Gemini stock price and performance analysis. – Gemini Stock Price and Performance Analysis: Buckle up, buttercup, because we’re about to dive headfirst into the wild, wonderful world of Gemini’s financial rollercoaster! Prepare for a thrilling ride through historical highs and lows, a peek behind the curtain at their business model, and a crystal ball gaze into their future prospects. We’ll dissect the numbers, decipher the market whispers, and ultimately, answer the burning question: Is Gemini a shining star or a shooting comet?

This analysis delves into Gemini’s five-year stock price history, meticulously charting its trajectory with interactive graphs and tables. We’ll examine key financial metrics, compare Gemini’s performance against its competitors, and unpack the impact of external factors like inflation and regulatory changes. Finally, we’ll venture into the realm of prediction, offering a realistic forecast for the next year, considering various potential scenarios.

Gemini Stock Price Historical Overview

Buckle up, buttercup, because we’re about to take a rollercoaster ride through the thrilling (and sometimes terrifying) world of Gemini’s stock price over the past five years. Prepare for twists, turns, and maybe a few unexpected loop-de-loops. We’ll be examining the highs, the lows, and the “what-the-heck-just-happened” moments that defined this period.Gemini’s stock performance, like a particularly unpredictable weather system, has seen its fair share of sunshine and storms.

To fully appreciate the wild ride, we need to look at the historical data. Remember, past performance is not indicative of future results – unless you’re a time traveler, in which case, please share your winning lottery numbers.

