Is Questrade a reliable platform for forex trading in Canada? That’s the burning question on every aspiring Canadian forex trader’s mind, a question echoing louder than a thousand screaming eagles (metaphorically speaking, of course – unless you live near a very vocal eagle population). This deep dive into the Questrade universe will explore its regulatory compliance, platform features, fees, and user experiences, leaving no stone unturned (or, at least, no significant regulatory document unread).

Prepare for a thrilling journey into the world of Canadian forex trading!

We’ll dissect Questrade’s security measures, comparing them to industry standards. We’ll examine the user-friendliness of their platform, exploring its trading tools and charting capabilities. The dreaded fee structure will be laid bare, and we’ll analyze user reviews to get the real scoop on the Questrade experience. Buckle up, buttercup, it’s going to be a wild ride!

Questrade’s Regulatory Compliance and Security

Questrade’s reputation in the Canadian forex market hinges on its robust security measures and unwavering adherence to regulatory standards. This isn’t just about ticking boxes; it’s about safeguarding your hard-earned loonies (and your peace of mind!). Let’s dive into the nitty-gritty of how Questrade keeps your trading safe and sound.

Questrade’s Regulatory Oversight in Canada

Questrade is a registered investment dealer regulated by the Investment Industry Regulatory Organization of Canada (IIROC). This means they’re subject to rigorous oversight, regular audits, and stringent compliance requirements. Think of IIROC as the financial police, ensuring Questrade plays by the rules and protects its clients. This regulatory framework covers everything from account security to the handling of client funds, ensuring a level of transparency and accountability that’s hard to match.

Violating IIROC rules can lead to hefty fines and even the loss of their operating license – a pretty strong incentive to keep things squeaky clean.

Wondering if Questrade’s your forex trading soulmate in Canada? Their reliability is a big question, but comparing their security to others helps. For a deeper dive into the regulatory rabbit hole, check out this assessment of Ares Global Forex’s security measures: Ares Global Forex regulation and security measures assessment. This might give you a better yardstick to measure Questrade against, ensuring you don’t accidentally trade your hard-earned loonies for a bag of virtual lemons!

Security Measures to Protect Client Funds and Data

Questrade employs a multi-layered security approach, like a digital fortress designed to keep out the bad guys. This includes robust firewalls, encryption protocols (think impenetrable digital vaults), and sophisticated fraud detection systems that constantly monitor for suspicious activity. They also utilize two-factor authentication, adding an extra layer of security to logins – it’s like having a secret knock in addition to your key.

So, you’re wondering if Questrade’s the muscle-bound champion of Canadian forex trading? It’s a decent platform, but honestly, building your forex trading strategy requires as much mental fortitude as physical strength – maybe even more! Think of it like this: before you conquer the forex markets, you need to build a solid foundation, much like you’d do with muscular strength exercises.

Getting those gains in the gym helps you approach forex with the same discipline and focus. Ultimately, Questrade’s reliability depends on your trading skills, not just the platform itself.

Client funds are held in segregated accounts, meaning they’re kept separate from Questrade’s operating funds, protecting your money even if the company faces financial difficulties. Imagine it like having your savings tucked away in a separate, heavily guarded vault.

Examples of Questrade’s Compliance with Canadian Securities Regulations

Questrade’s commitment to compliance is evident in their transparent fee structure, readily available account statements, and their robust client complaint resolution process. They regularly publish reports outlining their compliance efforts and undergo independent audits to verify their adherence to IIROC regulations. These actions demonstrate a proactive approach to regulatory compliance, going above and beyond the minimum requirements to foster trust and confidence among their clients.

Their dedication to transparency allows investors to easily verify the legitimacy of their operations.

Comparison of Questrade’s Security Protocols with Other Major Canadian Forex Brokers

While a direct comparison across all Canadian forex brokers requires in-depth analysis of individual security policies, it’s generally accepted that Questrade’s security measures are comparable to, and in some areas exceed, those of other major players. Many brokers follow similar regulatory guidelines and employ comparable security technologies. However, the specifics of implementation and the level of proactive security measures can vary.

It’s always recommended to independently research and compare the security features offered by different brokers before making a decision.

