Comparing the best forex trading platforms for beginners: Dive into the thrilling world of forex trading, where fortunes are made (and sometimes lost!) with the click of a button. This isn’t your grandpa’s piggy bank; we’re talking global currency markets, where the stakes are high and the potential rewards even higher. But before you jump headfirst into this exciting – and potentially perilous – adventure, choosing the right platform is crucial.

Think of it like picking the right chariot for a Roman chariot race – a rickety old thing might get you trampled, while a sleek, well-maintained one could lead you to victory (and maybe a laurel wreath or two).

This guide will navigate you through the maze of forex trading platforms, helping you identify the features that matter most to beginners. We’ll compare user interfaces (because let’s face it, a confusing platform can be a trader’s worst nightmare), examine educational resources (knowledge is power!), and dissect the crucial aspects of security and regulation (because nobody wants their hard-earned cash vanishing into thin air).

We’ll even throw in some humorous anecdotes along the way – because let’s be honest, learning about forex doesn’t have to be a soul-crushing experience.

Introduction to Forex Trading for Beginners

Forex trading, or foreign exchange trading, might sound intimidating, like some secret society of money wizards whispering in hushed tones about pips and spreads. But fear not, aspiring currency king or queen! It’s essentially buying and selling currencies to profit from their fluctuating values. Think of it like shopping for different types of money – you buy low, sell high, and hope for a tidy profit.

It’s a global market, operating 24/5, offering plenty of opportunities (and challenges!).Forex trading involves speculating on the value of one currency against another. For example, you might buy the Euro (EUR) against the US dollar (USD), hoping the Euro will strengthen relative to the dollar, allowing you to sell it later at a higher price. The price is expressed as a rate, like EUR/USD = 1.10, meaning 1 Euro buys you 1.10 US dollars.

Profits (or losses) are made based on the difference between the buying and selling prices. It’s a thrilling rollercoaster ride, but remember – always trade responsibly and within your means.

Opening a Demo Account: A Step-by-Step Guide

Before diving headfirst into the shark-infested waters of live trading, it’s crucial to practice with a demo account. This allows you to hone your skills without risking any real money. Think of it as a virtual trading playground where you can experiment with different strategies and get a feel for the market. Most reputable forex brokers offer free demo accounts.

Here’s a general process:

- Choose a Broker: Research and select a regulated forex broker that offers a demo account. Look for user-friendly platforms and educational resources.

- Register: Create an account on the broker’s website. You’ll typically need to provide some basic personal information.

- Fund Your Demo Account (Virtually): Most brokers will automatically provide you with a virtual sum of money to practice with. This is not real money; it’s just for practice purposes.

- Start Trading!: Familiarize yourself with the platform’s interface and start placing trades. Experiment with different strategies and learn from your mistakes – in a risk-free environment!

Essential Forex Terminology for Beginners

Understanding the jargon is half the battle. Forex trading has its own unique language, but once you get the hang of it, it’s surprisingly straightforward.

- Pip (Point in Percentage): The smallest price movement in a currency pair. For most pairs, a pip is 0.0001.

- Spread: The difference between the bid price (the price at which you can sell a currency) and the ask price (the price at which you can buy a currency).

- Lot: A standard unit of currency traded. A standard lot is typically 100,000 units of the base currency.

- Leverage: Borrowing money from your broker to increase your trading power. While leverage can magnify profits, it can also magnify losses, so use it cautiously.

- Margin: The amount of money you need to have in your account to open and maintain a position. It’s a percentage of the total trade value.

- Currency Pair: Two currencies traded against each other, like EUR/USD (Euro/US Dollar) or GBP/JPY (British Pound/Japanese Yen).

Remember: Never invest more money than you can afford to lose. Forex trading involves significant risk.

Key Features to Consider When Choosing a Platform

Choosing the right forex trading platform is like picking the perfect pair of dancing shoes – you need something comfortable, supportive, and that allows you to move freely (and profitably!). A clunky, confusing platform can quickly turn a potentially exciting journey into a frustrating stumble. Let’s explore the key features that will make your forex trading experience a smooth, stylish waltz, rather than a clumsy tango.So, you’re ready to dive into the thrilling world of forex trading, but navigating the plethora of platforms available can feel like trying to find a needle in a haystack – a haystack filled with confusing jargon and hidden fees.

