How to Open a Forex Account in Canada with Questrade Global: So you’re ready to dive into the thrilling (and sometimes terrifying) world of forex trading? Hold onto your toques, eh? This isn’t your grandma’s knitting circle; it’s the wild west of finance, but with more spreadsheets and less tumbleweeds. We’ll guide you through opening a Questrade Global account, navigating the paperwork jungle, and understanding the platform’s quirks – all while keeping your sense of humour intact (because let’s face it, you’ll need it).

This guide will walk you through the essential steps, from meeting the eligibility requirements (yes, there are rules, even in the wild west) to understanding the fees and navigating the trading platform. We’ll demystify the process, turning potential confusion into confident clicks. Prepare for a journey filled with charts, graphs, and the occasional exhilarating (or heart-stopping) trade.

Questrade Global Account Eligibility Requirements in Canada: How To Open A Forex Account In Canada With Questrade Global

So, you’re ready to dive into the thrilling world of forex trading with Questrade Global? Fantastic! But before you start imagining your yacht in the Mediterranean (don’t worry, we’ll get there!), let’s navigate the slightly less glamorous, but equally important, world of eligibility requirements. Think of this as the pre-flight checklist before your financial jet takes off.Becoming a Questrade Global forex trader isn’t a walk in the park, or a stroll down a Canadian beach (although those are lovely).

There are a few hoops to jump through, but don’t worry, we’ll make it painless (mostly). We’ll cover the age restrictions, residency needs, and the necessary documentation – the paperwork passport to your forex adventures.

Minimum Age Requirements

To open a Questrade Global forex account, you must be of legal age to enter into a contract in the province or territory of Canada where you reside. This generally means you must be at least 18 years old. However, some provinces may have higher age limits for certain financial activities. It’s always best to check the specific regulations in your province to ensure full compliance.

Think of it as the “Are you old enough to buy this” rating, but for serious financial dealings.

Residency Requirements

Questrade Global welcomes Canadian citizens and permanent residents. If you’re a Canadian citizen, your passport or birth certificate will be your best friend in this process. Permanent residents will need to provide their permanent resident card. Unfortunately, this isn’t a system where you can claim residency based on your extensive knowledge of Canadian hockey or poutine recipes (delicious as they are).

Proof of residency is essential.

So you want to conquer the forex world from the comfort of your Canadian cabin? Opening a Questrade Global forex account is easier than catching a moose (almost!). But before you dive in headfirst, you might want to check out this awesome comparison: Agr Forex vs Questrade: A comparison of forex trading platforms in Canada , to see if Questrade is your best bet.

Then, armed with knowledge, you’ll be ready to open that account and start trading like a pro (or at least, like someone who knows which platform to use!).

Required Documentation for Account Verification

Getting verified is like unlocking a secret level in a video game – once you’re in, the fun begins! To prove your identity, you’ll need a government-issued photo ID. This could be a passport, driver’s license, or other acceptable form of identification. Think of it as your digital “golden ticket” to the forex world. For proof of address, you’ll need a recent utility bill (gas, electricity, water), bank statement, or other official document showing your current address.

So, you’re ready to conquer the forex market? Opening a Questrade Global account in Canada is easier than finding a decent poutine – though maybe not that easy. Once you’ve navigated the account setup, you’ll have plenty of time to celebrate your financial wins with a delicious meal from halal culinary delights. Then, back to those forex charts, because even a winning trader needs a good meal plan! Remember, responsible trading is key, unlike choosing between shawarma and biryani.

This isn’t a game of “hide-and-seek” with your address; Questrade needs to know where to send your (hopefully) substantial profits.

Financial Requirements and Restrictions

While there isn’t a minimum deposit requirement to open a Questrade Global forex account, remember that forex trading involves risk. You’ll need sufficient funds to manage your trading activities and absorb potential losses. Think of it like this: you wouldn’t attempt to climb Mount Everest in flip-flops, would you? Similarly, don’t approach forex trading without a proper financial understanding and a cushion for unexpected market fluctuations.

Remember, responsible trading is key. Always trade within your means and never invest more than you can afford to lose. It’s a wise approach to consider your risk tolerance and overall financial situation before diving into the exciting but volatile world of forex.

Step-by-Step Guide to Opening a Questrade Global Forex Account

Embarking on your forex trading journey with Questrade Global? Buckle up, buttercup, because it’s smoother than a freshly-poured latte. This guide will walk you through the process with the grace of a seasoned ballroom dancer.

