How can I download and use the Coinbase app for trading crypto in Canada? Ah, the siren song of digital gold! This isn’t your grandpappy’s piggy bank; we’re talking about navigating the wild, wild west of cryptocurrency, but with the (relatively) user-friendly interface of Coinbase. Prepare for a journey filled with exhilarating highs (hopefully), nail-biting lows (possibly), and enough jargon to make your head spin (definitely).

Let’s dive into the digital gold rush, Canadian style!

This guide will walk you through everything from downloading the app and setting up your account (with all the necessary security measures, because nobody wants their Bitcoin stolen by a mischievous badger) to actually buying, selling, and trading crypto. We’ll even tackle the slightly less glamorous, but equally important, topic of Canadian tax implications. Buckle up, buttercup, it’s going to be a ride.

App Download and Installation: How Can I Download And Use The Coinbase App For Trading Crypto In Canada?

Embark on your crypto journey with Coinbase! Downloading and setting up your account is easier than mastering the intricacies of blockchain technology (though we won’t lie, that’s a pretty high bar). Let’s get you started with a smooth and painless process, filled with the thrill of anticipation, not frustration.

First things first: you’ll need a smartphone. If you’re still rocking a flip phone, we salute your dedication to simplicity, but this might not be the best device for navigating the wild west of cryptocurrency. Once you’ve located your smartphone, follow these simple steps.

Downloading the Coinbase App

Downloading the Coinbase app is a straightforward affair, much like ordering a pizza (except instead of pizza, you get… well, the potential for digital riches!). The process is almost identical regardless of your operating system.

For iOS users (Apple iPhones and iPads), navigate to the Apple App Store. Search for “Coinbase” and tap the official Coinbase app icon (it’s the one with the cool blue and white logo). Tap “Get” and then use your Apple ID to authorize the download and installation. For Android users, open the Google Play Store, search for “Coinbase,” locate the official app, and tap “Install.” The installation process will then commence.

It’s like magic, but with less sparkly dust and more lines of code.

So, you want to dive into the wild world of Canadian crypto trading? Downloading the Coinbase app is as easy as pie – just hit your app store! Once you’re in, the real fun begins: picking your coins. To help you choose wisely, check out this list of Top altcoins with high potential for investment in 2024 before you start buying.

Then, it’s back to Coinbase to make your trades and potentially become a crypto millionaire (or at least, a slightly wealthier Canadian!).

Coinbase Account Verification in Canada

Now for the slightly more serious bit: verifying your identity. Think of it as showing your passport at the crypto airport. Coinbase needs to confirm you’re a real person (and not a mischievous bot trying to manipulate the market). This involves providing some personal information, including:

Your full legal name, date of birth, address, and a government-issued photo ID (like a driver’s license or passport). You’ll also need to take a selfie to confirm your identity. This may seem intrusive, but it’s all part of Coinbase’s commitment to keeping your crypto safe (and preventing those pesky money-laundering schemes). Don’t worry; your selfie won’t end up on any embarrassing meme pages (we hope).

Coinbase Account Types for Canadian Traders

Coinbase offers a few different account types, each tailored to different needs. The most common is the individual account, perfect for solo crypto adventurers. If you’re collaborating with a friend or family member on your crypto investments, a joint account might be a better fit. Currently, Coinbase doesn’t offer corporate accounts specifically designed for Canadian businesses.

iOS vs. Android App Interface Comparison

While both the iOS and Android versions of the Coinbase app share core functionalities, there are some subtle differences in the user interface. These differences are mainly cosmetic, and both versions offer a smooth and intuitive experience. Here’s a quick comparison:

| Feature | iOS | Android | Notes |

|---|---|---|---|

| Overall Design | Sleek, minimalist, consistent with Apple’s design language. | More material design-oriented, slightly more colorful. | Personal preference plays a large role here. |

| Navigation | Intuitive tab bar navigation at the bottom. | Similar tab bar navigation, potentially slight differences in iconography. | Both are user-friendly and easy to navigate. |

| Transaction History | Clear and concise display of transaction details. | Similar presentation of transaction details. | Minor visual variations, but functionally identical. |

| Security Features | Identical security features, including two-factor authentication. | Identical security features, including two-factor authentication. | Security is paramount, and both versions provide the same robust protection. |

Account Setup and Security

Setting up your Coinbase account is like building a digital fortress for your crypto – you wouldn’t leave the gate unlocked, would you? Let’s get you properly secured and ready to navigate the exciting (and sometimes slightly terrifying) world of cryptocurrency trading. We’ll cover everything from password prowess to the art of two-factor authentication.Account creation is straightforward, but security is paramount.

