Expert reviews of the top day trading platforms for Canadians: Prepare for liftoff, eh? Navigating the world of Canadian day trading can feel like trying to predict the next hockey brawl – chaotic, exciting, and potentially very lucrative. But fear not, fellow Canucks! This deep dive into the best platforms will equip you with the knowledge to trade with the confidence of a seasoned NHL goalie (even if your portfolio currently resembles a minor league team’s budget).

We’ll dissect fees, features, and security like a hockey analyst dissecting a game-winning goal, ensuring you find the perfect platform to suit your trading style.

This guide cuts through the jargon and delivers clear comparisons of leading day trading platforms available to Canadians. We’ll examine crucial aspects like regulatory compliance, platform security, trading tools, and customer support. Think of us as your personal trading Sherpas, guiding you through the icy peaks and treacherous valleys of the Canadian online trading market. Get ready to score big!

Expert Opinions on Platform Security and Reliability: Expert Reviews Of The Top Day Trading Platforms For Canadians

Choosing a day trading platform is like choosing a vault for your digital gold – security and reliability are paramount. One misplaced decimal point can wipe out your gains faster than a caffeinated squirrel on a sugar rush, so let’s delve into the fortress-like security measures (or, conversely, the rickety shacks) of some popular Canadian platforms. We’ll examine the technological safeguards, uptime records, and any past security incidents that might make you think twice before entrusting your hard-earned loonies to them.Expert reviews consistently highlight the critical importance of robust security protocols in the volatile world of day trading.

The platforms we’re examining are judged not only on their speed and functionality but also on their ability to protect user data and funds from unauthorized access and cyber threats. A platform’s reputation for reliability is equally crucial; downtime can mean missed opportunities and potential losses, so consistent uptime is a non-negotiable requirement for serious traders.

Platform Security Measures

The security features of these platforms vary, but generally include encryption of data both in transit and at rest, using protocols like SSL/TLS. Many also implement two-factor authentication (2FA), often involving a time-based one-time password (TOTP) generated by an authenticator app on your phone, adding an extra layer of protection against unauthorized logins. Some platforms go further, offering features like IP address whitelisting, allowing access only from pre-approved devices and locations.

Expert reviews of the top day trading platforms for Canadians can be a lifesaver, especially when navigating the wild west of online brokerage. But let’s be honest, sometimes you need to trade on the go, which is why checking out resources like Finding the best mobile app for day trading Canadian stocks is crucial. Ultimately, the best platform depends on your individual needs, so do your research before you start throwing your money around like confetti!

Think of it like having a digital bouncer at the door of your trading account, only letting in the authorized guests. Others may offer biometric authentication for added convenience and security. The strength of these measures varies from platform to platform, influencing the overall security rating assigned by experts.

Platform Reliability and Uptime

Reliability is measured by uptime – the percentage of time a platform is available and functioning correctly. Experts scrutinize historical data to assess a platform’s track record. A platform boasting 99.9% uptime is considered highly reliable, meaning only a few minutes of downtime per year. However, even short periods of downtime can be critical during volatile market conditions.

Reviews often cite specific instances of outages and the platform’s response time in resolving them. Quick resolution and transparent communication during outages are crucial factors influencing the overall reliability rating. Imagine the frustration of missing a crucial trade because your platform decided to take an unscheduled nap.

Past Security Breaches and Outages

While most platforms maintain a strong security posture, past incidents can provide valuable insights into their resilience and response capabilities. Expert reviews often analyze any reported security breaches or significant outages. The nature of the breach (e.g., data leak, unauthorized access), the platform’s response, and the steps taken to prevent future incidents are all considered. A platform’s transparency in disclosing and addressing such events is also a key factor.

So, you’re hunting for the best Canadian day trading platforms, eh? Expert reviews are crucial, but picking the right platform is only half the battle. You also need to know where to put your hard-earned loonies! That’s where knowing the Top performing stocks for day trading in the Canadian market comes in handy. Armed with this knowledge, you can choose a platform that best suits your chosen stocks and your trading style.

Happy trading!

For example, a platform that swiftly acknowledges a problem, communicates clearly with its users, and takes proactive steps to rectify the situation will generally receive higher marks than one that downplays or ignores incidents. Remember, a platform’s history can be just as revealing as its current security features.

Platform Fees and Pricing Structures

Navigating the world of Canadian day trading platforms can feel like traversing a minefield of hidden fees. Understanding the cost structure is crucial, as seemingly small differences can significantly impact your bottom line, especially with high-volume trading. Let’s dissect the pricing strategies of popular platforms to help you choose the one that best aligns with your trading style and budget.

