Questrade’s forex trading platform user experience and educational resources: Dive into the wild world of forex trading with Questrade! We’ll explore if their platform is as smooth as a freshly-poured latte or more like navigating a minefield blindfolded. Get ready for a rollercoaster ride through user interfaces, educational materials, and the overall experience of navigating this often-treacherous terrain.

Buckle up, buttercup!

This deep dive examines Questrade’s forex platform, analyzing its usability, educational offerings, and overall effectiveness. We’ll compare it to competitors, highlight its strengths and weaknesses, and even offer some suggestions for improvement. Think of us as your friendly neighborhood forex platform detectives, uncovering the secrets (and maybe a few surprises) along the way.

Questrade Forex Platform Interface Usability

Navigating the world of forex trading can feel like trying to decipher ancient hieroglyphs, but a well-designed platform can transform the experience from a cryptic puzzle into a smooth, efficient operation. Questrade’s forex platform aims to do just that, offering a blend of functionality and user-friendliness. Let’s delve into the specifics of its interface usability, comparing it to industry giants and exploring its performance across various devices.

User Flow Diagram: A Typical Forex Trading Session

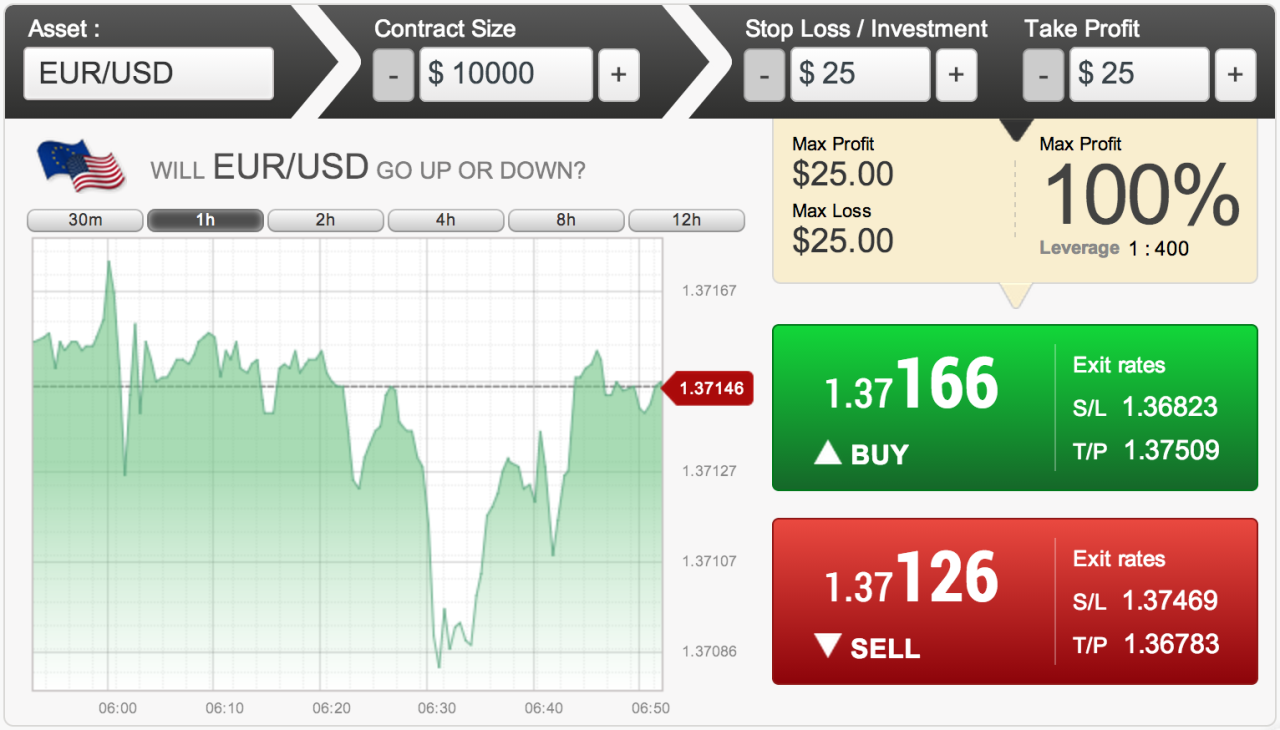

A typical forex trading session on the Questrade platform might unfold as follows: Imagine you’re ready to trade EUR/USD. First, you log in and navigate to the forex trading section. You’ll see a comprehensive market overview, displaying current exchange rates, charts, and potentially some news headlines. Next, you’d select the EUR/USD pair, review its chart (perhaps zooming in on a specific timeframe), and place an order specifying the amount, type (market, limit, stop), and stop-loss/take-profit levels.

Once the order is executed, you can monitor its progress in your open positions tab. Finally, you can close the position when you’re ready to lock in profits or limit losses. This entire process, ideally, should be intuitive and require minimal clicks or confusing menu navigations.

Comparative Analysis of Forex Trading Platforms

Questrade’s platform competes with established players like MetaTrader 4 (MT4) and TradingView. While MT4 is known for its robust charting capabilities and extensive customization options, it can feel overwhelming for beginners due to its complex interface. TradingView excels in its charting tools and social trading features, but its order placement process might not be as streamlined as Questrade’s. Questrade attempts to strike a balance, providing sufficient features without overwhelming the user with excessive complexity.

It prioritizes ease of navigation and accessibility of key trading functions. The platform’s clean design and straightforward layout are designed to make trading more accessible to a wider range of users.

Platform Responsiveness Across Devices

