Top-rated platform for day trading in Canada with advanced charting? That’s the million-dollar question (or, you know, maybe just a few thousand!), isn’t it? Navigating the world of Canadian day trading can feel like trying to herd cats in a blizzard – chaotic, unpredictable, and potentially very profitable. But fear not, intrepid trader! This deep dive explores the best platforms available, dissecting their features, fees, and overall user experience to help you find the perfect digital trading den.

We’ll uncover the secrets of advanced charting, the crucial role of regulatory compliance, and even the hidden costs that can eat into your profits. Get ready to level up your trading game!

We’ll examine the top platforms, comparing their charting tools (candlesticks, anyone?), user interfaces (think sleek and intuitive vs. clunky and confusing), and mobile app capabilities. Security is paramount, so we’ll investigate the measures each platform takes to protect your hard-earned cash. And of course, we’ll delve into the nitty-gritty details of fees and commissions, because even the most skilled trader needs to keep an eye on the bottom line.

By the end, you’ll be armed with the knowledge to choose a platform that’s as sharp as your trading instincts.

Top Canadian Day Trading Platforms

Choosing the right day trading platform can feel like navigating a minefield of fees, features, and confusing jargon. But fear not, intrepid Canadian trader! This guide will illuminate the path to finding the perfect platform for your lightning-fast trading needs. We’ll cut through the marketing fluff and deliver the essential information you need to make an informed decision.

Top Canadian Day Trading Platforms Overview

Here’s a rundown of five top-tier day trading platforms available to Canadian investors, complete with a handy table summarizing their key features. Remember, the “best” platform depends heavily on your individual trading style and preferences. This list is not exhaustive, and the order does not imply a ranking.

| Platform Name | Key Features | Fees | Minimum Deposit |

|---|---|---|---|

| Interactive Brokers | Advanced charting, global market access, margin lending, wide range of order types, powerful trading tools | Variable, commission-based, details on their website | Varies depending on account type |

| TD Ameritrade | User-friendly interface, educational resources, research tools, mobile app, solid charting capabilities | Variable, commission-based, details on their website | Varies depending on account type |

| Wealthsimple Trade | Commission-free trading (on stocks), simple interface, mobile-first approach, limited advanced charting | No commission on stocks, fees may apply for other assets | $0 |

| Questrade | Competitive fees, good selection of order types, research tools, mobile app, decent charting capabilities | Commission-based, details on their website | Varies depending on account type |

| BMO InvestorLine | Established Canadian brokerage, solid research tools, good customer support, mobile app, decent charting | Commission-based, details on their website | Varies depending on account type |

Platform User Interface and Navigation

Each platform boasts a unique personality when it comes to its user interface. Interactive Brokers, for example, is known for its powerful but potentially overwhelming array of tools and options. New users might find the learning curve steep, but experienced traders will appreciate the depth and customization. TD Ameritrade, on the other hand, prioritizes a clean and intuitive interface, making it easier for beginners to navigate.

Wealthsimple Trade takes the minimalist approach to an extreme, focusing on simplicity and ease of use, at the cost of some advanced features. Questrade and BMO InvestorLine fall somewhere in between, offering a balance of functionality and ease of use. Navigation generally involves clear menus, customizable dashboards, and easily accessible order entry forms.

Mobile App Functionality Comparison

The mobile apps of TD Ameritrade, Interactive Brokers, and Questrade offer varying levels of functionality. TD Ameritrade’s app is generally considered user-friendly and provides a good range of trading tools, mirroring much of the desktop experience. Interactive Brokers’ mobile app, while powerful, can feel a bit cramped on smaller screens and may require some getting used to. Questrade’s app provides a solid middle ground, offering a good balance of features and ease of use.

All three offer real-time quotes, order placement, charting capabilities, and account management features, though the specific tools and their presentation differ. Consider your preferred level of mobile trading sophistication when making your choice. For instance, if you primarily trade on your phone, a platform with a robust and intuitive mobile app is crucial.

