What’s the best platform for day trading with options and futures? – What’s the best platform for day trading with options and futures? Ah, the million-dollar question (or maybe the million-dollar

-loss*, depending on your skills!). Navigating the wild west of options and futures requires the right tools, and choosing the wrong platform can be like trying to lasso a greased piglet – slippery and frustrating. This deep dive explores the features, regulations, and technological aspects of various platforms, helping you find the perfect trading saddle for your high-stakes rodeo.

We’ll pit popular platforms against each other, examining their charting tools (because a good chart is a trader’s best friend), order types (the weapons in your arsenal), and real-time data feeds (your crystal ball). We’ll also delve into the nitty-gritty details like margin requirements (how much you need to risk), commission structures (how much they’ll take), and user interfaces (because nobody wants a platform that looks like it was designed by a caveman).

Get ready for a thrilling ride as we untangle the complexities of this exciting – and potentially lucrative – world!

Platform Features Comparison

Choosing the right platform for day trading options and futures is like picking the perfect superhero sidekick – it needs to have the right powers (features) to help you conquer the market. We’ll delve into the key features of three popular platforms, highlighting their strengths and weaknesses to help you find your ideal trading partner.

Platform Feature Comparison Table

Let’s face it, a picture (or in this case, a table) is worth a thousand words when comparing trading platforms. This table compares three popular platforms across crucial features. Remember, the best platform depends on your individual trading style and preferences.

Picking the perfect platform for day trading options and futures is like choosing the right superhero sidekick – it needs to be reliable! If you’re a Canadian looking to minimize costs, check out the Top rated Canadian forex brokers with low commissions to see if their offerings complement your chosen platform. Ultimately, the best platform depends on your specific needs and risk tolerance, but low commissions are always a plus, right?

| Platform Name | Charting Tools | Order Types | Real-Time Data Features |

|---|---|---|---|

| Interactive Brokers (IBKR) | Extensive charting capabilities with customizable indicators, drawing tools, and multiple timeframes. Supports advanced charting techniques like Renko and Heikin-Ashi. | Offers a wide array of order types including limit, stop, market, trailing stops, bracket orders, and complex order combinations. | Provides real-time market data from multiple exchanges globally, with options for various data levels and speeds. Offers sophisticated market depth information. |

| TD Ameritrade | User-friendly charting with a good selection of indicators and drawing tools. Offers various chart types and timeframes. | Provides a solid range of order types including limit, stop, market, and various conditional orders. Offers less complex order combinations compared to IBKR. | Provides real-time data for US markets, with different data packages available. Market depth information is available. |

| NinjaTrader | Highly customizable and powerful charting tools, catering to advanced traders. Allows for extensive backtesting and strategy development. | Offers a wide range of order types, including many sophisticated options and futures-specific orders. Allows for custom order creation. | Provides real-time data feeds for various markets, with options for high-frequency data. Supports direct market access (DMA). |

Margin Requirements and Commission Structures

The cost of doing business in the day trading world is influenced heavily by margin requirements and commissions. These can significantly impact your profitability. Understanding these costs is crucial for choosing the right platform.

So, you’re wrestling with the age-old question: What’s the best platform for day trading options and futures? It’s a jungle out there! But before you get lost in the algorithmic wilderness, consider broadening your horizons. Perhaps mastering forex first, using the power of ATS systems as detailed in this excellent guide: Downloadable PDF on mastering forex trading using ATS systems , could give you a serious trading advantage before tackling options and futures.

Then, and only then, can you confidently pick the perfect platform for your day-trading needs!

Here’s a comparison (note that these are subject to change and depend on your account type and trading volume):

- Interactive Brokers (IBKR): Generally offers competitive margin rates and commission structures, often lower for high-volume traders. Commission structures can be complex, varying based on asset class and volume.

- TD Ameritrade: Offers tiered commission structures, with lower commissions for higher trading volumes. Margin requirements are generally in line with industry standards.

- NinjaTrader: Commission structures vary depending on the brokerage you connect it to. Margin requirements are determined by your broker.

User Interface and Ease of Navigation

The user interface is your battle station. A clunky, confusing interface can cost you precious seconds (and potentially, money) during fast-paced day trading.