Expert reviews of the top day trading platforms for Canadians can be a real rollercoaster – some are smooth sailing, others a bumpy ride! To navigate this, figuring out which platform reigns supreme is key, and that leads us to the burning question: Which Canadian brokerage offers the best day trading tools? Ultimately, understanding the answer helps you choose the right platform from the expert reviews and avoid a trading disaster.

Different platforms employ various fee models, impacting your overall trading expenses. Some charge per trade, others offer subscription-based plans, and some even combine both approaches. Understanding these nuances is key to maximizing your profits.

Fee Models Comparison

Here’s a breakdown of common fee structures, illustrating how different platforms approach pricing. Remember, these are examples and specific rates are subject to change, so always check the platform’s website for the most up-to-date information.

| Platform | Commission Rate (per trade) | Inactivity Fees | Other Fees | Fee Model |

|---|---|---|---|---|

| Example Platform A | $5 + 0.01% of trade value | $10/month after 3 months of inactivity | Data fees may apply | Per-trade commission |

| Example Platform B | $0 commission on trades under $1000; $7 + 0.005% above $1000 | None | Potential margin interest | Tiered commission |

| Example Platform C | N/A | $25/month | Account maintenance fee of $5/month | Subscription-based |

Cost-Effectiveness Across Trading Styles

The most cost-effective platform varies greatly depending on your trading frequency and volume. Let’s consider three common trading styles:

- Scalper (High Volume, Small Profits): A scalper making hundreds of trades daily would likely benefit from a platform with low per-trade commissions, even if a subscription model might seem cheaper at first glance. The cumulative effect of high per-trade fees on frequent trades can quickly outweigh the subscription cost.

- Swing Trader (Moderate Volume, Moderate Profits): A swing trader, making fewer trades per week, might find a tiered commission structure or a subscription model more appealing, depending on the average trade size and the platform’s pricing tiers. The potential savings from zero commission on smaller trades might offset the costs of larger ones.

- Long-Term Investor (Low Volume, Large Profits): A long-term investor executing only a few trades per year would likely find a platform with minimal per-trade commissions or a low subscription fee the most cost-effective option. Inactivity fees become less of a concern.

Remember to factor in all fees, including inactivity fees, data fees, and potential margin interest, when assessing the overall cost-effectiveness of a platform. Don’t just focus on the commission rate!

Customer Support and Resources

Navigating the often-turbulent waters of day trading requires more than just sharp instincts and a lucky streak. A robust support system, both in terms of responsive customer service and readily available educational resources, can be the difference between a profitable trade and a painful loss. Let’s dive into how the top Canadian day trading platforms stack up in this crucial area.Choosing a platform isn’t just about the bells and whistles; it’s about the safety net it provides when things go sideways.

Reliable customer support and comprehensive educational resources are your life preservers in this high-stakes game. Think of it as choosing a financial advisor – you wouldn’t go with someone who’s impossible to reach, right?

So, you’re hunting for the best day trading platforms in Canada? Expert reviews are your best friend, but before you dive headfirst into the world of rapid-fire trades, it’s crucial to understand the legal landscape. Check out this guide on Understanding forex trading regulations and licensing in Canada to avoid any regulatory hiccups. Then, armed with that knowledge, you can confidently compare platforms and find the perfect one for your Canadian trading adventures!

Customer Support Channels and Responsiveness

The availability and speed of customer support vary significantly across platforms. Some boast 24/7 phone support, a feature invaluable when a market-moving event happens outside of regular business hours. Others might rely primarily on email, which can lead to frustrating delays, especially during peak trading periods. Live chat support is becoming increasingly common, offering a quick and convenient way to address immediate issues.

The quality of support also differs; some platforms employ knowledgeable agents who can provide helpful solutions, while others leave you feeling like you’re navigating a labyrinth of automated responses. Consider the platform’s average response times and customer satisfaction ratings when making your decision. For example, Platform A might boast a 2-minute average live chat response time, while Platform B’s email support could take up to 24 hours.

Quality and Comprehensiveness of Educational Resources

A good day trading platform doesn’t just offer the tools to trade; it empowers you with the knowledge to use them effectively. Look for platforms that offer a comprehensive suite of educational resources, including tutorials, webinars, and market analysis tools. Some platforms go above and beyond, offering simulated trading environments where you can practice your strategies without risking real money.

Expert reviews of the top day trading platforms for Canadians often highlight speed and reliability. But if you’re a thrill-seeker diving headfirst into the fast-paced world of forex, you’ll need a broker built for speed – check out the Best forex brokers in Canada for scalping and day trading to find your perfect match. Then, armed with this knowledge, you can return to those expert reviews and choose a platform that truly complements your chosen broker.

The quality of these resources varies greatly; some platforms provide basic tutorials, while others offer in-depth courses taught by experienced traders. Consider the depth and breadth of the educational materials offered, as well as the accessibility and user-friendliness of the platform’s learning resources. For instance, Platform X might offer a series of beginner-friendly videos, while Platform Y provides advanced webinars on technical analysis.

