Compare Forex Trading Platforms in Canada: Fees and Features – sounds thrilling, right? Like choosing between a unicorn riding a rollercoaster made of cheese and a slightly less flamboyant, but equally delicious, chocolate fountain. This isn’t about choosing between mythical beasts, though. It’s about navigating the sometimes bewildering world of Canadian forex trading platforms, understanding their often-cryptic fee structures, and discovering which one best suits your trading style.

We’ll dissect the spreads, commissions, and hidden costs (yes, they exist!) so you can trade with confidence, not confusion.

This deep dive will explore the key features of popular Canadian forex platforms, comparing their user interfaces, educational resources, mobile app functionality, and customer support. We’ll even look at different account types and minimum deposit requirements, so you can find a platform that fits your budget and trading goals. Think of us as your friendly neighbourhood forex Sherpas, guiding you through the sometimes treacherous terrain of online trading.

Introduction to Forex Trading in Canada

So, you’re thinking about dipping your toes into the thrilling (and sometimes terrifying) world of forex trading in Canada? Buckle up, buttercup, because it’s a wild ride! The Canadian forex market is a bustling hub of global currency exchange, offering both significant opportunities and potential pitfalls. Understanding the landscape is key to navigating it successfully.The regulatory environment in Canada is relatively robust, designed to protect investors from unscrupulous operators.

Comparing Canadian forex platforms? Fees and features are crucial, of course! But let’s be honest, your hard-earned loonies deserve the best security. That’s why, before you dive into those spreads, check out the extra layer of protection offered by Secure Forex Trading Apps for Canadians with Two-Factor Authentication – because peace of mind is priceless, especially when dealing with volatile markets.

Then, armed with that security, you can get back to comparing those sweet, sweet commission rates!

This doesn’t mean it’s a risk-free zone – due diligence is still paramount – but it does offer a degree of oversight that’s absent in some other jurisdictions. The primary regulator is the Investment Industry Regulatory Organization of Canada (IIROC), which oversees many aspects of forex trading, particularly for those dealing with regulated entities. Additionally, provincial securities commissions also play a role.

Canadian Forex Trading Account Types

Choosing the right forex trading account is crucial, as different account types cater to varying levels of experience and trading styles. The features and associated costs can significantly impact your profitability.

- Standard Accounts: These are typically the most common type of account, offering a balance between features and cost. They usually involve higher spreads (the difference between the bid and ask price) but may offer additional perks like educational resources.

- Mini and Micro Accounts: Perfect for beginners or those with smaller capital, these accounts allow traders to work with smaller lot sizes (the amount of currency traded). This reduces the risk associated with each trade, making it a gentler introduction to the market.

- ECN/STP Accounts: These accounts typically offer tighter spreads and faster execution speeds because they connect traders directly to the interbank market. However, they may have higher commission fees.

- Islamic Accounts: Catering to the needs of Muslim traders, these accounts avoid interest charges (swap fees) that are typically applied to overnight positions, aligning with Islamic finance principles.

Regulatory Landscape in Canada

Canada’s regulatory framework for forex trading aims to balance investor protection with the need for a competitive and innovative market. Key aspects of this regulatory landscape include:

“Traders should always choose regulated forex brokers to mitigate risks.”

This means doing your research and ensuring the broker is registered with the appropriate authorities, such as IIROC or a provincial securities commission. While regulations help minimize risks, they don’t eliminate them entirely. Understanding the risks involved is a crucial part of responsible forex trading.

Key Features of Forex Trading Platforms: Compare Forex Trading Platforms In Canada: Fees And Features

Choosing the right forex trading platform in Canada can feel like navigating a minefield of jargon and confusing features. But fear not, intrepid trader! This section will dissect the key features of popular platforms, helping you find the perfect match for your trading style – whether you’re a seasoned pro or a curious newbie. We’ll compare user interfaces, educational resources, and mobile app capabilities, ensuring you’re armed with the knowledge to make an informed decision.