Let’s examine the user experience of each platform:

- Interactive Brokers (IBKR): Known for its powerful but initially complex interface. Requires a steeper learning curve, but offers unmatched customization and functionality for experienced traders.

- TD Ameritrade: Boasts a user-friendly and intuitive interface, making it a great choice for beginners and those who prefer simplicity. Navigation is straightforward and efficient.

- NinjaTrader: Offers a highly customizable interface, allowing traders to tailor it to their specific needs. The initial learning curve can be somewhat steep, but its powerful features are worth the effort for experienced traders.

Regulatory Considerations and Security

Navigating the world of options and futures trading isn’t just about picking the right platform; it’s also about understanding the legal minefield and ensuring your hard-earned cash (and your sanity!) are safe. Think of it as choosing the right climbing gear before scaling Mount Everest – you wouldn’t want to find out your harness is made of spaghetti halfway up, would you?The regulatory landscape for options and futures trading varies wildly depending on where you are.

This isn’t a case of one-size-fits-all; each jurisdiction has its own set of rules, overseen by different regulatory bodies. Ignoring these rules can lead to hefty fines, legal battles, and the distinct possibility of your trading account vanishing faster than a magician’s rabbit.

Regulatory Bodies and Their Rules

Different countries have different regulatory bodies governing options and futures trading. In the United States, the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC) are the key players. The CFTC primarily oversees futures and swaps, while the SEC focuses on options and other securities. Their rules cover everything from account minimums and margin requirements to reporting requirements and anti-fraud measures.

In the UK, the Financial Conduct Authority (FCA) holds a similar role, ensuring fair markets and protecting investors. These bodies set standards, conduct investigations, and impose sanctions on those who don’t play by the rules. Failing to understand these regulations can lead to significant problems, potentially even criminal charges in severe cases. Imagine the embarrassment of having your trading prowess featured on a “Wall Street’s Most Wanted” poster!

Platform Security Measures

Protecting your account and data is paramount. Reputable platforms employ various security measures to safeguard your information and funds. A lack of robust security measures is a red flag, potentially exposing you to identity theft, unauthorized trading, and financial loss. Think of it as choosing a bank – you’d want one with multiple layers of security, not one with a vault door held shut by a rusty padlock and a prayer.The importance of strong security measures cannot be overstated.

A breach can have devastating consequences, not only financially but also in terms of personal data protection. Here are some key security features you should expect from a reputable platform:

- Two-factor authentication (2FA): This adds an extra layer of security, requiring a code from your phone or another device in addition to your password.

- Encryption: Platforms should use encryption to protect your data both in transit and at rest.

- Regular security audits: Reputable platforms undergo regular security audits to identify and address vulnerabilities.

- Firewall protection: Firewalls act as a barrier, preventing unauthorized access to the platform’s systems.

- Account monitoring: Sophisticated platforms often employ systems to monitor accounts for unusual activity, alerting users to potential security breaches.

Dispute Resolution Processes

Even with the best security measures in place, disputes can still arise. Knowing how a platform handles disputes is crucial. A transparent and efficient dispute resolution process is essential, ensuring that issues are addressed fairly and promptly. Before signing up, research the platform’s policies on handling complaints and resolving disputes. Some platforms offer internal dispute resolution mechanisms, while others may require arbitration or legal action.

Picking the perfect platform for day trading options and futures is like choosing the right weapon for a ninja – crucial! But before you unleash your inner financial warrior, maybe consider broadening your horizons. If forex is more your style, check out this beginner’s guide to FX spot trading: What is FX spot trading and how does it work for beginners?

. Then, armed with this knowledge, you can conquer the options and futures world, one profitable trade at a time!

Understanding these processes beforehand can save you a lot of headaches (and potentially legal fees) down the line. Think of it as having a well-defined plan B in case things go sideways – it’s better to be prepared than to be caught off guard.

Technological Aspects and Performance: What’s The Best Platform For Day Trading With Options And Futures?

Day trading, especially with options and futures, is a high-speed game. A platform’s technological prowess isn’t just a nice-to-have; it’s the difference between a profitable trade and a missed opportunity, or worse, a significant loss. Think of it like this: your trading platform is your Formula 1 car – you need speed, reliability, and a cockpit that’s both intuitive and packed with cutting-edge tech.

