Live forex trading charts and real-time market data: Dive into the thrilling world of currency trading where fortunes are made (and sometimes lost!) based on the flick of a digital needle. This isn’t your grandma’s knitting circle; it’s a high-stakes game of interpreting swirling charts, deciphering cryptic indicators, and anticipating global economic tremors. We’ll unravel the mysteries of candlestick patterns, explore the impact of breaking news, and arm you with the knowledge to navigate this exhilarating, if sometimes unpredictable, market.

From understanding the nuances of different chart types (candlestick, bar, line – oh my!) to mastering technical indicators and interpreting real-time market data, we’ll equip you with the tools to make informed trading decisions. We’ll also cover risk management, crucial for survival in this fast-paced environment. Get ready to unlock the secrets of successful forex trading – one chart at a time!

Understanding Live Forex Trading Charts

Navigating the wild world of forex trading requires more than just a crystal ball and a lucky rabbit’s foot (though those might help!). A crucial element is understanding and interpreting live forex trading charts. These visual representations of price movements are your window into the market’s soul, revealing patterns and trends that can inform your trading decisions. Think of them as your trusty map in a sometimes treacherous financial jungle.

Forex Chart Types

Forex charts come in various flavors, each offering a unique perspective on price action. The three most common types are candlestick, bar, and line charts. Choosing the right chart depends on your trading style and the information you’re seeking. Understanding their strengths and weaknesses is key to making informed trading choices.

Candlestick Charts

Candlestick charts are arguably the most popular choice among forex traders. Each “candle” represents a specific time period (e.g., 1 hour, 4 hours, 1 day), showing the opening, closing, high, and low prices. A green (or white) candle indicates a closing price higher than the opening price (a bullish signal), while a red (or black) candle signifies a closing price lower than the opening price (a bearish signal).

The long “wick” (or shadow) above the candle body shows the high of the period, and the wick below shows the low. By observing the candle’s size and shape, traders can identify potential price reversals or continuations. For example, a long green candle with a small lower wick could suggest strong buying pressure.

Staring at live forex trading charts and real-time market data can feel like watching paint dry (unless you’re a paint-drying enthusiast, of course!). But to truly conquer the forex beast, you need a strategic edge. That’s where this amazing resource comes in: Downloadable PDF on mastering forex trading using ATS systems , which will help you interpret those charts like a seasoned pro.

Then, armed with knowledge, you can return to your live forex charts and dominate the market – or at least, not lose your shirt.

Bar Charts

Bar charts are similar to candlestick charts, but instead of candles, they use vertical bars. The top of the bar represents the high price, the bottom represents the low price, and a small horizontal line on the left and right indicate the opening and closing prices, respectively. While less visually appealing than candlestick charts, bar charts convey the same essential information.

They are a good choice for traders who prefer a simpler, less visually cluttered presentation.

Line Charts

Line charts are the simplest type. They plot the closing price of each period, connecting the points with a line. This creates a smooth visual representation of price trends over time. Line charts are great for identifying overall trends and long-term price movements but lack the detailed information on highs, lows, and opening/closing prices provided by candlestick and bar charts.

Chart Patterns

Chart patterns are recurring formations on price charts that can suggest future price movements. These patterns aren’t foolproof predictions, but they offer valuable clues. For example, a “head and shoulders” pattern, characterized by three peaks resembling a head and two shoulders, often signals a potential price reversal. Similarly, a “triangle” pattern suggests consolidation before a breakout, either upward or downward.

Recognizing these patterns takes practice and experience, but mastering them can significantly improve your trading strategy.

Technical Indicators

Technical indicators are mathematical calculations applied to price data to generate signals and confirm trends. They’re like the supporting cast in your trading movie – they provide additional context and insights. Some popular indicators include:* Moving Averages (MA): Smooth out price fluctuations, helping to identify trends.

Relative Strength Index (RSI)

Measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

MACD (Moving Average Convergence Divergence)

Identifies momentum changes and potential trend reversals.

