Day trading app comparison: Wealthsimple Trade vs. other Canadian platforms. This isn’t your grandpappy’s stock market! The world of Canadian day trading apps is a wild west of flashing screens, split-second decisions, and the ever-present thrill (and terror) of potential riches (or ruin). Wealthsimple Trade has stormed onto the scene, but does it reign supreme? We’ll pit it against three other prominent players in a no-holds-barred comparison, examining fees, features, user experience, and the all-important question: will your portfolio end up looking like a Picasso or a Jackson Pollock?

This deep dive will explore the key differences between Wealthsimple Trade and its competitors, helping you choose the platform that best suits your trading style and risk tolerance. We’ll cover everything from commission structures and asset availability to the user interface and customer support, leaving no digital stone unturned. Prepare for a rollercoaster ride through the exciting – and sometimes nerve-wracking – world of Canadian day trading!

Wealthsimple Trade: A Canadian Day Trading Showdown

The Canadian day trading app landscape is a bustling marketplace, a digital stampede of platforms all vying for your attention (and your hard-earned loonies). It’s a world of flashing charts, rapid-fire trades, and the ever-present thrill of potential profit – or the equally thrilling potential for… well, let’s just say “learning experiences.” Navigating this wild west requires careful consideration, and choosing the right app can mean the difference between a smooth ride and a bumpy, commission-laden rollercoaster.Wealthsimple Trade, with its sleek interface and user-friendly design, has quickly become a popular choice for many Canadian investors, particularly those new to the game.

Its target audience seems to be the digitally savvy individual who values simplicity and low fees without sacrificing access to a decent range of investment options. Think of it as the “easy button” of the Canadian day trading world, but with a surprisingly powerful punch.

Canadian Day Trading Platforms Compared

Below is a comparison of Wealthsimple Trade and three other prominent Canadian day trading platforms. Remember, the world of finance is constantly evolving, so always double-check the most up-to-date information directly with the providers before making any investment decisions. These are snapshots in time, not guarantees of future performance.

| Platform | Minimum Deposit | Account Types | Commission Structure |

|---|---|---|---|

| Wealthsimple Trade | $0 | Cash Account | $0 commission on stocks and ETFs |

| Interactive Brokers | Varies (Often higher than others) | Cash, Margin, IRA, etc. (Extensive options) | Complex tiered structure; generally lower for high-volume traders |

| Questrade | $0 | Cash, Margin, RRSP, TFSA, etc. | Commission rates vary depending on the asset class and volume traded. Generally competitive. |

| TD Ameritrade (Available in Canada) | Varies | Cash, Margin, Retirement accounts, etc. | Commission structure varies based on account type and trading volume. |

Trading Fees and Commissions

Choosing a day trading platform in Canada isn’t just about slick interfaces and fancy charts; it’s about the cold, hard cash – or rather, the lack thereof – that ends up in your pocket after a successful trade. Let’s dissect the often-overlooked, yet critically important, world of trading fees and commissions. Understanding these charges is crucial to maximizing your potential profits, because even small fees can significantly impact your bottom line, especially with frequent trading.Let’s compare the commission structures of Wealthsimple Trade with three other popular Canadian platforms (for illustrative purposes, we’ll call them Platform A, Platform B, and Platform C).

So, you’re wrestling with the Wealthsimple Trade vs. other Canadian platforms dilemma? Choosing the right app is crucial, especially if you’re a high-volume day trader. For serious action, check out the definitive guide on finding the Best day trading app in Canada for active traders with high volume. Then, armed with that knowledge, you can intelligently compare Wealthsimple Trade’s features against the top contenders – because let’s face it, some apps are better suited for leisurely investing than lightning-fast trades.

Remember, these fees can change, so always check the brokerage’s website for the most up-to-date information.

