What is FX spot trading and how does it work for beginners? – What is FX spot trading and how does it work for beginners? Ah, the siren song of global finance! Imagine, you, a humble beginner, wielding the power to buy and sell currencies like a digital Midas, turning mere dollars into… well, hopefully more dollars. This isn’t some get-rich-quick scheme (though the

-potential* is there, wink wink), but rather a journey into the fascinating world of foreign exchange, where fortunes are made and lost on the shifting sands of international economics.

Buckle up, buttercup, it’s going to be a wild ride!

FX spot trading, at its heart, is the buying and selling of currencies at the current market rate – the “spot” rate. You’re essentially exchanging one currency for another, profiting (or losing) based on the fluctuations in their relative values. Currency pairs, like EUR/USD (Euro/US Dollar), represent this exchange. A trade might involve a bank selling Euros to a company needing to pay a European supplier, the price determined by the current market rate.

This isn’t some shadowy backroom deal; it’s a highly regulated and incredibly liquid market, moving trillions of dollars daily.

Introduction to FX Spot Trading

So, you’re curious about FX spot trading? Fantastic! Think of it as the ultimate global currency swap meet, but instead of trading Beanie Babies, you’re trading, well, currencies. It’s a fast-paced, exciting world where fortunes can be made (or lost!), but with a little knowledge, you can navigate this thrilling marketplace.FX spot trading is simply the buying and selling of one currency for another at the current market price – the “spot” price.

It’s a transaction that settles within two business days. No fancy futures contracts or complicated derivatives here; it’s a straight-up exchange. Think of it like exchanging dollars for euros at a currency exchange booth, only on a much, much larger scale and with potentially much higher stakes.

Currency Pairs and Their Notation

Currency pairs are exactly what they sound like: two currencies traded against each other. The notation is straightforward: the first currency listed is the

- base currency*, and the second is the

- quote currency*. For example, EUR/USD means you’re trading euros (base) against US dollars (quote). A quote of EUR/USD 1.10 means that one euro buys you 1.10 US dollars. Simple, right? Well, almost.

The world of currency pairs is vast, encompassing major, minor, and exotic pairs, each with its own unique volatility and trading characteristics.

Example of an FX Spot Trade

Let’s say Imagine a large multinational corporation, “MegaCorp,” needs to pay a supplier in Japan 10 million Japanese Yen (JPY). MegaCorp holds US dollars (USD). To complete the payment, they need to exchange USD for JPY. They contact their bank, who provides them with the current spot rate of USD/JPY (let’s say it’s 130). MegaCorp then instructs their bank to buy 10 million JPY.

The bank calculates the equivalent USD amount: 10,000,000 JPY / 130 JPY/USD = $76,923.08 (approximately). MegaCorp transfers this USD amount to the bank, and the bank facilitates the exchange, ensuring MegaCorp’s supplier receives their payment in JPY. The bank, in this scenario, acts as an intermediary, facilitating the transaction and earning a small commission or spread on the exchange rate.

This is a simplified example, but it illustrates the fundamental process of an FX spot trade.

How FX Spot Trading Works

So, you’ve dipped your toe into the world of FX spot trading – welcome to the exhilarating (and sometimes terrifying) rollercoaster of global currency markets! Now let’s get down to the nitty-gritty of how it actually works. Forget the flashy ads; this is the real deal.

FX spot trading, at its core, is the buying and selling of one currency for another at the current market price, for settlement within two business days. Think of it like a super-fast, internationally-flavored swap meet, except instead of vintage furniture, you’re trading yen for euros, or dollars for pounds. It’s all about timing and a little bit of educated guesswork (or a lot, depending on your trading style!).