A clunky, slow platform is like driving a rusty jalopy in a Grand Prix.The speed and reliability of order execution, the quality of charting tools, and the usability of mobile apps are all critical factors in choosing a platform. These features directly impact your ability to react swiftly to market changes and implement your day trading strategy effectively.

Let’s delve into the nitty-gritty.

Order Execution Speed and Reliability

Different platforms boast varying levels of speed and reliability in executing trades. Some platforms utilize sophisticated algorithms and high-speed connections to ensure minimal latency, while others may experience delays, particularly during periods of high market volatility. For example, imagine a scenario where you’re day trading Apple stock options. You identify a fleeting opportunity to buy a call option at a specific price, anticipating a price surge.

If your platform experiences even a fraction of a second delay in executing your order, the price could jump, making your trade unprofitable or even impossible to execute. The difference between a platform with sub-millisecond order execution and one with several-second delays can be the difference between profit and loss in this fast-paced environment. A reliable platform will also provide real-time order status updates, preventing confusion and potential errors.

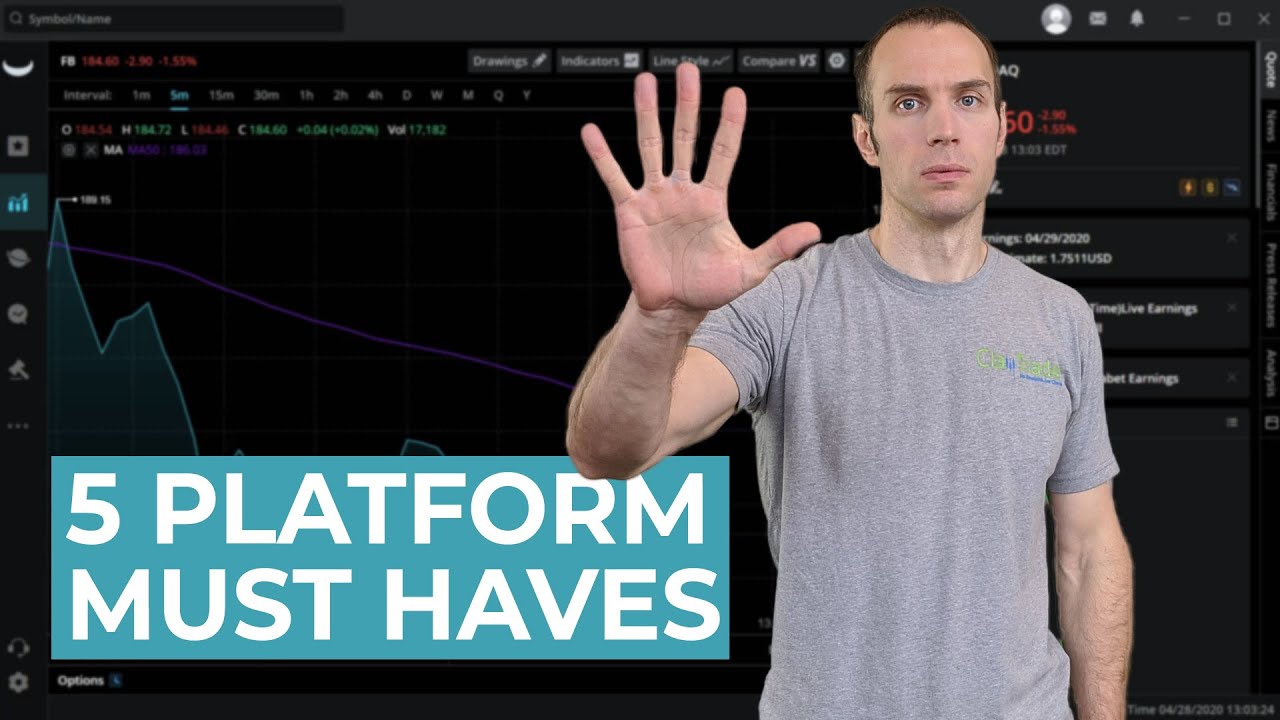

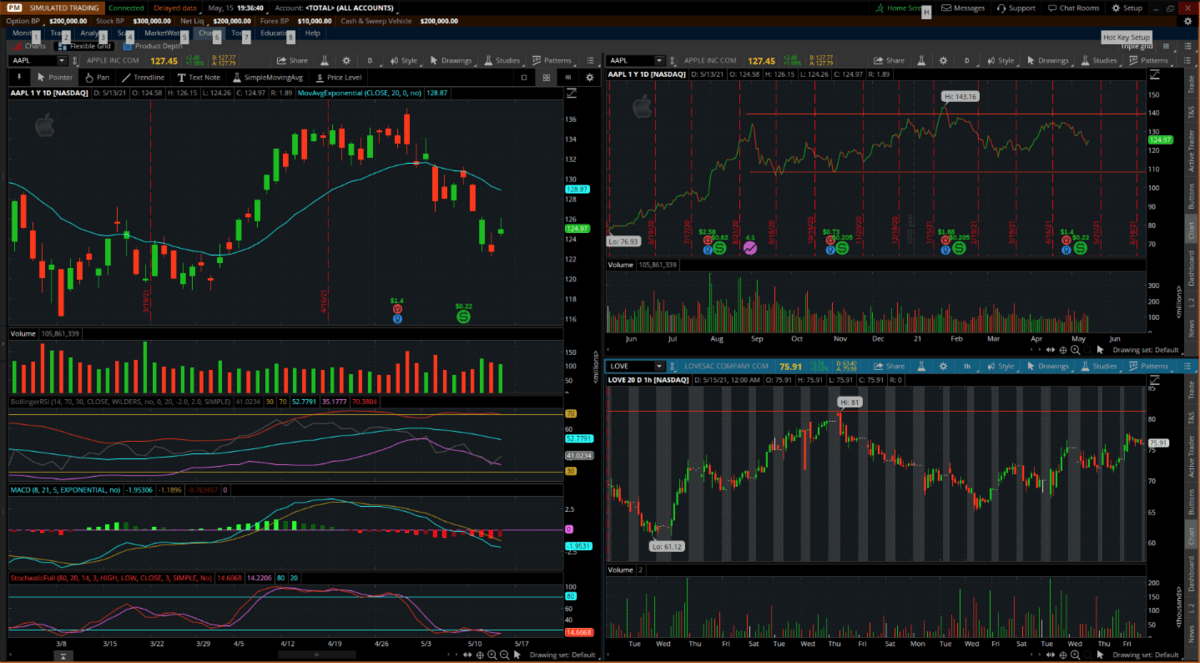

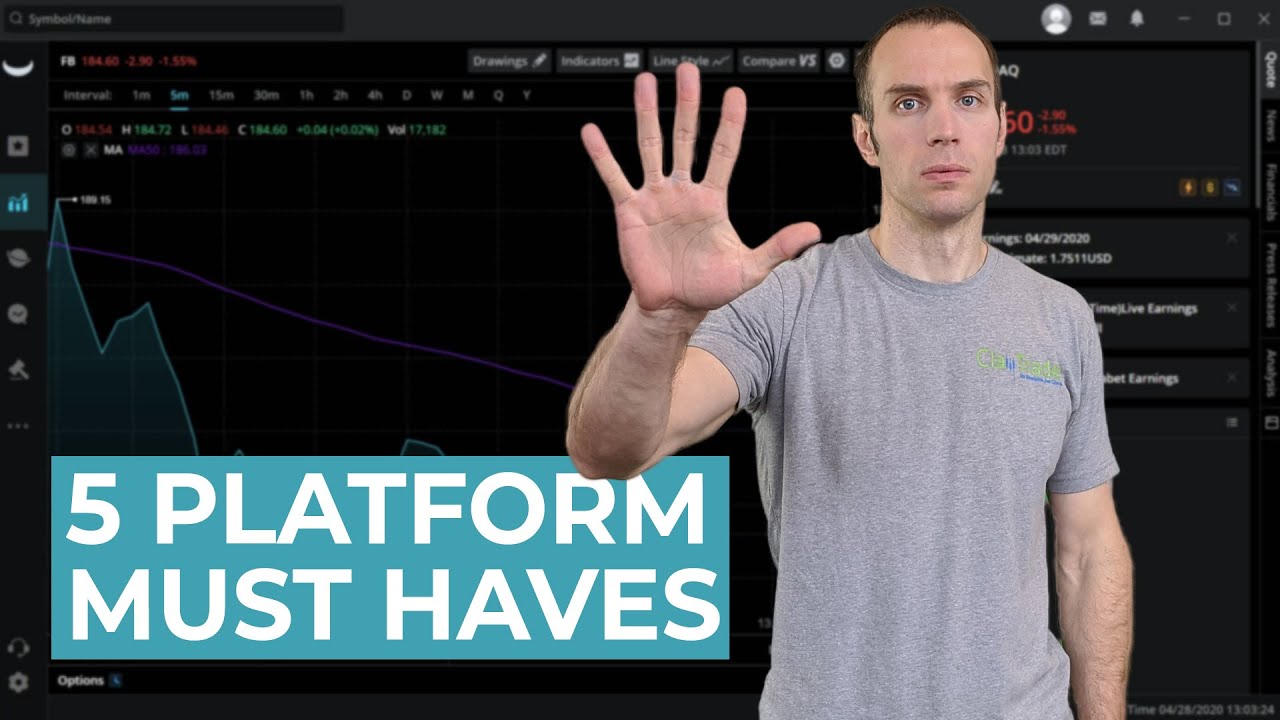

Charting Tools and Data Visualization, What’s the best platform for day trading with options and futures?

