Comparison of the best day trading platforms available in Canada? Forget spreadsheets and snooze-inducing comparisons! Prepare for a whirlwind tour of the Canadian day trading jungle, where nimble-fingered traders battle it out for market supremacy armed with nothing but their wits and the right platform. We’re diving deep into the world of fees, features, and frankly, the sheer thrill of watching your portfolio fluctuate like a rollercoaster on a caffeine binge.

Get ready to choose your weapon (platform) wisely!

This comprehensive guide cuts through the jargon and reveals the hidden strengths and weaknesses of top Canadian day trading platforms. We’ll dissect everything from commission structures that could make a miser blush to the user-friendliness (or lack thereof) of their mobile apps. We’ll even tackle the age-old question: Can a platform really be

-too* feature-rich? (Spoiler alert: yes.) Whether you’re a seasoned pro or a wide-eyed newbie, this guide will arm you with the knowledge you need to conquer the Canadian markets.

Introduction to Canadian Day Trading Platforms

So, you want to dive into the thrilling, sometimes terrifying, world of Canadian day trading? Buckle up, buttercup, because it’s a wild ride. The Canadian day trading landscape is a vibrant mix of established players and newer entrants, all vying for your attention (and your hard-earned loonies). Navigating this digital battlefield requires understanding the tools of the trade – namely, the platforms themselves.Choosing the right platform is like choosing the right hockey stick – the wrong one can leave you feeling clumsy and frustrated, while the right one can help you score big.

These platforms aren’t just websites; they’re your command centers, providing real-time market data, charting tools, order execution, and more. The differences between them can be significant, impacting your trading speed, efficiency, and ultimately, your profitability.

Canadian Day Trading Regulatory Environment

The Canadian Securities Administrators (CSA) oversee the regulatory landscape for day trading. This means adhering to strict rules and regulations designed to protect investors and maintain market integrity. This includes registration requirements for advisors, reporting obligations, and limitations on certain trading strategies. Understanding these regulations is crucial to avoid any legal snafus and to ensure your trading activities remain compliant.

Ignoring these rules can lead to hefty fines or even legal action – definitely not a good way to spend your profits (or what should be your profits!). Think of it as the referee making sure the game is fair, even if it means occasionally calling a penalty on your favourite player.

Key Features Differentiating Day Trading Platforms

Several key features set Canadian day trading platforms apart. These features are crucial considerations when selecting a platform tailored to your specific needs and trading style. The speed of order execution, for instance, can be the difference between a profitable trade and a missed opportunity. Real-time data feeds are essential for informed decisions, and robust charting tools allow for technical analysis and pattern identification.

Choosing the best Canadian day trading platform is a wild goose chase, a financial safari if you will! But if you’re feeling adventurous and want to tackle options and futures, the question becomes much more specific – check out this guide: What’s the best platform for day trading with options and futures? to help you navigate the complexities before returning to the Canadian platform comparison.

Ultimately, the “best” platform depends entirely on your individual needs and risk tolerance.

Finally, the platform’s user interface and overall ease of use are important factors that shouldn’t be overlooked; a clunky platform can quickly become a source of frustration.

Examples of Key Features and Their Impact

Let’s say you’re a scalper, executing many trades throughout the day. A platform with lightning-fast order execution is paramount. Conversely, if you’re a swing trader, holding positions for longer periods, the speed might be less critical, but access to advanced charting tools for technical analysis becomes significantly more important. Consider the scenario of a sudden market shift.

Choosing the best Canadian day trading platform can be a real workout! You need the stamina to research all the options, the focus to avoid impulsive decisions, and the mental strength to handle those market swings. To build that mental fortitude, maybe try some muscular strength exercises – a strong body often leads to a strong mind.

Then, armed with newfound strength (both physical and mental!), you can conquer the world of Canadian day trading platforms.

A platform with real-time alerts could provide you with the early warning you need to adjust your positions and mitigate potential losses. In contrast, a platform lacking this feature could leave you vulnerable to unexpected market movements. The platform’s commission structure is another critical factor, directly impacting your overall profitability. A platform with high commissions could eat into your profits, particularly for high-frequency traders.

Therefore, comparing commission structures across different platforms is essential for maximizing your returns.

Comparing Canadian day trading platforms? It’s a jungle out there, filled with more fees than a Tim Hortons lineup! But speed is key, so finding the right app matters; that’s why checking out Best Canadian day trading app with low latency and order execution? is crucial before you dive into the market. Ultimately, choosing the best platform depends on your individual needs and trading style, so do your research!