The Mechanics of an FX Spot Trade

Let’s break down the process into easily digestible steps. Imagine you’re trading like a seasoned pro (even if you’re not quite there yet!).

| Action | Description | Example | Impact |

|---|---|---|---|

| Open an Account | Choose a broker and open a trading account, providing necessary identification and funding. | Register with a reputable broker like OANDA or Interactive Brokers, deposit funds via bank transfer. | Provides access to the trading platform and allows you to place orders. |

| Analyze the Market | Research currency pairs, using technical and fundamental analysis to identify potential trading opportunities. | Review charts, economic news, and geopolitical events to predict price movements. For example, positive economic data might strengthen a currency. | Informs your trading decisions, aiming to increase the likelihood of profitable trades. |

| Place an Order | Specify the currency pair, the amount to trade (usually in base currency units), and the type of order (market or limit). | Buy 10,000 EUR/USD at the current market price (a market order). | Initiates the trade execution process with your broker. |

| Broker Execution | Your broker acts as an intermediary, matching your order with another trader or providing liquidity from their own trading book. | Your broker finds a counterparty willing to sell you 10,000 EUR for the equivalent amount in USD at the prevailing market rate. | The trade is completed at the agreed-upon price. |

| Settlement | The transaction settles within two business days, with the currencies exchanged between the accounts. | Two business days after placing the order, your account reflects the purchased EUR and the corresponding deduction in USD. | Finalizes the trade and reflects the outcome in your account balance. |

The Role of Market Makers and Brokers

Market makers are crucial players; they provide liquidity by quoting bid and ask prices for currency pairs. Think of them as the ever-present vendors at the currency swap meet, always ready to buy or sell. Brokers act as the middlemen, connecting you to these market makers (or sometimes acting as market makers themselves).

Bid and Ask Prices: The Heart of the Matter

The bid price is what a market maker is willing to

-buy* a currency at, while the ask price is what they’re willing to

-sell* it at. The difference between the bid and ask price is called the spread – your trading costs. A smaller spread is better for you. Profit or loss is determined by the difference between your entry and exit prices, taking into account the spread.

Profit/Loss = (Exit Price – Entry Price) x Lot Size – Spread

Understanding Currency Quotes and Exchange Rates

So, you’ve bravely ventured into the wild world of FX spot trading. Congratulations! Now, let’s tame the beast that is currency quotes and exchange rates. Think of it as learning a new language – once you grasp the basics, you’ll be fluent in financial jargon in no time.Exchange rates, the heart of FX trading, represent the value of one currency relative to another.

They’re not randomly plucked from a hat; instead, they’re a dynamic dance influenced by a multitude of factors. Think supply and demand – if everyone wants Euros, the Euro will strengthen against other currencies. But it’s more nuanced than that. Economic indicators (like inflation and interest rates), political stability, global events (like a sudden war or a pandemic), and even market sentiment (speculation and trader psychology) all play a crucial role in pushing and pulling these rates.

It’s a complex system, but understanding the key players helps you navigate it.

Currency Pair Quotes and Their Interpretation

Currency pairs are quoted as one currency against another. For example, EUR/USD represents the Euro against the US dollar. A quote of 1.1000 means that 1 Euro can buy you 1.10 US dollars. The first currency in the pair (EUR in this case) is called the “base currency,” while the second (USD) is the “quote currency.” A rise in the quote means the base currency has strengthened (appreciating) against the quote currency.

Conversely, a fall indicates the base currency has weakened (depreciating). Let’s look at some examples:* GBP/USD 1.2500: One British Pound buys 1.25 US Dollars.

USD/JPY 110.00

One US Dollar buys 110 Japanese Yen.

EUR/GBP 0.8500

One Euro buys 0.85 British Pounds.Notice how the numbers change depending on which currency is the base. The interpretation always revolves around how much of the quote currency you get for one unit of the base currency.

Direct and Indirect Quotes

Now, let’s talk about direct and indirect quotes. A direct quote expresses the price of a foreign currency in terms of the domestic currency. For example, if you’re in the US, a direct quote for the Euro would be EUR/USD. An indirect quote is the inverse – the price of the domestic currency in terms of the foreign currency.

So, you’re diving into the wild world of FX spot trading? It’s like a financial rollercoaster, except instead of screaming, you’re meticulously analyzing currency pairs. Need the mental fortitude for this thrilling ride? Then check out best strength training program to build the resilience needed to handle those market swings. After all, a strong mind and body are crucial for navigating the unpredictable nature of FX spot trading!

So, the indirect quote for the Euro from a US perspective would be USD/EUR. It’s essentially the reciprocal of the direct quote. Understanding this distinction is key to avoiding confusion when comparing exchange rates from different sources.

