Wealthsimple Crypto review: fees, security, and user experience – sounds thrilling, right? Like a high-stakes heist movie, but instead of diamonds, we’re dealing with digital assets. Buckle up, because this isn’t your grandpappy’s brokerage. We’re diving headfirst into the wild world of Wealthsimple Crypto, examining its fees (are they highway robbery or a bargain basement deal?), its security (Fort Knox or a flimsy shack?), and its user experience (intuitive masterpiece or a digital labyrinth?).

Prepare for a rollercoaster ride of insights!

This review meticulously dissects Wealthsimple Crypto, comparing it to competitors, analyzing its fee structure’s impact on various trading strategies, and scrutinizing its security measures. We’ll explore the platform’s user interface, supported cryptocurrencies, trading features, customer support, and regulatory compliance. Think of us as your personal cryptocurrency Sherpas, guiding you through the sometimes treacherous terrain of digital finance.

Fees Charged by Wealthsimple Crypto: Wealthsimple Crypto Review: Fees, Security, And User Experience

Let’s talk turkey – or rather, let’s talk about the cost of buying, selling, and holding your crypto on Wealthsimple Crypto. Nobody likes unexpected fees, especially when you’re trying to navigate the already volatile world of digital currencies. So, let’s get down to brass tacks and dissect their fee structure. We’ll compare it to other players in the crypto exchange arena to see how Wealthsimple stacks up.

So, you’re pondering the Wealthsimple Crypto review: fees, security, and user experience? It’s a decent platform, but if you’re a total newbie, you might want to check out this guide on the Best Canadian crypto exchange for beginners before diving in headfirst. After all, navigating the world of crypto fees and security can feel like a minefield, so a little extra prep for Wealthsimple Crypto or any other exchange is always a good idea.

Wealthsimple Crypto Fee Breakdown

The beauty of simplicity (or so they claim!) is often reflected in the fee structure. However, simplicity doesn’t always mean cheap, so let’s examine the details. The following table Artikels the typical fees you might encounter. Remember, these fees are subject to change, so always check Wealthsimple’s official website for the most up-to-date information.

| Fee Type | Description | Amount | Notes |

|---|---|---|---|

| Trading Fee | Fee charged for buying or selling cryptocurrencies. | Variable, typically 1.5% of the trade value. | This is a relatively high fee compared to some competitors. The percentage can fluctuate based on market conditions and volume. |

| Withdrawal Fee | Fee charged for withdrawing cryptocurrencies to an external wallet. | Varies depending on the cryptocurrency. | Check Wealthsimple’s website for specific fees per cryptocurrency. Expect to pay more for less common coins. |

| Deposit Fee | Fee charged for depositing fiat currency (e.g., CAD). | Usually none. | While deposits are typically free, some payment methods might incur additional fees imposed by your bank or payment processor. |

| Inactive Account Fee | Fee for accounts with no activity for a prolonged period. | Not applicable. | Wealthsimple Crypto does not currently charge an inactive account fee. However, this is always subject to change. |

Comparison with Other Exchanges

To put Wealthsimple Crypto’s fees into perspective, let’s compare them to two other popular exchanges: Coinbase and Kraken. While specific fees can change, the general comparison provides a useful benchmark. Coinbase generally has higher fees than Kraken, but both tend to be lower than Wealthsimple Crypto’s 1.5% trading fee. Kraken, for example, offers a maker-taker fee structure which can be more advantageous for high-volume traders.

Impact of Fees on Trading Strategies

Wealthsimple Crypto’s higher fees directly impact profitability, especially for high-frequency traders or those employing strategies that involve numerous small trades. For example, a day trader executing multiple trades throughout the day would see their profits significantly eroded by the cumulative trading fees. In contrast, a buy-and-hold investor would be less affected, as they incur fees only at the time of buying and selling.

High-volume traders might find that other exchanges with lower fee structures, like Kraken’s maker-taker system, are more suitable for maximizing profits. The 1.5% fee is a substantial cost that needs to be factored into any trading strategy.

