Detailed guide to forex trading on Questrade platform – Detailed guide to forex trading on Questrade platform: Prepare for liftoff, aspiring forexonauts! This isn’t your grandpappy’s stuffy finance manual. We’re diving headfirst into the thrilling world of currency trading on Questrade’s platform, armed with wit, wisdom, and a healthy dose of caffeine. Forget dry explanations; we’re about to unlock the secrets of forex trading with a guide so engaging, you’ll actually

-enjoy* learning.

Get ready to conquer the currency markets!

This comprehensive guide navigates you through the entire forex trading process on Questrade, from setting up your account and understanding the platform’s interface to mastering trading strategies and managing risk effectively. We’ll demystify technical analysis, explain various order types, and equip you with the knowledge to confidently navigate the sometimes-chaotic world of currency exchange. Whether you’re a seasoned trader or a curious newbie, this guide provides the tools and insights you need to succeed.

Buckle up, it’s going to be a wild ride!

Account Setup and Funding on Questrade

So, you’re ready to dive into the thrilling world of forex trading? Excellent! But before you can start making (or losing, let’s be realistic) money, you need to set up your Questrade account. Think of it as getting your trading license – except instead of a badge, you get access to a potentially lucrative (and potentially terrifying) world of currency fluctuations.

Setting up your account and funding it might seem daunting, but it’s really just a series of straightforward steps. We’ll walk you through it, hand-holding you every step of the way (metaphorically, of course. We can’t actually hold your hand through a screen).

Opening a Questrade Forex Trading Account

The process of opening a Questrade account for forex trading is surprisingly painless. First, head to the Questrade website. You’ll be greeted with a friendly (hopefully) interface that will guide you through the account application. You’ll need to provide some basic personal information, such as your name, address, and date of birth. Think of it as a slightly more exciting version of filling out a form for a library card – except the stakes are considerably higher.

Mastering forex trading on the Questrade platform? This detailed guide will have you swimming in pips! But if you’re after lightning-fast trades and want to keep more of your hard-earned cash, check out the best options for low-fee day trading in Canada – Best day trading app in Canada with low fees and commission. – before diving headfirst into Questrade’s forex offerings.

Then, armed with this knowledge, you’ll conquer the forex market like a seasoned pro!

You’ll also need to choose a username and password, so choose wisely! A password like “password123” is strongly discouraged; your financial future depends on it. You’ll also need to answer a few security questions. Again, choose wisely! Don’t make it too easy for a mischievous monkey to guess your answers.

Funding Your Questrade Account

Once your account is approved (which usually happens pretty quickly), it’s time to fund it. Questrade offers a variety of funding methods, each with its own quirks.

Here’s a breakdown:

- Electronic Funds Transfer (EFT): This is generally the fastest and most convenient method, typically taking 2-5 business days. Fees are usually minimal or nonexistent.

- Wire Transfer: A more traditional method, wire transfers can be slightly slower (3-7 business days) and may incur fees from both Questrade and your bank. Think of it as the more formal, slightly slower cousin of EFT.

- Debit/Credit Card: Convenient but may have higher fees and potentially lower transfer limits. Think of it as the fast-food option – quick and easy, but maybe not the most economical in the long run.

Identity Verification and Documentation

To comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, Questrade will require you to verify your identity. This usually involves uploading copies of your government-issued ID (like a driver’s license or passport) and proof of address (like a utility bill). Don’t worry, it’s not as scary as it sounds. Just make sure your documents are clear and legible – you don’t want a blurry picture of your driver’s license to derail your forex trading dreams.

Questrade Account Types for Forex Trading

Questrade offers different account types, each catering to different needs and trading styles. Choosing the right one is crucial for optimizing your trading experience.

| Account Type | Minimum Deposit | Fees | Features |

|---|---|---|---|

| Standard Account | $0 | Commission-based, spreads vary | Access to all currency pairs, margin trading, advanced charting tools |

| (Example of a hypothetical Premium Account – Questrade may not offer this exact type) Premium Account | $10,000 | Lower commissions, tighter spreads | Dedicated account manager, priority customer support, access to exclusive research |

Note: The specific fees and features can change, so always check Questrade’s official website for the most up-to-date information. This table serves as a general example.

