Canadian Forex Market Hours and Best Times to Trade: Dive headfirst into the thrilling world of Canadian forex trading! Forget sleepy markets; we’re talking about a whirlwind of economic news, global market influences, and the sweet, sweet scent of potential profit. This isn’t your grandma’s knitting circle; this is where fortunes are made (or, let’s be honest, sometimes lost with a dramatic flourish).

Get ready to learn the secrets to timing your trades like a seasoned pro, because when it comes to forex, timing is everything – almost as important as not accidentally hitting the “sell all” button.

This guide unravels the mysteries of the Canadian forex market, revealing the optimal hours to trade and the factors that influence your success. We’ll explore the interplay between global markets, economic news, and market liquidity, arming you with the knowledge to navigate the sometimes turbulent waters of currency trading. We’ll cover strategies, technical analysis, fundamental analysis, and even throw in a few tips to help you avoid those oh-so-painful trading blunders.

Buckle up, buttercup, it’s going to be a wild ride!

Understanding Canadian Forex Market Hours

So, you want to dive into the thrilling world of Canadian forex trading? Buckle up, because understanding market hours is the first step to avoiding a spectacular, currency-induced faceplant. Think of it as knowing when the buffet is open – you wouldn’t want to show up at 3 am, would you?

The Canadian forex market, like most markets, doesn’t operate 24/7. It’s a busy bee during specific hours, taking breaks for coffee (and maybe poutine) just like the rest of us. Knowing these hours is crucial for maximizing your trading opportunities and minimizing the risk of missing out on potentially lucrative moves.

