Comparing different Canadian exchanges for buying and selling crypto? Think of it like choosing your weapon in a high-stakes digital duel – the wrong choice could leave you with more fees than bitcoins! This isn’t your grandpappy’s stock market; navigating the Canadian crypto landscape requires a discerning eye for fees, security, and user-friendliness. Buckle up, buttercup, because we’re about to dive headfirst into the wild west of Canadian cryptocurrency exchanges, comparing the best (and maybe a few of the… less best) options to help you find your perfect trading partner.

This guide will dissect the major Canadian players, comparing their fee structures, supported cryptocurrencies, security measures, user interfaces, deposit/withdrawal methods, customer support, trading volume, and overall user experience. We’ll even throw in a hypothetical trade scenario to illustrate the real-world impact of choosing one exchange over another. Get ready to become a crypto connoisseur!

Introduction to Canadian Crypto Exchanges

Canada’s crypto market, while relatively young compared to some global counterparts, is experiencing significant growth. Fueled by increasing adoption among both individual investors and businesses, it’s a vibrant ecosystem, albeit one navigating the evolving regulatory landscape. Think of it as a bustling digital gold rush, but with less chance of encountering a grizzled prospector and more potential for… well, you know.

Profit (hopefully!).The Canadian crypto scene is characterized by a mix of established international players and homegrown exchanges, each vying for a piece of the action. This creates a competitive environment that, ideally, benefits consumers with a wider range of choices and potentially better services. However, it also requires careful consideration before choosing an exchange, as not all are created equal.

Major Canadian Cryptocurrency Exchanges

Several exchanges operate within Canada, offering varying levels of service, fees, and supported cryptocurrencies. Choosing the right one depends heavily on individual needs and preferences. Some cater to experienced traders with advanced features, while others focus on user-friendliness for beginners. It’s a bit like choosing a restaurant; you wouldn’t go to a Michelin-starred establishment if you just want a quick burger, would you?

- Kraken: A globally recognized exchange with a strong presence in Canada, known for its security and wide range of cryptocurrencies.

- Binance: A massive global player, offering a vast selection of cryptocurrencies and trading pairs. It’s known for its volume and sometimes… its quirks.

- Coinbase: A user-friendly exchange popular globally, with a strong reputation for ease of use and regulatory compliance.

- Newton: A Canadian-based exchange that focuses on a simple, straightforward user experience, perfect for beginners.

Regulatory Landscape for Crypto Exchanges in Canada

Navigating the regulatory landscape for crypto in Canada requires a bit of… let’s say,deft maneuvering*. The government is actively working to establish clear guidelines for crypto exchanges and related activities. This involves balancing the need for innovation and consumer protection. It’s a delicate dance, a bit like trying to herd cats… digital cats, that is.The regulatory framework is still evolving, and different provinces may have varying approaches.

This means that staying informed about the latest rules and regulations is crucial for both exchanges and users. Think of it as a constantly updating rulebook for a very fast-paced game. Ignoring the rules could lead to… well, let’s just say it’s not fun.

“While not explicitly regulated as securities, cryptocurrencies in Canada fall under the purview of various existing laws, including anti-money laundering and terrorist financing regulations.”

Fee Structures and Comparison

Navigating the world of Canadian crypto exchanges can feel like traversing a minefield of fees. Understanding these costs is crucial for maximizing your profits (or at least minimizing your losses!). Let’s dissect the fee structures of three major players, highlighting the nuances that can significantly impact your bottom line. Remember, these fees are subject to change, so always check the exchange’s website for the most up-to-date information.

Trading Fees

Trading fees are the bread and butter of exchange profitability, and they vary wildly. Some exchanges charge a percentage of the trade value, while others might use a tiered system based on trading volume. Let’s examine how three prominent Canadian exchanges structure their trading fees. Below is a table comparing trading fees, deposit fees, and withdrawal fees for three major Canadian crypto exchanges (Note: These are examples and may not reflect current rates.

