How to open and use a Questrade practice account for forex? Ah, the siren song of simulated riches! Before you leap into the thrilling (and sometimes terrifying) world of real forex trading, Questrade offers a virtual playground where you can hone your skills without risking your hard-earned cash. This guide will walk you through the process, from setting up your account to mastering the art of the simulated trade – think of it as forex boot camp, but with less screaming and more satisfying virtual profits (or, you know, losses – it’s all part of the learning experience!).

Prepare for a journey into the fascinating world of virtual currency, where the only thing at stake is your pride (and maybe a little bit of your sanity).

We’ll cover everything from the straightforward account registration process (no hidden traps, we promise!), to navigating Questrade’s forex platform (it’s surprisingly user-friendly, once you get the hang of it), and finally, the art of placing and managing practice trades. We’ll even delve into the crucial differences between a practice account and a live one – trust us, there are some key distinctions.

By the end, you’ll be ready to confidently tackle the world of forex trading, armed with the knowledge and experience gained from your Questrade practice account. Buckle up, buttercup, it’s going to be a wild ride!

Account Registration Process

Embarking on your forex trading journey with a Questrade practice account is like taking a test drive before buying the car – exciting, risk-free, and a fantastic way to learn the ropes. This process is surprisingly straightforward, even for those whose tech skills are less than stellar (we’ve all been there!). Let’s navigate the registration waters together.

Creating a Questrade practice account for forex trading involves a few simple steps. Think of it as filling out a slightly more detailed online form than your average pizza order. The key is to be accurate and patient; rushing could lead to unexpected hiccups later.

Required Information for Practice Account Registration

The information required to open a Questrade practice account is minimal compared to a real account. This is because there’s no real money involved, reducing the need for extensive verification. However, you still need to provide some basic details to ensure a smooth and secure experience.

The registration process begins with visiting the Questrade website and navigating to the practice account section (imagine a button clearly labelled “Practice Account” – it’s usually prominently displayed). You’ll then be presented with a registration form. This form will require specific information to create your account.

