Choosing the Right Forex Broker in Canada Based on Trading Style: Forget the Wild West of online trading! Navigating the Canadian forex market requires more than just a lucky horseshoe and a prayer. This isn’t about picking a broker based on a catchy jingle or a ridiculously handsome spokesperson (though those are nice bonuses, let’s be honest).

This is about finding the perfect trading partner, a financial soulmate if you will, one whose features and fees align flawlessly with your unique trading style. Whether you’re a lightning-fast scalper, a patient swing trader, or somewhere in between, finding the right fit is crucial for maximizing your profits and minimizing your stress (and nobody wants stressed-out forex trading!).

This guide will help you unearth your ideal Canadian forex broker, turning your trading journey from a chaotic rollercoaster into a smooth, profitable cruise.

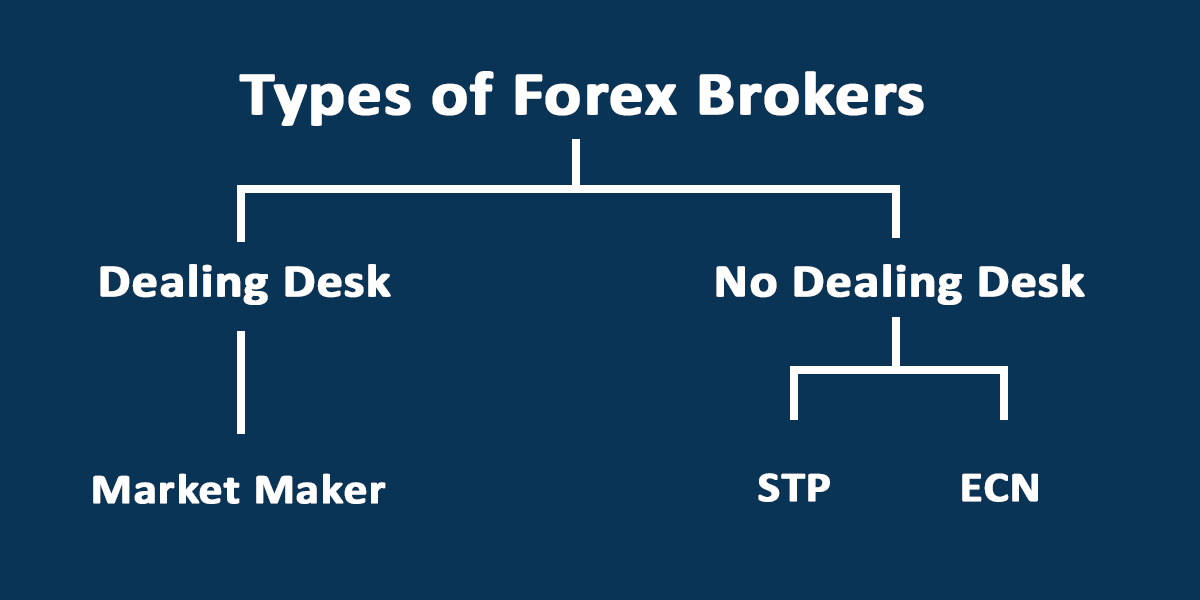

We’ll delve into the regulatory landscape of Canadian forex, exploring the licensing requirements and the importance of choosing a regulated broker. Then, we’ll match your trading style – be it scalping, day trading, swing trading, or long-term investing – with the right broker type (ECN, STP, Market Maker), platform (MetaTrader 4, 5, or proprietary), and account type. We’ll also dissect the often-confusing world of fees, commissions, and spreads, helping you understand how they impact your bottom line.

Finally, we’ll arm you with the knowledge to assess customer support, educational resources, and broker reputation, ensuring you make an informed decision and avoid any trading catastrophes (like accidentally wearing mismatched socks to your virtual trading desk).