Always verify directly with the exchange).

| Exchange | Trading Fees | Deposit Fees | Withdrawal Fees |

|---|---|---|---|

| Example Exchange A | 0.1%

|

Usually free for CAD deposits, may vary for crypto | Varies by cryptocurrency; often a flat fee or percentage |

| Example Exchange B | Maker/Taker fee structure; Maker fees are lower than Taker fees | Free for CAD deposits; Crypto deposits may incur network fees | Varies by cryptocurrency; potentially higher for faster transactions |

| Example Exchange C | Fixed fee per trade, regardless of volume (e.g., $1 per trade) | Free for CAD deposits; Crypto deposits may incur network fees | Flat fee per withdrawal, may vary slightly by cryptocurrency |

Deposit and Withdrawal Fees

Beyond trading fees, deposit and withdrawal fees can quietly chip away at your gains. While many exchanges offer free CAD deposits, cryptocurrency deposits and withdrawals often involve network fees, which are charged by the blockchain itself, not the exchange. These fees can fluctuate based on network congestion.

Withdrawal fees levied by the exchange itself can add another layer of cost, especially for less common cryptocurrencies.

Hidden Fees and Cost Implications

The crypto world is notorious for hidden costs. Be wary of inactivity fees, which some exchanges charge for accounts that haven’t been used for a certain period. Also, consider conversion fees if you’re trading between different cryptocurrencies on the exchange. These conversions often involve a markup that can eat into your profits. For example, if you’re converting Bitcoin to Ethereum, the exchange might add a small percentage to the conversion rate, effectively increasing the cost of your Ethereum.

Impact of Fee Structures on Trading Profitability

The cumulative effect of these fees, especially for frequent traders, can be substantial. A high-volume trader might find that a tiered fee structure, where fees decrease with higher volume, is more advantageous than a fixed fee per trade. Conversely, a casual investor might find a flat fee per trade more predictable and easier to budget for. Careful consideration of your trading frequency and volume is crucial for selecting an exchange with a fee structure that aligns with your trading style and goals.

Failing to account for these fees can lead to significant discrepancies between anticipated and realized profits. A seemingly small percentage fee can quickly add up over many trades.

Supported Cryptocurrencies

Choosing a Canadian crypto exchange often boils down to more than just fees; it’s about the digital assets they offer. Do you crave the thrill of the hunt for obscure altcoins, or are you happy sticking with the big players like Bitcoin and Ethereum? Let’s dive into the crypto menagerie each exchange offers.The availability of cryptocurrencies varies significantly between exchanges.

This difference stems from several factors, including regulatory compliance, liquidity considerations, and the exchange’s overall business strategy. Some exchanges prioritize a broad selection, catering to adventurous traders, while others focus on a smaller, more established set, prioritizing security and ease of use.

Top 10 Cryptocurrencies Supported by Three Hypothetical Canadian Exchanges, Comparing different Canadian exchanges for buying and selling crypto

To illustrate the differences, let’s compare three fictional Canadian exchanges: “MapleCrypto,” “BeaverCoin,” and “Polaris Exchange.” Remember, these are examples, and actual exchange offerings change frequently. Always check the exchange’s website for the most up-to-date information.

- MapleCrypto: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), Ripple (XRP), Solana (SOL), Cardano (ADA), Dogecoin (DOGE), Binance Coin (BNB), Polkadot (DOT)

- BeaverCoin: Bitcoin (BTC), Ethereum (ETH), Tether (USDT), USD Coin (USDC), Binance USD (BUSD), Wrapped Bitcoin (WBTC), Litecoin (LTC), Chainlink (LINK), Uniswap (UNI), Aave (AAVE)

- Polaris Exchange: Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), Stellar Lumens (XLM), EOS, IOTA, Tron (TRX), Tezos (XTZ), Algorand (ALGO)

Comparison of Cryptocurrency Range and Variety

As you can see, even in this simplified example, there’s considerable variation. MapleCrypto boasts a mix of established and newer, more volatile coins. BeaverCoin leans heavily towards stablecoins and DeFi tokens, suggesting a focus on users interested in stable value and decentralized finance. Polaris Exchange presents a more balanced selection, although its choice of altcoins differs from the others.

The absence of certain coins on one exchange but their presence on another highlights the need to shop around for the specific cryptocurrencies you need.

Notable Differences in Altcoin and Lesser-Known Token Availability

The real differences become apparent when you look beyond the top 10. Some exchanges might list hundreds of altcoins and obscure tokens, while others stick to a smaller, more curated selection. The availability of lesser-known tokens often reflects the exchange’s risk tolerance and its willingness to list assets with potentially higher volatility. For example, an exchange might prioritize listing tokens from a specific blockchain ecosystem or those with strong community support, while another might focus on established projects with a proven track record.