Comparison of Top Platforms

Choosing the right day trading platform in Canada can feel like navigating a minefield of fees and commissions. One wrong step, and your profits could vanish faster than a loonie in a Tim Hortons lineup. This section dissects the fee structures of some leading platforms, helping you choose a platform that won’t eat into your hard-earned gains. We’ll explore how different fee structures impact your bottom line and uncover those sneaky hidden fees that can leave you scratching your head (and your wallet).

Fee Structures of Leading Canadian Day Trading Platforms

Understanding the fee landscape is crucial for successful day trading. Different platforms employ varying commission structures, impacting profitability significantly. The following table compares the fee structures of five leading Canadian day trading platforms. Note that fees can change, so always check the platform’s website for the most up-to-date information.

| Platform Name | Commission Structure | Minimum Deposit | Other Fees |

|---|---|---|---|

| Interactive Brokers | Tiered commission structure based on trade volume, generally very competitive. | Varies, but generally low. | Inactivity fees, regulatory fees, potential margin interest. |

| TD Ameritrade | Commission-free for many ETFs and stocks, but fees may apply for options and other instruments. | Varies depending on account type. | Regulatory fees, potential inactivity fees, margin interest. |

| Questrade | Low fixed commission per trade. | Generally low. | Account maintenance fees (may vary), inactivity fees, regulatory fees. |

| Wealthsimple Trade | Commission-free for stocks and ETFs. | No minimum deposit. | No account maintenance fees, but potential regulatory fees. |

| National Bank Direct Brokerage | Commission structure varies based on trade volume and account type. | Varies. | Account maintenance fees (potential), regulatory fees, margin interest. |

Impact of Fee Structures on Profitability

The cumulative effect of fees, especially on high-frequency day trading, can significantly reduce profitability. A seemingly small commission per trade can quickly add up over numerous transactions. For instance, a trader executing 50 trades daily at a $5 commission would pay $250 in commissions alone, impacting their potential profits considerably. Choosing a platform with a competitive fee structure is therefore paramount.

Platforms offering tiered commissions can be beneficial for high-volume traders, as their costs per trade decrease with increased trading activity.

Implications of Hidden Fees and Charges

Hidden fees are the bane of every trader’s existence. These often overlooked charges can dramatically erode profits. These can include inactivity fees (charged if your account remains dormant for a certain period), data fees (for accessing real-time market data), and regulatory fees (passed on by the platform). Always carefully review the platform’s fee schedule before opening an account to avoid unpleasant surprises.

Choosing the right Canadian day trading platform can feel like navigating a minefield of fees and features. But before you dive in headfirst, maybe brush up on the basics with this handy guide: Forex trading for dummies: a simple step-by-step guide. Understanding forex fundamentals will give you a solid foundation before comparing platforms for your Canadian day trading adventures.

A seemingly attractive commission structure might be offset by substantial hidden fees, making it less cost-effective than a platform with slightly higher upfront commissions but fewer hidden charges. Think of it like buying a seemingly cheap car – only to discover expensive repair costs down the road.

Platform Features and Functionality: Comparison Of The Best Day Trading Platforms Available In Canada?

Choosing the right day trading platform in Canada isn’t just about finding a pretty interface; it’s about finding the tools that’ll make you feel like a Wall Street wizard (even if you’re trading from your couch in your pajamas). This section dives into the nitty-gritty of platform features, comparing charting capabilities, order types, and mobile app experiences to help you find your perfect trading match.