Understanding Questrade’s Forex Trading Platform

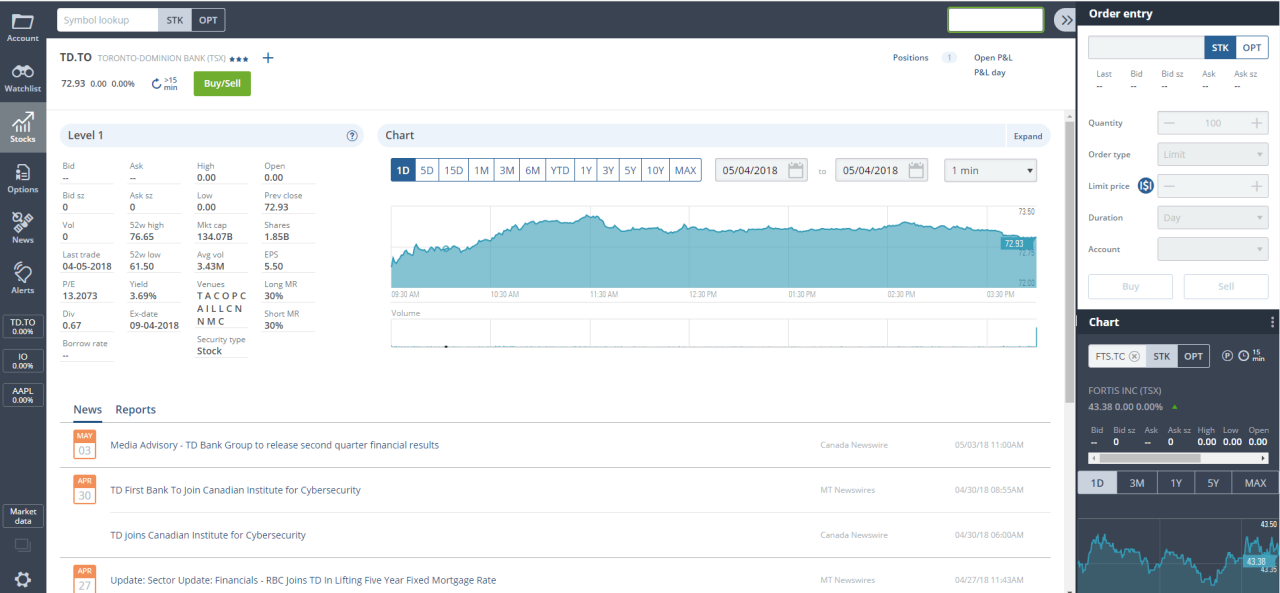

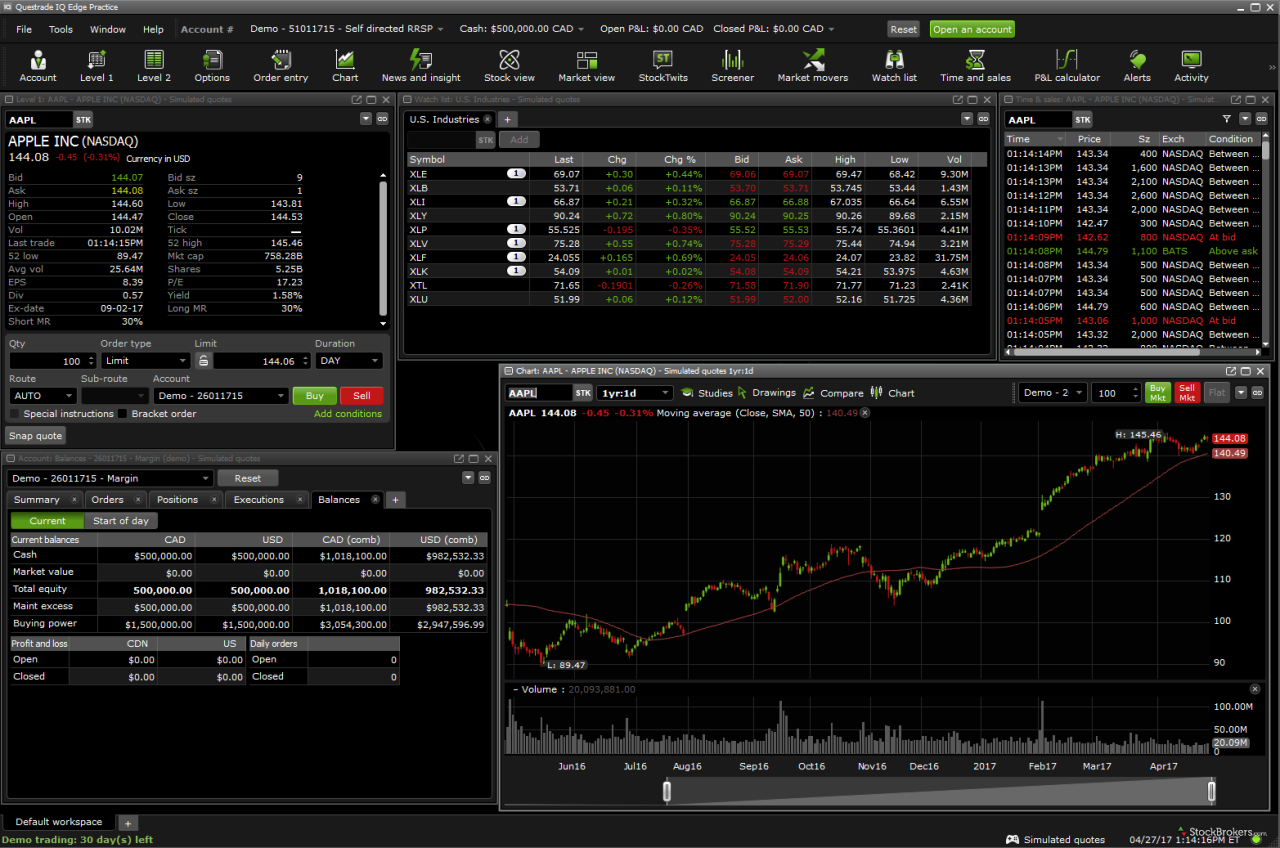

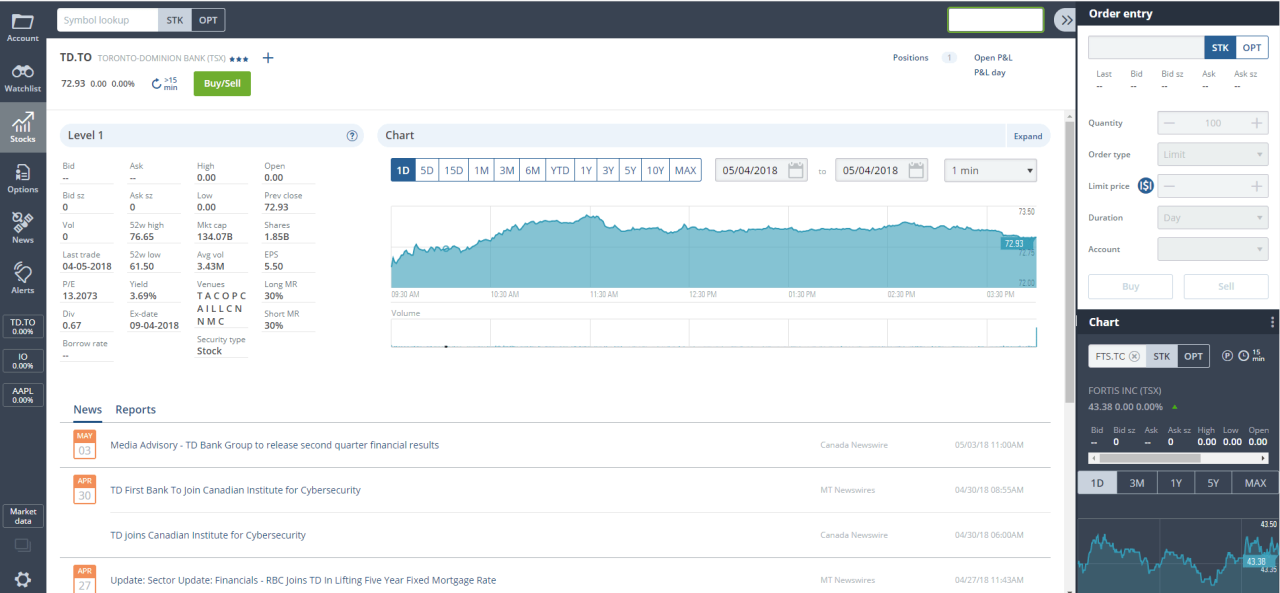

So, you’ve successfully navigated the slightly bewildering, yet ultimately rewarding, process of setting up your Questrade account and funding it. Congratulations! Now, let’s dive headfirst into the exciting world of Questrade’s forex trading platform. Think of it as your personal spaceship to the financial galaxy, complete with charts, graphs, and the occasional asteroid field of unexpected market volatility. Buckle up, it’s going to be a wild ride.Questrade’s platform, while initially appearing somewhat spartan compared to some of its flashier competitors, boasts a surprisingly intuitive interface once you get the hang of it.

Navigation is largely straightforward, with clearly labelled menus and easily accessible tools. Think of it as a well-organized toolbox – everything is there, you just need to know where to find the right wrench (or in this case, the right order type).

