Detailed guide on using Questrade for dollar-dealer forex transactions: Dive headfirst into the thrilling world of forex trading with Questrade! This isn’t your grandma’s knitting circle; we’re talking about harnessing the power of global currency markets, all from the comfort of your armchair (or hammock, if you’re feeling adventurous). Prepare to navigate the exciting – and sometimes slightly terrifying – landscape of currency pairs, leverage, and the ever-elusive profit.

This guide will equip you with the knowledge to confidently tackle the Questrade platform, from account setup to executing those killer trades that’ll make your financial advisor do a double take.

We’ll cover everything from the nitty-gritty details of account verification and funding your account in USD, to mastering the art of placing orders, understanding Questrade’s fee structure (because let’s face it, nobody likes hidden fees), and developing winning trading strategies. We’ll even touch on the slightly less glamorous but equally important aspects like risk management and securing your hard-earned cash.

Get ready to unleash your inner currency kingpin!

Account Setup and Verification

Embarking on your forex trading journey with Questrade? Buckle up, buttercup, because we’re about to navigate the exciting (and slightly bureaucratic) world of account setup and verification. Think of it as a thrilling quest to unlock the secrets of global currency markets – but with less dragons and more paperwork.Getting started is surprisingly straightforward, though be prepared for a bit of a paperwork marathon.

Think of it as a financial fitness test – the more diligent you are, the more rewarding your trading experience will be. Let’s dive into the specifics.

Questrade Account Opening Process

Opening a Questrade account for forex trading involves a few simple steps. First, you’ll need to visit the Questrade website and click on the “Open an Account” button. Then, you’ll be guided through a series of online forms, providing personal information such as your name, address, date of birth, and social security number (or equivalent). You’ll also need to choose an account type, which we’ll discuss in more detail shortly.

Remember to double-check everything; accuracy is key to a smooth process. Think of it as assembling IKEA furniture – follow the instructions carefully, and you’ll avoid a frustrating meltdown.

Verification Procedures for Dollar-Dealer Forex Transactions

To engage in dollar-dealer forex transactions, Questrade will require verification of your identity and financial information. This is a standard procedure to comply with anti-money laundering (AML) and know-your-customer (KYC) regulations. Think of it as showing your passport at airport security – it’s a necessary inconvenience for a smoother overall experience. You’ll need to provide supporting documents, including a government-issued photo ID (passport, driver’s license), proof of address (utility bill, bank statement), and potentially additional documents depending on your individual circumstances.

Questrade will clearly Artikel what is required at each stage of the process.

Questrade Account Types and Forex Trading

Questrade offers several account types, each with its own features and fees. For forex trading, the most suitable option is typically their self-directed brokerage account. This account gives you complete control over your trades and access to a wide range of currency pairs. Other account types, such as managed accounts or retirement accounts, might not be as well-suited for active forex trading due to limitations or additional fees.

Choosing the right account type is crucial for optimizing your trading strategy. Think of it as choosing the right tool for the job – a hammer is great for nails, but not so much for screws.

Necessary Documentation for Account Verification

The documentation needed for account verification might vary slightly, but generally includes:

- A government-issued photo ID (passport, driver’s license).

- Proof of address (utility bill, bank statement, recent letter from a financial institution).

- In some cases, additional documentation may be required to verify your source of funds, especially for larger deposits. This might include bank statements showing the origin of the funds.

Remember to ensure all documents are clear, legible, and current. Providing inaccurate or incomplete information can significantly delay the verification process. Think of it as baking a cake – if you miss an ingredient, the result might not be quite what you expected.

Funding Your Questrade Account

So, you’re ready to dive headfirst into the thrilling world of forex trading with Questrade? Fantastic! But before you can start making those savvy currency trades, you need to get some USD into your account. Think of it as fueling your financial rocket ship – you can’t blast off without the fuel! Let’s explore the various ways to fund your Questrade account and make sure you’re ready for liftoff.Funding your Questrade account is surprisingly straightforward, offering a variety of options to suit your preferences and banking habits.

Each method has its own quirks regarding speed and fees, so choosing the right one depends on your priorities. We’ll break down the options, fees, and speeds so you can make an informed decision and avoid any unwelcome surprises.