Understanding Canadian Forex Regulations and Broker Licensing

Navigating the world of Forex trading in Canada requires a healthy dose of caution, much like navigating a moose-filled highway at night. To avoid becoming roadkill in the financial jungle, understanding Canadian regulations is paramount. This section will illuminate the regulatory landscape and help you choose a broker that won’t leave you with a wallet lighter than a feather.Canadian forex brokers are primarily overseen by two main regulatory bodies: the Investment Industry Regulatory Organization of Canada (IIROC) and the Autorité des marchés financiers (AMF) in Quebec.

These watchdogs ensure brokers play fair, preventing scams and protecting your hard-earned loonies. Choosing a regulated broker is not merely a suggestion; it’s a vital step in safeguarding your investments and ensuring a smoother trading experience. Think of it as wearing a helmet while riding a unicycle – highly recommended, even if it seems a bit over-the-top.

Regulatory Bodies Overseeing Forex Brokers in Canada

The primary regulatory bodies in Canada are the IIROC and the AMF. IIROC is a national self-regulatory organization that oversees investment dealers and advisors across Canada (excluding Quebec). The AMF, on the other hand, regulates the securities industry in Quebec. While their jurisdictions differ, both organizations share a common goal: to maintain the integrity and stability of the Canadian financial markets.

They achieve this through stringent licensing requirements, ongoing monitoring, and enforcement actions against non-compliant brokers. Understanding the specific regulations of each body is crucial, especially if you reside in Quebec.

Licensing Requirements for Forex Brokers in Canada

To operate legally in Canada, forex brokers must meet specific licensing requirements set by either IIROC or the AMF, depending on their province of operation. These requirements are quite rigorous, involving background checks, financial audits, and demonstrating sufficient capital reserves. The process is designed to weed out fly-by-night operators and ensure that only financially sound and reputable firms are allowed to offer their services to Canadian traders.

Picking the perfect Canadian forex broker is like choosing a superhero – it depends on your style! Are you a scalper needing lightning-fast execution, or a long-term investor prioritizing low fees? To help you decide, check out this comparison of Questrade forex trading fees and commissions compared to other platforms to see if they fit your budget.

Ultimately, the best broker is the one that aligns with your trading strategy and keeps your wallet happy.

Think of it as a rigorous boot camp for brokers, designed to ensure only the fittest (and most honest) survive.

Importance of Choosing a Regulated Broker for Canadian Traders

Choosing a regulated broker is not optional; it’s a non-negotiable aspect of responsible forex trading in Canada. Regulated brokers are subject to regular audits, ensuring transparency and accountability. They are also required to maintain client funds in segregated accounts, protecting your money from the broker’s operational risks. In the unlikely event of broker insolvency, regulatory protection can help you recover some or all of your funds.

Picking the perfect Forex broker in Canada? It’s a bit like choosing the right spice for your dish – you need the right blend for your trading style. Need a break from charts? Fuel up with some delicious halal culinary delights before diving back into those spreads and pips! Remember, a well-chosen broker is just as crucial to your forex success as the right ingredients are to a perfect meal.

In short, choosing a regulated broker is like having a financial safety net – it might not always be needed, but when it is, you’ll be incredibly grateful for its presence.

Comparison of Key Features of Different Regulatory Bodies in Canada

| Regulatory Body | Jurisdiction | Licensing Requirements | Client Protection Measures |

|---|---|---|---|

| IIROC (Investment Industry Regulatory Organization of Canada) | All provinces except Quebec | Stringent licensing process, including background checks, financial audits, and capital adequacy requirements. | Segregated client accounts, investor compensation funds (depending on the broker’s membership). |

| AMF (Autorité des marchés financiers) | Quebec | Similar to IIROC, with specific requirements tailored to Quebec’s regulatory framework. | Segregated client accounts, investor compensation funds (depending on the broker’s membership). |

Matching Trading Style to Broker Features

Choosing the right Forex broker in Canada isn’t just about finding a pretty website; it’s about finding a perfect dance partner for your trading style. Just like a tango requires a different approach than a waltz, your trading strategy needs a broker that complements it, not clashes. Get the wrong partner, and you’ll be tripping over your feet (and losing money!)Different broker types offer vastly different features, impacting your trading experience and profitability.