Canadian Forex Market Trading Hours

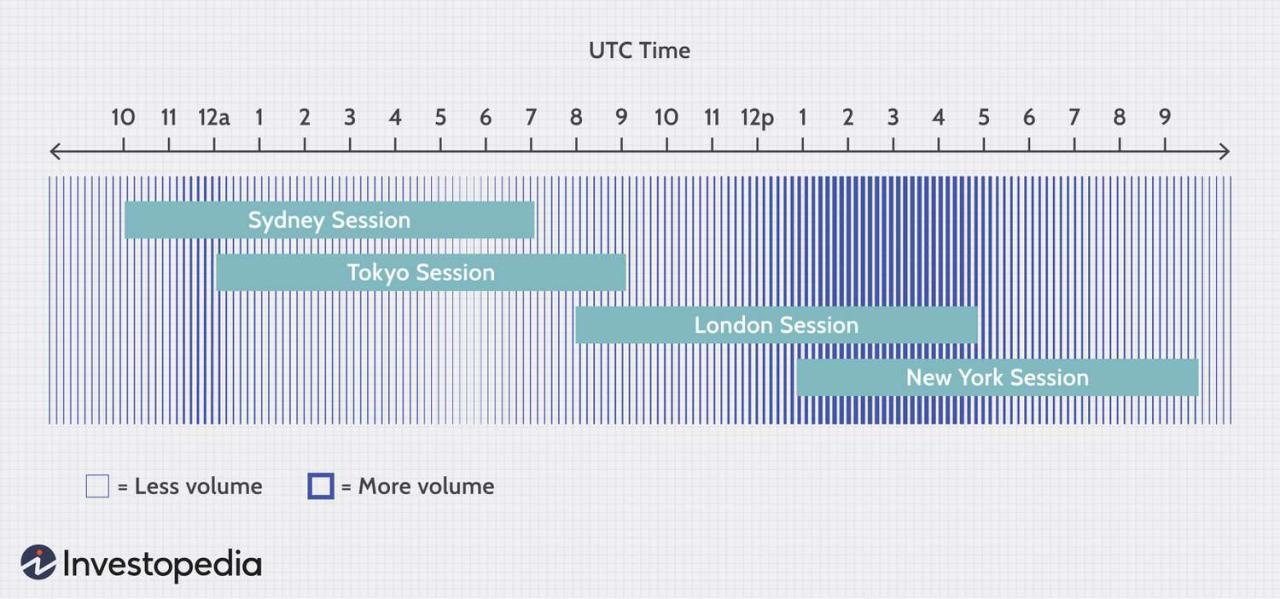

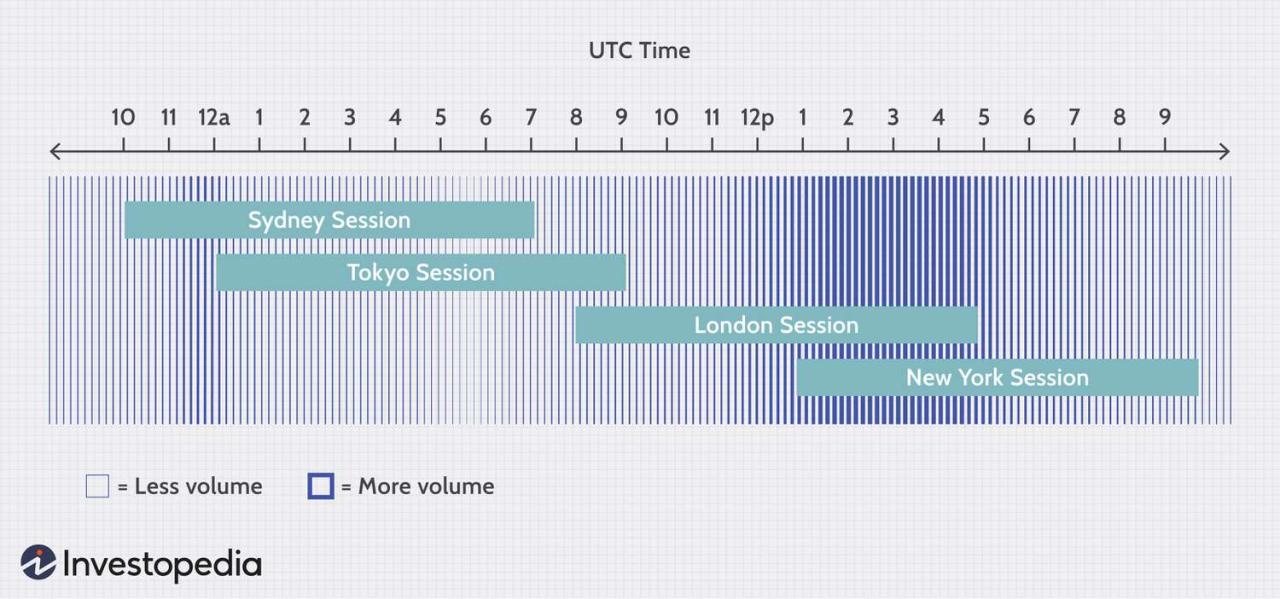

The standard trading hours for the Canadian forex market are generally aligned with the overlap of major global markets. This maximizes liquidity and trading volume, making it easier to buy and sell currency pairs at competitive prices. Think of it as the prime-time of the forex world – the sweet spot where everyone’s awake and trading.

Weekdays are your goldmine. The market typically opens when the Asian markets are winding down and the European markets are getting started. This overlap creates a significant amount of trading activity, making it an exciting time to be involved. Weekends? Think of it as a well-deserved rest for the market – it’s closed, giving traders a chance to catch their breath (and perhaps contemplate their trading strategies over a Tim Hortons coffee).

So, you’re eyeing those sweet Canadian forex market hours, eh? Knowing the best times to trade is half the battle, but let’s be honest, sometimes you need a little extra help. That’s where leveraging technology comes in – check out Reliable forex trading robots and automated systems for Questrade to potentially optimize your strategy. Then, armed with this robotic assistance and your knowledge of Canadian market timings, you’ll be raking in the loonies (and maybe some euros too!).

Comparison with Major Global Markets, Canadian forex market hours and best times to trade

The Canadian market’s hours are intricately intertwined with those of other major financial centers. Understanding these relationships helps you anticipate market movements and capitalize on global trends. It’s like having a front-row seat to a global financial ballet, but with less tutus and more spreadsheets.

So, you’re diving into the wild world of Canadian forex trading? Knowing the best times to trade, dictated by overlapping market hours, is crucial. But before you start raking in the loonies (metaphorically, of course!), it’s wise to understand the rules of the game. Check out this guide on Forex trading regulations and licensing in Canada for beginners to avoid any regulatory hiccups.