Bollinger Bands

Show price volatility and potential support and resistance levels.Each indicator has its strengths and weaknesses, and combining multiple indicators can provide a more comprehensive picture. It’s crucial to understand how each indicator works and its limitations before incorporating it into your trading strategy. Remember, indicators are tools, not magic wands!

Comparison of Chart Types

| Chart Type | Advantages | Disadvantages | Best For |

|---|---|---|---|

| Candlestick | Visually rich, shows open, high, low, close; good for identifying patterns | Can be visually overwhelming for beginners | Identifying short-term and long-term trends, pattern recognition |

| Bar | Simple, shows open, high, low, close; easy to interpret | Less visually appealing than candlestick charts | Traders who prefer a simpler approach, identifying trends |

| Line | Simple, shows closing prices; ideal for identifying long-term trends | Lacks detail on intra-period price action | Identifying long-term trends, overall market direction |

Interpreting Real-Time Market Data: Live Forex Trading Charts And Real-time Market Data

The world of forex trading is a thrilling rollercoaster ride, a chaotic ballet of global economics and investor sentiment. Understanding real-time market data is your ticket to navigating this wild ride without ending up face-first in the dirt. It’s about deciphering the cryptic whispers of the market, translating the numbers into actionable insights, and, hopefully, making some serious profit along the way.Real-time data is the lifeblood of forex trading.

It’s the constant stream of information – price fluctuations, volume changes, and economic indicators – that paints a picture of the current market mood. By learning to interpret this data, you can anticipate market shifts, identify potential trading opportunities, and, most importantly, minimize your risk.

Live forex trading charts? They’re like a rollercoaster of green and red, a thrilling ride of fluctuating fortunes! To truly master this wild ride, though, you need the right tools. That’s where understanding Questrade’s platform comes in – check out this guide Understanding Questrade’s forex trading platform features and tools. to navigate the market’s ups and downs.

Armed with this knowledge, you’ll be interpreting those live forex charts like a seasoned pro, predicting the next big move (hopefully a profitable one!).

Impact of Economic News Releases on Live Forex Charts

Economic news releases, like a sudden gust of wind, can dramatically alter the course of forex charts. The release of data such as inflation rates, unemployment figures, or interest rate decisions can cause significant and immediate price movements. For example, if a country unexpectedly announces higher-than-expected inflation, its currency might weaken as investors anticipate potential interest rate hikes to combat inflation.

Conversely, positive economic news often strengthens a currency. The speed and magnitude of these reactions depend on the significance of the news and the market’s prior expectations. A surprise announcement will generally have a more dramatic impact than one that aligns with market forecasts. Imagine it like this: a perfectly anticipated rainstorm might cause a slight ripple in the market pond, but a sudden, unexpected hurricane will create a tsunami.

Live forex trading charts? Real-time market data? It’s like watching a financial rollercoaster, only instead of screaming, you’re calmly assessing your next move. To get a handle on the best platforms for this thrilling ride, especially if you’re a Canadian trader, check out this comprehensive review: Questrade forex trading platform review: pros and cons for Canadian traders.

Then, armed with knowledge, you can conquer those live charts and make your fortune (or at least, avoid a financial meltdown!).

Influence of Global Events on Real-Time Market Data

Global events – from political upheavals and natural disasters to geopolitical tensions and technological breakthroughs – exert a powerful influence on forex markets. A major political event in a specific country can cause its currency to plummet or soar depending on the event’s perceived impact on the country’s economic stability and future prospects. Think of the impact of Brexit on the British Pound, or the effect of a major global pandemic on various currencies.

These events often trigger volatility and create opportunities for both profits and losses. The key is to assess the potential impact of such events and adjust your trading strategy accordingly.

Identifying Market Sentiment from Real-Time Data

Gauging market sentiment – whether traders are generally bullish (optimistic) or bearish (pessimistic) – is crucial for successful trading. Real-time data provides several clues. A surge in trading volume coupled with a sharp price increase often indicates strong bullish sentiment. Conversely, a significant drop in volume accompanied by a price decline might suggest weakening bullish sentiment or the onset of bearishness.