Account Application Form Completion

The Questrade Global application form is your passport to the exciting world of forex trading. Think of it less as a chore and more as a thrilling quest to fill in the blanks. You’ll be providing personal information, including your full name, address, date of birth, and social insurance number (SIN). Don’t worry, your details are handled with the utmost security—they’re safer than your grandma’s secret cookie recipe.

You’ll also need to choose a username and password; pick something memorable but not so obvious that a goldfish could crack it. Crucially, you’ll need to declare your trading experience and risk tolerance. Be honest! It’s like telling your doctor you’ve been sneaking extra cookies—it’s best to be upfront. Finally, you’ll select your account type and currency.

Uploading Supporting Documentation and Identity Verification, How to Open a Forex Account in Canada with Questrade Global

Now for the pièce de résistance: verifying your identity. Think of this as your digital handshake with Questrade Global. You’ll need to upload clear, legible copies of your government-issued photo ID (like a driver’s license or passport) and proof of address (a recent utility bill or bank statement will do the trick). Ensure these documents are crisp and easy to read; blurry photos are like trying to read a fortune teller’s scribbles – frustrating and unhelpful.

Opening a Forex account with Questrade Global in Canada? Piece of cake! First, gather your documents, then navigate their user-friendly site. But before you dive in headfirst, check out this insightful comparison: Comparing Questrade’s global FX offering with other Canadian forex brokers to make sure it’s the right fit for your trading style. Then, get back to conquering those currency markets!

Questrade Global will review your documents to confirm your identity. This process is vital for security and compliance, so don’t skip it.

Funding Your Questrade Global Forex Account

Ready to fuel your trading engine? Funding your account is as easy as ordering a pizza online (almost!). Questrade Global offers several convenient funding methods, including wire transfers, and potentially others depending on your region. Each method has its own quirks and potential fees, so be sure to check the specifics on the Questrade Global website. There’s usually a minimum deposit requirement, so be prepared to make a commitment (but not a reckless one!).

Once your funds are transferred, you’ll be ready to start trading. Remember, start small, learn the ropes, and don’t bet the farm on your first trade!

- Create an Account: Visit the Questrade Global website and click the “Open an Account” button. Prepare for a smooth and intuitive process.

- Complete the Application: Fill out the application form with accurate personal and financial information. Remember the cookie analogy from earlier!

- Upload Documents: Upload clear copies of your identification and address verification documents. No blurry photos allowed!

- Fund Your Account: Choose your preferred funding method and transfer the minimum required amount. Remember to check fees!

- Start Trading (responsibly!): Once your account is funded and verified, you’re ready to dip your toes into the exciting world of forex trading. Remember, responsible trading is key!