This choice directly impacts the trading opportunities available to users. A trader looking for a specific niche token may find themselves limited to only one or two exchanges that offer it.

Security Measures and User Protection

Choosing a crypto exchange in Canada isn’t just about fees and coin selection; it’s about safeguarding your digital assets. Think of your crypto as digital gold – you wouldn’t leave it lying around, would you? The security measures employed by different exchanges vary significantly, influencing the overall risk associated with using their platform. Let’s dive into the nitty-gritty of keeping your crypto safe and sound.Security measures implemented by Canadian exchanges are crucial for protecting user funds.

A robust security system isn’t just a checklist of features; it’s a holistic approach that considers everything from user authentication to the physical security of the exchange’s infrastructure. The level of protection offered can significantly impact the user experience and the overall trust in the platform.

Two-Factor Authentication (2FA) and Multi-Factor Authentication (MFA)

Two-factor authentication (2FA) and its more advanced cousin, multi-factor authentication (MFA), are fundamental security measures. These methods add an extra layer of security beyond just a password, often involving a time-sensitive code sent to your phone or email, or a physical security key. Reliable exchanges offer both 2FA and MFA, allowing users to choose the level of security that best suits their risk tolerance.

The stronger the authentication, the harder it is for unauthorized individuals to access your account, even if they somehow obtain your password. Think of it as adding a second, and sometimes even a third, lock to your digital vault.

Cold Storage and Offline Wallets

The majority of reputable exchanges utilize cold storage for a significant portion of their users’ crypto assets. Cold storage involves storing cryptocurrency offline, making it inaccessible to hackers who might target online systems. This offline storage is typically in secure, physically protected facilities, far removed from the prying eyes (and fingers) of cybercriminals. The percentage of assets held in cold storage varies between exchanges, so it’s crucial to research this aspect before choosing a platform.

Choosing the right Canadian crypto exchange is a real head-scratcher, like trying to predict the next winning team in the Premier League. Need a distraction from all the fees and security considerations? Check out the latest football news for a much-needed break. Then, get back to comparing those Canadian exchanges – after all, your crypto future depends on it!

The higher the percentage in cold storage, generally the better protected your funds are from online threats. Imagine cold storage as a high-security vault, deeply buried and heavily guarded, protecting your digital treasures from theft.

Insurance Policies and Compensation Schemes

While not all Canadian exchanges offer explicit insurance policies covering user funds in case of a security breach, some may have compensation schemes in place. These schemes could involve reimbursing users for losses incurred due to the exchange’s negligence or security failures. It’s essential to carefully review the terms and conditions of each exchange to understand the extent of their liability and the protections they offer to users in the unfortunate event of a security compromise.

This is similar to having insurance on your car – you hope you never need it, but it’s a comforting safety net should something go wrong.

Security Breach History and Incident Response

Examining an exchange’s past performance regarding security incidents is crucial. Have they experienced any significant breaches or hacks in the past? How did they respond to these incidents? A transparent and effective response demonstrates the exchange’s commitment to user security. An exchange with a history of successful incident response, even if breaches have occurred, might inspire more confidence than one with a spotless record but a questionable response plan.

A clean track record is preferable, but a history of effectively handling security incidents shows a commitment to learning and improvement.