Let’s break down the key players and find the best match for your trading style.

Picking the perfect Forex broker in Canada is like choosing a superhero sidekick – it’s gotta match your style! Before you leap into the wild world of currency trading, however, make sure you’ve got the right training; check out this beginner’s guide Forex Trading Education Resources for Canadians: Beginners Guide to avoid becoming a villain’s victim.

Then, armed with knowledge, you can find that broker that’ll help you conquer the forex markets!

Broker Types and Their Suitability for Different Trading Styles

ECN (Electronic Communication Network) brokers act as a middleman, connecting your trades directly to other market participants. This generally means tighter spreads, but often involves commissions. STP (Straight Through Processing) brokers are similar, routing your orders to liquidity providers, also usually resulting in tighter spreads and potentially commissions. Market makers, on the other hand, act as the counterparty to your trades.

They offer potentially wider spreads, but often no commissions.Scalpers, those lightning-fast traders who profit from tiny price movements, need the speed and low latency of ECN or STP brokers. Their high-frequency trading requires minimal slippage and the best execution speeds available. Day traders, focusing on intraday price swings, benefit from similar characteristics. Swing traders, who hold positions for days or weeks, are less concerned about microsecond latency, making STP or even a well-regulated market maker potentially suitable.

Long-term investors, holding positions for months or years, are the least sensitive to spread variations and can consider a wider range of broker types.

Impact of Commission Structures, Spreads, and Leverage on Trading Styles, Choosing the Right Forex Broker in Canada Based on Trading Style

Commission structures, spreads, and leverage are crucial considerations. Scalpers and day traders, making many trades, are highly sensitive to commissions and spreads. Even small differences can significantly impact their profitability. A low commission and tight spread ECN broker is ideal for them. Swing traders and long-term investors are less impacted by small spread variations but should still consider the overall cost of trading.Leverage, the ability to control a larger position with a smaller deposit, is a double-edged sword.

While it can magnify profits, it also magnifies losses. Scalpers and day traders might use moderate leverage to amplify their short-term gains, while swing traders and long-term investors generally prefer lower leverage to manage risk. It’s crucial to remember that excessive leverage can quickly lead to account liquidation.

High leverage is a double-edged sword; it can boost profits, but it can also sink your ship faster than you can say “margin call”!

Key Features to Prioritize Based on Trading Style

Choosing the right broker requires careful consideration of your trading style and risk tolerance. Here’s a quick guide to help you prioritize features:

- Scalpers: Ultra-low latency, tight spreads, ECN/STP execution, low commissions, advanced charting tools.

- Day Traders: Low latency, tight spreads, ECN/STP or a reputable market maker, charting tools, access to news and analysis.

- Swing Traders: Reasonable spreads, reliable execution, good charting and analysis tools, access to fundamental data.

- Long-Term Investors: Competitive spreads, reliable platform, research tools, strong customer support.

Remember, thorough research and careful consideration of your trading style are essential to finding the perfect Forex broker in Canada. Don’t just settle for the first flashy website you see; find a partner that will help you achieve your trading goals.

Evaluating Broker Platforms and Technology

Choosing the right Forex trading platform is like choosing the right car – you wouldn’t try to win a Formula 1 race in a minivan, would you? Your trading style dictates the features you need, and the platform is your trusty steed in this high-octane financial rodeo. A poorly chosen platform can lead to missed opportunities, frustrating delays, and even significant financial losses.

So buckle up, and let’s explore the options.

Trading Platform Comparison: MetaTrader 4, MetaTrader 5, and Proprietary Platforms

The Forex world offers a smorgasbord of trading platforms, each with its own strengths and quirks. MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are industry stalwarts, boasting extensive customization options and large communities of users. MT5, the newer sibling, offers enhanced charting capabilities and more advanced order types, making it appealing to more sophisticated traders. However, MT4 remains popular due to its simpler interface and vast library of readily available expert advisors (EAs).