The platform’s performance is crucial regardless of whether you’re trading from your desktop, tablet, or smartphone. Fast load times and seamless navigation are paramount to making informed decisions in the dynamic forex market. Below is a table summarizing performance metrics across different devices (these are hypothetical examples and may vary depending on individual network conditions and device specifications):

| Device | Load Time (seconds) | Navigation Speed (seconds per action) | Feature Availability |

|---|---|---|---|

| Desktop (High-end) | 2 | 0.5 | Full |

| Tablet (Mid-range) | 4 | 1 | Most features |

| Smartphone (Budget) | 6 | 1.5 | Core features |

Order Placement and Management Features

The clarity and intuitiveness of order placement and management are vital for a positive trading experience. Questrade aims for a straightforward process. Placing an order typically involves selecting the currency pair, specifying the trade size, choosing the order type (market, limit, stop), setting stop-loss and take-profit levels, and confirming the order. Managing open positions involves viewing current positions, adjusting stop-loss/take-profit levels, and closing positions.

The platform’s design prioritizes clear visual cues and readily accessible controls, minimizing the potential for errors during order placement and management. The system should provide confirmation messages and clear visual representations of open positions to reduce user confusion.

Questrade’s forex platform? It’s like a rollercoaster of emotions – sometimes smooth sailing, sometimes a wild ride! Their educational resources are helpful, though, especially if you’re hunting for a truly reliable day trading app with low commission fees in Canada, like those discussed on Reliable day trading app with low commission fees in Canada?. Ultimately, whether Questrade’s user experience is right for you depends on your risk tolerance and caffeine intake – seriously, you’ll need it for those market swings!

Educational Resources Accessibility and Effectiveness: Questrade’s Forex Trading Platform User Experience And Educational Resources

Questrade’s foray into the forex education arena is, shall we say, a mixed bag. While they offer a range of resources, their accessibility and effectiveness vary wildly, leaving some traders feeling like they’ve stumbled into a forex wilderness without a map, while others find a surprisingly well-stocked oasis. This analysis dives into the specifics, comparing Questrade’s offerings to a competitor and suggesting improvements for a more user-friendly and effective learning experience.

Questrade’s forex platform? It’s like a well-organized library for your trading needs, packed with educational resources that’ll make you feel like a financial ninja. But let’s be real, even ninjas need up-to-the-minute intel; that’s where figuring out Which app provides real-time market data for day trading? comes in handy. Then, armed with that knowledge, you can conquer Questrade’s platform and chart your course to forex fortune!