Questrade’s Forex Trading Platform Interface and Navigation

The main trading screen typically displays a customizable watchlist of your chosen currency pairs, complete with real-time price quotes, charts, and order entry windows. You can easily add or remove pairs, adjust chart sizes and timeframes, and personalize the display to your liking. Think of it as creating your own personalized cockpit view. The platform’s overall design prioritizes clarity and efficiency, minimizing distractions while providing all the essential information at a glance.

Menus are logically organized, allowing for quick access to account information, order history, and various analytical tools. The learning curve is relatively gentle, making it suitable for both beginners and seasoned traders.

Order Types Available on Questrade’s Platform

Understanding the different order types is crucial for successful forex trading. Choosing the wrong order type can lead to missed opportunities or, worse, unexpected losses. Let’s explore the most common ones:

- Market Order: This is your “buy it now” option. You’re buying or selling at the current market price, offering speed and simplicity but potentially sacrificing price precision. Example: You see EUR/USD surging and want in immediately; a market order executes your trade at the best available price at that instant.

- Limit Order: This allows you to specify the exact price at which you want to buy or sell. If the market reaches your price, your order is executed. If not, it remains open until canceled or the market closes. Example: You believe GBP/USD will reach 1.30, so you place a buy limit order at 1.30. The order will only execute if the price reaches this level.

- Stop Order: A stop order is triggered when the market price reaches a certain level, often used to limit potential losses or protect profits. Example: You own EUR/USD and want to limit losses if the price falls significantly. You might place a stop-loss order at 1.10, selling your position if the price drops to that level. Alternatively, you can place a stop-limit order which sets both a stop price and a limit price for your order execution.

Technical Analysis Tools and Features

Questrade’s platform offers a robust suite of technical analysis tools, empowering you to delve into the fascinating world of chart patterns and indicators. These tools are crucial for identifying potential trading opportunities and managing risk.

- Charting Tools: You’ll find a variety of chart types (candlestick, bar, line), drawing tools (trend lines, Fibonacci retracements, etc.), and timeframes (from 1-minute to monthly), allowing you to analyze price movements in detail and identify patterns.

- Technical Indicators: The platform provides access to a wide range of technical indicators, such as moving averages, RSI, MACD, and Bollinger Bands, each offering unique insights into market momentum, trends, and volatility. Understanding these indicators takes time and practice, but they can significantly enhance your trading strategy.

Walkthrough: Placing and Managing Forex Orders

Let’s imagine you want to buy 10,000 units of EUR/USD. First, you locate the EUR/USD pair in your watchlist. Then, you select the “New Order” button. You’ll then choose “Market Order” (for immediate execution) or “Limit Order” (to specify your entry price). You input the order size (10,000 units), and click “Submit.” To manage your order, you can monitor its status in your “Open Orders” tab.

You can also modify or cancel open orders before they are filled. For stop orders, you would similarly specify the stop price, triggering the order if the market moves against your position. Remember, always use appropriate risk management techniques, such as stop-loss orders, to protect your capital.

Forex Trading Strategies on Questrade

So, you’ve conquered the Questrade platform, funded your account, and are raring to go. But before you dive headfirst into the wild world of forex trading, let’s equip you with some strategies that are less “jumping off a cliff” and more “carefully scaling a mountain.” Remember, even seasoned traders occasionally slip, so we’ll focus on strategies and risk management to help you stay upright.

Popular Forex Trading Strategies for Beginners

Choosing the right strategy is crucial, especially when starting. Think of it like choosing your weapon in a video game – a shotgun’s great for close-range battles, but a sniper rifle is better for long-range engagements. Similarly, different strategies suit different market conditions and trading styles. We’ll explore a few beginner-friendly options.

- Trend Following: This involves identifying and trading in the direction of established trends. Imagine it like surfing – you want to ride the wave, not fight it. On Questrade, you can use various indicators (like moving averages) to spot these trends. For example, a consistently rising 20-day moving average might signal an uptrend.

- Support and Resistance Trading: Support and resistance levels are price points where the market tends to bounce or reverse. Think of them as invisible walls. Traders often place buy orders near support (expecting a bounce) and sell orders near resistance (expecting a reversal). Identifying these levels requires chart analysis, but Questrade’s charting tools can help visualize them.

- Range Trading: Some currency pairs move within a defined range for extended periods. Range trading involves buying low within that range and selling high, profiting from the price fluctuations within those boundaries. Identifying these ranges often involves observing past price action and using indicators like Bollinger Bands, readily available on the Questrade platform.