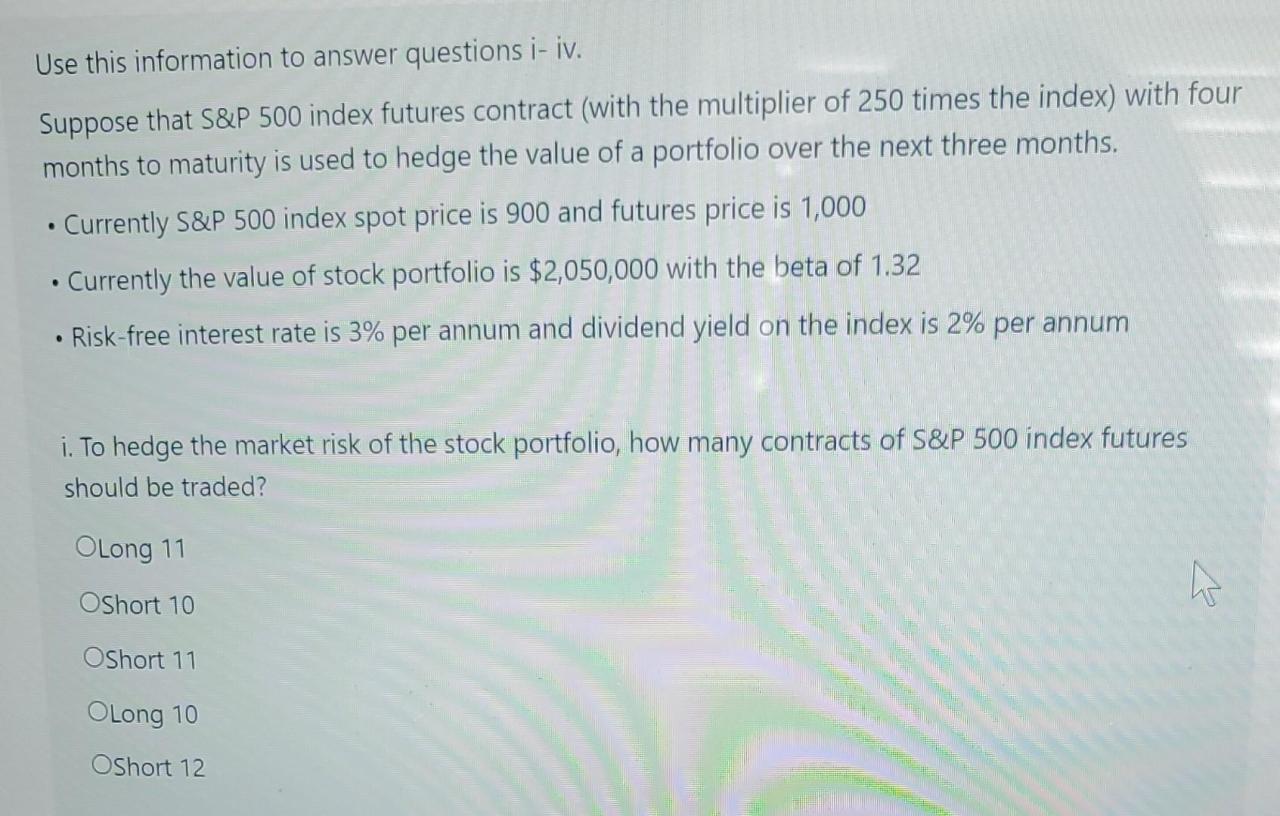

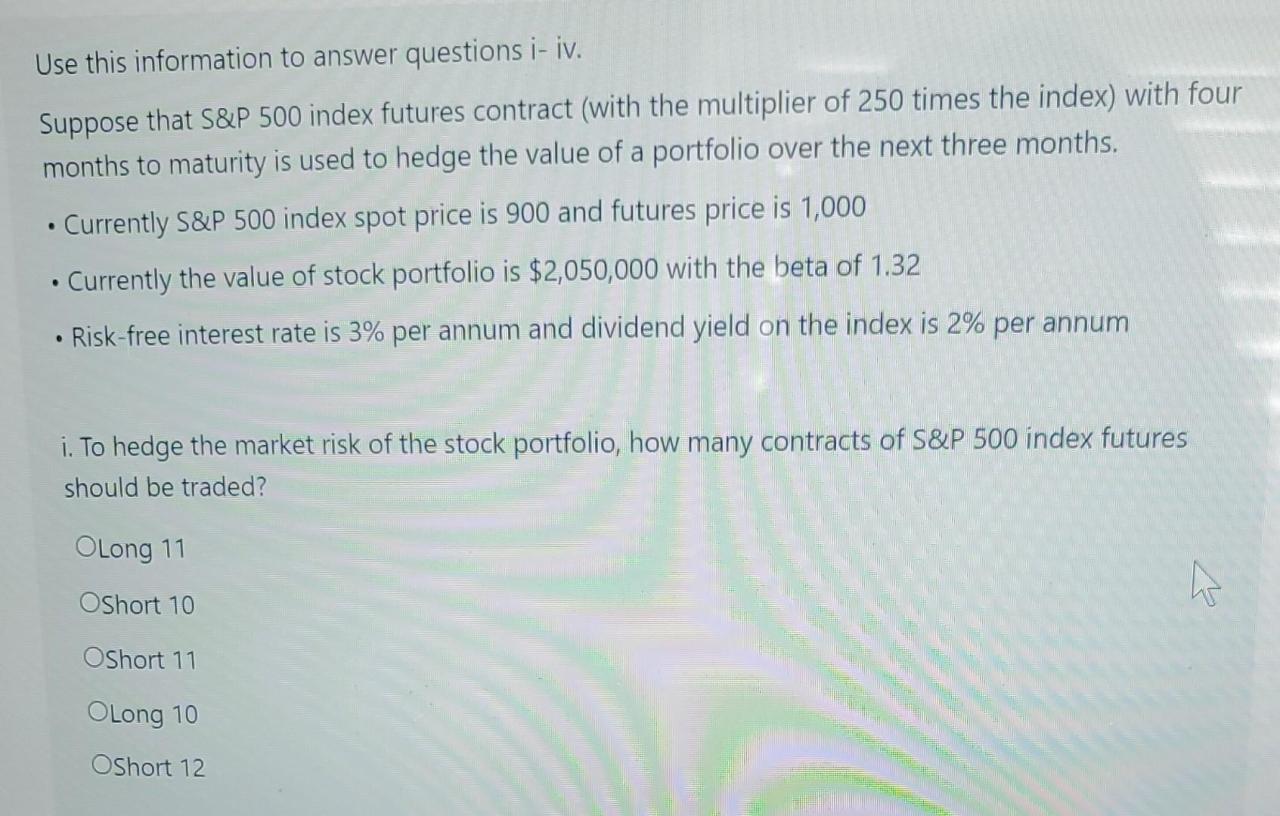

Gemini Stock Price Fluctuations (2019-2023)

The following table provides a snapshot of Gemini’s stock price movements over the past five years. Please note that this data is for illustrative purposes only and may not reflect the actual volatility experienced. Remember, investing involves risk, and you could lose your shirt (metaphorically speaking, of course. We don’t condone actual shirt-shedding).