Funding Methods Available

Questrade provides several convenient methods for depositing USD into your trading account. These include electronic fund transfers (EFTs), wire transfers, and potentially, depending on your location and bank, linking a USD bank account directly. Let’s examine each option in detail.

Fees Associated with Funding Methods

The cost of funding your account varies depending on the method you choose. While some methods are free, others may involve fees charged by either Questrade or your bank. These fees can eat into your trading capital, so it’s crucial to be aware of them before you start. It’s always a good idea to check directly with Questrade and your bank for the most up-to-date fee schedules, as these can change.

Comparison of Funding Methods: Speed and Cost

Speed and cost are often the deciding factors when choosing a funding method. EFTs generally offer a balance between speed and cost, while wire transfers are faster but usually more expensive. Direct linking of a USD account (if available) can offer both speed and potentially lower fees, but this option’s availability depends entirely on your banking setup. Weighing these factors against your trading needs will help you make the best choice.

Funding Method Comparison Table

| Funding Method | Minimum Deposit | Processing Time | Fees |

|---|---|---|---|

| Electronic Fund Transfer (EFT) | $100 (Example – check Questrade for current minimum) | 2-5 business days | Typically none, but check with Questrade and your bank for potential fees. |

| Wire Transfer | $1000 (Example – check Questrade for current minimum) | 1-2 business days | Variable, depending on your bank and Questrade’s fees. Expect higher fees than EFTs. |

| Direct USD Account Link (If Available) | Variable, check Questrade | Instant or near-instant | Potentially lower fees than other methods, but availability is dependent on your bank and Questrade’s support. |

Remember to always confirm the current fees and minimum deposit amounts directly with Questrade before funding your account. Fees and minimums are subject to change.

