Is Coinsquare a trustworthy and reliable cryptocurrency exchange? That’s the burning question on many crypto-curious minds! This deep dive into the Coinsquare universe explores its regulatory compliance, security features, user experiences, fee structure, and the overall vibe of the platform. We’ll uncover whether Coinsquare is a safe haven for your digital assets or a digital Wild West. Buckle up, crypto cowboys and cowgirls!

From its licensing and security protocols to user reviews and transaction speeds, we’ll leave no digital stone unturned in our quest to answer this crucial question. We’ll compare Coinsquare to its competitors, examine its fee structure with a magnifying glass, and delve into the nitty-gritty of its supported cryptocurrencies. Prepare for a rollercoaster ride through the exciting – and sometimes treacherous – world of cryptocurrency exchanges!

Coinsquare’s Regulatory Compliance and Security Measures

Coinsquare’s trustworthiness hinges significantly on its adherence to regulations and its commitment to robust security. Let’s delve into the nitty-gritty of how they stack up against the crypto-wild-west standards. Think of it as a crypto-security audit, but with significantly less jargon and more amusing anecdotes (hopefully).Coinsquare’s Regulatory Landscape and Security ProtocolsCoinsquare operates under a fairly robust regulatory framework, a welcome change from the often-lawless landscapes of some other exchanges.

Their compliance isn’t just a box-ticking exercise; it’s a fundamental aspect of their operations, aiming to build trust and protect users. This isn’t just about avoiding legal trouble; it’s about showing they take security seriously. Let’s explore the details.

So, is Coinsquare trustworthy? That’s a question many crypto-curious folks ponder. If you’re looking for more options and perhaps a smoother experience, checking out The best currency trading apps with advanced features might be wise. Ultimately, the trustworthiness of Coinsquare depends on individual experiences, but exploring alternatives is always a smart move in the wild west of cryptocurrency.

Registration and Licensing

Coinsquare is registered as a Money Services Business (MSB) in several Canadian provinces, including Ontario. This registration subjects them to rigorous anti-money laundering (AML) and know your customer (KYC) regulations. Think of it as a crypto-equivalent of having your business license checked and approved by the local sheriff (a much friendlier sheriff, hopefully). This regulatory oversight provides a layer of protection for users, ensuring that Coinsquare operates within a defined legal framework.

The specific provinces and the precise details of their registration can be easily verified through official government channels. The level of scrutiny they face is quite high, which is good news for users concerned about the legitimacy of the platform.

Wondering if Coinsquare’s crypto-promises are as solid as a bitcoin block? Before you dive headfirst into the digital ocean, maybe consider diversifying. If crypto’s got you feeling a little shaky, check out some safer waters with Forex trading strategies for beginners with small accounts – it might be a less volatile way to grow your nest egg.

Then, armed with forex savvy, you can revisit that Coinsquare question with a clearer head and a fatter wallet. Is Coinsquare truly trustworthy? The answer, my friend, is blowing in the wind (or maybe on a forex chart).

Security Protocols Employed

Coinsquare utilizes a multi-layered security approach to safeguard user funds and data. They employ things like two-factor authentication (2FA), cold storage for a significant portion of their crypto holdings (think of it as a super-secure, offline vault), and advanced encryption techniques. Their security measures also include regular security audits and penetration testing, which are like having a team of highly skilled digital burglars try to break into their systems to find vulnerabilities before real bad actors do.

This proactive approach demonstrates a commitment to staying ahead of evolving cyber threats. These measures, while not foolproof (nothing ever truly is in the world of cybersecurity), significantly reduce the risk of unauthorized access and theft.

Comparison with Other Exchanges

Comparing Coinsquare’s security to other major exchanges requires a nuanced approach. While some exchanges might boast flashier security features, the effectiveness ultimately depends on implementation and ongoing maintenance. Coinsquare’s approach seems reasonably solid when compared to industry standards, but it’s essential to remember that the crypto-world is a constantly evolving landscape, and no exchange is completely immune to breaches.

Regularly checking security updates and comparing features to similar exchanges is a good practice for any crypto user.