Common Terms in Currency Quotes

Understanding the jargon is crucial. Here’s a quick rundown:

These terms are fundamental to understanding how currency quotes work and are essential for anyone involved in FX trading.

- Pip (Point in Percentage): The smallest price movement in a currency pair. Usually, it’s the fourth decimal place (e.g., 0.0001 for most pairs). Think of it as the currency equivalent of a single grain of sand in the vast desert of the forex market.

- Lot: A standard unit of trading volume. A standard lot is typically 100,000 units of the base currency. Think of it as a big, heavy shopping cart full of currency. There are also mini-lots (10,000 units) and micro-lots (1,000 units) for smaller trades.

- Bid Price: The price at which a market maker is willing to buy a currency.

- Ask Price (Offer Price): The price at which a market maker is willing to sell a currency.

- Spread: The difference between the bid and ask prices. This is the market maker’s profit margin. It’s the cost of your trade, so keep an eye on this!

Risks and Rewards of FX Spot Trading: What Is FX Spot Trading And How Does It Work For Beginners?

So, you’ve learned the basics of FX spot trading – congratulations! Now for the slightly less glamorous, but equally crucial, part: understanding the risks and rewards. Think of it like this: FX trading is a rollercoaster – exhilarating highs and stomach-churning lows. Knowing how to buckle your seatbelt (risk management) is the key to enjoying the ride without ending up in a heap at the bottom.FX spot trading offers the potential for significant profits, but it’s a double-edged sword.

The very factors that make it exciting – high leverage and market volatility – also contribute to substantial losses if not handled carefully. Let’s dive into the specifics.

So you’re diving into the wild world of FX spot trading – buying and selling currencies like a financial ninja? It’s all about those instantaneous trades, but choosing the right platform is key. To help you decide, check out this comparison: How does Questrade’s currency exchange platform compare to other options in Canada? Understanding these platforms is crucial before you start making those lightning-fast trades, so do your research!

Leverage and Volatility: The Double-Edged Sword

Leverage, the ability to control a larger position with a smaller initial investment, is a powerful tool in FX trading. It amplifies both profits and losses. A small market movement can lead to a large gain or a devastating loss depending on your position size and leverage level. Volatility, the speed and extent of price fluctuations, adds another layer of complexity.

So, you’re diving into the wild world of FX spot trading – buying and selling currencies at the current market price, basically a super-fast money-exchange. Want to give it a whirl? Well, first you’ll need a brokerage account, and a good option is Questrade; check out this guide on How to open a Questrade account for forex and currency trading.

to get started. Then, once you’re set up, you can start navigating the thrilling, slightly terrifying, rollercoaster that is FX spot trading!

High volatility means prices can swing wildly in short periods, increasing the risk of sudden, significant losses. Imagine trying to ride a bucking bronco – exhilarating, but potentially painful if you don’t know how to stay on.

Potential Rewards and Their Relationship to Risk Management

The potential rewards in FX spot trading are directly proportional to the risks taken. Successful traders skillfully manage risk to maximize potential profits while minimizing losses. This involves careful position sizing, using stop-loss orders, and diversifying your portfolio across different currency pairs. Think of it as a calculated gamble – the bigger the potential payoff, the higher the stakes.

However, a well-defined risk management strategy significantly increases your odds of success. It’s not about eliminating risk entirely, but about controlling it.

Risk Management Strategies for Beginners

Effective risk management is paramount for beginners. It’s not about avoiding risk altogether (that would mean missing out on potential profits!), but about understanding and controlling it. This involves setting realistic profit targets and, crucially, stop-loss orders to limit potential losses. Beginners should start with small position sizes and gradually increase them as they gain experience and confidence.

Never invest more than you can afford to lose. This is not a get-rich-quick scheme; it’s a long-term strategy requiring discipline and patience.

