Comparing the best day trading platforms for TSX stocks – sounds thrilling, right? Forget spreadsheets and dusty brokerages; we’re diving headfirst into the wild world of Canadian stock trading, where fortunes are made (and sometimes lost) in the blink of an eye. This isn’t your grandpappy’s stock market; this is high-octane, adrenaline-fueled day trading on the TSX, and choosing the right platform is crucial.

We’ll be your trusty Sherpas, guiding you through the icy peaks of commission fees and the treacherous valleys of user interfaces, helping you find the perfect platform to match your trading style. Buckle up, it’s going to be a wild ride!

This guide meticulously compares several popular TSX day trading platforms, examining their strengths and weaknesses across various key aspects. From commission structures and available trading tools to user experience, security measures, and customer support, we leave no stone unturned in our quest to help you make an informed decision. We’ll analyze everything from charting capabilities and order types to the availability of demo accounts and educational resources, ensuring you have all the information you need to choose the platform that best fits your needs and risk tolerance.

Prepare for a comprehensive deep dive into the heart of TSX day trading platforms!

Introduction to TSX Day Trading Platforms

So, you’re thinking about diving headfirst into the thrilling, rollercoaster-like world of TSX day trading? Buckle up, buttercup, because it’s a wild ride! The Toronto Stock Exchange (TSX), Canada’s premier stock market, offers a diverse range of opportunities for the intrepid day trader, but navigating the platform landscape can feel like trying to find a loonie in a snowdrift.

This guide will illuminate the path, helping you choose the platform that best suits your needs and trading style (and hopefully, your caffeine tolerance).The TSX, home to some of Canada’s biggest companies, is a bustling marketplace where millions of shares change hands daily. It’s a blend of established giants and exciting newcomers, making it a dynamic environment for both seasoned veterans and eager newcomers to the trading game.

However, choosing the right platform is crucial for success; the wrong platform can be like trying to win a marathon in flip-flops – possible, but incredibly painful.

Popular TSX Day Trading Platforms

Several platforms cater specifically to TSX day trading, each offering a unique blend of features and functionalities. Choosing the right one depends on your experience level, trading style, and budget. We’ll examine three popular options to give you a flavour of what’s out there. Remember, this isn’t an exhaustive list, and the best platform for you will depend on your individual needs.

Comparison of Key Features

Here’s a comparison table highlighting key features of three popular TSX day trading platforms. Keep in mind that fees and features can change, so always check the provider’s website for the most up-to-date information. Think of this table as your trusty compass in the wilderness of online brokerage.

| Platform Name | Commission Fees (Approximate) | Available Tools | Mobile App Features |

|---|---|---|---|

| Interactive Brokers | Variable, often very competitive, depending on volume. | Advanced charting, real-time data, options trading, margin accounts, sophisticated order types. | Full functionality mirroring the desktop platform; robust charting and order entry. |

| TD Ameritrade (Available in Canada) | Generally competitive commission fees, with potential for tiered pricing based on volume. | Solid charting tools, real-time data, research tools, educational resources, margin accounts. | User-friendly interface, good for beginners, access to most key features of the desktop platform. |

| Questrade | Often advertised as low-cost or commission-free for certain trades; check their current fee schedule. | Basic to intermediate charting tools, real-time data, educational resources, limited options trading. | Functional mobile app, suitable for basic trading activities. |

Platform Fees and Commission Structures

Navigating the world of TSX day trading platforms can feel like traversing a minefield of hidden fees. Understanding the commission structures and associated costs is crucial to maximizing your profits – because let’s face it, every penny counts when you’re trying to predict the next market move. Ignoring these charges is like trying to win a marathon while carrying a sack of potatoes – it’s possible, but significantly harder.The fees charged by TSX day trading platforms vary wildly, impacting your bottom line more than you might initially think.

Some platforms employ a straightforward commission-based model, while others might layer on additional fees for services like data access or account maintenance. Let’s dissect these pricing models to help you choose a platform that aligns with your trading style and budget.

