Questrade forex trading fees and commissions compared to other platforms – a topic that sounds as exciting as watching paint dry, right? Wrong! This deep dive into the often-murky world of forex fees will illuminate the hidden costs, surprising savings, and potential pitfalls lurking within your trading adventures. We’ll pit Questrade against its rivals, revealing which platform offers the best bang for your buck (or, more accurately, your pip).

Prepare for a thrilling rollercoaster ride through spreadsheets and spread sheets – it’s going to be legen…wait for it…dary!

We’ll dissect Questrade’s fee structure, examining everything from commissions and spreads to those sneaky overnight fees that can creep up on you like a ninja in socks. Then, we’ll unleash the power of comparison, pitting Questrade against formidable competitors like Interactive Brokers, TD Ameritrade, and OANDA. We’ll analyze how different trading styles and volumes impact your bottom line, helping you choose the platform that aligns perfectly with your financial goals (and your desire for a stress-free trading experience).

Questrade Forex Trading Fees

So you’re thinking about diving into the thrilling, sometimes terrifying, world of forex trading with Questrade? Buckle up, buttercup, because we’re about to dissect those fees like a seasoned surgeon dissecting a particularly plump frog. Understanding the cost of your forex adventures is crucial – it’s the difference between sipping champagne on a yacht and…well, let’s just say it’s not champagne on a yacht.

So, you’re wrestling with Questrade’s forex fees – are they a ninja-like ambush on your profits, or a gentle tickle? Comparing them to other platforms is a whole other ball game, especially when considering options. If you’re thinking of branching out into options trading, though, you’ll need a solid app, and finding the Best day trading app for options trading in Canada?

is crucial. Back to Questrade – those forex fees might seem less daunting once you’ve mastered options trading!

Questrade Forex Trading Fees: A Detailed Breakdown

Let’s get down to brass tacks (or should we say, brass pips?). Questrade’s forex fees aren’t exactly hidden in a mysterious Mayan temple, but they can be a bit…scattered. To help you navigate this financial jungle, we’ve compiled a handy table. Remember, these fees are subject to change, so always double-check Questrade’s official website for the most up-to-date information.

(We wouldn’t want you to accidentally fund someone else’s yacht, would we?)

| Fee Type | Description | Amount | Notes |

|---|---|---|---|

| Spread | The difference between the bid and ask price. | Variable, depends on the currency pair and market conditions. | Questrade’s spreads are generally competitive, but they can widen during periods of high volatility. Think of it as the toll you pay to enter the forex highway. |

| Commission | A per-trade fee charged by Questrade. | $0 for most accounts (certain accounts may have different structures) | Questrade often advertises commission-free trading, but remember the spread acts as a built-in fee. It’s like paying for a “free” pizza with a hefty tip. |

| Overnight Financing Fee (Swap) | Charged for holding positions open overnight. | Variable, depends on the currency pair and interest rate differentials. | This fee reflects the interest rate difference between the two currencies in the pair. It can be positive or negative, depending on the position. It’s like paying rent for your open position in the forex hotel. |

| Inactivity Fee | Charged if your account is inactive for a certain period. | Varies, check Questrade’s website for details. | Even forex ninjas need to occasionally dust off their trading keyboards. |

| Account Maintenance Fee (if applicable) | A monthly fee for maintaining the account (depending on account type and balance). | Varies; check Questrade’s website for details. | This is the cost of keeping your forex dreams alive. It’s the price of having a seat at the table. |

Questrade Forex Account Types and Fee Variations

Questrade offers various account types, and fees can differ slightly depending on which account you choose. Generally, the differences aren’t monumental, but it’s worth checking the specifics before committing. Think of it as choosing between a standard economy car and a slightly more luxurious model – both get you to the destination, but the ride might be a little more comfortable in one.

The differences in fees are usually related to the minimum account balance requirements or access to specific features.