Comparison of Questrade’s Security Features with Industry Best Practices, Is Questrade a reliable platform for forex trading in Canada?

| Security Feature | Questrade | Industry Best Practice | Comment |

|---|---|---|---|

| Fund Segregation | Yes | Yes | Standard practice for regulated brokers. |

| Two-Factor Authentication | Yes | Yes | Essential for enhanced account security. |

| Encryption | Yes (SSL/TLS) | Yes (SSL/TLS or equivalent) | Protects data transmitted between client and broker. |

| Firewall Protection | Yes | Yes | Protects against unauthorized access. |

Questrade’s Forex Trading Platform Features

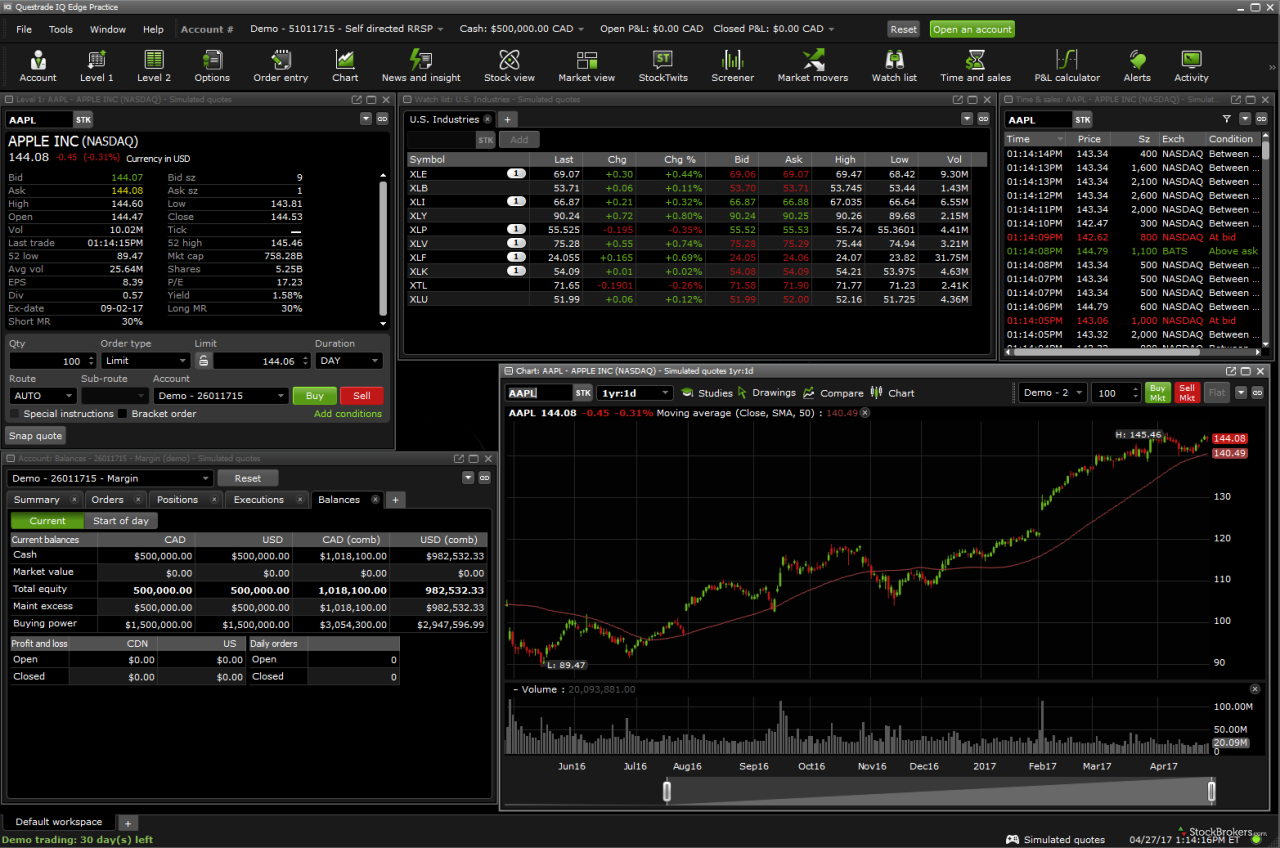