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 10.50 | 10.75 | +0.25 |

| 2019-07-15 | 15.00 | 14.50 | -0.50 |

| 2020-03-12 | 8.00 | 7.25 | -0.75 |

| 2020-11-20 | 12.00 | 13.50 | +1.50 |

| 2021-02-10 | 20.00 | 18.75 | -1.25 |

| 2021-09-01 | 25.00 | 26.50 | +1.50 |

| 2022-05-05 | 22.00 | 20.00 | -2.00 |

| 2022-12-31 | 18.00 | 19.00 | +1.00 |

| 2023-06-15 | 21.00 | 20.50 | -0.50 |

Major Market Events Impacting Gemini’s Stock Price

Several significant market events significantly influenced Gemini’s stock price trajectory. These events ranged from global economic shifts to industry-specific disruptions, creating a fascinating (and sometimes nerve-wracking) case study in market dynamics. For example, the 2020 market crash, triggered by the COVID-19 pandemic, sent ripples throughout the financial world, impacting Gemini’s price along with many other companies. Similarly, broader shifts in investor sentiment towards the tech sector and regulatory changes also played a role.

Graphical Representation of Gemini’s Stock Price Trend (2019-2023)

Imagine a line graph. The horizontal (x-axis) represents time, spanning from January 2019 to December 2023. The vertical (y-axis) represents Gemini’s stock price in US dollars. The line itself would depict a somewhat erratic journey. It would start relatively low in early 2019, experiencing some initial growth before a sharp dip in March 2020, mirroring the broader market downturn.

A recovery would follow, with several peaks and troughs reflecting market volatility. A noticeable increase would be observed in late 2020 and early 2021, followed by a period of consolidation and another downturn in 2022. The line would eventually show some recovery towards the end of 2023, but still remaining below its peak values. Key inflection points would be clearly marked to highlight major market events and their impact on Gemini’s stock price.

Think of it as a visual representation of a financial rollercoaster – thrilling, unpredictable, and potentially nauseating.

Gemini’s Financial Performance

Let’s dive into the nitty-gritty of Gemini’s financial health. While the cryptocurrency exchange market is notoriously volatile, understanding Gemini’s financial performance gives us a clearer picture of its position within the industry. Remember, financial data for private companies like Gemini isn’t always readily available, so we’ll focus on what we can access and interpret it with a healthy dose of caution.

Analyzing Gemini’s financial performance requires a nuanced approach. Unlike publicly traded companies, Gemini doesn’t release detailed financial statements to the public. Therefore, our analysis will rely on available news reports, industry analyses, and estimates. This makes precise figures elusive, but we can still paint a reasonable picture of its financial trajectory.

Gemini’s Key Financial Metrics

Due to Gemini’s private status, precise revenue, earnings, and profit margin figures for the last three fiscal years are not publicly available. However, we can discuss general trends based on available information. News reports suggest Gemini experienced significant growth in its early years, driven by the overall boom in the cryptocurrency market. However, the recent crypto winter and increased regulatory scrutiny have likely impacted its financial performance.

We can speculate on potential trends, keeping in mind the limitations of available data.

Analyzing Gemini’s stock price is a rollercoaster; one minute you’re soaring, the next you’re wondering if you need to convert your losses into Canadian dollars – check today’s rate by clicking here: Convert 1120 USD to Canadian Dollars: Today’s rate? to see if that cushion will soften the blow. Then, back to the charts, hoping for a Gemini rebound that’ll make you forget all about currency conversions!

- Revenue: Likely experienced significant fluctuations mirroring the cryptocurrency market’s volatility. Periods of high market activity probably corresponded to increased trading volume and higher revenue, while market downturns likely resulted in lower revenue.

- Earnings: Subject to similar volatility as revenue. Profitability would depend on factors such as trading fees, custody fees, and the cost of operations. The crypto winter likely reduced earnings.

- Profit Margins: Probably compressed during periods of market downturn, due to decreased trading volume and increased operational costs. Conversely, periods of high market activity would likely lead to improved profit margins.

Comparison with Competitors

Comparing Gemini’s financial performance to its competitors is challenging due to the lack of public financial data for many major players in the crypto exchange space. However, we can make some general observations. Companies like Coinbase, Binance, and Kraken are often cited as Gemini’s main competitors. These exchanges vary significantly in size, geographical reach, and offered services.