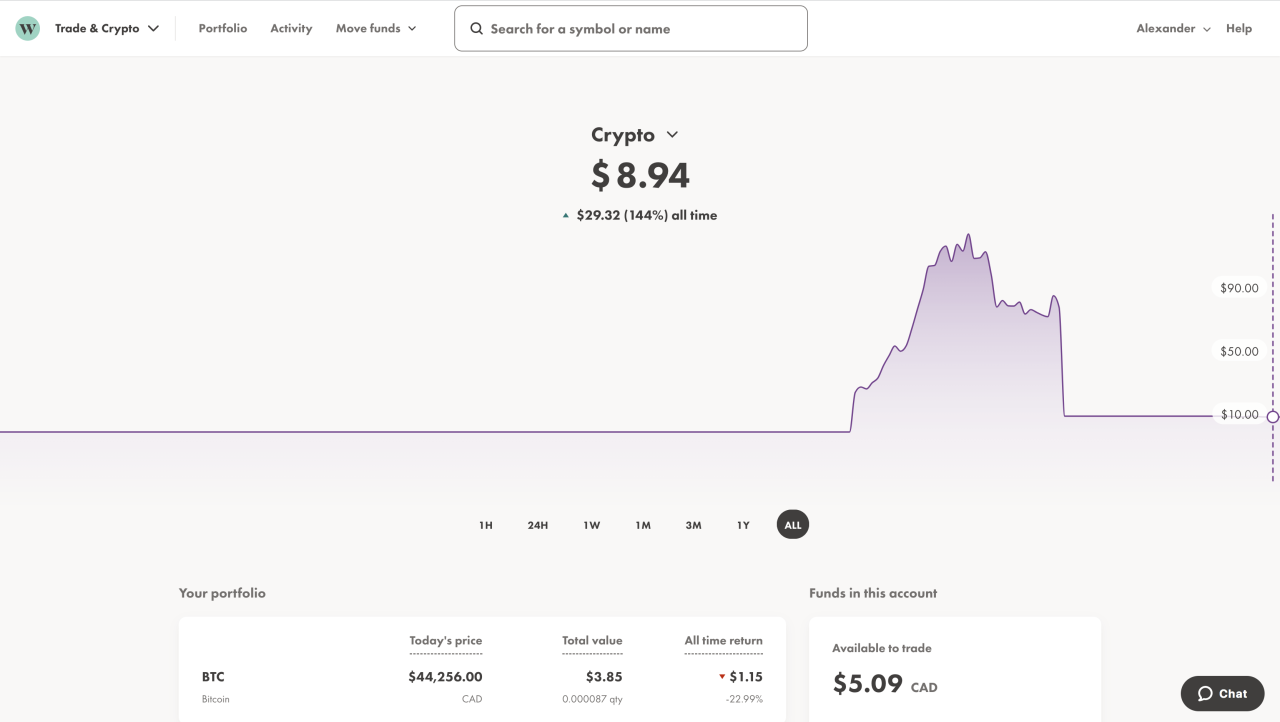

User Experience and Interface of Wealthsimple Crypto

Navigating the world of cryptocurrency can feel like traversing a digital jungle, but a good platform can tame the beast. Wealthsimple Crypto aims for user-friendliness, and while it largely succeeds, there’s always room for improvement. This section delves into the platform’s interface, examining its strengths and weaknesses to give you a clear picture of the user experience.

Wealthsimple Crypto boasts a clean, minimalist design. It’s generally intuitive, especially for users already familiar with Wealthsimple’s other investment platforms. However, some aspects could benefit from a more sophisticated approach, particularly for those new to crypto trading.

Ease of Use and Navigation

The platform’s straightforward design makes buying and selling crypto relatively simple. The process is streamlined, with clear instructions at each step. However, accessing advanced features like setting up recurring buys or viewing detailed transaction history could be more intuitive. For example, the location of the transaction history is somewhat hidden, requiring a few extra clicks.