Step-by-Step Guide to Account Creation

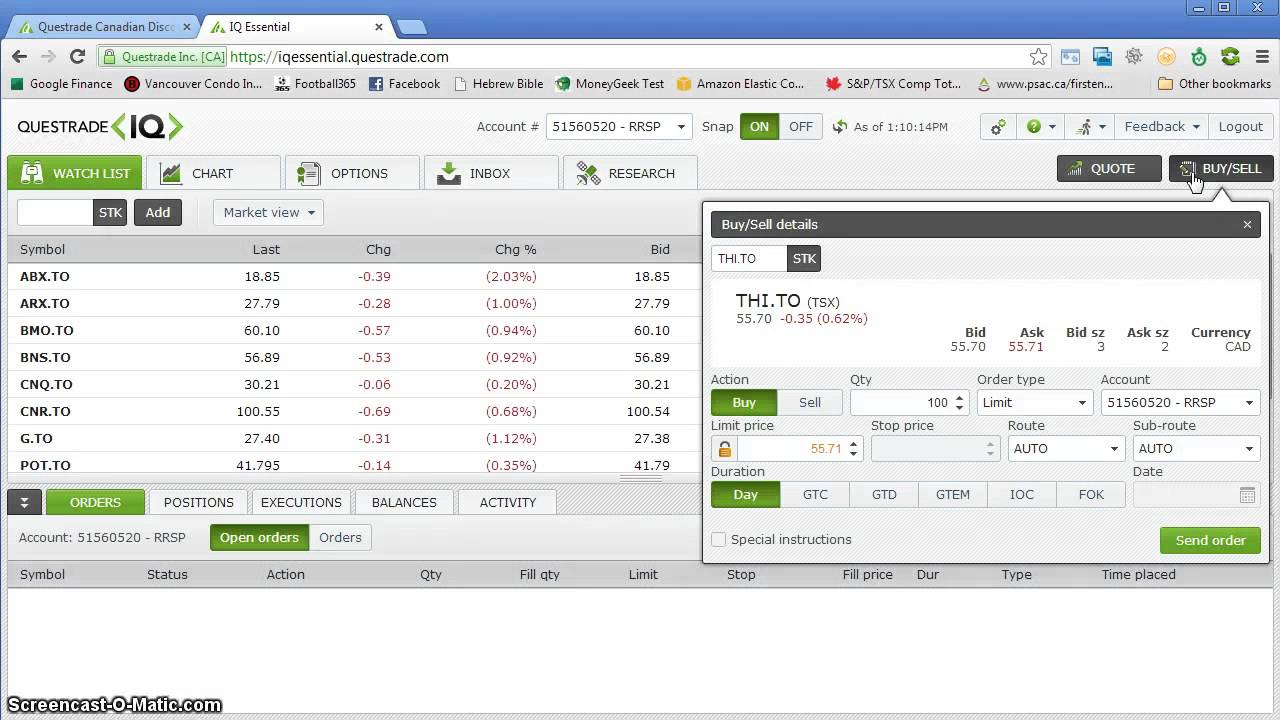

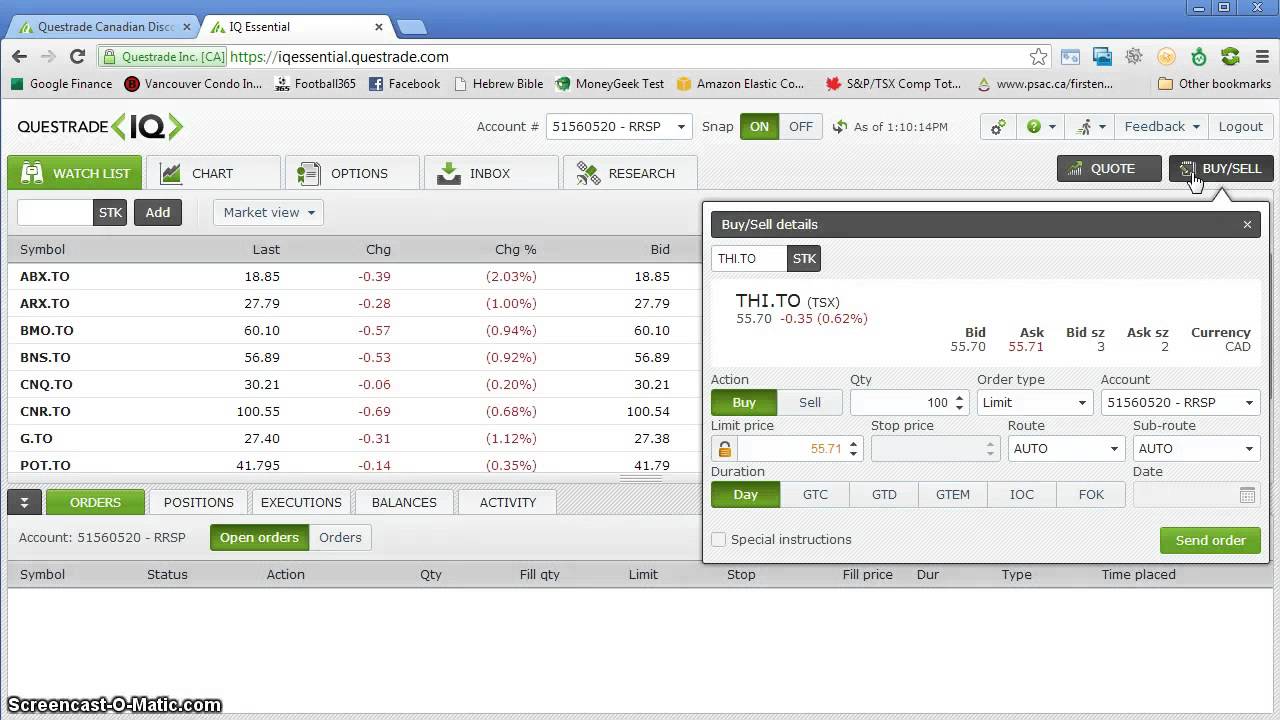

Let’s break down the account creation process step-by-step. Each step will be accompanied by a detailed description of a hypothetical screenshot. Remember, these screenshots are illustrative; your actual screens might have slightly different layouts depending on Questrade’s updates.