So, you’re wrestling with Questrade’s forex fees – are they a better deal than Interactive Brokers’ or Oanda’s? The answer, my friend, might depend on your overall trading strategy. If you’re also eyeing the volatile world of crypto, figuring out the best mobile app is crucial; check out this helpful guide: Which mobile app is best for day-trading cryptocurrency?

Then, armed with that knowledge, you can better assess if Questrade’s forex fees fit your broader investment picture – because let’s face it, low fees are only half the battle!

Potential Hidden Fees or Costs Associated with Questrade Forex Trading

While Questrade is generally transparent about its fees, it’s important to be aware of potential hidden costs. These often stem from slippage (the difference between the expected execution price and the actual execution price) and potential negative swaps during periods of high market volatility. Slippage can occur especially during news events or periods of high trading volume. It’s like trying to catch a greased pig – you might get it, but you might also end up with nothing but mud on your hands.

Always understand your risk tolerance and manage your positions accordingly.

So you’re comparing Questrade’s forex fees to other platforms? It’s a jungle out there, a financial savanna! While you’re navigating those complex commission structures, remember to take a break and treat yourself – perhaps with some delicious halal culinary delights to recharge your trading brain. Then, armed with a full stomach and renewed focus, you can conquer those Questrade forex fee comparisons like a pro.

Comparison of Questrade’s Forex Fees with Competitors

So, you’re ready to dive into the thrilling world of forex trading, but the murky waters of fees are making you hesitant? Don’t worry, we’re here to shed some light (and maybe a little humor) on how Questrade stacks up against the competition. We’ll dissect those fee structures, comparing Questrade to some of its major rivals, so you can choose the broker that best suits your trading style and budget.

Think of us as your friendly neighborhood fee detectives!