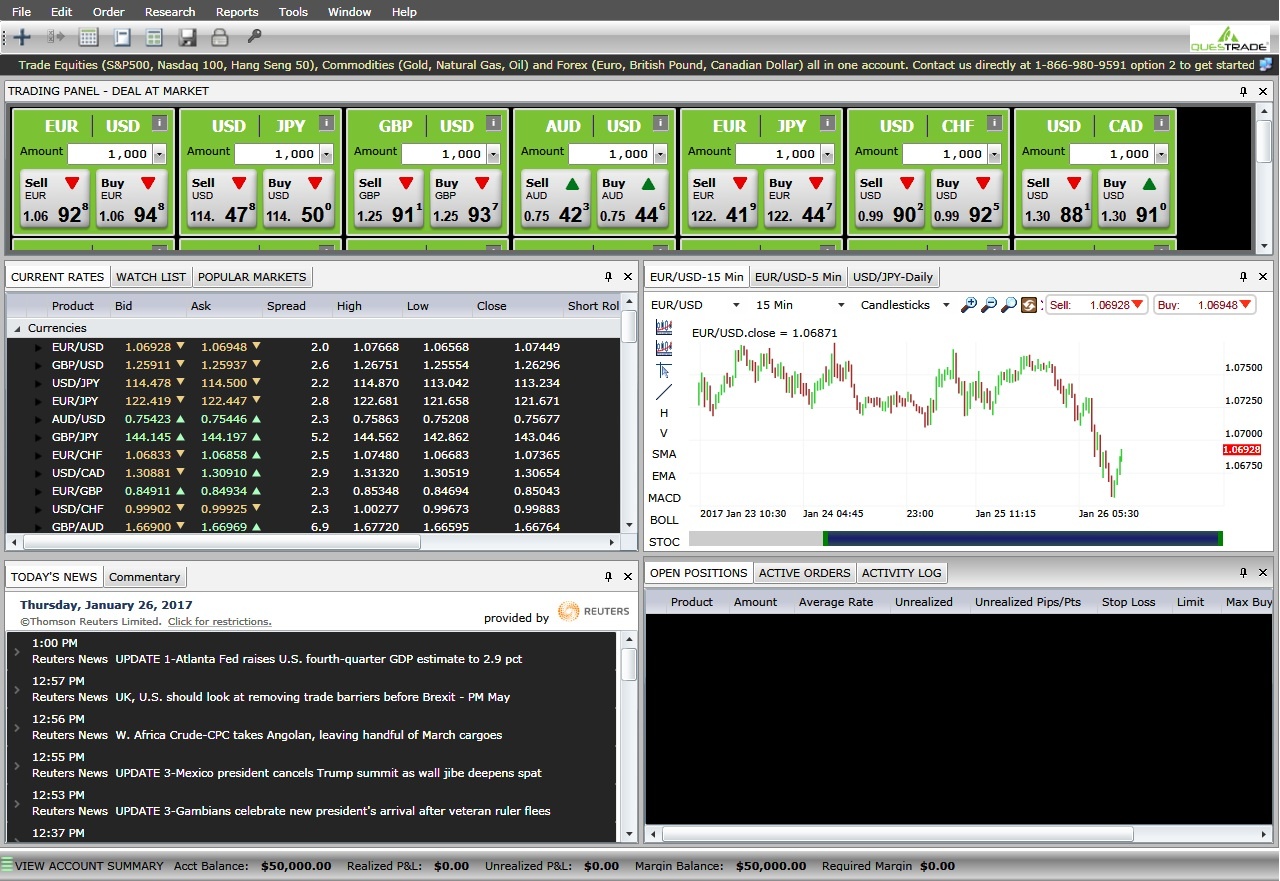

Navigating the Questrade Forex Platform

So, you’ve successfully funded your Questrade account – congratulations, you’re officially one step closer to forex fortune (or, at least, a slightly less boring Tuesday). Now, let’s dive into the heart of the matter: the Questrade trading platform itself. Think of it as your personal spaceship to the exciting (and sometimes terrifying) world of currency trading. Buckle up, because it’s going to be a wild ride.The Questrade platform boasts a clean, intuitive interface, even if you’re less tech-savvy than a dial-up modem.

The main screen usually displays your open positions, pending orders, and a customizable chart area. You’ll find various tabs or menus offering access to account information, research tools, and educational resources. Don’t be intimidated by the initial array of buttons and graphs; most of the crucial functions are readily accessible. Think of it like learning to drive a stick shift – initially daunting, but eventually, you’ll be parallel parking your profits with ease.

Placing Different Order Types

Understanding order types is fundamental to successful forex trading. Choosing the right order type can be the difference between a profitable trade and a painful loss. This section details the three most common order types on the Questrade platform: market orders, limit orders, and stop-loss orders. Mastering these will dramatically increase your control over your trades.

- Market Orders: These are your “buy it now” orders. They execute immediately at the best available market price. Think of it as grabbing a limited-edition sneaker – you want it, you get it, no questions asked. The downside is you don’t have control over the exact execution price, which can be slightly higher or lower than expected due to market volatility.

So you’re diving headfirst into the wild world of Questrade forex? This detailed guide on using Questrade for dollar-dealer forex transactions will have you swimming with the sharks (metaphorically, of course!). Need a quick example? Check out this handy guide on a specific conversion: How to convert 433 CAD to USD using Questrade’s forex services , then get back to mastering the art of the deal with our comprehensive guide.

You’ll be a forex pro in no time!

- Limit Orders: These are your “buy it at this price or lower” orders. You specify the exact price at which you want to buy or sell. If the market price reaches your specified limit, the order is executed. This allows you to buy low and sell high, but there’s a risk your order might not be filled if the market moves too quickly.

It’s like setting a price alert on your favorite online retailer.

- Stop-Loss Orders: These are your “emergency brakes.” You set a price at which your position is automatically closed if the market moves against you. This helps limit potential losses, ensuring your losses don’t spiral out of control. Think of it as a safety net for your trading adventures. It’s crucial to use stop-loss orders to manage risk responsibly.

Managing Open Positions and Pending Orders

Once you’ve placed your orders, it’s essential to monitor them effectively. The Questrade platform provides tools to track your open positions and pending orders, offering a clear overview of your current trades. This section will detail how to manage these effectively to maximize your gains and minimize your losses.The platform typically displays a summary of your open positions, including the currency pair, entry price, current profit/loss, and the ability to close the position at any time.