Fear not, aspiring trader! This section will illuminate the essential features to look for, transforming your search from a daunting task into a confident selection.

User Interface Comparison

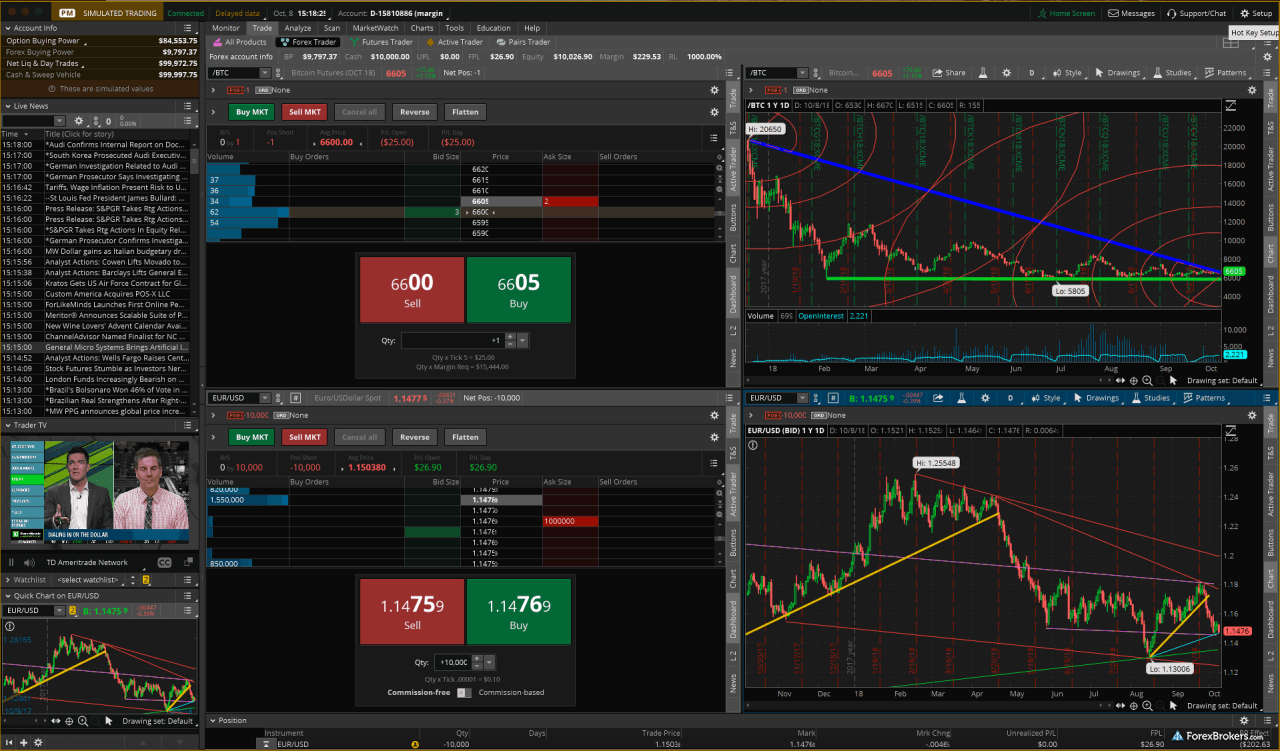

The user interface (UI) is your gateway to the forex market. A well-designed UI should be intuitive and easy to navigate, even for complete beginners. Think of it as the dashboard of your trading spaceship – you need clear, concise information presented in a way that doesn’t overload your senses. Some platforms, like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), are known for their customizable layouts, allowing you to arrange charts, indicators, and order tickets exactly how you like them.

Others, such as cTrader, offer a more streamlined and modern design, prioritizing simplicity and ease of use. Conversely, some platforms might be visually appealing but lack the functionality needed for effective trading. The key is to find a balance between aesthetics and practicality. A platform that’s visually stunning but difficult to use is like a beautiful car with a broken engine – it looks great, but it won’t get you anywhere.