Think of your Coinbase account as your digital bank vault; you wouldn’t leave the key under the welcome mat, would you? Let’s ensure your crypto is as safe as houses (or, you know, digital fortresses).

So, you wanna dive into the wild world of Canadian crypto trading with Coinbase? Download the app, it’s easier than teaching a squirrel to ride a unicycle! But if you’re feeling adventurous and want to explore riskier waters (and potentially bigger rewards!), check out the Leveraged cryptocurrency trading options available in Canada before you start. Remember though, Coinbase is great for beginners, while leveraged trading is more for experienced crypto-cowboys (and -girls!).

Back to Coinbase – once downloaded, just sign up and you’re ready to roll!

Password Creation and Security

A strong password is your first line of defense. Think of it as the sturdy lock on your digital vault door. Avoid obvious choices like “password123” or your pet’s name. Aim for a password that’s at least 12 characters long, including a mix of uppercase and lowercase letters, numbers, and symbols. A good password manager can help you generate and securely store these complex passwords, saving you the headache (and the risk of forgetting!).

Consider using a passphrase – a longer, more memorable string of words – for even stronger security. Think “MyDogLovesBananas123!” instead of “Password1”.

Two-Factor Authentication (2FA)

Two-factor authentication adds an extra layer of security, like installing a second, reinforced door on your digital vault. It requires a second form of verification, usually a code sent to your phone via text message or an authentication app, in addition to your password. This means even if someone gets your password, they still can’t access your account without that second code.

Enabling 2FA is like adding an alarm system to your digital fortress – highly recommended!

Email Verification

Verifying your email address is crucial. It’s like registering your digital vault with the authorities – ensuring only you can claim it. This step is necessary to receive important account updates, security alerts, and potentially recover your account if something goes wrong. Think of it as registering your home address for important mail.

So, you want to dive into the Canadian crypto-verse with Coinbase? Downloading and using the app is a breeze, but before you unleash your inner Bitcoin billionaire, consider your options! For a comprehensive look at the security and legal standing of other exchanges, check out this detailed review of Newton’s operations: Detailed review of Newton crypto exchange’s legality and security.

Then, armed with knowledge, get back to conquering Coinbase and its crypto treasures!

Linking a Canadian Bank Account or Credit Card

Adding a Canadian bank account or credit card is how you’ll deposit and withdraw funds. It’s like setting up the supply lines to your digital fortress. Coinbase supports various Canadian banks and credit cards. The process typically involves entering your banking details securely within the app. Remember, double-check everything before submitting!

Payment Methods for Canadian Users

Canadian users have several options for funding their accounts. This includes linking a bank account (Interac e-Transfer is a popular choice), using a credit or debit card, or potentially other methods that Coinbase may offer. Always review the fees associated with each method before making a deposit or withdrawal. It’s like choosing the most efficient supply route for your digital fortress – some routes might be faster, others cheaper.

Coinbase Account Setup Flowchart

Imagine a flowchart:

1. Download and Install

The Coinbase app is downloaded from your device’s app store.

2. Account Creation

Provide your email address, create a strong password, and agree to the terms of service.

3. Verification

Verify your email address via a link sent to your inbox.

4. 2FA Setup

Enable two-factor authentication for enhanced security.

5. Bank/Card Linking

Link a Canadian bank account or credit card.

6. Initial Deposit

Make your first deposit using your preferred payment method.