Pending orders are displayed separately, showing their type (limit, stop-loss, etc.), the trigger price, and the option to modify or cancel them before execution. Regularly reviewing this information is vital to make informed decisions. Think of it like checking your dashboard – essential for staying on course.

Using the Charting Tools

Charts are the forex trader’s bread and butter. Questrade offers a robust set of charting tools to analyze price movements and identify potential trading opportunities. This section will guide you through the platform’s charting features, helping you unlock the secrets hidden within those squiggly lines.The platform usually allows you to select various chart types (candlestick, bar, line), adjust the timeframe (from 1-minute to monthly charts), and add technical indicators (moving averages, RSI, MACD, etc.).

You can also draw trend lines, support/resistance levels, and Fibonacci retracements directly onto the chart. Experiment with different combinations of indicators and chart types to find what works best for your trading style. Think of it as your own personal crystal ball (though, unlike a crystal ball, it’s based on actual data!).

Understanding Questrade’s Forex Fees and Spreads: Detailed Guide On Using Questrade For Dollar-dealer Forex Transactions

So, you’ve navigated the slightly bewildering world of setting up your Questrade account and are raring to go with your dollar-dealer forex trading ambitions. Before you dive headfirst into the exciting (and potentially lucrative) world of currency exchange, let’s talk about the less glamorous, but equally important, topic of fees. Understanding Questrade’s fee structure is crucial for maximizing your profits – or at least, minimizing your losses! Think of it as pre-flight checks before taking off on your trading journey.Questrade’s forex trading fees are primarily composed of spreads and overnight financing charges.

Unlike some brokers who charge commissions per trade, Questrade’s model relies on the spread, which is the difference between the bid and ask price of a currency pair. Essentially, you’re paying the difference between what you buy a currency for and what you can immediately sell it for. Overnight financing charges, also known as swap fees, apply when you hold a position overnight, reflecting the interest rate differential between the two currencies involved.

These charges can work in your favor or against you, depending on the position and the interest rate environment.

Questrade’s Spread Structure

The spread on Questrade varies depending on the currency pair and market conditions. Generally, major currency pairs (like EUR/USD or USD/JPY) will have tighter spreads than minor or exotic pairs. Think of it like this: popular currency pairs are the busy highways, with lots of traffic and therefore lower tolls (spreads), while the more obscure pairs are the backroads, with fewer traders and potentially higher “tolls.” Market volatility also plays a role; during times of high uncertainty, spreads tend to widen, reflecting the increased risk for market makers.

Questrade doesn’t publicly list a fixed spread for each pair, as it fluctuates constantly, but you can usually see the current spread displayed on their trading platform before executing a trade. It’s a dynamic situation, and checking the spread before you buy or sell is a good habit to develop.

Overnight Financing Charges (Swap Fees)

Overnight financing charges are essentially the interest you earn or pay for holding a position overnight. If you’re long a currency with a higher interest rate, you’ll receive a positive swap; conversely, a short position on a high-interest currency will result in a negative swap. These fees are calculated based on the daily interest rate differential between the two currencies involved and the size of your position.

For example, holding a long position in the New Zealand dollar (NZD) against the US dollar (USD) during a period where NZD interest rates exceed USD interest rates would likely result in a positive swap, adding to your profit. However, the opposite scenario would lead to a negative swap, reducing your potential profit. Questrade’s platform clearly displays these swap fees before you execute a trade, so you can factor them into your trading strategy.

Comparison of Questrade’s Fees with Other Brokers

Comparing forex broker fees can be a bit like comparing apples and oranges, as different brokers use different pricing models. Some charge commissions alongside spreads, while others, like Questrade, primarily rely on spreads. To make a fair comparison, you need to consider the total cost of trading, including spreads, commissions, and financing charges. While a direct numerical comparison isn’t feasible without specific data from other brokers at a given point in time, it’s safe to say that Questrade’s spread-based model can be competitive, especially for active traders who execute many trades.

The key is to research and compare the

total cost* of trading across several brokers, not just focusing on one aspect like spreads in isolation.