Essential Features for Beginners

For beginners, certain features are paramount. Educational resources are crucial; look for platforms offering tutorials, webinars, and perhaps even demo accounts to practice without risking real money. Charting tools are your visual roadmap, so ensure the platform offers a range of chart types (candlestick, bar, line), technical indicators (moving averages, RSI, MACD), and drawing tools. Understanding different order types (market orders, limit orders, stop-loss orders) is essential for risk management, so make sure the platform clearly explains and facilitates their use.

These features will help you learn the ropes and build confidence before diving into live trading.

Customer Support and Accessibility

Imagine this: you’re in the middle of a crucial trade, and suddenly, something goes wrong. A reliable customer support team is your lifeline in such situations. Look for platforms offering multiple support channels – email, phone, and live chat – with prompt response times. Accessibility is also key; the platform should be easy to access from various devices (desktop, mobile) and operate smoothly regardless of your internet connection.

A platform with poor customer support is like a ship sailing without a compass – you might reach your destination, but it’ll be a much more perilous journey.

Choosing the right forex platform as a newbie can feel like navigating a minefield of confusing jargon and hidden fees. So, before you jump in headfirst, consider the reliability of your chosen platform; for Canadian traders, a key question is often, “Is Questrade a reliable platform for forex trading in Canada?” Is Questrade a reliable platform for forex trading in Canada?

Answering that question helps you narrow down your options when comparing the best forex trading platforms for beginners and making a smart, informed decision.

Comparing Popular Forex Trading Platforms

Choosing the right forex trading platform can feel like navigating a minefield of jargon and confusing features. Fear not, aspiring forex tycoon! This section will dissect some popular platforms, helping you find the perfect fit for your budding trading empire. We’ll examine key features and help you avoid any potentially disastrous pitfalls (like accidentally buying a small island nation instead of a currency pair).

Popular Forex Trading Platforms Compared

Below is a comparison of four popular forex trading platforms. Remember, this is not an exhaustive list, and the best platform for you will depend on your individual needs and trading style. Think of it as a taste test before you commit to a full-blown culinary adventure in the world of forex.

| Platform | Minimum Deposit | Spreads (Typical) | Leverage | Available Assets | Platform Type |

|---|---|---|---|---|---|

| MetaTrader 4 (MT4) | Varies by broker (often low) | Varies by broker (competitive) | Varies by broker (high) | Forex, CFDs, Metals | Web-based, Desktop, Mobile |

| MetaTrader 5 (MT5) | Varies by broker (often low) | Varies by broker (competitive) | Varies by broker (high) | Forex, CFDs, Metals, Futures, Stocks | Web-based, Desktop, Mobile |

| cTrader | Varies by broker (often low) | Generally tight | Varies by broker (high) | Forex, CFDs | Web-based, Desktop, Mobile |

| TradingView | Depends on Broker Integration | Varies depending on broker connection | Varies depending on broker connection | Forex, Stocks, Futures, Crypto | Web-based, Mobile |

Pros and Cons of Each Platform

Let’s delve into the good, the bad, and the downright hilarious aspects of each platform. Think of this as a brutally honest review, because in the world of forex, honesty is the best policy (and also the most profitable). MetaTrader 4 (MT4): Pros: Ubiquitous, tons of indicators and expert advisors (EAs), massive community support. Cons: Can feel a bit dated compared to MT5, fewer features.

MetaTrader 5 (MT5): Pros: More advanced charting tools, economic calendar, improved order management. Cons: Steeper learning curve than MT4, not as widely adopted yet. cTrader: Pros: Known for its speed and low latency, excellent charting, sophisticated order management. Cons: Smaller community compared to MT4/MT5, might not be as many third-party indicators available. TradingView: Pros: Excellent charting and analysis tools, free version available, massive community, integrated with many brokers.

Cons: Not a standalone trading platform, requires a broker account for actual trading.