- Screenshot 1: The Welcome Screen. This screen shows a welcoming message and two prominent buttons: “Open a Real Account” and “Open a Practice Account.” The “Open a Practice Account” button is brightly colored, perhaps blue or green, to draw your attention. Below the buttons, there might be some brief information about the benefits of a practice account.

- Screenshot 2: Personal Information. This screen shows a form requiring basic personal details. Fields include First Name, Last Name, Email Address, and a Password. There’s a clear indication of required fields (perhaps with an asterisk). A small note at the bottom might remind you to choose a strong password.

So you want to conquer the forex world with Questrade’s practice account? Excellent! Mastering virtual trades is key before risking real cheddar. But if you’re also eyeing the Canadian stock market, check out Best app for day trading stocks and ETFs in Canada. for some killer day-trading apps. Then, armed with knowledge from both worlds, return to your Questrade practice account and become a forex tycoon (or at least, a slightly less broke one).

- Screenshot 3: Account Creation Confirmation. After submitting your details, this screen displays a confirmation message, perhaps saying something like, “Your practice account has been successfully created!” It might also provide your account login details or a link to your account dashboard. There might also be links to helpful resources or tutorials.

Comparison of Practice and Real Account Information

The following table compares the information required for a practice account versus a real account. Note that real accounts require significantly more verification to comply with regulatory requirements.

| Information | Practice Account | Real Account |

|---|---|---|

| Name | Required (First and Last) | Required (First and Last), Legal Name as per Government ID |

| Email Address | Required | Required, must be verifiable |

| Password | Required (must meet complexity requirements) | Required (must meet complexity requirements) |

| Address | Not Required | Required (Full Residential Address, Proof of Address required) |

| Phone Number | Not Required | Required (for account verification and security) |

| Financial Information | Not Required | Required (Bank Account Details for funding and withdrawals) |

| Government-Issued ID | Not Required | Required (Passport, Driver’s License, etc., for verification) |