Insurance Coverage

Information regarding Coinsquare’s specific insurance coverage for user assets is not readily available on their public website. However, it is worth noting that many exchanges do not explicitly detail their insurance policies, relying instead on general security measures and compliance. The lack of publicly available information on this specific point should be a factor in your overall risk assessment of using the platform.

KYC and AML Compliance

| Jurisdiction | Compliance Status | Details | Source |

|---|---|---|---|

| Canada (Various Provinces) | Compliant (Registered MSB) | Registered as a Money Services Business, subject to AML/KYC regulations. | FINTRAC, Provincial regulatory bodies |

Coinsquare’s Fees and Trading Experience

Navigating the world of cryptocurrency exchanges can feel like traversing a digital jungle – full of hidden fees, confusing interfaces, and the occasional lurking jaguar (okay, maybe not jaguars, but you get the idea). Let’s shed some light on Coinsquare’s fees and overall user experience, comparing it to the competitive landscape. We’ll see if it’s a smooth, well-maintained path or a bumpy, overgrown trail.Coinsquare’s Fee Structure and Trading Platform Analysis

Trading Fees

Coinsquare employs a maker-taker fee system, a common practice among exchanges. Maker fees reward users who add liquidity to the order book (placing limit orders that aren’t immediately filled), while taker fees are charged to users who remove liquidity (placing market orders that immediately execute). The exact fees vary depending on your trading volume and whether you’re a maker or taker.

So, is Coinsquare trustworthy? That’s a question as complex as finding the perfect halal satay, which brings me to a fantastic resource for all your halal culinary adventures. But back to Coinsquare – trustworthiness in crypto is a bit like trust in a street food vendor; you gotta do your homework before you take the plunge, right?

Generally, expect lower fees for higher trading volumes, a common incentive structure designed to reward active traders. Specific fee schedules are readily available on Coinsquare’s website, and it’s always wise to check their current rates before executing any trades. Failure to do so might lead to unpleasant surprises, like finding out your transaction fees are higher than anticipated.

Withdrawal Fees

Withdrawal fees vary depending on the cryptocurrency you’re withdrawing and the network used for the transaction. These fees are typically charged to cover the network costs associated with transferring the cryptocurrency off the Coinsquare platform. Again, checking the specific fees before initiating a withdrawal is crucial to avoid unexpected costs. Imagine the disappointment of initiating a withdrawal only to realize a significant portion of your crypto is going towards fees!

Comparison with Competitors

Let’s pit Coinsquare against some well-known competitors to get a clearer picture. Direct fee comparisons are tricky, as fees fluctuate and are often tiered based on trading volume. However, a general comparison can provide valuable insights. For instance, some exchanges might offer lower maker fees but higher taker fees, while others might have a flatter fee structure across the board.

So, you’re wondering if Coinsquare is the real McCoy in the crypto world? Before you dive headfirst into digital assets, maybe consider sharpening your trading skills first. Practicing with a demo account is a smart move, and you can learn the ropes with forex trading by checking out this helpful resource: Learning forex trading with a demo account in Canada.

Mastering the basics might make you a more savvy investor, regardless of whether you choose Coinsquare or another platform for crypto.

It’s essential to analyze the fee structure in relation to your trading style – are you a frequent trader who benefits from lower maker fees, or a more casual trader who primarily uses market orders?

So, you’re wondering about Coinsquare’s trustworthiness? It’s a valid question in the wild west of crypto! Finding reliable financial institutions is crucial, whether it’s digital currencies or, say, the more traditional markets – like when you’re searching for Finding a trustworthy forex broker in Austria. The need for due diligence remains the same; research is your best friend before entrusting your hard-earned cash, regardless of whether it’s Bitcoin or Euros.

| Exchange | Trading Fee | Withdrawal Fee |

|---|---|---|

| Coinsquare | Variable, Maker/Taker model (check their website for current rates) | Variable, depends on cryptocurrency and network (check their website for current rates) |

| Binance | Variable, Maker/Taker model (check their website for current rates) | Variable, depends on cryptocurrency and network (check their website for current rates) |

| Kraken | Variable, Maker/Taker model (check their website for current rates) | Variable, depends on cryptocurrency and network (check their website for current rates) |

| Coinbase Pro | Variable, Maker/Taker model (check their website for current rates) | Variable, depends on cryptocurrency and network (check their website for current rates) |

Customer Support

Coinsquare offers various customer support channels, including email, phone, and potentially live chat. The responsiveness and helpfulness of their support team can vary, as is the case with many customer support services across different industries. It’s always a good idea to check their website for the most up-to-date contact information and their stated response times. Remember, patience is a virtue, especially in the sometimes-challenging world of cryptocurrency support.