The quality of a platform’s charting tools is paramount for technical analysis. Advanced platforms offer a wide array of customizable charts, indicators, and drawing tools, allowing traders to identify patterns, trends, and potential trading opportunities. For instance, a platform with robust charting tools might allow you to overlay multiple technical indicators, such as moving averages and RSI, on a candlestick chart, providing a comprehensive view of the asset’s price action.

Picking the perfect platform for day trading options and futures is like choosing the right weights for your workout – you need something that matches your skill level and goals. Before you dive in headfirst, though, remember to build a solid foundation; check out these muscular strength exercises for traders – strong mental fortitude is just as important as a killer trading strategy! Then, you can confidently conquer those volatile markets and choose the best platform for your needs.

In contrast, a platform with limited charting capabilities might hinder your ability to perform thorough technical analysis, potentially leading to suboptimal trading decisions. The ability to easily customize charts and save preferred settings is also crucial for efficiency. Think of it as having a highly customizable dashboard in your Formula 1 car – you need the information you need, presented in a way that’s easy to understand and react to at a glance.

Mobile App Features and Usability

In today’s mobile-first world, a robust and user-friendly mobile app is a must-have for any serious day trader. A good mobile app should offer the same functionality and performance as the desktop platform, allowing traders to monitor markets, execute trades, and manage their portfolios on the go. Features like real-time quotes, customizable alerts, and advanced charting capabilities are essential.