Proprietary platforms, developed by individual brokers, often integrate unique features tailored to their specific offerings. These can be a double-edged sword: while offering bespoke functionalities, they might lack the widespread community support and third-party add-ons of MT4/MT5. The choice often depends on your trading style and comfort level with technology. A scalper might prefer the lightning-fast execution of a low-latency proprietary platform, while a swing trader might find the extensive charting tools of MT5 more beneficial.

Platform Stability, Speed, and User-Friendliness: Impact on Trading Styles

In the fast-paced world of Forex, platform stability is paramount. Imagine placing a crucial trade only to have your platform freeze at the most critical moment – a nightmare scenario for any trader. Speed is equally important, especially for scalpers who rely on executing trades within milliseconds. A sluggish platform can lead to slippage, where the actual execution price differs significantly from the intended price, eating into profits.

User-friendliness is also crucial; a complex, confusing interface can distract from the task at hand and lead to costly errors. Day traders, for example, need an intuitive platform that allows them to quickly monitor multiple markets and execute trades efficiently.

Charting Tools, Indicators, and Order Execution: A Platform Feature Showdown

The charting capabilities of a platform are crucial for technical analysis. Sophisticated traders might require advanced charting tools, multiple timeframes, and a wide range of technical indicators. MT5 generally edges out MT4 in this regard, offering more advanced charting options and a broader selection of built-in indicators. Proprietary platforms sometimes incorporate unique charting tools designed to cater to specific trading styles.

Order execution speed is another critical factor. Scalpers, for instance, need platforms with extremely fast order execution to capitalize on fleeting market opportunities. The reliability and accuracy of order fills vary across platforms, and it’s essential to research a broker’s execution quality before committing.

Picking the perfect Canadian Forex broker is like choosing a superhero sidekick – it needs to match your style! Do you prefer a high-flying, adrenaline-pumping approach, or a more methodical, steady-as-she-goes strategy? Before you leap into the exciting world of forex trading, though, you might want to check if your chosen path is even legal: Is it legal to trade forex in Canada as an international student using Questrade?

Once you’ve sorted the legal side, you can confidently focus on finding the broker that’s your perfect trading match.

Mobile Trading App Feature Comparison

| Broker | Platform Availability | Charting Capabilities | Order Execution |

|---|---|---|---|

| Example Broker A | MT4, MT5, Proprietary App | Advanced charting tools, multiple timeframes | Fast and reliable execution |

| Example Broker B | MT4, Proprietary App | Basic charting, limited indicators | Average execution speed |

| Example Broker C | MT5, WebTrader | Advanced charting, customizable layouts | Fast execution, low latency |

| Example Broker D | Proprietary App only | Good charting, limited indicator library | Reliable, but not the fastest |

Assessing Broker Account Types and Funding Options

Choosing the right Forex account and funding method is like picking the perfect pair of shoes for a marathon – the wrong choice can leave you limping! The good news is, Canadian Forex brokers offer a variety of options to suit different trading styles and risk tolerances. Let’s break down the key considerations.

Forex Account Types in Canada

Canadian Forex brokers typically offer a range of account types designed to cater to various trader needs and experience levels. These often include micro, mini, and standard accounts, each differing significantly in minimum deposit requirements, leverage levels, and overall trading conditions. Understanding these differences is crucial for aligning your account with your trading strategy and capital.

Comparison of Account Types: Minimum Deposits, Leverage, and Trading Conditions

The table below illustrates the typical differences between micro, mini, and standard accounts. Note that these are general examples, and specific requirements may vary across different brokers. Always check the broker’s website for the most up-to-date information.

| Account Type | Minimum Deposit (CAD) | Typical Leverage | Trading Conditions |

|---|---|---|---|

| Micro | $100 – $500 | 1:100 – 1:500 | Ideal for beginners, smaller lot sizes, lower risk |

| Mini | $500 – $2000 | 1:100 – 1:200 | Suitable for intermediate traders, medium lot sizes, moderate risk |

| Standard | $2000+ | 1:50 – 1:200 | Best for experienced traders, larger lot sizes, higher risk potential |

Funding Methods for Canadian Forex Traders

Canadian Forex traders have access to a variety of convenient and secure funding methods. Choosing the right method depends on your personal preferences and the speed of transactions you require.Choosing the appropriate method is critical for seamless and secure transactions. Some brokers may offer a wider selection of methods than others.