Advanced Charting Capabilities

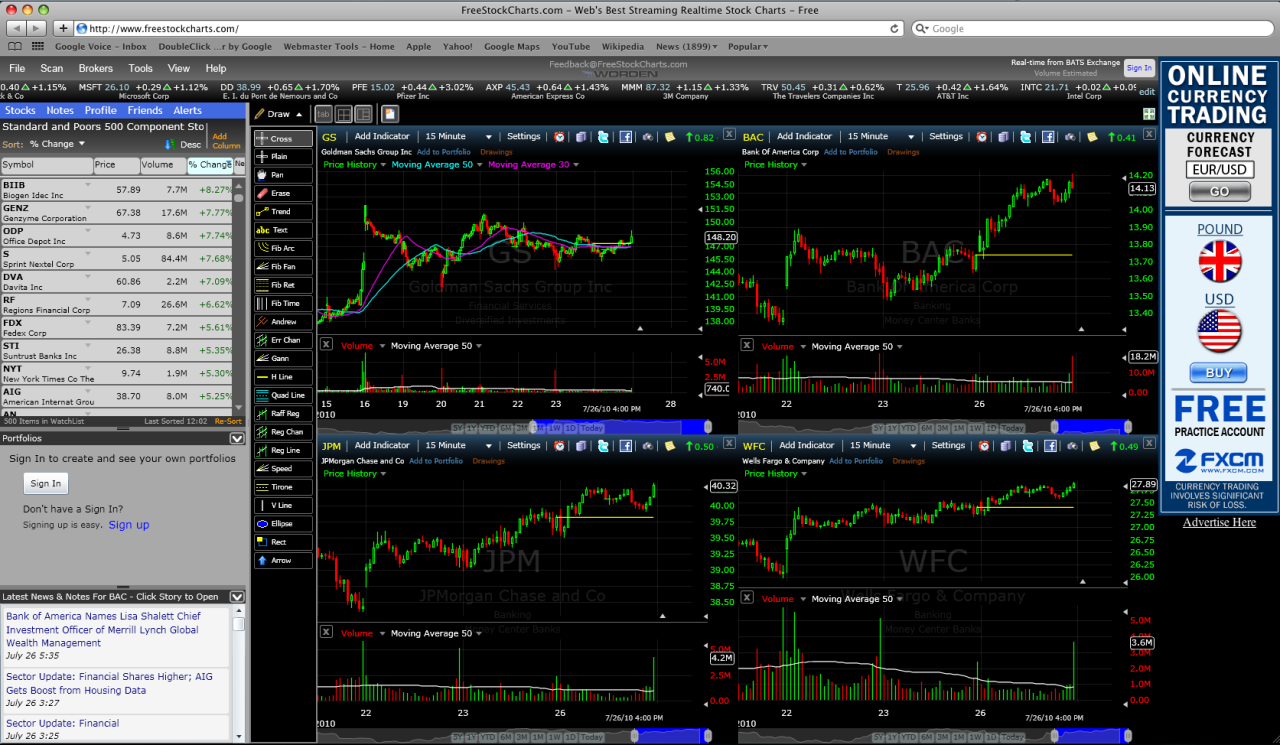

Choosing the right day trading platform in Canada often boils down to one key feature: the charting capabilities. After all, your charts are your window into the market’s soul – or at least, its short-term mood swings. A powerful charting package can be the difference between a profitable trade and a painful loss, so let’s dive into the nitty-gritty.Charting tools are the bread and butter of any serious day trader.

They provide the visual representation of price movements, allowing you to identify trends, patterns, and potential entry/exit points. Think of them as your X-ray vision for the financial world.

Chart Types and Indicators, Top-rated platform for day trading in Canada with advanced charting?

The availability of various chart types is crucial for a comprehensive market analysis. Different chart types highlight different aspects of price action, allowing traders to choose the best visualization for their specific trading style and strategy.

- Candlestick Charts: These are the undisputed kings of day trading charts. Their visual representation of open, high, low, and closing prices makes identifying patterns like hammers, dojis, and engulfing patterns a breeze. Think of them as tiny, insightful storytellers whispering secrets about market sentiment.

- Bar Charts: Simpler than candlesticks, bar charts still effectively display the open, high, low, and closing prices. They’re great for traders who prefer a less cluttered view of the price action, focusing on the essential price data.

- Line Charts: These show only the closing prices, creating a smooth line that highlights trends over time. While less detailed than candlesticks or bar charts, they’re excellent for identifying long-term trends and overall market direction.