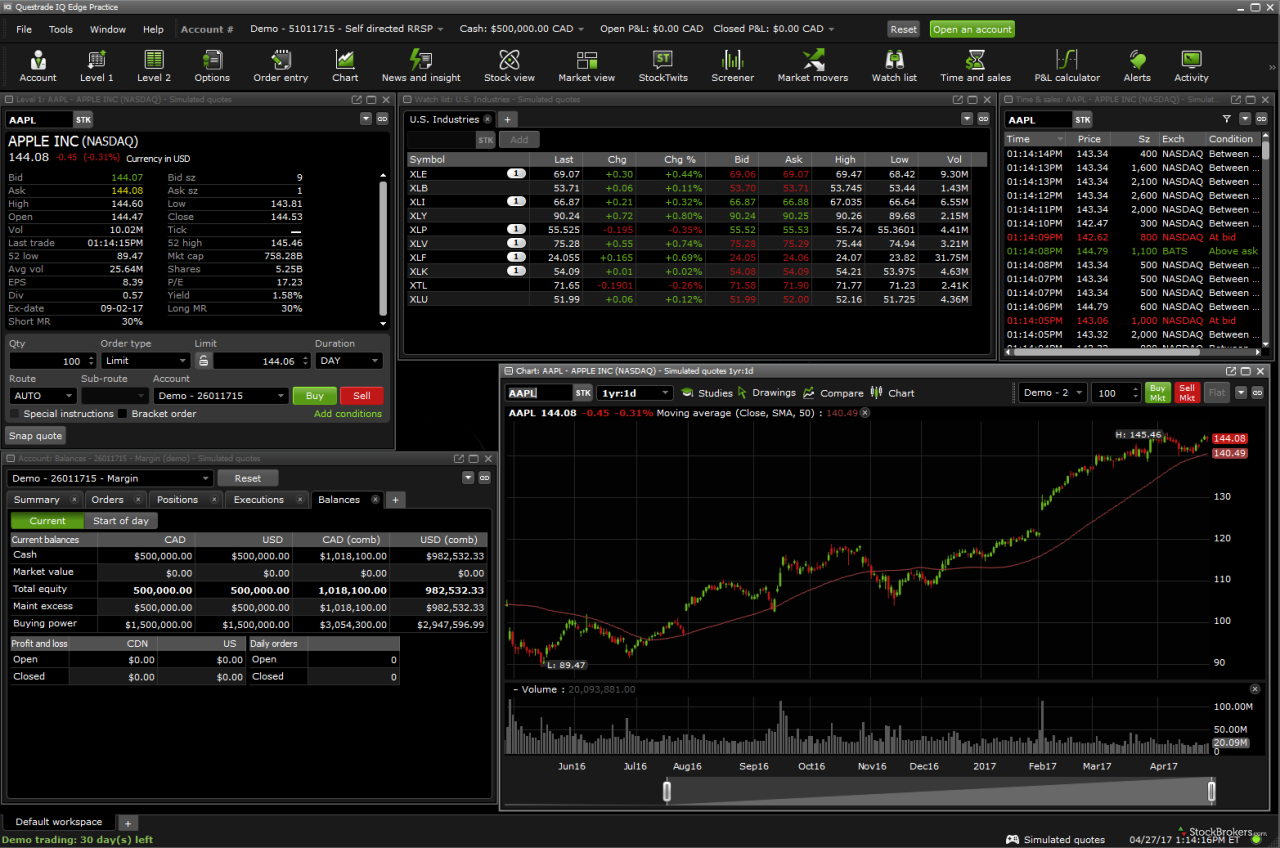

Questrade’s forex trading platform, while not flashy like some competitors, offers a solid and reliable experience for Canadian traders. Think of it as a well-worn, comfortable pair of trading shoes – maybe not the most stylish, but perfectly functional and ready for the long haul. Let’s delve into the specifics.

The platform boasts a range of features designed to cater to both novice and experienced forex traders. Its functionality is underpinned by a commitment to security and regulatory compliance, as previously discussed. The focus here is on the practical aspects of using the platform for your daily trading needs.