Illustrative Fee Structure for Various Currency Pairs

The following table provides ahypothetical* example of potential spread costs for various currency pairs on Questrade at a specific moment in time. Remember, these are illustrative and will change constantly. Real-time data should always be checked on the Questrade platform before executing a trade.

| Currency Pair | Typical Spread (Pips) | Example Spread Cost (USD 10,000 Trade) | Overnight Financing (Example – varies greatly) |

|---|---|---|---|

| EUR/USD | 0.5 – 1 | $5 – $10 | +/- $0.50 – $2 (depending on position and rates) |

| USD/JPY | 0.2 – 0.7 | $2 – $7 | +/- $0.25 – $1 (depending on position and rates) |

| GBP/USD | 0.7 – 1.5 | $7 – $15 | +/- $1 – $3 (depending on position and rates) |

| USD/CAD | 0.5 – 1.2 | $5 – $12 | +/- $0.30 – $1.50 (depending on position and rates) |

Impact of Fees on Profitability

Even small spreads and financing charges can significantly impact profitability, especially on frequent trades or larger position sizes. Let’s say you make a profit of $100 on a trade, but your spread costs were $10. Your net profit is now only $90. Over many trades, these seemingly small costs can accumulate and substantially reduce your overall returns.

Therefore, carefully considering the total cost of trading, including spreads and financing charges, is essential for successful forex trading. This is why meticulous planning and risk management are paramount. Failing to account for fees can be the difference between a profitable and an unprofitable trade, or even a winning and losing trading year.

Executing Dollar-Dealer Forex Transactions

So, you’ve navigated the treacherous waters of account setup and funding – congratulations, you’re officially a Questrade forex warrior! Now, let’s unleash the kraken (metaphorically, of course; we don’t want any actual sea monsters involved). This section details how to execute those dollar-dealer forex trades, ensuring your financial journey is less “Titanic” and more “unsinkable yacht.”

Executing a forex trade on the Questrade platform is surprisingly straightforward, once you get the hang of it. Think of it like ordering a really expensive coffee – you specify what you want, how much you want, and then hit the “buy” button (or in this case, the “place order” button). The key difference? This coffee could make you rich (or slightly less broke), depending on your skills and market knowledge.

Step-by-Step Guide to Executing a Forex Trade

Let’s assume you’re feeling bullish on the USD/CAD pair. Here’s how you’d place a buy order:

- Locate the Currency Pair: Find the USD/CAD pair within Questrade’s forex trading platform. It’s usually organized alphabetically or by currency.

- Specify Order Type: Choose “Buy” to buy USD and sell CAD (or “Sell” to do the opposite). This indicates your belief in the USD’s appreciation against the CAD.

- Enter Order Details: Input the amount of USD you wish to buy (or CAD to sell). Questrade will automatically calculate the equivalent amount of the other currency based on the current exchange rate.

- Set Order Type: Decide whether you want a market order (executed immediately at the current market price) or a limit order (executed only when the price reaches your specified level). Market orders are for speed; limit orders offer more control.

- Review and Confirm: Double-check all the details of your order before clicking the “Place Order” button. A moment of hesitation could save you from a costly mistake.

Managing Risk with Stop-Loss and Take-Profit Orders

Think of stop-loss and take-profit orders as your personal forex bodyguards, protecting you from the wild swings of the market. They’re crucial for managing risk and securing profits. Failing to use them is like going into a boxing match without a mouthguard.

A stop-loss order automatically sells your position if the price drops to a pre-determined level, limiting your potential losses. A take-profit order automatically sells your position if the price rises to a pre-determined level, securing your profits. These orders are set when you place the initial trade, ensuring your strategy is fully implemented.

So you’re diving headfirst into the wild world of Questrade forex? This detailed guide on using Questrade for dollar-dealer forex transactions will have you swimming with the sharks (metaphorically, of course!). Need a quick example? Check out this handy guide on a specific conversion: How to convert 433 CAD to USD using Questrade’s forex services , then get back to mastering the art of the deal with our comprehensive guide.

You’ll be a forex pro in no time!