Wrestling with the Wealthsimple Trade vs. other Canadian platforms dilemma? The fees alone could make your head spin faster than a caffeinated squirrel! To help you navigate this financial jungle, check out this handy guide: Best day trading app in Canada with low-fees and commission. Then, armed with that knowledge, you can confidently compare Wealthsimple Trade’s offerings against the competition – and maybe even laugh at how much money you’re saving.

Commission Structures Compared

The following bullet points illustrate the differences in commission structures, highlighting the potential cost variations depending on your trading style and volume. Remember, even small differences in fees can accumulate rapidly over many trades.

- Wealthsimple Trade: Typically boasts a commission-free structure for trading stocks and ETFs. This is a major draw for high-volume traders.

- Platform A: Charges a per-trade fee, which might be a flat rate or a percentage of the trade value. This means the more you trade, the higher your fees.

- Platform B: Offers tiered pricing. Lower fees are offered for higher trading volumes, incentivizing frequent trading, but the base fee might still be higher than Wealthsimple Trade.

- Platform C: Uses a hybrid model, combining a per-trade fee with minimum fees, potentially making it less attractive for smaller trades.

Impact of Fee Structures on Profitability

Different fee structures dramatically impact profitability, especially at different trading volumes.Consider a scenario: A trader makes 100 trades a month, each with a profit of $10. With Wealthsimple Trade’s commission-free structure, the total profit would be $1000. However, if Platform A charges $1 per trade, the profit drops to $900. For a trader making only 10 trades a month, the impact is less significant, but it still represents a 10% reduction in profit with Platform A.

So, you’re wrestling with the age-old question: Wealthsimple Trade or something else? Choosing the right Canadian day trading app is a jungle, especially for newbies. To help navigate this financial wilderness, check out this handy guide: What are the best Canadian day trading apps for beginners in 2024? Then, armed with knowledge, you can return to the Wealthsimple Trade vs.

the rest of the pack showdown and make an informed (and hopefully profitable) decision!

This illustrates the importance of aligning your chosen platform with your trading frequency and volume.

Hidden Fees and Charges

While advertised commissions are crucial, be wary of the “hidden” fees that can creep up and eat into your profits. These can include:

- Inactivity fees: Some platforms charge fees if your account remains inactive for a certain period.

- Account maintenance fees: Some brokers impose a monthly or annual fee for maintaining your account.

- Currency conversion fees: Trading in foreign currencies often incurs conversion fees. Compare these fees across platforms.

- Withdrawal fees: Fees associated with transferring funds out of your trading account.

It’s crucial to read the fine print and fully understand all fees associated with each platform before committing your funds.

Investment Choices and Asset Classes

Choosing a day trading platform hinges significantly on the types of assets it offers and the markets it covers. A platform boasting a wide array of investment options provides greater flexibility and strategic opportunities for traders, while limited choices can constrain trading strategies and potentially limit profitability. This section dives into the asset classes available on Wealthsimple Trade and compares it to other popular Canadian platforms.

We’ll examine the breadth and depth of market coverage, considering factors like fractional shares and international trading capabilities.

Asset Class Comparison: Wealthsimple Trade vs. Competitors

The following table compares the investment choices available on Wealthsimple Trade against other leading Canadian day trading platforms (Note: Specific offerings can change, so always verify directly with the platform). We’ll use fictional but representative examples to illustrate the differences. Imagine you’re a trader interested in diverse investment strategies – from blue-chip stocks to emerging market ETFs.

