Understanding Questrade’s practice account for forex trading beginners: Dive headfirst into the thrilling (and slightly terrifying) world of forex trading without risking your life savings! This isn’t your grandpappy’s lemonade stand; we’re talking about global currencies, leveraged bets, and the potential to make (or lose) a small fortune. But fear not, fledgling financier! Questrade’s practice account is your virtual sandbox, a safe space to hone your skills and learn the ropes before unleashing your inner Gordon Gekko on the real market.

Get ready to conquer the world of forex, one virtual dollar at a time.

This guide will walk you through setting up your Questrade practice account, navigating the platform’s interface, understanding the mechanics of forex trading (including the sometimes-scary concepts of leverage and margin), developing effective risk management strategies, and utilizing Questrade’s educational resources. We’ll also explore the psychological shift from practice to live trading, ensuring you’re prepared for the real deal. Buckle up, it’s going to be a wild ride!

Account Registration and Setup: Understanding Questrade’s Practice Account For Forex Trading Beginners

Embarking on your forex trading journey with Questrade’s practice account is like taking a test drive before buying the actual sports car – you get to experience the thrill without risking your hard-earned cash. This section will guide you through the simple, yet crucial, steps of setting up your virtual trading playground.Creating a Questrade practice account is surprisingly straightforward, even for digital dinosaurs.

It’s a process designed to be user-friendly, so don’t worry about accidentally launching a nuclear missile (that’s a different kind of trading altogether).

Registration Process

To begin your practice account adventure, navigate to the Questrade website and locate the “Practice Account” or similar section. You’ll be prompted to create an account, which typically involves providing your email address, creating a strong password (think something memorable, but not “password123”), and choosing a username. Think of this as your digital alter ego – the fearless forex trader you always knew you could be.

So, you’re a forex newbie wrestling with Questrade’s practice account? Mastering virtual trades is key before diving into the real thing. To truly grasp the market forces at play, understanding the role of major players is vital, like those Dollar dealer definition and role in the Canadian forex market , which significantly impacts Canadian currency fluctuations. Then, armed with this knowledge, return to Questrade’s demo and conquer those virtual trades like a pro!

You will also need to provide some personal information such as your full name, address, and date of birth to comply with regulatory requirements. Remember, even in the practice arena, rules exist.

So you’re diving into the wild world of forex with Questrade’s practice account? Smart move, newbie! Before you risk your hard-earned loonies, though, consider checking out this resource for finding a Reliable day trading app with low commission fees in Canada? to compare options. Once you’ve done your research and are ready to graduate from the practice account, you’ll be a forex trading ninja!

Information Required

During registration, Questrade will require certain information to verify your identity and comply with Know Your Customer (KYC) regulations. This is essential for maintaining the security and integrity of the platform. Think of it as your virtual passport to the world of forex. Expect to provide details such as your full name, address, date of birth, and possibly your social security number (depending on your jurisdiction).

Mastering forex on Questrade’s demo account? Think of it as your virtual forex playground before diving into the real thing. But if stocks and ETFs are also on your radar, you might want to check out the Best Canadian day trading app for both stocks and ETFs? to see what else is out there. Then, armed with this broader knowledge, return to conquering Questrade’s practice account and become a forex ninja!

You may also be asked to answer some security questions to further protect your account.

Verification Process

After submitting your application, Questrade may request additional verification steps. This could involve verifying your email address through a link sent to your inbox or providing identification documents such as a driver’s license or passport. This process is vital to ensure the security of your account and prevent fraudulent activities. Consider it your digital security clearance. It may take a few minutes to a few days, depending on Questrade’s verification procedures.

Practice Account vs. Live Account

Understanding the differences between a practice and live account is crucial before you leap into the exciting (and sometimes terrifying) world of real forex trading. The table below highlights the key distinctions:

| Feature | Practice Account | Live Account | Key Difference Summary |

|---|---|---|---|

| Funds | Virtual money provided by Questrade | Your own real money | Risk vs. Reward |

| Trading Conditions | Simulates real market conditions | Real market conditions, including slippage and commissions | Simulated vs. Real |

| Consequences of Losses | No financial consequences | Financial losses from trades | Zero Risk vs. Financial Risk |

| Account Features | Full range of trading tools and features | Full range of trading tools and features, plus access to withdrawals and deposits | Limited Access vs. Full Access |

Understanding Forex Trading Mechanics on Questrade

So, you’ve bravely navigated the treacherous waters of Questrade account registration. Congratulations! Now, let’s dive into the exhilarating (and sometimes terrifying) world of forex trading mechanics. Think of it as learning to ride a rollercoaster – initially terrifying, but once you get the hang of it, incredibly thrilling (and potentially profitable!).