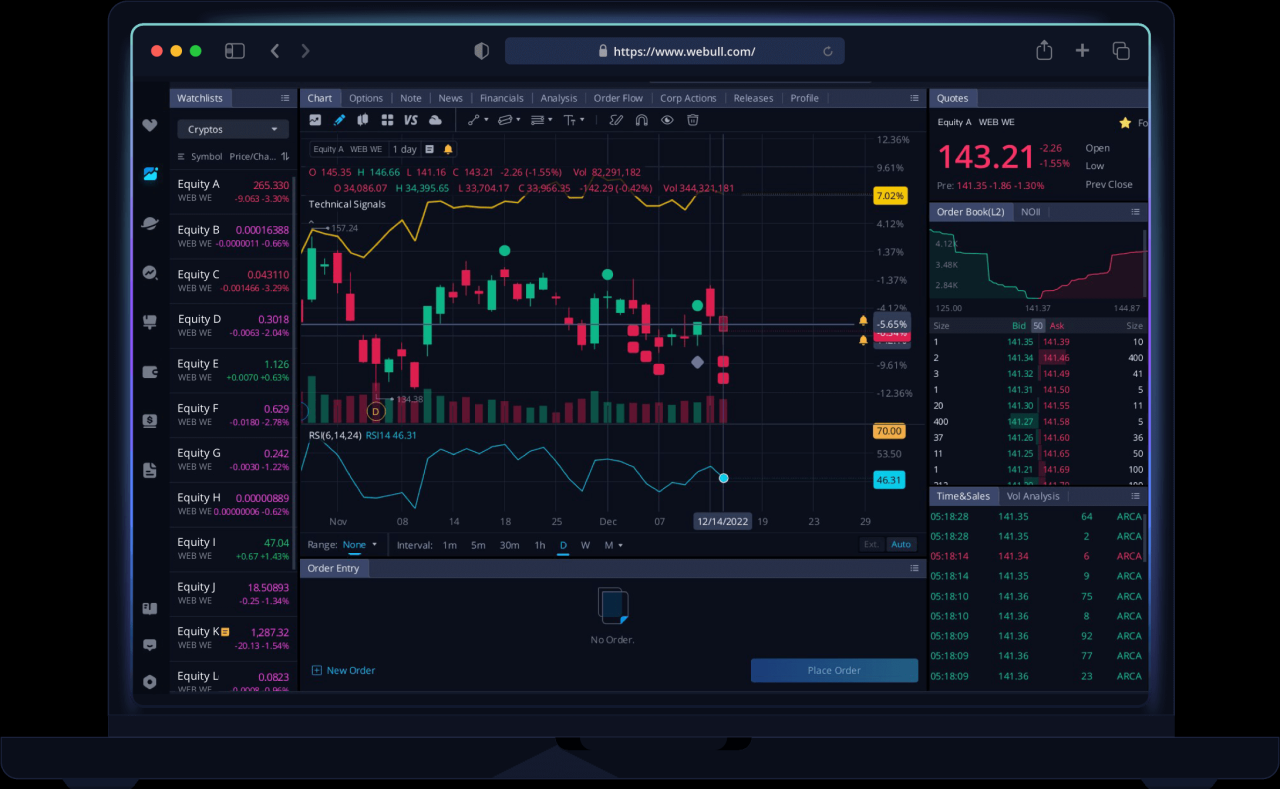

Charting Tools and Technical Analysis

Charting tools are the bread and butter of technical analysis. Different platforms offer varying levels of customization and sophistication. Some platforms might boast an arsenal of indicators, drawing tools, and chart types (candlestick, line, bar, you name it!), while others might offer a more streamlined, minimalist approach. The best platform for you will depend on your trading style and the complexity of your analysis.

For instance, a platform with advanced charting might include options for backtesting strategies using historical data, allowing traders to refine their approach before risking real capital. A simpler platform might focus on ease of use and quick access to essential indicators.

Order Types and Execution Speeds

Speed is of the essence in day trading. The order types and execution speeds offered by a platform directly impact your ability to capitalize on fleeting market opportunities. Consider the range of order types available: market orders, limit orders, stop-loss orders, trailing stop orders, and potentially more exotic order types. Faster execution speeds are crucial for minimizing slippage (the difference between the expected price and the actual execution price).

A platform with robust infrastructure and direct market access (DMA) will generally offer superior execution speeds compared to one that relies on slower routing mechanisms. Imagine trying to buy a rapidly appreciating stock – a slow platform could mean missing out on significant gains.