- Bank Transfers: A reliable and widely accepted method, though typically slower than others.

- Credit/Debit Cards: Fast and convenient, but may incur fees depending on the broker and your card provider.

- E-Wallets (e.g., PayPal, Skrill, Neteller): Offer quick transactions and often provide an extra layer of security, but may also have associated fees.

- Interac Online: A popular online payment system in Canada, offering a secure and convenient way to fund your trading account.

Broker Security Measures for Client Funds

Protecting your hard-earned money is paramount. Reputable Canadian Forex brokers employ various security measures to safeguard client funds, including:

- Segregated Accounts: Client funds are kept separate from the broker’s operating capital, minimizing the risk of loss in case of broker insolvency. This separation ensures client funds are protected and not mixed with the broker’s operational funds.

- SSL Encryption: Secure Socket Layer (SSL) encryption protects your personal and financial information during online transactions. This protects your sensitive data while transferring funds or accessing your account.

- Regulatory Compliance: Licensed and regulated brokers in Canada are subject to strict rules and oversight by regulatory bodies like the Investment Industry Regulatory Organization of Canada (IIROC), ensuring compliance with industry standards and protecting investor interests.

- Two-Factor Authentication (2FA): Many brokers offer 2FA, adding an extra layer of security to your account by requiring a second verification method beyond your password.

Examining Customer Support and Educational Resources: Choosing The Right Forex Broker In Canada Based On Trading Style

Choosing a Forex broker is like choosing a life partner – you need someone reliable, supportive, and ideally, someone who doesn’t leave you stranded in a blizzard of technical jargon. While profitability is the ultimate goal, the journey to forex success is significantly smoother with a broker that provides stellar customer support and readily available educational resources. Let’s dive into what makes a truly great support system in the often-chaotic world of currency trading.The quality of a broker’s customer service and educational materials directly impacts a trader’s success and overall trading experience.

Poor support can lead to missed opportunities, costly mistakes, and a general sense of frustration. Conversely, robust educational resources and responsive support can empower traders to make informed decisions, manage risks effectively, and ultimately, boost their trading performance. This is especially critical for Canadian traders navigating the unique regulatory landscape of the Canadian forex market.

Multilingual Support and Accessibility for Canadian Traders

The availability of multilingual support is crucial for Canadian traders, given the country’s diverse linguistic landscape. Imagine this: you’re facing a critical trading issue at 2 AM, and the only support available is in Mandarin. Not ideal, right? A broker offering support in both English and French is essential for ensuring all Canadian traders feel comfortable and supported.

Picking the perfect Canadian Forex broker is like choosing a dance partner – gotta find the right rhythm! Your trading style dictates the broker you need, so don’t just jump in with any old firm. Luckily, boost your knowledge with awesome webinars from brokers listed on this helpful resource: Top Forex Brokers in Canada Offering Educational Webinars.

Then, armed with that extra savvy, you can waltz right into profitable trades!

This extends beyond just language; it also includes accessibility features for traders with disabilities, ensuring inclusivity and equal access to support services. For example, a broker might offer screen reader compatibility for their platform and website, or provide written transcripts of webinars for those who prefer to read rather than listen. This demonstrates a commitment to serving all members of the Canadian trading community.

Evaluating Customer Support and Educational Resources

Choosing a broker with excellent support and educational resources is paramount for success. Here are key criteria to consider when evaluating a broker’s offerings:

- Response Time: How quickly do they respond to inquiries via phone, email, or live chat? Aim for near-instantaneous responses for urgent matters.

- Resolution Time: How efficiently do they resolve issues? A broker who can swiftly address problems minimizes potential losses.

- Support Channels: Do they offer multiple channels (phone, email, live chat, social media)? More options mean more convenience.