Coinsquare’s Reputation and User Reviews

Coinsquare, like any cryptocurrency exchange, has a reputation shaped by the collective experiences of its users. Sifting through the online chatter reveals a mixed bag, a veritable crypto-cocktail of praise and peril. While some users sing its praises, others offer a less harmonious tune. Understanding this duality is key to forming an informed opinion.Coinsquare’s Public Image and User Feedback SummaryPublicly available reviews on platforms like Trustpilot and the App Store showcase a spectrum of opinions.

While some users laud Coinsquare’s security measures and relatively user-friendly interface, others express frustration with customer support responsiveness and occasionally high fees. A careful analysis reveals recurring themes that paint a more nuanced picture of the exchange’s standing.

Notable Incidents and Controversies

Coinsquare’s history isn’t without its bumps in the road. While no catastrophic events have completely derailed the platform, several incidents have fueled negative reviews. For example, past instances of prolonged account verification processes or temporary service disruptions have led to user dissatisfaction and negative online commentary. These incidents, while not necessarily indicative of widespread systemic issues, highlight the importance of robust contingency planning and transparent communication with users.

Furthermore, comparisons with other exchanges often highlight areas where Coinsquare could improve. For instance, the lack of 24/7 customer support, compared to some competitors, has been a point of contention for many users.

Positive User Experiences

Many positive reviews highlight Coinsquare’s relatively straightforward user interface, making it accessible even for those new to cryptocurrency trading. Users often praise the platform’s security features, particularly its robust two-factor authentication system, providing a sense of security in managing their digital assets. Some users also cite the availability of a range of cryptocurrencies as a positive aspect, appreciating the diverse trading options offered.

For example, a user named “CryptoNewbie123” on Trustpilot stated, “I found Coinsquare easy to navigate, even as a beginner. The security features gave me confidence.”

Negative User Experiences

Conversely, negative reviews frequently focus on customer support issues. Response times are often cited as being too slow, with some users reporting difficulty resolving problems in a timely manner. High fees, especially compared to some competitors, are another recurring complaint. Furthermore, occasional technical glitches and website downtime have also contributed to negative experiences. One user, “DisgruntledTrader,” on a different review platform lamented, “Their customer support was unresponsive, and I spent days trying to resolve a simple issue.”

Summary of User Feedback by Aspect

To better understand the overall user sentiment, we can categorize feedback across key aspects:

| Aspect | Positive Feedback | Negative Feedback |

|---|---|---|

| Security | Robust two-factor authentication, generally secure platform | Concerns about past security incidents (though no major breaches reported) |

| Fees | Competitive fees in some areas | High fees compared to other exchanges in certain trading pairs |

| Customer Support | Helpful support staff in some cases | Slow response times, difficulty resolving issues |

| Trading Experience | User-friendly interface, diverse cryptocurrency selection | Occasional technical glitches, website downtime |

Key Themes Emerging from User Reviews

- Customer support responsiveness is a major area for improvement.

- Security is generally considered adequate, but past incidents raise some concerns.

- Fee structure is a point of contention, with some users finding them excessive.

- The platform’s user interface is generally praised for its ease of use.

- Occasional technical issues and downtime detract from the overall user experience.

Coinsquare’s Supported Cryptocurrencies and Trading Pairs: Is Coinsquare A Trustworthy And Reliable Cryptocurrency Exchange?

