Coinsquare Capital Markets fees and security measures: Dive into the wild world of digital currency trading with Coinsquare! We’re peeling back the curtain on their fees – think of it as a thrilling treasure hunt for the best rates – and their security, because nobody wants their digital gold stolen by mischievous goblins (or worse, hackers!). Prepare for a rollercoaster ride of financial facts and security secrets, with enough twists and turns to keep even the most seasoned crypto-veteran on the edge of their seat.

This exploration will cover Coinsquare’s fee structure, comparing it to other platforms; examining their security protocols (think Fort Knox meets cutting-edge technology); and assessing how transparent and user-friendly their approach truly is. We’ll also look at how all this impacts your decision to trade with them, whether you’re a casual investor or a high-roller with a penchant for risk (and reward!).

Coinsquare Capital Markets Fee Structure: Coinsquare Capital Markets Fees And Security Measures

Navigating the world of cryptocurrency trading can feel like traversing a minefield of fees. Understanding these costs is crucial for maximizing your profits. Let’s shed some light on Coinsquare Capital Markets’ fee structure, comparing it to its competitors and exploring how these fees impact different trading strategies. Think of it as a financial treasure map, helping you avoid costly pitfalls.

Trading Fees

Coinsquare’s trading fees are a percentage of the total transaction value, varying depending on the cryptocurrency pair traded and the trading volume. While they don’t explicitly publish a fixed fee schedule for every pair, their fees are generally competitive within the market. For high-volume traders, Coinsquare may offer maker-taker fee structures, rewarding those who add liquidity to the order book.

However, specific details regarding maker-taker rebates are best obtained directly from Coinsquare. This dynamic fee structure allows Coinsquare to adapt to market fluctuations and offer attractive rates for various trading styles.

Navigating Coinsquare Capital Markets’ fees can feel like a penalty shootout – intense and potentially costly! But their security measures are supposedly as robust as a goalie’s reflexes. Need a break from the financial drama? Check out the latest football news for a less stressful game. Then, back to the Coinsquare fees – remember to always read the fine print before investing, just like scouting an opponent’s weaknesses!

Withdrawal Fees

Coinsquare charges withdrawal fees that vary depending on the cryptocurrency being withdrawn and the chosen network. These fees cover the network transaction costs, which are outside of Coinsquare’s control. Expect to see higher withdrawal fees for faster transaction speeds. For example, withdrawing Bitcoin via the Lightning Network will likely have a lower fee than using the standard Bitcoin blockchain.

It’s always advisable to check the exact fee before initiating a withdrawal to avoid unpleasant surprises.

Deposit Fees

Generally, Coinsquare does not charge fees for depositing cryptocurrencies. However, it’s important to note that any network fees associated with sending your crypto to Coinsquare will be your responsibility. These network fees are determined by the blockchain and are not controlled by Coinsquare. Always check the network fees before initiating a deposit to avoid unexpected charges.

Inactivity Fees

Coinsquare does not appear to currently charge inactivity fees. However, it’s prudent to regularly review their fee schedule as policies can change.

Fee Comparison

Understanding Coinsquare’s fees in relation to its competitors is essential. Below is a comparison, acknowledging that fees can change and this data is a snapshot in time and should be verified independently with each exchange.

| Fee Type | Coinsquare Fee | Competitor A Fee (Example: Kraken) | Competitor B Fee (Example: Binance) |

|---|---|---|---|

| Trading Fee (BTC/USD) | Variable, generally competitive | Variable, maker-taker model | Variable, maker-taker model with tiered discounts |

| Withdrawal Fee (BTC) | Variable, depends on network | Variable, depends on network | Variable, depends on network |

| Deposit Fee (BTC) | Generally none, network fees apply | Generally none, network fees apply | Generally none, network fees apply |

| Inactivity Fee | None (currently) | None (currently) | None (currently) |

Impact of Fee Structure on Trading

Coinsquare’s fee structure, like that of most exchanges, impacts traders differently depending on their trading volume and strategy. High-frequency traders with large volumes might find that even small differences in fees significantly affect their profitability. Conversely, smaller traders might find the fees less impactful on their overall returns. Scalpers, who execute many trades with small profit margins, are particularly sensitive to trading fees, while long-term investors are less affected by them.