Analyzing price charts for patterns like candlestick formations can also reveal insights into market sentiment. For example, a series of consecutive bearish candlesticks might indicate a prevailing bearish sentiment. Remember, sentiment is not a guarantee of future price movements, but it’s a valuable tool for understanding the current market mood and adjusting your trading strategy accordingly.

Key Economic Indicators and Their Influence on Currency Pairs

Understanding key economic indicators is paramount to successful forex trading. These indicators provide insights into a country’s economic health and can significantly impact its currency’s value.

Here’s a list of some key indicators and their typical influence:

- Gross Domestic Product (GDP): A strong GDP growth rate usually strengthens a currency, reflecting a healthy economy.

- Inflation Rate: High inflation often weakens a currency, as it erodes purchasing power. Central banks often raise interest rates to combat inflation, which can in turn support the currency.

- Interest Rates: Higher interest rates typically attract foreign investment, strengthening the currency. Lower interest rates tend to have the opposite effect.

- Unemployment Rate: Low unemployment usually signals a strong economy and supports the currency. High unemployment often weakens a currency.

- Trade Balance: A positive trade balance (exports exceeding imports) generally strengthens a currency, while a negative trade balance weakens it.

Utilizing Data for Trading Strategies

So, you’ve conquered the terrifying world of live forex charts and real-time data – congratulations, you’re officially less terrified than you were five minutes ago! Now, let’s turn that newfound knowledge into actual, profitable trades. This section will dissect how to use that data to craft winning strategies, manage risk like a seasoned pro, and spot those elusive support and resistance levels.

Buckle up, buttercup, it’s going to be a wild ride.

Successfully navigating the forex market hinges on a well-defined trading strategy, a robust risk management plan, and the ability to interpret market signals effectively. Think of it like this: you wouldn’t sail the ocean without a map, a compass, and a life vest, right? The same principle applies to forex trading.

A Mean Reversion Strategy, Live forex trading charts and real-time market data

This strategy capitalizes on the tendency of price movements to revert to their average values. We’ll use a simple moving average (SMA) as our indicator. The strategy involves identifying when the price moves significantly away from the SMA, indicating potential overbought or oversold conditions. When the price deviates, we enter a trade in the opposite direction, expecting it to eventually return to the average.

For example, if the price is significantly above the 20-period SMA, we’d enter a short position, anticipating a price drop back towards the average. Conversely, if the price is significantly below the SMA, we’d enter a long position. Stop-loss orders are crucial to limit potential losses if the price continues moving against our position. The choice of SMA period (e.g., 20, 50, 100) depends on the trader’s timeframe and risk tolerance.

Risk Management Techniques Using Live Market Data

Effective risk management is paramount in forex trading. One crucial technique is using stop-loss orders to limit potential losses on each trade. A stop-loss order automatically closes a position when the price reaches a predetermined level, preventing further losses. The placement of the stop-loss order should be based on a careful analysis of the chart, considering factors such as support levels, volatility, and risk tolerance.

Live forex trading charts and real-time market data can be a rollercoaster; one minute you’re soaring, the next you’re plummeting. To handle the stress, you need mental fortitude – and a strong body! That’s why I supplement my charting with a killer best strength training program , because a healthy mind resides in a healthy body. Then, I’m ready to tackle those volatile forex charts with renewed focus and unwavering resolve!

Another essential risk management technique is position sizing. This involves determining the appropriate amount of capital to allocate to each trade, ensuring that a single losing trade does not significantly impact the overall trading account. Position sizing should be based on the trader’s risk tolerance and account size. Diversification across multiple currency pairs can also help reduce risk.

Never put all your eggs in one basket, especially when that basket is floating on a sea of volatile currencies!

Identifying Support and Resistance Levels

Support and resistance levels are crucial for identifying potential entry and exit points in forex trading. Support levels represent price points where the buying pressure is strong enough to prevent further price declines. Resistance levels, conversely, represent price points where the selling pressure is strong enough to prevent further price increases. These levels can be identified by observing previous price highs and lows on the chart.