Crypto Trading on Coinbase

So, you’ve bravely navigated the treacherous waters of app download and account setup. Congratulations! Now, let’s unleash the Kraken (metaphorically speaking, unless you’re actually trading Kraken – then, unleash it responsibly!). This section dives into the exhilarating (and sometimes terrifying) world of crypto trading on Coinbase in Canada. Buckle up, buttercup, it’s going to be a wild ride.

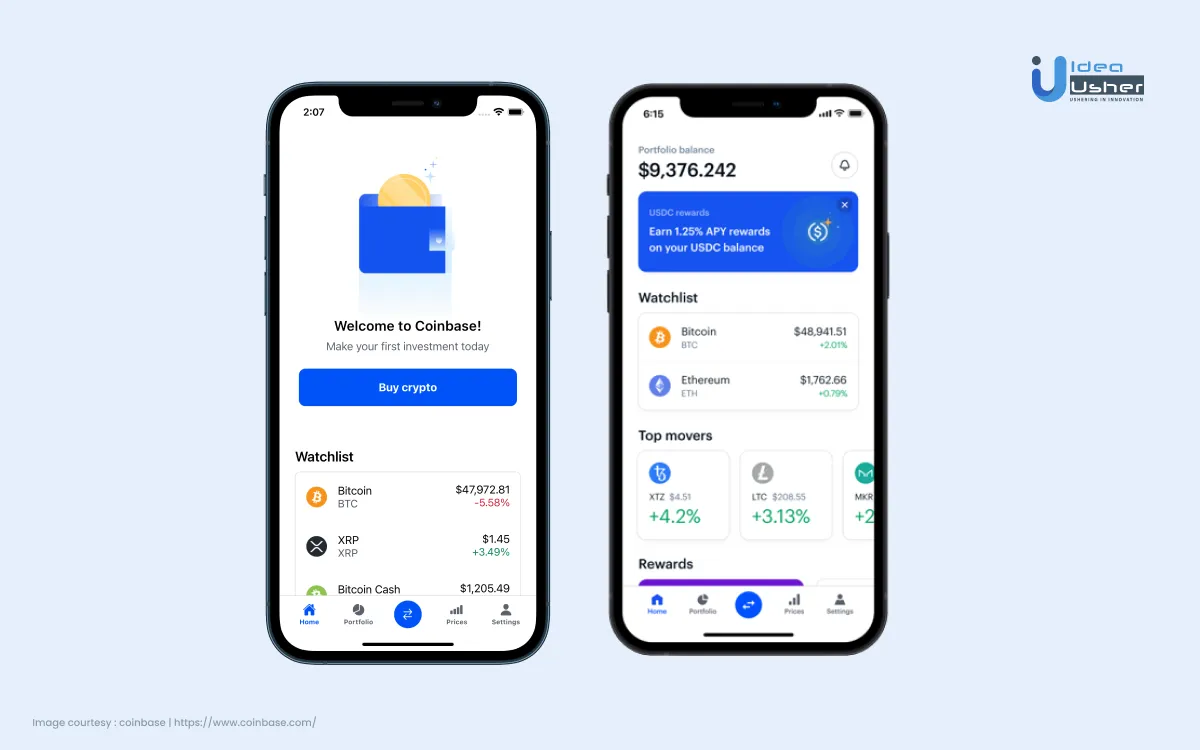

Coinbase offers a relatively user-friendly interface for buying, selling, and trading a variety of cryptocurrencies. The process is generally straightforward, but understanding the fees and different order types is crucial for maximizing your profits (or, at the very least, minimizing your losses). Remember, the crypto market is as volatile as a caffeinated squirrel on a unicycle – proceed with caution and a healthy dose of humor.