Therefore, a careful analysis of your trading style and volume is necessary to assess the overall cost impact of using Coinsquare.

Navigating Coinsquare Capital Markets’ fees can feel like a treasure hunt, but their security measures are thankfully less of a riddle. Want to level up your trading game and understand the broader forex landscape before diving in? Check out this Complete guide to spot foreign exchange market trading for a comprehensive overview. Then, armed with knowledge, you can confidently assess if Coinsquare’s fees align with your forex strategy and risk tolerance.

Security Measures Employed by Coinsquare Capital Markets

Protecting your digital assets is serious business, and at Coinsquare Capital Markets, we don’t take it lightly. We understand that entrusting us with your crypto is a big deal, so we’ve built a fortress of security measures to keep your investments safe and sound. Think of it as a digital bank vault, but way cooler (and with fewer marble columns).We employ a multi-layered approach to security, combining cutting-edge technology with rigorous adherence to industry best practices.

This isn’t just about ticking boxes; it’s about proactively safeguarding your assets against the ever-evolving landscape of cyber threats. We’re constantly updating and improving our security protocols to stay ahead of the game, because let’s face it, the bad guys never sleep.

Navigating Coinsquare Capital Markets’ fees can feel like a treasure hunt, but their security measures are thankfully less of a riddle. Before you dive in, though, remember that smart investing requires knowledge, so check out this guide on Profitable forex trading strategies for beginners to boost your chances of actually making a profit. Then, armed with knowledge and a keen eye for fees, you can conquer Coinsquare’s cost structure like a seasoned pro!

Cold Storage and Multi-Signature Wallets

The lion’s share of our clients’ digital assets are stored offline in secure, geographically diverse cold storage facilities. Think of it as a super-secret, high-tech vault hidden away from prying eyes and internet-based shenanigans. Access to these cold storage wallets requires multiple authorized individuals, each possessing a unique piece of the digital key. This multi-signature approach means no single person has complete control, significantly reducing the risk of unauthorized access or theft.

It’s like having a super-secure combination lock with multiple, independently controlled tumblers. Even if one part of the system is compromised, the others remain secure, safeguarding your funds.

Encryption Methods and Data Protection

We utilize robust encryption methods, both in transit and at rest, to protect your personal information and transaction data. Think of it as wrapping your data in layers of impenetrable digital armor. This ensures that even if someone were to somehow gain unauthorized access, your information would remain indecipherable. We employ advanced encryption standards (AES) and other industry-leading technologies to safeguard your data, providing an extra layer of protection against unauthorized access or data breaches.

Our systems are regularly audited and updated to maintain the highest levels of security.

Compliance with Financial Regulations and Security Standards

Coinsquare Capital Markets operates under a strict regulatory framework, adhering to all applicable laws and regulations. We regularly undergo independent security audits to ensure our systems and processes meet the highest industry standards. Think of these audits as a rigorous health check for our security systems, ensuring they’re fit and functioning at peak performance. This proactive approach allows us to identify and address potential vulnerabilities before they can be exploited, minimizing risk and ensuring the ongoing security of our platform.

Our commitment to compliance is not just a checkbox; it’s a cornerstone of our operational philosophy.

Hypothetical Security Breach Response

Let’s imagine a worst-case scenario: a sophisticated, targeted attack manages to bypass our initial security layers (a highly unlikely event, but we plan for the improbable). Our immediate response would involve a multi-pronged approach. First, we’d immediately isolate the affected system to prevent further damage. Then, our dedicated security team would launch a full-scale investigation, working closely with external cybersecurity experts to identify the source of the breach and contain the damage.

We would also notify affected users immediately and transparently, providing regular updates on the situation and the steps we’re taking to rectify the issue. We’d leverage our robust incident response plan, drawing on lessons learned from industry best practices and past incidents. The goal? To minimize the impact on our users and restore their confidence in our platform.