Understanding Questrade Global’s Forex Trading Platform and Tools

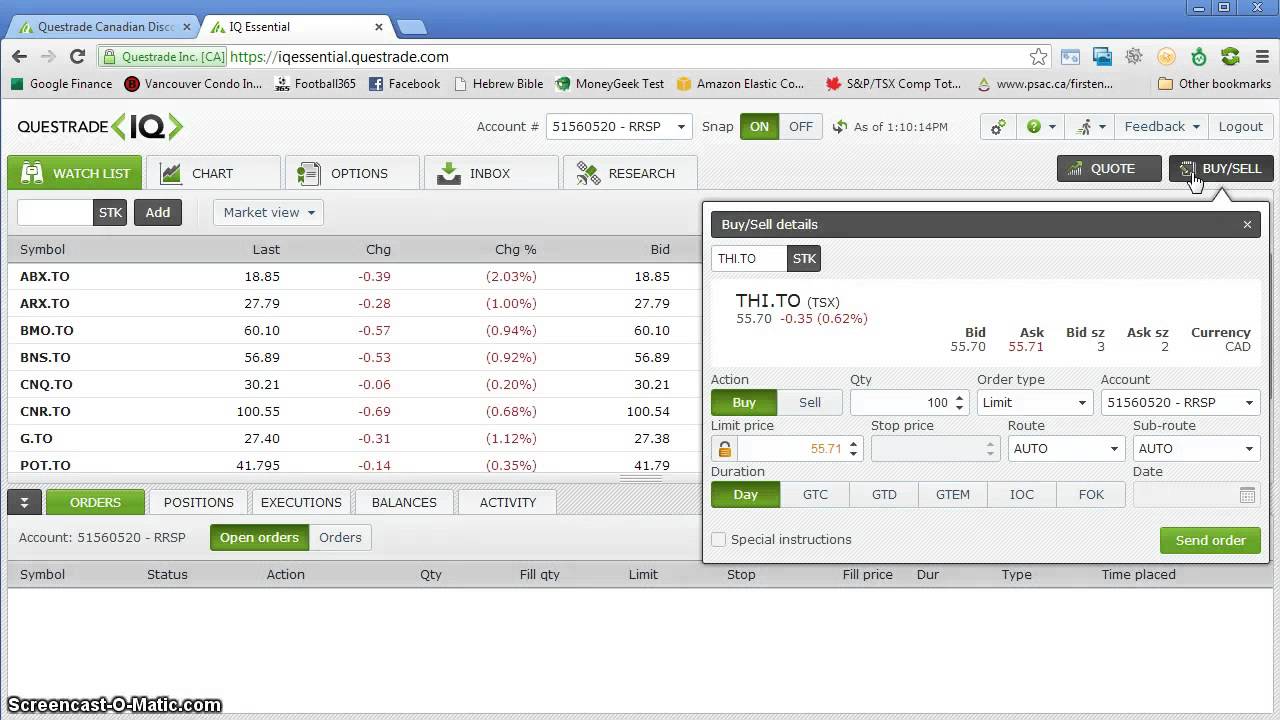

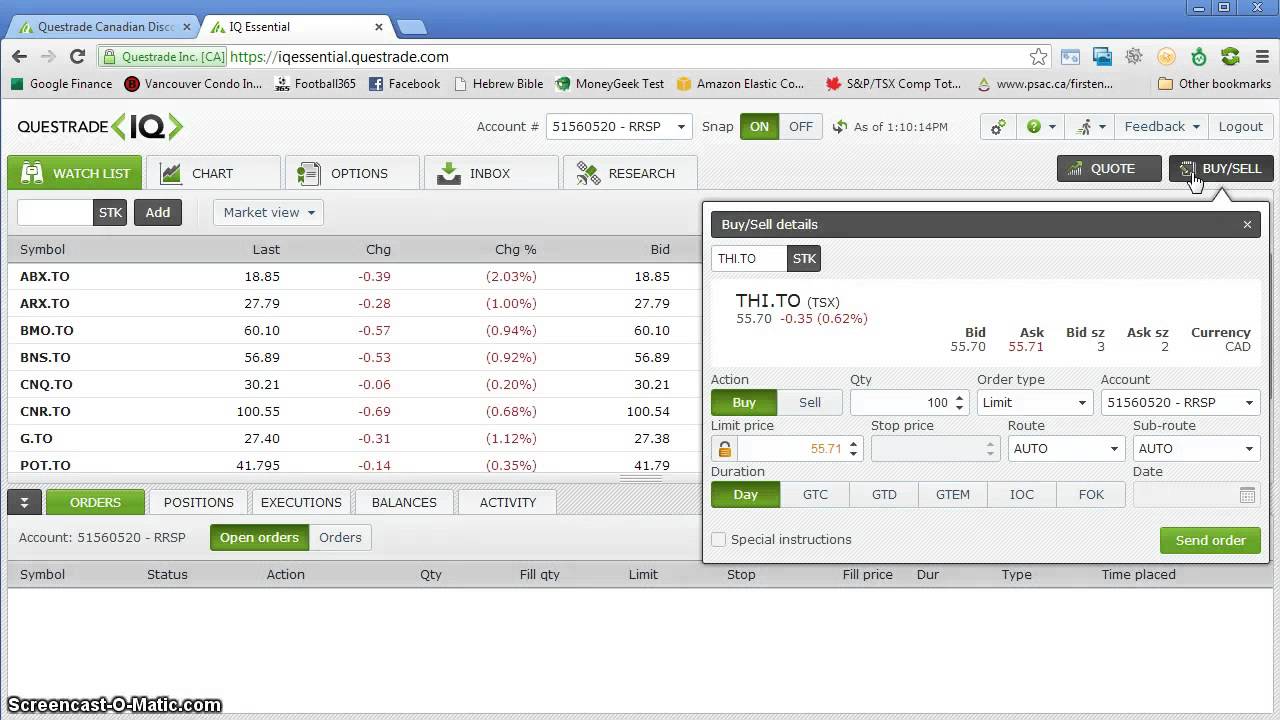

So, you’ve successfully navigated the treacherous waters of opening a Questrade Global forex account. Congratulations! Now, let’s dive into the exciting world of actuallyusing* their platform. Think of it as getting the keys to your brand new, high-powered trading spaceship – but before blasting off, you’ll want to familiarize yourself with the controls, right?Questrade Global offers a robust trading platform packed with features designed to make your forex trading experience smoother than a freshly-waxed polar bear.

