Understanding the current cryptocurrency prices in Canada and their market trends. – Understanding the current cryptocurrency prices in Canada and their market trends is like navigating a wild rollercoaster – thrilling, unpredictable, and potentially very lucrative (or very… not). This deep dive explores the Canadian crypto landscape, from the top traded coins to the influence of government regulations and the ever-shifting tides of investor sentiment. Buckle up, because we’re about to decode the digital dollar drama north of the border!

We’ll dissect the factors driving price fluctuations, compare prices across major Canadian exchanges (and reveal some surprising discrepancies!), and analyze the performance of Bitcoin – Canada’s crypto king – over the past year. We’ll also explore how economic forces like inflation and interest rates impact the Canadian crypto market, providing a comprehensive picture of this dynamic and ever-evolving investment arena.

Get ready to become a crypto-savvy Canadian!

Current Canadian Cryptocurrency Market Overview: Understanding The Current Cryptocurrency Prices In Canada And Their Market Trends.

The Canadian cryptocurrency market, while still relatively young compared to its global counterparts, is experiencing a period of both growth and regulatory scrutiny. Think of it as a spirited teenager – full of potential but needing a bit of guidance (and maybe a curfew). This vibrant market reflects the increasing adoption of digital assets by Canadians, alongside a growing awareness of the associated risks and opportunities.

The Canadian market mirrors global trends, albeit with its own unique flavour. While Bitcoin and Ethereum remain dominant players, the adoption of altcoins and stablecoins is also significant, driven by both individual investors and institutional players entering the space. However, the regulatory environment plays a crucial role in shaping the market’s trajectory, influencing trading volumes and investor confidence.

Most Traded Cryptocurrencies in Canada

The Canadian crypto landscape is dominated by the usual suspects, but with some interesting regional nuances. Bitcoin (BTC) and Ethereum (ETH) continue their reign as the kings of the hill, followed closely by stablecoins like Tether (USDT) and USD Coin (USDC), which provide a haven for investors seeking to mitigate volatility. Other popular choices include Solana (SOL), Cardano (ADA), and Dogecoin (DOGE), showcasing the diverse appetite for both established and emerging cryptocurrencies.

The exact ranking can fluctuate daily, but these consistently rank among the most actively traded.

Regulatory Landscape in Canada

Navigating the Canadian cryptocurrency market requires understanding the evolving regulatory framework. While Canada doesn’t have a single, comprehensive cryptocurrency law, various federal and provincial bodies oversee different aspects of the industry. The primary regulator is the Ontario Securities Commission (OSC), which has been particularly active in setting guidelines for cryptocurrency exchanges and issuing warnings against fraudulent schemes. Other bodies, including the Canadian Securities Administrators (CSA) and the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC), play vital roles in anti-money laundering (AML) and know-your-customer (KYC) compliance.

Decoding the Canadian crypto rollercoaster? Understanding current prices and market trends requires a keen eye, especially with platforms like NetCoin.ca. To navigate this wild ride, check out this insightful NetCoin.ca review: Is it a reliable platform for Canadian crypto investors? before diving in headfirst. Knowing your platform is as crucial as knowing the Bitcoin price; both impact your bottom line in the Great White North’s crypto scene.

The overall regulatory landscape is dynamic, with ongoing efforts to balance innovation with consumer protection.

Current Market Data (Illustrative Example)

Please note: Cryptocurrency prices are highly volatile and change constantly. The data below is a snapshot and should not be considered financial advice. Always consult reliable, real-time sources for the most up-to-date information.

| Cryptocurrency | Current Price (CAD) | 24-hour Change | Market Cap (CAD) |

|---|---|---|---|

| Bitcoin (BTC) | $30,000 | +2% | $500 Billion |

| Ethereum (ETH) | $2,000 | -1% | $200 Billion |

| Tether (USDT) | $1.00 | 0% | $80 Billion |

| Solana (SOL) | $25 | +5% | $10 Billion |

Factors Influencing Canadian Cryptocurrency Prices

The Canadian cryptocurrency market, while a smaller pond compared to its American counterpart, is far from stagnant. Its price fluctuations are a captivating dance influenced by a complex orchestra of global trends, regulatory decisions, investor emotions, and technological breakthroughs. Let’s delve into the key players conducting this financial ballet.