Coinbase, being a publicly traded company, offers more transparent financial information, allowing for a more concrete comparison (although even Coinbase’s performance fluctuates dramatically with the crypto market). Based on publicly available information, Coinbase generally operates on a larger scale than Gemini, though this does not necessarily indicate superior financial performance.

So, you’re diving deep into Gemini’s stock price and performance analysis? Smart move! But before you get too engrossed, remember that savvy investors diversify. For Canadians looking for a secure and affordable crypto trading experience, check out Best crypto trading platform in Canada with low fees and good security. Then, armed with your crypto knowledge and a well-diversified portfolio, you can return to your fascinating Gemini analysis with renewed confidence!

Factors Influencing Gemini’s Financial Performance

Several factors significantly impact Gemini’s financial success or struggles. These factors are interconnected and constantly evolving.

Analyzing Gemini’s stock price is a rollercoaster; one minute you’re soaring, the next you’re questioning your life choices. To offset potential losses, maybe consider diversifying – perhaps by using a Canadian exchange with low fees; finding the best one can be tricky, so check out this helpful resource: Which Canadian crypto exchange offers the lowest fees? Then, armed with that savings, you can bravely face another day of Gemini’s unpredictable stock performance.

- Cryptocurrency Market Volatility: The inherent volatility of the cryptocurrency market is the single biggest factor influencing Gemini’s revenue and profitability. Bull markets lead to increased trading volume and higher fees, while bear markets have the opposite effect.

- Regulatory Landscape: The ever-changing regulatory environment for cryptocurrency exchanges globally is another crucial factor. Stringent regulations can increase compliance costs and limit growth, while a more lenient regulatory approach can foster expansion and increased activity.

- Competition: The intense competition within the cryptocurrency exchange market, with numerous established and emerging players, puts pressure on Gemini to innovate, offer competitive fees, and maintain a strong reputation for security and reliability.

- Technological Advancements: Gemini’s ability to adapt to technological advancements and incorporate new features and services is vital for maintaining a competitive edge. This includes innovations in security, trading platforms, and customer service.

Analysis of Gemini’s Business Model: Gemini Stock Price And Performance Analysis.

Gemini, the cryptocurrency exchange co-founded by the Winklevoss twins, operates on a multifaceted business model designed to capture various revenue streams within the rapidly evolving crypto landscape. It’s a bit like a crypto Swiss Army knife – aiming to be useful in many different ways, but with the inherent risks that come with such a diverse approach.Gemini’s core business model revolves around facilitating cryptocurrency trading and custody.

Revenue is generated primarily through trading fees, which are charged on each transaction executed on its platform. Additional income streams include interest earned on customer assets held in custody, fees for institutional services (like prime brokerage), and potential revenue from its growing ecosystem of products and services, such as Gemini Earn and Gemini Credit Card. Think of it as a bustling marketplace with various stalls, each generating its own income.

Gemini’s Business Model Strengths

Gemini’s strengths lie in its established brand reputation, regulatory compliance (a big plus in the often-wild west of crypto), and a focus on institutional clients. The Winklevoss twins’ early entry into the space and their public profile have given Gemini a degree of trust and recognition that smaller exchanges often lack. Compliance with regulations in multiple jurisdictions helps attract institutional investors who are often risk-averse.

Furthermore, Gemini’s institutional offerings cater to the growing demand for sophisticated crypto trading and custody solutions from large financial players. This focus allows them to compete effectively in a higher-margin segment of the market.

Gemini’s Business Model Weaknesses, Gemini stock price and performance analysis.

Despite its strengths, Gemini faces challenges. The highly competitive nature of the cryptocurrency exchange market is a significant weakness. Many other exchanges offer similar services, often with lower fees or more advanced features. Gemini’s relatively smaller market share compared to giants like Binance and Coinbase puts pressure on its ability to compete effectively on price and scale.

Furthermore, reliance on fluctuating cryptocurrency prices inherently impacts trading volumes and consequently, revenue. A prolonged bear market, for instance, could significantly dampen trading activity and revenue generation.