So, you’re pondering Wealthsimple Crypto’s fees, security, and overall user experience – a valid concern when entrusting your digital dough! Before diving in headfirst, though, you might want to check out this insightful article on whether Coinsquare is a safe bet: Is Coinsquare a trustworthy and reliable cryptocurrency exchange?. Knowing your options helps you make an informed decision about where to park your precious bitcoin, returning you to the crucial Wealthsimple Crypto review.

- Strength: The buying and selling process is exceptionally easy, even for beginners. The clear visual representation of prices and transaction fees is a definite plus.

- Weakness: Finding advanced settings and detailed transaction history requires more navigation than ideal. A more prominent menu or improved search function would enhance usability.

- Improvement Suggestion: A simplified dashboard displaying key metrics (portfolio value, recent transactions, pending orders) alongside quick access to advanced settings would greatly enhance the user experience.

Areas for User Experience Improvement

While Wealthsimple Crypto provides a functional platform, several areas could be improved to enhance the overall user experience. These improvements would cater to both novice and experienced users, enhancing the platform’s appeal and functionality.

So, you’re pondering the Wealthsimple Crypto review: fees, security, and user experience? It’s a crucial part of any crypto journey, especially if you’re hoping to, well, actually profit from cryptocoin – check out profit from cryptocoin for some savvy tips – because let’s face it, low fees and a secure platform are your best friends when navigating the wild west of digital currencies.

Back to Wealthsimple: Is their user experience as smooth as advertised, or are there hidden pitfalls? The answer, my friend, is out there.

- Improved Charting Tools: The current charting tools are basic. Integrating more advanced charting features with customizable indicators would attract more serious traders.

- Enhanced Portfolio Tracking: While portfolio tracking is available, adding features like performance comparisons against other cryptocurrencies or market benchmarks would provide more insightful data for users.

- Better Educational Resources: Incorporating more comprehensive educational resources within the platform, such as interactive tutorials or glossary of terms, would significantly improve user understanding and reduce potential confusion.

Mock-up of an Improved User Interface Element

Imagine an improved dashboard. Instead of the current layout, consider a visually appealing dashboard with a clear overview of the user’s portfolio. This dashboard would display the total portfolio value prominently, along with individual cryptocurrency holdings, their current prices, and percentage changes. A small, interactive chart displaying recent price movements for each cryptocurrency would be integrated directly into the dashboard.

Below this, a quick-access menu would allow users to buy, sell, or view transaction history with a single click. The design would utilize a clean, modern aesthetic with clear, concise labels and intuitive icons, ensuring ease of navigation and comprehension for users of all technical skill levels. The color scheme would be calming and professional, avoiding overly bright or distracting colors.

This revised dashboard would aim for clarity and efficiency, making the overall user experience smoother and more engaging. The rationale behind this design is to provide users with immediate access to crucial information and streamline their interactions with the platform. This would significantly enhance user satisfaction and engagement.

Supported Cryptocurrencies and Trading Features

So, you’ve conquered the fees, navigated the user interface, and are ready to dive headfirst into the thrilling world of digital assets? Let’s explore the crypto-verse Wealthsimple offers, shall we? Prepare for a rollercoaster ride of digital currencies and trading options (but hopefully without the stomach-churning drops!).Wealthsimple Crypto doesn’t boast the largest selection of cryptocurrencies compared to some of its more established competitors.

However, it offers a curated selection of popular and established digital assets, aiming for a balance between accessibility and risk management. This strategy might appeal to users prioritizing a less overwhelming and potentially safer trading experience.

Supported Cryptocurrencies, Wealthsimple Crypto review: fees, security, and user experience

The available cryptocurrencies on Wealthsimple Crypto can change, so it’s always best to check their website for the most up-to-date list. However, at the time of writing, a typical selection might include the following:

- Bitcoin (BTC)

- Ethereum (ETH)

- Bitcoin Cash (BCH)

- Litecoin (LTC)

- Dogecoin (DOGE)

Remember, this list isn’t exhaustive and is subject to change based on market conditions and Wealthsimple’s internal decisions. Always verify directly with Wealthsimple before making any investment decisions.