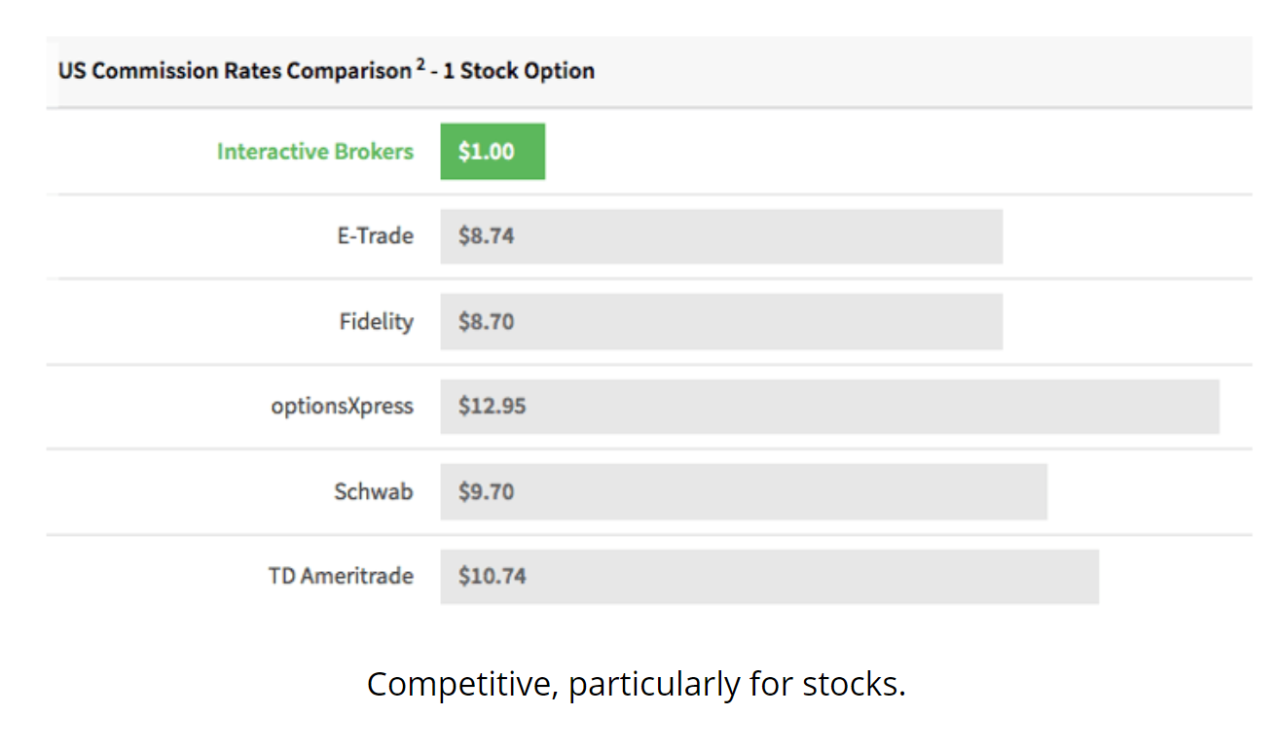

Questrade Forex Fees Compared to Interactive Brokers, TD Ameritrade, and Oanda

Let’s get down to brass tacks and compare Questrade’s forex fees with three prominent competitors: Interactive Brokers (IBKR), TD Ameritrade, and Oanda. Remember, fee structures can change, so always check the broker’s website for the most up-to-date information. This comparison uses typical scenarios and may not cover every single fee.

So, you’re wrestling with Questrade’s forex fees – are they truly the kraken of charges, or a friendly dolphin compared to others? The answer might depend on your trading style, because if you’re thinking of branching out into futures, you’ll need a killer mobile app; check out this guide to find the best one for day trading: Which mobile app is best for day trading futures contracts?

. Back to Questrade, remember to factor in all costs before you dive headfirst into those currency markets!

| Broker | Fee Type | Amount | Notes |

|---|---|---|---|

| Questrade | Commission per lot (standard account) | $0 | Questrade often uses a spread-based pricing model, meaning the commission is built into the spread between the bid and ask prices. This can be advantageous for smaller trades. |

| Interactive Brokers | Commission per lot | Variable, often low but can depend on volume | IBKR is known for its competitive pricing, especially for high-volume traders. They offer a tiered commission structure. |

| TD Ameritrade | Commission per lot | Variable, generally higher than IBKR | TD Ameritrade’s forex fees tend to be more straightforward, though possibly less competitive for large trade volumes. |

| Oanda | Spread | Variable, often tighter than Questrade for some currency pairs | Oanda’s pricing model is predominantly spread-based, and the spread itself can vary based on market conditions and the currency pair. They are known for their transparency. |

| Questrade | Spread | Variable | The spread on Questrade can be wider than Oanda for some pairs, but the absence of commissions can make it more appealing for smaller traders. |

Implications of Fee Differences for Various Trading Styles

The differences in fee structures significantly impact traders with varying styles and volumes. High-frequency traders making numerous small trades might find Questrade’s commission-free structure attractive, even if the spread is slightly wider. Conversely, high-volume traders executing large orders might benefit from Interactive Brokers’ tiered commission structure. Scalpers who focus on small price movements will need to carefully evaluate the spreads offered by each broker to optimize their profitability.

Long-term investors might find the nuances of fee structures less critical compared to other aspects of their trading strategy. It’s all about finding the right fit for your individual needs.

Impact of Spreads on Questrade Forex Trading Costs

Spreads, the difference between the bid and ask price of a currency pair, are a fundamental component of forex trading costs. Unlike explicit commissions, spreads are baked into the price, silently chipping away at your profits (or adding to your losses). Understanding how Questrade’s spreads impact your trading is crucial for maximizing your returns. Think of spreads as the invisible tax on every forex transaction.Spreads are dynamic, fluctuating constantly based on market volatility and liquidity.

A wider spread means a higher cost per trade, while a tighter spread represents a lower cost. Questrade’s spreads, like those of other brokers, are influenced by these market forces, meaning they aren’t static numbers you can simply memorize. This inherent variability is a key factor to consider when comparing Questrade to its competitors.