Then, armed with knowledge and a healthy dose of caution, you can conquer those Canadian forex market hours like a pro!

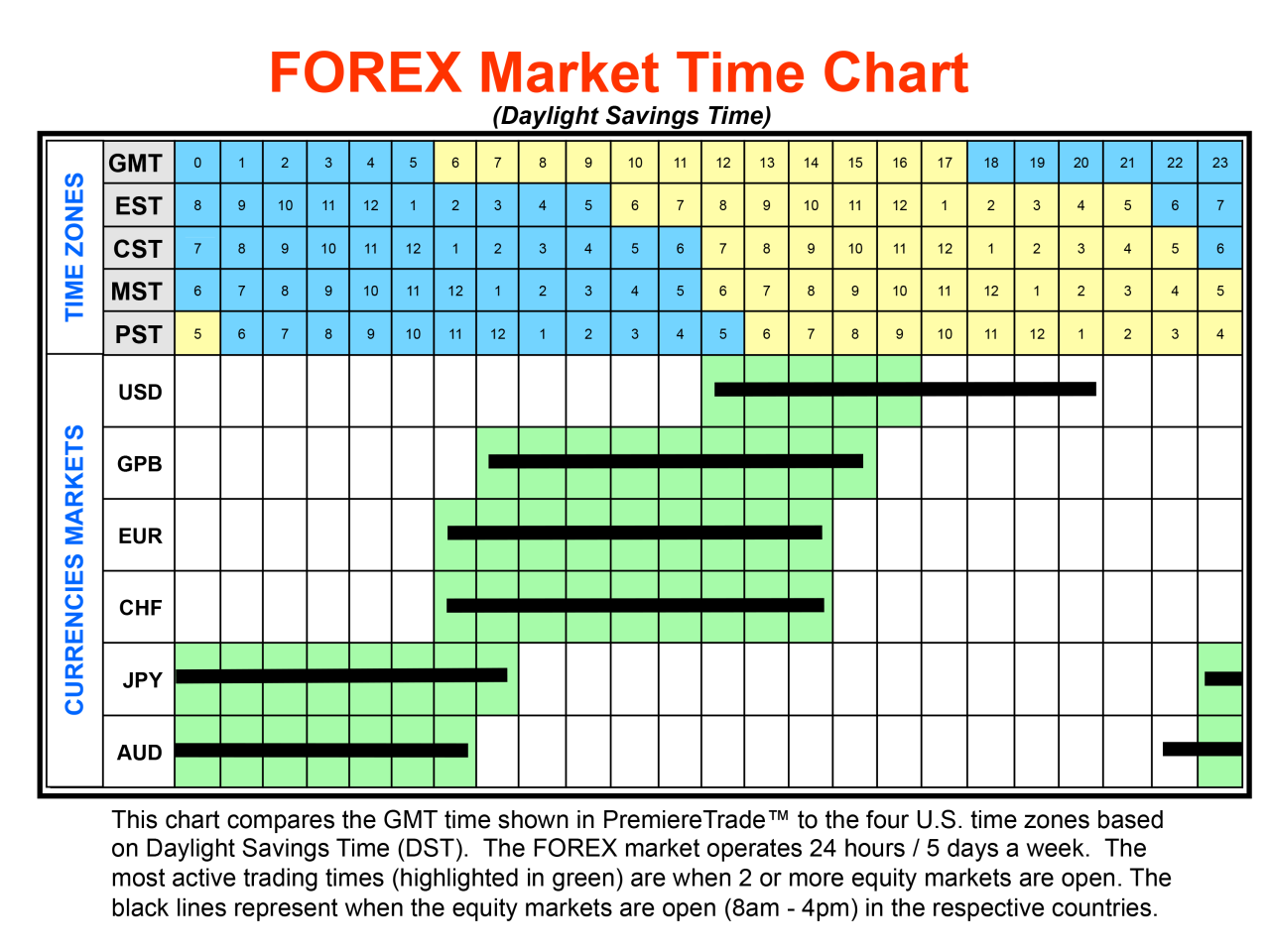

| Market Name | Opening Time (EST) | Closing Time (EST) | Time Zone |

|---|---|---|---|

| Canadian Forex Market | 8:00 AM | 5:00 PM | EST (Eastern Standard Time) |

| London Forex Market | 3:00 AM | 12:00 PM | GMT (Greenwich Mean Time) |

| New York Forex Market | 8:00 AM | 5:00 PM | EST (Eastern Standard Time) |

| Tokyo Forex Market | 7:00 PM | 4:00 AM | JST (Japan Standard Time) |

Factors Influencing Best Trading Times in Canada: Canadian Forex Market Hours And Best Times To Trade

Timing the Canadian forex market is a bit like trying to catch a greased piglet – exhilarating, potentially lucrative, and requiring a healthy dose of strategy. Understanding the factors that influence the best trading times is key to avoiding a muddy, frustrating experience. Several key elements contribute to the optimal moments for entering and exiting trades in the Canadian dollar market.Economic News Releases Influence on Canadian Forex TradingEconomic news releases, those little bombshells of data, are major movers in the forex market.

Think of them as the market’s caffeine shots – a strong dose can send the CAD soaring or plummeting. Announcements like the Bank of Canada’s interest rate decisions, employment figures, and inflation reports can trigger significant volatility. For example, an unexpected interest rate hike might cause a sharp appreciation of the CAD, while disappointing employment data could send it sliding.

So, you’re eyeing the Canadian forex market? Knowing those sweet, sweet trading hours is key, but don’t forget about your own personal trading strength! To maximize your gains, both financial and physical, check out this best strength training program for peak performance. After all, a strong body equals a strong mind (and hopefully, a strong portfolio) – which is crucial when navigating the sometimes-chaotic world of Canadian forex market hours and best times to trade.

Traders need to be keenly aware of the release schedule and the potential impact of these announcements on their positions. Successful traders often adjust their strategies around these events, either by taking advantage of the volatility or by temporarily exiting the market to avoid unwanted surprises.Market Liquidity and Optimal Trading TimesLiquidity, simply put, refers to the ease with which you can buy or sell a currency pair.