Risk Management Techniques on Questrade

Risk management isn’t about avoiding losses entirely (that’s impossible!), but about controlling them. It’s like wearing a seatbelt – you still might get into an accident, but the seatbelt significantly reduces the impact.

- Position Sizing: Never risk more than a small percentage (e.g., 1-2%) of your trading capital on any single trade. This prevents a single losing trade from wiping out your account. Questrade allows you to set order sizes precisely, enabling strict adherence to this crucial rule.

- Stop-Loss Orders: These automatically close a trade if the price moves against you by a predetermined amount. Think of it as a safety net. Setting a stop-loss order is non-negotiable – it limits your potential losses.

- Take-Profit Orders: These automatically close a trade when it reaches a predetermined profit target. This helps lock in profits and prevents letting gains turn into losses if the market reverses unexpectedly. Questrade’s platform makes setting both stop-loss and take-profit orders simple and straightforward.

Order Management Strategies: Trailing Stops vs. Stop-Loss Orders

Stop-loss orders are your basic safety net. Trailing stops are a more sophisticated version – they automatically adjust your stop-loss order as the price moves in your favor. Imagine a dog on a leash following you; as you walk forward, the leash adjusts to stay attached. Similarly, a trailing stop follows your winning trade, protecting your profits as the price moves favorably.

However, trailing stops can be triggered prematurely if the market experiences a sudden reversal. Both have their place; the choice depends on your trading style and risk tolerance.

Example Trading Plan: A Beginner’s Approach, Detailed guide to forex trading on Questrade platform

Let’s say we’re using a trend-following strategy with the EUR/USD pair. We’ve identified an uptrend using a 20-day moving average. Our trading plan would include:

- Strategy: Trend following using the 20-day moving average.

- Entry: Buy EUR/USD when the price closes above the 20-day moving average.

- Stop-Loss: Place a stop-loss order below the recent swing low (a significant low point in recent price action), limiting potential loss to 1% of trading capital.

- Take-Profit: Set a take-profit order at a level representing a risk-reward ratio of 1:2 (double the potential profit compared to the potential loss). This could be determined by using Fibonacci retracements or other technical analysis tools available on the Questrade platform.

- Position Sizing: Only risk 1% of trading capital on this trade.

This is a simplified example. Real-world trading involves more nuances, but this illustrates the basic components of a robust trading plan incorporating risk management and a specific strategy. Remember, always backtest your strategies using historical data before risking real money. Questrade’s platform provides the tools to do this effectively.

Analyzing Forex Market Data on Questrade

Navigating the forex market successfully requires more than just a lucky hunch and a caffeine addiction. It demands a deep understanding of market data, and Questrade provides the tools to help you become a data-driven forex ninja (or at least a competent trader). This section will equip you with the knowledge to decipher the cryptic messages whispered by charts and economic indicators.

Accessing and interpreting real-time forex market data on Questrade is surprisingly straightforward. Once logged in, you’ll find a wealth of information at your fingertips. The platform provides live quotes, charting tools with various technical indicators, and access to news feeds – all crucial for staying ahead of the curve. Think of it as your personal, always-on, forex oracle (but remember, even oracles can be wrong sometimes!).

Understanding how to effectively use these tools is key to successful trading. For example, the live quotes allow you to instantly see the current exchange rate of a currency pair, helping you to make informed decisions about when to buy or sell. The charts allow you to visualize price movements over time, identifying patterns and trends. News feeds provide you with real-time updates on global events that could impact currency values.

It’s a data-rich environment, so take your time to explore and familiarize yourself with all the available tools.

The Economic Calendar and its Importance

The economic calendar is your secret weapon against market surprises. This regularly updated schedule lists upcoming economic announcements – things like interest rate decisions, employment reports, and inflation figures – that can significantly impact currency values. Imagine it as a sneak peek into the future, albeit a slightly fuzzy one. For example, if the US Federal Reserve is expected to raise interest rates, the US dollar (USD) might strengthen in anticipation, affecting pairs like EUR/USD or GBP/USD.

Conversely, unexpectedly weak employment numbers could lead to a currency weakening. Questrade’s platform typically integrates an economic calendar directly into its trading interface, making it easy to monitor upcoming events and their potential influence on your trades. Planning your trades around these announcements allows you to capitalize on predictable market movements or to avoid potential volatility.

So you’re diving into the wild world of forex trading with Questrade? Excellent choice! But before you conquer the currency markets, you might want to check out this handy comparison of Canadian day trading apps, including a deep dive into Wealthsimple Trade: Day trading app comparison: Wealthsimple Trade vs. other Canadian platforms. It’ll help you decide if Questrade’s your best bet, or if greener (and potentially more profitable) pastures await.