User Community and Forums

A vibrant online community can be an invaluable resource for day traders. Many platforms host forums or social media groups where users can share tips, strategies, and experiences. These communities can provide a sense of camaraderie, as well as a wealth of knowledge and support. The quality and activity level of these communities vary significantly, however. Some forums are bustling hubs of activity, while others are sparsely populated and relatively inactive.

Consider the size and engagement level of the platform’s community when assessing its overall value. A strong community can provide a sense of belonging and support, helping new traders navigate the sometimes overwhelming world of day trading. Imagine the difference between a quiet, deserted forum and one buzzing with helpful discussions and shared insights. The latter would undoubtedly offer a far richer and more supportive experience.

Illustrative Examples of Platform Use

Let’s ditch the dry theory and dive headfirst into the exhilarating world of day trading in Canada, showcasing how two popular platforms handle real-world scenarios. Prepare for some thrilling (and hopefully profitable) rides!We’ll explore two fictional traders, Brenda and Carlos, each using a different platform to navigate the Canadian market. Brenda favours the sleek and intuitive “TradeSwift,” while Carlos prefers the robust, feature-rich “MapleTrade.” Their experiences will highlight the unique strengths and weaknesses of each platform.

TradeSwift Platform: A Market Order and Limit Order Example, Expert reviews of the top day trading platforms for Canadians

Brenda, our intrepid trader, decides to buy 100 shares of “Northern Lights Cannabis Corp” (NLCC). She uses TradeSwift’s clean interface to place a market order. This means she wants to buy the shares at the best available price immediately. The order executes swiftly, showing a confirmation on her screen with the exact price paid and the number of shares acquired.

Later that day, anticipating a price dip, Brenda decides to place a limit order to buy another 100 shares of NLCC at $5.00 or less. This ensures she won’t overpay. TradeSwift’s order management system clearly displays her pending limit order, allowing her to monitor its status and cancel it if needed before the market closes. A key strength of TradeSwift is its user-friendly interface; even a novice could navigate its order placement tools with ease.

However, a potential weakness is its limited charting capabilities compared to MapleTrade.

