Questrade forex trading fees and commissions compared to other platforms: Dive into the wild world of forex fees! Think of it as a thrilling treasure hunt, except instead of gold doubloons, you’re searching for the best bang for your buck when trading currencies. We’ll navigate the sometimes murky waters of spreads, commissions, and hidden charges, comparing Questrade to its competitors to help you find the most cost-effective path to forex fortune (or at least, to avoid unnecessary losses).

This deep dive will dissect Questrade’s fee structure, revealing the nitty-gritty details of their commissions, spreads, and other potential costs. We’ll then pit Questrade against other popular trading platforms – think of it as a forex fee cage match! – to see how they stack up. We’ll examine different account types, trade sizes, and trading frequencies to paint a complete picture of the financial landscape.

Prepare for a rollercoaster of numbers, charts, and enough financial jargon to make your head spin (in a good way, we promise!).

Questrade Forex Trading Fees

Navigating the world of forex trading can feel like traversing a dense jungle, especially when it comes to understanding fees. But fear not, intrepid trader! We’re here to shed some light on Questrade’s forex fee structure, making it as clear as a perfectly executed trade. We’ll break down the costs, so you can focus on what truly matters: making money (or, at least, not losing it all to hidden fees).

Questrade’s Forex Fee Structure

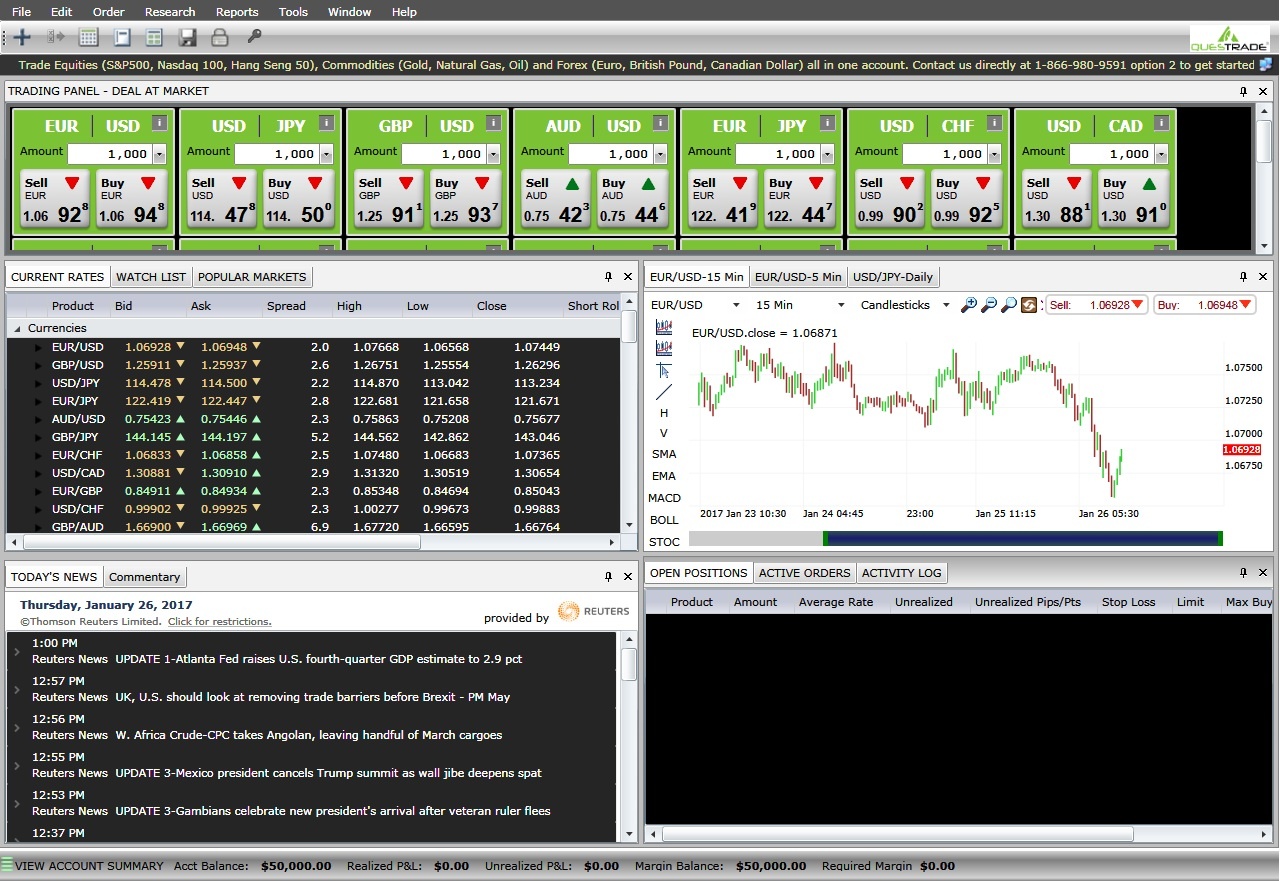

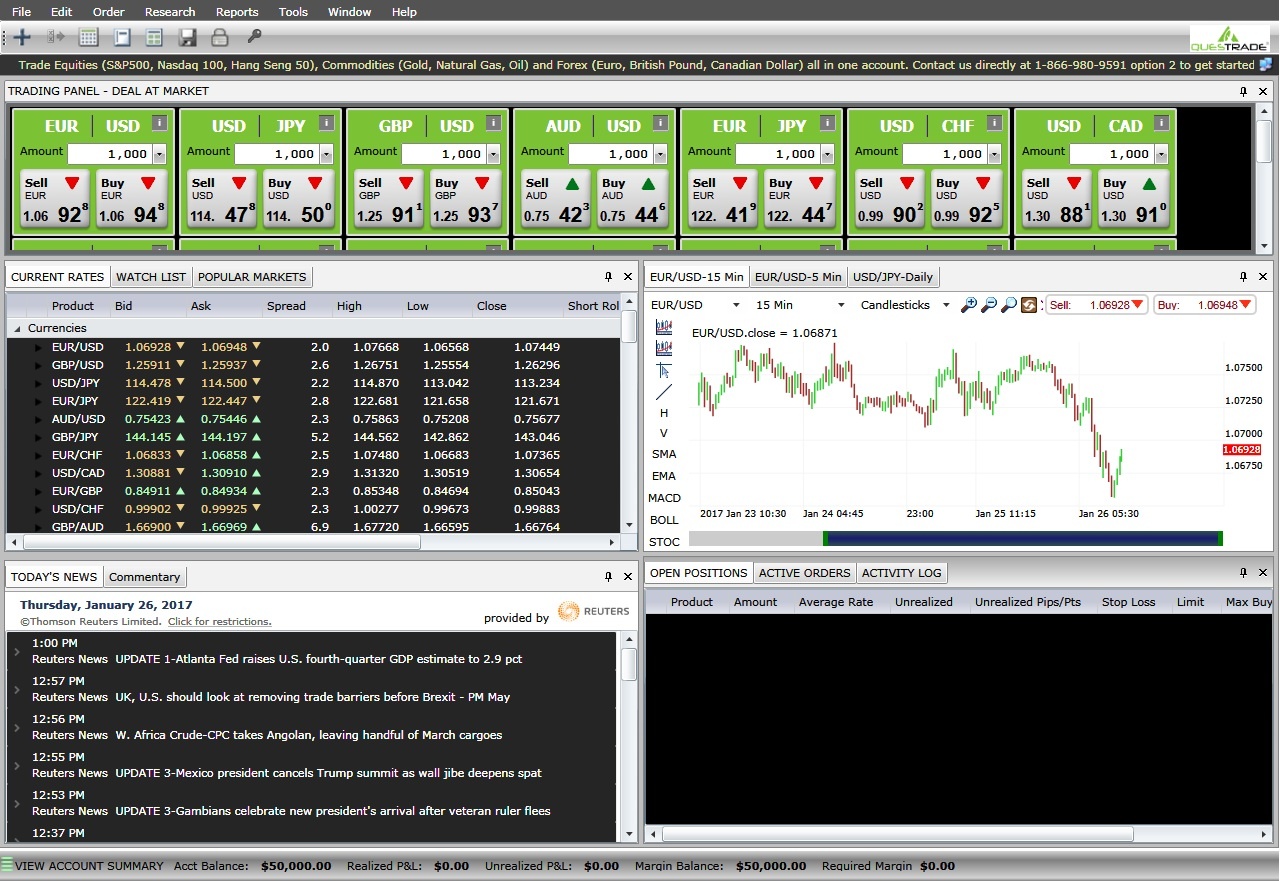

Questrade’s forex trading fees primarily consist of spreads and commissions. Spreads represent the difference between the bid and ask price of a currency pair, while commissions are additional fees charged per trade. Unlike some brokers who might bury you under a mountain of obscure charges, Questrade keeps things relatively straightforward. There are no hidden fees or surprise charges lurking in the shadows (unless you count the occasional unexpected market swing – but that’s not Questrade’s fault!).

