Understanding Forex Market Hours in Canada and Global Markets: Dive headfirst into the thrilling, sometimes chaotic, always captivating world of global currency trading! Imagine a never-sleeping market, a swirling vortex of buy and sell orders echoing across continents. This isn’t your grandpappy’s stock market; this is forex, where the clock never stops ticking, and the opportunities—and the potential pitfalls—are as vast as the world itself.

Prepare to unravel the mysteries of time zones, overlapping sessions, and the art of trading when the rest of the world is asleep (or wide awake, depending on your perspective!).

This guide will illuminate the intricacies of forex trading hours, specifically focusing on the Canadian perspective. We’ll explore how Canada’s market interacts with the giants—London, New York, Tokyo—and how understanding these overlaps can be the key to maximizing profits (or, at the very least, minimizing losses). We’ll delve into practical strategies, risk management techniques, and even throw in a hypothetical trading scenario to keep things exciting.

Buckle up, buttercup, it’s going to be a wild ride!

Introduction to Forex Market Hours

The forex market, also known as the foreign exchange market, is a global, decentralized marketplace where currencies are traded. Unlike stock markets that have specific opening and closing times, forex operates 24 hours a day, five days a week, making it a truly global beast. This constant activity is driven by the fact that different parts of the world are active at different times, creating a continuous flow of trading opportunities.

Think of it as a never-ending game of global currency musical chairs, except instead of chairs, it’s trillions of dollars.The 24-hour trading cycle is essentially a relay race across the globe. It begins in Sydney, Australia, then moves to Tokyo, London, and finally New York, with each major financial center taking the baton and driving activity for a significant portion of the day.

This overlapping schedule means there’s always somewhere in the world where the market is bustling with activity, creating a dynamic and potentially lucrative (or disastrous, depending on your skills) environment for traders.

Navigating the chaotic world of forex trading hours, from Toronto to Tokyo, can feel like trying to herd cats. But mastering those global time zones becomes way easier once you’ve got a solid grasp of the tools at your disposal. Luckily, understanding the ins and outs is a breeze thanks to resources like Questrade’s forex trading platform user experience and educational resources , which can help you conquer those market hours with confidence and maybe even a little less caffeine.

Significance of Forex Market Hours for Canadian Traders

Understanding forex market hours is absolutely crucial for Canadian traders. Canada operates within the North American time zone, meaning Canadian traders primarily interact with the later portions of the London session and the majority of the New York session. This overlap provides ample trading opportunities, but also requires careful consideration of market volatility. Knowing when major market events are likely to occur, and understanding the potential impact of news releases during specific trading sessions, is paramount to successful trading.

Navigating the wild world of forex trading hours, from Vancouver to Tokyo, can feel like trying to herd cats. Understanding the overlaps and time zones is crucial, especially when choosing a platform. To help you conquer this chaotic clock, check out this killer review: Questrade forex trading platform review and comparison with other Canadian brokers , which will help you pick the right tool for your trading strategy, no matter what time zone the market’s in.

For example, a major economic announcement from the US during the New York session will significantly impact the USD/CAD exchange rate, potentially leading to large price swings that a well-informed trader can capitalize on – or avoid being caught off guard by. Ignoring these time zones is like trying to navigate a busy highway blindfolded – you might get lucky, but it’s more likely to end badly.

Canadian Forex Market Hours

The Canadian forex market, like a diligent beaver building its dam, operates within specific hours, dictated by the overlap of global trading sessions. Understanding these hours is crucial for Canadian traders hoping to avoid becoming the proverbial beaver caught in a flood of unexpected market movements. Let’s dive into the specifics, shall we?The primary trading hours for the Canadian dollar (CAD) generally mirror the overlap of major global markets, primarily New York and London.

While technically open 24/5, the most active period for CAD trading occurs during these overlaps, reflecting the highest liquidity and volatility. Think of it as the prime time for forex – the peak hours when the most players are on the field.

Canadian Market Hours Compared to Global Markets

The Canadian market’s prime trading hours usually align with the New York session (8:00 AM to 5:00 PM EST) and the London session (8:00 AM to 4:00 PM GMT). This overlap creates a period of heightened activity. Imagine a bustling marketplace – the London traders are just wrapping up their day as the New York traders are getting started, and the Canadians are right in the middle, enjoying the action.

Tokyo’s session (7:00 PM to 4:00 AM EST) provides some pre-market activity for the Canadians, setting the stage for the main event. This means Canadian traders can participate in a significant portion of the daily global forex activity, but they also need to be aware of the quieter periods, especially overnight.

Impact of Overlapping Trading Sessions on Market Liquidity and Volatility

The overlapping sessions create a significant impact on both liquidity and volatility. During these overlaps, the market experiences higher liquidity because more traders from different regions are actively participating. This increased liquidity generally leads to tighter spreads (the difference between the bid and ask price) and easier execution of trades. Think of it like a well-stocked supermarket – you have plenty of choices and can easily find what you need.Conversely, increased participation also translates to increased volatility.

Navigating the wild world of forex trading hours, from Toronto’s time zone to Tokyo’s, can be a real rollercoaster! Knowing when the markets are open is crucial, and even more so when you’re using a secure app. That’s why choosing the right platform is key; check out this list of Secure Forex Trading Apps for Canadians with Two-Factor Authentication to keep your hard-earned loonies safe.