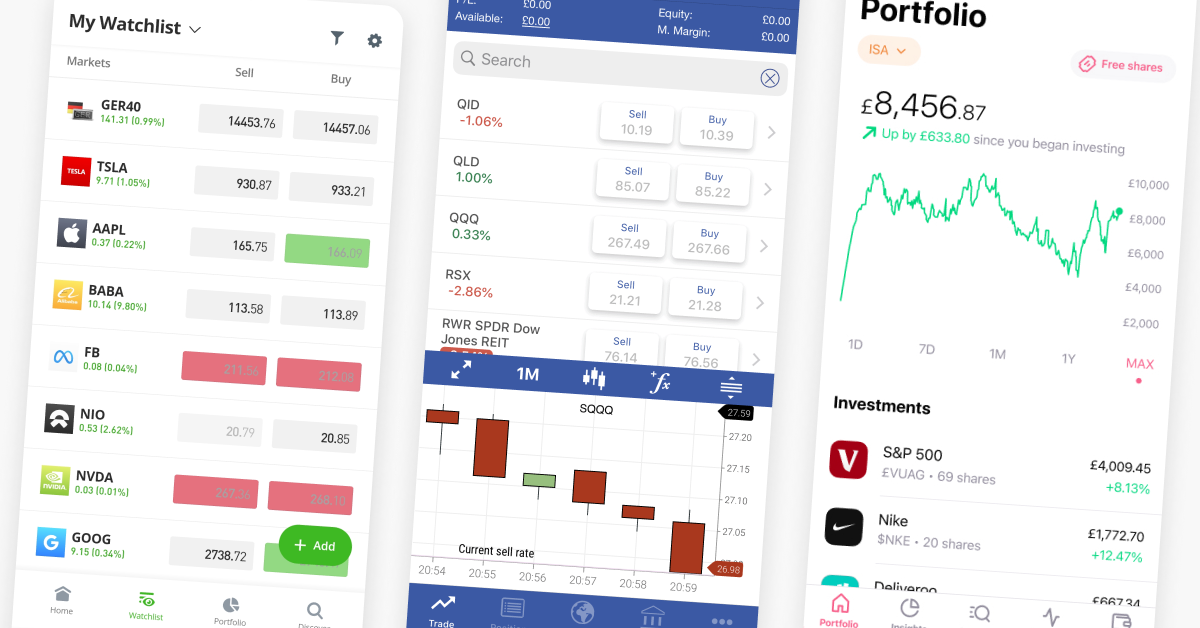

Mobile App Functionalities and User Experience

In today’s mobile-first world, a robust mobile app is almost a necessity for day traders. A good mobile app should mirror the functionality of the desktop platform, offering seamless access to charting tools, order placement, account management, and news feeds. User experience is paramount; a clunky or confusing app can be a major hindrance during crucial trading moments.

Consider factors like intuitive navigation, responsive design, and the availability of features like real-time quotes and alerts. Think of it this way: a well-designed mobile app is your portable trading command center, letting you react to market changes wherever you are, whether you’re sipping coffee at a cafe or relaxing on a patio (responsibly, of course!).

Picking the perfect Canadian day trading platform can be a wild goose chase, especially when considering religious compliance. Before you dive into comparing platforms like Wealthsimple Trade or Interactive Brokers, you might want to check if your chosen strategy aligns with your beliefs; a quick read on Is forex trading halal according to Islamic finance principles? could save you some serious soul-searching (and maybe some losses!).

Then, armed with this knowledge, you can confidently compare those Canadian platforms!

Research and Data Access

Choosing a day trading platform in Canada is like picking a fishing rod – you need the right tools to reel in those profits. And a crucial part of that toolkit is access to high-quality research and data. The right platform will provide you with the insights you need to make informed decisions, turning your day trading from a gamble into a (hopefully) lucrative strategy.

Let’s dive into the data-driven deep end.The availability and quality of market data are paramount for successful day trading. Different platforms offer varying levels of access, ranging from basic charting tools to sophisticated analytical packages. The cost of real-time data feeds can significantly impact your overall trading expenses, so it’s vital to understand what you’re getting for your money.

Beyond the raw data, some platforms offer unique research tools and resources that can provide a competitive edge.

Real-time Data Feeds and Costs

Real-time data is the lifeblood of day trading. Without it, you’re essentially trading blind. The speed at which you receive price updates can be the difference between a profitable trade and a missed opportunity. Most Canadian platforms offer real-time data feeds, but the cost varies considerably. Some platforms might include a basic level of real-time data in their subscription fees, while others charge extra for premium data packages or access to specific exchanges.

For example, one platform might offer real-time quotes for TSX-listed stocks as standard, but charge extra for access to US markets or options data. Understanding these cost structures is crucial for budgeting your trading operations.

Quality and Breadth of Market Data

The quality of market data is just as important as its availability. You need accurate, reliable information to make sound trading decisions. Look for platforms that provide comprehensive market data, including historical price data, volume data, and other relevant indicators. The breadth of data coverage is also important. Does the platform provide data for all the markets you intend to trade?

Does it offer data on different asset classes, such as stocks, options, futures, and forex? A platform with a wide range of data sources provides a more complete picture of the market and enables you to make more informed decisions. For instance, a platform offering detailed fundamental data alongside technical indicators provides a more holistic view than one solely focused on price charts.