Risk Management Techniques

| Risk | Mitigation Strategy | Example |

|---|---|---|

| High Leverage | Use lower leverage ratios; start with small position sizes | Instead of using 1:100 leverage, start with 1:10 or even 1:5. |

| Market Volatility | Diversify your portfolio across different currency pairs; use stop-loss orders | Don’t put all your eggs in one basket. If you’re trading EUR/USD, consider also trading GBP/USD or USD/JPY. Set a stop-loss order to automatically close your position if the price moves against you by a predetermined amount. |

| Overtrading | Develop a trading plan and stick to it; take regular breaks | Create a detailed plan specifying your entry and exit points, risk tolerance, and position size. Avoid emotional trading decisions. |

| Lack of Knowledge | Continuously educate yourself about the market; practice on a demo account | Regularly read market analysis, participate in forex forums, and hone your skills using a demo account before risking real money. |

Trading Platforms and Tools

Stepping into the world of FX spot trading feels a bit like entering a high-tech cockpit. Forget dusty charts and abacuses; your arsenal is a sophisticated trading platform brimming with tools designed to help you navigate the volatile waters of currency markets. These platforms aren’t just pretty interfaces; they’re your command center for executing trades, analyzing market trends, and managing your risk.The features of a typical FX trading platform are surprisingly diverse, ranging from the essential to the downright luxurious.

At a minimum, you’ll find a user-friendly interface for placing orders (buy/sell), viewing real-time currency quotes, and accessing your account balance and trading history. Many platforms offer advanced order types, allowing for more nuanced control over your trades, such as stop-loss orders (to limit potential losses) and take-profit orders (to lock in profits). Some even include news feeds and economic calendars, keeping you up-to-date on events that could impact the markets.

Think of it as having a financial news channel and a personal assistant rolled into one.

Charting Tools in FX Trading

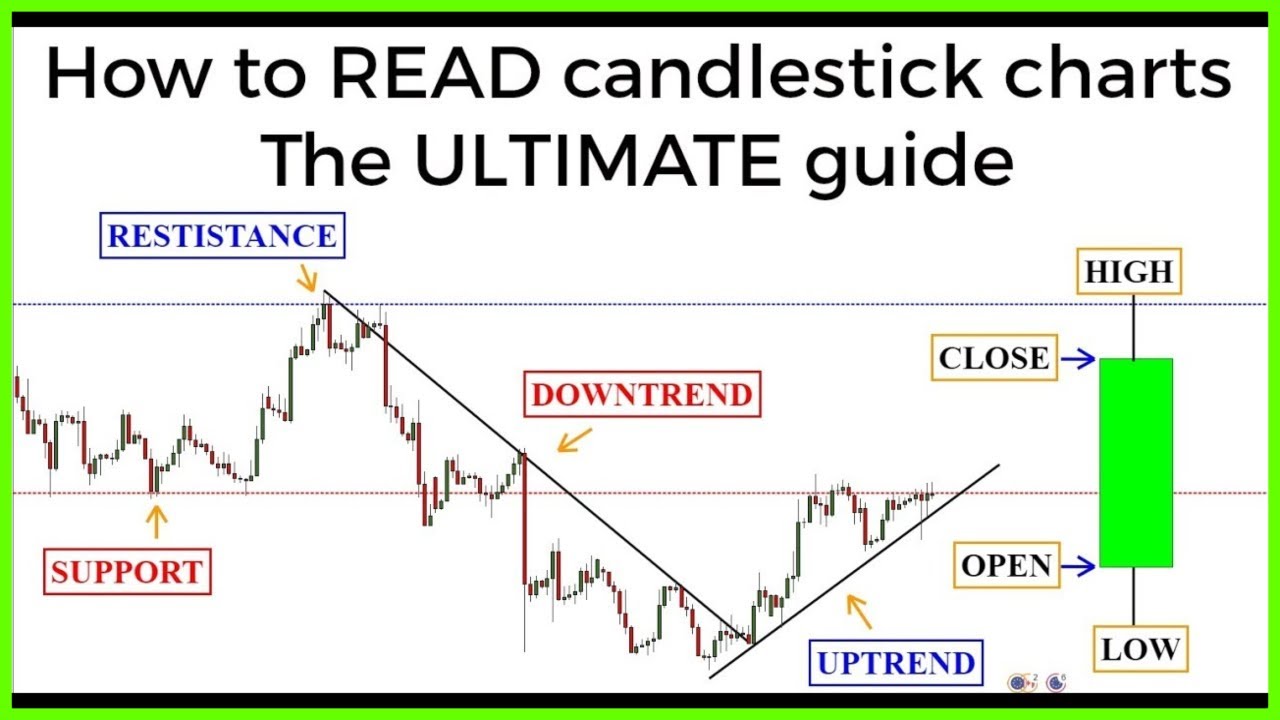

Charting tools are the visual heart of any FX trading platform. They transform raw market data into easily digestible graphs, revealing trends, patterns, and potential opportunities. Most platforms offer a range of chart types, including candlestick charts (which show price movements over specific time periods), line charts (simple price representations), and bar charts (similar to candlestick charts but simpler).

