bustling, multi-lingual marketplace. Understanding the currency pairs and the various instruments you can trade is crucial to success. Think of it as learning the local lingo before striking a deal – you wouldn’t try to buy a rug in Marrakech without knowing the price in Dirhams, would you?This section will demystify the common currency pairs available on Canadian forex trading apps and explain the different types of trading instruments, helping you choose the tools that best suit your trading style and risk tolerance.

We’ll also delve into the exciting world of leverage, explaining how it can amplify both your profits and your losses.

Commonly Traded Currency Pairs, Choosing the best forex trading app for Canadians

Canadian forex traders will find a plethora of currency pairs to choose from, each offering unique opportunities and risks. The most popular pairs generally involve the Canadian dollar (CAD), but the global market offers many more.

| Currency Pair | Description | Volatility | Typical Trading Strategy |

|---|---|---|---|

| EUR/CAD | Euro vs. Canadian Dollar | Moderate | Trend following, ranging |

| USD/CAD | US Dollar vs. Canadian Dollar (Loonie) | Moderate to High | Scalping, day trading, swing trading |

| GBP/CAD | British Pound vs. Canadian Dollar | Moderate to High | News trading, fundamental analysis |

| AUD/CAD | Australian Dollar vs. Canadian Dollar | Moderate | Carry trades, pairs trading |

| JPY/CAD | Japanese Yen vs. Canadian Dollar | Low to Moderate | Long-term investing, hedging |

Trading Instruments: CFDs and Forex Options

Forex trading isn’t just about buying and selling currencies directly. Sophisticated instruments like Contracts for Difference (CFDs) and forex options offer additional layers of trading strategies.CFDs allow you to speculate on the price movement of an asset without actually owning it. Imagine it as betting on the price difference between the entry and exit points of a trade.

Forex options, on the other hand, give you the

- right*, but not the

- obligation*, to buy or sell a currency pair at a specific price on or before a certain date. This provides a degree of risk management not always present in direct forex trading.

Leverage Options

Leverage is the ability to control a larger position with a smaller amount of capital. It’s like using a financial lever to amplify your trading power. However, remember that leverage is a double-edged sword; while it can magnify profits, it can also dramatically increase losses. Different brokers and platforms offer varying leverage ratios, so it’s crucial to understand the implications before employing it.

For example, a 1:100 leverage means you can control $100,000 worth of currency with only $1,000 of your own money. While this can be exciting, a small price movement against your position can lead to significant losses. Always trade responsibly and within your risk tolerance.

Conclusion

So, there you have it – your passport to the exciting world of Canadian forex trading apps! Remember, the perfect app isn’t a one-size-fits-all deal. It’s about finding the one that aligns with your trading style, risk tolerance, and, let’s be honest, your aesthetic preferences. Don’t be afraid to explore, compare, and test the waters (metaphorically, of course – unless you’re into underwater trading, then… go for it!).

Happy trading, and may your profits be plentiful!