Regulatory Compliance of Forex Trading Platforms

Regulatory compliance is paramount. Choosing a platform regulated by a reputable authority protects you from shady dealings and ensures your funds are relatively safe. Think of it as your financial safety net – you wouldn’t go bungee jumping without one, would you? Always check the platform’s regulatory status before depositing any funds. Examples of reputable regulatory bodies include the FCA (UK), ASIC (Australia), and the CFTC/NFA (USA).

The specific regulatory body will depend on the broker offering the platform, not the platform itself. Always verify this information on the broker’s website.

Educational Resources and Tools Offered by Platforms

So, you’ve bravely decided to take the plunge into the thrilling, sometimes terrifying, world of forex trading. Congratulations! But before you start throwing your hard-earned cash at the market like confetti at a wedding, you need a solid education. Luckily, many forex trading platforms offer a surprising amount of learning resources – some better than others, of course.

Think of it as choosing between a dusty, dog-eared textbook and a vibrant, interactive online course. The right resources can make all the difference between a smooth sailing journey and a shipwreck.Choosing a platform based solely on its flashy interface is like judging a book by its cover (and let’s be honest, some forex platform covers arevery* flashy).

So, you’re diving into the wild world of forex trading, eh? Choosing the right platform is like picking the perfect pair of dancing shoes – you need something comfortable and reliable. For Canadian beginners, a key consideration is currency exchange, and to help you compare, check out this insightful article: How does Questrade’s currency exchange platform compare to other options in Canada?

. Understanding your exchange options is crucial before you even think about those fancy forex charts and potentially lucrative trades!

The real treasure lies in the depth and quality of its educational materials. We’ll delve into the educational resources offered by different platforms, comparing their strengths and weaknesses to help you navigate this learning landscape. Think of us as your trusty Sherpas guiding you up the Mount Everest of forex knowledge (minus the altitude sickness, hopefully).

Educational Resource Comparison Across Platforms

Different platforms boast different educational approaches. Some favour short, punchy videos perfect for busy bees, while others offer in-depth courses that require a more significant time commitment. MetaTrader 4 and 5, for instance, offer basic tutorials and built-in indicators, but they lack the extensive structured learning paths found on platforms like TradingView or Babypips. TradingView excels with its charting tools and educational articles, while Babypips provides a structured curriculum ideal for complete novices.

Think of it as the difference between learning to bake a cake from a quick recipe versus enrolling in a prestigious culinary school. Each has its merits. A beginner might benefit from the structured approach, while a more experienced trader might appreciate the flexibility of a platform like TradingView.

Examples of Comprehensive Learning Materials

A truly comprehensive learning program should cover a range of topics, from fundamental analysis (understanding economic indicators) to technical analysis (using charts and patterns to predict price movements). It should also include risk management strategies (crucial for avoiding financial ruin), order placement tutorials, and ideally, access to a demo account. A good platform will offer a mix of learning styles: videos, articles, webinars, and interactive exercises.

So, you’re diving headfirst into the wild world of forex trading, eh? Comparing the best platforms for beginners can feel like choosing between a thousand different flavors of ice cream. To help narrow it down, understanding a specific platform’s strengths is key, and that’s where checking out Understanding Questrade’s forex trading platform features and tools. comes in handy.

Then, armed with this knowledge, you can confidently continue comparing and conquer the forex jungle!

For example, a platform might offer a video series explaining candlestick patterns, followed by an interactive quiz to test your understanding, culminating in a simulated trading session using a demo account. This layered approach ensures retention and practical application.

Hypothetical Learning Path Using Babypips

Let’s imagine a beginner, let’s call him Bob, using Babypips. Bob’s learning journey could start with Babypips’ free forex course, covering the basics of currency pairs, pip values, and leverage. He’d then move on to learning about fundamental and technical analysis, practicing chart interpretation through Babypips’ resources. Once comfortable with the concepts, Bob could transition to their lessons on risk management, learning to set stop-loss and take-profit orders.

Finally, he could utilize their demo account to test his newfound knowledge in a risk-free environment before venturing into live trading. This structured path allows Bob to build a strong foundation before taking on the complexities of live trading.