Then, armed with knowledge, return to your Questrade forex guide and become a currency kingpin!

Utilizing Fundamental and Technical Analysis Tools

Questrade offers a range of tools to support both fundamental and technical analysis. Fundamental analysis focuses on the underlying economic factors affecting a currency (like interest rates, inflation, and political stability), while technical analysis uses charts and indicators to identify patterns and predict future price movements. Questrade’s platform typically provides access to a variety of charting tools, allowing you to customize your charts with various indicators (like moving averages, RSI, MACD), and access to news and economic data.

So you’re diving into the wild world of forex trading with Questrade? Excellent choice! But before you conquer the currency markets, you might want to check out this handy comparison of Canadian day trading apps, including a deep dive into Wealthsimple Trade: Day trading app comparison: Wealthsimple Trade vs. other Canadian platforms. It’ll help you decide if Questrade’s your best bet, or if greener (and potentially more profitable) pastures await.

Then, armed with knowledge, return to your Questrade forex guide and become a currency kingpin!

By combining both approaches, you create a more holistic and well-informed trading strategy. For instance, you might use fundamental analysis to identify a currency that’s likely to appreciate due to strong economic data, and then use technical analysis to determine the optimal entry and exit points for your trades.

Key Economic Indicators and Their Impact

Understanding the influence of key economic indicators is crucial for successful forex trading. A change in these indicators can trigger significant market reactions.

Here are some examples, illustrating the potential impact:

- Interest Rates: Higher interest rates generally attract foreign investment, strengthening the currency. For example, a surprise interest rate hike by the Bank of England could cause the GBP to appreciate against other currencies.

- Inflation Rates: High inflation erodes purchasing power, usually leading to a weaker currency. Persistent high inflation in a country could weaken its currency against those with lower inflation.

- Gross Domestic Product (GDP): Strong GDP growth indicates a healthy economy, typically boosting the currency’s value. Strong GDP numbers for the Eurozone could lead to a stronger EUR.

- Unemployment Rate: Low unemployment suggests a strong economy, supporting the currency. Conversely, high unemployment can signal economic weakness and lead to currency depreciation.

- Trade Balance: A positive trade balance (exports exceeding imports) generally strengthens a currency, while a negative balance weakens it. A large trade surplus for Japan could strengthen the JPY.

Managing Your Forex Trades on Questrade: Detailed Guide To Forex Trading On Questrade Platform

So, you’ve bravely entered the world of forex trading on the Questrade platform. Congratulations! You’ve learned to set up your account, understand the platform, and even dabbled in some strategies. Now comes the crucial part: keeping your cool and managing those trades like a seasoned pro (or at least, like someone who hasn’t lost their shirt). This section will guide you through closing, modifying, monitoring, and generally keeping a watchful eye on your forex adventures.

Closing and Modifying Forex Trades

Closing a trade on Questrade is thankfully less dramatic than a Hollywood stock market crash. Simply locate the open position in your Questrade trading platform. You’ll see options to close the trade either partially or completely. Modifying a trade, such as adjusting your stop-loss or take-profit orders, is equally straightforward. These adjustments can be crucial for managing risk and locking in profits.

Remember, however, that market volatility can outsmart even the most carefully planned modifications, so keep your wits about you! Think of it as a delicate dance between you and the unpredictable forex market – one false step and… well, let’s just say it’s best to be prepared.

Monitoring Open Positions and Risk Management

Keeping tabs on your open positions is like being a vigilant shepherd guarding your flock (your investments, in this case). The Questrade platform provides tools to monitor your open trades, including real-time price movements and profit/loss calculations. Crucially, you should actively manage your risk exposure. Never invest more than you can afford to lose – this is the golden rule of forex trading, repeated ad nauseam for a reason.

So you’re diving into the wild world of forex trading with Questrade? Excellent choice! But before you conquer the currency markets, you might want to check out this handy comparison of Canadian day trading apps, including a deep dive into Wealthsimple Trade: Day trading app comparison: Wealthsimple Trade vs. other Canadian platforms. It’ll help you decide if Questrade’s your best bet, or if greener (and potentially more profitable) pastures await.

Then, armed with knowledge, return to your Questrade forex guide and become a currency kingpin!

Utilize stop-loss orders to limit potential losses on each trade. Diversification across different currency pairs can also help to mitigate risk. Imagine your portfolio as a well-balanced meal – don’t put all your eggs (or your forex capital) in one basket!