A breakout above a resistance level can signal a bullish trend, while a breakout below a support level can signal a bearish trend. It’s important to note that these levels are not static and can shift over time depending on market conditions.

Examples of Trading Strategies for Different Market Conditions

Range-Bound Market Strategy: In a range-bound market, prices fluctuate within a defined trading range. A strategy here might involve buying near the support level and selling near the resistance level, profiting from the price oscillations within the range. Think of it like bouncing a ball – predictable and profitable if timed correctly. Stop-losses would be placed below the support and above the resistance.

This strategy is less risky than trend-following strategies but potentially less profitable.

Trend-Following Strategy: In a trending market, prices consistently move in one direction. A trend-following strategy would involve identifying the trend (uptrend or downtrend) and entering trades in the direction of the trend. For example, in an uptrend, we would buy when the price pulls back to a support level and aim to ride the wave higher. Conversely, in a downtrend, we would sell when the price bounces off resistance.

Live forex trading charts and real-time market data: the rollercoaster of fluctuating currencies! Before you jump in headfirst, though, you might want to ponder a crucial question: Is this whole thrilling ride even religiously kosher? Check out this insightful article to find out if Is forex trading halal according to Islamic finance principles? before you risk your shekels (or dirhams, or rupees…).

Then, armed with this knowledge, get back to those exhilarating charts!

This strategy has higher risk but potentially higher rewards. Think of it as surfing a massive wave – exhilarating, but wipeouts can be brutal!

Visual Representation of Market Data

Stepping into the world of live forex trading feels a bit like entering the cockpit of a futuristic spaceship. Instead of thrusters and navigation systems, you’re surrounded by a dazzling array of charts, graphs, and numbers all vying for your attention. Understanding how this visual information is presented is crucial for navigating the often turbulent waters of the forex market.The visual elements of a typical live forex trading platform are designed to provide a comprehensive, yet digestible, overview of market conditions.

At the heart of the platform lies the chart itself, usually displaying price movements over various timeframes – from the frantic tick-by-tick action of seconds to the slower, more deliberate pace of months. These charts often use candlestick patterns or line graphs, each offering a slightly different perspective on price action. Accompanying the main chart are a plethora of indicators, usually displayed as separate graphs or numerical values, providing additional insights into momentum, trend strength, and potential turning points.

These indicators range from simple moving averages to more complex algorithms, all working in concert to paint a more complete picture of the market’s current state. Real-time data feeds, constantly updating prices and volume, complete the scene, ensuring that the trader is always working with the most up-to-date information.

Comparison of Data Visualization Techniques

Forex trading platforms employ a variety of data visualization techniques to cater to different trading styles and preferences. Candlestick charts, for instance, are incredibly popular for their ability to concisely display price action over a given period, revealing opening, closing, high, and low prices. Line charts, on the other hand, provide a simpler, smoother representation of price movements, ideal for identifying trends.

Some platforms even offer “Heikin Ashi” charts, which smooth out price fluctuations to highlight the overall trend more clearly. Beyond charts, indicators play a vital role. Moving averages help identify trends, while Relative Strength Index (RSI) and Stochastic Oscillator provide insights into overbought and oversold conditions. Each technique offers a unique perspective, and skilled traders often combine several to form a holistic view of the market.

Live forex trading charts and real-time market data are a trader’s best friend, offering a glimpse into the chaotic yet thrilling world of currency exchange. Want to know how to navigate this exciting landscape with a platform that actually makes sense? Check out this comprehensive Questrade foreign exchange trading platform review and tutorial to master those charts and make informed decisions.

Then, armed with knowledge, you can confidently conquer those live forex trading charts and real-time market data!

Visual Representation of a Significant Price Movement

Imagine a candlestick chart depicting the EUR/USD pair. For several days, the chart shows a clear uptrend, with consistently higher highs and higher lows. The RSI indicator, positioned below the main chart, sits comfortably in the overbought zone (above 70), suggesting a potential reversal. Suddenly, a large bearish candlestick appears, a long red candle engulfing the previous day’s bullish candle.