Let’s explore what it has to offer, comparing it to some other major players in the Canadian forex brokerage scene.

Questrade Global Platform Comparison

Choosing the right forex trading platform is crucial, as it’s your cockpit for navigating the volatile world of currency markets. This table compares Questrade Global’s offerings against other prominent Canadian brokers. Note that specific features and fees are subject to change, so always verify directly with the broker.

| Broker Name | Platform Features | Fees (Illustrative Examples) | Customer Support |

|---|---|---|---|

| Questrade Global | Web-based platform, advanced charting, technical indicators, various order types, educational resources. | Spreads vary depending on currency pair; commissions may apply. Example: USD/CAD spread might average 1 pip. | Phone, email, online help center. Response times vary. |

| [Competitor A – Replace with actual Broker Name] | [List key features – e.g., MetaTrader 4/5, charting tools, etc.] | [Provide illustrative fee examples – e.g., commission per trade, spread averages] | [Describe customer support channels and typical response times] |

| [Competitor B – Replace with actual Broker Name] | [List key features] | [Provide illustrative fee examples] | [Describe customer support channels and typical response times] |

| [Competitor C – Replace with actual Broker Name] | [List key features] | [Provide illustrative fee examples] | [Describe customer support channels and typical response times] |

Charting Tools and Technical Indicators

The Questrade Global platform boasts a comprehensive suite of charting tools to help you visualize market trends and make informed trading decisions. Imagine it as your personal crystal ball, but instead of predicting the future, it helps you analyze past performance and potentially anticipate future price movements. You’ll find a variety of chart types (candlestick, bar, line), drawing tools (trend lines, Fibonacci retracements, etc.), and a plethora of technical indicators (RSI, MACD, moving averages, Bollinger Bands, and many more).

These tools are your secret weapons in deciphering the often-cryptic language of the forex market. For example, using moving averages can help smooth out price fluctuations and identify potential support and resistance levels.

So you want to conquer the forex world from the comfort of your Canadian cabin? Opening a Questrade Global forex account is easier than you think! Before diving headfirst into the thrilling (and sometimes terrifying) world of real money trading, however, check out this handy guide on Understanding Questrade’s practice account for forex trading beginners to hone your skills.

Then, armed with virtual victory (and hopefully fewer virtual losses!), you’ll be ready to open that real account and trade like a pro (or at least, a slightly less-clueless pro).

Educational Resources and Trading Tools

Navigating the forex market can feel like trying to solve a Rubik’s Cube while riding a unicycle – challenging, but rewarding with practice. Questrade Global understands this and provides a range of educational resources to empower its traders. These resources might include tutorials, webinars, market analysis reports, and perhaps even access to a demo account for risk-free practice.

These resources are invaluable for both beginners and seasoned traders looking to refine their strategies. Think of them as your forex training academy – equipping you with the knowledge and skills to succeed.

Order Types

Executing trades efficiently is key to successful forex trading. Questrade Global offers a variety of order types to suit different trading styles and risk tolerances.A market order is like shouting your order at the top of your lungs in a crowded marketplace – it executes immediately at the best available price. A limit order, on the other hand, is more patient.

It only executes if the price reaches your specified level. A stop-loss order is your safety net, automatically closing your position if the price moves against you by a certain amount, limiting potential losses. Think of it as your emergency parachute in case things go south. Other order types may also be available, offering additional flexibility and control over your trades.

Always familiarize yourself with the specific order types offered by Questrade Global and their implications before using them.

Fees and Charges Associated with Questrade Global Forex Trading

Navigating the world of forex trading can feel like traversing a dense jungle, but understanding the cost landscape is crucial to maximizing your profits (or at least minimizing your losses!). Let’s shed some light on the fees and charges associated with Questrade Global forex trading, so you can avoid any unwelcome surprises. Think of this as your survival guide to the forex financial wilderness.

Questrade Global, like other brokers, charges fees to cover their operational costs and, let’s be honest, to make a profit. These fees can significantly impact your overall trading performance, so it’s essential to understand what you’re paying for.