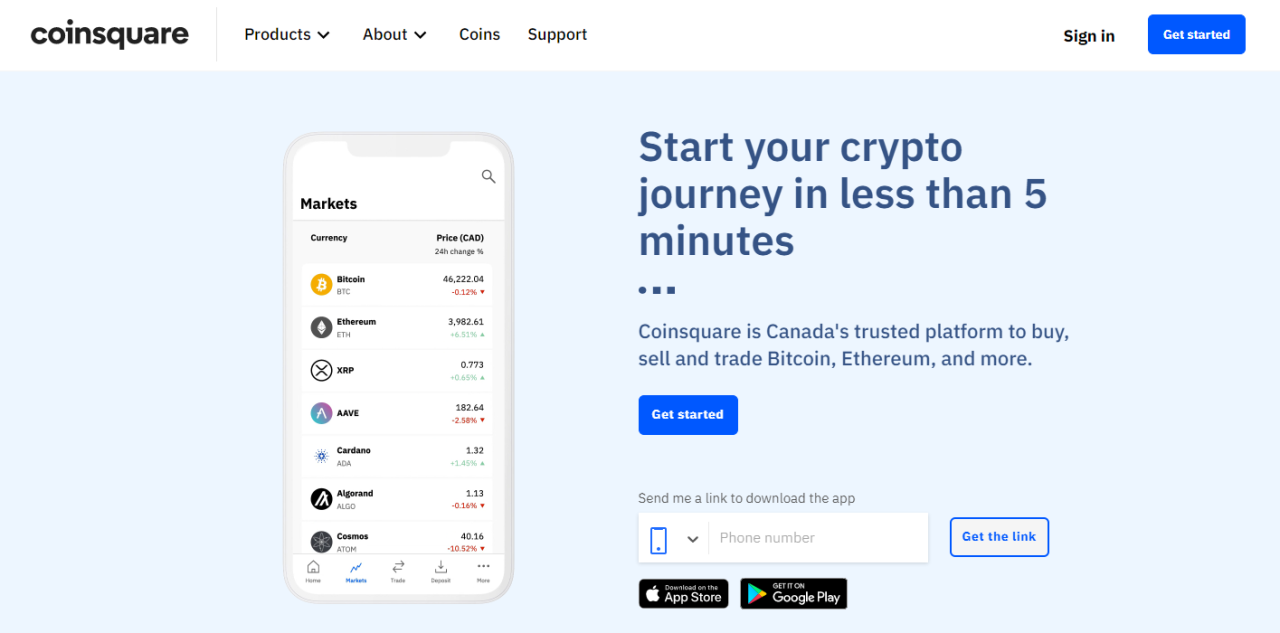

Coinsquare’s selection of cryptocurrencies might not boast the sheer volume of a behemoth like Binance, but it offers a curated collection designed for a specific type of investor. Think of it as a boutique selection rather than a sprawling supermarket of digital assets. This curated approach has its advantages, as we’ll explore.Coinsquare’s cryptocurrency offerings are tailored to cater to a range of investor needs, from beginners dipping their toes into the crypto world to more seasoned traders looking for established and reliable options.

While they may not offer every obscure altcoin imaginable, their focus on established and regulated assets provides a level of comfort and security that some might find appealing.

Supported Cryptocurrencies and Trading Pairs

Providing an exact, up-to-the-minute list of all cryptocurrencies and trading pairs available on Coinsquare is difficult because these offerings can change frequently. However, a typical selection might include Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and potentially several others, along with various trading pairs like BTC/CAD, ETH/CAD, and so on. It’s crucial to always check Coinsquare’s official website for the most current information.

So, is Coinsquare legit? That’s a question as old as time itself, or at least as old as Bitcoin. While pondering the trustworthiness of crypto exchanges, one might also wonder about the profitability of other ventures, like, say, Is automated forex trading profitable in Canada? – a completely different beast, but equally risky! Ultimately, the reliability of Coinsquare hinges on individual experiences, just like the success of any automated trading system.

So, do your research!

Comparison to Competitors

Compared to giants like Binance or Coinbase, Coinsquare’s range is more limited. Binance, for instance, offers hundreds, if not thousands, of cryptocurrencies. Coinbase, while smaller than Binance, still boasts a considerably wider selection than Coinsquare. This difference reflects a deliberate strategy by Coinsquare to prioritize security and regulatory compliance over sheer breadth of offerings.

Limitations on Trading Certain Cryptocurrencies, Is Coinsquare a trustworthy and reliable cryptocurrency exchange?