So, you’re wrestling with the Wealthsimple Crypto review – fees, security, user experience, the whole shebang? It’s a jungle out there! Before you dive headfirst into real crypto, maybe try practicing your moves first; check out this guide on Finding the best crypto trading platform for paper trading to hone your skills. Then, armed with knowledge, you can confidently tackle the Wealthsimple Crypto review and decide if it’s the right platform for your (hopefully soon-to-be-massive) crypto fortune.

Trading Features

Wealthsimple Crypto offers a relatively straightforward trading experience, prioritizing simplicity over an overwhelming array of advanced tools. This approach can be a boon for beginners, but seasoned traders might find it a bit limiting.Wealthsimple primarily supports market orders. Market orders execute trades at the best available price at the moment the order is placed. Think of it as shouting “I’ll take whatever I can get!” in the bustling crypto marketplace.

While simple, this can lead to slightly less favorable prices compared to more sophisticated order types. Currently, Wealthsimple does not offer limit orders or stop-loss orders, which are more common among competitors. Limit orders allow you to buy or sell at a specific price, while stop-loss orders help mitigate risk by automatically selling if the price drops below a predetermined level.

So, you’re wrestling with the Wealthsimple Crypto review – fees, security, user experience, the whole shebang? It’s a jungle out there! If you’re thinking of branching out into forex, finding a reliable partner is crucial, which is why checking out resources like Finding a trustworthy forex broker in Austria might be a smart move before you dive headfirst.

Back to Wealthsimple, remember to compare their fees against other platforms before making any rash crypto decisions.

Comparison with Competitors

Compared to giants like Coinbase or Binance, Wealthsimple Crypto’s selection of cryptocurrencies is significantly smaller. Coinbase and Binance offer hundreds, if not thousands, of different cryptocurrencies. Wealthsimple’s limited selection is a double-edged sword; it simplifies the user experience but also limits diversification opportunities. Furthermore, the absence of advanced order types like limit and stop-loss orders puts Wealthsimple at a disadvantage for more experienced traders seeking greater control over their trades.

However, Wealthsimple’s focus on simplicity and user-friendliness makes it a more accessible platform for beginners who might be intimidated by the complexity of other exchanges.

Customer Support and Resources

Navigating the sometimes-treacherous waters of cryptocurrency can leave even seasoned investors feeling a bit adrift. Luckily, a robust customer support system can be your trusty life raft, guiding you back to shore when things get choppy. Let’s see how Wealthsimple Crypto handles the inevitable questions and emergencies that arise in the crypto world.Wealthsimple Crypto’s customer support channels aim for a balance between high-tech efficiency and old-fashioned human connection.

While they don’t offer a 24/7 hotline staffed by singing crypto-gurus (alas!), their approach is designed to provide assistance when you need it most. The effectiveness of this approach, however, varies based on user experiences.

So, you’re wrestling with the Wealthsimple Crypto review – fees, security, user experience, the whole shebang? It’s a jungle out there! If you’re looking for alternative ways to grow your money, maybe check out some Forex trading strategies for beginners with small accounts before diving headfirst into crypto. Then, armed with newfound financial wisdom (or at least a slightly different headache), you can return to dissecting those Wealthsimple Crypto fees with a fresh perspective.

Available Support Channels

Wealthsimple Crypto primarily relies on email and in-app support. Email support, while reliable, can sometimes involve a bit of a wait, especially during periods of high volume. In-app support allows for a more direct line of communication, though the responsiveness can fluctuate. The absence of a readily available phone number or live chat might be a disappointment for some users who prefer immediate, real-time assistance.

Examples of Customer Support Quality and Responsiveness

User reviews paint a mixed picture. Some users praise the helpfulness and thoroughness of Wealthsimple Crypto’s support team, highlighting instances where complex issues were resolved effectively and efficiently. For example, one user reported a successful resolution to a transaction error, with the support team providing clear and concise instructions. Conversely, other users express frustration with response times, citing delays in receiving replies to emails and a lack of immediate assistance via live chat or phone.

These delays, understandably, can be particularly stressful during market volatility. These contrasting experiences suggest that the quality and responsiveness of support can be inconsistent, potentially dependent on the complexity of the issue and the current workload of the support team.