Commission Structures: A Comparative Overview

Different platforms utilize diverse commission structures. Some charge a flat fee per trade, regardless of the trade size. Others opt for a tiered system, offering lower commissions for higher trading volumes. A few even use a percentage-based model, where the commission is a percentage of the total trade value. Imagine trying to compare apples, oranges, and grapefruits – it’s a bit of a juggling act.

For instance, Platform A might charge a flat $5 per trade, while Platform B charges $2 per trade plus a percentage based on trade value. Platform C, on the other hand, might offer a tiered system, decreasing the per-trade cost as your trading volume increases. Understanding these nuances is vital for selecting the platform best suited to your trading frequency and investment strategy.

Additional Platform Fees

Beyond commissions, be wary of hidden costs lurking in the fine print. Inactivity fees are common; some platforms penalize accounts that remain dormant for extended periods. Data fees are another potential expense, particularly if you require real-time market data or advanced charting tools. Think of these as the unexpected costs of a vacation – you planned for the flights and hotels, but then there are airport taxes, baggage fees, and that unexpected souvenir purchase.

These additional fees can quickly eat into your profits if you’re not paying attention.

Commission-Free Trading Platforms and Their Limitations

Several platforms advertise commission-free trading, which sounds incredibly appealing. However, it’s essential to understand the fine print. Often, these “free” platforms generate revenue through other means, such as:

- Data fees: While the trades might be free, access to real-time data or advanced charting features may come at a cost.

- Higher spreads: The broker might make money by widening the bid-ask spread, meaning the difference between the buying and selling price is larger than on other platforms. This subtly eats into your profits with every trade.

- Account minimums: Some commission-free platforms require substantial minimum account balances, potentially excluding smaller investors.

- Limited features: The trade-off for zero commissions might be fewer research tools, charting options, or educational resources.

Remember, there’s no such thing as a truly free lunch in the world of finance. Carefully weigh the benefits of commission-free trading against any potential limitations before making a decision.

Picking the perfect day trading platform for TSX stocks is like choosing your weapon in a financial ninja battle! You need speed, low commissions, and maybe even a cute mascot. But before you dive into the TSX, consider broadening your horizons; understanding forex is key, and that’s where this guide comes in handy: How to choose the right forex broker in Canada based on my trading style.

Once you’ve mastered the forex fundamentals, you’ll be a TSX trading samurai, slicing through those buy and sell orders like a hot knife through butter.

Trading Tools and Features

Choosing the right day trading platform for TSX stocks isn’t just about low fees; it’s about having the right tools to help you navigate the sometimes-chaotic world of the Canadian stock market. Think of it like choosing the right weapon for a battle – a dull butter knife won’t cut it (pun intended!). The right platform will give you the edge you need to make informed decisions and, hopefully, profit.Let’s dive into the nitty-gritty of charting tools, real-time data, and order types, comparing what’s on offer from various platforms.

Picking the perfect day trading platform for TSX stocks can feel like choosing a unicorn – rare and magical! But if your ambitions stretch beyond the TSX, consider broadening your horizons with the speed and low fees offered by reliable forex brokers, like those detailed on this helpful site: Reliable forex brokers in Canada with low fees and fast execution.

Then, armed with that knowledge, you can confidently return to comparing the best TSX platforms, knowing you’ve explored all your options!

Remember, the “best” platform depends heavily on your individual trading style and needs.