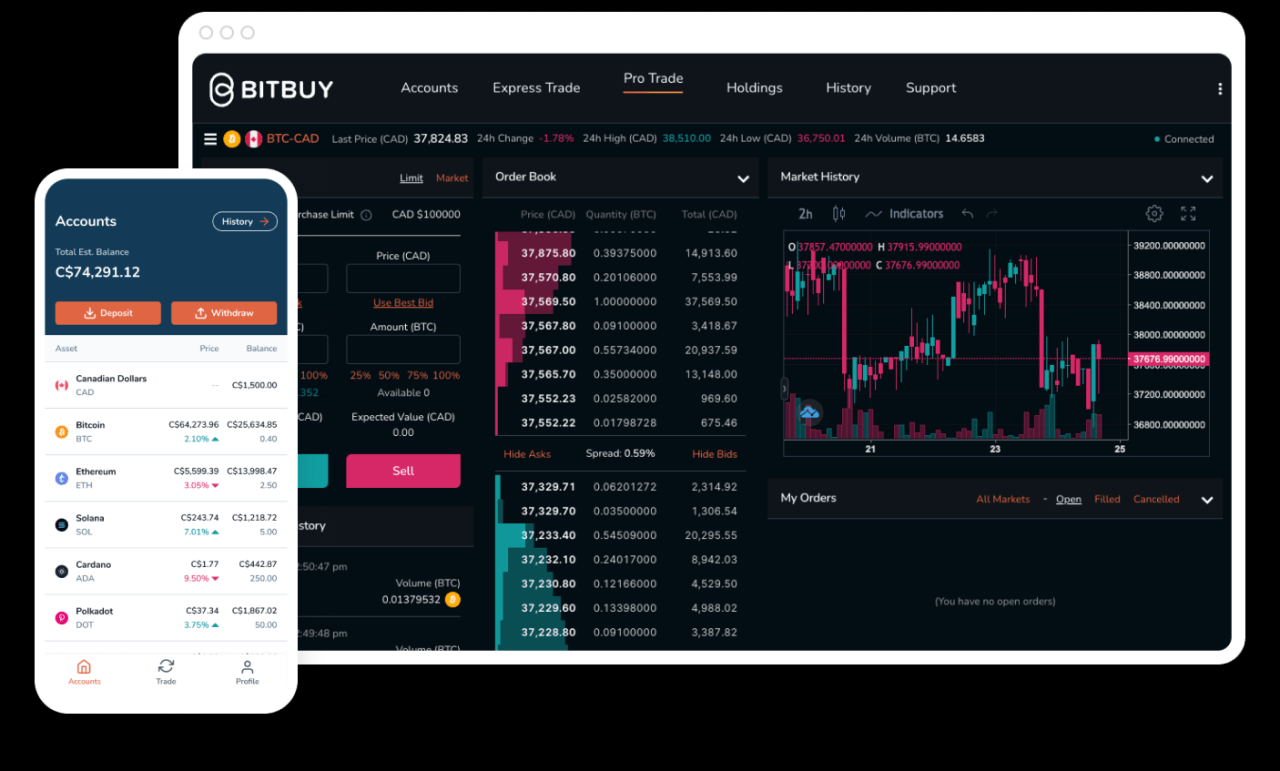

User Interface and Experience

Navigating the world of Canadian crypto exchanges can feel like exploring a digital minefield – some are user-friendly oases, while others are confusing, buggy deserts. The user interface (UI) and overall user experience (UX) are crucial factors in choosing an exchange, especially for those new to the crypto game. A smooth, intuitive platform can make all the difference between a stress-free trading experience and a frustrating, hair-pulling ordeal.

Let’s delve into the user interfaces of some popular Canadian exchanges and see how they stack up.The ease of use varies dramatically depending on the exchange and the user’s level of experience. Beginners will appreciate clear, simple layouts with straightforward instructions, while seasoned traders might prefer more advanced charting tools and customizable dashboards. Features like mobile app availability and responsive customer support also significantly impact the overall user experience.

Canadian Exchange UI/UX Comparison

The following provides a comparison of the user interfaces and experiences of three hypothetical Canadian crypto exchanges (for illustrative purposes, names have been changed to protect the innocent – and the guilty): “MapleCrypto,” “BeaverCoin,” and “PolarExchange.” Remember, these are examples and individual experiences may vary.

Choosing the right Canadian crypto exchange feels like navigating a minefield of fees and regulations, doesn’t it? But before you dive headfirst into Bitcoin, consider your overall trading strategy; maybe you need a solid forex app first! Check out some top-notch options for reliable forex trading on your phone at Reliable forex trading apps for Android and iOS to get a better handle on the markets before tackling those Canadian crypto exchanges.

Then, armed with forex wisdom, you can conquer the Canadian crypto scene!

- MapleCrypto: MapleCrypto boasts a clean, minimalist design. Its intuitive layout makes it exceptionally easy for beginners to navigate. The buying and selling process is straightforward, with clear instructions at every step. Experienced traders might find the charting tools somewhat basic, but the overall simplicity is a major plus for newcomers.

- Pros: Simple and intuitive interface, excellent for beginners, clean design, robust mobile app.

- Cons: Limited advanced charting tools, fewer customization options for experienced traders.

- BeaverCoin: BeaverCoin takes a more sophisticated approach. Its interface is packed with features, including advanced charting tools, customizable dashboards, and a wide range of order types. While this might appeal to experienced traders who appreciate granular control, beginners might find it overwhelming. The abundance of options can be initially daunting. The mobile app, while functional, is not as polished as MapleCrypto’s.