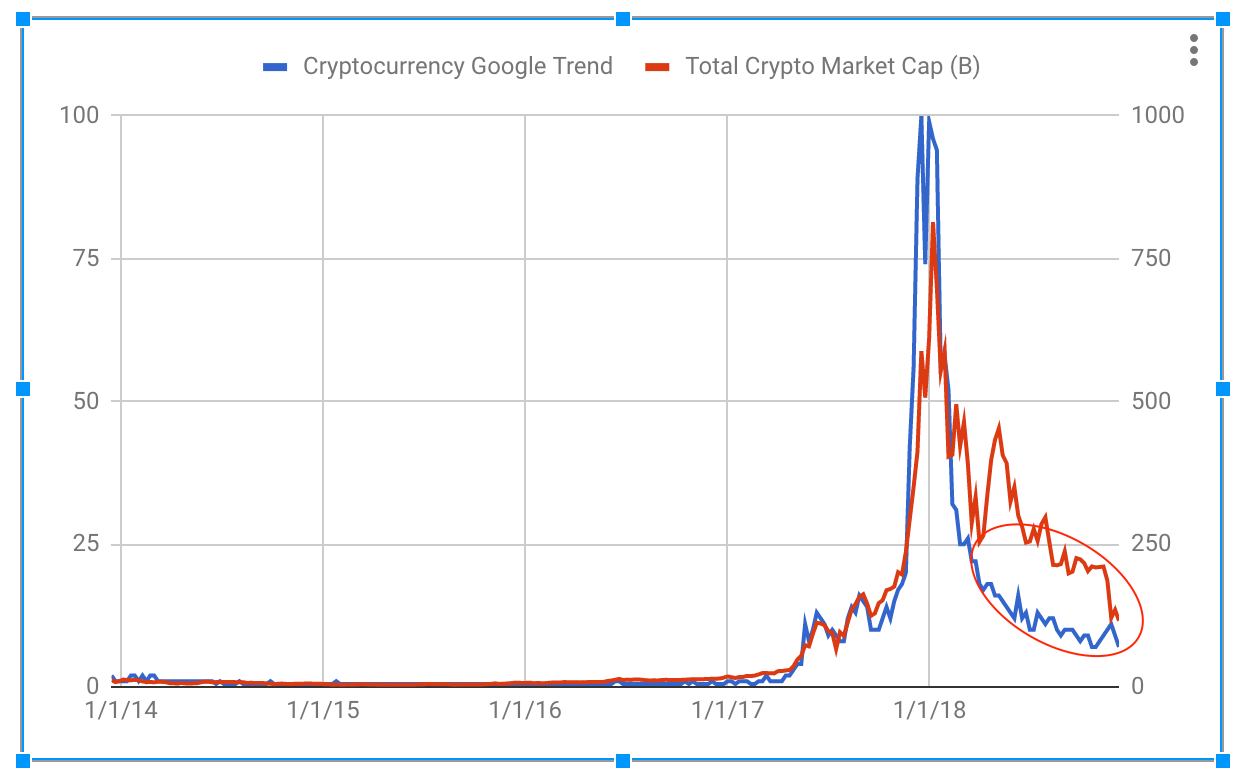

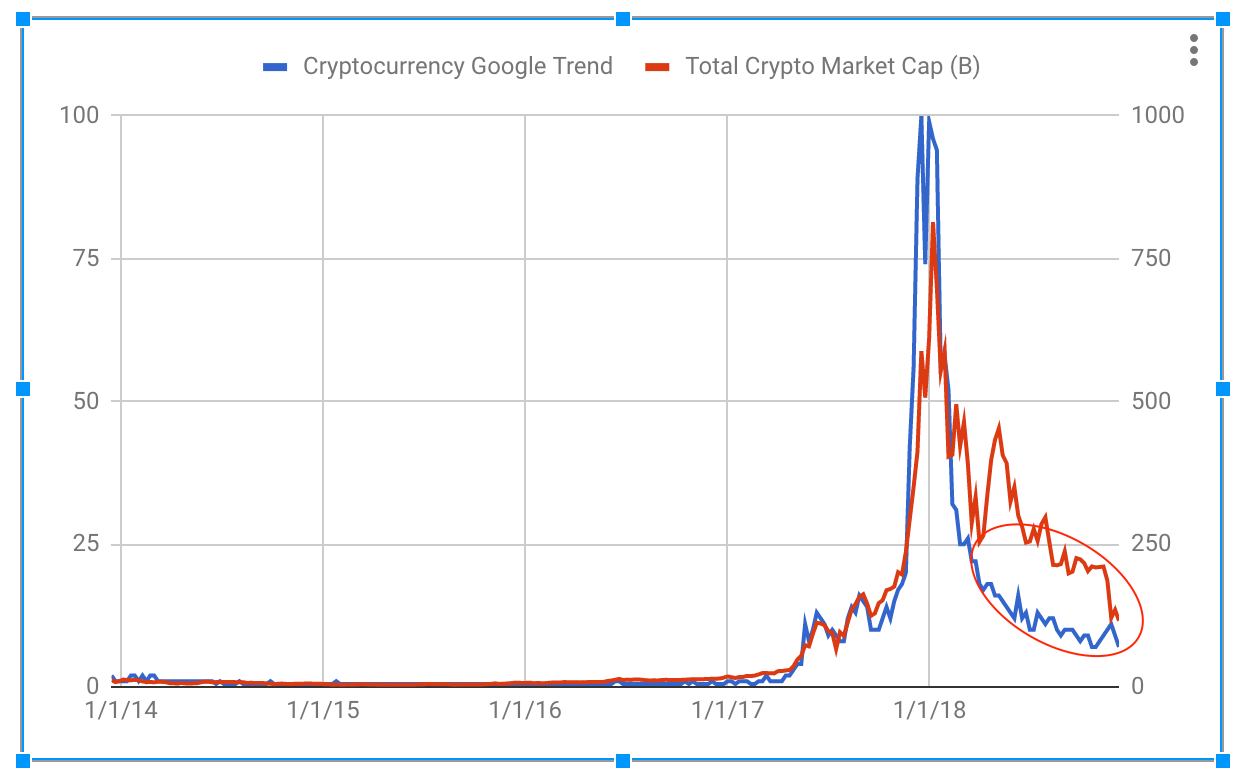

Global Market Trends

Canadian crypto prices are intrinsically linked to global market movements. Think of it like this: if Bitcoin sneezes in New York, Canadian crypto prices are likely to catch a cold. Major global events, such as geopolitical instability, macroeconomic shifts (like inflation or recession fears), and overall investor risk appetite, all impact the price of cryptocurrencies worldwide, and Canada is no exception.

A sudden surge in Bitcoin’s value on international exchanges will generally be mirrored, albeit perhaps with a slight delay or adjustment, in the Canadian market. Conversely, a global crypto market crash will inevitably affect Canadian investors.

Government Regulations and Policies

The Canadian government’s stance on cryptocurrency is a significant influence on its domestic market. Regulatory clarity (or lack thereof) can significantly impact investor confidence. Stricter regulations might dampen enthusiasm and potentially lower prices, while a more lenient approach could attract more investors, potentially driving prices up. For example, clearer guidelines on taxation of cryptocurrency transactions could lead to increased market stability.