Charting Tools and Technical Indicators

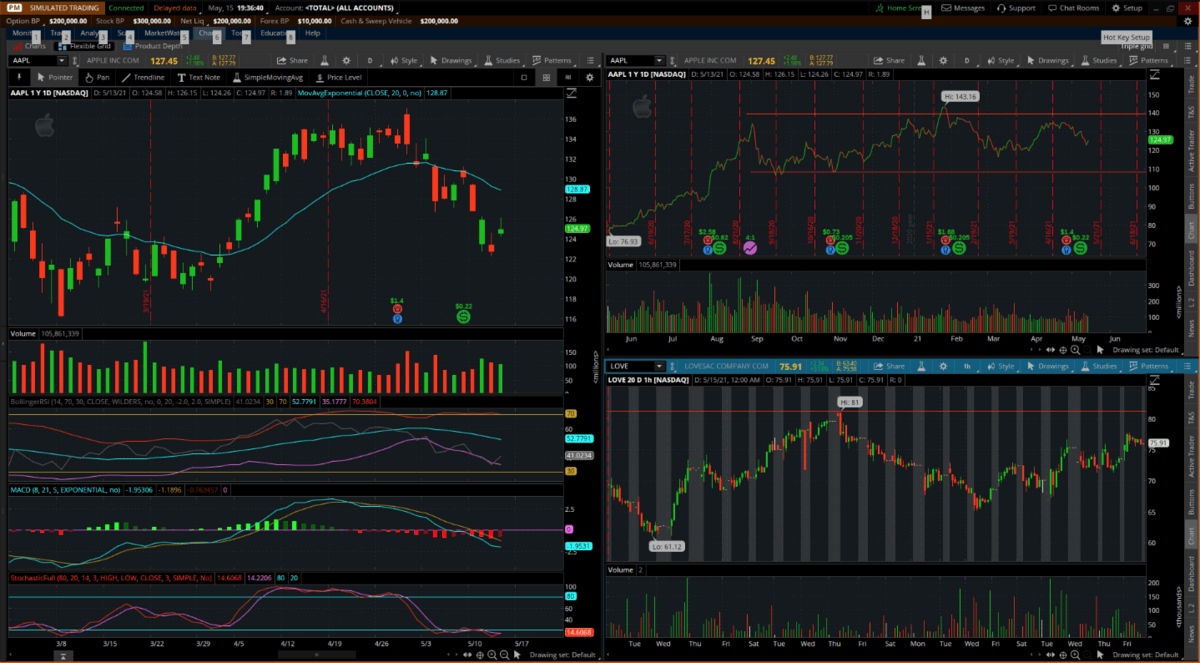

The charts are your battlefield map. A good platform will offer a variety of charting styles (candlestick, bar, line), customizable timeframes (from one-minute to daily), and a comprehensive suite of technical indicators. We’re talking Relative Strength Index (RSI), Moving Averages (MA), MACD, Bollinger Bands – the whole shebang. The ability to overlay multiple indicators and draw trendlines, support/resistance levels, and Fibonacci retracements is crucial for technical analysis.

Some platforms might even offer advanced charting features like Renko charts or Heikin-Ashi candles, catering to more sophisticated traders. A platform lacking in this department is like a chef without a knife – severely limiting their potential.

Real-Time Data Feeds: Speed and Reliability

In the fast-paced world of day trading, speed is king. Real-time data feeds are the lifeblood of your trading decisions. A lag of even a few seconds can mean the difference between a profitable trade and a missed opportunity, or worse, a loss. Reliability is equally important; a data feed that frequently drops or provides inaccurate information is a recipe for disaster.

Look for platforms that boast low latency and high uptime, preferably with multiple data providers to ensure redundancy. Think of it as your internet connection – you wouldn’t want to be streaming a crucial game with buffering, would you?

Order Types Supported

Beyond the basics, the range of order types offered significantly impacts your trading strategies. All platforms will support market orders (executed immediately at the best available price) and limit orders (executed only at a specified price or better). However, advanced order types like stop-loss orders (automatically sell when the price drops below a certain level, limiting potential losses), stop-limit orders (a combination of stop and limit orders), and trailing stop orders (adjusts the stop price as the price moves in your favor) are essential for risk management.

Some platforms might even offer more exotic order types, such as bracket orders or OCO (One Cancels Other) orders, providing further control over your trades. The more options available, the more control you have over your risk and potential rewards.

Picking the perfect day trading platform for TSX stocks is a workout in itself – you need stamina, strategy, and maybe a little caffeine. But before you dive into the charts, remember your mental and physical strength are key. Check out this best strength training program to keep your game strong, both inside and outside the trading arena.

Then, armed with a healthy body and mind, you can conquer those TSX markets!