This hypothetical scenario underscores our commitment to preparedness and swift, decisive action in the face of adversity.

Navigating Coinsquare Capital Markets’ fees can feel like deciphering ancient hieroglyphs, but their security measures are supposedly top-notch (knock on wood!). If all that feels a bit overwhelming for a newbie, perhaps consider simpler options; check out Best forex trading apps for beginners in Canada to ease your way into the exciting (and sometimes terrifying) world of forex.

Then, once you’re a seasoned pro, you can bravely tackle Coinsquare’s fee structure again!

Transparency and User Experience Related to Fees and Security

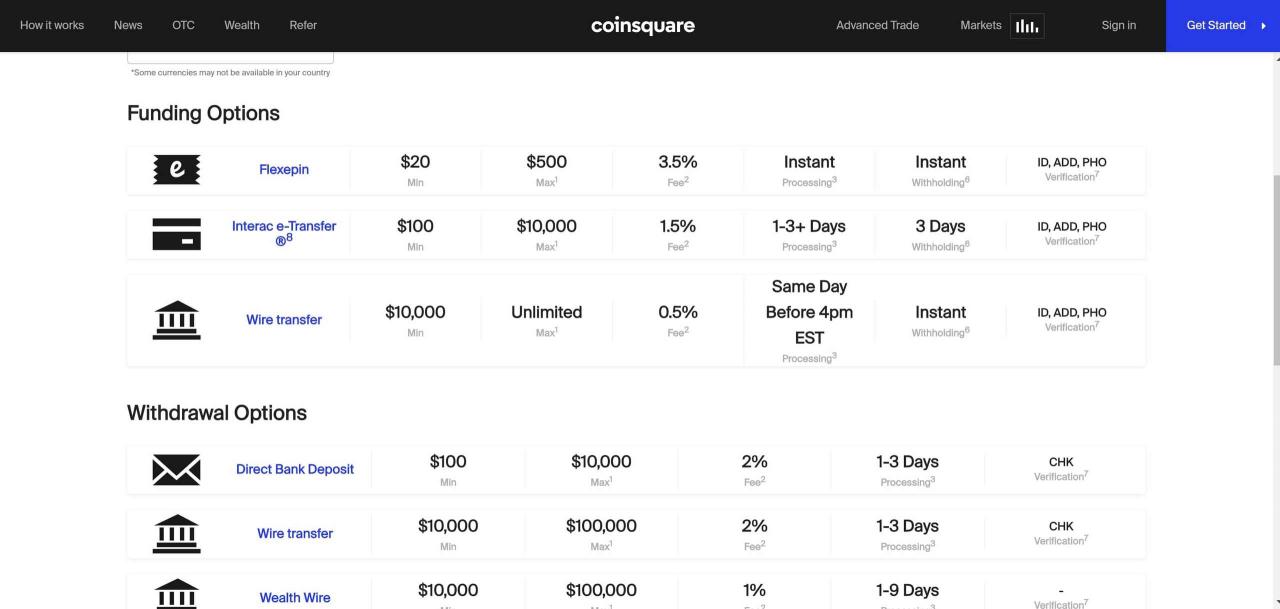

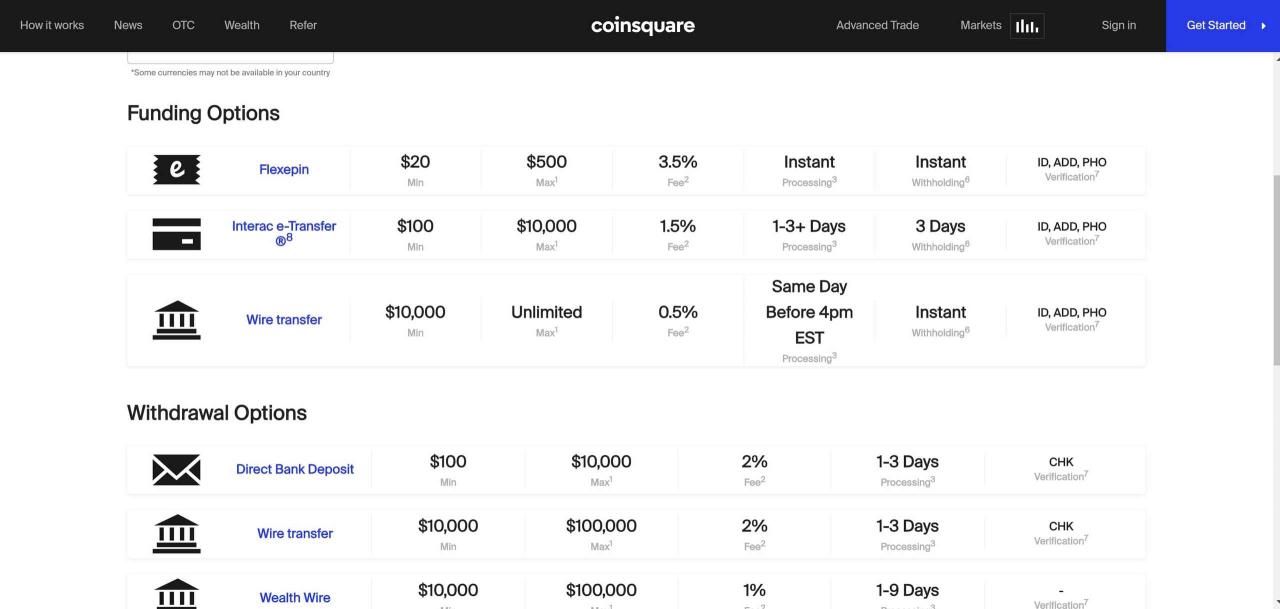

Coinsquare aims for crystal-clear communication regarding its fees and security protocols, striving to make even the most financially-challenged user feel comfortable navigating their platform. They understand that transparency builds trust, and a confused user is an unhappy user – a sentiment nobody wants in the volatile world of cryptocurrency. Their approach blends user-friendly interfaces with comprehensive documentation, hoping to strike a balance between simplicity and thoroughness.Coinsquare communicates its fee structure and security measures through a multi-pronged approach.

Their website features prominently displayed fee schedules, often broken down by transaction type and asset. These schedules aren’t buried in legal jargon; instead, they’re presented in a clear, concise format with helpful explanations. Imagine a well-organized table, clearly labeling each fee, its percentage or flat rate, and a brief description of what it covers. They also offer interactive fee calculators that allow users to estimate costs before committing to a transaction – think of it as a virtual shopping cart that shows you the final price before checkout.