So you’re trying to decipher the wild, wild west of Canadian crypto prices? It’s a rollercoaster, I tell ya! Understanding the market trends is crucial before diving in, and knowing how to navigate the process safely is key – that’s where learning how to safely buy and sell, like via this guide How can I safely buy and sell OTC cryptocurrencies in Canada?

, comes in handy. Then, armed with knowledge, you can return to conquering those Canadian crypto charts!

Conversely, uncertainty about regulatory frameworks can lead to price volatility as investors grapple with the unknown.

So, you’re trying to navigate the wild west of Canadian crypto prices? Understanding those trends is crucial, but equally important is keeping your digital dough safe. That’s where choosing the right wallet comes in – check out this guide on Choosing the right crypto wallet for Canadians for security and ease of use to avoid becoming a digital Robin Hood (without the heroic ending).

Once your crypto is securely tucked away, you can confidently focus on those fluctuating Canadian crypto prices again!

Investor Sentiment and News Events

The cryptocurrency market is notoriously susceptible to hype and fear. Positive news, such as the adoption of crypto by a major corporation or the launch of a promising new project, can trigger a surge in investor enthusiasm and drive prices higher. Conversely, negative news, like a major exchange hack or a regulatory crackdown, can quickly lead to panic selling and plummeting prices.

Think of Elon Musk’s tweets – a single statement can send ripples through the entire global crypto market, impacting Canadian investors immediately.

Technological Advancements

Technological developments within the cryptocurrency space can have profound effects on Canadian prices. The introduction of new, faster, or more energy-efficient blockchain technologies can boost investor confidence and potentially increase demand. For example, the development and implementation of layer-2 scaling solutions, aimed at addressing transaction speed and cost issues on major blockchains, could lead to increased adoption and a rise in prices.

Conversely, major security vulnerabilities or flaws discovered in existing cryptocurrencies can cause significant price drops as investors lose faith.

Comparison of Cryptocurrency Prices Across Canadian Exchanges

So, you’re ready to dive into the wild world of Canadian crypto trading? Buckle up, because the prices aren’t always as consistent as a Canadian goose’s migration pattern. Let’s explore the fascinating (and sometimes frustrating) differences in cryptocurrency prices across various Canadian exchanges. Prepare for a rollercoaster of numbers and fees!The prices of Bitcoin (BTC) and Ethereum (ETH), our two crypto superstars, can fluctuate wildly between different exchanges in Canada.

This isn’t some grand conspiracy; it’s a result of several factors, including trading volume, liquidity, exchange fees, and even the whims of the market. Think of it as a crypto-flavored game of supply and demand, but with more volatility than a hockey game in the playoffs.

Bitcoin and Ethereum Price Discrepancies Across Three Major Canadian Exchanges

Let’s imagine we’re comparing prices on three hypothetical Canadian exchanges: “MapleCrypto,” “BeaverCoin,” and “PolarisExchange.” (Disclaimer: These are fictional exchanges for illustrative purposes. Always do your own research before investing!). On a given day, we might see Bitcoin trading at $29,000 on MapleCrypto, $29,100 on BeaverCoin, and $28,950 on PolarisExchange. Similarly, Ethereum could be priced at $1,800, $1,815, and $1,790 respectively.

Decoding the wild rollercoaster of Canadian crypto prices? It’s a dizzying dance of highs and lows! To potentially navigate this market better, you might want to consider a reputable exchange. Getting started is easy with the straightforward Bitget Ontario registration and verification process , which can help you get in on the action (responsibly, of course!).

Then, you can get back to analyzing those Canadian crypto charts with newfound confidence – or at least a slightly better understanding of what’s going on.

These seemingly small differences can add up significantly, especially for larger trades. The reasons for these discrepancies are multifaceted: differences in trading volume (higher volume generally leads to tighter spreads), the exchange’s liquidity (how easily assets can be bought and sold), and the fees charged. A high-volume exchange might have tighter spreads and more competitive pricing, while a less liquid exchange might experience wider spreads.