Unique Research Tools and Resources

Beyond the standard market data, some platforms offer unique research tools and resources that can enhance your trading strategy. These might include advanced charting tools, technical analysis indicators, fundamental data analysis tools, news feeds, or even access to analyst reports. For example, some platforms provide integrated screeners that allow you to filter stocks based on specific criteria, such as price, volume, or fundamental metrics.

Others might offer backtesting capabilities, allowing you to test your trading strategies on historical data before deploying them in live trading. These added features can significantly improve your trading efficiency and profitability. Consider a platform offering customizable alerts based on specific market events or price movements; this proactive approach can significantly improve trading responsiveness.

Security and Reliability

Choosing a day trading platform is like choosing a bank – you need to trust them with your hard-earned cash (and potentially your sanity!). Security and reliability are paramount; after all, you don’t want your life savings vanishing into the digital ether because of a dodgy platform. This section delves into the security measures, uptime, and regulatory compliance of leading Canadian day trading platforms.Security measures implemented by different platforms vary, impacting user data protection and overall platform trustworthiness.

Reliability, measured by platform uptime and responsiveness, directly affects trading efficiency and profitability. Regulatory compliance ensures adherence to Canadian securities laws, protecting both the platform and its users.

Data Security Measures, Comparison of the best day trading platforms available in Canada?

Robust security measures are crucial for protecting user data from unauthorized access and cyber threats. Leading Canadian platforms typically employ a multi-layered approach, including encryption of data both in transit and at rest, two-factor authentication (2FA), and regular security audits. For example, a platform might use AES-256 encryption for data at rest and TLS 1.2 or higher for data in transit, offering a high level of protection against data breaches.

They also might employ intrusion detection and prevention systems to monitor for suspicious activity and block malicious attempts. The level of detail provided regarding specific security measures often varies between platforms, so careful review of their security policies is recommended.

Platform Uptime and Reliability

Day trading demands consistent access to the market. Platform downtime can mean missed opportunities and lost profits. Therefore, a platform’s uptime and overall reliability are critical considerations. Reputable platforms typically boast high uptime percentages, often exceeding 99.9%, with scheduled maintenance communicated well in advance. However, unforeseen outages can still occur due to technical issues or external factors.

Choosing the best Canadian day trading platform is a wild goose chase, a financial safari if you will! The key is finding one that fits your style, and that often means prioritizing affordability. For active traders, the question becomes even more crucial, so check out this guide for reliable and affordable options: Reliable and affordable day trading broker in Canada for active traders?

Ultimately, comparing platforms comes down to finding the perfect balance between features and fees – happy hunting!

A platform’s ability to quickly resolve these issues and minimize disruption is a key indicator of its reliability. Look for platforms with transparent uptime reporting and clear communication channels for service disruptions.

Regulatory Compliance and Safeguards

Canadian day trading platforms are subject to stringent regulations to protect investors. These regulations ensure that platforms operate ethically and transparently, adhering to rules set by the Investment Industry Regulatory Organization of Canada (IIROC) and other relevant authorities. Compliance includes measures like maintaining adequate capital reserves, adhering to strict Know Your Client (KYC) and Anti-Money Laundering (AML) procedures, and providing regular audits of their operations.

Platforms that openly demonstrate their regulatory compliance and provide details about their safeguards inspire greater trust and confidence. Checking a platform’s registration with IIROC is a crucial step before signing up.

Platform Suitability for Different Trader Types

Choosing the right day trading platform is like picking the perfect pair of shoes – the wrong choice can lead to blisters (and losses!). The ideal platform depends heavily on your experience level and trading style. A beginner needs a user-friendly interface with robust educational resources, while an advanced trader might prioritize sophisticated charting tools and advanced order types.

Let’s break down which platforms best suit different trader profiles.

This section analyzes the suitability of popular Canadian day trading platforms for beginners, intermediate, and advanced traders. We’ll consider factors such as ease of use, available tools, and the overall learning curve. Remember, the “best” platform is subjective and depends on your individual needs and preferences.