Questrade Account Types and Associated Fees

Questrade offers various account types, but the fee structure for forex trading generally remains consistent across them. While specific details might vary slightly depending on your account type and trading volume, the core components remain the same: spreads and commissions. It’s worth noting that high-volume traders might be able to negotiate better spreads with Questrade, highlighting the potential for cost savings through increased trading activity.

Think of it as a reward for your dedication to the hustle.

Examples of Questrade Forex Trading Costs

Let’s illustrate with some concrete examples. Imagine you’re trading EUR/USD, a popular major currency pair. The spread might be, say, 0.7 pips. If you trade 100,000 units, and the commission is $7 per trade (this is a hypothetical example; actual fees may vary), your total cost would be the spread cost plus the commission. For a smaller trade size, the commission would remain the same, but the spread cost would be proportionally smaller.

Trading exotic pairs like USD/TRY usually involves wider spreads reflecting the lower liquidity, leading to higher overall trading costs.

Comparison of Questrade Forex Fees Across Currency Pairs

The following table provides a hypothetical comparison of Questrade’s fees for different currency pairs, assuming a 100,000 unit trade size. Remember that these are illustrative examples, and actual spreads and commissions can fluctuate based on market conditions and your trading volume. Always check Questrade’s website for the most up-to-date information.

| Currency Pair | Spread (Pips) | Commission ($) | Total Cost ($) |

|---|---|---|---|

| EUR/USD | 0.7 | 7 | 7.70 |

| USD/JPY | 0.8 | 7 | 8.80 |

| GBP/USD | 0.9 | 7 | 9.90 |

| USD/TRY | 2.5 | 7 | 25.70 |