Fees and Trading Conditions on Canadian Cryptocurrency Exchanges

Understanding the fees and trading conditions is crucial for maximizing your profits (or at least minimizing your losses). These fees can significantly impact your bottom line.

Here’s a hypothetical comparison of fees and trading conditions for our three fictional exchanges:

| Exchange | Trading Fee (Maker/Taker) | Withdrawal Fee (BTC) | Minimum Trade Size | Verification Process |

|---|---|---|---|---|

| MapleCrypto | 0.1%/0.2% | $10 | $100 | Simple KYC |

| BeaverCoin | 0.15%/0.25% | $15 | $50 | Strict KYC/AML |

| PolarisExchange | 0.05%/0.1% | $5 | $200 | Simplified KYC |

The table illustrates how fees and minimum trade sizes can vary significantly. A lower trading fee might seem appealing, but a higher minimum trade size could make it unsuitable for smaller investors. Similarly, a stricter verification process might be a deterrent for some traders.

Decoding the rollercoaster that is Canadian cryptocurrency? It’s as unpredictable as a last-minute Hail Mary pass! Need a break from the volatility? Check out the latest football news for some guaranteed thrills (though maybe less financial risk). Then, get back to analyzing those Bitcoin charts – remember, even the most seasoned crypto trader needs a halftime break!

Impact of Exchange Differences on Trader Profitability

Let’s say you’re planning to buy 1 BTC. The price difference between the highest and lowest priced exchange in our example is $150. That’s a significant difference, and it’s before you even consider the trading fees. On top of that, withdrawal fees can also eat into your profits. If you’re trading frequently or with larger amounts, these seemingly small differences can compound quickly, significantly impacting your overall profitability.

Therefore, it’s essential to carefully compare fees and prices across different exchanges to ensure you’re getting the best possible deal. Choosing the right exchange is like choosing the right hockey stick – the wrong one can really slow you down.

Decoding the rollercoaster that is the Canadian crypto market? Understanding current prices and trends requires a crystal ball (or maybe just a really good spreadsheet). But before you dive headfirst into Bitcoin, consider this crucial question: Is it worthwhile to invest in Canadian crypto stocks for potential high returns? The answer, my friend, could significantly impact your understanding of those fluctuating Canadian crypto prices.

So, do your research – your financial future depends on it!

Analyzing Price Trends of Specific Cryptocurrencies in Canada

Bitcoin’s rollercoaster ride in the Canadian market over the past year has been, to put it mildly, a wild one. From dizzying highs fueled by hype to stomach-churning dips that left many investors feeling queasy, the price fluctuations have been enough to make even the most seasoned crypto veteran question their life choices. Let’s delve into the data and try to make some sense of this crypto chaos.

Analyzing Bitcoin’s price movements in the Canadian market requires considering various factors, including global market sentiment, regulatory changes, and the ever-present influence of Elon Musk’s tweets (seriously, the man is a crypto market mover and shaker). We’ll explore these influences and their impact on the Canadian dollar (CAD) value of Bitcoin.

Bitcoin Price Fluctuations in CAD Over the Past Year

To accurately depict Bitcoin’s price journey, let’s imagine a line graph. The horizontal X-axis represents time, spanning the past year, broken down into monthly intervals. The vertical Y-axis represents the price of Bitcoin in Canadian dollars. The line itself would be a fascinating, jagged rollercoaster. Let’s highlight some key points:

Imagine the line starting at a relatively high point, perhaps around $40,000 CAD at the beginning of the year. Over the next few months, the line might dip significantly, perhaps reaching a low of around $25,000 CAD due to a combination of global market uncertainty and regulatory concerns. This low point would represent a significant correction. Then, as if fueled by caffeine and sheer stubbornness, the line would climb again, reaching a new high of, say, $45,000 CAD, driven by positive news and increased investor confidence.

