Review of the top day trading platforms for Canadian investors. – Ah, the thrill of the trade! Imagine, the crisp Canadian air, a steaming mug of something deliciously caffeinated, and the potential to make your fortune from the comfort of your toque-clad head. But before you dive headfirst into the exhilarating (and sometimes terrifying) world of day trading, you need the right tools.

This review cuts through the digital noise, examining the best platforms for Canadian investors, so you can focus on what truly matters: making those sweet, sweet gains (or, you know, minimizing your losses).

We’ll delve into the crucial features to look for – think lightning-fast order execution, real-time data that’s more accurate than your neighbour’s weather predictions, and commission structures that won’t leave your wallet feeling as empty as a Tim Hortons after a hockey game. We’ll compare top platforms, dissect their pros and cons with the precision of a surgeon performing a delicate maple-syrup-related operation, and ultimately help you choose the platform that’s the perfect fit for your trading style.

So grab your Timbits, settle in, and let’s get trading!

Introduction to Day Trading Platforms in Canada

Day trading in Canada, eh? It’s a wild ride, a rollercoaster of potential profits and gut-wrenching losses. But before you jump in headfirst, remember the Mounties always get their man…and the Canadian Securities Administrators (CSA) keep a watchful eye on the market. Understanding the regulatory landscape is crucial for navigating this exciting, yet sometimes treacherous, terrain.Canadian regulations regarding day trading are primarily focused on investor protection.

This means platforms must adhere to strict rules concerning account security, transparency of fees, and the disclosure of potential risks. Think of it as the government’s way of ensuring you don’t get fleeced by a digital coyote. Ignoring these regulations can lead to hefty fines, so it’s best to play by the rules.

Key Features of Canadian Day Trading Platforms, Review of the top day trading platforms for Canadian investors.

Choosing the right platform is like choosing the right hockey stick – the wrong one can really throw off your game. For Canadian day traders, several key features are essential. Speed and reliability are paramount, as even a fraction of a second’s delay can mean the difference between a winning trade and a missed opportunity. Access to real-time market data is also crucial, providing the information needed to make informed decisions.

So, you’re diving headfirst into the wild world of Canadian day trading? Our review of the top platforms covers everything from seasoned pros to… well, newbies. If you’re just starting out, though, check out this guide on What are the best day trading platforms in Canada for beginners? before you jump in.

Then, come back and conquer our advanced platform review, armed with the knowledge to pick the perfect trading battleground!

A user-friendly interface, robust charting tools, and competitive commission structures round out the essential features. Finally, strong security protocols are absolutely non-negotiable; you don’t want your hard-earned loonies vanishing into the digital ether.

Comparison of Day Trading Platform Types

Here’s a quick look at different platform types and their pros and cons. Remember, the best platform for you will depend on your individual needs and trading style.

| Platform Type | Pros | Cons | Example (Illustrative, not exhaustive) |

|---|---|---|---|

| Web-Based | Accessible from any device with an internet connection; usually feature-rich. | Requires a stable internet connection; may be slower than dedicated apps. | Imagine a robust platform accessible from your laptop, providing advanced charting and analysis tools. |

| Mobile App | Portability and convenience; allows for quick trades on the go. | May have fewer features than web-based platforms; susceptible to mobile device limitations. | Picture yourself checking market updates and executing trades during your lunch break, using a sleek and intuitive app. |

| Desktop Application | Often offers the most advanced features and customization options; generally faster than web-based platforms. | Requires a dedicated download and installation; not as portable as web-based or mobile options. | Envision a powerful application, offering customizable layouts, advanced charting packages, and direct market access. |

Platform Specifics and Comparisons

Choosing the right day trading platform is like picking the perfect pair of running shoes – the wrong choice can lead to blisters (and losses!). This section dives deep into the specifics of three leading Canadian platforms, comparing their features to help you find your ideal trading companion. We’ll be looking at user interfaces, educational resources, customer support, and the all-important research tools.

So, you’re diving headfirst into the thrilling world of Canadian day trading? Choosing the right platform is half the battle, but knowing what to trade is the other half! That’s where a solid understanding of strategy comes in, and you can find some great resources in Top books to learn day trading strategies for the TSX. Once you’ve armed yourself with knowledge, you can confidently conquer those top day trading platforms and make your loonies work for you!