Spread Cost Calculation Examples

Let’s illustrate how spreads affect your trading costs. Imagine you’re trading EUR/USD, and Questrade’s spread is currently 1.2 pips. This means the ask price is 1.2 pips higher than the bid price. A pip, or point in price, represents the smallest price movement in a currency pair.For a trade size of 10,000 units (a standard lot), each pip is worth $1.

Therefore, a 1.2-pip spread on a 10,000 unit trade costs you $12 (1.2 pips x $1/pip). If you were trading 100,000 units (10 lots), the spread cost would be $120 (1.2 pips x $10/pip). These costs are incurred regardless of whether your trade is profitable or not. It’s like paying a toll every time you enter the forex highway.

Comparison of Questrade Spreads with Competitors

Direct spread comparisons require real-time data, which is constantly changing. However, we can discuss general observations. Generally, Questrade aims for competitive spreads, often falling within the range of other major online brokers. Some competitors might offer slightly tighter spreads on popular pairs during high liquidity periods, while others might have wider spreads, particularly on less frequently traded pairs or during volatile market conditions.

The best way to make a precise comparison is to check current spreads directly on each platform’s website or trading platform before executing any trade. Don’t rely solely on marketing materials; always look at the live market data. Think of it like comparing grocery store prices – the advertised price might not always be the final price at the checkout.

Remember, the overall cost of forex trading isn’t solely determined by spreads. Other factors, such as financing costs (for holding positions overnight) and potential commissions (though Questrade’s commission structure is often straightforward), contribute to the total cost. A comprehensive comparison needs to consider all these elements.

Non-Commission Fees and Their Significance

So, you’ve meticulously compared Questrade’s forex commissions and spreads to the competition, and you’re feeling pretty savvy. But hold your horses, intrepid trader! The world of forex fees isn’t just about the obvious; lurking in the shadows are the often-overlooked non-commission fees. These sneaky little charges can nibble away at your profits like a particularly aggressive squirrel on a nut stash.

So you’re wrestling with Questrade’s forex fees – are they a kraken compared to other platforms? To truly maximize your gains, you need the right tools, and that’s where figuring out What’s the best day trading app for Canadian residents with advanced charting? comes in. Once you’ve got your charting sorted, you can really zero in on whether Questrade’s pricing structure is giving you the best bang for your buck.

After all, even the slickest charts can’t compensate for crippling commissions!

Let’s shine a light on these hidden costs and see how they stack up against the competition.Non-commission fees, while seemingly insignificant individually, can cumulatively impact your bottom line, especially if you’re a less active trader or if you make frequent withdrawals. Understanding these fees is crucial for making informed decisions about which brokerage best suits your trading style and frequency.

Ignoring them could be as financially unwise as leaving your wallet on a park bench – trust us, you don’t want that.

Questrade’s Non-Commission Fees

Questrade, like most brokers, levies certain fees beyond commissions and spreads. These fees cover the costs associated with maintaining your account and processing transactions. Let’s break down the main culprits. Inactivity fees, for instance, are charged if your account remains dormant for an extended period. Think of it as a “use it or lose it” (or at least pay for it) scenario.

Account maintenance fees are a regular charge for simply having an account open. Finally, withdrawal fees apply each time you transfer funds out of your account. These fees, while seemingly small, can add up, especially if you’re not consistently trading. Remember, even small leaks can sink a ship, or at least your trading profits.