Leverage and Margin in Forex Trading

Forex trading uses leverage, a powerful tool that allows you to control a larger position than your account balance would normally allow. Imagine it as borrowing money from Questrade to amplify your potential profits (and losses!). For example, a 1:50 leverage means you can control $50 worth of currency for every $1 in your account. Margin is the amount of money you need to keep in your account to maintain your leveraged position.

Questrade will require a certain margin percentage; if your account balance falls below this level (a margin call!), Questrade might automatically close your positions to limit your losses. Think of margin as the security deposit for your forex rollercoaster ride. Remember, high leverage magnifies both gains and losses – it’s a double-edged sword that needs careful handling.

Mastering forex trading? Start with Questrade’s practice account – it’s like a virtual playground for your financial ambitions! Once you’re ready to dive into the real thing, check out How to open a Questrade forex account for international students in Canada for a smooth transition. Then, armed with experience and a live account, you can conquer the forex world (or at least, make slightly less disastrous trading decisions).

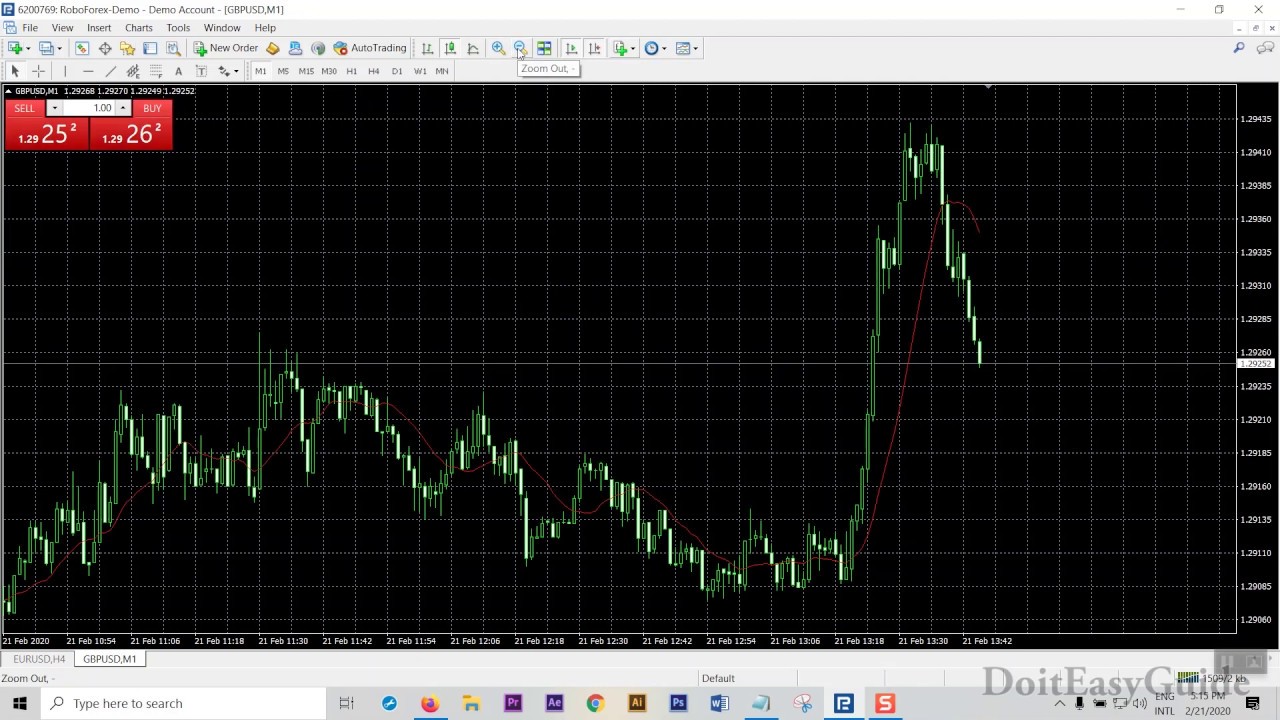

Interpreting Forex Charts and Indicators

Questrade offers various charting tools to visualize currency price movements. These charts typically display price (usually in the form of candlestick charts) over time, allowing you to identify trends and patterns. Indicators are mathematical calculations applied to price data, designed to provide additional insights. Common indicators include moving averages (smoothing out price fluctuations to identify trends), Relative Strength Index (RSI) to gauge momentum and potential overbought/oversold conditions, and MACD (Moving Average Convergence Divergence) to identify potential shifts in momentum.

Interpreting these charts and indicators requires practice and understanding of technical analysis principles. Don’t expect to become a chart-reading guru overnight; it’s a skill honed over time.

Order Types and Execution

Questrade offers various order types to execute your trades. A market order is executed immediately at the best available price. Think of it as shouting your order at the top of your lungs in a crowded marketplace. A limit order lets you specify the price at which you want to buy or sell. It’s like setting a price target and waiting for the market to come to you.

So, you’re diving into the wild world of forex with Questrade’s practice account – smart move! Mastering virtual trades before risking real cheddar is key. But if you’re itching for a real-world Canadian experience with low fees and high leverage, check out this awesome resource: Best forex trading app in Canada with low fees and high leverage.

Then, armed with knowledge and maybe a new app, confidently conquer Questrade’s practice account and become a forex ninja!