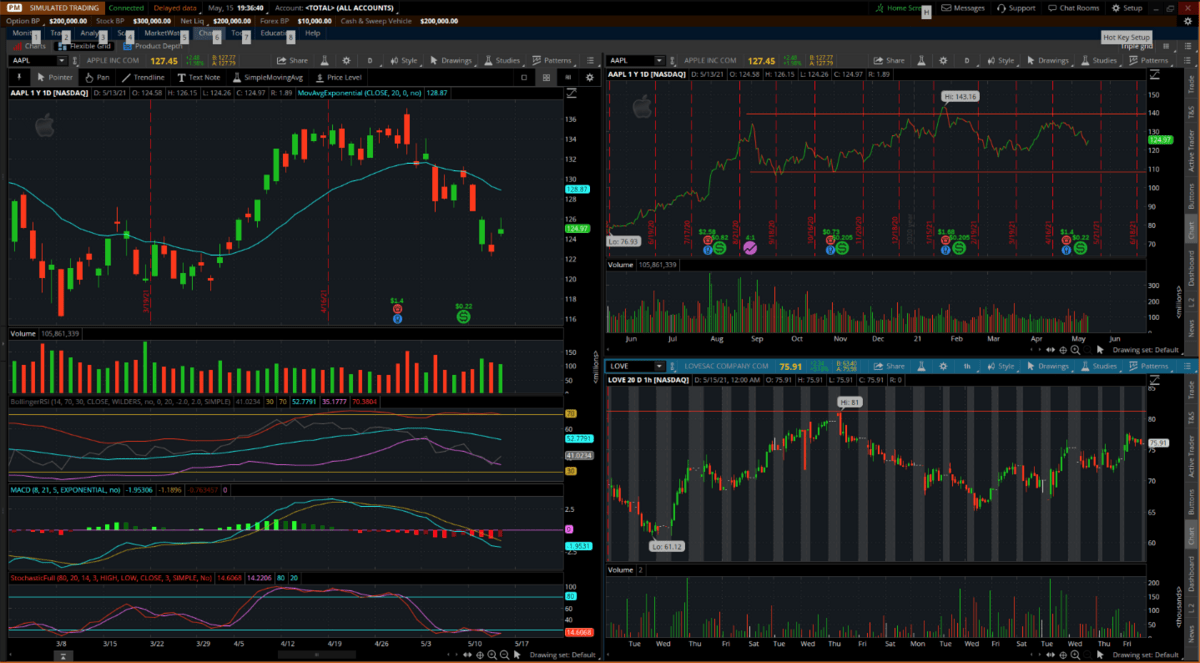

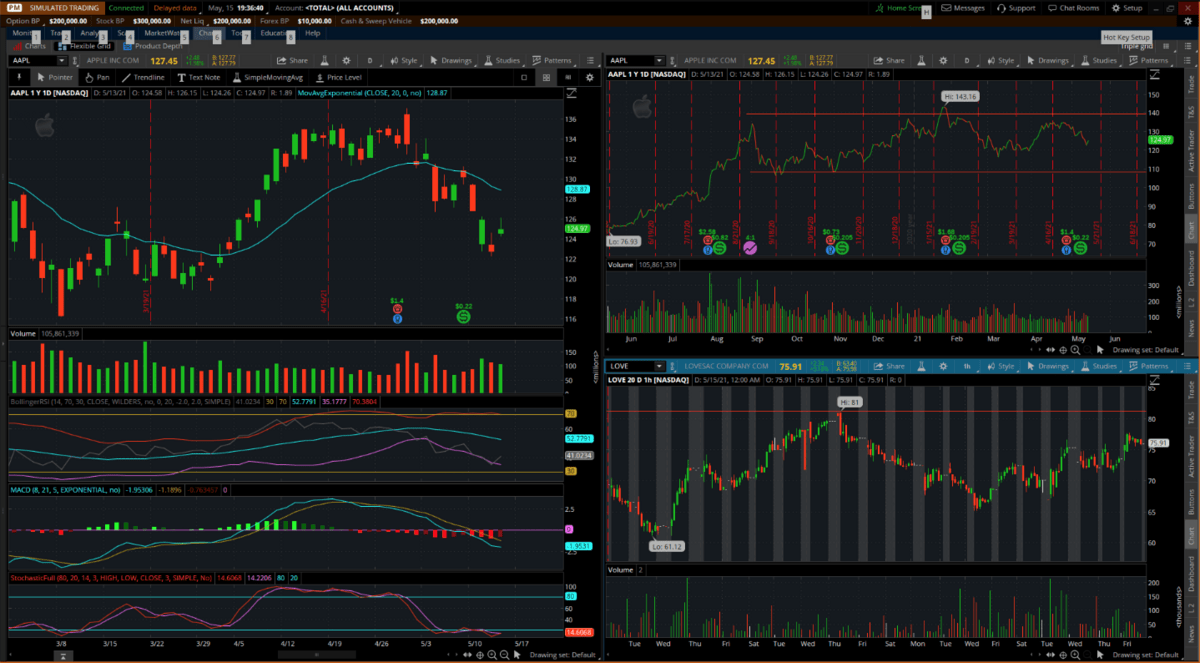

MapleTrade Platform: Charting Tools and Technical Indicators

Carlos, our seasoned veteran, is analyzing the price action of “BeaverTails Inc.” (BTI) on MapleTrade. He utilizes MapleTrade’s advanced charting tools to plot various technical indicators, including moving averages and RSI. Imagine a screen displaying a candlestick chart of BTI’s stock price, overlaid with a 20-day and 50-day moving average. The RSI indicator sits below, showing a reading of 30, suggesting the stock might be oversold.

Carlos interprets this as a potential buying opportunity. He then uses MapleTrade’s drawing tools to identify support and resistance levels on the chart. Based on this technical analysis, he places a limit buy order for 50 shares of BTI at $12.50, confident that the stock will bounce off the support level. MapleTrade’s comprehensive charting and analytical tools are a significant advantage, but its interface can feel overwhelming to new users compared to the simpler TradeSwift.

A Fictional Scenario: Technical Analysis and Order Execution on MapleTrade

Let’s envision Carlos using MapleTrade’s charting capabilities to analyze the price movement of “Tim Hortons Inc.” (THI). He observes a clear head-and-shoulders pattern forming on the daily chart, a bearish reversal pattern often indicating a price decline. The RSI indicator confirms this bearish sentiment, showing a reading above 70, indicating overbought conditions. Furthermore, the 20-day moving average has crossed below the 50-day moving average, a classic bearish signal.

Based on this analysis, Carlos decides to execute a sell order. He could choose a market order to sell his THI shares immediately at the prevailing market price or place a limit order to sell at a specific price, ensuring he receives at least his target price. He might even use a stop-loss order to protect against further losses if the price suddenly reverses.

The depth of MapleTrade’s charting tools allows for sophisticated technical analysis, but its complexity might be a barrier for less experienced traders.

Final Thoughts

So, there you have it – a comprehensive look at the top day trading platforms catering to the discerning Canadian trader. Remember, the perfect platform is as individual as your favourite Tim Hortons order. While some platforms boast sleek interfaces and advanced charting tools, others excel in customer support and educational resources. Use this guide as your compass, navigate the options carefully, and may your trades always be green (and profitable!).

Happy trading, friends!