Comparison of Non-Commission Fees Across Brokers

Let’s see how Questrade’s non-commission fees compare to some of its competitors. The following table provides a snapshot, but always verify the most up-to-date information directly with the brokers. Remember, these fees are subject to change, so always check the current fee schedule before opening an account.

| Broker | Fee Type | Amount | Notes |

|---|---|---|---|

| Questrade | Inactivity Fee | Varies (Check Questrade’s website) | Typically charged after a period of inactivity. |

| Questrade | Account Maintenance Fee | Generally None | Questrade typically does not charge a standard account maintenance fee. |

| Questrade | Withdrawal Fee | Varies by method (Check Questrade’s website) | Fees may vary depending on the withdrawal method used. |

| Interactive Brokers | Inactivity Fee | Varies (Check IBKR’s website) | Similar to Questrade, inactivity fees apply after a period of no activity. |

| Interactive Brokers | Account Maintenance Fee | Varies (Check IBKR’s website) | May depend on account type and activity. |

| Interactive Brokers | Withdrawal Fee | Varies by method (Check IBKR’s website) | Fees may vary depending on the withdrawal method. |

| TD Ameritrade | Inactivity Fee | Generally None | Typically no inactivity fees are charged. |

| TD Ameritrade | Account Maintenance Fee | Generally None | Typically no account maintenance fees are charged. |

| TD Ameritrade | Withdrawal Fee | Varies by method (Check TD Ameritrade’s website) | Fees vary based on withdrawal method. |

| Oanda | Inactivity Fee | Varies (Check Oanda’s website) | Check Oanda’s website for the most up-to-date information. |

| Oanda | Account Maintenance Fee | Generally None | Typically no account maintenance fee is charged. |

| Oanda | Withdrawal Fee | Varies by method (Check Oanda’s website) | Withdrawal fees are dependent on the method used. |

Illustrative Examples of Forex Trading Costs on Questrade

Let’s ditch the jargon and dive into some real-world examples of how Questrade’s forex fees can impact your bottom line. We’ll examine three scenarios, showcasing the interplay of spreads, commissions (or lack thereof!), and overnight financing charges. Remember, these are illustrative examples and actual costs may vary based on market conditions and the specific currency pair traded.Understanding these costs is crucial for savvy forex trading.

Failing to factor in these expenses can lead to unpleasant surprises and significantly impact your profitability. A little planning can go a long way!

Small Trade Example: EUR/USD

This example depicts a small trade, perfect for beginners dipping their toes into the forex market.

So you’re wrestling with Questrade’s forex fees – are they a gentle tickle or a full-on bear hug compared to the competition? Well, before you get too tangled up in spreads, consider broadening your horizons: if you’re also eyeing stocks and ETFs, check out Best Canadian day trading app for both stocks and ETFs? to see if a different platform might be a better fit for your overall trading strategy.

Then, you can return to your Questrade forex fee analysis with a clearer perspective!

- Trade Size: 1,000 EUR/USD (approximately $1,100 USD at an exchange rate of 1.10)

- Spread: Let’s assume a spread of 1 pip (0.0001). This means the buy price is 1 pip higher than the sell price. For a 1,000 unit trade, this translates to a cost of 1,000 x 0.0001 = $1.10 (assuming the USD is the quote currency).

- Commission: Questrade doesn’t charge commissions on forex trades, which is a big plus!

- Overnight Fees: If you hold the position overnight, you might incur overnight financing charges, depending on the leverage used and the interest rate differentials between the Eurozone and the US. Let’s assume a negligible overnight fee of $0.05 for this small trade.

- Total Cost: $1.10 (spread) + $0.05 (overnight fee) = $1.15. This is a relatively low cost for a small trade.

Large Trade Example: GBP/JPY

Now, let’s ramp things up with a larger trade. This illustrates the importance of understanding the impact of spreads on larger positions.

- Trade Size: 100,000 GBP/JPY (approximately $130,000 USD at an exchange rate of 1.30 USD/GBP and 130 JPY/USD)

- Spread: Let’s assume a spread of 2 pips (0.0002). This translates to a cost of 100,000 x 0.0002 = $26.00 USD (assuming the JPY is the quote currency, and a simplified conversion for illustration).

- Commission: Again, no commission fees from Questrade.