Comparison with Other Popular Platforms: Questrade Forex Trading Fees And Commissions Compared To Other Platforms

So, you’ve wrestled with Questrade’s forex fees – congratulations! Now, let’s see how they stack up against the gladiators of the forex arena. This isn’t a cage match, but a careful comparison of pricing structures to help you choose the platform that best suits your trading style and wallet. Remember, the cheapest isn’t always the best – it’s about finding the right balance between cost and features.

We’ll be pitting Questrade against three other popular platforms: Interactive Brokers (IBKR), TD Ameritrade, and OANDA. Each platform boasts its unique strengths and weaknesses, and their fee structures reflect this diversity. We’ll examine their different commission models, highlighting how fixed versus variable commissions can significantly impact your bottom line. Think of it as choosing between a predictable monthly gym membership or paying per-session – both work, but one might be better for your budget and usage patterns.

Fee Structure Differences Across Platforms

The forex world is a wild west of fees. Some platforms charge commissions, others rely on spreads (the difference between the bid and ask price), and some do a delightful combination of both. Questrade, for instance, generally relies on spreads, while IBKR might charge a commission on top of a spread. TD Ameritrade and OANDA also use a mix of spreads and commissions, varying depending on the currency pair and trading volume.

Questrade’s forex fees? Let’s just say they’re a rollercoaster – sometimes thrillingly low, sometimes a bit stomach-churning. But hey, if forex isn’t your jam, you could always explore other avenues for wealth creation, like learning how to profit from cryptocoin , which might offer a more… volatile, yet potentially rewarding ride. Then you can reassess those Questrade fees with a newly-minted crypto fortune, and maybe they won’t seem so bad after all.