Questrade Global Forex Account Fee Schedule

Here’s a breakdown of the common fees you might encounter. Remember, always check Questrade Global’s official website for the most up-to-date information, as fees can change.

| Fee Type | Description | Amount | Currency |

|---|---|---|---|

| Spread | The difference between the bid and ask price of a currency pair. This is Questrade’s primary revenue source for forex trading. | Variable, depends on the currency pair and market conditions. | CAD (or the base currency of the pair) |

| Commission | A per-trade fee charged in addition to the spread, especially on larger trades. Questrade Global’s commission structure should be explicitly Artikeld in their fee schedule. | Variable, often dependent on trade volume. Check their website for details. | CAD (or the base currency of the pair) |

| Inactivity Fee | Charged if your account remains inactive for a specified period (e.g., six months or a year). | Varies; check Questrade’s specific terms and conditions. | CAD |

| Account Maintenance Fee | Some brokers charge a small monthly fee for maintaining the account, although this is less common with active traders. | Potentially applicable; check Questrade’s specific terms and conditions. | CAD |

| Withdrawal Fee | Charged for withdrawing funds from your account. | Varies depending on the withdrawal method. Check Questrade’s website for details. | CAD |

| Financing Fee (Overnight Fees/Swap Fees) | Charged for holding positions overnight, reflecting interest rate differentials between currencies. | Variable, depending on the currency pair and the interest rate differential. | CAD (or the base currency of the pair) |

Commissions and Spreads

Understanding the difference between commissions and spreads is crucial. The spread is the difference between the buy (ask) and sell (bid) price of a currency pair. It’s the broker’s profit margin built into the price. A smaller spread is generally better for the trader. Commissions, on the other hand, are separate fees charged per trade, usually on top of the spread.

Some brokers offer commission-free trading, but they often compensate by widening the spread.

Opening a Forex account with Questrade Global in Canada? Piece of cake! First, you’ll need some Canadian dollars, and if you’ve got 54 USD burning a hole in your pocket, check out this handy guide on How to convert 54 USD to CAD using Questrade or a similar platform to smoothly transition your funds. Once you’re all set with CAD, you’re practically ready to dive headfirst into the exciting world of forex trading with Questrade!

Inactivity and Other Hidden Charges

Many brokers, including Questrade Global, may impose inactivity fees if your account shows no trading activity for a prolonged period. This is to offset the cost of maintaining the account. Other potential “hidden” charges could include fees for specific services (like advanced research tools) or international wire transfers. Always carefully review the complete fee schedule and terms and conditions to avoid surprises.

Comparison with Other Canadian Forex Brokers

Questrade Global’s fee structure should be compared to other major Canadian forex brokers like Interactive Brokers, OANDA, and FXCM. Each broker has its own pricing model, so comparing spreads, commissions, and other fees is essential before choosing a platform. Look for transparent fee schedules and avoid brokers with unclear or overly complex pricing structures. Remember, the “best” broker depends on your individual trading style and volume.

Opening a Questrade Global forex account in Canada? Piece of cake! Just follow their straightforward process, but before you unleash your inner Gordon Gekko, consider this crucial question: Can I use Questrade for AI-powered forex trading strategies? The answer will heavily influence your trading style. Once you’ve sorted that out, you’ll be well on your way to conquering the Canadian forex market (or at least, having a slightly better shot at it than usual).

Risk Management and Security Measures with Questrade Global

Forex trading, while potentially lucrative, is inherently risky. Think of it like riding a rollercoaster – exhilarating, but with the potential for a stomach-churning drop. Understanding and implementing robust risk management strategies is crucial to mitigating potential losses and ensuring a sustainable trading journey. Questrade Global, recognizing this inherent volatility, provides various tools and safeguards to protect both your funds and your sanity.The unpredictable nature of currency markets means losses are a possibility, even with meticulous planning.

Factors like geopolitical events, economic indicators, and even social media trends can significantly impact currency values. Therefore, never invest more than you can afford to lose. Diversification, setting stop-loss orders (automatic sell orders to limit losses), and employing position sizing techniques are essential strategies to control risk. Imagine spreading your investments across different currency pairs like spreading your bets across different horses in a race – you’re less likely to lose everything if one horse stumbles.

Questrade Global’s Security Measures

Questrade Global employs a multi-layered security approach to protect client assets and data. This includes robust encryption protocols to safeguard personal and financial information transmitted online, sophisticated firewall systems to prevent unauthorized access, and regular security audits to identify and address potential vulnerabilities. Think of it as Fort Knox for your forex funds – multiple layers of protection designed to keep the bad guys out.