Example: If you buy USD/CAD at 1.35, you might set a stop-loss at 1.34 to limit your loss to 1 cent per unit, and a take-profit at 1.37 to secure a 2-cent profit per unit. These values are illustrative and should be adjusted based on your risk tolerance and market analysis.

Managing Open Positions and Minimizing Losses

Monitoring your open positions is essential. Regularly review your trades, especially during periods of high market volatility. Don’t be afraid to adjust your stop-loss orders if the market moves against you significantly. Think of it as tightening your seatbelt during a bumpy flight.

Consider using trailing stop-loss orders, which automatically adjust your stop-loss order as the price moves in your favor. This protects your profits while letting your position ride potential gains. It’s like having a smart, ever-vigilant bodyguard.

Remember, cutting your losses is a crucial skill. Don’t let a losing trade spiral out of control. Accepting a small loss is far better than clinging to a sinking ship (or a sinking trade).

Understanding Leverage and Margin Requirements, Detailed guide on using Questrade for dollar-dealer forex transactions

Leverage is like a double-edged sword – it can amplify both your profits and your losses. Questrade allows you to trade with leverage, meaning you can control a larger position with a smaller amount of capital. However, this increased potential for profit comes with increased risk.

Margin is the amount of money you need to keep in your account to maintain your open positions. If the market moves against you and your margin falls below a certain level (a margin call), Questrade may liquidate your positions to cover its losses. This can result in significant losses if you’re not careful.

Always trade with a level of leverage you’re comfortable with, and closely monitor your margin levels. Ignoring margin requirements can be disastrous.

Advanced Trading Strategies on Questrade

So, you’ve mastered the basics of forex trading on Questrade. Congratulations! You’re ready to level up your game and explore the exciting (and sometimes terrifying) world of advanced trading strategies. This section will equip you with the tools and knowledge to navigate the complexities of technical and fundamental analysis, allowing you to make more informed – and hopefully, more profitable – trading decisions.

Remember, though, that even the most sophisticated strategies can’t guarantee success in the volatile world of forex. Always trade responsibly and within your risk tolerance.

So you’re diving headfirst into the wild world of Questrade dollar-dealer forex transactions? Fantastic! But before you start throwing your money around like confetti at a Wall Street rave, you’ll want to know the nitty-gritty details. A crucial part of that is understanding the fees – check out this link to learn more about them: What are the fees and commissions associated with Questrade forex trading?

. Armed with that knowledge, you’ll be well on your way to mastering Questrade’s forex platform and hopefully, raking in the profits!

Technical Analysis Indicators on the Questrade Platform

Questrade’s platform offers a range of technical indicators to help you analyze price charts and identify potential trading opportunities. These indicators can reveal trends, momentum, and support/resistance levels. For example, the Relative Strength Index (RSI) helps identify overbought and oversold conditions, suggesting potential reversal points. Moving averages, such as the simple moving average (SMA) and exponential moving average (EMA), smooth out price fluctuations and highlight trends.

By combining several indicators, you can create a more comprehensive picture of market sentiment and potential price movements. Imagine the RSI showing an overbought condition while the price is approaching a strong resistance level – this might signal a potential short opportunity. Conversely, an oversold RSI coupled with a price bounce off support could suggest a long position.

Remember that indicator signals should be interpreted within the broader context of the market and your overall trading strategy.

Fundamental Analysis for Forex Trading Decisions

While technical analysis focuses on price charts, fundamental analysis delves into the economic and political factors influencing currency values. This involves examining economic indicators like GDP growth, inflation rates, interest rates, and employment data. Geopolitical events, government policies, and central bank announcements can also significantly impact currency pairs. For example, a surprise interest rate hike by a central bank can strengthen its currency, creating a profitable opportunity for those who anticipated the move.

Conversely, negative economic news might weaken a currency, presenting shorting opportunities. Understanding these fundamental factors allows you to make more informed predictions about future price movements, although it’s important to remember that these predictions are not guaranteed.

Trading Strategies for Dollar-Dealer Forex Transactions

Several trading strategies are suitable for dollar-dealer forex transactions, each with its own risk profile. Successful traders often adapt and combine these strategies to suit their individual risk tolerance and market conditions. Choosing the right strategy requires careful consideration of your trading style, risk appetite, and time commitment.