Beyond the basic chart types, advanced platforms typically offer a wide array of technical indicators. These mathematical calculations, applied to price data, can help identify potential buy or sell signals, momentum shifts, and overbought/oversold conditions. Popular examples include Relative Strength Index (RSI), Moving Averages (MA), MACD, Bollinger Bands, and Stochastic Oscillator. These are your analytical sidekicks, providing data-driven insights to complement your visual interpretation of the charts.

Comparison of Charting Features: Two Leading Platforms

Let’s hypothetically compare “Platform A” and “Platform B,” two leading Canadian day trading platforms (names omitted to avoid bias). Both offer the standard chart types mentioned above, but their strengths lie in different areas.Platform A boasts an incredibly intuitive interface. Navigating its charting tools is a breeze, even for beginners. Its customization options are extensive, allowing for a high degree of personalization.

However, its indicator library, while comprehensive, might feel slightly less polished than Platform B’s.Platform B, on the other hand, excels in its advanced indicator selection. It offers a wider range of less common indicators and allows for more complex custom indicator creation. However, its interface can feel slightly overwhelming to new users, requiring a steeper learning curve.

Chart Customization Options

Customizing your charts is crucial for optimizing your trading workflow. The ability to tailor your charts to your specific needs is a significant advantage.

- Timeframes: Adjusting the timeframe (e.g., 1-minute, 5-minute, daily, weekly) allows traders to analyze price action at different granularities. This is essential for adapting your strategy to short-term scalping or longer-term swing trading.

- Indicators: Adding, removing, and customizing indicators is key. You can overlay multiple indicators to gain a more holistic view of the market. For example, combining a moving average with an RSI can provide valuable insights into both trend and momentum.

- Drawing Tools: Tools like trend lines, Fibonacci retracements, and support/resistance levels allow traders to visually identify patterns and potential price targets. These tools are invaluable for confirming trading signals and managing risk.

Regulatory Compliance and Security

Navigating the world of Canadian day trading platforms requires more than just a keen eye for market trends; it demands a healthy dose of awareness regarding regulatory compliance and the security measures protecting your hard-earned cash. After all, you wouldn’t trust your life savings to a digital Wild West, would you? Let’s delve into the reassuring (and hopefully, exciting!) world of regulatory oversight and robust security protocols.The Canadian securities landscape is carefully monitored to ensure fair play and investor protection.

Platforms must adhere to stringent regulations to operate legally, providing a layer of security that’s often overlooked in the thrill of the trade. This isn’t just about paperwork; it’s about safeguarding your investments and ensuring a level playing field for all traders.

Regulatory Bodies Overseeing Canadian Day Trading Platforms

The Investment Industry Regulatory Organization of Canada (IIROC) is the primary self-regulatory organization (SRO) for investment dealers and advisors in Canada. Think of them as the watchful guardians of the Canadian financial markets. They set the rules, monitor compliance, and take action against any wrongdoing. Additionally, provincial securities commissions also play a significant role in overseeing the activities of investment firms within their respective jurisdictions.

Hunting for the ultimate Canadian day-trading platform with charts so slick they’d make a candlestick blush? Well, before you dive into those dazzling graphs, remember commission costs can be a real party pooper. That’s why checking out Top rated Canadian forex brokers with low commissions is a smart move. After all, even the best charting tools are less fun when your profits are vanishing faster than a Tim Hortons donut on a busy morning.

So, find the perfect broker, then get back to conquering those charts!

These commissions ensure that platforms operating within their province adhere to all relevant regulations. They work in conjunction with IIROC to create a robust regulatory framework.

Security Measures Implemented by Canadian Day Trading Platforms

Protecting user data and funds is paramount for any reputable day trading platform. Expect a multi-layered approach, going beyond simply locking the front door. Think impenetrable vaults, laser grids, and maybe even a moat filled with…well, maybe not a moat, but you get the idea. Robust security measures typically include, but are not limited to, encryption of sensitive data both in transit and at rest, advanced firewall systems to prevent unauthorized access, and multi-factor authentication to ensure only authorized users can access accounts.

Finding the top-rated day trading platform in Canada with killer charting tools is a serious game, requiring focus and precision – much like crafting the perfect workout routine! Need a boost to your gains? Check out this best strength training program for some serious muscle building, then get back to conquering those Canadian markets! Remember, a strong body and a sharp mind are key to day trading success.