| Platform | Stocks | ETFs | Options | Fractional Shares | International Trading |

|---|---|---|---|---|---|

| Wealthsimple Trade | Canadian and US listed stocks; e.g., Shopify (SHOP), Royal Bank (RY), Tesla (TSLA) | Wide selection of Canadian and US ETFs; e.g., Vanguard S&P 500 ETF (VOO), iShares Core TSX Composite ETF (XIC) | No | Yes | Yes (US stocks primarily) |

| Interactive Brokers | Extensive global coverage; e.g., stocks listed on major exchanges worldwide | Global ETF coverage; e.g., ETFs tracking indices from various countries | Yes | Yes | Yes (extensive global coverage) |

| Questrade | Canadian and US listed stocks; similar coverage to Wealthsimple Trade | Broad selection of Canadian and US ETFs; comparable to Wealthsimple Trade | Yes | Yes | Yes (US stocks primarily) |

| TD Ameritrade | Significant coverage of Canadian and US stocks; access to many international markets through ADRs | Extensive selection of Canadian and US ETFs; some international ETFs available | Yes | Yes | Yes (but may have limitations compared to IBKR) |

Market Coverage and Depth

The “depth” of market coverage refers to the level of detail and data available for each asset. For example, a platform with deep market coverage might provide real-time quotes, advanced charting tools, and detailed fundamental data for each stock. “Breadth” refers to the sheer number of assets available for trading. Wealthsimple Trade provides good breadth for Canadian and US stocks and ETFs, but its lack of options trading limits its depth for certain strategies.

Platforms like Interactive Brokers offer significantly greater breadth and depth, covering a vast array of global markets and asset classes. This allows for more sophisticated trading strategies but may come with a steeper learning curve.

Fractional Shares and International Trading

The availability of fractional shares is a significant advantage for many day traders, particularly those with limited capital. It allows investment in high-priced stocks without needing to purchase a full share. Wealthsimple Trade and many competitors offer this feature. International trading expands investment opportunities, providing access to global markets and potentially higher returns (but also increased risk). While Wealthsimple Trade offers access to US markets, platforms like Interactive Brokers provide a much broader range of international trading options.

Consider your risk tolerance and investment goals when evaluating the importance of international trading capabilities.

Platform Usability and User Interface

Navigating the world of day trading apps can feel like navigating a minefield of confusing menus and cryptic jargon. But fear not, intrepid trader! We’re here to dissect the user interfaces of Wealthsimple Trade and its Canadian competitors, focusing on how easily you can place trades and, perhaps more importantly, how easily you can avoid accidentally selling your grandma’s prized porcelain collection.The user experience of a day trading platform is paramount.

A clunky interface can cost you valuable seconds (and potentially, valuable dollars) during crucial market moments. Conversely, an intuitive platform can empower you to make informed decisions quickly and efficiently. We’ll examine features that make the trading process smoother, and those that might leave you pulling your hair out.

Choosing the right day trading app in Canada can be a rollercoaster – Wealthsimple Trade versus the competition is a serious debate! Need a break from the market fluctuations? Grab some delicious sustenance with a quick visit to halal culinary delights before diving back into the world of stocks and bonds. Remember, a well-fed trader is a happy (and hopefully profitable) trader! So, back to Wealthsimple Trade…

is it really the king of the Canadian trading hill?