Navigating the Questrade Forex Platform

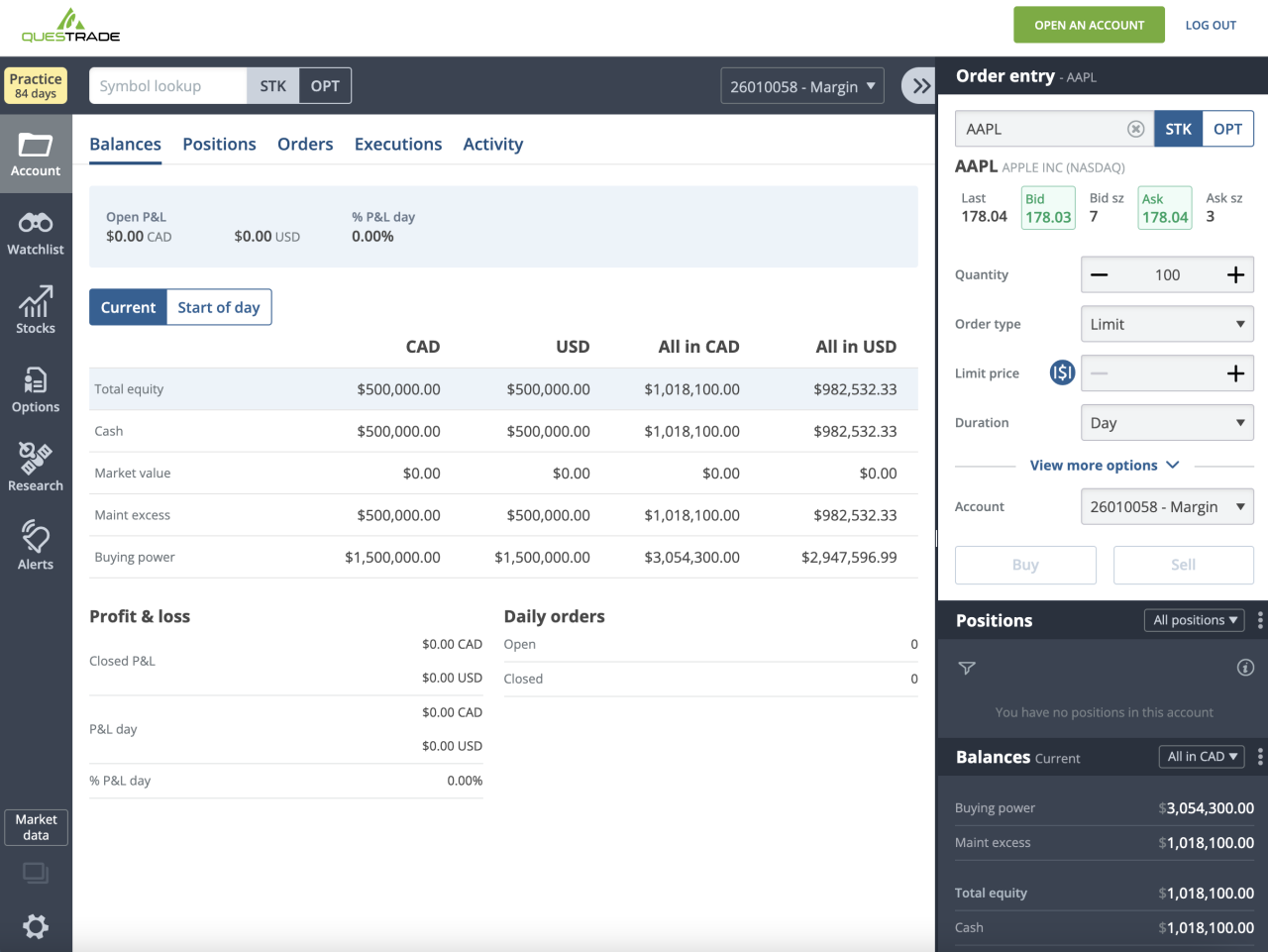

So, you’ve successfully wrestled your way through the account registration process – congratulations! Now, the real fun begins: exploring the Questrade forex trading platform. Think of it less like navigating a minefield and more like piloting a sleek, futuristic spaceship (albeit one that deals in currency, not warp speed). Don’t worry, we’ll guide you through the cockpit.The Questrade platform, even in practice mode, offers a surprisingly intuitive interface.

It’s designed to be user-friendly, even for those whose experience with financial markets extends only to watching Wolf of Wall Street (and maybe wishing you could pull off that kind of thing… legally, of course). The layout is clean and uncluttered, avoiding the information overload that can often plague trading platforms. Key information, such as current exchange rates, your account balance, and open positions, is readily visible, preventing you from needing a magnifying glass and a PhD in finance to understand what’s going on.

Platform Layout and Key Features

The platform generally features a modular design. You’ll likely find separate sections for charting, order entry, account monitoring, and news feeds. The charting tools are quite robust, allowing for various technical indicators and chart types (candlestick, bar, line – choose your fighter!). The order entry section is straightforward, with clear fields for specifying the currency pair, order type (market, limit, stop), and quantity.