Buying, Selling, and Trading Cryptocurrencies

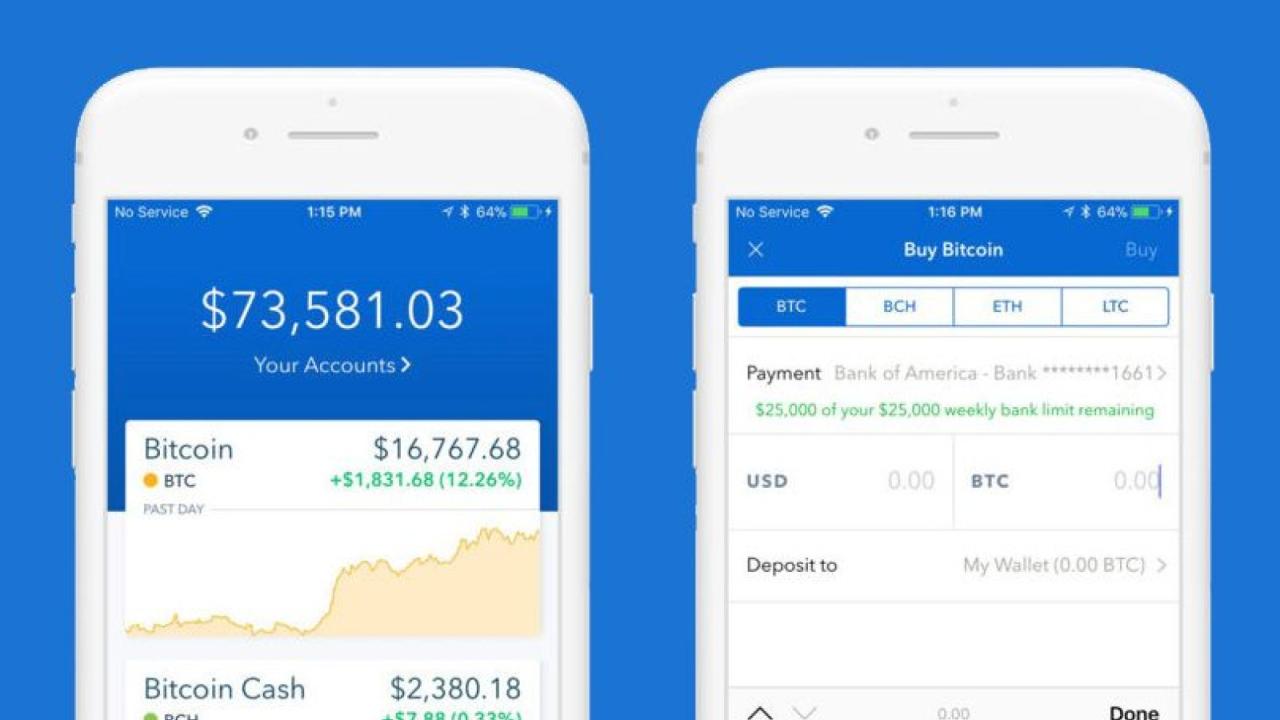

The core functionality of Coinbase revolves around buying, selling, and trading crypto. To buy, simply select the cryptocurrency you desire (Bitcoin, Ethereum, Dogecoin – the choice is yours!), enter the amount you wish to purchase in Canadian dollars, and confirm the transaction. Selling follows a similar process, reversing the flow of digital assets for cold, hard (or digital) cash.

Trading involves exchanging one cryptocurrency for another – for example, swapping your Bitcoin for some shiny new Ethereum. Coinbase provides real-time pricing, allowing you to make informed (hopefully!) decisions. Remember to always check the current market conditions before making any trades. A sudden dip can turn your potential gains into a digital ghost town.

Coinbase Fees in Canada

Coinbase, like most exchanges, charges fees for its services. These fees can vary depending on the payment method, the cryptocurrency traded, and the transaction volume. Transaction fees are typically a percentage of the total trade value, while withdrawal fees depend on the cryptocurrency and the withdrawal method. It’s crucial to review Coinbase’s fee schedule before making any transactions to avoid any unpleasant surprises.

Think of these fees as the toll you pay to traverse the thrilling highway of cryptocurrency trading. Sometimes, the toll is high, sometimes it’s low – it’s all part of the unpredictable journey.

Comparison with Other Canadian Crypto Platforms

Coinbase isn’t the only crypto trading platform available in Canada. Other popular options include Kraken, Binance, and others. Each platform has its own strengths and weaknesses, such as fee structures, available cryptocurrencies, and trading features. Coinbase generally emphasizes ease of use, making it a good choice for beginners. However, more advanced traders might find the features of platforms like Binance more appealing due to their wider range of trading options and lower fees in some cases.