A stop-loss order automatically closes your position if the price moves against you, limiting potential losses. This is your safety net, preventing a small mistake from becoming a financial catastrophe. Placing these orders on the Questrade platform is typically done through an intuitive order entry window.

Comparison of Forex Pairs

Understanding the characteristics of different currency pairs is crucial for successful forex trading. Volatility refers to how much a currency pair’s price fluctuates. Major pairs (like EUR/USD) are generally more liquid and less volatile than exotic pairs (like USD/TRY).

| Currency Pair | Description | Volatility | Liquidity |

|---|---|---|---|

| EUR/USD | Euro/US Dollar – The most traded pair | Medium | High |

| USD/JPY | US Dollar/Japanese Yen – Influenced by economic data from both countries | Medium | High |

| GBP/USD | British Pound/US Dollar – Often affected by Brexit-related news | Medium-High | High |

| USD/CAD | US Dollar/Canadian Dollar – Sensitive to commodity prices | Medium-Low | High |

Risk Management and Practice Strategies

So, you’ve conquered the Questrade practice account setup and are bravely wading into the wild world of forex trading. Congratulations! But before you start throwing virtual money at exotic currency pairs like a confetti cannon at a wedding, let’s talk about something crucial: risk management. Think of it as your financial life raft in the stormy seas of the forex market – you’ll be glad you packed it.Risk management in forex trading, especially for beginners, isn’t about avoiding losses entirely (that’s about as likely as finding a unicorn riding a unicycle).

So you’re diving headfirst into the wild world of forex trading with Questrade’s practice account? Smart move, rookie! Before you start making virtual millions (or losing them – it’s all practice!), maybe grab a quick break and check out some football news to clear your head. Then, armed with fresh perspective and hopefully some winning team inspiration, get back to mastering those currency charts and becoming a Questrade forex pro!

It’s about controlling losses and maximizing your chances of long-term success. It’s the difference between a thrilling roller coaster ride and a terrifying freefall.

Stop-Loss and Take-Profit Orders

Stop-loss and take-profit orders are your best friends in the forex world. A stop-loss order automatically closes your trade when the price moves against you by a predetermined amount, limiting your potential losses. Think of it as your emergency brake. A take-profit order automatically closes your trade when the price moves in your favor by a predetermined amount, securing your profits.

This is your “cash out” button, ensuring you don’t let a winning trade turn sour. Setting these orders before entering a trade is essential, preventing emotional decisions during market fluctuations. For example, if you buy EUR/USD at 1.1000, you might set a stop-loss at 1.0980 (limiting your loss to 20 pips) and a take-profit at 1.1030 (securing a 30 pip profit).