Mastering forex trading on a Questrade practice account is like learning to juggle chainsaws – initially terrifying, but eventually rewarding. Want to diversify your financial acrobatics? Then check out how to profit from cryptocoin – it’s a whole different beast! But once you’ve conquered the Questrade demo, you’ll be ready to tackle anything, even the volatile world of digital currencies.

Account monitoring displays your current equity, unrealized P/L, and open positions in a readily accessible format. Finally, integrated news feeds provide real-time updates on market-moving events. Think of it as your own personal financial news ticker, keeping you in the loop and hopefully, ahead of the curve.

Mastering Questrade’s forex practice account is your first step to financial freedom (or at least, simulated financial freedom!). Before you leap into the wild world of real currency trading, however, consider diversifying your digital portfolio; check out this guide to find the Best mobile app for day trading cryptocurrencies in Canada. Then, armed with crypto knowledge and Questrade practice account prowess, you’ll be ready to conquer the markets (virtually, at first, of course!).

Efficient Navigation and Use of Platform Tools

Mastering the platform involves understanding its core functionalities. Familiarize yourself with keyboard shortcuts – they can dramatically speed up your trading. For example, a quick keystroke might let you place an order without navigating through multiple menus. Experiment with different chart types and indicators to find what suits your trading style. Don’t be afraid to play around in the practice account; it’s the perfect sandbox for testing strategies without risking real money.

Remember, the goal isn’t just to

- use* the tools, but to

- understand* how they work and how they can inform your trading decisions.

Key Functionalities for Forex Trading

Before diving in, it’s important to understand the core functionalities relevant to forex trading. This isn’t rocket science, but it’s certainly more involved than ordering a pizza online.

- Order Entry and Management: This allows you to place, modify, and cancel orders with precision.

- Real-time Market Data: Access to live exchange rates and market depth is crucial for making informed decisions.

- Charting Tools: Analyze price movements using various chart types and technical indicators.

- Account Monitoring: Track your trading performance, including P/L, open positions, and account balance.

- News and Economic Calendar: Stay informed about market-moving events that can impact your trades.

Accessing and Interpreting Real-time Market Data

Real-time market data is the lifeblood of forex trading. Questrade’s platform typically provides this data in a variety of formats, including live price quotes, charts, and market depth information. Understanding this data is paramount. For example, a sudden spike in the EUR/USD exchange rate might indicate a significant news event or a shift in market sentiment. Learning to interpret these changes is a key skill to develop.

Don’t just look at the numbers; consider the context. What news events are happening? What is the overall market trend? This holistic approach is crucial for successful trading. Think of it as reading a thrilling financial novel, but with potentially much higher stakes.

So you want to conquer the forex world with Questrade’s practice account? Excellent! Mastering the virtual battlefield before diving into the real thing is key. But before you get too comfy with your simulated millions, consider broadening your horizons – check out this awesome comparison of trading apps for Canadians, including Interactive Brokers: Comparing the best day trading apps for Canadian investors: Interactive Brokers vs.

others. Then, armed with newfound knowledge, return to your Questrade practice account and show those virtual currencies who’s boss!

Placing Practice Trades

So, you’ve conquered the Questrade practice account registration and navigated the platform like a seasoned forex trader (or at least, you’ve found your way around). Now comes the fun part: actually placing some trades! Remember, this is a practice account, so feel free to experiment without the fear of losing real money. Think of it as your personal forex sandbox – build sandcastles (or maybe, more accurately, currency castles) to your heart’s content.Let’s dive into the exhilarating world of virtual forex trading.

We’ll cover the essential order types, showing you how to set them up and understand the associated risks and rewards. Think of this as your crash course in avoiding financial ruin… virtually, of course.

Buy and Sell Orders

Buy orders are placed when you believe the price of a currency pair will rise. You’re essentially betting that the value of the base currency will increase relative to the quote currency. A sell order, conversely, is placed when you expect the price to fall. You’re predicting the base currency will weaken against the quote currency. For example, a buy order on EUR/USD means you anticipate the Euro will strengthen against the US dollar.