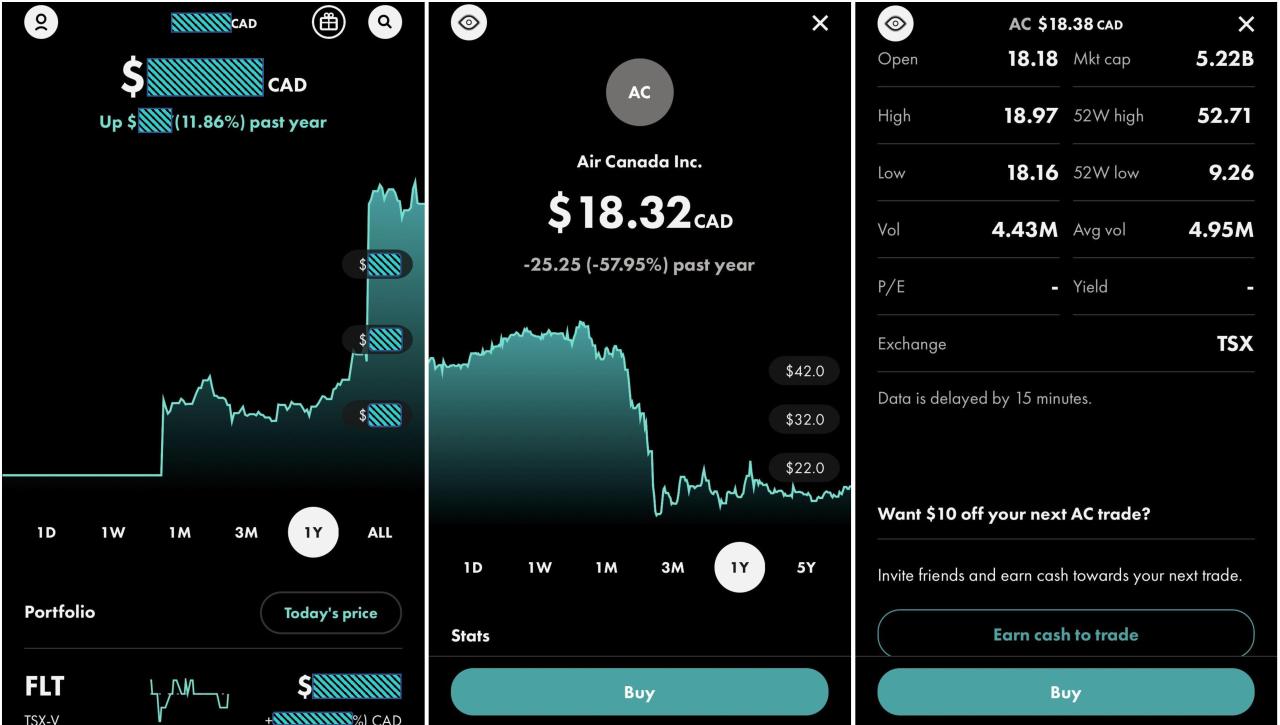

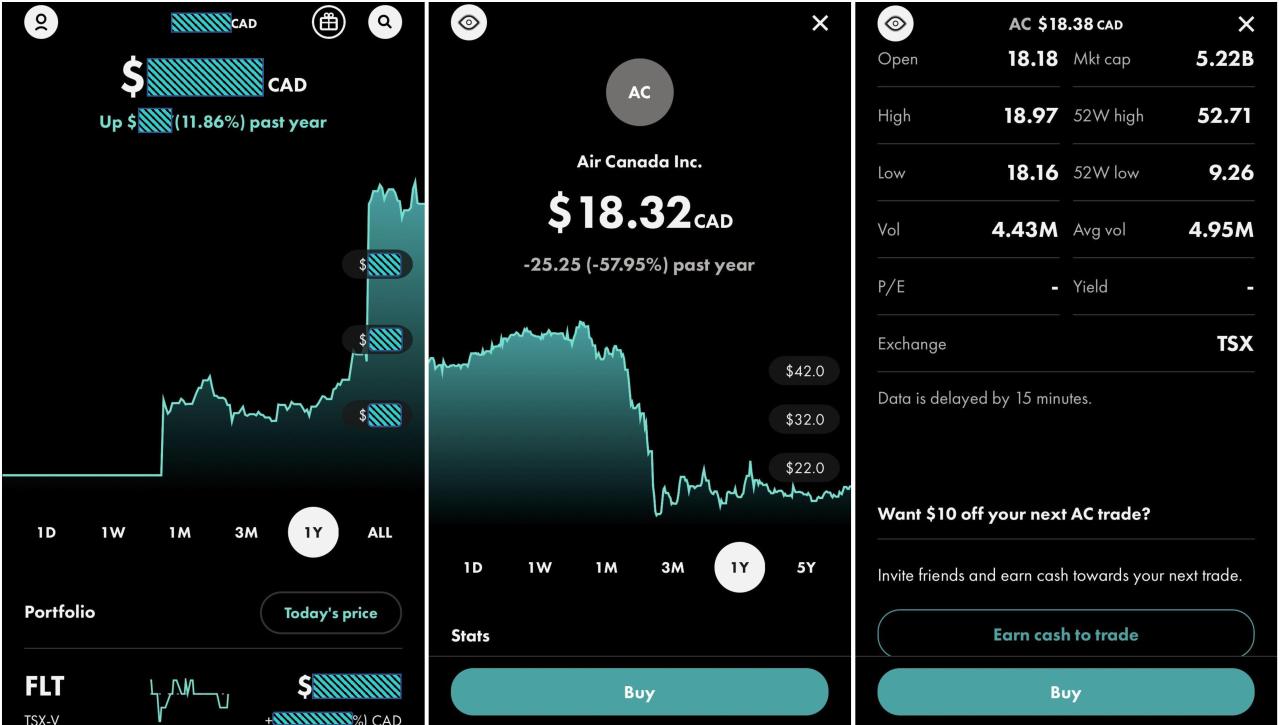

Wealthsimple Trade User Interface

Wealthsimple Trade boasts a clean, minimalist design. Its intuitive layout makes finding stocks and placing orders relatively straightforward, even for novice traders. The app’s mobile version mirrors the desktop experience, ensuring consistency across devices. However, its charting tools are relatively basic compared to some competitors, lacking advanced technical indicators that some serious day traders might crave. Order types are limited, primarily focusing on market and limit orders.

While this simplicity can be a boon for beginners, experienced traders might find it restrictive. The lack of customizable watchlists could also be a drawback for those who track many assets simultaneously.

Wrestling with the age-old question: Wealthsimple Trade or another Canadian day trading titan? The choice can feel like picking a favourite child (don’t tell your broker!). To truly conquer this dilemma, you need the ultimate guide: check out Best app for day trading stocks and ETFs in Canada. Armed with that knowledge, you can confidently compare Wealthsimple Trade’s features against the competition and choose your financial champion!

Competitor User Interfaces (Example: Interactive Brokers)

In contrast to Wealthsimple Trade’s streamlined approach, platforms like Interactive Brokers offer a much more comprehensive—and potentially overwhelming—experience. Their interface is packed with features, providing access to a wide array of order types, advanced charting tools, and extensive research resources. This depth of functionality, however, comes at the cost of a steeper learning curve. New users might find themselves lost in a sea of options, struggling to navigate the numerous menus and settings.