Imagine a scenario where you’re traveling and need to quickly react to breaking news impacting the market. A well-designed mobile app allows you to do so seamlessly, without compromising your trading strategy. Conversely, a poorly designed app with slow loading times or limited functionality could leave you scrambling to react, potentially resulting in missed opportunities or costly mistakes. A poorly designed app is like having a steering wheel that’s constantly slipping – it’s a recipe for disaster.

Educational Resources and Support

Choosing a day trading platform isn’t just about speed and charting tools; it’s also about how well the platform equips you to succeed. A robust educational program can be the difference between consistently profitable trading and a string of unfortunate losses (and a rapidly dwindling bank account!). Let’s dive into the learning resources and support systems offered by various platforms.Educational resources vary wildly across platforms.

Picking the perfect platform for day trading options and futures is like choosing a superhero sidekick – it needs to be reliable! Before you leap into the wild world of options and futures, though, maybe brush up on the basics with this handy guide: Forex trading for dummies: a simple step-by-step guide. Understanding forex fundamentals can give you a solid foundation before tackling the more complex world of options and futures trading platforms.

Some offer the bare minimum – a few FAQs and maybe a dusty blog – while others provide comprehensive training programs rivaling those of prestigious financial institutions. The level of support, too, can be a game-changer. Imagine needing help urgently during a volatile market – a quick response time is crucial. Let’s explore the specifics.