- Knowledge Base: Is there a comprehensive FAQ section or help center? A well-organized knowledge base can often answer questions before you even need to contact support.

- Educational Materials: Do they offer webinars, tutorials, market analysis reports, and educational courses? The quality and breadth of these resources should be considered.

- Account Manager Availability: Do they provide dedicated account managers for higher-tier accounts? This personalized support can be incredibly valuable for experienced traders.

- Accessibility Features: Does the broker offer support and resources that are accessible to traders with disabilities?

Understanding Broker Fees and Charges

Choosing a Forex broker in Canada isn’t just about finding the shiniest platform; it’s about understanding the often-hidden costs that can nibble away at your profits faster than a beaver gnawing on a particularly delicious-looking dam. Let’s dive into the murky world of broker fees, armed with our metaphorical magnifying glasses and a healthy dose of skepticism.

Picking the perfect Canadian forex broker is like choosing a superhero sidekick – it depends on your style! If you’re a lightning-fast scalper, speed and low latency are crucial, so finding the right fit is paramount. Check out this guide for reputable options if that’s your jam: Finding a Reputable Forex Broker in Canada for Scalping. Ultimately, matching your broker to your trading approach is key to forex success (and avoiding superhero-level meltdowns!).

Forex brokers employ various methods to generate revenue, and these methods directly impact your trading costs. Understanding these fees is crucial for maximizing your potential profits, regardless of your chosen trading strategy. Ignoring them is like trying to navigate a minefield blindfolded – potentially disastrous.

Types of Forex Broker Fees

Several types of fees can significantly impact your trading experience. Let’s examine the most common culprits.

- Spreads: This is the difference between the bid (sell) and ask (buy) price of a currency pair. It’s the broker’s profit margin, and tighter spreads generally mean lower costs. Think of it as the broker’s silent commission, constantly chipping away at your trades.

- Commissions: Some brokers charge a fixed commission per trade, often in addition to the spread. This is a more transparent fee structure, but it adds a direct cost to each transaction. This is the broker shouting, “Hey, I want my cut!”

- Overnight Fees (Swap Fees): Holding positions open overnight incurs swap fees, reflecting the interest rate differential between the currencies involved. These can be significant for long-term trades and are especially relevant for those employing swing or position trading strategies.

- Inactivity Fees: If you leave your account dormant for an extended period, some brokers may charge inactivity fees. It’s their way of saying, “Get trading or get out!”

Impact of Fees on Different Trading Styles

The impact of these fees varies considerably depending on your trading style. Let’s examine how different strategies are affected.

- Scalpers: Scalpers, who make many small trades throughout the day, are highly sensitive to spreads. Even small differences in spreads can significantly impact their profitability due to the sheer volume of trades.

- Day Traders: Day traders, who close their positions before the end of the trading day, are also primarily concerned with spreads, although overnight fees are not a factor.

- Swing Traders: Swing traders, who hold positions for several days or weeks, need to consider both spreads and overnight fees. The accumulation of overnight fees can eat into their profits if not carefully managed.

- Position Traders: Position traders, who hold positions for extended periods, must carefully evaluate all fees, including inactivity fees, as these can significantly impact their long-term returns.

Example Broker Fee Structures

The following table provides a simplified illustration of fee structures. Remember, these are examples and actual fees can vary.

| Broker | Spread (USD/CAD) | Commission (per lot) | Overnight Fee (USD/CAD, per lot) |

|---|---|---|---|

| Broker A | 1.5 pips | $5 | $2 |

| Broker B | 1.8 pips | $0 | $1 |

| Broker C | 2.0 pips | $0 | $0 |

| Broker D | 1.2 pips | $7 | $3 |

Calculating Trading Costs

Let’s illustrate how to calculate the overall trading cost for a 1-lot trade (100,000 units) with different brokers. We’ll assume a price movement of 10 pips.