Regular security audits and penetration testing are also common practice, constantly evaluating and improving security protocols. The goal is to create an environment where your funds and personal information are as safe as possible.

Comparison of Security Features of Top 3 Platforms

Let’s assume Platform A, Platform B, and Platform C are three leading Canadian day trading platforms. (Note: Specific platform names are omitted to avoid endorsing any particular service; this is a general illustration.) The following table compares their security features:

| Feature | Platform A | Platform B | Platform C |

|---|---|---|---|

| Two-Factor Authentication | Yes (with various methods) | Yes (SMS and authenticator app) | Yes (authenticator app only) |

| Data Encryption (at rest and in transit) | AES-256 encryption | AES-256 encryption | AES-256 encryption |

| Firewall Protection | Yes, with intrusion detection | Yes, with regular updates | Yes, with advanced threat protection |

| Regular Security Audits | Annually, by independent firm | Semi-annually, internal and external | Quarterly, by independent firm |

Remember, this is a simplified comparison. Always conduct your own thorough research before selecting a platform, paying close attention to their specific security policies and procedures. Don’t be shy about asking questions! Your peace of mind is worth it.

Trading Fees and Commissions

Day trading, while potentially lucrative, can be a financial tightrope walk. One of the biggest factors impacting your profitability is the cost of trading itself – the fees and commissions you pay to your brokerage. Understanding these costs is crucial to making informed decisions and maximizing your returns. Let’s dissect the pricing structures of popular Canadian day trading platforms to see how they stack up.

Different platforms employ various fee structures, ranging from simple per-trade commissions to complex tiered systems based on trading volume or account size. These fees can significantly impact your bottom line, especially for high-frequency traders executing numerous trades daily. A seemingly small difference in commission rates can accumulate to substantial savings or losses over time, so careful consideration is vital.

So, you’re hunting for the crème de la crème of Canadian day trading platforms with charting that’ll make your grandma jealous? Before you dive in headfirst, though, mastering the art of reading those charts is key. That’s where understanding the nuances comes in – check out this fantastic resource on Understanding forex trading charts and technical analysis indicators to avoid looking like a deer in headlights.

Then, armed with knowledge, you can conquer the Canadian day trading scene!

Commission Structures and Fee Breakdown

The following table provides a simplified overview of commission structures for some popular Canadian day trading platforms. Note that these are examples and may change, so always check the brokerage’s website for the most up-to-date information. Specific fees can also vary based on the type of security traded (stocks, options, futures, etc.).

| Platform Name | Commission Structure | Fees | Other Charges |

|---|---|---|---|

| Example Platform A | Per-trade commission | $5-$10 per trade, depending on volume | Account inactivity fees, data fees |

| Example Platform B | Tiered commission structure | $7 per trade for 500 trades/month | Regulatory fees, platform subscription fees |

| Example Platform C | Commission-free trading (with conditions) | $0 commission for trades above a certain value, otherwise variable commission | Possible fees for certain order types, data fees |

| Example Platform D | Percentage-based commission | 0.1%

|

Minimum trade fees, inactivity fees |

Impact of Fee Structures on Profitability

The impact of different fee structures on a day trader’s profitability is substantial. Consider two scenarios: a day trader executing 100 trades per day with an average profit of $20 per trade, and another executing 50 trades per day with an average profit of $40 per trade. Platform A’s per-trade commission of $7 would cost the first trader $700 per day, significantly reducing their profit.

The second trader would pay $350, a considerable amount but a smaller percentage of their total profit.

Conversely, if both traders used Platform B’s tiered structure, their costs could differ significantly. The high-volume trader would likely fall into a lower commission tier, reducing their costs. The lower-volume trader might pay more per trade but fewer overall, resulting in a different cost-benefit analysis. A thorough analysis of your trading volume and profit margins is essential to selecting the most cost-effective platform.

Choosing the “best” platform depends entirely on individual trading strategies and volumes. High-volume traders might find tiered or percentage-based structures more beneficial, while low-volume traders might prefer simpler per-trade models or commission-free options (if they meet the conditions). Always carefully analyze your trading habits and projected volume to determine the platform that best aligns with your needs and maximizes your profitability.