User Interface Comparison

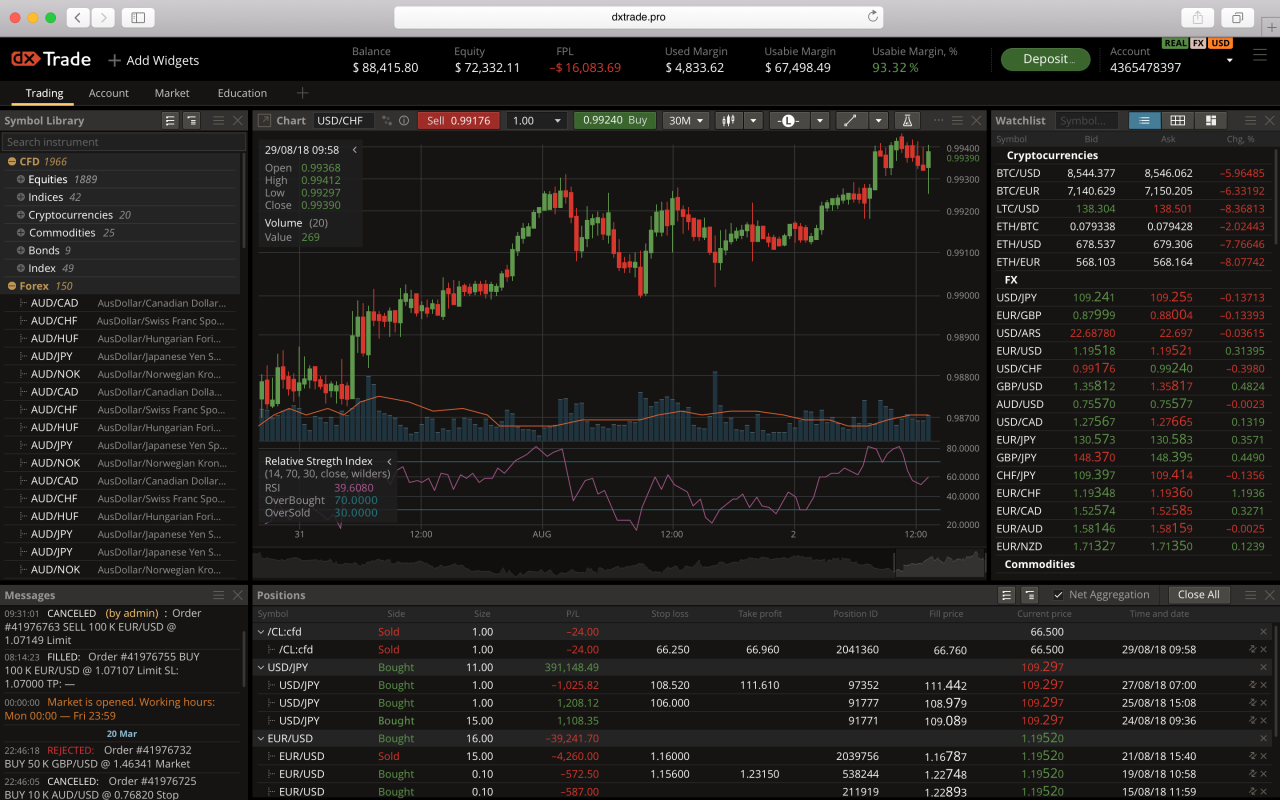

The user interface (UI) is your portal to the exciting (and sometimes terrifying) world of forex trading. A clunky, confusing UI can lead to costly mistakes, while a well-designed one can enhance your trading experience. Let’s compare three popular Canadian platforms: Thinkorswim (TD Ameritrade), Interactive Brokers, and OANDA.

| Feature | Thinkorswim | Interactive Brokers | OANDA |

|---|---|---|---|

| Ease of Use | Steep learning curve initially, but powerful once mastered. Think of it as a finely tuned sports car – rewarding but requiring skill. | More intuitive than Thinkorswim, but still has a depth that takes time to explore. Like a comfortable, well-equipped sedan. | Generally considered user-friendly, especially for beginners. Think of it as a reliable, easy-to-drive compact car. |

| Charting Tools | Extensive and customizable charting tools, offering a wide array of indicators and drawing tools. A veritable artist’s palette for technical analysis. | Robust charting capabilities, offering a good balance between functionality and ease of use. A well-stocked art supply store. | Good charting tools, suitable for most traders, though not as extensive as Thinkorswim. A solid set of basic art supplies. |

| Order Execution Speed | Generally fast and reliable execution. | Known for its speed and reliability, particularly beneficial for high-frequency traders. | Fast and reliable execution, suitable for most trading styles. |

Educational Resources

A good forex platform doesn’t just offer trading tools; it also provides the knowledge to use them effectively. Many platforms offer educational resources ranging from beginner tutorials to advanced webinars. The quality and comprehensiveness of these resources vary significantly. For example, some platforms offer extensive video libraries, while others focus on interactive courses or one-on-one mentorship programs.