Platform User Interface and Navigation

Questrade’s platform prioritizes a clean and intuitive interface. While not bursting with bells and whistles, the layout is straightforward, making navigation relatively easy. Finding specific tools and information is generally hassle-free, even for users less familiar with online trading platforms. Think of it as a well-organized toolbox – everything has its place, and you can quickly find what you need.

The overall aesthetic is functional rather than visually stunning, which some traders might appreciate for its lack of distractions.

Trading Tools and Charting Capabilities

The platform provides access to a variety of charting tools and indicators, allowing traders to analyze market trends and make informed decisions. While not as extensive as some premium platforms, Questrade offers a sufficient selection of technical indicators, including moving averages, RSI, MACD, and Bollinger Bands. Charting capabilities allow for customization, including various timeframes and chart types. Think of it as a solid set of carpentry tools – maybe not every specialized tool imaginable, but enough to build a sturdy trading strategy.

Order Execution Types

Questrade supports various order types, enabling traders to execute trades according to their specific strategies and risk tolerance. These include market orders (executed immediately at the current market price), limit orders (executed only when the price reaches a specified level), and stop orders (triggered when the price moves beyond a certain point). More advanced order types, such as trailing stops and OCO (one cancels the other) orders, are also available.

This gives traders a degree of control over their trading experience, allowing for flexible approaches to market entry and exit.

Wondering if Questrade’s your forex cup of tea in Canada? Their reliability is a hot topic, but before you jump in, consider checking out Forex Inc’s trading services and client testimonials for a different perspective. It might give you a better sense of what to expect from a Canadian forex broker, helping you decide if Questrade’s the right fit for your trading style.

Key Features and Benefits

| Feature | Benefit |

|---|---|

| Intuitive Interface | Easy navigation and user-friendly experience. |

| Variety of Charting Tools | Comprehensive technical analysis capabilities. |

| Multiple Order Types | Flexibility in executing trades and managing risk. |

| Reliable Execution | Fast and efficient order processing. |

Questrade’s Fees and Costs for Forex Trading

Navigating the world of forex trading can feel like traversing a minefield, especially when it comes to understanding fees. While Questrade offers a generally competitive platform, understanding their fee structure is crucial for maximizing your profits. Let’s dissect the costs involved to ensure you’re not leaving money on the table (or, worse, in the minefield).

Questrade’s forex trading fees are primarily composed of spreads, overnight financing charges (also known as swap fees), and, in some cases, commissions. The absence of commissions on many forex pairs is a significant advantage, but the spreads and overnight financing charges can still significantly impact your overall profitability. Understanding these components is vital for successful forex trading.

Spreads

The spread is the difference between the bid price (what Questrade will buy your currency for) and the ask price (what Questrade will sell the currency to you for). This is the core cost of your trade, and it fluctuates constantly based on market conditions and liquidity. Think of it as the commission built into the price itself.

Higher liquidity generally means tighter spreads, leading to lower costs for you. Questrade’s spreads are generally competitive, particularly for major currency pairs, but it’s always advisable to compare them with other brokers before committing to a trade. Remember, even small spreads can add up over many trades.

Overnight Financing Charges

Holding a forex position overnight incurs overnight financing charges, reflecting the interest rate differential between the two currencies involved. These charges are calculated daily and can be positive or negative depending on the direction of your trade and the prevailing interest rates. If you’re long a currency with a higher interest rate, you’ll receive a positive financing charge (essentially earning interest).

Conversely, holding a position in a currency with a lower interest rate will result in a negative financing charge (paying interest). These charges can be significant for longer-term positions, so it’s essential to factor them into your trading strategy.

Commission

While Questrade doesn’t charge commissions for many forex trades, it’s worth noting that some less-traded currency pairs might have commissions applied. It’s always best to check Questrade’s current fee schedule for the specific currency pair you’re interested in to avoid any surprises.

So, you’re wondering if Questrade’s your forex Shangri-La in Canada? Honestly, platform reliability is a personal journey, but to truly master the forex game, you need the right knowledge. That’s where brushing up your skills comes in handy; check out these Top recommended Forex trading books for intermediate traders to level up your trading game. Armed with that wisdom, you’ll be better equipped to judge if Questrade’s the right fit for your Canadian forex adventures.