Position Sizing

Position sizing is all about determining how much capital to risk on each trade. It’s not about how much you

- want* to win, but how much you’re

- willing* to lose. A common strategy is to risk only a small percentage of your account balance (e.g., 1-2%) on any single trade. Let’s say you have a $1000 practice account and decide to risk 1%. That means you’d only risk $10 on each trade. This helps prevent a single losing trade from wiping out your account.

Proper position sizing allows you to survive the inevitable losing trades and stay in the game long enough to profit from the winning ones.

Best Practices for Risk Management in a Practice Forex Trading Environment

Before diving into the real thing, your practice account is the perfect place to hone your risk management skills. Here’s a list of best practices:

- Define your risk tolerance: How much are you comfortable losing on a single trade or over a series of trades? This is a personal decision, but a good starting point is 1-2% of your account balance.

- Always use stop-loss orders: Never enter a trade without a pre-defined stop-loss. It’s your safety net.

- Experiment with different position sizing strategies: Find what works best for your trading style and risk tolerance.

- Keep a detailed trading journal: Record every trade, including your entry and exit points, stop-loss and take-profit levels, and the rationale behind your decisions. This allows you to analyze your performance and identify areas for improvement.

- Practice patience: Don’t rush into trades. Take your time to analyze the market and wait for high-probability setups.

- Don’t chase losses: If a trade goes against you, don’t try to recover your losses by increasing your position size. Stick to your risk management plan.

- Regularly review your performance: Analyze your trading journal and identify areas where you can improve your risk management strategies.

Utilizing Questrade’s Educational Resources

So, you’ve bravely ventured into the wild world of forex trading with Questrade’s practice account. Congratulations! Now, let’s talk about leveling up your skills beyond just clicking buttons. Questrade, bless their cotton socks, offers a surprisingly robust selection of educational resources designed to help you avoid becoming another forex statistic (the kind involving significant losses, not the kind involving impressive feats of mathematical prowess).Questrade’s educational resources act as your personal forex Sherpas, guiding you through the treacherous (but potentially lucrative!) terrain of currency trading.

They’re not just dusty old textbooks; they’re interactive tools and informative materials designed to make learning engaging and, dare we say, even fun. Mastering these resources will significantly improve your understanding of forex strategies, risk management, and overall trading proficiency. Think of them as your secret weapon in the quest for forex financial freedom (or at least, slightly less stressful trading).

Questrade’s Forex Educational Resources Overview

Questrade provides a variety of learning materials, catering to different learning styles. These resources range from beginner-friendly articles and videos to more advanced webinars and market analyses. They are designed to build a solid foundation in forex trading concepts and equip you with the knowledge needed to navigate the complexities of the market. Effective utilization of these resources can significantly enhance your trading skills and minimize potential losses.

Utilizing Questrade’s Learning Materials for Strategy Development

The educational resources aren’t just passive information dumps; they’re actively designed to help you develop and refine your forex trading strategies. For instance, learning about different chart patterns through their video tutorials allows you to identify potential entry and exit points with greater confidence. Similarly, understanding fundamental analysis through their articles can help you make informed decisions based on economic indicators and news events.

By combining this knowledge with your practice trading experience, you can begin to formulate your own unique and effective trading strategies.

Examples of Effective Resource Utilization for Skill Enhancement

Let’s say you’re struggling to understand candlestick patterns. Instead of just staring blankly at charts, you can watch Questrade’s video tutorials on candlestick patterns multiple times, pausing and rewinding as needed. You can then apply this knowledge to your practice account, identifying patterns on real-time charts and testing your analysis. If you’re having trouble with risk management, review their articles and webinars on position sizing and stop-loss orders.

Practice implementing these concepts in your practice account, observing how they affect your trades and adjusting your approach as needed. Remember, consistent review and practical application are key.