This signals a significant shift in momentum. Simultaneously, the RSI plummets, dropping sharply below 70, confirming the change in trend. The moving average lines, previously sloping upwards, begin to flatten and then turn downwards, reinforcing the bearish signal. The volume accompanying the large bearish candle is significantly higher than previous days, indicating strong selling pressure. This dramatic visual shift clearly communicates a substantial price drop and warns of a potential trend reversal.

Importance of Clear and Concise Data Presentation

Clear and concise data presentation is paramount for effective trading decisions. A cluttered or poorly designed trading platform can lead to missed opportunities and costly mistakes. The ability to quickly interpret charts, indicators, and data feeds is crucial for making timely and informed decisions, especially in fast-moving markets like forex. A well-designed platform prioritizes readability and ease of use, allowing traders to focus on analyzing market dynamics rather than deciphering confusing visuals.

The ability to customize chart layouts, choose preferred indicators, and adjust timeframes is essential for tailoring the visual representation to individual trading strategies and risk tolerances. Ultimately, a clear and efficient visual representation of market data is the cornerstone of successful forex trading.

Technical Analysis in Real-Time

So, you’ve conquered the basics of reading forex charts – congratulations, you’re halfway to becoming a forex ninja! Now, let’s unleash the power of technical analysis in the thrilling, ever-changing world of live forex trading. Think of technical analysis as your crystal ball (though, unlike a real crystal ball, it’s not guaranteed to be 100% accurate – more on that later!).

It helps you decipher the market’s cryptic messages, spotting trends and potential turning points before your competitors. Prepare for some seriously cool insights!