The ability to zoom in and out, adjust timeframes, and overlay technical indicators makes charting tools invaluable for technical analysis. Imagine being able to see the market’s heartbeat in real-time, visualizing its ups and downs, and anticipating its next move.

Technical Indicators

Technical indicators are mathematical calculations applied to price data to generate signals that can help predict future price movements. They’re not crystal balls, but they can provide valuable insights. Some common examples include:* Moving Averages: These smooth out price fluctuations to identify trends. A simple moving average (SMA) averages prices over a defined period, while an exponential moving average (EMA) gives more weight to recent prices.

So, you’re wondering about FX spot trading? It’s basically buying and selling currencies at the current market rate – think of it as super-fast international money swapping! Want to dive deeper and learn how to do it using a platform like Questrade? Check out this fantastic guide: Forex trading for dummies: a beginner’s guide using Questrade. Then, armed with knowledge, you can conquer the thrilling (and sometimes terrifying) world of instant currency exchanges! It’s all about timing and a little bit of luck, or maybe a lot of research.

Relative Strength Index (RSI)

This measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI above 70 often suggests an asset is overbought, while below 30 suggests it’s oversold.

MACD (Moving Average Convergence Divergence)

This indicator uses two moving averages to identify momentum changes and potential trend reversals. Crossovers of the MACD lines can signal buy or sell opportunities.

Bollinger Bands

These bands plot standard deviations around a moving average, showing price volatility. Price bounces off the bands can indicate potential support or resistance levels.These are just a few examples; numerous other indicators exist, each with its own strengths and weaknesses. Successful traders often combine several indicators to confirm signals and reduce the risk of false signals.

Types of Trading Platforms

Choosing the right platform is crucial. Different platforms cater to different needs and trading styles.

So, you’re diving into the wild world of FX spot trading – buying and selling currencies like a financial ninja? It’s all about instant trades, but if you’re thinking of automating things with robots and AI, you’ll need the right platform. That’s where the question arises: Is Questrade suitable for algorithmic or AI-powered forex trading? Understanding this is key before you start flinging your virtual yen around! Back to basics: remember, spot trading means immediate execution – no waiting around for futures contracts.

- Web-based Platforms: Accessible through any web browser, these platforms offer convenience and require no software download. However, they may have fewer features than desktop platforms.

- Desktop Platforms: These platforms are downloaded and installed on your computer, offering more advanced features, customization options, and often better performance than web-based platforms. However, they require a download and may not be accessible from different devices.

- Mobile Platforms: Designed for smartphones and tablets, these platforms provide on-the-go trading access. Features are typically more limited than desktop platforms, but they’re ideal for quick trades and market monitoring.

The best platform for you will depend on your technical skills, trading style, and the features you need. Some platforms even offer a combination of web and desktop interfaces, giving you the flexibility to trade from anywhere.

Illustrative Example

Let’s dive into a thrilling (and hopefully profitable!) hypothetical FX spot trade scenario. Imagine you’re a seasoned (or aspiring!) FX trader, ready to make your mark on the global currency market. We’ll walk through a simple trade, illustrating the calculations, potential profit/loss, and the impact of leverage – the FX trader’s best friend (and sometimes worst enemy!).We’ll follow the adventures of our intrepid trader, let’s call him “Forex Fred,” as he navigates the exciting world of currency exchange.