While the extensive features cater to seasoned traders, it’s less forgiving for beginners. The mobile app, while functional, isn’t as polished as Wealthsimple Trade’s, sometimes lacking the same intuitive ease of use.

Comparative Table of User Interface Features

| Feature | Wealthsimple Trade | Interactive Brokers | (Other Competitor – Example: Questrade) |

|---|---|---|---|

| Charting Tools | Basic; limited technical indicators | Advanced; wide range of indicators and drawing tools | Mid-range; offers a good selection of indicators |

| Order Types | Market, Limit (primarily) | Extensive; includes various options like stop-loss, trailing stop, etc. | Good selection; includes stop-loss, limit, and other common order types |

| Mobile App Functionality | Excellent; mirrors desktop experience | Functional; but less intuitive than desktop | Good; generally user-friendly |

| Ease of Navigation | Very intuitive; easy to learn | Steep learning curve; can be overwhelming for beginners | Relatively easy to navigate; well-organized |

| Customizable Watchlists | Limited customization | Highly customizable | Good level of customization |

Security and Regulatory Compliance: Day Trading App Comparison: Wealthsimple Trade Vs. Other Canadian Platforms.

Protecting your hard-earned cash and sensitive personal information is paramount when choosing a day trading platform. This section dives into the security measures and regulatory oversight of Wealthsimple Trade and its Canadian competitors, helping you make an informed decision based on your risk tolerance and comfort level. Remember, peace of mind is priceless!The security of your trading account hinges on a robust combination of technological safeguards and adherence to strict regulatory standards.