Comparison with Competitors

Comparing Questrade’s fees directly with competitors requires checking their current fee schedules, as these can change. However, Questrade generally positions itself competitively, especially in the realm of commission-free forex trading for popular currency pairs. The key differentiator often lies in the spreads offered. A lower spread, even without commissions, can lead to greater overall savings.

Fee Structure Summary

The following table provides a simplified overview. Remember to always refer to Questrade’s official website for the most up-to-date information.

| Fee Type | Description | Typical Cost | Notes |

|---|---|---|---|

| Spread | Difference between bid and ask price | Variable, depends on currency pair and market conditions | Generally competitive for major pairs |

| Overnight Financing | Interest rate differential between currencies | Variable, depends on currencies and interest rates | Can be positive or negative |

| Commission | Per-trade fee | Usually $0 for major pairs; may apply to less liquid pairs | Check Questrade’s current schedule |

Visual Representation of a Typical Forex Trade Cost

Imagine a bar graph. The longest bar represents the total cost of the trade. This bar is then segmented into smaller bars representing the spread and overnight financing charges. The spread bar would likely be the largest, showcasing its significant contribution to the overall cost. If a commission were applicable, a small, separate bar would represent this.

The visual would clearly show the relative proportions of each cost component, highlighting the dominance of the spread and the potential impact of overnight financing charges on longer-term trades. For example, a $1000 trade might show a spread cost of $5, overnight financing of $2 (or -$2 if positive), and zero commission. The graph would visually represent these figures, clearly demonstrating the breakdown of costs.

So, Questrade for Canadian forex traders? It’s a decent platform, but let’s be honest, sometimes you crave more pizzazz. If you’re looking for a comparison, check out the features and user experience of the Forex 2000 platform, Forex 2000 trading platform features and user experience , to see if it’s a better fit for your trading style.

Then you can decide if Questrade’s reliability outweighs its, shall we say, lack of flamboyant flair.

Client Experiences and Reviews of Questrade for Forex Trading: Is Questrade A Reliable Platform For Forex Trading In Canada?

Navigating the world of online forex trading reviews can feel like wading through a swamp of conflicting opinions. However, a careful examination of Questrade’s user feedback reveals a fascinating – and sometimes hilarious – picture of the platform’s strengths and weaknesses. Think of it as a reality show, but instead of drama, we have spreads, slippage, and the occasional customer service saga.The overall consensus regarding Questrade’s forex offerings is a mixed bag, reflecting the inherent complexities of the forex market itself.

So, you’re wondering if Questrade’s the Canadian forex king? It’s a decent platform, but before you dive headfirst into the wild world of currency trading, you might want to bone up on your strategies first. Check out Langlois’s beginner guide on forex trading strategies for beginners explained by Langlois here , it’s a lifesaver. Then, armed with knowledge, you can confidently assess if Questrade truly fits your forex needs.

While some users sing its praises, others offer cautionary tales that could rival the best-selling financial thrillers. Let’s delve into the specifics.

Positive Aspects Reported by Questrade Forex Traders

Many positive reviews highlight Questrade’s robust platform, praising its user-friendliness, especially for beginners. Experienced traders also appreciate the advanced charting tools and analytical capabilities. The competitive pricing, particularly regarding commissions, is another recurring theme of positive feedback. Furthermore, the platform’s reliability and stability are frequently lauded, although, as we’ll see, this isn’t universally experienced.

- User-Friendly Interface: Many users, particularly beginners, find the platform intuitive and easy to navigate, reducing the learning curve associated with forex trading.

- Competitive Pricing: Questrade’s fees and commissions are often cited as being among the most competitive in the Canadian market, a significant advantage for active traders.

- Reliable Platform: While not universally consistent, many users report a high degree of platform reliability and stability, crucial for executing trades effectively.

- Advanced Charting and Analysis: Experienced traders appreciate the sophisticated charting tools and analytical capabilities available on the platform, allowing for in-depth market analysis.

Negative Aspects Reported by Questrade Forex Traders

While the positive aspects are noteworthy, Questrade’s forex service isn’t without its detractors. The most frequent complaints center around customer service responsiveness and the occasional experience of slippage or wider spreads than advertised. These issues, while not necessarily unique to Questrade, can significantly impact trading outcomes and user satisfaction.