Trading Costs and Fees

Navigating the world of forex trading involves more than just predicting market movements; it’s also about understanding the often-hidden costs that can significantly impact your bottom line. Think of it like this: you wouldn’t buy a car without knowing the price of gas, would you? Similarly, ignoring trading costs can lead to a nasty surprise – and a smaller profit (or bigger loss!).

Let’s dissect the various fees and charges to ensure you’re not leaving money on the table.Let’s explore the three main cost components that can nibble away at your forex profits: spreads, commissions, and swap fees. Understanding these is crucial for choosing a platform that aligns with your trading style and risk tolerance.

Choosing the right forex platform as a newbie can feel like navigating a minefield of hidden fees and dodgy deals. Before you jump in headfirst comparing the best forex trading platforms for beginners, remember to arm yourself with knowledge – check out this crucial guide on How to avoid forex scams and fraud when using Questrade or other platforms.

to avoid becoming a victim. Then, and only then, can you confidently compare platforms and pick the perfect one for your budding forex empire!

Spreads

Spreads represent the difference between the bid and ask price of a currency pair. It’s the cost of executing a trade, essentially the broker’s profit margin. A smaller spread translates directly into lower trading costs. For example, a spread of 1 pip on a EUR/USD trade means you’ll pay 1 pip more to buy than you’ll receive when selling.

While seemingly small, these pips accumulate over multiple trades, especially for high-frequency traders. Larger spreads can quickly erode your profits, particularly during volatile market conditions. Consider that a 2 pip spread on a 100,000 unit trade is $20. That’s $20 gone before you even make a single pip of profit!

So, you’re diving into the wild world of forex trading, eh? Choosing the right platform is crucial, like picking the perfect surfboard before tackling a tsunami. A big factor in that decision is understanding the cost, so check out this link to see What are the Questrade forex trading fees and commissions? to get a clearer picture.

Knowing the fees helps you compare platforms and avoid nasty surprises, ensuring you keep more of your hard-earned (or soon-to-be-hard-earned) cash.

Commissions

Some brokers charge commissions on top of spreads, acting as a separate fee for facilitating your trades. These commissions can vary widely depending on the broker and the trading volume. A broker might charge a fixed fee per trade, or a percentage of the trade value. It’s important to note that a broker with low spreads might actually be more expensive overall if they also charge significant commissions.

Choosing the right forex platform is like picking the perfect workout – you need the right tools for success! While comparing the best forex trading platforms for beginners, remember that a strong foundation is key, much like finding the best strength training program for building muscle. So, before diving into the exciting (and sometimes terrifying) world of currency exchange, make sure your trading platform is equally robust and beginner-friendly.

For example, Broker A might have a 1-pip spread but a $5 commission per trade, while Broker B has a 1.5-pip spread but no commission. If you make many smaller trades, Broker B might be cheaper overall.

Swap Fees

Swap fees, also known as rollover fees, apply when you hold a position overnight. These fees compensate brokers for the interest differential between the two currencies in a pair. They can be positive or negative, depending on the direction of your trade and the interest rates of the involved currencies. A long position in a high-interest currency against a low-interest currency will generally result in a negative swap fee (you’ll earn money!), while the opposite is true for a short position.

These fees are often calculated daily and can become significant for longer-term positions. For example, holding a large position in a high-yielding currency for a week can result in substantial swap costs, even if your trade is otherwise profitable. This is a critical consideration for swing or position traders.

- Platform A: Low spreads (0.5 pips on average), moderate commissions ($3 per trade), negligible swap fees.

- Platform B: Higher spreads (1.2 pips on average), no commissions, moderate swap fees.

- Platform C: Average spreads (1 pip on average), high commissions ($7 per trade), low swap fees.

The above example highlights how different fee structures can impact your profitability. Careful analysis of these costs is essential before choosing a platform. Remember, the cheapest option isn’t always the best option. The optimal choice depends on your individual trading style, frequency, and position holding periods.