Educational Material Variety and Quality

The quality of educational materials varies significantly. Some platforms provide beginner-friendly tutorials covering fundamental concepts like option pricing and risk management. Others go further, offering advanced courses on technical analysis, algorithmic trading strategies, and even psychology for traders. Think of it like this: one platform might give you a basic cookbook, while another offers a culinary school education.

Consider platforms offering video tutorials, interactive lessons, downloadable guides, and glossaries of trading terms. A robust platform will also cater to different learning styles, not just relying on dense text. For instance, a platform with a strong visual learning component, utilizing charts and graphs to explain complex concepts, would be highly beneficial for many traders.

Customer Support Channels and Responsiveness

Effective customer support is paramount, especially in the fast-paced world of day trading. Platforms should offer multiple contact channels, including phone, email, and live chat. The speed of response is also a critical factor. A platform with slow response times could leave you stranded during a critical moment. Imagine trying to resolve a technical issue during a crucial trade – you need immediate assistance.

Look for platforms with clearly stated response time commitments and readily available contact information. Some platforms even offer personalized support through dedicated account managers for high-volume traders. This personalized touch can be invaluable for those navigating complex trading strategies.

Simulated Trading Environments

Before risking real money, a simulated trading environment is essential. This allows you to practice your strategies and refine your techniques without facing actual financial consequences. The quality of the simulator matters. A realistic simulation should accurately reflect real-market conditions, including order execution speeds, slippage, and commission fees. Many platforms offer demo accounts with virtual funds, allowing you to test various strategies and learn from mistakes without financial repercussions.

The quality of the simulator is paramount, mirroring real-market conditions as closely as possible. Consider platforms that offer both paper trading accounts (using virtual money) and simulated futures contracts to practice your options and futures trading strategies.

Trading Tools and Strategies

Day trading options and futures is a high-octane sport, demanding both nerves of steel and a finely-tuned arsenal of tools. The right platform can be the difference between a winning streak and a rapid descent into the red. Choosing wisely means understanding not just the platform’s features, but how those features translate into effective trading strategies.The platforms available offer a dizzying array of tools designed to give you an edge in this fast-paced market.

These range from simple charting tools to sophisticated algorithms that analyze market trends and predict future movements (though no algorithm canguarantee* riches, sadly!). The best platform for you will depend on your individual trading style and risk tolerance.

Advanced Trading Tools

Choosing the right platform often hinges on the availability of advanced tools that streamline your workflow and enhance your analytical capabilities. These tools can significantly impact your trading success, providing real-time insights and automating tasks that would otherwise be incredibly time-consuming.

Picking the perfect platform for day trading options and futures is like choosing a superhero sidekick – it’s gotta be reliable! But before you dive headfirst into the wild world of derivatives, you might want to ponder the ethical side; check out this article on whether forex trading, a cousin to futures, aligns with Islamic finance principles: Is forex trading halal according to Islamic finance principles?

. Then, armed with both financial savvy and ethical awareness, you can conquer the day trading arena!

- Scanners: Many platforms offer powerful scanners that sift through thousands of options and futures contracts, identifying those that meet your specific criteria. Think of them as highly efficient market detectives, flagging potentially profitable opportunities based on factors like price, volume, volatility, and implied volatility. For example, TradeStation’s scanner allows you to set complex filters based on multiple technical indicators and options Greeks, helping you quickly locate options with high probability of profit.

- Real-Time Alerts: Imagine getting a text message the second your favorite stock hits a predetermined price target. That’s the power of real-time alerts. Platforms like NinjaTrader and Interactive Brokers offer customizable alerts that notify you of significant price movements, volume spikes, or breaches of technical indicators, allowing for swift reaction to market events.

- Backtesting Capabilities: Before risking real money, you can test your strategies using historical data. Platforms like thinkorswim (TD Ameritrade) provide robust backtesting environments, letting you simulate trades and assess the performance of your strategies under various market conditions. This helps refine your approach and identify potential weaknesses before they cost you money. This is like practicing your free throws before the big game.

Platform Support for Day Trading Strategies

Different platforms offer varying levels of support for different day trading strategies. Understanding your preferred approach is crucial for selecting the appropriate platform.Scalping, a strategy focused on capturing small profits from quick price movements, requires a platform with extremely low latency and fast order execution. Swing trading, which involves holding positions for a few days or weeks, demands charting tools and analytical features to identify longer-term trends.