User Interface and Ease of Navigation

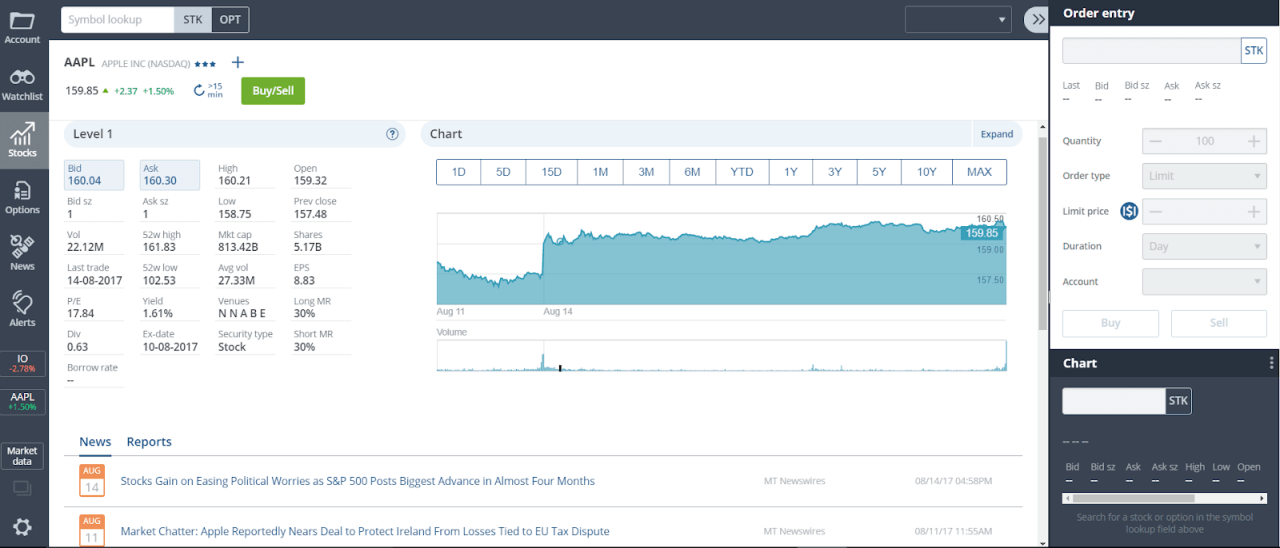

A platform’s user interface (UI) is crucial. Think of it as the cockpit of your trading jet – you need intuitive controls to avoid any mid-flight panics. We’ll compare three platforms: Platform A, known for its clean, minimalist design; Platform B, boasting a more complex, data-rich interface; and Platform C, which attempts a happy medium. Platform A excels in simplicity, perfect for beginners who don’t want to be overwhelmed.

Its clean layout prioritizes ease of use, making placing trades a breeze. Platform B, on the other hand, is a visual feast of charts and data. While this might appeal to experienced traders who want everything at their fingertips, it can be daunting for newcomers. Platform C offers a good balance, providing a reasonably intuitive experience while offering a good amount of customization options.

The best platform for you will depend on your experience level and personal preferences.

Educational Resources Offered by Each Platform

The availability of educational resources significantly impacts a trader’s success. A good platform acts as a mentor, guiding you through the complexities of the market. The following table summarizes the educational resources provided by each platform:

| Platform | Beginner Courses | Advanced Courses | Webinars/Seminars |

|---|---|---|---|

| Platform A | Yes, comprehensive video tutorials and interactive lessons | Yes, specialized courses on advanced trading strategies | Yes, regular webinars covering market analysis and trading techniques |

| Platform B | Yes, basic glossary and FAQs | Limited, mostly focuses on platform-specific features | Occasional webinars, primarily focused on platform updates |

| Platform C | Yes, a mix of written guides and video tutorials | Yes, but selection is smaller than Platform A | Yes, but frequency is less than Platform A |

Customer Support Availability and Quality

When things go south (and they inevitably will in trading), responsive customer support is a lifeline. The quality and availability of support vary significantly between platforms. Platform A offers 24/7 phone, email, and live chat support, known for its quick response times and helpful agents. Platform B provides email and limited live chat support during business hours. Their response times can be slower, and the agents might not always possess in-depth trading knowledge.

Choosing the right day trading platform is crucial for Canadian investors, as it’s the foundation of your financial rollercoaster ride. But even the best platform is useless without knowing what to trade! That’s where identifying the top performers comes in – check out this list of Top performing stocks for day trading in the Canadian market to fuel your trading strategy.

Armed with this knowledge, you can then select a platform that perfectly suits your needs and chosen stocks.