A Hypothetical Trade: EUR/USD

Forex Fred believes the Euro (EUR) is about to strengthen against the US dollar (USD). He decides to buy 10,000 Euros at the current spot exchange rate of 1.10 USD/EUR. This means he’s paying 1.10 USD for every 1 EUR. His initial investment, therefore, is 10,000 EUR

1.10 USD/EUR = 11,000 USD.

Profit/Loss Calculation

After a week, the EUR/USD exchange rate rises to 1.12 USD/EUR. Feeling smug, Forex Fred sells his 10,000 Euros at this new, higher rate. His proceeds are 10,000 EUR1.12 USD/EUR = 11,200 USD. Subtracting his initial investment, his profit is 11,200 USD – 11,000 USD = 200 USD. A tidy profit for a week’s work, right?

The Impact of Leverage

Now, let’s introduce leverage. Imagine Forex Fred used a 1:10 leverage ratio. This means he only needed to put down 10% of the initial investment as margin. His margin requirement would be 11,000 USD

So, you’re diving into the wild world of FX spot trading – buying and selling currencies like a caffeinated hummingbird? Before you leap, though, you might want to check out if your chosen platform is up to snuff. Is it sturdy enough for your currency-juggling antics? To help you decide, check out this article: Is Questrade a reliable platform for forex trading in Canada?

Then, armed with this knowledge, you can confidently navigate the thrilling, sometimes terrifying, world of instant currency exchanges. Happy trading!

- 0.10 = 1,100 USD. His profit remains 200 USD, but his return on investment (ROI) is significantly amplified. His ROI is calculated as (200 USD / 1,100 USD)

- 100% = 18.18%. Without leverage, his ROI would have been a much smaller (200 USD / 11,000 USD)

- 100% = 1.82%. Leverage magnifies both profits and losses, so it’s a double-edged sword!

Visual Representation on a Chart, What is FX spot trading and how does it work for beginners?

On a currency chart, Forex Fred’s trade would be represented as an upward-sloping line. The x-axis would represent time, and the y-axis would represent the EUR/USD exchange rate. The entry point of the trade would be marked at the 1.10 level, while the exit point would be shown at the 1.12 level. The line connecting these two points would visually depict the price appreciation of the Euro against the dollar during the holding period.

The overall visual would be a clear, upward trend line indicating a successful trade. The slope of the line would represent the magnitude of the price movement, and therefore the profit generated.

Getting Started

So, you’re ready to dive into the thrilling (and sometimes terrifying) world of FX spot trading? Fantastic! But before you start throwing virtual money at screens, remember that knowledge is power (and a much better investment than impulsive trades). Proper preparation is key to navigating the complexities of the forex market and avoiding costly mistakes. Think of this as your pre-flight checklist before taking off on your trading journey.Now, let’s equip you with the resources you need to embark on your forex education.

Remember, continuous learning is crucial in this dynamic market. The following resources provide a solid foundation and will help you stay ahead of the curve.

Reputable Resources for FX Spot Trading Education

Choosing the right learning materials can significantly impact your trading success. Investing time in quality resources will pay dividends in the long run, preventing costly errors and fostering a deeper understanding of market dynamics. Consider the following options to supplement your existing knowledge.

- Beginner-friendly online courses: Many platforms offer structured courses covering fundamental concepts, technical analysis, and risk management. These courses often include interactive exercises and quizzes to reinforce learning.

- Books on forex trading: Several reputable books provide in-depth explanations of forex trading strategies, technical indicators, and market analysis techniques. Look for books with positive reviews and a focus on practical application.

- Educational webinars and seminars: Many financial institutions and trading platforms host free webinars and seminars that offer valuable insights into forex trading. These sessions can provide a deeper understanding of market trends and trading strategies.

- Reputable financial websites and blogs: Several websites and blogs offer articles, tutorials, and analysis on forex trading. However, always critically evaluate the information you find online and cross-reference it with multiple sources.

Last Recap

So, there you have it – a beginner’s foray into the thrilling, slightly terrifying world of FX spot trading. Remember, it’s a marathon, not a sprint. Understanding the mechanics, managing risk, and continuously learning are key. While the potential rewards are tantalizing (think exotic vacations funded by shrewd currency swaps!), the risks are real. Don’t jump in headfirst; start small, learn the ropes, and always remember: even the most seasoned traders have experienced setbacks.

Treat this journey as an adventure in financial literacy, and who knows? You might just discover a hidden talent for global currency maneuvering. Happy trading (responsibly, of course!)