Understanding these nuances is key to maximizing your profits (or at least minimizing your losses!).

Impact of Commission Models

The choice between fixed and variable commissions is a bit like choosing between a comfortable, predictable salary and a commission-based sales job. Fixed commissions offer transparency and predictability; you know exactly what you’ll pay per trade. Variable commissions, on the other hand, can fluctuate based on factors like trading volume or market conditions. While potentially lower in some scenarios, this unpredictability can make budgeting tricky.

Spreads, meanwhile, are the silent assassins of forex trading – they might seem small, but they add up over time, especially for frequent traders.

Comparative Table of Forex Trading Fees

Let’s cut to the chase and present a comparison table. Remember that these are examples and actual fees can vary depending on market conditions, currency pairs, and account type. Always check the latest fee schedules on each platform’s website before making any trading decisions. Think of this table as a snapshot, not a definitive, eternally unchanging law of the forex universe.

| Platform Name | Spread (Example for EUR/USD) | Commission (per standard lot) | Minimum Trade Size | Total Cost (Example for 1 standard lot) |

|---|---|---|---|---|

| Questrade | 0.8 pips (example) | $0 | 0.01 lots | ~$8 (based on spread) |

| Interactive Brokers | 0.2 pips (example) | $2 (example) | 0.01 lots | ~$4 (spread + commission) |

| TD Ameritrade | 1.0 pips (example) | $0 – $2 (variable, example) | 0.01 lots | ~$10 – $12 (spread + commission) |