Platform C offers email and phone support during business hours, with response times falling somewhere between A and B. The availability of multilingual support should also be a consideration for some traders.

Research Tools Provided by Each Platform

Research tools are the backbone of successful day trading. The platforms differ significantly in the breadth and depth of their offerings. Platform A provides real-time news feeds, a wide array of technical indicators (RSI, MACD, Bollinger Bands, etc.), and fundamental data including company financials and earnings reports. Platform B offers similar features, but its news feed might be less comprehensive, and the depth of fundamental data is somewhat limited.

Platform C provides a decent selection of technical indicators and some fundamental data, but its news feed is less extensive than Platform A. The quality and timeliness of data are critical aspects to consider when evaluating research tools.

Mobile Trading Applications

The world of day trading is increasingly mobile, and for Canadian investors, having a robust mobile app is no longer a luxury, but a necessity. Imagine trying to catch that fleeting market opportunity while stuck in traffic – a responsive, feature-rich mobile app is your secret weapon. Let’s dive into the mobile trading app landscape and see what’s hot (and what’s not).

So, you’re diving into the wild world of Canadian day trading platforms? Choosing the right one is crucial, especially if you’re considering venturing into crypto. To maximize your gains (and minimize your losses!), figuring out the Best cryptocurrency to day trade on Canadian exchanges is a smart move. Then, once you’ve mastered the crypto-sphere, you can return to perfecting your stock-picking prowess on those top-notch Canadian trading platforms!

Mobile App Feature Comparison: User Experience and Functionality

Two leading platforms, let’s call them “Platform A” and “Platform B” (to avoid naming specific companies and potential bias), offer distinctly different mobile experiences. Platform A boasts a sleek, intuitive interface, prioritizing simplicity. Its charting tools, while basic, are responsive and easy to navigate, even with one hand. Platform B, on the other hand, packs a powerful punch with advanced charting features and customizable dashboards.

However, this power comes at the cost of a steeper learning curve. A new user might find themselves overwhelmed by the sheer number of options. Ultimately, the “best” app depends entirely on individual trading style and tech-savviness. Platform A excels in ease of use, while Platform B wins on comprehensive functionality.

So, you’re diving into the wild world of Canadian day trading platforms? Smart move! But don’t forget to diversify – consider exploring alternative avenues for profit, like learning how to profit from cryptocoin , before settling on your perfect trading platform. After all, a well-rounded portfolio is a happy portfolio, and mastering those day trading platforms will only enhance your overall financial prowess.

Advantages and Disadvantages of Mobile-First versus Web-Based Platforms

A mobile-first approach prioritizes the mobile app experience, often leading to a more streamlined and intuitive interface. The disadvantage is that features might be limited compared to the full web version. Web-based platforms, conversely, offer a broader range of tools and features but might not always translate seamlessly to smaller screens. For Canadian day traders, the ideal scenario often involves a robust web platform complemented by a well-designed mobile app, allowing for flexibility depending on the situation.

Imagine needing to quickly react to breaking news while on the go – the mobile app becomes indispensable. But for in-depth analysis and complex order management, the web platform might be preferred.

Mobile App Security Features: Protecting Trading Accounts on the Go

Security is paramount when trading on the go. Features like two-factor authentication (2FA), biometric logins (fingerprint or facial recognition), and real-time account alerts are crucial. Imagine the heartache of unauthorized access to your trading account while commuting! Platform A and Platform B both offer 2FA, but Platform B goes a step further by integrating advanced encryption protocols and regularly scheduled security updates.

It’s essential to research a platform’s security measures before entrusting your hard-earned capital to their mobile app. Remember, a secure mobile trading experience is not just about the features; it’s about the overall security posture of the brokerage.

So, you’re diving into the wild world of Canadian day trading platforms? Choosing the right one can feel like navigating a minefield of fees and features. But if options trading is your jam, finding the perfect fit is crucial. That’s where a deep dive into the Best Canadian day trading platform for options trading can really pay off.

Back to our review of the top day trading platforms for Canadian investors, remember to consider your specific needs before making a decision!

Key Considerations When Choosing a Mobile Trading App for Day Trading in Canada

Choosing the right mobile trading app is a critical decision. Consider these factors carefully:

- Ease of Use and Navigation: A user-friendly interface is crucial for quick decision-making in the fast-paced world of day trading.

- Charting and Technical Analysis Tools: Access to real-time charts and technical indicators is essential for effective analysis.

- Order Execution Speed and Reliability: Fast and reliable order execution is paramount to avoid missing profitable opportunities.