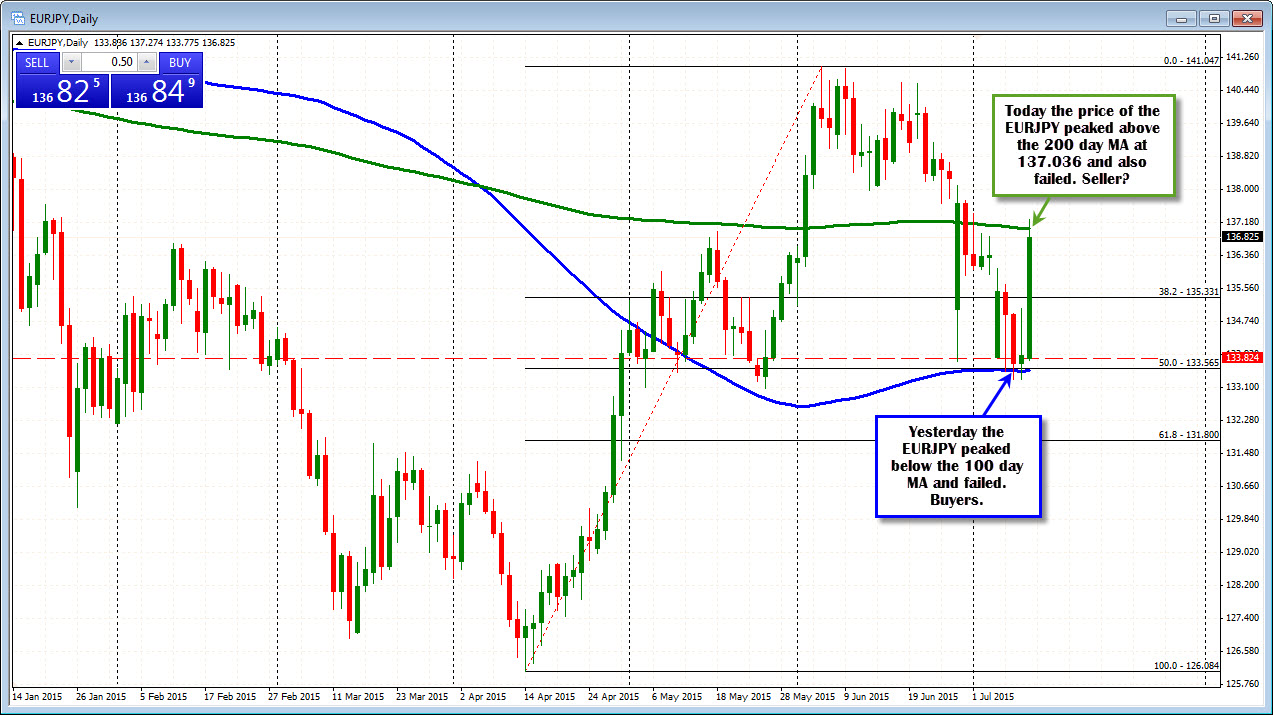

Moving Averages and Trend Identification

Moving averages are like the market’s gentle hand, smoothing out the daily price fluctuations and revealing the underlying trend. Several types exist, but the most common are simple moving averages (SMA) and exponential moving averages (EMA). SMAs calculate the average price over a specific period (e.g., 20 days), while EMAs give more weight to recent prices, making them more responsive to recent market changes.

When a shorter-term moving average crosses above a longer-term moving average (a “golden cross”), it’s often interpreted as a bullish signal, suggesting an upward trend is likely. Conversely, a “death cross” (shorter-term moving average crossing below a longer-term moving average) is often seen as a bearish signal, hinting at a potential downward trend. Visualize this: imagine two lines on your chart; when the faster line crosses above the slower line, it’s a potential buy signal, and vice versa.

Remember, though, these are just signals, not guarantees!

Oscillators: RSI and MACD

Oscillators, such as the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD), are like the market’s pulse monitors. They measure momentum and identify overbought or oversold conditions. The RSI ranges from 0 to 100; readings above 70 often suggest an overbought market (potential for a price correction), while readings below 30 suggest an oversold market (potential for a price rebound).

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages. Crossovers of the MACD lines, or divergences between the MACD and price action, can signal potential trend changes. For instance, a bullish divergence occurs when the price makes lower lows, but the MACD makes higher lows, suggesting a potential upward trend reversal. Think of them as your market’s early warning system.

Pitfalls of Real-Time Technical Analysis

While technical analysis is a powerful tool, it’s crucial to be aware of its limitations, especially in the fast-paced world of live trading. One major pitfall is “confirmation bias,” where traders tend to focus on signals that confirm their pre-existing beliefs, ignoring contradictory evidence. Another common mistake is over-reliance on a single indicator. Remember, the market is complex; using multiple indicators and considering fundamental analysis can provide a more holistic view.

Lastly, whipsaws – sudden and sharp price reversals – can easily catch unprepared traders off guard, leading to significant losses. These are not your friendly neighborhood squirrels; they’re market forces that can wipe out your gains in a heartbeat.

Implementing a Technical Analysis Strategy

Let’s Artikel a step-by-step procedure for applying technical analysis to live forex charts. Remember, this is just a sample strategy; adapt it to your risk tolerance and trading style.

- Choose your currency pair: Select a pair based on your analysis of market conditions and your trading goals.

- Select your indicators: Decide which moving averages (e.g., 20-day SMA, 50-day EMA) and oscillators (RSI, MACD) you’ll use. Don’t overload yourself; start with a few and master them before adding more.

- Identify potential entry points: Look for confluence – where multiple indicators suggest a potential trade setup. For example, a golden cross on your moving averages combined with an RSI reading below 30 might signal a long position (buying).

- Set your stop-loss and take-profit levels: This is crucial for risk management. A stop-loss order automatically exits your position if the price moves against you, limiting your potential losses. A take-profit order automatically exits your position when your target profit is reached.

- Execute your trade: Place your order based on your analysis and risk management plan.

- Monitor your trade: Keep an eye on your position and the market conditions. Be prepared to adjust your strategy if needed.

Ultimate Conclusion

So, there you have it – a whirlwind tour of the captivating world of live forex trading charts and real-time market data. Remember, mastering this arena requires patience, discipline, and a healthy dose of caffeine. While we’ve armed you with the knowledge to navigate the complexities, always remember that trading involves risk, and no strategy guarantees success. But with careful analysis, a well-defined strategy, and a dash of audacity, you might just find yourself riding the wave to profitable shores.

Happy trading!