Scenario 1: Broker A

Spread cost: 1.5 pips

10 USD/CAD = 15 USD

Commission cost: $5

Total cost: 15 USD + 5 USD = 20 USD

Scenario 2: Broker B

Spread cost: 1.8 pips

10 USD/CAD = 18 USD

Commission cost: $0

Total cost: 18 USD

Scenario 3: Broker C

Spread cost: 2.0 pips

10 USD/CAD = 20 USD

Commission cost: $0

Total cost: 20 USD

Scenario 4: Broker D

Spread cost: 1.2 pips

10 USD/CAD = 12 USD

Commission cost: $7

Total cost: 12 USD + 7 USD = 19 USD

Analyzing Broker Reputation and Client Reviews

Choosing a Forex broker is a bit like choosing a life partner – you want someone reliable, trustworthy, and hopefully, not prone to sudden, inexplicable disappearances with your hard-earned cash. Before you leap into a trading relationship, thorough due diligence on a broker’s reputation is crucial. Don’t just fall for slick marketing; dig deeper to uncover the truth behind the promises.Researching a broker’s reputation requires a multi-pronged approach, going beyond the surface-level sparkle.

Think of it as a detective investigation, but instead of solving a crime, you’re solving for the best trading partner. We’ll equip you with the tools to do just that.

Reliable Sources for Unbiased Client Reviews

Finding truly unbiased reviews can feel like searching for a unicorn in a field of glitter – it’s out there, but you need to know where to look. Avoid reviews solely on the broker’s website (those are often suspiciously positive!). Instead, cast a wider net. Reputable financial news websites, independent review platforms, and forums dedicated to Forex trading often host more candid feedback.

Look for platforms with robust verification systems to minimize the impact of fake reviews. Consider checking sites like Trustpilot or Forex Peace Army, but remember to always cross-reference information.

Interpreting and Evaluating Online Broker Reviews

Reading online reviews is like deciphering ancient hieroglyphics – you need a key to unlock their true meaning. Don’t just focus on the star rating; delve into the specifics. Look for recurring themes in both positive and negative reviews. A few isolated negative comments might be dismissed as individual experiences, but a consistent pattern of complaints about, say, withdrawal delays or unresponsive customer service, is a serious red flag.

Pay close attention to the detail provided in the reviews. Vague comments are less helpful than specific examples of positive or negative interactions with the broker. A review stating “terrible customer service” is less useful than one detailing a specific instance of poor service and the broker’s response (or lack thereof).

The Significance of Client Feedback in Broker Selection

Client feedback is the unsung hero of broker selection. It offers a real-world perspective, revealing aspects that glossy marketing brochures often gloss over. Positive reviews can highlight excellent customer service, efficient platforms, and transparent fee structures. Negative reviews can warn you about potential pitfalls, such as hidden fees, execution problems, or difficulties withdrawing funds. Remember, a single negative review isn’t necessarily a deal-breaker, but a cluster of similar negative comments should make you pause and consider alternatives.

The volume and consistency of feedback are key indicators of a broker’s overall reputation.

Methods for Researching Broker Reputation and Track Record

Beyond online reviews, consider investigating a broker’s regulatory standing. Check if they are licensed and regulated by the appropriate Canadian authorities, such as the Investment Industry Regulatory Organization of Canada (IIROC) or other relevant bodies. A properly licensed broker provides a degree of protection for investors. You can also look for information on the broker’s history, including any past regulatory actions or legal disputes.

Many regulatory bodies maintain public records that can be accessed online. Checking for news articles or press releases related to the broker can also provide valuable insight into their past performance and reputation. Finally, consider reaching out to other traders and asking for their experiences with different brokers. Networking within the trading community can be a valuable source of information.

Final Review

So, there you have it! Finding the right Canadian forex broker doesn’t have to feel like searching for the legendary Yeti in a blizzard. By understanding your trading style, researching broker offerings, and carefully considering the factors Artikeld above, you can confidently select a broker that perfectly complements your approach. Remember, the right broker isn’t just a tool; it’s a strategic partner in your financial success.

Now go forth, conquer the forex markets, and may your trades always be green (or at least, not alarmingly red!).