High liquidity means many buyers and sellers are active, allowing for smooth and quick transactions. Low liquidity, on the other hand, can lead to wider spreads and difficulty executing trades at your desired price. The Canadian forex market is generally most liquid during the overlapping trading sessions of North America and Europe (roughly between 8:00 AM and 4:00 PM ET).

Outside these hours, liquidity can thin out significantly, making it harder to enter or exit trades without slippage or substantial price impacts. Think of it like a crowded marketplace versus a deserted one – you’ll find more bargains and better deals in the bustling marketplace.Periods of Highest and Lowest Volatility in the Canadian Forex MarketVolatility is the wild child of the forex world – exciting but potentially risky.

The Canadian forex market generally experiences higher volatility during the release of major economic data and geopolitical events. These periods offer greater potential for profit, but also carry a higher risk of significant losses. Conversely, periods of lower volatility, often seen during quieter news cycles, provide opportunities for more conservative, trend-following strategies. For instance, the hours immediately following the release of key economic data often show significantly increased volatility compared to the pre-release period.

Understanding these patterns helps traders to manage risk appropriately.Trading Volume During Different Times of Day and WeekTrading volume mirrors liquidity, to a large extent. Higher volume generally equates to better liquidity and tighter spreads. The Canadian dollar market usually sees its highest trading volume during the overlap of North American and European trading sessions, with activity tapering off during Asian trading hours and overnight periods.

Similarly, trading volume tends to be higher during the weekdays and lower on weekends. The beginning and end of the week can also display slightly higher volatility due to accumulated market sentiment and the potential for unexpected news events over the weekend. This variation in volume influences the ease of executing trades and the potential for slippage.

So, you’re eyeing the Canadian forex market? Knowing its hours is half the battle, but minimizing losses is the other half! To master that, check out this amazing resource on Comprehensive guide to forex trading spreads and their impact on profits – it’s a lifesaver! Armed with that knowledge, you’ll be a forex ninja, conquering those Canadian market hours like a boss.