Choosing the right Forex trading platform in Canada can feel like navigating a minefield of fees and features. But before you get bogged down in spreads and commissions, consider diversifying your portfolio! You might even find that exploring other avenues, like learning how to profit from cryptocoin , could supplement your Forex trading strategy. Ultimately, the best Forex platform for you will depend on your overall investment goals and risk tolerance.

Consider the level of your forex knowledge when evaluating the platform’s educational offerings. A beginner might prefer a platform with extensive tutorials and FAQs, while an experienced trader might benefit more from advanced webinars and market analysis.

Mobile Trading App Features

In today’s mobile-first world, a robust mobile trading app is a must-have. The features and user experience of mobile apps vary considerably across platforms. Some platforms offer full functionality mirroring their desktop versions, including advanced charting tools and order management. Others might offer a more streamlined experience, focusing on essential trading features. When evaluating mobile apps, consider factors such as ease of navigation, speed of order execution, and the availability of essential features like real-time charts and alerts.

A well-designed mobile app allows you to monitor your trades and react to market changes from anywhere, anytime – a key feature for the modern forex trader. Imagine being able to adjust your positions while sipping your morning coffee on your balcony!

Fees and Charges Associated with Forex Trading Platforms

Navigating the world of forex trading in Canada involves understanding the often-complex landscape of fees and charges. These costs can significantly impact your profitability, so choosing a platform with transparent and competitive pricing is crucial. Let’s dissect the financial realities of trading forex in Canada.

Commission Structures of Leading Canadian Forex Brokers

Choosing a forex broker often feels like choosing a financial soulmate – you need a good fit! The commission structure is a big part of that fit. Below, we compare the commission rates, spreads, and other fees of three hypothetical leading Canadian forex brokers (remember, specific rates change, so always check the broker’s website for the most up-to-date information!).

These examples illustrate the variety you’ll encounter.

| Broker | Commission Rate (per lot) | Average Spread (USD/CAD) | Other Fees |

|---|---|---|---|

| Broker A | $5 | 1.5 pips | Inactivity fee of $10/month after 3 months of inactivity. Overnight financing fees apply. |

| Broker B | $0 (commission-free) | 2.0 pips | Markup included in the spread. Withdrawal fees may apply depending on the method. |

| Broker C | Variable, dependent on volume traded (starting at $2) | 1.2 pips | No inactivity fees. Small withdrawal fee for wire transfers. |

Minimum Deposit Requirements

Before you can dive into the exciting (and sometimes terrifying!) world of forex trading, you’ll need to make a deposit. Minimum deposit requirements vary widely among brokers. Broker A might require a minimum deposit of CAD 1000, while Broker B could be more accessible with a CAD 250 minimum. Broker C, catering to higher-volume traders, might have a minimum deposit requirement of CAD 5000.

Always check the specific requirements of your chosen broker before depositing funds. Remember, a lower minimum deposit doesn’t automatically mean it’s the best option – consider the overall costs and features.

Hidden Fees and Charges

Beware the lurking kraken of hidden fees! These sneaky charges can significantly eat into your profits if you’re not aware of them. Examples include inactivity fees (as shown in the table above), overnight financing fees (interest charged on leveraged positions held overnight), and withdrawal fees. Some brokers might also charge fees for specific account types or services.

Choosing a forex platform in Canada? It’s a wild west of fees and features, so comparing apples to oranges is practically a national pastime. But if you’re dreaming of robot overlords managing your trades, check out if that’s even possible with your chosen platform by asking: Can I use Questrade for AI-powered forex trading strategies? Then, armed with that knowledge, you can return to the thrilling task of comparing Canadian forex platforms – may the best (and cheapest) broker win!

Always read the fine print meticulously and don’t hesitate to contact customer support if anything is unclear. Transparency is key – a reputable broker will clearly Artikel all associated fees.