Furthermore, their security measures are detailed in a dedicated section of their website, outlining their security protocols, including things like two-factor authentication, cold storage practices, and insurance policies, often with accompanying infographics illustrating the processes. These aren’t just dry policy documents; they’re designed to be accessible and understandable.

Fee Information Clarity and Accessibility

Coinsquare’s fee information aims for broad accessibility, catering to users with varying levels of financial knowledge. The use of plain language, avoiding technical jargon wherever possible, is a key component of their strategy. For example, instead of saying “Maker-Taker Fee Schedule,” they might use descriptive language like “Fees for placing buy or sell orders.” They also use visual aids extensively, such as charts and graphs, to simplify complex information.

However, while generally user-friendly, some users may still find the level of detail overwhelming, particularly those with limited experience in finance or technology. For example, the nuances of different order types and their associated fees might require further simplification for novice users.

Security Information Clarity and Accessibility

Coinsquare’s approach to communicating security measures follows a similar path towards accessibility. Their security documentation provides a general overview of their security protocols, aiming to build user confidence without overwhelming them with technical details. However, the level of detail provided might still be insufficient for users who want a deeper understanding of the technical aspects of their security infrastructure.

Navigating Coinsquare Capital Markets’ fees can feel like deciphering ancient hieroglyphs, but their security measures are thankfully less cryptic. Before you dive headfirst into potentially confusing trading fees, however, consider brushing up on the basics with these Essential tutorials for beginners in forex currency trading ; understanding forex fundamentals will help you better assess the value proposition of any platform’s fees and security.