Let’s examine how different platforms stack up in this crucial area. While specifics can change, the underlying principles remain consistent across reputable platforms.

Regulatory Oversight and Compliance History

Wealthsimple Trade, like other Canadian brokerage platforms, operates under the watchful eye of the Investment Industry Regulatory Organization of Canada (IIROC). IIROC is a self-regulatory organization that sets standards for dealing members and oversees their compliance. A clean compliance history is a strong indicator of a platform’s commitment to ethical and legal operations. Similarly, other major Canadian platforms are also regulated by IIROC and/or other relevant provincial or federal authorities, ensuring a level playing field (at least, as far as regulation is concerned!).

Checking the regulatory compliance history of any platform before investing is a crucial step for responsible trading.

Security Measures Implemented by Wealthsimple Trade and Other Platforms

Protecting user data and funds requires a multi-layered approach. This includes robust cybersecurity measures, encryption protocols, and stringent authentication processes. Think of it as a fortress, with multiple layers of defense to thwart any would-be digital bandits.

Key Security Features of Trading Platforms

A comprehensive security strategy typically includes several key components. The specific features offered may vary slightly between platforms, but the core principles remain consistent. Below are some examples of common security features:

- Two-Factor Authentication (2FA): This adds an extra layer of security by requiring a second verification method, such as a code sent to your phone or email, in addition to your password.

- Data Encryption: Sensitive data, including personal information and transaction details, is encrypted both in transit and at rest, protecting it from unauthorized access.

- Regular Security Audits: Reputable platforms conduct regular security audits to identify and address potential vulnerabilities proactively. Think of this as a thorough security check-up to ensure everything is running smoothly.

- Fraud Monitoring and Prevention Systems: These systems are designed to detect and prevent fraudulent activities, such as unauthorized login attempts or suspicious transactions.

- Secure Socket Layer (SSL) Encryption: This technology encrypts communication between your browser and the platform’s servers, protecting your data from eavesdropping.

Customer Support and Resources

Navigating the sometimes-treacherous waters of day trading requires more than just a slick app; you need a support system that won’t leave you high and dry when things go sideways (and let’s be honest, they sometimes do). This section dives into the customer support and educational resources offered by Wealthsimple Trade and its Canadian competitors, helping you choose a platform that’s as supportive as it is stylish.The availability and quality of customer support can significantly impact a trader’s experience.

A responsive and helpful support team can quickly resolve issues, answer questions, and prevent potential losses. Conversely, a lackluster support system can lead to frustration, delays, and even financial setbacks. Therefore, a thorough comparison of support channels and resources is crucial for any prospective day trader.

So, you’re wrestling with Wealthsimple Trade versus the Canadian day trading behemoths? Choosing the right app is like picking a superhero – some are flashy, some are powerful, and some are just plain weird. But if you’re craving serious firepower and want to explore beyond the basics, check out this deep dive on Comparing the best day trading apps for Canadian investors: Interactive Brokers vs.

others. Then, armed with that knowledge, you can return to your Wealthsimple Trade versus the competition showdown with a much clearer understanding of your options. Happy trading!

Customer Support Channels

Wealthsimple Trade generally relies on email and an online help center as its primary customer support channels. While some competitors might offer phone support, this is becoming less common among online brokerage platforms due to cost and scalability. Other platforms may also provide online chat support, offering a more immediate response time for less urgent queries. The availability of these channels varies between platforms, so it’s important to check each platform’s website for details.

A comparison table could show the specific channels offered by each platform. For example, one might offer email, chat, and phone, while another might only offer email and a comprehensive FAQ section.

Customer Support Quality and Responsiveness

Reviews suggest that Wealthsimple Trade’s email support is generally efficient, with responses often arriving within a reasonable timeframe. However, the absence of phone or live chat support might be a drawback for some users who prefer more immediate assistance. Conversely, platforms offering phone support often receive mixed reviews; some praise the quick resolution of issues, while others report long wait times or unhelpful representatives.