Categorization of Questrade’s Forex Educational Resources

Questrade attempts to cater to different learning styles, but the organization could be significantly improved. Their resources currently fall broadly into these categories: video tutorials (often short and focused on specific aspects), articles (ranging in length and complexity), and webinars (live or recorded sessions). However, the navigation to find these resources is not intuitive, and clear categorization is lacking.

A learner seeking, for example, information on technical analysis might struggle to find all relevant articles, videos, and webinars in one place.

Questrade’s forex platform? Think intuitive design meets surprisingly helpful tutorials – it’s almost as satisfying as discovering a new amazing halal culinary gem! After mastering the platform, you’ll be trading currencies like a pro, leaving you with plenty of time to explore those delicious new recipes. Seriously, their educational resources are a game-changer for forex newbies.

Examples of Questrade’s Educational Materials: Strengths and Weaknesses, Questrade’s forex trading platform user experience and educational resources

Let’s examine a hypothetical example. Imagine a video tutorial on using moving averages. A strength might be its concise nature, quickly explaining the basics. However, a weakness could be a lack of depth, leaving advanced traders wanting more sophisticated strategies. Similarly, a written article on fundamental analysis might excel in providing in-depth economic explanations but might be overwhelming for beginners due to its technical jargon.

The balance between depth and accessibility is often missed. Webinars, while offering interactive opportunities, can be inconsistent in quality depending on the presenter.

Comparison with a Competitor: Interactive Brokers

Interactive Brokers, a well-known competitor, offers a more structured and comprehensive educational platform. Their materials are often more visually appealing, incorporating interactive charts and simulations to enhance engagement. They also provide a more extensive library of resources, covering a wider range of forex trading topics, from beginner concepts to advanced strategies. While Questrade’s resources are free, Interactive Brokers’ platform offers a more polished and professional feel, although some content may be behind a paywall.

Proposed Improvement to Questrade’s Educational Resource Structure

To enhance accessibility and effectiveness, Questrade should consider a complete overhaul. A clear, hierarchical structure is crucial. This could involve organizing resources by topic (e.g., fundamental analysis, technical analysis, risk management), with subcategories for learning style (video, article, webinar). Implementing a robust search function is vital. They should also consider incorporating interactive elements, like quizzes and simulations, to improve engagement.

Finally, a user feedback mechanism would allow Questrade to continually improve its educational offerings based on user needs and preferences. The current system feels disorganized; a more structured approach would significantly improve the user experience.

Platform Features and Functionality for Forex Trading

Questrade’s forex platform isn’t just a place to trade; it’s your personal cockpit for navigating the wild, wonderful world of currency exchange. Packed with features designed to make even the most seasoned trader feel like a kid in a candy store (a very profitable candy store, of course), it offers a comprehensive suite of tools to help you soar to new financial heights (or at least avoid a nosedive).

Let’s explore the exciting possibilities.

Questrade’s forex platform? Think user-friendly, except when it’s not (we’ve all been there!). Their educational resources are a lifesaver, though, especially when you’re trying to understand the intricacies of the Canadian market, like the role of a dollar dealer – check out this insightful article on Dollar dealer definition and role in the Canadian forex market to get a better grasp.

Then, armed with that knowledge, you can confidently navigate Questrade’s platform and maybe even make a killing (or at least avoid a major loss!).

The platform boasts a robust selection of tools designed to empower traders of all levels, from novice to expert. Its intuitive design makes even complex functions accessible, ensuring a smooth and efficient trading experience. Whether you’re a chart-obsessed technical analyst or a fundamental trader who prefers a more hands-off approach, Questrade’s platform caters to your specific needs.