Then, armed with knowledge, you can confidently return to conquering Coinsquare’s fee schedule.

For instance, while they explain the use of cold storage, they may not delve into the specific cryptographic algorithms employed or the details of their disaster recovery plan. This approach prioritizes user trust over in-depth technical information.

Suggestions for Improving Communication of Fees and Security Practices

Improving the user experience around fees and security requires a focus on proactive and clear communication.

Here are some suggestions:

- Implement interactive tutorials and FAQs that guide users through the fee structure and security features in a step-by-step manner.

- Develop personalized fee and security summaries based on the user’s trading activity and risk profile. This allows users to see only the information directly relevant to them.

- Offer multilingual support for fee and security information to cater to a wider user base.

- Create short, animated explainer videos that visually demonstrate the key aspects of their security measures and fee calculations. Imagine a friendly cartoon character guiding the user through the process.

- Conduct regular user surveys to gauge understanding and identify areas for improvement in communication. This feedback loop is crucial for continuous improvement.

Comparison of Coinsquare’s Security with Industry Best Practices

Coinsquare, like any cryptocurrency exchange, walks a tightrope – balancing user accessibility with robust security. Let’s delve into how their security measures stack up against the industry’s top players, acknowledging that the crypto security landscape is constantly evolving, and what’s “best practice” today might be yesterday’s news tomorrow. Think of it as a cybersecurity arms race, but with fewer explosions (hopefully).The security of a cryptocurrency exchange is paramount.

User funds are at stake, and a breach can have devastating consequences, not just financially, but also in terms of reputational damage. A robust security posture isn’t just a checklist; it’s a continuous process of improvement and adaptation. We’ll examine Coinsquare’s approach, highlighting both its strengths and areas for potential enhancement.

Coinsquare’s Security Features Compared to Industry Standards

A key aspect of evaluating any exchange’s security is comparing its features against those commonly found in top-tier exchanges. This allows for a more objective assessment of its overall security posture. While specific details of some security measures are understandably kept confidential for security reasons, we can still make a general comparison based on publicly available information.

Navigating Coinsquare Capital Markets’ fees can feel like a treasure hunt, but remember, those shiny profits might need a bit of tax-savvy polishing! Before you celebrate your forex wins, understanding the Canadian tax implications is crucial, so check out this helpful guide: Understanding Canadian tax implications for forex trading profits. Then, armed with this knowledge, you can confidently tackle Coinsquare’s security measures and fees, knowing you’re playing the game by the rules (and maybe even ahead of them!).

- Multi-Factor Authentication (MFA): Top-tier exchanges universally employ MFA, and Coinsquare is no exception. This adds an extra layer of protection beyond just a password, often using methods like Google Authenticator or SMS codes. This is a fundamental security measure that Coinsquare correctly implements.

- Cold Storage: The majority of cryptocurrency assets should be stored offline (“cold storage”) to protect against hacking. While Coinsquare doesn’t publicly disclose the precise percentage of assets held in cold storage, the industry best practice is to maintain a significant portion offline. Transparency on this aspect would significantly boost user confidence.

- Regular Security Audits: Independent, third-party security audits are a crucial indicator of an exchange’s commitment to security. The frequency and results of these audits should be made public, allowing users to assess the robustness of the exchange’s security protocols. The availability of this information for Coinsquare would strengthen its position in the market.

- Insurance Coverage: Some exchanges carry insurance policies to cover losses in the event of a security breach. This provides an additional layer of protection for users. The existence and details of such insurance, if any, should be transparently communicated by Coinsquare.

- Advanced Encryption: Utilizing robust encryption methods for both data in transit and at rest is essential. While the specifics of Coinsquare’s encryption methods aren’t publicly detailed, it’s reasonable to assume they utilize industry-standard encryption protocols. Again, greater transparency would be beneficial.