Strategies for Trading During Optimal Times

Trading the Canadian forex market during its optimal hours requires a keen understanding of market dynamics and a well-defined strategy. Successfully navigating this landscape demands more than just knowing when to trade; it necessitates a proactive approach incorporating risk management and a systematic method for identifying and exploiting opportunities. Let’s delve into the strategies that can turn those optimal trading hours into profitable ones.

Successful Canadian Forex Trading Strategies

Several strategies can be particularly effective during the Canadian market’s peak activity. One such approach is the “News-Driven Scalping Strategy.” This strategy involves leveraging the high volatility surrounding significant economic news releases, such as the Canadian employment report or interest rate announcements. Traders employing this method quickly enter and exit positions, aiming to profit from small price movements amplified by the news.

Another example is the “Range-Bound Trading Strategy,” which is suitable during periods of lower volatility within the optimal trading hours. This strategy focuses on identifying predictable price ranges and placing trades based on price bouncing off support and resistance levels. Careful analysis of charts, using indicators like moving averages and Bollinger Bands, is crucial for this strategy. Finally, the “Momentum Trading Strategy” capitalizes on strong price trends that often develop during periods of high liquidity.

This approach requires quick decision-making and a thorough understanding of technical analysis indicators to identify and ride these trends.

Sample Trading Plan Incorporating Optimal Trading Times

A sample trading plan could focus on the overlap between the Canadian and US trading sessions (roughly 12:00 PM to 4:00 PM ET). This period typically sees increased liquidity and volatility. The plan would include:

- Market Analysis: Conducting pre-market analysis of economic indicators, news events, and technical chart patterns relevant to the Canadian dollar (CAD).

- Trade Selection: Choosing one or two specific currency pairs involving the CAD, based on the pre-market analysis and the trader’s chosen strategy (e.g., USD/CAD, EUR/CAD).

- Position Sizing: Determining the appropriate lot size for each trade, based on risk tolerance and account size. Never risk more than 1-2% of your account on any single trade.

- Entry and Exit Points: Defining clear entry and exit points using technical indicators and price action analysis. Stop-loss orders should be placed to limit potential losses.

- Monitoring and Adjustment: Continuously monitoring the market and adjusting the trading plan as needed, based on real-time market conditions.

This plan emphasizes discipline and risk management, crucial elements for successful forex trading.

Risk Management Techniques During High Volatility

High volatility, often present during the best trading times, presents both opportunities and risks. Effective risk management is paramount. This includes:

- Smaller Position Sizes: Reducing the size of trades to minimize potential losses during periods of increased price swings.

- Tight Stop-Loss Orders: Placing stop-loss orders closer to the entry price to limit potential losses should the market move against the trade.

- Trailing Stop-Losses: Utilizing trailing stop-losses to lock in profits as the trade moves in a favorable direction while protecting against sudden reversals.

- Diversification: Spreading trades across multiple currency pairs to reduce the impact of any single losing trade.

Implementing these techniques can significantly mitigate risk and protect trading capital during periods of heightened volatility.

So, you’re keen to conquer the Canadian forex market, eh? Knowing the best times to trade is half the battle – overlapping with London and New York sessions is key. But before you dive headfirst into those fluctuating currencies, you might want to brush up on your skills first. Check out this amazing resource for advanced forex techniques: Best books to learn advanced forex trading techniques for beginners.

Armed with knowledge, you’ll be a Canadian forex trading champion in no time, mastering those market hours like a lumberjack fells a tree!

Identifying and Capitalizing on Trading Opportunities

A step-by-step procedure for identifying and capitalizing on trading opportunities during the best trading times involves:

- Monitoring Economic Calendars: Keeping track of upcoming economic news releases and events that could impact the CAD.

- Analyzing Technical Charts: Identifying potential trading setups using technical indicators and chart patterns (e.g., candlestick patterns, moving averages, RSI).

- Evaluating Market Sentiment: Gauging overall market sentiment towards the CAD through news articles, analyst reports, and social media sentiment analysis.

- Executing Trades: Placing trades based on the identified opportunities, adhering to the pre-defined trading plan.