Platform Suitability Matrix

The following table categorizes popular Canadian day trading platforms (replace with actual platform names) based on their suitability for different trader experience levels. Note that this is a general guideline, and individual experiences may vary.

| Platform Name | Beginner Suitability | Intermediate Suitability | Advanced Suitability |

|---|---|---|---|

| Platform A (e.g., Interactive Brokers) | Medium – Steep learning curve, but excellent educational resources are available. | High – Wide range of tools and order types are accessible once you’ve mastered the basics. | High – Offers advanced charting, algorithmic trading, and margin accounts for experienced traders. |

| Platform B (e.g., Questrade) | High – User-friendly interface and intuitive design make it easy to get started. | Medium – Offers some advanced features but lacks the breadth of Platform A. | Medium – Suitable for intermediate traders but may lack the specialized tools for very advanced strategies. |

| Platform C (e.g., Wealthsimple Trade) | High – Extremely simple and straightforward, ideal for absolute beginners. | Low – Limited advanced features restrict its usefulness for intermediate traders. | Low – Not designed for advanced strategies or high-volume trading. |

Features Catering to Different Trading Styles

Different platforms offer features tailored to specific trading styles. For example, scalpers benefit from platforms with extremely low latency and advanced order types, while swing traders might prioritize robust charting and technical analysis tools.

Let’s consider some examples:

- Scalping: Platforms with low latency (the delay between placing an order and its execution) are crucial for scalpers who profit from tiny price movements. Platform A, with its advanced order routing and direct market access, would likely be preferred.

- Swing Trading: Swing traders, holding positions for days or weeks, need strong charting tools and fundamental data. Platform B, while not as advanced as Platform A, offers a good balance of charting capabilities and research tools.

- Day Trading (General): A platform with a user-friendly interface, a variety of order types (limit, stop-loss, etc.), and real-time market data is beneficial for general day trading. Platform B and even Platform C could serve this purpose well, depending on the trader’s skill level and trading volume.

Illustrative Examples of Trading Scenarios

Let’s ditch the boring textbook examples and dive into some real-world (hypothetical, of course!) day trading scenarios in Canada. We’ll see how different platforms might handle these situations, focusing on order execution, fees, and potential profits (or losses – let’s be realistic!). Remember, these are illustrative and actual results may vary based on market conditions and individual platform specifics.Imagine you’re a Canadian day trader with accounts on two popular platforms: Platform A (think high-speed execution, hefty fees) and Platform B (think slightly slower execution, lower fees).

Scenario 1: The Quick Breakout

This scenario involves a rapidly rising stock. Let’s say you’re eyeing XYZ Corp., a Canadian tech company, and see a sudden price jump on the news of a major partnership. You want to get in – fast*.

- Platform A: You place a market order to buy 100 shares of XYZ at the current market price. The order executes almost instantly, at $15.50 per share. However, Platform A charges a commission of $10 plus a per-share fee of $0.02. Your total cost is $1550 + $10 + ($0.02

– 100) = $1570. The stock immediately rises to $16.00. - Platform B: You place the same market order on Platform B. Due to slightly slower execution, the order fills at $15.55 per share. The commission is only $5 flat. Your total cost is $1555 + $5 = $1560. The stock still rises to $16.00.

Scenario 2: The Slow and Steady Climb

Now, let’s consider a different scenario. You’re interested in a more established company, ABC Corp., known for its consistent growth. You decide on a limit order.

- Platform A: You place a limit order to buy 200 shares of ABC at $25.00. The stock slowly climbs throughout the day, eventually reaching your limit price, and your order is filled. Your total cost, including commissions (same structure as above), is $5000 + $10 + ($0.02

– 200) = $5050. - Platform B: You place the same limit order on Platform B. The order is filled at the same price, but your total cost, including commissions, is $5000 + $5 = $5005.

Scenario 3: The Unexpected Dip

This scenario tests how each platform handles a sudden market downturn. Let’s say DEF Corp. experiences a sharp drop due to negative news. You have a stop-loss order in place.

- Platform A: You had a stop-loss order to sell 150 shares of DEF at $10.00. The order executes swiftly at $10.02. Including commissions, your total cost is $10.02

– 150 + $10 + ($0.02

– 150) = $1523. - Platform B: You had the same stop-loss order on Platform B. While the execution is slightly slower, your order fills at $10.05. Your total cost, including commissions, is $10.05

– 150 + $5 = $1512.50.

Final Wrap-Up

So, there you have it – a battlefield map of the Canadian day trading landscape. Remember, the “best” platform is subjective; it hinges on your individual trading style, risk tolerance, and caffeine intake (seriously, it’s a factor). Don’t be afraid to test the waters, experiment with different platforms, and discover which one best suits your unique trading personality.

May your trades be swift, your profits be plentiful, and your coffee always strong. Happy trading!