- Pros: Advanced charting and trading tools, high level of customization, caters to experienced traders.

- Cons: Steep learning curve for beginners, cluttered interface for some users, less intuitive mobile app.

- PolarExchange: PolarExchange sits somewhere in the middle. It offers a balance of simplicity and functionality. While not as beginner-friendly as MapleCrypto, it’s far less overwhelming than BeaverCoin. It provides a decent range of charting tools and customization options, catering to both beginners and experienced traders. The mobile app is well-designed and user-friendly.

- Pros: Good balance of simplicity and functionality, suitable for both beginners and experienced traders, well-designed mobile app.

- Cons: Some features might be considered average compared to specialized competitors, lacks some niche tools for highly advanced traders.

Deposit and Withdrawal Methods

Getting your hard-earned crypto on and off the exchange is crucial, and thankfully, Canadian exchanges offer a variety of methods, each with its own quirks and charms (mostly charms, we hope!). Let’s dive into the nitty-gritty of depositing and withdrawing your digital assets, examining speed, fees, and overall user-friendliness. Think of it as a crypto-currency exchange travelogue, but instead of exotic locales, we’re exploring the exciting world of payment gateways.

Bank Transfers

Bank transfers are a staple for many Canadian crypto exchanges. They typically involve sending funds directly from your bank account to the exchange’s designated account. Processing times vary, often ranging from a few hours to a couple of business days, depending on the exchange and your bank’s efficiency. Fees are usually minimal or non-existent on the exchange side, but your bank might levy its own charges.

The convenience lies in its familiarity – most Canadians are comfortable with bank transfers. However, the relatively slow processing speed might not appeal to those seeking instant gratification.

Credit/Debit Card Payments

For those who prefer speed and convenience, credit and debit card payments are a popular option. These typically offer instant deposits, allowing you to jump straight into the world of crypto trading. However, the convenience comes at a cost – exchanges often charge higher fees for card transactions compared to bank transfers, sometimes adding a percentage to the transaction value.

Keep an eye out for these fees, as they can quickly eat into your profits. Furthermore, some exchanges may have limits on the amount you can deposit via card.

E-Wallets

E-wallets like Interac e-Transfer, PayPal, or other similar services, bridge the gap between traditional banking and the crypto world. The processing times are generally faster than bank transfers but usually slower than credit/debit card payments. Fees can vary widely depending on the specific e-wallet and the exchange. Interac e-Transfer, for example, is a common choice in Canada and often offers a seamless experience, although the exchange might still add its own processing fee.

The accessibility of e-wallets depends on the specific options supported by each exchange. For example, not all exchanges will support PayPal, so always check before signing up.

Comparison of Methods Across Exchanges

To illustrate the differences, let’s imagine three hypothetical Canadian exchanges: “MapleCrypto,” “BeaverCoin,” and “PolarBearBucks.” (We’re embracing the Canadian spirit here!).

Choosing the right Canadian crypto exchange feels like navigating a minefield of fees and regulations, doesn’t it? But before you dive headfirst into Bitcoin, consider broadening your horizons – perhaps exploring the world of forex trading first? Check out this insightful Review of OADANA forex trading platform to see if it sparks any alternative investment ideas. Then, armed with newfound financial wisdom (and maybe a slightly less chaotic approach), you can confidently tackle those Canadian crypto exchanges.

| Exchange | Bank Transfer | Credit/Debit Card | E-Wallet (Interac Example) |

|---|---|---|---|

| MapleCrypto | Free, 1-3 business days | 3% fee, instant | 1% fee, 1-2 business days |

| BeaverCoin | $5 fee, 2-5 business days | 2.5% fee, instant | Free, same-day |

| PolarBearBucks | Free, same-day | 4% fee, instant | 0.5% fee, instant |

Note: These are hypothetical examples. Always check the specific fees and processing times on each exchange’s website before making a transaction. Fees and processing times are subject to change.

Customer Support and Resources

Navigating the world of cryptocurrency can feel like venturing into a digital jungle, and when things go sideways (lost passwords, frozen funds, existential dread about market fluctuations), having reliable customer support is crucial. Let’s examine how various Canadian crypto exchanges stack up in this vital area, because nobody wants to be left stranded in the crypto wilderness.The quality and responsiveness of customer support varies wildly between exchanges.