| OANDA | 0.9 pips (example) | $0 | 0.01 lots | ~$9 (based on spread) |

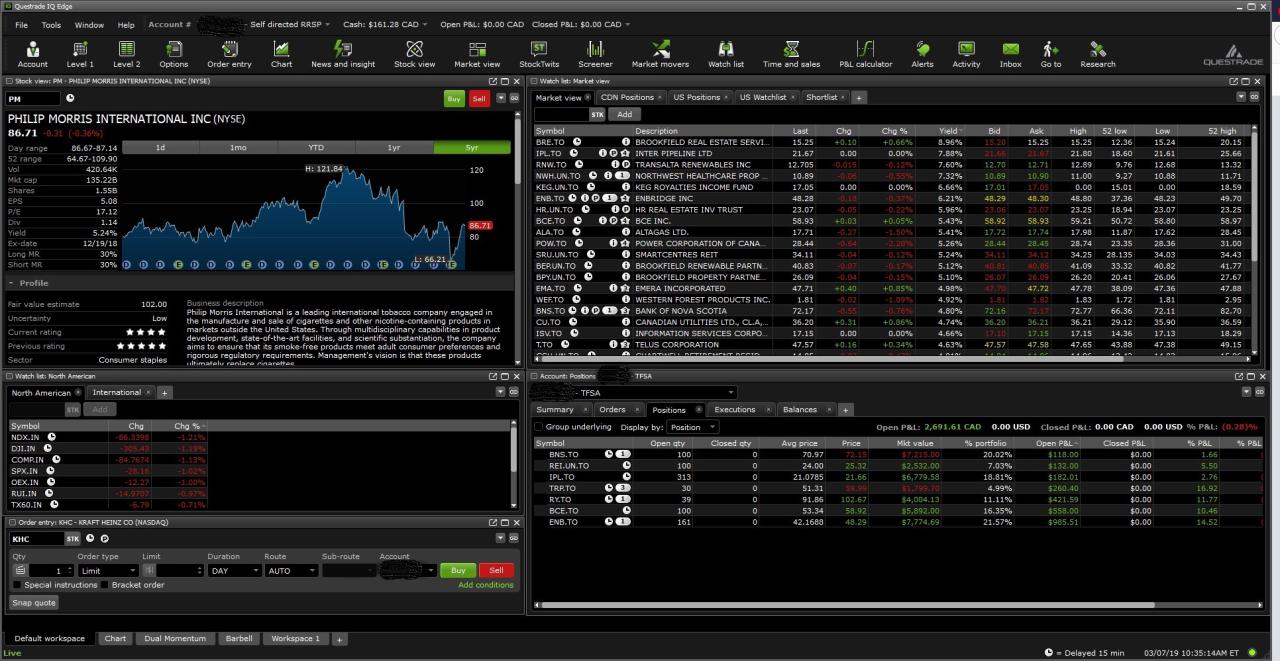

Impact of Trade Volume and Frequency on Costs

Forex trading, like any other market, has its own unique cost structure. The more you trade, and the more frequently you trade, the more significant these costs become. This isn’t necessarily a bad thing – high-volume trading often reflects a more active and potentially profitable strategy – but understanding how volume and frequency impact your bottom line is crucial for maximizing returns.

Let’s dive into how this plays out on Questrade and its competitors.The relationship between trading volume, frequency, and cost is generally linear, but not always perfectly so. Platforms often employ tiered fee structures, meaning costs per trade decrease as your trading volume increases. This is a bit like a loyalty program for active traders, rewarding those who commit significant capital and time.

Conversely, infrequent traders might find that their per-trade costs are higher, making it more important for them to select a platform with competitive flat fees or low minimums. However, the overall cost can still be surprisingly high for those making many small trades, even with low per-trade fees.

So, you’re wrestling with Questrade’s forex fees – are they the kraken of commission charges, or a friendly dolphin? To truly understand, comparing them to other platforms is key, and that involves looking at the features on offer. If advanced order types are your jam, you might want to check out Top-rated day trading apps with advanced order types.

before committing. Ultimately, Questrade’s pricing needs careful evaluation against what you’re getting in return for your hard-earned cash.

Cost Differences for High-Frequency and Infrequent Traders

High-frequency traders, those executing hundreds or even thousands of trades daily, are acutely sensitive to even the smallest changes in commission structure. A difference of just a few cents per trade can add up to thousands of dollars over time. For instance, if a high-frequency trader executes 1000 trades a day at a cost of $0.01 more per trade on one platform versus another, that’s a daily difference of $10, or $2500 per month! Conversely, an infrequent trader making only a few trades per month might find that a platform with slightly higher per-trade fees but lower minimums or spreads is more cost-effective overall.

So you’re wrestling with Questrade’s forex fees – are they a better deal than other platforms’ predatory pricing? The answer might depend on your trading style, but if you’re a day trader, finding a slick app is key; check out this resource for a secure and user-friendly day trading app for Android: Finding a secure and user-friendly day trading app for Android.

Then, armed with the right tech, you can really analyze those Questrade fees and see if they’re worth it in the long run.

They are less impacted by minor differences in commission because their total trade volume is lower.

Tiered Fee Structures and Their Advantages

Many platforms, including some competitors to Questrade, offer tiered fee structures. These reward high-volume traders with lower per-trade costs. Imagine a scenario where Platform A charges $5 per trade for volumes under 100 trades per month, $3 per trade for 100-500 trades, and $1 per trade for over 500 trades. Platform B, in contrast, maintains a flat fee of $2 per trade regardless of volume.

So, you’re wrestling with Questrade’s forex fees – are they a heavyweight champ or a featherweight flop compared to the competition? To truly master the forex ring, though, you need the right tools and training, which is why checking out Day trading app recommendations with educational resources. is a smart move. Armed with that knowledge, you’ll be better equipped to analyze whether Questrade’s pricing structure is a knockout or a knockdown.

A high-frequency trader executing 1000 trades per month would pay $1000 on Platform B but only $1000 on Platform A. The infrequent trader, however, might find Platform B more attractive due to its simplicity and consistent cost.

Cost Implications of Various Trading Styles

Let’s illustrate with a table comparing hypothetical costs across different trading styles and platforms:

| Trading Style | Trades/Month | Questrade (Hypothetical) | Platform B (Hypothetical) | Platform C (Hypothetical) |

|---|---|---|---|---|

| Infrequent | 5 | $25 | $10 | $15 |

| Moderate | 50 | $150 | $100 | $75 |

| High-Frequency | 500 | $500 | $1000 | $250 |

*Note: These are hypothetical examples and do not reflect actual Questrade pricing. Actual costs will vary depending on the specific trading instruments, leverage used, and any applicable promotions.*

Non-Commission Fees and Other Charges

So, you’ve conquered the commission hurdle, but the forex trading fee fiesta doesn’t end there! Like a mischievous gremlin hiding in your trading platform, non-commission fees can nibble away at your profits if you’re not careful. Let’s shine a light on these hidden costs and see how they stack up against the competition. Think of it as a treasure hunt, but instead of gold, we’re hunting for ways to minimize unexpected expenses.These additional fees, often overlooked in the initial excitement of low commissions, can significantly impact your overall trading costs.