Risks Associated with Gemini’s Business Strategy

The cryptocurrency market is inherently volatile, and this presents a substantial risk. Sharp price swings can directly impact trading volumes and potentially lead to significant losses for both Gemini and its customers. Regulatory uncertainty also poses a considerable risk. Changes in regulations in different jurisdictions could significantly affect Gemini’s operations and profitability. For example, a sudden ban on certain cryptocurrencies or stricter KYC/AML regulations could severely impact its business.

Finally, security breaches, though hopefully rare, represent a catastrophic risk for any exchange, potentially leading to loss of customer funds and reputational damage. Think of it as navigating a minefield of regulatory hurdles and market volatility.

Opportunities for Gemini

Despite the risks, Gemini has significant opportunities for growth. The increasing institutional adoption of cryptocurrencies presents a massive opportunity for Gemini’s institutional services. Expansion into new markets and the development of innovative products and services (like DeFi integration or NFT marketplaces) could also significantly boost revenue and market share. Furthermore, strategic partnerships with other players in the crypto ecosystem could help Gemini gain access to new customer segments and enhance its product offerings.

The potential for growth is substantial, provided Gemini can navigate the inherent risks and challenges.

Impact of External Factors on Gemini’s Stock Price

Gemini’s stock price, like a particularly temperamental chameleon, shifts hues based on the ever-changing landscape of the global economy and regulatory environment. Its performance isn’t solely determined by its internal workings; external forces play a significant, often unpredictable, role. Understanding these influences is key to comprehending the rollercoaster ride that is Gemini’s stock valuation.Macroeconomic factors exert a powerful gravitational pull on Gemini’s stock price, much like the moon affects the tides.

Periods of high inflation, for example, can erode consumer spending, potentially impacting trading volume and, consequently, Gemini’s revenue. Similarly, rising interest rates can make borrowing more expensive, affecting Gemini’s own financial operations and potentially dampening investor enthusiasm for riskier assets like cryptocurrency exchange stocks. Conversely, a period of low inflation and low interest rates might create a more favorable environment for investment in the cryptocurrency market, potentially boosting Gemini’s stock price.

The relationship isn’t always straightforward, however; unexpected shifts in these factors can lead to sudden and dramatic changes in market sentiment.

Macroeconomic Factors and Gemini’s Stock Price

The correlation between macroeconomic indicators and Gemini’s stock performance is complex and not always linear. For instance, during periods of high inflation, investors might seek safer havens, leading to a decline in Gemini’s stock price. Conversely, during periods of economic uncertainty, investors might turn to cryptocurrencies as a hedge against inflation, potentially driving up Gemini’s value. The impact of interest rate changes is equally nuanced.

Higher rates can increase borrowing costs for Gemini, affecting profitability, but can also signal a stronger economy, potentially increasing investor confidence and driving up demand for its services. Analyzing historical data, comparing Gemini’s performance during periods of high versus low inflation and interest rates, reveals these intricate relationships. For example, we could compare Gemini’s performance during the 2020-2021 period of low interest rates and relatively low inflation with its performance during the inflationary period of 2022.

This comparison would highlight the differing impacts of these macroeconomic conditions.

Regulatory Changes and Industry Trends

The cryptocurrency industry is notoriously volatile, and regulatory uncertainty is a major contributing factor. Changes in regulatory frameworks, both domestically and internationally, can significantly impact Gemini’s operations and investor confidence. Stringent regulations might increase compliance costs, while a lack of clear regulatory guidelines could create uncertainty and deter potential investors. Conversely, positive regulatory developments, such as the clarification of cryptocurrency tax laws or the establishment of clear regulatory frameworks, could boost investor confidence and lead to increased trading volume and a higher stock price.

The emergence of new technologies, such as decentralized finance (DeFi) and non-fungible tokens (NFTs), also presents both opportunities and challenges for Gemini. Adapting to these trends quickly and effectively will be crucial for maintaining its competitive edge and influencing its stock price positively.

Comparative Effects of External Factors

Different external factors influence Gemini’s stock price in varying ways and with different degrees of intensity. Macroeconomic factors like inflation and interest rates tend to have a broader, more systemic impact, affecting investor sentiment across the entire market. Regulatory changes, on the other hand, have a more targeted effect, specifically impacting the cryptocurrency industry and, by extension, Gemini. Industry trends, such as the rise of DeFi or the adoption of new technologies, can influence Gemini’s long-term growth prospects and its ability to compete in the evolving cryptocurrency landscape.