- Overnight Fees: Overnight fees will be proportionally higher for a larger trade. Let’s assume an overnight fee of $2.00.

- Total Cost: $26.00 (spread) + $2.00 (overnight fee) = $28.00. The spread cost is significantly higher for this larger trade.

Trade Held Overnight Example: USD/CAD, Questrade forex trading fees and commissions compared to other platforms

This example highlights the potential impact of overnight financing charges, especially for trades held over multiple days.

- Trade Size: 50,000 USD/CAD (approximately $37,500 USD at an exchange rate of 0.75 CAD/USD)

- Spread: Let’s assume a spread of 0.5 pips (0.00005). This translates to a cost of 50,000 x 0.00005 = $2.50 USD.

- Commission: Zero commission, thanks again Questrade!

- Overnight Fees: Holding this position for three nights could incur significant overnight financing charges, depending on interest rate differentials and leverage. Let’s assume a total overnight fee of $7.50 for the three-night period.

- Total Cost: $2.50 (spread) + $7.50 (overnight fees) = $10.00. The overnight fees are a substantial portion of the total cost in this scenario.

Factors Affecting Questrade’s Forex Fee Structure

Questrade’s forex fee structure, while seemingly straightforward, dances a complex tango with several influential factors. Think of it as a financial foxtrot – elegant, but with hidden steps that can significantly impact your bottom line. Understanding these factors is crucial for optimizing your trading strategy and minimizing unnecessary expenses. Let’s delve into the intricacies of this financial waltz.The primary movers and shakers in Questrade’s forex fee landscape are market conditions, trading volume, and account type.

These elements interweave to create a unique cost profile for each trader, highlighting the importance of careful consideration before diving into the exciting (and sometimes unpredictable) world of forex trading.

Market Conditions and Their Influence on Fees

Market volatility significantly influences the spread, which is the core component of Questrade’s forex fee structure. During periods of high volatility, such as geopolitical events or major economic announcements, spreads widen. This means the difference between the bid and ask price increases, resulting in higher trading costs for Questrade clients. Conversely, during calmer market periods, spreads typically narrow, leading to lower costs.

Imagine it like this: during a storm, the price of a life raft (your currency trade) will skyrocket; during calm seas, it’s much cheaper. This inherent variability is a characteristic of forex trading itself, not unique to Questrade.

Trading Volume and its Impact on Costs

While Questrade doesn’t directly charge commissions on forex trades, the volume of your trading activity indirectly impacts your overall cost. High-volume traders, though not benefiting from volume discounts in the traditional sense, might find that their average spread remains competitive over time, mitigating the impact of wider spreads during volatile periods. This is because frequent trading allows them to potentially capture more favorable price movements.

Conversely, low-volume traders may experience a higher average cost per trade due to a higher proportion of trades occurring during periods of wider spreads. Think of it like buying in bulk – you might not get a direct discount, but your overall average cost might be lower.

Account Type and Associated Fee Variations

Questrade offers different account types, each potentially affecting forex trading costs. While the core fee structure (spreads) remains largely consistent across accounts, some premium accounts might offer access to advanced trading tools or tighter spreads with certain providers, potentially offsetting the higher account maintenance fees. The choice of account type should be carefully considered based on your trading frequency, sophistication, and overall financial goals.

It’s akin to choosing between an economy and first-class airline ticket; both get you to the destination, but the comfort and potentially the overall cost per mile differ.

Conclusion: Questrade Forex Trading Fees And Commissions Compared To Other Platforms

So, there you have it – a comprehensive, (relatively) painless exploration of Questrade’s forex fees and a head-to-head showdown with the competition. Remember, the cheapest option isn’t always the best. Choosing the right platform depends on your individual needs and trading habits. Armed with this knowledge, you can confidently navigate the forex market, leaving those pesky fees in the dust – or at least minimizing their impact on your portfolio.

Happy trading (and may your pips always be plentiful)!