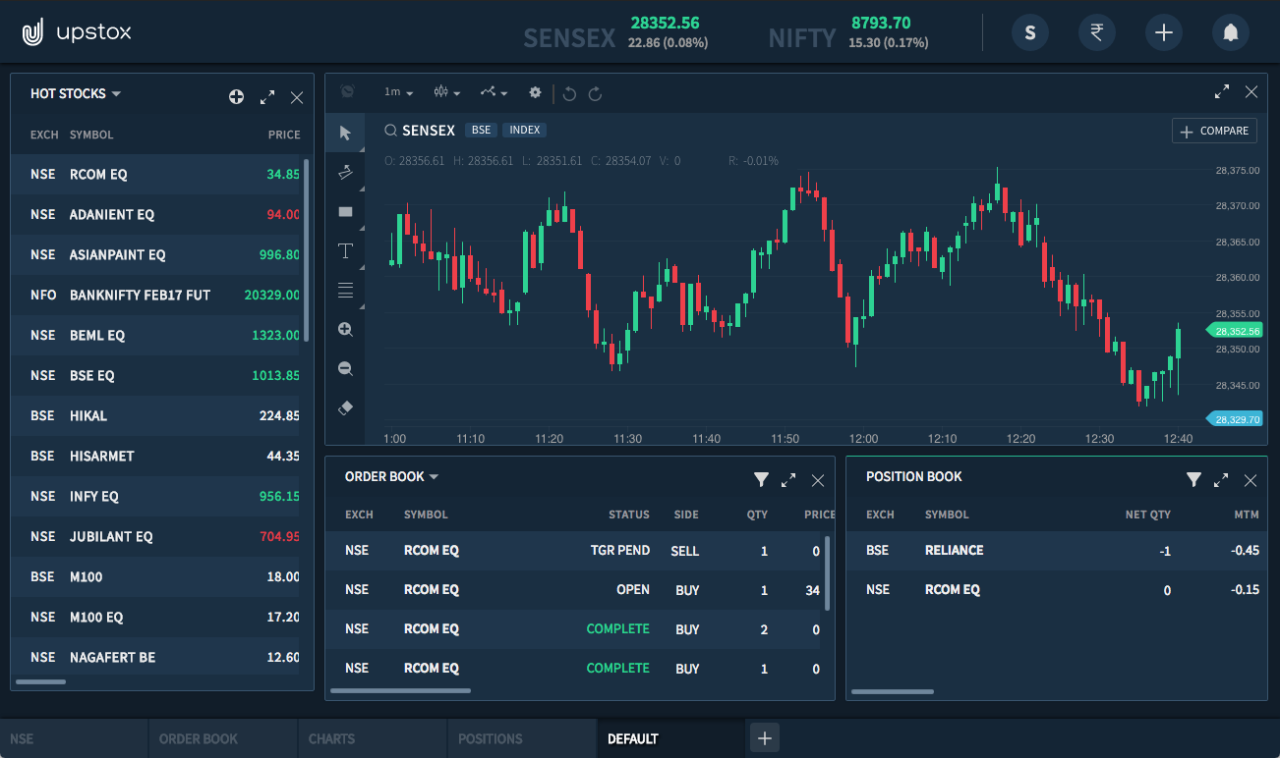

Platform User Interface and Experience

Choosing a day trading platform is like choosing a pair of shoes – you need something comfortable, supportive, and stylish enough to make you feel confident strutting your stuff on the trading floor (metaphorically speaking, of course). A clunky, confusing interface can lead to costly mistakes and a whole lot of frustration. Let’s dive into the user experience of some popular TSX day trading platforms.The user interface (UI) and overall user experience (UX) are crucial factors in determining a platform’s effectiveness.

A well-designed platform streamlines the trading process, allowing you to react quickly to market changes and execute trades efficiently. Conversely, a poorly designed platform can be a major source of stress and hinder your ability to make profitable trades. We’ll examine both desktop and mobile app experiences to get a complete picture.

Desktop Platform Usability

Each platform boasts a unique design philosophy. Some prioritize a clean, minimalist approach, while others offer a more cluttered, feature-rich environment. However, the key is finding a balance between functionality and ease of use. For example, Platform A might excel with its intuitive drag-and-drop charting tools, while Platform B might impress with its highly customizable workspace, allowing traders to arrange their screens to perfectly fit their workflow.

The best platform for you will depend on your individual preferences and trading style. A trader who primarily uses technical analysis might prioritize charting capabilities, while a fundamental trader might focus on news feeds and research tools.