Understanding these charges is crucial for making informed decisions and maximizing your profitability. Ignoring them is like leaving your wallet open on a busy street – you might be surprised at what goes missing.

So, you’re wrestling with Questrade’s forex fees – are they a better deal than the competition’s cutthroat pricing? It’s a jungle out there! But before you get too bogged down, remember that efficient trading relies on a killer app; check out this resource for the Best mobile app for day trading cryptocurrencies and stocks. Then, armed with the right tools, you can return to meticulously comparing Questrade’s forex fees to find the best bang for your buck.

Overnight Financing Charges, Questrade forex trading fees and commissions compared to other platforms

Overnight financing charges, also known as swap fees, are fees charged for holding a position open overnight. These fees reflect the interest rate differential between the two currencies involved in the trade. For example, if you hold a long position in the EUR/USD pair and the European Central Bank’s interest rate is lower than the Federal Reserve’s, you’ll likely pay a swap fee.

Conversely, if the ECB rate is higher, you might receive a small payment. The magnitude of these fees varies depending on the currencies involved, the size of your position, and the prevailing interest rate differentials. Questrade’s swap fees are generally competitive, but comparing them to platforms like Interactive Brokers or Oanda is essential to find the best deal.

Failing to account for these charges, especially for long-term positions, can lead to a significant erosion of profits. Imagine holding a large position for a month; those seemingly small daily fees can quickly add up to a substantial amount.

Inactivity Fees

Some platforms, including certain account types within Questrade, might charge inactivity fees if your account shows little to no trading activity for an extended period. This fee acts as an incentive to keep your account active and, from the broker’s perspective, justifies the cost of maintaining your account. While Questrade generally doesn’t impose these fees on active traders, it’s always wise to review their terms and conditions to confirm.

A comparison with other brokers like TD Ameritrade, which may have different inactivity fee structures, should be undertaken. These fees can be surprisingly hefty and, if you plan on taking a break from trading, choosing a platform with a more lenient inactivity policy might save you money.

So you’re wrestling with Questrade’s forex fees – are they a gentle tickle or a full-body takedown compared to the competition? To maximize your profits, you need the right tools, and that often means a killer mobile app. Check out this list of Top rated mobile apps for day trading stocks and forex. to see if you can shave those Questrade fees down to size.

Ultimately, the best app will help you make smarter trades, regardless of your broker’s fee structure.

Deposit and Withdrawal Fees

Deposit and withdrawal fees vary greatly across platforms. While Questrade generally offers free or low-cost deposit methods, some less common methods might incur fees. Similarly, withdrawal fees might apply depending on the method chosen. Platforms like Interactive Brokers often have a wider array of options, some of which may be fee-free, while others might charge a premium. Carefully considering these fees is important, especially for frequent deposits and withdrawals.

These fees, though small individually, can add up over time, especially for scalpers or day traders who frequently move funds.

Comparison of Non-Commission Fees

Understanding the overall cost of trading requires a comprehensive view of all fees. Here’s a comparison of non-commission fees across a few popular platforms. Note that specific fees can change, so always refer to the most up-to-date information on each broker’s website.

- Questrade: Overnight financing charges (vary depending on currency pair and position size), potential fees for certain deposit/withdrawal methods (usually minimal or non-existent for common methods).

- Interactive Brokers: Overnight financing charges (vary), generally low or no fees for common deposit/withdrawal methods, potential inactivity fees depending on account type.

- Oanda: Overnight financing charges (vary), generally transparent fee structure for deposits and withdrawals, typically no inactivity fees.