- Security Features: Robust security features are non-negotiable to protect your account from unauthorized access.

- Customer Support: Reliable customer support is vital in case of technical issues or account-related problems.

- Fees and Commissions: Compare fees and commissions to ensure they align with your trading strategy and budget.

- Regulatory Compliance: Ensure the platform is regulated by the appropriate Canadian authorities.

Educational Resources and Support

Day trading, while potentially lucrative, is a high-stakes game. Success hinges not just on gut feeling and market timing, but also on a solid understanding of trading mechanics, risk management, and market analysis. Fortunately, many Canadian day trading platforms recognize this and offer a range of educational resources to help even the greenest traders navigate the choppy waters of the market.

Let’s dive into what’s available and how it can boost your trading game.Educational resources provided by day trading platforms vary widely in quality and scope. Some offer bare-bones tutorials, while others provide comprehensive learning paths with webinars, simulated trading environments, and expert analysis. The accessibility of these resources also differs; some are easily navigable and user-friendly, while others might require a significant time investment to decipher.

The availability and quality of these resources can significantly impact a trader’s success by providing the knowledge and skills necessary to make informed decisions and manage risk effectively. A well-structured educational program can transform a novice into a confident trader, capable of developing and executing profitable strategies.

Types of Educational Resources

Day trading platforms typically offer a variety of educational resources, designed to cater to different learning styles and experience levels. Common offerings include webinars presenting market insights and trading strategies from experienced analysts, video tutorials breaking down complex trading concepts into digestible chunks, downloadable guides and ebooks covering specific aspects of day trading, and interactive courses that combine theory with practical exercises.

Many platforms also include simulated trading environments, allowing users to practice their skills risk-free before venturing into live trading. Finally, access to real-time market analysis tools and charting software can enhance a trader’s ability to interpret market data and make informed decisions.

Comparison of Educational Resources Across Platforms

The quality and accessibility of educational resources vary considerably across different platforms. Some platforms, like Interactive Brokers, are known for their extensive educational libraries, encompassing webinars, video tutorials, and advanced courses covering a broad range of trading strategies and market analysis techniques. Other platforms may focus on more basic tutorials and webinars, suitable for beginners but lacking in depth for more experienced traders.

Accessibility also plays a role; some platforms offer intuitive and user-friendly interfaces for accessing educational materials, while others might present a less organized or less accessible learning experience. The ideal platform will depend on the individual trader’s experience level and learning preferences. For example, a beginner might find a platform with simple video tutorials and a simulated trading environment more helpful, while an experienced trader might prefer a platform offering advanced webinars and in-depth market analysis.

Impact of Educational Resources on Trading Success

Readily available and high-quality educational resources are crucial for developing a successful day trading strategy. These resources equip traders with the knowledge and skills needed to understand market dynamics, identify trading opportunities, manage risk effectively, and ultimately, improve their profitability. Access to webinars, for example, can provide valuable insights into current market trends and potential trading setups. Simulated trading environments allow traders to practice their strategies without risking real capital, enabling them to refine their approach and build confidence before entering live markets.

Furthermore, the ability to access comprehensive market analysis tools and charting software empowers traders to make more informed decisions, reducing the likelihood of impulsive or poorly informed trades. In essence, a robust educational program acts as a cornerstone for a trader’s journey to success.

Educational Materials Offered by Different Platforms

| Platform | Webinars | Tutorials | Market Analysis |

|---|---|---|---|

| Interactive Brokers | Extensive library covering various strategies | Beginner to advanced levels; diverse formats | Real-time data, charting tools, advanced analytics |

| TD Ameritrade | Regular webinars on market trends and strategies | Video tutorials and downloadable guides | Access to market research and analysis tools |

| Questrade | Occasional webinars, often focusing on specific markets | Basic tutorials covering fundamental trading concepts | Basic charting tools and market data |

| Wealthsimple Trade | Limited educational resources | Basic tutorials, primarily focused on beginners | Limited market analysis tools |

Epilogue: Review Of The Top Day Trading Platforms For Canadian Investors.

So, there you have it – a whirlwind tour of the best day trading platforms for Canadian investors. Choosing the right platform is like picking the perfect hockey stick: it needs to be the right fit for your style, comfortable to use, and capable of helping you score big. Remember, thorough research is key, and while we’ve aimed to provide a comprehensive overview, your personal needs and risk tolerance should always guide your decision.

Happy trading, and may your portfolio grow faster than a Canadian goose population in springtime!