Security and Regulation

Choosing a forex trading platform is like choosing a bank – you wouldn’t trust your life savings to just any roadside shack, would you? Similarly, selecting a regulated broker is paramount for protecting your hard-earned cash and ensuring a fair trading environment. Ignoring this crucial aspect can lead to a world of hurt, so let’s dive into the vital role of security and regulation in forex trading.Reputable forex brokers are overseen by various regulatory bodies, acting as guardians of the trading realm.

These bodies establish and enforce rules designed to protect traders from fraud, manipulation, and the general chaos that can erupt in unregulated markets. Think of them as the superheroes of the financial world, swooping in to save the day (and your money) when things go sideways. This regulatory oversight is not just a suggestion; it’s a necessity for anyone serious about forex trading.

Regulatory Bodies and Their Roles

Regulatory bodies around the globe play a crucial role in maintaining the integrity of the forex market. Their responsibilities encompass a wide range of protective measures, ensuring fair play and preventing unscrupulous practices. Failure to adhere to their regulations can result in hefty fines, operational restrictions, or even the complete shutdown of a broker’s operations. This creates a powerful incentive for brokers to maintain high standards and prioritize client security.For example, the Financial Conduct Authority (FCA) in the UK meticulously monitors brokers operating within its jurisdiction, demanding rigorous compliance with its rules and regulations.

Similarly, the Commodity Futures Trading Commission (CFTC) in the United States and the Australian Securities and Investments Commission (ASIC) in Australia perform similar crucial oversight functions, each with its own set of regulations and enforcement mechanisms. These organizations act as watchdogs, ensuring that brokers operate ethically and transparently. Choosing a broker regulated by one of these established bodies offers a significant layer of protection for your trading activities.

Security Measures Implemented by Reputable Platforms, Comparing the best forex trading platforms for beginners

Beyond regulatory oversight, reputable forex platforms implement robust security measures to safeguard user funds and data. These measures often go beyond the minimum requirements set by regulatory bodies, reflecting a commitment to exceeding industry standards and prioritizing client protection.For instance, many platforms utilize advanced encryption technologies, such as SSL (Secure Sockets Layer) and TLS (Transport Layer Security), to protect sensitive information transmitted between the trader’s computer and the broker’s servers.

This encryption acts like a digital fortress, preventing unauthorized access to personal data and trading details. Furthermore, many platforms employ two-factor authentication (2FA), adding an extra layer of security by requiring a second verification method, such as a code sent to the trader’s mobile phone, before allowing access to their account. This makes it significantly harder for hackers to gain unauthorized access, even if they manage to obtain a user’s password.

Segregation of client funds is another critical security measure. Reputable brokers typically hold client funds in separate accounts, separate from their operational funds, providing an additional layer of protection in case of broker insolvency. This ensures that client funds remain protected even if the broker faces financial difficulties.

Mobile Trading Apps and Usability: Comparing The Best Forex Trading Platforms For Beginners

The world of forex trading isn’t just about sitting at your desktop anymore; it’s about seizing opportunities on the go. Mobile trading apps have revolutionized how we interact with the markets, allowing for quick reactions and constant market monitoring, even during your morning commute or while sipping your latte (responsibly, of course!). Choosing a platform with a user-friendly mobile app is crucial for beginners, as it can significantly impact your trading experience and success.Mobile trading apps offer incredible flexibility and convenience, enabling you to execute trades, monitor your portfolio, and access market news and analysis from anywhere with an internet connection.

This accessibility empowers traders to react quickly to market shifts and capitalize on fleeting opportunities, a feature particularly beneficial for active traders or those dealing with volatile markets. However, the quality of the app itself can make or break this experience; a poorly designed app can be more frustrating than helpful.

Mobile App Feature Comparison

A good mobile trading app should be more than just a miniature version of the desktop platform; it needs to be intuitive, responsive, and packed with the features you need. Let’s compare some hypothetical examples to illustrate this. Imagine three apps: “ForexFly,” “TradeTitan,” and “ChartChamp.”ForexFly boasts a clean, simple interface, perfect for beginners. It focuses on ease of use with large, clear buttons and a streamlined order placement process.