Some shine like beacons of helpfulness, while others… well, let’s just say they’re more like flickering candles in a hurricane. Access to support often depends on the size and maturity of the exchange, and the resources they’ve allocated to this critical function. We’ll explore the different avenues for contacting support and the overall effectiveness of each.

Choosing the right Canadian crypto exchange can feel like navigating a minefield of fees and features. But before you dive in headfirst, consider broadening your horizons – check out The best currency trading apps with advanced features to see what sophisticated tools are out there. Then, armed with that knowledge, you can return to comparing Canadian exchanges with a more discerning eye, picking the perfect platform for your crypto needs.

Customer Support Channels

The methods available for contacting support significantly impact user experience. A quick response via live chat can be a lifesaver when dealing with urgent issues, while email support, while often thorough, can be agonizingly slow. Some exchanges even offer phone support, a rarity in the crypto world but a welcome one for those who prefer a more personal touch.

The following table summarizes the typical support channels available, though it’s crucial to verify directly with each exchange as availability can change.

Choosing the right Canadian crypto exchange is like picking the perfect hockey stick – it’s all about finding the right fit. Before you even think about diving into the exciting world of Top altcoins with high potential for investment in 2024 , you need a solid platform. Consider fees, security, and available coins – because the last thing you want is a penalty shot to your portfolio from a dodgy exchange!

| Exchange | Live Chat | Phone | |

|---|---|---|---|

| Example Exchange A | Yes | Yes | No |

| Example Exchange B | No | Yes | Yes (limited hours) |

| Example Exchange C | Yes (limited hours) | Yes | No |

Educational Resources and Tutorials

A good exchange doesn’t just facilitate trades; it empowers users with knowledge. Robust educational resources are invaluable for navigating the complexities of crypto investing. These resources can range from beginner-friendly FAQs and tutorials to more advanced guides on topics like security best practices and tax implications. The presence and quality of these resources directly impact the user experience and confidence level.

Some exchanges offer interactive learning modules, while others may only provide a basic help section. The availability of these resources helps determine how user-friendly and approachable an exchange truly is. For example, Exchange A might boast a comprehensive blog with articles on various crypto topics, while Exchange B may only offer a sparsely populated FAQ section.

The difference is significant for users of all experience levels.

Trading Volume and Liquidity

Choosing a Canadian crypto exchange isn’t just about fees; it’s about finding a bustling marketplace where your trades won’t feel like shouting into the void. Trading volume and liquidity are the unsung heroes (or villains, depending on your trading strategy) of a successful crypto journey. High volume means a lot of buying and selling activity, while liquidity refers to how easily you can buy or sell an asset without significantly impacting its price.Understanding the interplay between trading volume and liquidity is crucial for navigating the sometimes-whimsical world of cryptocurrency.

High volume generally implies better liquidity, making it easier to execute trades quickly at a fair price. Conversely, low volume can lead to price slippage (buying or selling at a less favorable price than expected) and difficulty filling orders. Think of it like trying to sell a vintage comic book: a popular, high-volume market (like eBay) will get you a fair price quickly, while a niche collector’s group might take ages and offer less.

Trading Volume and Liquidity Comparison Across Exchanges

The trading volume for popular cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and others varies significantly across different Canadian exchanges. While precise, real-time data fluctuates constantly, a general comparison might show that larger, more established exchanges tend to have higher trading volumes for major cryptocurrencies. Smaller exchanges, while potentially offering unique features, might experience lower liquidity, particularly for less popular altcoins.

This means that placing a large order on a smaller exchange could significantly impact the price, while the same order on a larger exchange would likely have a minimal effect. For example, a large buy order on a low-volume exchange might drive the price up considerably, whereas the same order on a high-volume exchange would likely only cause a small, temporary price increase.

So you’re comparing Canadian crypto exchanges? It’s a wild west out there, eh? But before you dive in headfirst, remember that understanding market trends is key – just like mastering those Advanced forex trading chart analysis techniques can help you navigate the volatile waters of currency pairs, similar skills can help you choose the right exchange and time your trades.

Ultimately, smart crypto investing needs a bit of savvy chart reading, regardless of your chosen Canadian platform.