Best Practices for Utilizing Wealthsimple Crypto Support

To maximize your chances of a smooth and efficient support experience, consider these tips:Before contacting support, thoroughly check Wealthsimple Crypto’s extensive FAQ section and help center. Many common issues are addressed there, saving you time and potentially resolving your problem instantly. If you need to contact support, clearly and concisely explain your issue, providing any relevant transaction IDs, screenshots, or other supporting documentation.

Being organized and providing complete information from the outset will streamline the process and help the support team address your concerns more quickly. Remember, patience is a virtue, especially in the world of customer service. While immediate responses aren’t always guaranteed, persistence often pays off. Finally, keep a record of your interactions with the support team, including dates, times, and summaries of conversations.

This documentation can be invaluable if further assistance is required.

Regulatory Compliance and Legal Aspects

Navigating the wild west of cryptocurrency requires a sturdy legal framework, and Wealthsimple Crypto, like a trusty sheriff, attempts to keep things orderly. Let’s saddle up and examine the regulatory landscape they operate within, the legal implications for users, and their commitment to keeping things above board.Wealthsimple Crypto’s operations are subject to a variety of regulatory bodies, depending on the jurisdiction.

In Canada, where Wealthsimple is based, they’re primarily overseen by the Ontario Securities Commission (OSC) and other provincial securities commissions, as well as potentially FINTRAC (the Financial Transactions and Reports Analysis Centre of Canada) for anti-money laundering compliance. Depending on the user’s location, other international regulatory bodies might also apply. The regulatory landscape for crypto is constantly evolving, so staying informed is key.

Regulatory Oversight Bodies

Wealthsimple Crypto’s regulatory compliance is a multifaceted affair. The company operates under the purview of various regulatory bodies, ensuring adherence to anti-money laundering (AML) and know-your-customer (KYC) regulations. These regulations are designed to prevent illicit activities, such as money laundering and terrorist financing, from using cryptocurrency platforms. Specific regulatory bodies vary by jurisdiction, but generally include securities commissions at the provincial and/or federal level and financial intelligence units responsible for AML/KYC compliance.

Wealthsimple’s commitment to these regulations is crucial for maintaining user trust and operating legally.

Legal Implications of Using Wealthsimple Crypto

Using Wealthsimple Crypto for cryptocurrency trading has several legal implications users should understand. Perhaps the most significant is the tax treatment of cryptocurrency transactions. In many jurisdictions, including Canada, profits from cryptocurrency trading are considered taxable income. Capital gains taxes may apply to profits from selling cryptocurrencies held for longer than a certain period, while short-term gains are taxed as ordinary income.

It’s crucial to keep meticulous records of all transactions for tax purposes. Furthermore, users should be aware of any legal protections available in case of platform failures or security breaches. While Wealthsimple strives to protect user assets, understanding the limits of these protections is important. For instance, if a user’s account is compromised due to negligence on their part, they may not be fully reimbursed.

AML/KYC Compliance

Wealthsimple Crypto, like other reputable cryptocurrency platforms, rigorously adheres to AML/KYC regulations. This involves verifying user identities through processes like providing government-issued identification and proof of address. These measures are designed to prevent the use of the platform for illicit activities, such as money laundering. The platform also employs sophisticated monitoring systems to detect and report suspicious activities.

Non-compliance with these regulations can lead to significant penalties for both the platform and the users involved. Wealthsimple’s commitment to these regulations is a cornerstone of their operations and reflects their commitment to responsible and legal cryptocurrency trading.

Wrap-Up

So, is Wealthsimple Crypto the crypto kingdom you’ve been searching for? The answer, like a good Bitcoin price chart, is complex. While its user-friendly interface and robust security features are definite pluses, the fee structure might not suit all traders. Ultimately, whether Wealthsimple Crypto is the right fit depends on your individual needs and risk tolerance. Remember, always do your own research and never invest more than you’re comfortable losing – even if it involves cute cartoon llamas (which, let’s be honest, is a pretty compelling selling point).

Happy trading!