Arbitrage, which exploits price discrepancies across different markets, needs access to multiple exchanges and real-time data feeds. A platform’s suitability often depends on the specific strategy employed.

Hypothetical Strategy Implementation

Let’s imagine a scalping strategy using a platform like NinjaTrader. Our strategy focuses on exploiting small price fluctuations in the E-mini S&P 500 futures contract (ES). We use NinjaTrader’s advanced charting tools to identify potential entry and exit points based on short-term price action and volume. NinjaTrader’s low latency order execution ensures our trades are filled quickly, minimizing slippage.

We set real-time alerts for price movements of 1 point, triggering immediate buy or sell orders depending on the direction of the move. The platform’s backtesting capabilities allow us to refine the parameters of our strategy using historical data before implementing it with real funds. This iterative process of testing and refinement is key to successful scalping.

Cost-Benefit Analysis

Day trading options and futures is a high-stakes game, and choosing the right platform can significantly impact your bottom line. It’s not just about the bells and whistles; the fees and commissions can quietly eat away at your profits faster than a hungry alligator at a buffet. Let’s dissect the cost-benefit equation to help you make an informed decision.

Remember, the cheapest option isn’t always the best, and the most expensive isn’t necessarily the worst. It’s all about finding the sweet spot that aligns with your trading style and budget.

This analysis considers several key factors: commission structures (per-contract, tiered pricing, etc.), platform fees (monthly subscriptions, data fees, inactivity fees, etc.), and other potential expenses (like margin interest). We’ll explore how these costs can vary dramatically between platforms and how those differences can affect your overall profitability.

Platform Cost Comparison

The following table provides a simplified comparison of hypothetical cost structures. Actual costs can vary based on trading volume, specific plan selected, and other factors. Always check the latest fee schedules directly with the platform provider. These figures are for illustrative purposes only and should not be considered financial advice.

| Platform Name | Commission Structure | Fees | Total Cost Estimate (per month, high-volume trader) |

|---|---|---|---|

| Platform A (e.g., Interactive Brokers) | Tiered pricing, potentially very low per-contract costs with high volume | $10 monthly platform fee, potential data fees | $150 – $300 |

| Platform B (e.g., TD Ameritrade) | Fixed per-contract fees | No monthly platform fee, potential inactivity fees | $200 – $400 |

| Platform C (e.g., A smaller, niche platform) | Higher per-contract fees | Lower monthly fee or none | $300 – $500 |

Note: These are

-estimates* based on hypothetical high-volume trading scenarios. Low-volume traders will experience significantly lower costs. The “Total Cost Estimate” column reflects a combination of commissions and fees, assuming a significant trading volume. A low-volume trader would see substantially lower total costs on all platforms.

Impact of Platform Costs on Profitability

Let’s illustrate the impact of cost differences. Imagine two traders, both making $5000 in profit before fees. Trader A uses Platform A and pays $200 in fees, resulting in a net profit of $4800. Trader B uses Platform C and pays $400, leaving a net profit of $4600. That $200 difference, while seemingly small, can accumulate significantly over time and impact overall returns.

This example highlights how seemingly small differences in platform costs can significantly impact the bottom line. Even a seemingly small difference in commission structure can make a significant difference in your profitability, especially over time and with high trading volume.

The choice of platform is a crucial component of a successful day trading strategy. Minimizing costs while maximizing access to tools and resources is essential for maximizing profit. Remember that the cheapest platform isn’t always the best; a slightly more expensive platform with superior tools and execution speed might actually result in greater profits in the long run.

Closing Notes

So, the quest for the “best” day trading platform for options and futures is ultimately a personal journey. There’s no one-size-fits-all answer, as the ideal platform depends heavily on your individual trading style, risk tolerance, and technical expertise. However, by carefully considering the factors we’ve discussed – from charting capabilities and order execution speed to regulatory compliance and customer support – you can significantly increase your chances of finding a platform that empowers you to succeed (and hopefully, avoid becoming another cautionary tale in the annals of day trading).

Happy trading (and may the odds be ever in your favor!)