- Monitoring and Managing Trades: Continuously monitoring trades and adjusting stop-loss orders or taking profits as needed.

This methodical approach increases the probability of successful trades by combining fundamental and technical analysis with disciplined risk management.

Technical Analysis for Canadian Forex

Harnessing the power of technical analysis is crucial for navigating the sometimes-whimsical world of Canadian forex trading. By understanding and applying technical indicators and candlestick patterns, traders can gain a significant edge, identifying potential entry and exit points with greater precision and hopefully, minimizing those gut-wrenching losses that can make even the most seasoned trader question their life choices.

Remember, even the most sophisticated analysis doesn’t guarantee riches; it’s a tool, not a crystal ball.Technical indicators and candlestick patterns provide valuable insights into market sentiment and momentum, helping traders to anticipate price movements during peak trading hours. By combining these tools with an understanding of the Canadian market’s specific characteristics, traders can significantly improve their trading strategies and increase their chances of success.

So, you’re diving into the wild world of Canadian forex trading? Knowing the best times to trade, dictated by overlapping market hours, is crucial. But before you jump in, choosing the right platform is equally vital. Check out this comparison of top Canadian brokers like Comparing forex trading platforms in Canada: Questrade, Forex.com, and others to find your perfect match.

Then, armed with your chosen platform and knowledge of optimal trading times, you’ll be ready to conquer the Canadian forex market!

Think of it as adding a turbocharger to your trading engine – it makes things a lot faster and more efficient, but you still need to know how to drive!

Moving Averages and RSI in Canadian Forex Trading

Moving averages, such as the simple moving average (SMA) and exponential moving average (EMA), smooth out price fluctuations, revealing underlying trends. The RSI (Relative Strength Index), an oscillator, measures the magnitude of recent price changes to evaluate overbought or oversold conditions. During peak Canadian trading hours (often overlapping with the US session), the increased liquidity can amplify price movements, making these indicators particularly useful.

For example, a bullish crossover of a 50-day SMA above a 200-day SMA, coupled with an RSI above 70, might signal a strong upward trend, prompting a long position. Conversely, a bearish crossover with an RSI below 30 might suggest a short position. The key is to use these indicators in conjunction with other forms of analysis, rather than relying on them solely.

Candlestick Patterns for Optimal Entry and Exit Points

Candlestick patterns offer visual clues about market sentiment and potential price reversals. Identifying patterns like engulfing patterns, hammers, or dojis during peak trading hours can provide valuable entry and exit signals. For instance, a bullish engulfing pattern (where a large green candle completely engulfs a preceding red candle) during a period of high trading volume could signal a potential bullish reversal, offering a good opportunity to enter a long position.

Similarly, bearish engulfing patterns can signal short opportunities. Remember, confirmation from other indicators or price action is always advisable before acting on a single candlestick pattern.

Bullish Reversal Pattern: A Visual Description

Imagine a candlestick chart. We see a series of red candlesticks indicating a downtrend. Then, a small red candlestick appears, followed by a significantly larger green candlestick that completely engulfs the previous red candle. This large green candle closes near its high, showing strong buying pressure. This is a bullish engulfing pattern, a classic bullish reversal signal.

The implication in the Canadian forex market is that after a period of selling pressure, buyers have stepped in, potentially signaling a shift in momentum towards an upward trend. This pattern, when coupled with high volume, can be a strong indicator for a long position during peak trading hours.

Key Technical Indicators for Canadian Forex Trading

Choosing the right technical indicators depends heavily on your trading style and timeframe. Below are some key indicators categorized for short-term and long-term strategies.

- Short-Term (Scalping and Day Trading): RSI, MACD (Moving Average Convergence Divergence), Stochastic Oscillator, Bollinger Bands. These indicators react quickly to price changes, making them suitable for short-term trades.

- Long-Term (Swing and Position Trading): Moving Averages (200-day SMA, for example), Fibonacci Retracements, Ichimoku Cloud. These indicators are better suited for identifying longer-term trends and potential support/resistance levels.

Remember, no indicator is foolproof. Always use multiple indicators and combine them with other forms of analysis to make informed trading decisions. The Canadian forex market, like any other, is subject to unexpected events, so risk management remains paramount.