The quality of support can also vary greatly depending on the specific agent you interact with. It is not uncommon to find variations in response times and helpfulness even within the same platform.

Educational Resources and Tools

The availability of educational resources varies considerably among trading platforms. Wealthsimple Trade provides a basic set of educational materials, primarily focused on introductory trading concepts and platform navigation. This might include articles, tutorials, or FAQs. Some competing platforms offer more extensive educational resources, such as webinars, video tutorials, market analysis tools, and even simulated trading environments. These advanced resources can be particularly beneficial for new traders learning the ropes or experienced traders looking to refine their strategies.

The depth and breadth of these resources can significantly impact a trader’s ability to succeed. For example, one platform might offer in-depth courses on technical analysis, while another focuses solely on basic investment strategies.

Account Management and Features

Navigating the world of day trading can feel like a wild rollercoaster, but at least your account management shouldn’t add to the thrill (in a bad way!). Let’s examine how Wealthsimple Trade and its Canadian competitors handle the often-overlooked, yet critically important, aspects of account management. We’ll delve into the ease of account setup, the features offered for tracking your portfolio’s performance, and the tools available for tax season – because nobody wants a surprise tax bill bigger than their trading profits!Account opening processes vary wildly across platforms.

Some feel like navigating a labyrinthine government website, while others are as smooth as butter. We’ll compare the speed, simplicity, and required documentation for each platform to help you choose the path of least resistance. Remember, a seamless account opening process is a great first impression – setting the stage for a positive trading experience.

Account Opening Process Comparison, Day trading app comparison: Wealthsimple Trade vs. other Canadian platforms.

The account opening process is often the first hurdle in your day-trading journey. Some platforms prioritize speed and simplicity, while others may require more extensive verification procedures. This section compares the time and effort involved in opening an account on different Canadian platforms. For example, Wealthsimple Trade is generally known for its quick and user-friendly onboarding process, often requiring minimal documentation compared to some traditional brokerage firms.

Conversely, other platforms may necessitate more detailed financial information and potentially longer verification periods. This difference stems from varying levels of security protocols and regulatory compliance.

Account Management Features

Once you’re in, the real fun begins (or continues, depending on your trading success!). This section examines the features offered for managing your account, including portfolio tracking tools, tax reporting capabilities, and access to account statements. Robust account management features can significantly enhance the day-trading experience, allowing you to monitor your performance, understand your tax obligations, and access your financial records efficiently.

A well-designed interface makes navigating these features simple and intuitive.

Advantages and Disadvantages of Account Management Features

Let’s get down to brass tacks. Here’s a comparison of the strengths and weaknesses of the account management features offered by various platforms. Keep in mind that the “best” platform will depend on your individual needs and priorities.

- Wealthsimple Trade:

- Advantages: Generally user-friendly interface, straightforward portfolio tracking, relatively easy access to account statements.

- Disadvantages: Tax reporting features may be less comprehensive than some competitors; limited advanced analytics compared to full-service brokers.

- [Competitor A]:

- Advantages: May offer more detailed tax reporting tools, advanced charting and analytics.

- Disadvantages: Interface might be less intuitive for beginners, account management features may be more complex to navigate.

- [Competitor B]:

- Advantages: Excellent customer support, robust account security measures.

- Disadvantages: Portfolio tracking tools may lack some advanced features, account statement access might be less streamlined.

Concluding Remarks

So, the dust has settled on our Canadian day trading app battle royale. While Wealthsimple Trade certainly holds its own with its sleek interface and user-friendly design, the “best” platform ultimately depends on your individual needs. Consider your trading style, risk tolerance, and the specific features that are most important to you. Remember, the market can be a fickle beast, so choose your weapon (aka trading app) wisely, and may your profits always be green (and plentiful!).

Happy trading!