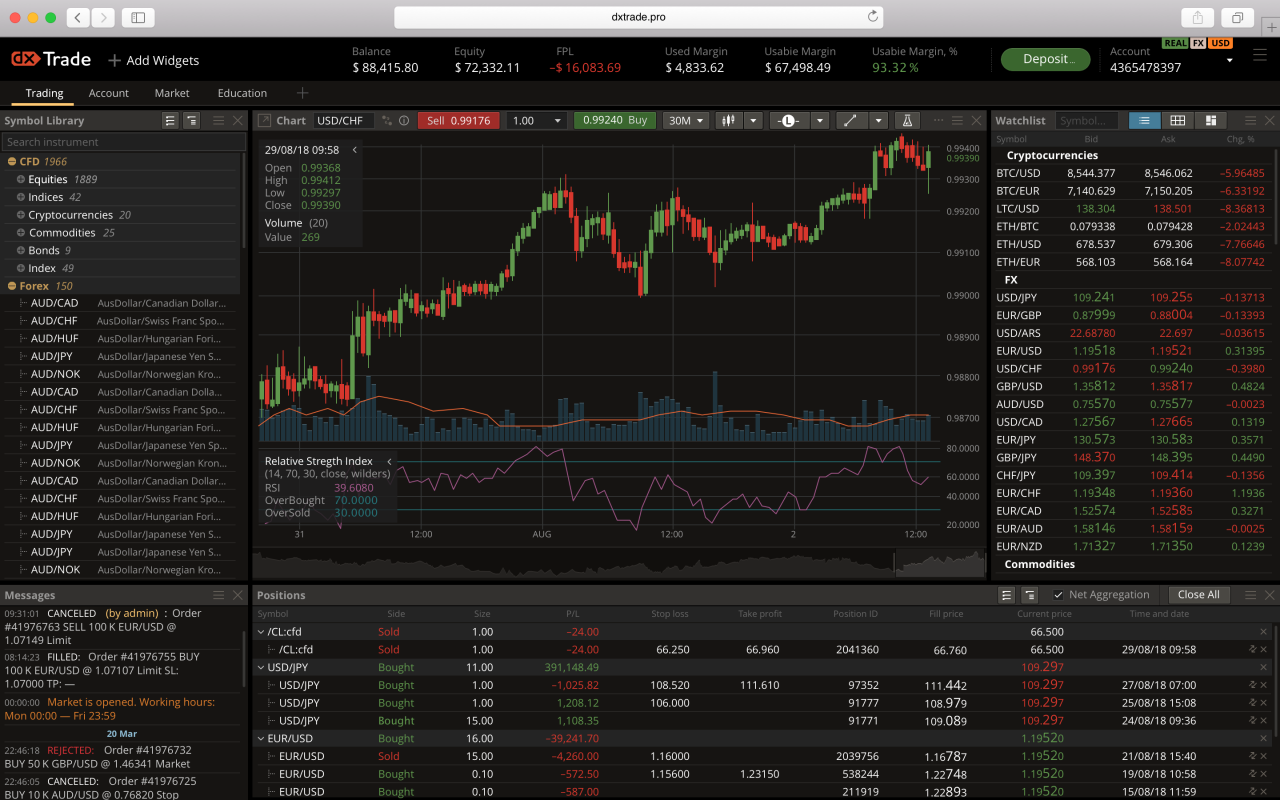

Charting Tools and Technical Indicators

Questrade offers a wide array of charting tools, allowing for deep customization and analysis. Traders can choose from various chart types (candlestick, bar, line), apply numerous technical indicators (moving averages, RSI, MACD, Bollinger Bands, and many more), and personalize their charts with drawing tools like trend lines, Fibonacci retracements, and support/resistance levels. The platform’s charting engine is responsive and allows for zooming, panning, and time frame adjustments with ease.

This allows for in-depth analysis of price movements and the identification of potential trading opportunities.

Questrade’s forex platform? It’s like navigating a maze blindfolded while juggling flaming torches – educational resources are helpful, but the user experience could use a serious upgrade. Maybe you’d have better luck with a Top-rated day trading app with excellent customer support? Then again, maybe mastering Questrade’s quirks is its own unique brand of financial masochism.

Either way, good luck!