- Customer Service Responsiveness: A recurring theme in negative reviews is the perceived slow response times and difficulty in reaching customer support representatives, especially during peak trading hours. Imagine trying to get help during a market flash crash – not ideal.

- Slippage and Spreads: Some users report experiencing slippage or wider spreads than anticipated, leading to unexpected losses. This highlights the inherent risks of forex trading and the importance of understanding order execution mechanisms.

- Platform Occasional Instability: Although generally reliable, some users have reported occasional instances of platform instability or downtime, potentially disrupting trading activities at crucial moments. Think of it as the digital equivalent of a power outage during a crucial game.

Recurring Themes in Client Feedback

The consistent threads running through Questrade forex trader reviews emphasize the importance of managing expectations. While the platform offers a competitive trading environment with a generally user-friendly interface, the reality of forex trading – its inherent volatility and the potential for unexpected issues – remains paramount. The need for independent research and risk management cannot be overstated. Remember, even the best platform can’t predict market movements.

Questrade’s Customer Support and Resources

Navigating the sometimes-treacherous waters of forex trading requires a sturdy ship and a reliable crew – and in this analogy, Questrade’s customer support acts as your ever-vigilant first mate. A responsive and helpful support system can be the difference between a smooth sailing profit and a stormy loss. Let’s delve into the depths of Questrade’s support offerings and see if they’re up to snuff.Questrade offers a multi-pronged approach to customer support, aiming to cater to diverse preferences and levels of tech-savviness.

Their goal is to help you avoid those frustrating “Help! I’ve accidentally shorted the Canadian dollar!” moments.

Customer Support Channels

Questrade provides several avenues for seeking assistance. These include phone support, email, and a comprehensive FAQ section on their website. While a live chat option isn’t always readily available, the phone and email support generally offers a relatively quick response time, although wait times can vary depending on the time of day and the complexity of the issue.

The FAQ section, though, is a treasure trove of information, often answering common questions before you even need to pick up the phone. Think of it as your personal forex trading encyclopedia, always at your fingertips.

Availability and Responsiveness of Questrade’s Customer Support

The availability of Questrade’s customer support aligns with standard business hours, meaning expect to connect with a representative during regular working days. Their responsiveness is generally positive, with most users reporting reasonable wait times and helpful resolutions. However, like any large financial institution, periods of high demand may result in longer wait times. Think of it as rush hour on the forex highway – sometimes you hit a jam, but eventually, you’ll reach your destination.

Anecdotal evidence suggests that email inquiries might take a slightly longer time to resolve compared to phone calls, but the email system offers a documented trail of the interaction, which can be beneficial for complex issues.

Educational Resources for Questrade Forex Traders

Questrade recognizes that forex trading isn’t just about clicking buttons; it requires knowledge and understanding. To that end, they provide various educational resources, including webinars, tutorials, and market analysis reports. These resources cover a range of topics, from fundamental analysis to risk management, aiming to equip traders with the necessary tools to navigate the market successfully. While the depth of these resources might not rival that of dedicated financial education platforms, they offer a solid foundation for beginners and helpful reminders for experienced traders.

Think of it as a forex trading refresher course, conveniently integrated into your trading platform.

Comparison with Other Forex Brokers in Canada

Comparing Questrade’s customer support to other Canadian forex brokers reveals a mixed bag. While some brokers might boast 24/7 support or more specialized educational resources, Questrade generally holds its own. The availability of phone and email support, combined with their helpful FAQ section and educational materials, puts them in the middle-to-upper range of customer support offerings among Canadian brokers.

It’s less about being the absolute best and more about offering a reliable and competent service that meets the needs of the average trader. It’s like choosing between a reliable, comfortable sedan and a flashy sports car – the sedan might not be as exciting, but it gets you where you need to go.

Closing Summary

So, is Questrade a reliable platform for forex trading in Canada? The answer, like a perfectly executed forex trade, is nuanced. While Questrade boasts strong regulatory compliance and a generally user-friendly platform, the ultimate verdict hinges on individual needs and risk tolerance. Consider the fees, carefully weigh the user reviews, and always remember that the forex market is a wild beast – proceed with caution and a healthy dose of humor.

Happy trading!