- TD Ameritrade: Overnight financing charges (vary), generally competitive fees for deposits and withdrawals, potential inactivity fees for certain accounts.

Illustrative Scenarios and Cost Calculations

Let’s get down to brass tacks and see how those forex fees stack up in real-world trading scenarios. We’ll pit Questrade against a couple of its competitors (let’s call them “Platform A” and “Platform B” to keep things general) and see who comes out on top in terms of cost-effectiveness. Remember, specific fee structures can change, so always check the latest information on each platform’s website.We’ll examine different trade sizes and currency pairs to illustrate how the cost varies.

Our calculations will include all relevant fees, providing a transparent view of the total expense for each trade.

Scenario 1: A Small Trade in EUR/USD

Let’s imagine a small trade of 1,000 EUR/USD. This is a common trade size for beginners.

Questrade: Assuming a spread of 1 pip (a common value for EUR/USD), the cost would be approximately 10 EUR (1 pip x 1,000 units). Other fees are minimal for this trade size.

Platform A: Platform A charges a commission of $5 per trade, plus a spread of 1.2 pips. This translates to a total cost of approximately $5 + 12 EUR (1.2 pips x 1,000 units). The exact EUR equivalent of the $5 commission will vary depending on the current exchange rate.

Platform B: Platform B charges a commission of 0.005% per trade plus a spread of 1.5 pips. For this trade, that would be 0.005% of (1000 EURcurrent EUR/USD rate) + 15 EUR (1.5 pips x 1,000 units). Again, the precise cost will depend on the exchange rate.

This scenario shows how even small trades can have varying costs depending on the platform’s fee structure. The seemingly small commission on Platform A can add up significantly when compared to Questrade’s spread-only model. Platform B’s percentage-based commission adds another layer of complexity and cost variability.

Scenario 2: A Larger Trade in GBP/JPY

Now, let’s consider a larger trade – 100,000 GBP/JPY. This represents a more significant investment.

Questrade: Let’s assume a spread of 2 pips. The cost would be approximately 2,000 JPY (2 pips x 100,000 units). Again, other fees are minimal for this trade size.

Platform A: With a $5 commission and a spread of 2.5 pips, the total cost would be approximately $5 (commission) + 2,500 JPY (2.5 pips x 100,000 units). The commission’s JPY equivalent would need to be calculated based on the current exchange rate.

Platform B: Using the 0.005% commission and a spread of 3 pips, the cost would be approximately 0.005% of (100,000 GBPcurrent GBP/JPY rate) + 3,000 JPY (3 pips x 100,000 units). This calculation also requires converting the GBP value to JPY.

In this scenario, the impact of the fixed commission on Platform A becomes less significant relative to the spread costs. However, Platform B’s percentage-based commission can still result in a substantial fee depending on the GBP/JPY exchange rate. Questrade’s straightforward spread-only model remains comparatively simpler and potentially more cost-effective.

Scenario 3: High-Frequency Trading – Illustrative Example

Imagine a day trader executing 50 trades of 10,000 USD/CHF pairs on each platform, with an average spread of 0.8 pips across all trades.

Questrade: The total cost would be approximately 4,000 USD (50 trades

- 10,000 units/trade

- 0.8 pips). Minimal additional fees are expected.

Platform A: The cost would be (50 trades

- $5/trade) + (50 trades

- 10,000 units/trade

- 0.8 pips) = $250 + 4000 USD = $4250.

Platform B: The cost calculation here would be significantly more complex due to the percentage-based commission and requires knowing the exact USD/CHF rate for each trade, along with a precise calculation of the commission on each trade. This would be far more expensive than Questrade and likely Platform A.

This example highlights how the accumulation of fees over numerous trades can significantly impact overall trading costs. Questrade’s transparency and simplicity are again advantageous in high-frequency trading. The percentage-based commission structure of Platform B becomes increasingly burdensome with a high volume of trades.

Last Point

So, the quest for the perfect forex trading platform is far from over, but armed with this knowledge, you’re now better equipped to conquer the fees and focus on what truly matters: profiting from your trades. Remember, the lowest fee isn’t always the best choice; consider the platform’s overall features, ease of use, and customer support to find your perfect match.

Happy trading!