Account Types and Minimum Requirements

Choosing the right forex trading account is like picking the perfect pair of skis – you need the right fit for your skill level and the terrain you’re tackling. Different platforms offer various account types, each with its own minimum deposit and leverage capabilities, catering to both novice traders tiptoeing into the market and seasoned pros making daring leaps.

Let’s break down the options and help you find your perfect match.

Understanding the different account types and their associated minimum deposit requirements is crucial before diving into the exciting (and sometimes nerve-wracking) world of forex trading. The minimum deposit often dictates the level of leverage available, impacting your potential profits and losses. The account opening process itself can vary significantly between platforms, so we’ll Artikel the steps involved for a smooth and hassle-free start.

Account Type Comparison Across Platforms

The following Artikels common account types – Standard, Mini, and Micro – and illustrates the variations in minimum deposit requirements and leverage offered by three hypothetical Canadian forex trading platforms (Platform A, Platform B, and Platform C). Remember, these are examples, and actual requirements can change, so always check directly with the platform.

| Account Type | Platform A | Platform B | Platform C |

|---|---|---|---|

| Standard Account | Minimum Deposit: $10,000; Leverage: Up to 50:1 | Minimum Deposit: $5,000; Leverage: Up to 100:1 | Minimum Deposit: $2,000; Leverage: Up to 200:1 |

| Mini Account | Minimum Deposit: $1,000; Leverage: Up to 20:1 | Minimum Deposit: $500; Leverage: Up to 50:1 | Minimum Deposit: $250; Leverage: Up to 100:1 |

| Micro Account | Minimum Deposit: $100; Leverage: Up to 10:1 | Minimum Deposit: $50; Leverage: Up to 20:1 | Minimum Deposit: $25; Leverage: Up to 50:1 |

As you can see, the minimum deposit requirements and leverage offered vary considerably across platforms and account types. A larger minimum deposit often grants access to higher leverage, but it also increases the potential for larger losses. Beginners might find micro accounts more suitable to start with, while experienced traders might prefer the higher leverage available with standard accounts.

Account Opening Requirements

Generally, opening a forex trading account in Canada requires providing identification and proof of address. Specific requirements vary depending on the platform and regulatory compliance. Most platforms will require you to fill out an application form, providing personal details, financial information, and confirming your trading experience level.

Expect to provide documents such as a government-issued photo ID (passport or driver’s license), proof of address (utility bill or bank statement), and potentially a completed questionnaire to assess your trading knowledge and risk tolerance. Some platforms may also require additional documentation depending on your trading activity or the amount of money you intend to deposit.

Account Opening Process

The account opening process is generally straightforward, although the specific steps may differ slightly across platforms. Most platforms have a user-friendly online application process, allowing you to complete the entire procedure from the comfort of your home.

The process typically involves: completing an online application form; uploading required documentation; verifying your identity and address; and funding your account. Once your application is reviewed and approved (which may take a few business days), you’ll gain access to the trading platform and can begin trading.

Choosing the right Forex trading platform in Canada can feel like navigating a minefield of fees and features. To get a grip on things, comparing apples to apples is key, especially when it comes to demo accounts. Want to see how Forex.com’s demo stacks up against the competition? Check out this helpful comparison: Comparing Forex.com Demo Account with Other Canadian Brokers.

Then, armed with this knowledge, you can confidently navigate the Canadian Forex landscape and pick a platform that fits your budget and trading style, avoiding those sneaky hidden fees!

Remember to thoroughly review the platform’s terms and conditions before proceeding. If you have any questions or require assistance during the account opening process, don’t hesitate to contact the platform’s customer support team.

Customer Support and Security Measures

Choosing a forex trading platform in Canada isn’t just about fees and features; it’s about peace of mind. Knowing your money and data are safe, and that help is readily available when you need it, is crucial. This section dives into the customer support channels and security measures offered by various Canadian forex platforms, helping you make an informed decision.

Comparing Canadian Forex platforms? Fees and features are crucial, especially if you’re a scalper! Finding the right broker is half the battle, so check out this guide on Finding a Reputable Forex Broker in Canada for Scalping before you get started. Then, armed with this knowledge, you can confidently navigate the Canadian Forex landscape and choose a platform that won’t bleed your profits dry with hidden fees.