TradeTitan, on the other hand, is feature-rich, offering advanced charting tools, multiple order types, and customizable watchlists. This might be overwhelming for beginners but is ideal for experienced traders. ChartChamp excels in its charting capabilities, providing a wide array of technical indicators and drawing tools, but its navigation might be slightly less intuitive than ForexFly.

Placing a Simple Trade Using a Hypothetical Mobile App

Let’s walk through placing a simple trade using our hypothetical ForexFly app. Imagine the screen displays a currency pair, EUR/USD, currently priced at 1.Below the price, you see clear buttons: “Buy,” “Sell,” and “Order.” Tapping “Buy” opens a new screen. This screen prompts you to enter the trade size (e.g., 10,000 units of EUR/USD), the stop-loss order (e.g., 1.0980), and the take-profit order (e.g., 1.1020).

Once you’ve entered your details, you review them on a confirmation screen before tapping “Confirm Order.” The app then executes your trade, updating your account balance and trade history in real-time.

Key Benefits of Mobile Trading

The benefits of mobile trading extend beyond mere convenience. Real-time market access allows traders to react swiftly to breaking news and economic events. The portability of mobile apps also allows traders to manage their positions on the go, making it easier to adjust strategies as needed. Finally, many mobile apps offer push notifications for important alerts, such as price changes or margin calls, keeping traders informed even when they aren’t actively monitoring their accounts.

Demo Accounts and Simulated Trading

Before you leap into the thrilling (and sometimes terrifying) world of real-money forex trading, think of a demo account as your personal, risk-free training ground. It’s like getting to practice your fancy footwork on a dance floor made of marshmallows – you can make mistakes, learn from them, and generally have a blast without the fear of financial injury.

This invaluable tool lets you test strategies, get comfortable with the platform’s interface, and develop your trading instincts before risking your hard-earned cash.Demo accounts mirror live trading environments, providing access to real-time market data and allowing you to execute trades just as you would in a live account. This realistic simulation is crucial for honing your skills and building confidence.

You’ll learn to navigate the platform, understand how order types work, and develop a feel for market fluctuations without the pressure of potential losses. It’s the ultimate forex sandbox, allowing you to experiment freely and discover your trading style.

Accessing and Using a Demo Account on MetaTrader 4

Let’s take MetaTrader 4 (MT4), a popular forex trading platform, as an example. To access a demo account, you typically need to register with a broker that offers MT4. Many brokers provide this service for free. Once registered, you’ll receive login credentials for your demo account. Downloading and installing the MT4 platform is usually straightforward; most brokers provide links and instructions.

After installation, you’ll use your login credentials to access your demo account. The interface will look nearly identical to a live account, but your account balance will be virtual currency. You can then practice placing various orders, setting stop-loss and take-profit levels, and analyzing charts, all without risking real capital. Familiarize yourself with the different order types (market orders, pending orders, etc.) and experiment with different trading strategies.

Limitations of Demo Accounts

While demo accounts are incredibly beneficial, it’s crucial to understand their limitations. The most significant difference is the psychological aspect. Trading with virtual money doesn’t replicate the emotional rollercoaster of risking real funds. The pressure, the fear of loss, and the adrenaline rush of a winning trade are absent in a demo account. This can lead to overconfidence and unrealistic expectations when transitioning to live trading.

Furthermore, market conditions can fluctuate, and while a demo account offers real-time data, it may not perfectly reflect the emotional and psychological impact of actual market volatility. Finally, demo accounts often don’t fully replicate the complexities of slippage and potential delays that can occur in live trading due to high market activity. While a demo account provides valuable practice, it’s not a perfect substitute for real-world trading experience.

Last Recap

So, there you have it – a whirlwind tour of the best forex trading platforms for beginners. Remember, choosing the right platform is the first step on your forex journey. It’s like picking the perfect pair of shoes for a marathon – the wrong ones will leave you with blisters, while the right ones will help you run the race of your life.

Do your research, compare features, and most importantly, choose a platform that feels right for you. Happy trading (and may your profits be plentiful!)