Mobile App Functionality

In today’s fast-paced world, mobile trading is essential. The ability to monitor your positions and execute trades on the go is a significant advantage. However, the quality of mobile apps varies significantly. Some platforms offer robust mobile apps that mirror the desktop experience, allowing for seamless transitions between devices. Others may provide a more limited experience, with fewer features and less intuitive navigation.

Key considerations include the ease of order placement, the quality of charting tools, and the availability of real-time market data. For instance, Platform C’s mobile app might offer one-touch order entry and customizable alerts, while Platform D might lack these crucial features, hindering the speed and efficiency of mobile trading.

User Experience Ranking

The following table ranks three hypothetical platforms (Platform A, B, and C) based on their user experience across various aspects. Remember, this is a subjective assessment based on general observations and could vary based on individual preferences.

| Platform | Intuitive Design | Responsiveness | Ease of Use (Overall) |

|---|---|---|---|

| Platform A | Excellent | Good | Excellent |

| Platform B | Good | Excellent | Good |

| Platform C | Fair | Fair | Fair |

Security and Reliability: Comparing The Best Day Trading Platforms For TSX Stocks

Choosing a day trading platform for TSX stocks isn’t just about snazzy charts and speedy execution; it’s about safeguarding your hard-earned cash and keeping your data out of the wrong hands. This section dives into the crucial aspects of security and reliability offered by various platforms, because let’s face it, nobody wants their carefully crafted trading strategy to go down in flames due to a platform meltdown.Security measures implemented by platforms vary, impacting the safety of user data and funds.

Picking the perfect day trading platform for TSX stocks can feel like navigating a minefield of fees and features. But before you leap into the exciting world of Canadian equities, remember the regulatory landscape! Understanding the rules of the game is crucial, so check out this guide on Understanding forex trading regulations and licensing in Canada to avoid any nasty surprises.

Then, armed with this knowledge, you can confidently conquer those TSX charts!

Reliability, measured by uptime and the absence of technical glitches, is equally vital for successful day trading. Finally, regulatory compliance ensures the platform operates within the legal framework, providing an additional layer of security and trustworthiness.

Picking the perfect day trading platform for TSX stocks can feel like choosing a unicorn – sparkly and elusive! But before you gallop into the world of high-frequency trading, remember the taxman lurks. Understanding the rules is crucial, so check out this guide on Forex trading tax implications in Canada for beginners to avoid a nasty surprise.

Then, armed with that knowledge, you can confidently return to comparing those TSX platforms!

Security Measures

Protecting your financial information is paramount. Robust platforms employ multiple layers of security, including encryption (both in transit and at rest) to protect your personal data and trading activity. Two-factor authentication (2FA) adds an extra layer of protection, requiring a second verification step beyond your password. Regular security audits and penetration testing are also critical, identifying and patching vulnerabilities before they can be exploited.

Some platforms even offer features like dedicated account managers and fraud monitoring systems to provide additional peace of mind. Imagine this: Your account is protected by a digital fortress, complete with laser grids and robotic guards (metaphorically speaking, of course).

Platform Uptime and Reliability

Downtime is the day trader’s nightmare. A platform experiencing frequent outages or slowdowns can mean missed opportunities and potentially significant financial losses. Reliable platforms boast impressive uptime percentages, often exceeding 99.9%, ensuring consistent access to markets. While no platform guarantees 100% uptime (even the best have occasional hiccups), a track record of minimal downtime and swift resolution of technical issues is a must-have.

Think of it like this: Your platform should be as reliable as your morning coffee – always there when you need it.

Regulatory Compliance

Operating legally and transparently is crucial for any reputable platform. This involves adhering to regulations set by governing bodies like the Investment Industry Regulatory Organization of Canada (IIROC). Check if the platform is properly licensed and registered with the relevant authorities. Transparency in their fee structure and operational procedures further reinforces their credibility. A platform that openly displays its regulatory compliance information shows a commitment to ethical and responsible practices, reassuring users that their investments are in safe hands.

Imagine a regulatory seal of approval, like a badge of honor, signifying trustworthiness and adherence to industry standards.