Comparing these impacts requires analyzing the interplay of these factors. For example, a period of high inflation combined with stringent new regulations could have a more negative impact on Gemini’s stock price than either factor in isolation. Conversely, a period of low interest rates coupled with positive regulatory developments could lead to a significant increase in the stock price.

Understanding these interactions is crucial for accurately predicting Gemini’s future performance.

Future Outlook and Projections for Gemini

Predicting the future of any stock, especially in the volatile cryptocurrency market, is like trying to catch a greased piglet – fun to try, but rarely successful. However, by analyzing current trends and considering potential scenarios, we can paint a reasonably plausible picture of Gemini’s stock price trajectory over the next year. Remember, this is not financial advice; consult a professional before making any investment decisions.

Analyzing Gemini’s stock price is a rollercoaster; one minute you’re soaring, the next you’re questioning your life choices. But hey, if the crypto market makes you nervous, maybe consider diversifying your portfolio – check out this insightful article on whether Is Bitbuy a good alternative to Wealthsimple Crypto for Canadian investors? before you jump ship completely.

Then, armed with this new knowledge, you can return to bravely facing the unpredictable Gemini stock performance charts.

This is purely speculative fun!Gemini’s future performance hinges on several key factors, including the overall health of the cryptocurrency market, the success of its own product offerings, and the regulatory landscape. A bullish market generally benefits Gemini, while a bearish market could significantly impact its profitability and, consequently, its stock price.

Deciphering Gemini’s stock price fluctuations is like navigating a rollercoaster blindfolded – thrilling, terrifying, and ultimately, unpredictable. But before we dive back into that wild ride, let’s quickly consider a different kind of value: to figure out your potential Gemini gains, you might need to know the USD equivalent of your crypto holdings first – check out this handy converter to see What is the value of 560 TRX in US dollars?

and then we can get back to the Gemini rollercoaster. Understanding the TRX value helps contextualize your overall portfolio’s performance against Gemini’s own ups and downs.

Projected Stock Price Movement in the Next 12 Months

Several factors contribute to our projections. Firstly, we’ve observed a correlation between Gemini’s performance and the price of Bitcoin (BTC). Historically, when BTC experiences significant price increases, Gemini’s revenue and stock price follow suit. Secondly, Gemini’s expansion into new markets and product offerings will influence its growth trajectory. Finally, regulatory clarity (or lack thereof) in the crypto space plays a crucial role in investor confidence.

Potential Scenarios Affecting Gemini’s Performance

We’ve identified four key scenarios, each with a projected impact on Gemini’s stock price. These scenarios consider both optimistic and pessimistic outlooks, offering a balanced perspective. The probabilities are subjective estimates based on current market conditions and expert opinions. Think of it as a sophisticated crystal ball gazing exercise!

| Scenario | Probability | Projected Stock Price (Illustrative – Assume current price is $X) | Justification |

|---|---|---|---|

| Bullish Crypto Market, Successful Product Launches | 30% | $X + 50% | A strong bull market, combined with successful new product adoption (e.g., increased institutional adoption of Gemini’s services), would drive significant revenue growth, leading to a substantial increase in stock price. This mirrors the growth seen during previous bull runs in the crypto market, where exchanges like Coinbase experienced substantial increases in their valuations. |

| Stagnant Crypto Market, Moderate Product Adoption | 40% | $X + 10% | A relatively flat crypto market, with moderate success in new product launches, would result in slow but steady growth for Gemini. This scenario assumes a level of market stability and continued user engagement, but without explosive growth. This would be similar to the performance observed in periods of consolidation within the crypto market. |

| Bearish Crypto Market, Regulatory Headwinds | 20% | $X – 20% | A significant downturn in the crypto market, coupled with unfavorable regulatory developments (e.g., increased restrictions on crypto trading), would negatively impact Gemini’s performance, potentially leading to a considerable decrease in its stock price. This scenario aligns with past market crashes, where crypto exchange valuations have been significantly impacted. Think of the 2018 bear market as a relevant example. |

| Unexpected Black Swan Event | 10% | $X – 40% or $X + 60% (Highly Volatile) | Unforeseen events, such as a major security breach or a significant technological disruption, could drastically affect Gemini’s stock price, either positively or negatively, depending on the nature and impact of the event. The unpredictable nature of such events makes precise prediction impossible. This is analogous to unexpected events such as the FTX collapse, which had a ripple effect throughout the entire crypto market. |

Investor Sentiment and Market Opinion

Gauging the collective mood of investors towards Gemini is like trying to herd cats – chaotic, unpredictable, and occasionally hilarious. While concrete data on investor sentiment can be hard to pin down, analyzing news cycles, social media chatter, and expert opinions paints a somewhat clearer (though still fuzzy) picture.The prevailing investor sentiment towards Gemini is a complex tapestry woven from threads of optimism, skepticism, and outright bewilderment.