Summary of Questrade’s Educational Resources

| Resource Type | Description | Link (if applicable) | Example Use Case |

|---|---|---|---|

| Articles | In-depth articles covering various forex topics. | (This would typically link to a Questrade education page. I cannot provide a specific live link as these change.) | Learning about fundamental analysis to understand the impact of economic news on currency pairs. |

| Videos | Tutorials and webinars explaining forex concepts visually. | (This would typically link to a Questrade education page. I cannot provide a specific live link as these change.) | Understanding candlestick patterns and their implications for trading decisions. |

| Webinars | Live or recorded sessions with forex experts. | (This would typically link to a Questrade education page. I cannot provide a specific live link as these change.) | Learning advanced trading strategies and techniques from experienced traders. |

| Market Analysis | Regular updates and insights on current market conditions. | (This would typically link to a Questrade education page. I cannot provide a specific live link as these change.) | Staying informed about market trends and adjusting your trading strategies accordingly. |

Transitioning from Practice to Live Trading

So, you’ve conquered the virtual world of Questrade’s practice account, trading forex like a seasoned pro (or at least, like a seasoned pro pretending to be a seasoned pro). Congratulations! But the real game is about to begin. The transition from practice to live trading is a significant leap, akin to graduating from a flight simulator to piloting a real plane – except instead of potential mid-air collisions, you’re dealing with the potential for financial turbulence.

Don’t worry, though; with the right preparation, you can make this transition smoothly.The key differences between a practice and a live account are, frankly, as stark as the difference between Monopoly money and actual cash. In your practice account, losses are virtual, meaning you can make wildly speculative trades without the sting of real financial consequences. In a live account, those losses become very real, very quickly.

The emotional impact of watching your hard-earned money dwindle is a significant factor often underestimated by new traders. The pressure is palpable. You’ll also be dealing with real-time market fluctuations and the potential for unexpected events that your practice account couldn’t quite replicate.

Key Differences Between Practice and Live Accounts

The emotional impact of real money trading is far greater than simulated trading. In a practice account, the psychological barriers to making risky trades are far lower. Live trading introduces the fear of loss, the pressure to perform, and the temptation to over-trade or panic sell. These psychological factors can significantly impact trading decisions, leading to impulsive actions that might not align with your trading plan.

Understanding and managing these emotions is crucial for success in live forex trading.

Psychological Aspects of the Transition

The jump from simulated trading to live trading often reveals unexpected psychological challenges. The absence of real financial risk in a demo account can foster overconfidence and lead to reckless trading strategies. Conversely, the fear of real losses can cause hesitation and missed opportunities. Many new traders experience a period of adjustment where their trading performance dips initially before stabilizing.

This is perfectly normal. Learning to manage the emotional rollercoaster is a key skill to develop.

Checklist Before Transitioning to Live Trading

Before you dive headfirst into the thrilling (and sometimes terrifying) world of live forex trading, take a deep breath and check this list:

- Define your risk tolerance: How much money are you comfortable losing without significantly impacting your financial well-being? This is crucial for setting realistic stop-loss orders.

- Develop a robust trading plan: This isn’t just a vague idea; it’s a detailed document outlining your trading strategy, risk management techniques, and emotional controls.

- Backtest your strategy thoroughly: Use historical data to simulate your trading plan and identify potential weaknesses before risking real money.

- Fund your account responsibly: Start with a smaller amount than you initially planned to invest. This allows you to gain experience with live trading without risking substantial capital.

- Understand Questrade’s fees and commissions: These can significantly impact your profitability, so factor them into your trading calculations.

- Practice, practice, practice: Even after feeling comfortable on the practice account, continue practicing until you feel completely confident in your abilities and strategy.

Considerations Before Live Trading, Understanding Questrade’s practice account for forex trading beginners

- Emotional preparedness: Are you mentally prepared for potential losses? Have you developed strategies to manage trading stress and avoid impulsive decisions?

- Financial preparedness: Do you have a sufficient emergency fund and other financial safety nets in place to absorb potential losses?

- Trading plan adherence: Can you stick to your trading plan even when facing losses or strong emotional impulses?

- Continuous learning: Are you committed to continuous learning and improvement of your trading skills?

Ending Remarks

So, you’ve conquered the virtual forex battlefield and emerged victorious (or at least, not completely bankrupt). Congratulations! You’ve now laid the groundwork for a potentially lucrative (and definitely educational) journey into the world of forex trading. Remember, practice makes perfect, and even the most seasoned traders started somewhere. Questrade’s practice account is your secret weapon, allowing you to refine your strategies, manage risk effectively, and build the confidence you need to transition to live trading.

Now go forth and trade – responsibly, of course!