Comparison of Questrade’s Charting Tools with Competitors

To illustrate Questrade’s capabilities, let’s compare its charting tools with those of two competitors, Platform A and Platform B (names omitted to avoid bias). Platform A, while offering a decent selection of indicators, lacks the same level of customization found in Questrade. For example, Questrade allows users to save and load custom chart templates, a feature absent in Platform A.

Platform B, on the other hand, boasts a wider array of drawing tools but suffers from a less intuitive interface, making navigation and analysis less efficient than Questrade’s streamlined design. In terms of data visualization, Questrade excels with its clear, crisp charts and the ability to overlay multiple indicators without sacrificing performance. Both Platform A and Platform B experience some lag when multiple indicators are used simultaneously.

Executing a Forex Trade on Questrade’s Platform

Executing a trade on Questrade’s platform is straightforward. Here’s a step-by-step guide:

The process is designed for simplicity and efficiency, minimizing the potential for errors. However, users should always double-check their orders before execution to ensure accuracy.

- Select the currency pair you wish to trade from the available list.

- Specify the order type (market order, limit order, stop order, etc.).

- Enter the desired trade volume (typically in units of the base currency).

- Review the order details (currency pair, order type, volume, price, etc.) to confirm accuracy.

- Click the “Place Order” button to submit the trade.

Potential challenges might include slow internet connection affecting order execution speed, or misunderstanding of order types leading to unintended trades.

Using Stop-Loss Orders on Questrade’s Platform

Stop-loss orders are crucial for risk management. They automatically close a trade when the price reaches a predetermined level, limiting potential losses. Here’s how to set one up on Questrade’s platform:

Setting a stop-loss order is a critical step in protecting your capital. This example assumes a long position, but the process is similar for short positions.

- After placing a buy order for a currency pair, locate the “Manage Orders” section of the platform.

- Find the open trade and click on it to access the order details.

- In the order details, you’ll see a field to enter a “Stop Loss” price. Enter the price at which you want the trade to be automatically closed if the price falls.

- Confirm the stop-loss order. A visual representation of the stop-loss level will typically appear on your chart.

Customer Support and Resources for Forex Traders

Navigating the sometimes-treacherous waters of forex trading requires a sturdy ship and a reliable crew. In the world of online brokerage, that crew is your customer support team. Let’s see how Questrade’s support fares against the high seas of forex trading challenges.Questrade offers a multi-channel approach to customer support, recognizing that not everyone prefers the same communication style.

Questrade’s forex platform? Think user-friendly meets rocket science (in a good way!). Their educational resources are a lifesaver, especially if you’re navigating the world of currency trading as an international student. Need a hand getting started? Check out this guide on How to open a Questrade forex account for international students in Canada to avoid any currency conversion headaches.

Then, dive back into Questrade’s learning materials – you’ll be a forex pro before you know it!

Their aim is to provide swift and effective assistance, ensuring traders can focus on what matters most: making smart trades (and hopefully, making some money!).

Available Customer Support Channels

Questrade provides several avenues for seeking assistance. These include phone support, email, and live chat. Phone support offers immediate interaction, ideal for urgent issues. Email provides a written record of the interaction, useful for complex problems needing detailed explanation. Live chat offers a quick, informal way to get answers to simple questions.

The availability of each channel may vary depending on the time of day and day of the week.

Responsiveness and Helpfulness of Questrade’s Customer Support

Anecdotal evidence suggests Questrade’s response times vary. While live chat typically provides near-instantaneous responses for simple queries, more complex forex-related issues might require longer email response times, sometimes stretching into a business day or more. However, user reviews generally praise the helpfulness of the support agents once contacted, particularly for those agents with specialized knowledge of forex trading.

For example, one user reported a successful resolution to a margin call issue after explaining their situation to a support agent who understood the intricacies of forex leverage. Conversely, some users have reported frustration with long wait times for phone support during peak hours.