Choosing the right platform depends on your individual needs and trading style. Think of it like choosing the right tool for the job – a hammer might be great for nails, but not so much for delicate surgery (unless you’re a very skilled surgeon, in which case, hats off to you!).

Coinbase Order Types

Understanding different order types is essential for effective crypto trading. Different strategies require different approaches. Selecting the right order type can be the difference between a profitable trade and a costly mistake. Let’s examine some of the common order types available on Coinbase:

- Market Order: This is the simplest order type. You buy or sell at the current market price. It’s fast but might not get you the best price, especially during volatile market conditions.

- Limit Order: You specify the price at which you want to buy or sell. The order will only be executed if the market price reaches your specified limit. This gives you more control over the price but might take longer to execute, or may not execute at all if the market price doesn’t reach your limit.

- Stop-Loss Order: This order is designed to limit potential losses. You set a price at which your order will automatically be executed (usually a sell order) if the market price drops below your specified stop price. This helps protect you from significant losses in case of a sudden market downturn.

Tax Implications and Regulations

Navigating the Canadian tax landscape for cryptocurrency trading can feel like traversing a crypto minefield – exciting, potentially lucrative, and fraught with the risk of unexpected explosions (in the form of hefty tax bills!). Don’t worry, though; understanding the rules isn’t as daunting as it might seem. This section will illuminate the path to tax compliance, helping you avoid any unpleasant surprises come tax season.

Cryptocurrency transactions in Canada are generally considered taxable events. This means that any profit you make from buying and selling crypto is subject to capital gains tax, just like profits from stocks or other investments. The CRA (Canada Revenue Agency) considers crypto a commodity, not currency, for tax purposes. This has significant implications for how you report your gains and losses.

So you want to dive into the wild world of crypto in Canada using Coinbase? Downloading and using the app is a breeze, but before you leap, consider checking out this Wealthsimple Crypto review: fees, security, and user experience for a comparison. After all, knowing your options is half the battle in the crypto arena, then get back to mastering that Coinbase app!

Capital Gains Tax on Cryptocurrency

Capital gains tax applies to the profit you make when you dispose of cryptocurrency. This “disposition” can occur when you sell, trade, or otherwise convert your crypto into another asset, including fiat currency like CAD. Only 50% of your capital gains are taxed, meaning the tax rate you pay depends on your overall income bracket. For example, if you have a $10,000 capital gain from crypto trading, only $5,000 is included in your taxable income.

So you wanna dive into the wild world of Canadian crypto trading? Downloading the Coinbase app is your first step – it’s easier than teaching a squirrel to ride a unicycle! Once you’re set up, the real fun begins: learning how to actually profit from cryptocoin and turning those digital coins into something tangible (like, say, a lifetime supply of squirrel-sized unicycles).

Then, of course, you’ll need to master the art of using Coinbase effectively to manage your crypto portfolio. Happy trading!

The tax you owe will then be calculated based on your marginal tax rate.

Tracking Cryptocurrency Transactions

The Coinbase app provides a comprehensive transaction history that is invaluable for tracking your crypto trades for tax purposes. You can download your transaction history as a CSV file, which can then be easily imported into tax software or spreadsheets. This history includes details like the date of the transaction, the type of cryptocurrency, the quantity traded, and the price in both CAD and the cryptocurrency’s value.

It’s crucial to keep accurate records of all your transactions, including any fees paid. Remember, the CRA expects meticulous record-keeping, so treat this aspect with the utmost care. Losing track of a few trades could lead to an audit, which nobody wants!

Resources for Canadian Coinbase Users

The CRA website is the ultimate authority on Canadian tax laws. They offer various guides, publications, and frequently asked questions specifically addressing cryptocurrency taxation. Coinbase itself doesn’t offer direct tax advice, but their help center provides information on downloading transaction history and generally good record-keeping practices. Consider consulting with a tax professional specializing in cryptocurrency if you’re unsure about any aspect of your tax obligations.