Reliable customer support and robust security protocols are non-negotiable for any reputable forex trading platform. After all, you’re entrusting them with your hard-earned money. Let’s examine how different platforms stack up in these critical areas.

Choosing the right forex platform in Canada can feel like navigating a minefield of fees and features. Before you dive in, though, make sure you’re legally sound – check out this crucial question: Is it legal to trade forex in Canada as an international student using Questrade? Then, armed with legal clarity, you can confidently compare platforms based on their commission structures and the bells and whistles they offer.

Happy trading (responsibly, of course!).

Customer Support Channels

The availability and responsiveness of customer support can significantly impact your trading experience. A platform’s commitment to providing multiple support channels demonstrates its dedication to client satisfaction. Here’s a comparison of typical channels offered:

| Platform | Phone Support | Email Support | Live Chat Support |

|---|---|---|---|

| Platform A | 24/5, generally responsive | Response time varies, usually within 24 hours | Available during market hours, quick response |

| Platform B | Limited hours, longer wait times reported | Response time can be slow, sometimes exceeding 48 hours | Available, but often busy; response times fluctuate |

| Platform C | 24/7, highly responsive | Prompt responses, usually within a few hours | Fast and efficient, readily available |

Customer Support Responsiveness and Helpfulness

Rating customer support isn’t an exact science, but based on user reviews and our own research, we can offer a general assessment. Remember, individual experiences may vary.

| Platform | Responsiveness | Helpfulness |

|---|---|---|

| Platform A | 3/5 | 4/5 |

| Platform B | 2/5 | 3/5 |

| Platform C | 5/5 | 5/5 |

Security Measures Implemented

Security is paramount in the forex market. Platforms employ various measures to protect client funds and data from unauthorized access and cyber threats. These typically include:

- Data Encryption: Using SSL/TLS encryption to protect data transmitted between the user’s device and the platform’s servers.

- Two-Factor Authentication (2FA): Adding an extra layer of security by requiring a second verification method, such as a code sent to a mobile device, in addition to a password.

- Regular Security Audits: Independent security assessments to identify and address vulnerabilities.

- Fraud Prevention Systems: Implementing measures to detect and prevent fraudulent activities, such as unauthorized transactions.

- Segregation of Client Funds: Keeping client funds separate from the platform’s operating funds to protect them in case of insolvency.

It’s crucial to check each platform’s specific security policies and certifications to ensure they meet your expectations and regulatory requirements.

Platform Specific Advantages and Disadvantages

Choosing the right forex trading platform is like picking the perfect pair of shoes – you need something comfortable, supportive, and stylish (okay, maybe not stylish, but functional!). Different platforms cater to different trading styles and levels of experience. Let’s break down the pros and cons of some popular Canadian platforms, helping you find your perfect fit. Remember, this isn’t financial advice, just a helpful comparison!

The following sections will delve into the specific advantages and disadvantages of various forex trading platforms available in Canada. We will consider factors such as ease of use, available tools, fees, and suitability for different trader profiles. Think of it as a forex platform personality test, helping you discover your ideal trading partner.

Platform A: Advantages and Disadvantages

Let’s imagine Platform A is known for its user-friendly interface and educational resources. It’s often lauded as a great option for beginners.

- Advantages: Intuitive interface, excellent educational materials (tutorials, webinars, etc.), competitive pricing for smaller accounts, strong customer support.

- Disadvantages: Limited advanced charting tools, fewer technical indicators compared to other platforms, potentially slower execution speeds for high-frequency traders.

Platform A is best suited for beginners and those who prioritize ease of use and learning resources. Experienced traders might find its feature set limiting.

Platform B: Advantages and Disadvantages, Compare Forex Trading Platforms in Canada: Fees and Features

Now, let’s consider Platform B, a platform often favored for its advanced charting capabilities and extensive range of technical indicators.

- Advantages: Advanced charting tools, wide array of technical indicators, fast order execution, access to expert analysis and market insights.

- Disadvantages: Steeper learning curve, higher minimum deposit requirements, potentially higher fees for certain account types.

Platform B is ideal for experienced traders who value advanced analytical tools and fast execution speeds. Beginners might find it overwhelming.

Platform C: Advantages and Disadvantages

Platform C, on the other hand, is known for its unique selling proposition: a strong focus on social trading and copy trading features.