Educational Resources and Customer Support

Navigating the sometimes-treacherous waters of TSX day trading requires more than just a sharp eye and a faster-than-a-speeding-bullet finger. A good day trading platform needs to provide robust educational resources and responsive customer support – your lifeline when things inevitably go sideways (and they will, at some point, even for the pros!). Let’s dive into how different platforms stack up in these crucial areas.Choosing a platform based solely on its flashy interface is like buying a sports car without checking if it has brakes.

A platform’s educational resources and customer support are your safety net, helping you avoid costly mistakes and navigate the inevitable bumps in the road. A responsive support team can be the difference between a profitable trade and a frustrating loss, so let’s see which platforms offer the best learning opportunities and the most reliable assistance.

Educational Resources Comparison

Many platforms offer a range of educational resources, aiming to empower even the greenest traders. These resources vary in quality and depth, ranging from basic tutorials to advanced webinars led by market experts. Some platforms even offer simulated trading environments, allowing you to practice your skills risk-free before venturing into the real market. Consider the depth of the material offered, its accessibility (beginner-friendly or expert-level), and the frequency of updates to ensure the information remains current and relevant.

For example, Platform A might boast a comprehensive library of video tutorials covering various trading strategies, while Platform B might focus more on interactive webinars and real-time market analysis.

Customer Support Channel Evaluation

The availability and responsiveness of customer support can significantly impact your trading experience. Platforms typically offer support via phone, email, and live chat. However, the speed and quality of responses can vary considerably. A platform with readily available phone support and quick response times via live chat is a definite plus, especially during critical trading moments. Consider factors such as wait times, the expertise of support staff, and the overall helpfulness of their responses.

For instance, Platform C might offer 24/7 phone support but struggle with long wait times, while Platform D might provide excellent email support with detailed and informative replies, but lack a live chat option.

So, you’re comparing the best day trading platforms for TSX stocks, huh? A noble quest! But before you dive headfirst into the world of Canadian equities, remember that forex is a whole different beast. If you’re considering branching out, finding a reliable broker is crucial – check out this resource for finding a reputable forex broker in Canada with phone support: Finding a reputable forex broker in Canada with phone support.

Back to TSX stocks – may your charts be green and your profits plentiful!

Platform Support System Strengths and Weaknesses

Here’s a summary comparing the strengths and weaknesses of each platform’s support system (hypothetical examples):

- Platform A:

- Strengths: Extensive video tutorial library, responsive live chat support.

- Weaknesses: Phone support wait times can be lengthy, email support response times are slow.

- Platform B:

- Strengths: Regular webinars with market experts, detailed FAQs section.

- Weaknesses: Limited live chat availability, phone support only during business hours.

- Platform C:

- Strengths: 24/7 phone support.

- Weaknesses: Long phone support wait times, lack of live chat or email support.

- Platform D:

- Strengths: Excellent email support with detailed responses, comprehensive help center.

- Weaknesses: No live chat option, phone support unavailable.