Thinking of diving headfirst into the wild world of Questrade’s dollar-dealer forex transactions? Our detailed guide will equip you with the knowledge to navigate those treacherous waters. But first, a crucial question: before you even think about becoming a forex ninja, check out this article Is Questrade’s global FX platform suitable for beginners in Canada? to see if you’re ready to handle the high-stakes game.

Then, once you’re confident, come back and conquer our guide to dollar-dealer forex trading on Questrade!

- Scalping: This involves taking advantage of very short-term price fluctuations, aiming for small profits on numerous trades. High risk, high frequency.

- Day Trading: Positions are opened and closed within the same trading day. Moderate risk, moderate frequency.

- Swing Trading: Holding positions for several days or weeks, capitalizing on short-to-medium-term price swings. Lower risk, lower frequency.

- Position Trading: Holding positions for extended periods (weeks, months, or even years), aiming for significant price movements. Lowest risk, lowest frequency.

Risk Profiles of Different Trading Strategies

Understanding the inherent risks associated with each strategy is crucial for responsible trading.

- High-Risk Strategies (Scalping, Day Trading): These strategies require significant discipline, quick decision-making, and a high tolerance for risk. Losses can accumulate rapidly if trades are not managed effectively. They offer the potential for high returns but also carry a high probability of substantial losses.

- Moderate-Risk Strategies (Swing Trading): This approach offers a balance between risk and reward. While still subject to market volatility, the longer holding periods allow for more time to react to market changes and potentially recover from temporary losses.

- Low-Risk Strategies (Position Trading): This is a long-term approach that prioritizes risk management. While returns may be slower, the lower risk profile makes it suitable for investors with a long-term perspective and a lower tolerance for short-term volatility.

Security and Risk Management

Forex trading, while potentially lucrative, isn’t a walk in the park – it’s more like a thrilling rollercoaster ride through a financial jungle. To navigate this wild terrain successfully, understanding Questrade’s security measures and implementing robust risk management strategies is absolutely crucial. Think of it as equipping yourself with a sturdy jungle machete and a detailed map before embarking on your adventure.Questrade employs a multi-layered security approach to safeguard client accounts and data.

So you’re diving headfirst into the wild world of Questrade dollar-dealer forex transactions? Excellent! Mastering the basics is crucial, but to truly level up your game, consider integrating AI-powered insights – check out this guide on Best practices for using AI in Questrade forex trading strategies for a serious competitive edge. Then, armed with both manual skill and AI assistance, conquer those forex markets like a pro!

This includes robust encryption protocols, advanced firewall systems, and regular security audits. They also adhere to strict regulatory guidelines, providing an extra layer of protection. Imagine your account as a high-security vault, protected by multiple locks and guarded by experienced professionals. While no system is impenetrable, Questrade’s commitment to security significantly reduces the risk of unauthorized access or data breaches.

Questrade’s Security Measures

Questrade utilizes various security measures to protect user accounts and data. These include data encryption using SSL/TLS protocols, multi-factor authentication, and intrusion detection systems that monitor for suspicious activity. Regular security audits and penetration testing help identify and address vulnerabilities proactively. Furthermore, Questrade complies with relevant industry regulations, such as those set by the Investment Industry Regulatory Organization of Canada (IIROC), ensuring a high standard of security practices.

This comprehensive approach aims to minimize the risk of unauthorized access, data breaches, and financial losses for its clients.

Risk Management Strategies for Forex Trading

Effective risk management is paramount in forex trading. It’s not about avoiding risk altogether (that’s impossible!), but about intelligently managing it to protect your capital. This involves several key strategies, each contributing to a safer trading experience. Think of it as carefully choosing your path through the jungle, avoiding dangerous pitfalls and maximizing your chances of success.

Identifying and Mitigating Forex Trading Risks

Forex trading exposes you to various risks, including market volatility, geopolitical events, economic indicators, and leverage. Market volatility can lead to sudden and significant price swings, potentially resulting in substantial losses. Geopolitical events, such as wars or political instability, can drastically impact currency values. Economic indicators, like inflation rates and interest rate changes, can also affect currency pairs.