So you want to dive into the wild world of Canadian crypto trading with Coinbase? Downloading the app is a breeze – just hit your app store! But before you start buying Bitcoin like it’s going out of style, you might wonder, “To truly maximize your crypto gains, check out this link: Which Canadian fintech company offers the best crypto platform?

Then, once you’ve done your research, get back to conquering Coinbase and its crypto riches!

This is especially recommended for those with complex trading strategies or significant crypto holdings. They can help navigate the complexities and ensure you are compliant.

Summary of Key Tax Implications

| Taxable Event | Tax Type | Reporting Deadline | Example |

|---|---|---|---|

| Sale of Bitcoin for CAD | Capital Gains Tax (50% of profit taxable) | April 30th of the following year | Sold 1 BTC for $50,000 CAD, purchased for $20,000 CAD. Taxable capital gain: $15,000. |

| Trading Bitcoin for Ethereum | Capital Gains Tax (if profit is realized) | April 30th of the following year | Traded 1 BTC for 2 ETH. A capital gain or loss is only realized when ETH is sold or otherwise disposed of. |

| Receiving crypto as payment for goods/services | Income Tax | April 30th of the following year | Received 0.5 BTC for freelance work. The fair market value of 0.5 BTC at the time of receipt is considered income. |

Customer Support and Resources

Navigating the world of cryptocurrency can feel like charting uncharted waters, even with a trusty app like Coinbase. Luckily, Coinbase offers several support channels to help Canadian users stay afloat and avoid any digital shipwrecks. Let’s explore the resources available to ensure a smooth and stress-free crypto journey.

Coinbase understands that technical hiccups and general crypto confusion are par for the course. Their support system aims to provide assistance efficiently, offering various avenues for help, from self-service options to direct contact with support agents. Remember, a little proactive research can often save you a lot of time and frustration.

Contacting Coinbase Support, How can I download and use the Coinbase app for trading crypto in Canada?

Coinbase’s customer support for Canadian users primarily relies on their comprehensive help center and email support. While a dedicated phone line isn’t available, the help center acts as a robust first point of contact, offering articles, FAQs, and troubleshooting guides designed to address a wide range of issues. Email support is another avenue for more complex problems or situations requiring personalized assistance.

Responding to emails might take some time, so patience is key. Think of it as waiting for that perfect Bitcoin price dip – it’s worth the wait!

Resolving Common Issues for Canadian Users

Common issues faced by Canadian Coinbase users often revolve around account verification, transaction processing delays, and understanding tax implications. For account verification delays, ensure all required documentation is accurate and complete. Transaction delays can sometimes be attributed to network congestion; checking the status of the blockchain can provide valuable insights. Regarding tax implications, the Coinbase website provides helpful information and links to relevant Canadian tax resources.

Remember, consulting a tax professional is always a wise move when dealing with crypto taxes.

Educational Resources on Coinbase

Coinbase is committed to educating its users, offering a treasure trove of resources to enhance your crypto knowledge. Their website and app boast an extensive learning center packed with articles, videos, and tutorials covering everything from basic crypto concepts to advanced trading strategies. These resources are invaluable for beginners and experienced traders alike, providing a clear path to navigate the often-complex world of digital currencies.

Consider it your personal crypto university – tuition is free!

Accessing the Coinbase Help Section and FAQ

Finding help within the Coinbase app is surprisingly straightforward. Most apps have a dedicated “Help” or “Support” section, usually accessible through a menu or settings icon. Within this section, you’ll discover a searchable knowledge base brimming with FAQs, articles, and video tutorials tailored to various issues. This self-service approach often resolves common problems quickly and efficiently. Think of it as a digital crypto mechanic’s guide, ready to help you troubleshoot minor issues before they become major headaches.

Closing Summary

So there you have it – a comprehensive guide to conquering the Coinbase app and the Canadian crypto market. Remember, while the potential rewards are enticing (think early Bitcoin adopters sipping margaritas on a yacht somewhere), the risks are real. Do your research, diversify your portfolio (don’t put all your eggs in one Doge-basket!), and always remember to treat your digital assets with the same care you’d give your actual, tangible valuables.

Happy trading (responsibly!), eh?