It’s a rollercoaster ride, to be sure, and the direction of the car depends heavily on recent events and overall market conditions.

Categorization of Investor Perspectives

Investor opinions on Gemini are far from monolithic. A range of viewpoints exists, reflecting the inherent volatility of the cryptocurrency market and the company’s relatively young age. Understanding these diverse perspectives is crucial for navigating the complexities of Gemini’s investment landscape.

- The Crypto-Bulls: This group believes wholeheartedly in Gemini’s potential, viewing it as a well-managed player in a burgeoning market. They point to Gemini’s relatively strong regulatory compliance and its established brand recognition as reasons for optimism. They see future growth fueled by the increasing mainstream adoption of cryptocurrencies.

- The Cautious Optimists: This more pragmatic group acknowledges Gemini’s strengths but remains hesitant due to the inherent risks associated with the cryptocurrency market. They’re watching closely for signs of sustained profitability and further regulatory clarity before committing significant capital.

- The Skeptics: This group harbors significant doubts about Gemini’s long-term prospects, citing the intense competition in the crypto space and the potential for regulatory crackdowns. They may point to past instances of market volatility or negative press as reasons for their concern.

- The Indifferents: This group, perhaps surprisingly large, simply hasn’t formed a strong opinion on Gemini. They may be unfamiliar with the company or unconvinced of the cryptocurrency market’s long-term viability.

Significant News and Events Influencing Investor Sentiment

Major news events, both positive and negative, have significantly swayed investor sentiment towards Gemini. These events often act as catalysts, shifting the overall market perception and driving price fluctuations.

- Regulatory Scrutiny: Any news regarding increased regulatory scrutiny of cryptocurrency exchanges, including Gemini, can trigger a wave of selling pressure. Conversely, positive regulatory developments could boost investor confidence.

- Market-Wide Crypto Crashes: Broader cryptocurrency market downturns invariably impact Gemini’s stock price, regardless of the company’s specific performance. These events often lead to a general flight to safety, affecting even relatively stable players.

- Partnership Announcements: Strategic partnerships with major financial institutions or technology companies can significantly improve investor sentiment, signaling Gemini’s growing influence and market acceptance. Conversely, the failure to secure such partnerships can dampen enthusiasm.

- Financial Reporting: Gemini’s quarterly and annual financial reports are closely scrutinized by investors. Positive earnings reports and strong revenue growth are typically met with positive market reactions, while disappointing results can lead to sell-offs.

Factors Potentially Shifting Future Investor Opinion

Predicting the future is a fool’s errand, but identifying key factors that could dramatically shift investor opinion on Gemini is a worthwhile endeavor. These factors can influence investor confidence and market valuation.

- Regulatory Clarity: Increased regulatory clarity within the cryptocurrency space could significantly benefit Gemini. A well-defined regulatory framework would reduce uncertainty and potentially attract institutional investors.

- Technological Advancements: Gemini’s ability to innovate and adapt to the rapidly evolving technological landscape will be crucial for maintaining its competitive edge. New features, improved security measures, and strategic technology partnerships could all sway investor sentiment.

- Market Adoption of Cryptocurrencies: The overall adoption rate of cryptocurrencies will have a significant impact on Gemini’s future performance. Increased mainstream acceptance could drive significant growth, while decreased adoption could lead to stagnation.

- Competition: The intense competition within the cryptocurrency exchange market is a constant threat. Gemini’s ability to differentiate itself from competitors and attract and retain customers will be critical for its long-term success.

Conclusion

So, there you have it – a whirlwind tour through the fascinating landscape of Gemini’s stock price and performance. While predicting the future is a risky business (even for seasoned financial gurus!), our analysis provides a solid foundation for understanding Gemini’s past, present, and potential future. Remember, investing always carries risk, so do your own research before making any financial decisions.

Now go forth and conquer the world of finance… or at least, your portfolio!