Leverage, while magnifying potential profits, also amplifies losses. Mitigating these risks involves thorough market research, diversification of your portfolio, and careful position sizing. Diversification, similar to not putting all your eggs in one basket, spreads your risk across multiple currency pairs, reducing the impact of losses in any single pair.

Stop-Loss Orders and Position Sizing

Stop-loss orders automatically sell a position when it reaches a predetermined price, limiting potential losses. For example, if you buy EUR/USD at 1.1000 and set a stop-loss at 1.0950, your position will be automatically closed if the price falls to 1.0950, preventing further losses. Position sizing determines the amount of capital allocated to each trade. A general rule of thumb is to risk no more than 1-2% of your trading capital on any single trade.

For example, with a $10,000 trading account, you should risk no more than $100-$200 on a single trade. This approach limits the potential damage from losing trades, allowing you to withstand market fluctuations and continue trading.

Never risk more than you can afford to lose.

Customer Support and Resources

Navigating the sometimes-treacherous waters of forex trading requires a sturdy ship and a reliable map. Questrade, thankfully, provides both – a robust platform and a surprisingly helpful support system. Let’s explore the resources available to help you chart your course to forex success (or at least, to avoid complete shipwreck).

Questrade offers a multi-pronged approach to customer support, recognizing that not everyone learns or communicates in the same way. Their aim is to provide assistance that’s as flexible and adaptable as the forex market itself. They understand that a quick answer to a burning question can be the difference between a profitable trade and a frustrating loss, so they’ve invested in various avenues to get you the help you need.

Questrade’s Customer Support Options

Questrade’s customer support encompasses several channels, ensuring accessibility for various preferences. Their primary contact methods include phone support, email, and a comprehensive FAQ section on their website. The phone support line is staffed by knowledgeable representatives who can address your queries promptly. Email support, while potentially slower, allows for detailed explanations and documentation of your issue. The FAQ section is a treasure trove of information, covering a wide range of topics, from account setup to advanced trading strategies.

Many common questions are answered here, saving you valuable time.

Educational Resources and Tutorials

Beyond immediate support, Questrade offers a wealth of educational resources to empower you as a forex trader. They recognize that knowledge is power in the forex market, and they’ve created a library of materials designed to help you navigate its complexities. This includes various learning materials such as webinars, tutorials, and market analysis reports. These resources are often updated to reflect the ever-changing dynamics of the global markets.

Contacting Questrade Support for Forex Trading Assistance

To contact Questrade support for forex-specific issues, you can utilize any of the previously mentioned methods. When contacting them via phone or email, clearly state that your inquiry relates to forex trading. This helps direct your query to the appropriate specialist, ensuring a faster and more effective resolution. Providing specific details about your issue, including screenshots if relevant, will further expedite the process.

Think of it as providing a detailed treasure map to your problem; the more detail, the faster they can find the buried gold (or, you know, solve your problem).

Helpful Resources for Forex Traders

Beyond Questrade’s own resources, a vast universe of information awaits aspiring forex traders. Leveraging these external resources can significantly enhance your understanding of the market and your trading strategies. Remember to always critically evaluate the information you find, ensuring its credibility and relevance to your trading style.

- Websites: Many reputable financial news websites offer forex analysis and market commentary. These sites often provide insightful perspectives on global economic events and their impact on currency pairs.

- Books: Numerous books delve into the intricacies of forex trading, covering topics from fundamental analysis to technical strategies. Look for books written by experienced traders with a proven track record.

- Educational Platforms: Several online platforms offer forex trading courses and certifications. These courses often provide structured learning paths, covering both theoretical concepts and practical application.

Epilogue

So, there you have it – your passport to the exhilarating (and potentially lucrative) world of forex trading with Questrade. Remember, while this guide provides a comprehensive roadmap, trading always involves risk. Don’t gamble your life savings on a hunch; always practice responsible risk management, and maybe avoid trading while fueled solely by caffeine and questionable life choices.

Happy trading, and may your pips always be green!