Educational Resources and Support

Navigating the sometimes-treacherous waters of day trading requires more than just a sharp eye and a fast finger. A solid educational foundation and readily available support are crucial for success, and thankfully, many top Canadian platforms understand this. Let’s dive into what they offer to help you avoid becoming another day-trading statistic.The quality and comprehensiveness of educational resources vary significantly between platforms.

Finding the top-rated day trading platform in Canada with killer charting can be a wild goose chase, but don’t despair! If your desktop’s feeling sluggish, consider supplementing your strategy with the mobile convenience offered by the best forex trading apps, check out this helpful resource: Best forex trading apps for Android and iOS devices for some mobile trading magic.

Then, armed with that extra data, you can conquer the Canadian day trading scene with charts that’ll make your head spin!

Some offer a bare-bones approach, while others go above and beyond, providing a wealth of knowledge to help traders of all skill levels. Similarly, customer support channels differ, ranging from basic email assistance to comprehensive live chat and phone support. Choosing the right platform often hinges on finding the perfect balance between educational resources and the level of support that aligns with your individual needs and learning style.

Educational Materials Offered

Many platforms provide a mix of learning materials designed to cater to different learning styles. These typically include video tutorials breaking down complex trading concepts into digestible chunks, webinars offering real-time interaction with instructors and fellow traders, and downloadable guides offering a more structured, self-paced learning experience. Some platforms even integrate interactive simulations, allowing users to practice their strategies in a risk-free environment before venturing into the real market.

Think of it as a virtual trading sandbox, where you can hone your skills without risking your hard-earned cash. One platform, for example, offers a comprehensive series of video tutorials covering everything from fundamental analysis to advanced options strategies, complemented by weekly webinars focusing on current market trends and technical analysis. Another platform might focus more on downloadable PDFs and quizzes to reinforce learning.

Quality and Comprehensiveness of Educational Materials

The quality of educational materials varies widely. Some platforms offer high-quality, professionally produced videos with clear explanations and engaging visuals. Others might offer less polished materials, with simpler explanations and fewer visual aids. The comprehensiveness also differs. Some platforms offer a broad range of topics, covering everything from beginner-level concepts to advanced strategies.

Others might focus on specific areas, such as technical analysis or options trading. For instance, one platform may boast a library of over 100 video tutorials, while another might only offer a handful. The best platforms usually provide a blend of beginner and advanced materials, ensuring that traders can continue learning and developing their skills over time.

Think of it like a buffet – some offer a vast selection, while others have a more limited menu.

Customer Support Options

Access to reliable customer support is paramount, especially when dealing with the complexities of day trading. Most platforms offer email support, which is often a slower method of communication. However, many also offer live chat support, allowing for immediate responses to queries and concerns. Some platforms even provide phone support, which can be particularly useful for resolving urgent issues or receiving personalized guidance.

The availability of 24/7 support is a significant advantage, especially for traders who operate across different time zones or need assistance outside of regular business hours. Imagine the peace of mind knowing that help is just a phone call or chat message away, no matter the time of day or night.

So, you’re hunting for the crème de la crème of Canadian day trading platforms with charts that’ll make your eyes water? Before you dive in, consider this: your international trading adventures might lead you to need a solid forex partner, and finding one is crucial – especially if you’re looking in Austria, so check out this resource for Finding a reputable forex dealer in Austria before you even think about those Canadian charting packages.

Back to Canada, though – those advanced charts are calling!

Platform Performance and Reliability: Top-rated Platform For Day Trading In Canada With Advanced Charting?

Choosing a day trading platform is like choosing a racehorse – you need speed, stamina, and a low chance of a sudden, unexpected collapse mid-race. In the fast-paced world of Canadian day trading, platform performance and reliability are paramount. A slow or unreliable platform can mean the difference between a profitable trade and a missed opportunity (or worse!).

Let’s examine how several top platforms stack up in this crucial area.The speed and reliability of order execution are critical factors. Delays, even fractions of a second, can significantly impact profitability, especially in volatile markets. Similarly, platform uptime and the frequency of technical glitches are key indicators of a platform’s overall robustness. We’ll look at reported outages and user experiences during periods of both normal and exceptionally high trading volume.