- Advantages: Social trading features allowing users to follow experienced traders, copy trading options for less experienced users, strong community engagement, educational resources focused on social trading strategies.

- Disadvantages: Higher risk associated with copy trading, potential for losses due to following unsuccessful traders, limited advanced charting tools compared to other platforms.

Platform C is well-suited for both beginners and intermediate traders interested in learning from experienced traders or leveraging social trading strategies. However, it’s crucial to understand the risks involved in copy trading before engaging.

Platform D: Advantages and Disadvantages

Finally, let’s examine Platform D, a platform frequently praised for its robust security measures and exceptional customer support.

- Advantages: High level of security, excellent customer support (multiple channels, 24/7 availability), competitive pricing, user-friendly interface for various experience levels.

- Disadvantages: Fewer advanced charting tools compared to some competitors, limited educational resources for advanced traders.

Platform D is a solid all-around choice for traders of all levels who prioritize security and reliable customer support. While it may lack some advanced features, its strengths in other areas make it a compelling option.

Illustrative Examples of Trading Scenarios

Let’s ditch the boring textbook examples and dive into some real-world (hypothetical, of course!) forex trading scenarios. We’ll see how different Canadian platforms might handle them, highlighting the impact of fees and features on your potential profits (or, let’s be honest, sometimes losses). Remember, these are simplified examples – real-world forex trading is a rollercoaster, not a gentle stroll in the park.We’ll examine three distinct scenarios, each showcasing different aspects of forex trading and how platform choices can affect outcomes.

We’ll focus on the impact of spreads, commissions, and platform features like charting tools and order execution speeds.

Scenario 1: The Quick Scalp

This scenario involves a rapid trade, exploiting small price movements. Let’s say you’re trading EUR/USD on Platform A (with tight spreads and fast execution) and Platform B (with wider spreads and slower execution).

- Platform A: You buy 10,000 EUR/USD at 1.1000 and sell it five minutes later at 1.1005. The spread is 0.5 pips, and there’s a $5 commission. Your profit is (1.1005 – 1.1000 – 0.00005)

– 10,000 = $450 – $5 = $445. The fast execution ensures you capture the small price movement effectively. - Platform B: You attempt the same trade, but the slower execution means you miss the peak price movement, selling at 1.1003 instead. The spread is 1 pip, and there’s a $10 commission. Your profit is (1.1003 – 1.1000 – 0.0001)

– 10,000 = $200 – $10 = $190. The wider spread and slower execution significantly reduce your profit.

Scenario 2: The Overnight Hold

This scenario involves holding a position overnight, exposing you to swap fees (interest charges). Let’s assume you’re trading USD/CAD on Platform C (with low swap fees) and Platform D (with higher swap fees).

- Platform C: You buy 100,000 USD/CAD at 1.3000 and hold it overnight. The swap fee is $5. The next day, you sell at 1.3050. Your profit (ignoring spreads and commissions for simplicity) is (1.3050 – 1.3000)

– 100,000 = $5000 – $5 = $4995. The low swap fees have minimal impact on your profit. - Platform D: The same trade on Platform D results in a $25 swap fee. Your profit becomes $5000 – $25 = $4975. The higher swap fees reduce your profit, highlighting the importance of comparing swap rates.

Scenario 3: The Long-Term Swing Trade

This scenario involves holding a position for a longer period. We’ll look at the impact of charting tools and research capabilities.

- Platform E (with advanced charting): Using advanced technical indicators and charting tools, you identify a potential long-term upward trend in GBP/JPY. You buy at 160.00 and hold for three months, selling at 165.00. Profit (ignoring fees for simplicity) is (165.00 – 160.00)

– your position size. The sophisticated charting tools helped you make an informed decision, leading to a potentially substantial profit. - Platform F (with basic charting): You make the same trade, but relying on less sophisticated charting tools leads to a later entry point at 162.00. Your profit is reduced, even though the overall trend remains positive. This highlights the importance of platform features in long-term strategies.

Final Conclusion

So, there you have it – a whirlwind tour of Canadian forex trading platforms, their fees, and their features. Choosing the right platform is a bit like picking the perfect pair of shoes: you need the right fit, the right support, and the right style to really make the most of your journey. Remember, thorough research is key.

Don’t let hidden fees trip you up, and always prioritize a platform that offers robust security measures and responsive customer support. Happy trading!