Furthermore, client funds are segregated from Questrade Global’s operating capital, meaning your money is kept separate and protected even in the unlikely event of financial difficulties. This separation provides an additional layer of security and peace of mind.

Regulatory Oversight and Client Protections

Questrade Global operates under the regulatory oversight of the Ontario Securities Commission (OSC) and is a member of the Investment Industry Regulatory Organization of Canada (IIROC). This regulatory framework provides a crucial safety net for Canadian clients, ensuring adherence to strict financial regulations and investor protection standards. IIROC’s oversight includes monitoring trading activities, enforcing compliance rules, and providing dispute resolution mechanisms.

Think of them as the referees of the financial world, making sure the game is played fairly. This regulatory framework offers significant protection, including compensation for losses due to specific types of misconduct by the firm, providing an additional layer of confidence for traders.

Client Support and Dispute Resolution

Questrade Global offers various client support channels, including phone, email, and online resources. Their customer service team is trained to assist with account inquiries, technical issues, and trading-related questions. In the event of a dispute, Questrade Global has established procedures for resolving complaints, including internal review processes and, if necessary, escalation to IIROC’s dispute resolution services. They aim to provide a smooth and efficient process for addressing any concerns or disagreements.

Having readily available support is like having a safety net beneath your trading platform – a reliable resource to catch you if you stumble.

Illustrative Example of Account Opening Process

Let’s follow the hilarious yet surprisingly straightforward journey of Barry, a Canadian maple syrup enthusiast with a penchant for financial adventure, as he navigates the world of Questrade Global forex trading. His goal? To finally understand if those rumours about forex trading being like a rollercoaster of emotions are true (spoiler: they are).Barry, armed with his trusty Tim Hortons double-double and a healthy dose of skepticism, decides to open a Questrade Global forex account.

He’s heard whispers of its user-friendly platform and competitive fees, and frankly, he’s tired of his investments only yielding the same returns as his annual hockey pool.

Account Application and Verification

Barry begins the online application process, feeling a little like he’s filling out a particularly intense tax form. He provides his personal information, address (complete with the obligatory Canadian postal code), and answers a few security questions that test his knowledge of Canadian geography (turns out, remembering the capital of Newfoundland and Labrador is crucial for forex trading success). The verification process involves uploading a copy of his driver’s license and a utility bill, proving he actually lives where he says he lives and isn’t some sort of forex-trading phantom.

He initially struggles to get a clear picture of his utility bill, resulting in a few rejected uploads. Finally, he discovers that his neighbour’s cat, Mittens, wasn’t in the frame of his last upload. Success!

Initial Funding

After a successful verification, Barry links his Canadian bank account to his new Questrade Global account. He opts for an e-transfer, a method as Canadian as hockey and poutine. The funds transfer smoothly, although he briefly panics when the transaction status says “pending” for a few minutes – a suspenseful period only rivalled by the final seconds of a Stanley Cup game.

Account Dashboard Overview

Once the funds clear, Barry is greeted with his shiny new Questrade Global account dashboard. It’s surprisingly intuitive, even for someone who once accidentally ordered 1000 pounds of maple syrup online. The dashboard displays his account balance (looking rather meagre at this point), his open positions (currently none, much to his relief), a chart displaying real-time currency movements (which seem to be fluctuating more wildly than Barry’s emotions), and a menu of trading tools.

He notices the account also includes a detailed transaction history, a helpful feature for tracking those moments of both triumph and despair.

Placing a Sample Trade

Feeling emboldened (and slightly caffeinated), Barry decides to place his first trade. He chooses a buy order for the EUR/USD currency pair, aiming for a small position size of 10,000 units. He sets a stop-loss order to limit potential losses and a take-profit order to secure his gains. The entire process is surprisingly smooth, even if the flashing numbers on the screen momentarily give him heart palpitations.

He’s now officially a forex trader, although he’s still not entirely sure what he’s doing.

Final Thoughts

Conquering the forex frontier with Questrade Global is now within your grasp! You’ve learned the ropes, from eligibility checks to understanding the platform’s nuances. Remember, while the potential rewards are enticing, responsible trading is key. So, go forth, Canadian trader, armed with knowledge and a healthy dose of caution. May your trades be profitable, and your coffee always strong.

Happy trading!