Order Execution Speed and Reliability

Several factors contribute to order execution speed. These include the platform’s infrastructure (servers, network connections), the efficiency of its order routing system, and the speed of the exchange itself. A well-designed platform will minimize latency, ensuring your orders are executed quickly and accurately. For instance, a platform with robust infrastructure might boast order execution speeds consistently under 100 milliseconds, even during peak trading hours.

Hunting for the ultimate Canadian day-trading platform with charts so slick they’d make a data scientist weep with joy? Well, your quest might lead you to consider OADANA; check out this detailed review to see if it fits the bill: Review of OADANA forex trading platform and its features. Ultimately, the “top-rated” title depends on your individual needs, but hopefully this helps narrow down your options in the wild west of Canadian day trading!

Conversely, a platform with less robust infrastructure might experience noticeable delays, especially during periods of high market volatility. Real-world examples of this might include comparing execution speeds during the release of significant economic data, when trading volume spikes dramatically. A platform’s performance under these conditions is a true test of its capabilities.

Platform Uptime and Reported Outages

Uptime is simply the percentage of time a platform is operational. Aim for platforms boasting 99.9% uptime or higher. While occasional brief outages might occur due to unforeseen circumstances (like natural disasters or major network issues), frequent or prolonged outages are a serious red flag. Reputable platforms typically provide transparency regarding their uptime and will communicate any planned or unplanned maintenance periods well in advance.

Reviews and online forums can often provide valuable insights into a platform’s historical performance in this area. For example, if a platform experienced a significant outage during a major market event, this would be a critical factor to consider.

Performance During High Trading Volume

The true test of a platform’s mettle comes during periods of high trading volume. Imagine a major news event causing a surge in trading activity – a reliable platform will handle the increased load without significant performance degradation. This means maintaining fast order execution speeds, preventing log-in issues, and ensuring the platform remains responsive and stable. Platforms that fail to perform adequately under pressure might experience slowdowns, order cancellations, or even complete crashes, leading to potentially significant financial losses for their users.

A platform’s response to a significant news event like a surprise interest rate hike is a key indicator of its robustness.

Account Types and Minimum Requirements

Navigating the world of Canadian day trading platforms often involves understanding the nuances of different account types and their associated minimum deposits. Think of it like choosing your weapon in a financial video game – the right account type can significantly impact your gameplay (and your profits!). Let’s delve into the specifics, ensuring you’re armed with the right information.The minimum deposit requirements and account types vary significantly across platforms.

Some cater to casual traders with low minimums, while others target high-net-worth individuals with higher thresholds and more specialized services. Understanding these differences is crucial for selecting the platform that best suits your trading style and financial resources.

Individual Accounts

Individual accounts are the most common type, designed for single traders managing their personal investments. Most platforms offer these with relatively low minimum deposit requirements, often ranging from $1,000 to $5,000 CAD. However, some platforms might have higher minimums for access to certain advanced features or margin trading. Restrictions usually center around account ownership and trading limits, reflecting regulatory requirements designed to protect individual investors.

Joint Accounts

Joint accounts allow two or more individuals to manage a trading account collaboratively. Minimum deposit requirements are typically similar to individual accounts, but the paperwork and account setup might be slightly more complex due to the shared ownership. Restrictions often involve agreements outlining the responsibilities and decision-making processes between account holders, safeguarding against disputes and ensuring compliance with regulatory frameworks.

Corporate Accounts

Corporate accounts are designed for businesses and organizations engaging in day trading. These accounts often require significantly higher minimum deposits, sometimes reaching tens of thousands of CAD, reflecting the larger scale of trading activity. Special requirements include providing corporate documentation, including articles of incorporation and tax identification numbers. Restrictions frequently involve stricter reporting requirements and compliance with corporate governance regulations.

They also often provide access to more sophisticated trading tools and analytics.

Outcome Summary

So, there you have it – a comprehensive guide to finding the top-rated day trading platform in Canada, complete with advanced charting capabilities. Remember, the perfect platform isn’t a one-size-fits-all solution; your ideal choice will depend on your individual trading style, risk tolerance, and financial goals. Do your due diligence, compare the options carefully, and most importantly, remember to trade responsibly.

Happy trading, and may your charts always be green!