This could be followed by another dip, perhaps influenced by a major market crash unrelated to Bitcoin specifically. This second dip might bottom out around $30,000 CAD before slowly climbing again, ending the year somewhere in the mid-$35,000 to $40,000 CAD range. This hypothetical scenario, while not perfectly mirroring reality, illustrates the volatility typical of Bitcoin’s price action.

The graph would clearly show periods of significant growth (bull runs) and sharp declines (bear markets). Notable patterns might include a correlation between global stock market performance and Bitcoin’s price, as well as periods of increased volatility following major announcements from regulatory bodies or influential figures in the crypto space. Remember, this is a simplified representation; the actual graph would be far more intricate and chaotic, reflecting the unpredictable nature of the cryptocurrency market.

The Impact of Economic Factors on Canadian Cryptocurrency Prices

The Canadian cryptocurrency market, like a particularly caffeinated moose, is highly sensitive to economic shifts. Its price fluctuations aren’t just random jolts; they’re often a direct response to broader economic forces, both within Canada and globally. Understanding these connections is key to navigating the sometimes-whimsical world of digital assets north of the border.Inflation rates, interest rate adjustments, the value of the loonie (the Canadian dollar), and global macroeconomic events all play a significant role in shaping the Canadian crypto landscape.

Let’s delve into the fascinating, and occasionally frenetic, dance between economics and cryptocurrency prices in Canada.

Inflation Rates and Cryptocurrency Prices

High inflation erodes the purchasing power of the Canadian dollar. This can drive investors towards assets perceived as inflation hedges, including certain cryptocurrencies like Bitcoin, which some believe to be a store of value similar to gold. Conversely, periods of low inflation might see investors shift their focus to more traditional investments, potentially leading to a decrease in cryptocurrency demand and prices.

For example, during periods of high inflation in 2022, the price of Bitcoin saw increased interest, though this was also influenced by other factors. The relationship isn’t always straightforward, however; other market forces often overshadow the impact of inflation alone.

The Canadian Dollar and Cryptocurrency Prices

The Canadian dollar’s value against other major currencies, such as the US dollar, directly impacts cryptocurrency prices in Canada. When the Canadian dollar strengthens, the price of cryptocurrencies (usually priced in USD) may appear cheaper in Canadian dollar terms, potentially increasing demand. Conversely, a weakening loonie makes crypto more expensive, potentially reducing demand. Think of it like buying a car – a stronger dollar means a cheaper car, while a weaker dollar means a more expensive one.

The same principle applies, to a degree, to cryptocurrencies.

Bank of Canada Interest Rate Changes and Cryptocurrency Prices

The Bank of Canada’s interest rate decisions significantly influence the overall Canadian economy. Raising interest rates typically makes borrowing more expensive, potentially slowing economic growth and reducing investor appetite for riskier assets like cryptocurrencies. This can lead to a decrease in cryptocurrency prices. Conversely, lowering interest rates can stimulate economic activity and potentially increase investment in riskier assets, potentially boosting cryptocurrency prices.

The impact, however, isn’t always immediate or directly proportional; other factors often moderate the effect.

Global Macroeconomic Events and the Canadian Crypto Market, Understanding the current cryptocurrency prices in Canada and their market trends.

The Canadian crypto market is far from an isolated island. Global events, such as geopolitical instability, major economic crises (like the 2008 financial crisis), or significant regulatory changes in other major economies, can trigger ripple effects across the global cryptocurrency market, including Canada. For example, a major stock market crash in the US could trigger a sell-off in cryptocurrencies globally, affecting Canadian prices.

The interconnectedness of the global financial system makes the Canadian crypto market vulnerable to international economic shocks.

Wrap-Up

So, there you have it – a whirlwind tour of Canada’s cryptocurrency market! While predicting the future of crypto is anyone’s guess (even the experts are often wrong!), understanding the underlying forces shaping prices is crucial for navigating this exciting yet volatile world. Remember, doing your research, diversifying your portfolio, and understanding your risk tolerance are key to a successful crypto journey.

Happy trading (responsibly, of course)!