So you want to conquer the forex world with a Questrade practice account? First, find the “practice account” button – it’s usually hiding somewhere, like a mischievous leprechaun’s pot of gold. Once you’re in, master the virtual trading. But if the Questrade interface feels like navigating a maze blindfolded, check out Review of the best Canadian day trading apps for quick order execution.

for speedier alternatives. Then, return to your Questrade practice account, armed with newfound knowledge and ready to rule the virtual forex markets!

A sell order implies the opposite. The process is usually straightforward: select the currency pair, choose “Buy” or “Sell,” specify the lot size (the amount of currency you’re trading), and confirm the order. Remember to consider the spread, which is the difference between the bid and ask price – it’s the commission you pay to execute the trade.

Stop-Loss and Take-Profit Orders

Now, let’s talk about risk management. These are your safety nets in the sometimes volatile world of forex. A stop-loss order automatically closes your position if the price moves against you by a predetermined amount, limiting your potential losses. A take-profit order automatically closes your position when the price reaches a target level, securing your profits. Setting these orders is crucial for protecting your capital and ensuring you don’t get emotionally attached to losing trades.

Imagine your stop-loss order as a life raft, ensuring you don’t sink with the ship, and your take-profit order as your treasure chest, automatically collecting your winnings.

Limit Orders

Limit orders allow you to buy or sell a currency pair only when it reaches a specific price. This strategy can be useful for entering a trade at a more favorable price, or for setting a price at which to exit a position. It’s like setting a trap for the price: it only gets caught if it wanders into your designated price range.

Using a limit order requires patience, but can result in more controlled entry and exit points.

Order Type Comparison

The following table summarizes the various order types and their characteristics. Remember, the specific features and terminology might vary slightly depending on the platform, so always check the Questrade help documentation for the most up-to-date information.

| Order Type | Description | Risk | Reward |

|---|---|---|---|

| Buy Order | Buy a currency pair, expecting price increase. | Potential for losses if price decreases. | Profit if price increases. |

| Sell Order | Sell a currency pair, expecting price decrease. | Potential for losses if price increases. | Profit if price decreases. |

| Stop-Loss Order | Automatically closes position if price moves against you by a set amount. | Limited potential loss. | No direct reward; it protects against further losses. |

| Take-Profit Order | Automatically closes position when price reaches a target level. | Limited potential profit. | Secures profits. |

| Limit Order | Buy or sell only when price reaches a specified level. | Potential for missed opportunities if price doesn’t reach the limit. | Potential for more favorable entry/exit prices. |

Managing and Monitoring Practice Trades

So, you’ve bravely ventured into the wild world of forex trading with your Questrade practice account. Congratulations! Now, the real fun begins: watching your virtual money (hopefully) multiply. But just like a real-life trading scenario, managing and monitoring your practice trades is crucial to learning effective strategies and avoiding disastrous (virtual) losses. Think of this phase as your forex boot camp – no actual casualties, just valuable lessons.Monitoring open trades and managing risk in a practice account mirrors the real thing, but without the heart-stopping fear of actual financial ruin.

This allows you to experiment with different strategies and observe their outcomes in a safe, controlled environment. It’s your chance to become a forex ninja, honing your skills before taking on the real markets.

Open Trade Monitoring

The Questrade platform provides a clear overview of your open trades. You’ll see key details like entry price, current price, profit/loss, and position size. Regularly reviewing this information is essential. Imagine it as your trading dashboard – keep a close eye on the numbers! Frequent monitoring allows for timely adjustments to your trading plan based on market movements.

Mastering forex trading? Start with Questrade’s practice account – it’s like a virtual playground for your financial ambitions! But if you crave real-time data thrills, check out this amazing resource for Canadian traders: Reliable day trading app for Canadian residents with real-time market data. Then, once you’re a virtual forex ninja, graduate to the real Questrade account – may your profits be plentiful!