Coinsquare, being a Canadian exchange with a focus on regulatory compliance, might impose limitations on trading certain cryptocurrencies, especially those considered higher risk or less regulated. This could involve temporarily suspending trading in a specific cryptocurrency or restricting access to it altogether. This approach minimizes risk for both the exchange and its users, even if it means a smaller selection.

Catering to Different Investor Needs

Coinsquare’s selection of cryptocurrencies is designed to appeal to different investor profiles. Beginners might appreciate the focus on well-known and established cryptocurrencies like Bitcoin and Ethereum, reducing the complexity of navigating a vast and potentially overwhelming market. More experienced investors might find the platform suitable for trading established assets with a strong track record, focusing on stable, liquid pairings.

Categorization of Supported Cryptocurrencies by Market Capitalization

The following table provides a hypothetical example of how Coinsquare’s cryptocurrencies might be categorized by market capitalization. Remember, the actual list and categorization will vary based on market fluctuations and Coinsquare’s decisions.

| Cryptocurrency | Market Cap Category |

|---|---|

| Bitcoin (BTC) | Large Cap |

| Ethereum (ETH) | Large Cap |

| Litecoin (LTC) | Mid Cap |

| Bitcoin Cash (BCH) | Mid Cap |

| Dogecoin (DOGE) | Small Cap (Illustrative – actual listing subject to change) |

Coinsquare’s Transaction History and Speed

Navigating the sometimes-whimsical world of cryptocurrency transactions can feel like riding a rollercoaster – exhilarating, but potentially stomach-churning if things go wrong. Understanding the speed and reliability of your chosen exchange’s transactions is crucial, and Coinsquare is no exception. Let’s delve into the nitty-gritty of their transaction processing times.Coinsquare’s transaction processing times vary depending on several factors, but generally, they aim for relatively swift execution.

While instantaneous transfers are the holy grail of digital finance, the reality often involves a bit more waiting. Deposits typically clear within minutes to a few hours, while withdrawals, due to security protocols, can take anywhere from a few hours to a business day or two. This isn’t unusual compared to other exchanges; it’s a balancing act between speed and security.

Deposit and Withdrawal Workflow

A typical deposit involves sending cryptocurrency to your designated Coinsquare wallet address. Once the network confirms the transaction (which depends on the cryptocurrency’s blockchain speed – Bitcoin is notoriously slower than some others), Coinsquare credits your account. Conversely, withdrawals require initiating a request through the Coinsquare platform, providing the recipient’s wallet address, and then waiting for Coinsquare to process and send the funds.

Potential delays can stem from network congestion, verification procedures (to prevent fraud), and occasional technical glitches. Think of it like sending a registered letter – it takes a little longer, but it’s safer.

Factors Influencing Transaction Times

Several factors influence how quickly your Coinsquare transactions are processed. Network congestion on the underlying blockchain is a major player; if the network is overloaded, transactions can take significantly longer. The specific cryptocurrency you’re using also matters; Bitcoin, with its larger block size, can be slower than smaller, faster cryptocurrencies like Litecoin. Coinsquare’s own internal processing capacity and any ongoing maintenance can also contribute to delays.

Finally, verification processes, especially for larger withdrawals, add a layer of security that may slow things down, but ultimately adds to the platform’s overall security.

User Experiences and Comparisons

User experiences vary, with some reporting near-instantaneous transactions while others have experienced delays. Many users report that deposits are generally faster than withdrawals, a common trend across most exchanges. Comparing Coinsquare’s speeds to other exchanges is tricky, as speed depends heavily on the cryptocurrency and network conditions. However, Coinsquare generally falls within the average range for most exchanges, neither blazingly fast nor agonizingly slow.

Some users have compared their experiences favorably to exchanges with known issues of slow processing, highlighting Coinsquare’s relative efficiency in this aspect.

Concluding Remarks

So, is Coinsquare a trustworthy and reliable cryptocurrency exchange? The answer, as with most things in the crypto-sphere, is nuanced. While Coinsquare boasts regulatory compliance and robust security measures, the ultimate verdict rests on individual risk tolerance and trading preferences. Our exploration revealed a platform with both strengths and weaknesses, highlighting the importance of thorough due diligence before entrusting your digital assets to any exchange.

Remember, the crypto world is wild, so choose your steed wisely!