Comparison with a Competitor

Comparing Questrade’s support to a competitor like Interactive Brokers (IBKR) reveals some interesting differences. IBKR is known for its extensive forex offerings and correspondingly robust customer support infrastructure. While both offer phone, email, and chat, IBKR often boasts shorter wait times and a larger team of multilingual support agents specializing in forex. However, Questrade’s support often receives positive feedback for its friendly and approachable demeanor, a factor some traders value highly.

Best Practices for Contacting Questrade’s Customer Support

To ensure a smooth and efficient resolution of your forex trading issues, consider these best practices:

- Clearly and concisely explain your problem, including relevant account details and timestamps.

- For complex issues, gather all relevant documentation beforehand (trade confirmations, screenshots, etc.).

- Utilize the most appropriate channel – live chat for quick questions, email for complex issues, and phone for urgent matters.

- Be patient and polite; remember that support agents are working hard to assist many clients.

- If your issue is not resolved, escalate the problem to a supervisor. Questrade’s escalation procedures are generally well-defined.

Security and Regulatory Compliance of Questrade’s Forex Offering

Navigating the world of forex trading requires trust, and that trust is built on a foundation of robust security and unwavering regulatory compliance. Questrade understands this, and their commitment to safeguarding both your data and your funds is a cornerstone of their platform. Let’s delve into the specifics of how they achieve this.Questrade employs a multi-layered approach to security, designed to protect user accounts and personal information from unauthorized access and cyber threats.

This involves robust encryption protocols for all data transmitted to and from the platform, firewalls to prevent malicious intrusions, and regular security audits to identify and address vulnerabilities before they can be exploited. Furthermore, Questrade utilizes advanced fraud detection systems that monitor account activity for suspicious patterns, helping to prevent and mitigate potential risks. Think of it as a digital fortress, complete with state-of-the-art defenses.

Data Encryption and Security Protocols

Questrade uses industry-standard encryption technologies, such as SSL/TLS, to protect data transmitted between users’ computers and Questrade’s servers. This ensures that sensitive information, such as login credentials and trading activity, remains confidential and secure during transmission. Data at rest is also encrypted, providing an additional layer of protection against unauthorized access even if a breach were to occur. Imagine your data locked away in a vault, accessible only with a highly secure key.

Regulatory Compliance and Licenses

Questrade operates under the strict regulatory oversight of various financial authorities. In Canada, for example, they are regulated by the Investment Industry Regulatory Organization of Canada (IIROC), a self-regulatory organization that sets high standards for the conduct and operations of its member firms. This ensures Questrade adheres to stringent rules and regulations designed to protect investors and maintain market integrity.

This regulatory oversight provides an independent assurance of Questrade’s commitment to fair practices and financial stability. It’s like having a trusted referee ensuring fair play in the forex game.

Comparison with a Competing Broker

While specific security protocols of competing brokers vary and are not publicly disclosed in complete detail for competitive reasons, a general comparison can be made. Many reputable brokers also employ robust encryption and adhere to regulatory standards in their respective jurisdictions. However, the specifics of their security measures, such as the types of encryption used and the frequency of security audits, might differ.

Choosing a broker should involve considering factors beyond just security features and include aspects such as platform usability, trading tools, and customer support. It’s about finding the right fit, not just the most secure option in a vacuum.

Account Verification and Identity Procedures

Verifying a user’s identity and account information is crucial for preventing fraud and ensuring compliance with anti-money laundering (AML) regulations. Questrade’s verification process typically involves providing identification documents such as a driver’s license or passport, proof of address, and potentially other supporting documents. This information is then carefully reviewed to confirm the user’s identity and prevent the creation of fraudulent accounts.

This thorough process is essential for maintaining the integrity of the platform and protecting all users. It’s a bit like airport security, ensuring only legitimate travelers can board the plane.

Closing Summary

So, is Questrade’s forex platform the holy grail of trading platforms? Well, that depends on your individual needs and trading style. While it boasts some impressive features and educational resources, it’s not without its quirks. Ultimately, the best way to determine if it’s right for you is to try it out (responsibly, of course!). Remember, trading involves risk, so always do your due diligence before diving headfirst into the forex market.

Happy trading (and may your pips be ever in your favor!)