For instance, if a trade starts moving against you, you can assess whether to cut your losses or hold on, based on your pre-defined risk management plan. Don’t just stare at the numbers, though; understand what they

mean* in relation to your overall strategy.

Closing Trades

Closing a trade is as simple as clicking a button (usually marked “Close” or a similar designation). The platform will automatically calculate your profit or loss based on the difference between your entry and exit prices. Remember, in a practice account, you’re not actually losing or gaining real money, but the experience of closing a trade, good or bad, is invaluable.

It reinforces the emotional aspect of trading – learning to manage those feelings is just as crucial as technical analysis. Practice closing both profitable and losing trades to build your discipline.

Effective Open Position Management

Effective open position management involves carefully considering several factors. This includes your initial risk assessment, market conditions, and your overall trading strategy. For example, if you’re using a trailing stop-loss order, you’ll want to monitor its adjustment as the market moves in your favor. This helps to lock in profits while minimizing potential losses. Conversely, if the market turns against you, you might consider adjusting your stop-loss to limit potential losses.

Remember, risk management isn’t just about limiting losses; it’s also about protecting your profits.

Analyzing Trade Performance

Questrade’s platform usually offers various tools to analyze your trade performance. This could include detailed reports showing your win rate, average profit/loss per trade, and overall profitability. These reports are your performance review – analyze them to identify patterns, successes, and areas for improvement. For example, if you consistently lose on trades entered during specific times of day, you might want to adjust your trading schedule.

If a certain strategy consistently underperforms, you may want to refine or replace it. This analytical process is key to becoming a more skilled trader. Use these tools; don’t just let them gather digital dust.

Understanding Practice Account Limitations: How To Open And Use A Questrade Practice Account For Forex

So, you’ve conquered the Questrade practice account – you’re a virtual forex trading ninja! But before you start daydreaming about your yacht fueled by forex profits, let’s ground ourselves in reality. Practice accounts are fantastic training grounds, but they’re not the real deal. Understanding their limitations is crucial for your future success (and sanity).The key difference between a practice and live account boils down to this: one uses fake money, the other uses real money.

Seems obvious, right? But the implications are far-reaching.

Simulated Market Conditions

Practice accounts simulate market conditions, but they aren’t perfect replicas. While Questrade strives for accuracy, the speed and volume of trades, and the subtle nuances of market psychology are simply not perfectly replicated. Think of it like practicing your golf swing in your living room versus on a real course – you might nail the swing, but the wind, the pressure, and the actual ball behave differently.

Slippages and delays, common in real trading, may be less pronounced or even absent in a practice environment. This can lead to an overly optimistic view of your trading abilities when you eventually transition to a live account. For example, an order execution delay of even a few seconds in live trading can significantly impact your profit or loss, a factor not fully reflected in the practice account.

Emotional Impact of Real Money

This is perhaps the biggest difference. Trading with real money triggers powerful emotions – fear, greed, excitement, anxiety – that are largely absent in a practice account. The thrill of a potential win, the gut-wrenching feeling of a losing trade, these are powerful motivators (and sometimes, demotivators) that significantly impact decision-making. The pressure of risking your own capital can be immense, and it’s something you can’t truly replicate in a simulated environment.

Imagine betting $100 versus betting $10,000 – the emotional response is drastically different, impacting trading strategies and risk management.

Limited Access to Advanced Features

Some advanced trading features or tools might be restricted or unavailable in a practice account. Questrade might limit access to certain order types, analytical tools, or charting features. This difference in functionality can impact your trading strategy and your ability to fully test it before moving to a live account. You might discover a limitation only after you switch to live trading.

Therefore, familiarizing yourself with all available tools in the live account environment is highly recommended before you start live trading.

Importance of Transitioning to a Live Account

While practice accounts are invaluable for learning, they’re just a stepping stone. Prolonged reliance on a practice account can create a false sense of security and hinder your ability to adapt to the realities of live trading. The transition to a live account should be made when you feel confident in your trading strategy, risk management techniques, and emotional resilience.