Fundamental Analysis for Canadian Forex

Fundamental analysis in the Canadian forex market is like being a detective, piecing together clues to predict the future price of the loonie (CAD). Unlike technical analysis which focuses on charts and patterns, fundamental analysis digs deep into the economic and political factors influencing the Canadian dollar’s value. Understanding these factors can give you a significant edge in your trading endeavors, though remember, even the best detective can’t always predict the future with perfect accuracy!

Impact of Canadian Economic Data on the CAD Exchange Rate

Key economic indicators paint a picture of Canada’s overall economic health, directly impacting the CAD’s strength. A strong economy generally leads to a stronger currency, attracting foreign investment and boosting demand. Conversely, weak economic data often results in a weaker CAD. For example, a higher-than-expected GDP growth rate signals economic prosperity, typically pushing the CAD upwards. Similarly, lower-than-expected inflation might indicate a weakening economy, potentially leading to a decline in the CAD’s value.

Interest rate changes announced by the Bank of Canada also significantly affect the currency; a rate hike generally strengthens the CAD, while a cut weakens it. Imagine it like this: Canada’s economy is a delicious cake. Strong economic data are the rich ingredients that make it desirable, driving up demand (and the CAD’s value). Weak data are the soggy bottom, making it less appealing and lowering its value.

Geopolitical Events and Their Influence on the Canadian Forex Market

The Canadian forex market isn’t an island; it’s susceptible to global events. Geopolitical instability, such as international conflicts or political uncertainty in major trading partners (like the US), can create volatility and impact the CAD. For instance, heightened trade tensions between Canada and another country could lead to a decline in the CAD, as investors become hesitant about investing in a potentially unstable market.

Similarly, global economic shocks, such as a major recession in a significant trading partner, can ripple through the Canadian economy, affecting the CAD’s value. Think of it as a ripple effect in a pond – a stone (geopolitical event) thrown into the water (global market) creates waves (volatility) that affect the Canadian dollar’s value.

Key Economic Indicators to Monitor

Several key economic indicators provide valuable insights into the Canadian economy and its impact on the CAD. Monitoring these indicators allows traders to anticipate potential shifts in the currency’s value.

- Gross Domestic Product (GDP): A measure of the total value of goods and services produced in Canada. Strong GDP growth usually boosts the CAD.

- Inflation Rate: The rate at which prices for goods and services are increasing. High inflation can weaken the CAD, while low inflation is generally positive.

- Interest Rates: Set by the Bank of Canada, these rates influence borrowing costs and investment decisions. Higher rates tend to attract foreign investment, strengthening the CAD.

- Employment Rate: The percentage of the working-age population that is employed. High employment typically signifies a healthy economy and supports a strong CAD.

- Trade Balance: The difference between the value of Canada’s exports and imports. A trade surplus (more exports than imports) is usually positive for the CAD.

Combining Fundamental and Technical Analysis

Fundamental analysis provides the “why” behind currency movements, while technical analysis provides the “how.” Combining both approaches offers a more comprehensive trading strategy. For example, if fundamental analysis suggests that the Canadian economy is strengthening (based on positive GDP growth and low inflation), a trader might look for bullish technical signals (such as rising price action and increasing trading volume) to confirm this prediction and enter a long position on the CAD.

Conversely, if fundamental analysis points towards a weakening economy (due to rising inflation and slowing GDP growth), a trader might look for bearish technical signals (like falling prices and declining volume) to confirm this prediction and consider a short position. Think of it as having two sets of eyes – one looking at the big picture (fundamentals), the other at the details (technicals).

Together, they provide a clearer, more informed perspective.

Ending Remarks

So, there you have it – the inside scoop on conquering the Canadian forex market. Remember, while understanding market hours and optimal trading times is crucial, success also hinges on a solid trading plan, diligent risk management, and a healthy dose of patience (and maybe a little bit of luck). Don’t be afraid to experiment, learn from your mistakes (yes, even the spectacular ones!), and remember that the forex market is a marathon, not a sprint.

Now go forth and trade, my friend, and may your profits be plentiful!