Significance of Trading Volume and Liquidity for Traders

High trading volume and liquidity are generally beneficial for traders because they allow for faster order execution at prices closer to the market price. This minimizes the risk of slippage and allows traders to execute their strategies more efficiently. Low liquidity, on the other hand, can lead to significant price slippage, making it difficult to enter or exit positions at desired prices.

This is particularly problematic for larger trades. Imagine trying to sell 100,000 units of a low-liquidity token – you might have to accept a significantly lower price per unit to find enough buyers willing to take your entire position. Conversely, a high-liquidity exchange would allow you to sell that volume without a drastic price drop.

Impact of High Trading Volume on Cryptocurrency Price and Availability

High trading volume can influence cryptocurrency prices in several ways. Increased demand (more buyers than sellers) usually drives prices upward, while increased supply (more sellers than buyers) tends to push prices down. However, it’s important to note that volume is just one factor among many influencing price; overall market sentiment, news events, and regulatory changes all play significant roles.

Consider the case of Bitcoin: periods of extremely high trading volume often correlate with significant price swings, both positive and negative. The increased trading activity amplifies the impact of buying and selling pressure, leading to more pronounced price movements. Similarly, high volume can affect availability – a surge in buying pressure for a specific cryptocurrency can quickly deplete available supply on an exchange, making it harder to purchase at the current price.

Illustrative Example: Comparing Different Canadian Exchanges For Buying And Selling Crypto

Let’s imagine you’re a crypto enthusiast looking to make a quick buck (or, you know, a slightly less quick buck, considering crypto’s volatility). We’ll follow your hypothetical Bitcoin trading journey across two popular (but fictionalized for simplicity’s sake) Canadian exchanges: “MapleCrypto” and “BeaverCoin.”This example will highlight how seemingly small differences in fees and execution speed can significantly impact your bottom line.

Remember, these numbers are illustrative and actual exchange fees and speeds can vary.

Bitcoin Purchase and Sale Comparison

Let’s say you decide to buy 0.1 Bitcoin (BTC) at a price of $30,000 CAD. Then, after a period of (hopefully) price appreciation, you sell it at $31,000 CAD. We’ll compare the outcomes on MapleCrypto and BeaverCoin.

- MapleCrypto: Imagine MapleCrypto charges a 0.5% trading fee per transaction. Buying 0.1 BTC would cost you $30,000 + ($30,000

– 0.005) = $30,150. Selling it at $31,000 would incur another $31,000

– 0.005 = $155 fee, leaving you with $30,845. Your profit is $30,845 – $30,150 = $695. The execution speed is reasonably fast, with your order filled within a few seconds. - BeaverCoin: Now, BeaverCoin boasts lower trading fees of only 0.25% per transaction. Buying 0.1 BTC costs $30,000 + ($30,000

– 0.0025) = $30,075. Selling at $31,000 would cost $31,000

– 0.0025 = $77.50, leaving you with $30,922.50. Your profit is $30,922.50 – $30,075 = $847.50. However, BeaverCoin’s execution speed is slightly slower, taking around 15 seconds to fill your order.

Profitability Implications

The difference in profit between MapleCrypto and BeaverCoin, in this example, might seem small – a mere $152.50. However, imagine making hundreds of such trades over time. Those seemingly insignificant fee differences accumulate rapidly. Furthermore, even a few seconds delay in execution speed, particularly in volatile markets, could mean the difference between locking in a profit or suffering a loss.

For high-frequency traders, these differences are magnified significantly.

“Even small percentage differences in fees and execution speed can significantly impact profitability, especially over the long term and with high trading volume.”

Impact of Speed Differences

The 15-second difference in execution speed on BeaverCoin might seem negligible, but consider a scenario where the Bitcoin price fluctuates significantly within that timeframe. If the price drops by even $100 during those 15 seconds, BeaverCoin’s slower execution could result in a $100 loss compared to MapleCrypto. In highly volatile markets, speed becomes a crucial factor in maximizing profitability and minimizing risk.

Final Thoughts

So, there you have it – a whirlwind tour of the Canadian crypto exchange scene! Choosing the right platform is crucial for a successful crypto journey. Remember, the best exchange for you depends on your individual needs and trading style. Whether you’re a seasoned trader or a crypto curious newbie, consider your comfort level with fees, security protocols, and user experience.

Do your homework, compare apples to apples, and may your crypto portfolio always be green (and profitable!). Happy trading!