Start with a small amount of capital to gain experience in a real-market setting before scaling up your investments. Remember, consistent profitability in a practice account doesn’t guarantee the same success in a live account. The leap is significant, and a cautious approach is essential.

Utilizing Educational Resources

So, you’ve bravely conquered the Questrade practice account – congratulations, intrepid trader! But the real journey begins now: mastering the art of forex. Luckily, Questrade doesn’t leave you stranded on a desert island of fluctuating currencies. They offer a surprisingly robust selection of educational resources to help you navigate the choppy waters of the forex market. Think of it as your personal forex sherpa, guiding you to the summit of profitable trading (or at least, less-lossy trading).Questrade’s educational resources are designed to cater to various learning styles and experience levels.

From beginner-friendly tutorials to advanced webinars, there’s something to help you level up your trading game, no matter your current skill set. Forget dusty textbooks and cryptic jargon; Questrade strives for clarity and practicality, equipping you with the knowledge you need to confidently make trading decisions.

Available Educational Materials

Questrade offers a diverse range of educational materials. These include video tutorials covering fundamental and technical analysis, explaining concepts like support and resistance levels, candlestick patterns, and various trading indicators. They also provide webinars hosted by experienced market analysts, often featuring live Q&A sessions. These webinars frequently cover current market trends, economic news, and strategies for navigating volatile market conditions.

Furthermore, Questrade offers downloadable guides and articles covering a wide range of forex-related topics, from risk management to order types. Imagine it as a buffet of forex knowledge – all you can eat (knowledge, that is, not actual buffet food – though that would be a fantastic perk!).

Effective Use of Educational Resources

To maximize the benefit of Questrade’s educational resources, it’s crucial to approach them strategically. Don’t just passively watch videos; actively engage with the material. Take notes, test your understanding by applying concepts to your practice trades, and don’t hesitate to revisit topics that require further clarification. Consider creating a personal trading journal to document your learning progress, your trades, and your insights – this is your forex diary, detailing your triumphs and (hopefully fewer) failures.

Participating in live webinars allows you to ask questions directly to experts, which can clarify any lingering doubts and provide invaluable insights. Remember, consistency is key. Dedicate regular time to learning, even if it’s just 15-30 minutes a day. Small, consistent efforts accumulate over time, building a solid foundation for successful trading.

Recommended Learning Paths, How to open and use a Questrade practice account for forex

A structured approach to learning is essential. Here are a few suggested learning paths, using Questrade’s practice account as your testing ground:

For beginners, a recommended path might involve starting with the fundamental analysis tutorials, focusing on understanding macroeconomic factors and their influence on currency pairs. Then, progress to technical analysis tutorials, learning about chart patterns and indicators. Finally, practice placing trades on your practice account, applying what you’ve learned and observing the outcomes.

Intermediate traders might benefit from focusing on advanced technical analysis, exploring different trading strategies, and delving into risk management techniques. Attending webinars on specific market events or economic indicators can provide valuable context for making trading decisions. Regularly reviewing and refining their trading strategies based on their practice account performance is crucial.

Advanced traders could focus on specialized topics like algorithmic trading, hedging strategies, or using more complex indicators. They should actively participate in webinars and engage with the Questrade community to share insights and refine their expertise. Continuous learning and adaptation to changing market conditions are paramount for this group.

Outcome Summary

So there you have it – your crash course in conquering the Questrade practice forex account! You’ve learned to navigate the platform, place trades like a seasoned pro (well, a seasoned

-simulated* pro), and understand the crucial differences between the practice and live environments. Remember, the practice account is your secret weapon – use it wisely, learn from your (inevitable) mistakes, and emerge victorious when you finally make the leap to live trading.

Now go forth and conquer… virtually, at least, for now!