Impact of Security Measures on User Trust and Confidence, Coinsquare Capital Markets fees and security measures

The security measures employed by Coinsquare directly influence user trust and confidence. Transparent communication about these measures is crucial. For example, publicly available information about security audits, insurance coverage, and the percentage of assets held in cold storage would significantly enhance user confidence. Conversely, a lack of transparency can breed suspicion and lead users to seek out exchanges with more readily available security information.

A clear and proactive communication strategy regarding security is essential for building and maintaining user trust. Think of it as a “security transparency” seal of approval – the more visible, the better.

Impact of Fees and Security on User Choice

Choosing a cryptocurrency exchange is a bit like choosing a romantic partner – you want someone reliable, trustworthy, and not too expensive. In the world of digital assets, fees and security are the two biggest factors influencing whether a user will stick with Coinsquare or jump ship to a competitor. Let’s dive into how these elements sway user decisions.The decision to use Coinsquare, or any exchange for that matter, hinges on a delicate balance between cost and security.

While low fees are undeniably attractive, particularly for high-volume traders, a robust security system is paramount for everyone, regardless of trading frequency. The perceived risk of losing funds far outweighs the allure of slightly cheaper transactions. This balance shifts depending on the user’s profile and trading habits.

Factors Influencing User Choice

High-volume traders, with their frequent transactions and large sums of money involved, are extremely sensitive to fees. Even a small percentage difference in fees can translate into significant savings or losses over time. For them, security is still crucial, but the cost-benefit analysis tilts heavily towards minimizing transaction costs. Conversely, casual investors, who may trade less frequently and with smaller amounts, may prioritize security above all else.

The potential loss of their investment, however small, might be a far greater concern than a slightly higher fee. For example, a casual investor might be willing to pay a slightly higher fee for the peace of mind provided by a platform with a strong reputation for security, like Coinsquare’s robust security features, which include advanced encryption and multi-factor authentication.

This contrasts with a high-volume trader who might be more inclined to seek out exchanges with the absolute lowest fees, even if it means accepting a slightly higher security risk.

Relative Importance of Fees and Security for Different User Segments

The relative importance of fees versus security differs drastically between user segments. Consider a hypothetical scenario: Two exchanges, Exchange A and Exchange B, offer similar services. Exchange A charges lower fees but has a less robust security system (imagine a slightly less secure website or weaker two-factor authentication), while Exchange B charges slightly higher fees but boasts top-notch security, comparable to Coinsquare’s.A high-volume trader making hundreds of transactions daily would likely choose Exchange A, accepting the slightly higher risk for substantial cost savings.

Their large trading volume means that even small fee reductions translate to considerable financial benefits. On the other hand, a casual investor making only a few trades per year would probably prefer Exchange B, prioritizing the peace of mind offered by a superior security system. The higher fees are a negligible cost compared to the potential loss of their investment.

This demonstrates how the optimal balance between fees and security is highly personalized.

Strategies to Attract a Wider Range of Users

To attract a wider user base, Coinsquare could implement a tiered fee structure. This would offer lower fees for high-volume traders while maintaining competitive fees for casual investors. This strategy would cater to both segments without compromising the security features that are crucial to Coinsquare’s reputation. Additionally, Coinsquare could launch targeted marketing campaigns highlighting its security features to attract users who prioritize security over minimal fees.

For example, campaigns could focus on the specific security measures implemented, such as cold storage for crypto assets, and emphasizing the platform’s regulatory compliance and track record. This approach would differentiate Coinsquare from competitors who might prioritize low fees over security, attracting users seeking a secure and reliable platform. Furthermore, Coinsquare could offer educational resources to help users understand the importance of security and how to manage their risk effectively.

This would build trust and confidence, particularly among less experienced investors.

Conclusive Thoughts

So, there you have it – a whirlwind tour of Coinsquare Capital Markets’ fees and security measures! While the fees might need a bit of a polish to compete with some rivals, their security measures appear robust enough to keep your digital assets safe from prying eyes. Ultimately, the choice of whether Coinsquare is right for you depends on your risk tolerance and trading style.

Remember, always do your own research before entrusting your hard-earned cash (or crypto!) to any platform. Happy trading!