So you’re diving into the wild world of forex trading with Questrade? Excellent choice! But before you conquer the currency markets, you might want to check out this handy comparison of Canadian day trading apps, including a deep dive into Wealthsimple Trade: Day trading app comparison: Wealthsimple Trade vs. other Canadian platforms. It’ll help you decide if Questrade’s your best bet, or if greener (and potentially more profitable) pastures await.

Then, armed with knowledge, return to your Questrade forex guide and become a currency kingpin!

Trading Journal and Performance Tracking

Maintaining a detailed trading journal is like having a personal forex therapist. It helps you analyze your past performance, identify recurring patterns (both good and bad), and learn from your mistakes. Record every trade, including entry and exit points, reasons for entering and exiting, and the overall outcome. Track your overall performance using key metrics such as win rate, average profit/loss, and maximum drawdown.

This data will be invaluable in refining your strategies and improving your trading discipline. Consider using a spreadsheet or dedicated trading journal software to streamline the process. Think of it as a detailed, honest self-reflection – crucial for any aspiring forex maestro.

So you’re diving into the wild world of forex trading with Questrade? Excellent choice! But before you conquer the currency markets, you might want to check out this handy comparison of Canadian day trading apps, including a deep dive into Wealthsimple Trade: Day trading app comparison: Wealthsimple Trade vs. other Canadian platforms. It’ll help you decide if Questrade’s your best bet, or if greener (and potentially more profitable) pastures await.

Then, armed with knowledge, return to your Questrade forex guide and become a currency kingpin!

Questrade Forex Trading Fees

Understanding the fees involved is essential to avoid unpleasant surprises. Questrade’s fee structure can vary depending on the currency pair and trading volume. Here’s a simplified breakdown (always check Questrade’s official website for the most up-to-date information):

| Fee Type | Description | Example Fee (USD) | Notes |

|---|---|---|---|

| Spread | The difference between the bid and ask price. | Varies by currency pair | Questrade’s spreads are competitive, but fluctuate. |

| Commission | A per-trade fee. | Varies; often negligible for many trades | Check Questrade’s current commission schedule. |

| Financing Fee (Overnight) | Charged for holding positions overnight. | Varies by currency pair and position size. | This fee can significantly impact long-term trades. |

| Inactivity Fee | Fee for accounts with little to no trading activity. | Check Questrade’s fee schedule. | Avoid this by keeping your account active. |

Security and Risk Management on Questrade

Navigating the forex market can feel like riding a rollercoaster – exhilarating highs and stomach-churning lows. But unlike a rollercoaster, your financial well-being is at stake. This section dives into the crucial aspects of security and risk management on the Questrade platform, ensuring you can enjoy the thrill of trading without jeopardizing your hard-earned cash. We’ll explore Questrade’s security measures, the importance of setting realistic goals, and strategies to tame the wild beast that is forex risk.Questrade employs robust security measures to protect client accounts and data.

They utilize advanced encryption technologies to safeguard your personal information and trading activities. Think of it as a high-tech fortress, protecting your financial kingdom from unwanted intruders. Multi-factor authentication adds another layer of security, acting like a sophisticated drawbridge, ensuring only you can access your account. Regular security audits and compliance with industry best practices further solidify Questrade’s commitment to protecting your investments.

This comprehensive approach helps minimize the risk of unauthorized access and data breaches, allowing you to focus on what truly matters: making smart trading decisions.

Questrade’s Security Measures

Questrade’s security infrastructure is designed to withstand sophisticated cyberattacks. This includes robust firewalls, intrusion detection systems, and data encryption at rest and in transit. They also adhere to stringent regulatory requirements, providing an extra layer of assurance for their clients. Account security features such as multi-factor authentication, password complexity requirements, and account monitoring tools further enhance the security of client accounts.

Imagine your account as a well-guarded vault, protected by multiple layers of security systems, making it incredibly difficult for unauthorized individuals to gain access.

Setting Realistic Trading Goals and Managing Risk

Setting realistic trading goals is paramount to successful and stress-free forex trading. Begin by defining your risk tolerance – how much are you comfortable losing? This isn’t about aiming for the moon; it’s about establishing achievable targets based on your experience and capital. A realistic approach might involve aiming for consistent small profits rather than chasing unrealistic overnight fortunes.

Proper risk management involves techniques like setting stop-loss orders to limit potential losses and diversifying your portfolio to avoid over-reliance on any single currency pair. Think of it as building a sturdy house on solid ground, rather than constructing a castle on shifting sands.