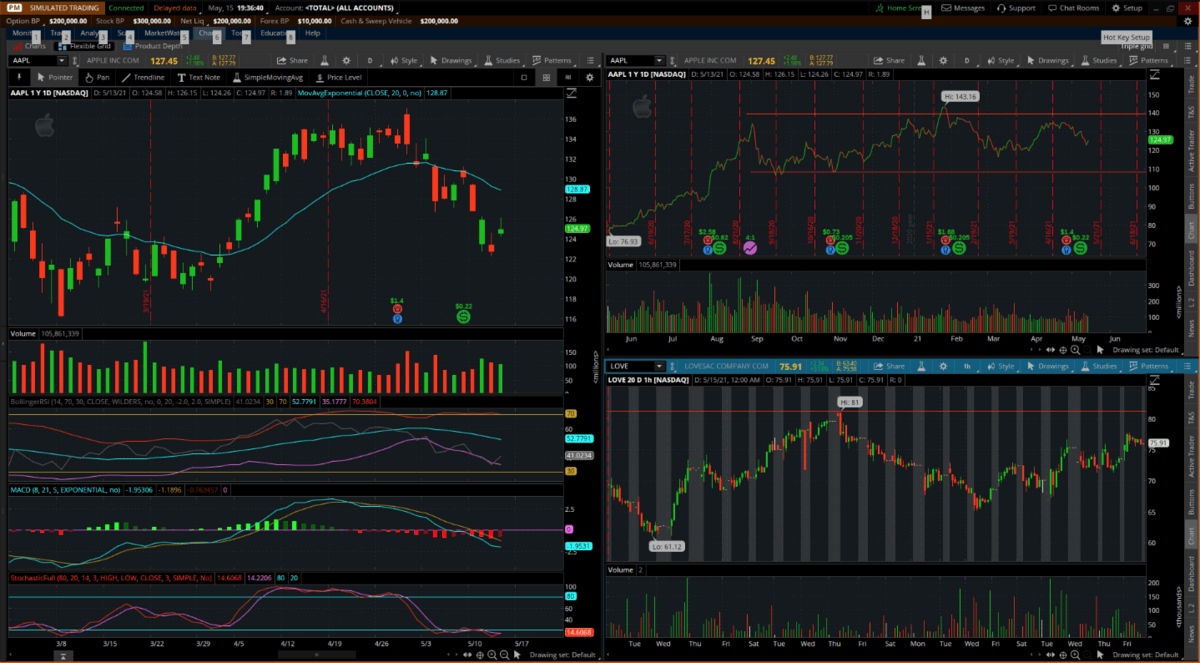

Simulated Trading and Demo Accounts

Before you leap into the thrilling (and sometimes terrifying) world of TSX day trading with real money, wouldn’t it be wise to test the waters first? Enter the wonderful world of simulated trading accounts – your personal day-trading sandbox where you can practice your strategies without the risk of emptying your wallet faster than a politician promises tax cuts.

These demo accounts are invaluable tools, allowing you to familiarize yourself with a platform’s interface, test your trading prowess, and refine your approach before risking a single Canadian dollar.Simulated trading accounts aren’t just for newbies; even seasoned traders use them to try out new strategies, test different indicators, or simply practice their speed and precision in a risk-free environment.

Think of it as your personal, high-stakes video game, except the “high stakes” are purely psychological. The thrill is real, but the financial consequences are (thankfully) not.

Demo Account Features and Functionalities, Comparing the best day trading platforms for TSX stocks

Different platforms offer varying levels of realism in their demo accounts. Some mirror the live trading experience almost perfectly, while others might have limitations on data feeds or available tools. It’s crucial to understand these differences to choose the demo account that best suits your needs and prepares you adequately for the real thing. For example, some platforms might limit the historical data available for backtesting in demo accounts, while others might offer full access to their charting and analytical tools.

Comparison of Demo Account Features Across Platforms

Let’s dive into a comparison of the simulated trading functionalities across various popular TSX day trading platforms. We’ll focus on key features, highlighting both strengths and weaknesses to help you make an informed decision. Remember, the “best” platform depends heavily on your individual trading style and preferences.

| Platform Name | Data Availability (Historical & Real-time) | Trading Tool Access | Order Types Supported | Account Funding | Limitations |

|---|---|---|---|---|---|

| Platform A | Full historical data; real-time delayed by 15 minutes | All charting and analytical tools available | All order types supported in live trading | Virtual funds provided | Limited number of simulated trades per day (e.g., 50) |

| Platform B | Limited historical data; real-time data available | Most charting tools available; some advanced indicators unavailable | Most common order types supported | Virtual funds provided; adjustable amount | No simulated margin trading |

| Platform C | Full historical data; real-time data available | All tools available; including advanced algorithmic trading tools | All order types supported | Virtual funds provided; unlimited | None; mirrors live trading environment almost exactly |

Final Review

So, there you have it – a whirlwind tour through the best day trading platforms for TSX stocks. Remember, the “best” platform is subjective and depends entirely on your individual needs and preferences. While some platforms may boast flashy interfaces and cutting-edge tools, others might prioritize simplicity and low fees. Ultimately, the key is to carefully weigh the pros and cons of each platform, considering factors like commission structures, trading tools, user experience, security, and customer support.

Happy trading (and may your profits be plentiful!)