Types of Forex Trading Risks and Mitigation Strategies

Forex trading presents several inherent risks. Market risk encompasses fluctuations in exchange rates, influenced by economic events, political instability, and market sentiment. Liquidity risk involves the inability to quickly buy or sell a currency pair at the desired price, particularly during volatile market conditions. Operational risk encompasses errors or failures in trading platforms, technology, or execution processes. Finally, counterparty risk relates to the failure of a broker or other trading partner to fulfill their obligations.

Mitigating these risks involves diversification, thorough market research, the use of stop-loss orders, and selecting a reputable and regulated broker like Questrade. This is akin to having a well-diversified investment portfolio and a reliable safety net in place.

Risk Management in Action: Scenario Examples

Consider a trader aiming to profit from the EUR/USD pair. A stop-loss order, placed at a predetermined level, would automatically limit losses if the exchange rate moves against the trader’s position. This prevents significant capital erosion during unexpected market swings. Imagine a scenario where geopolitical tensions suddenly surge, causing a sharp drop in the Euro. The stop-loss order acts as a safety net, preventing catastrophic losses.

Similarly, diversifying across multiple currency pairs reduces the impact of a single adverse event. If one currency pair underperforms, the losses are cushioned by the gains or stability of others, acting as a buffer against significant losses. This is like having multiple income streams; if one dries up, you still have others to rely on.

Educational Resources and Support on Questrade

Navigating the sometimes-treacherous waters of forex trading requires more than just a lucky gut feeling and a caffeine addiction. Fortunately, Questrade doesn’t leave you adrift in a sea of uncertainty. They offer a surprisingly robust selection of educational resources and support to help you chart your course to forex success (or at least, to avoid a complete shipwreck). Think of it as your personal forex life raft, complete with comfy cushions and maybe even a mini-fridge stocked with celebratory champagne (okay, maybe not the champagne, but you get the idea).Questrade understands that not everyone starts their forex journey with a PhD in financial engineering.

Their educational materials cater to a range of experience levels, from absolute beginners nervously clutching their first virtual dollar to seasoned traders looking to refine their strategies. This comprehensive approach ensures that everyone can find resources tailored to their needs and ambitions, making the learning curve a little less, well, curved.

Questrade’s Educational Resources for Forex Traders

Questrade provides a variety of learning materials to equip traders with the knowledge and skills necessary for successful forex trading. These resources range from introductory guides for novices to advanced analyses for experienced traders. This ensures that whether you’re a complete beginner or a seasoned professional, you can find something useful and relevant to enhance your trading capabilities.

Think of it as a buffet of forex knowledge – something for everyone, no matter your appetite.

Accessing and Utilizing Questrade’s Learning Materials

Accessing Questrade’s educational resources is generally straightforward. Most materials are available directly through their online platform. After logging into your account, look for sections labeled “Education,” “Learning Center,” or similar. These sections often contain articles, videos, webinars, and potentially even interactive tutorials. The layout and specific names might vary slightly depending on updates to the platform, so a quick search within the site’s help function can pinpoint the exact location.

Once you find the learning materials, simply navigate through the various topics to find the information you need. Many resources are categorized by skill level or topic, making it easy to find relevant materials quickly.

Questrade’s Customer Support Options

Should you encounter any difficulties or have questions that the learning materials don’t address, Questrade offers various customer support options. These typically include phone support, email support, and often a comprehensive FAQ section on their website. Their website also usually has a live chat feature for immediate assistance with common issues. While waiting times might vary depending on demand, Questrade generally aims to provide prompt and helpful support to its clients.

Remember, it’s always better to ask for help than to let a small problem snowball into a bigger one – your future forex self will thank you.

Helpful Resources Available on the Questrade Platform for Forex Traders

The availability and specifics of these resources can change, so always check the Questrade website for the most up-to-date information.

- Educational articles and guides: Covering various aspects of forex trading, from fundamental analysis to risk management.

- Video tutorials: Providing visual demonstrations and explanations of trading concepts and techniques.

- Webinars and seminars: Offering live interactive sessions with forex experts.

- Frequently Asked Questions (FAQ) section: Addressing common questions and concerns about forex trading on the Questrade platform.

- Glossary of terms: Defining key forex terminology to help traders understand the language of the market.

- Economic calendar: Providing a schedule of important economic events that can impact forex markets.

Final Review

So there you have it – your passport to the exciting world of forex trading on the Questrade platform. We’ve journeyed from account setup to risk management, covering everything in between with the grace of a seasoned ballerina and the humor of a stand-up comedian. Remember, forex trading involves inherent risks, so always trade responsibly and within your means.

Now go forth and conquer those currency pairs! May your pips be plentiful, and your losses… minimal. Happy trading!