Then, armed with your secure app and a grasp of global market timings, you can conquer the forex frontier!

More traders mean more buy and sell orders, leading to more price fluctuations. This can be both a blessing and a curse. While volatility creates opportunities for profit, it also increases the risk of losses. It’s like a thrilling rollercoaster ride – exciting, but you might get a bit queasy if you’re not prepared.For example, significant news releases from either the US or Europe during the overlap periods can cause sharp and rapid price movements in the CAD.

A surprise interest rate hike announced in the US during the overlapping NY/London/Canadian session could trigger immediate and dramatic shifts in the CAD value against other currencies. Traders need to be particularly vigilant during these times, prepared for rapid changes and equipped with appropriate risk management strategies.

Major Global Forex Market Centers and Their Overlap with Canada

So, you’ve conquered the Canadian forex market hours – congratulations! But the world of forex is a global village, a 24/7 bustling bazaar of currencies. Understanding how other major markets operate and how they intersect with Canada is crucial for maximizing your trading potential and minimizing those pesky surprises. Think of it as learning the local customs before venturing into a foreign market – except instead of spices, we’re talking about currency fluctuations.The forex market doesn’t sleep.

It’s a continuous, overlapping flow of trading activity across various global financial centers. This interconnectedness presents both exciting opportunities and unique challenges for Canadian traders. Let’s dive into the heart of this global forex rhythm.

Global Forex Market Centers and Their Overlap with Canadian Trading Hours

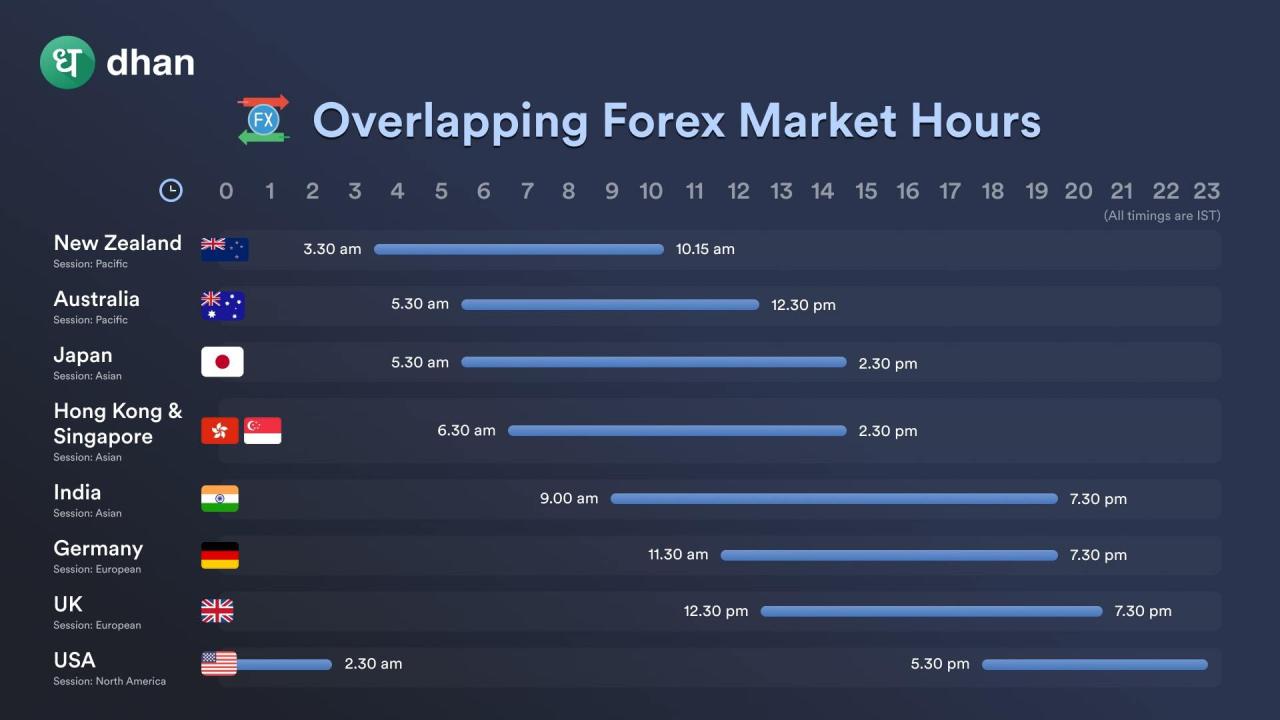

Understanding the overlap between Canadian market hours and those of other major forex centers is key to strategic trading. The following table Artikels the major centers, their operating hours in Coordinated Universal Time (UTC), and their relationship to the Canadian market (assuming Eastern Daylight Time (EDT) for simplicity). Remember that these are general guidelines; the actual trading activity can extend beyond these times.

| City | Open Time (UTC) | Close Time (UTC) | Overlap with Canadian Market (EDT) |

|---|---|---|---|

| Sydney | 22:00 | 07:00 | Significant overlap; provides early trading opportunities. |

| Tokyo | 23:00 | 06:00 | Significant overlap; a key period for Asian market influence. |

| London | 08:00 | 17:00 | Substantial overlap; the London market’s volume heavily influences global prices. |

| New York | 13:00 | 22:00 | Significant overlap; the North American market’s power is felt here. |

Implications of Overlaps for Canadian Traders

The overlap of these global markets presents both opportunities and challenges. For instance, the overlap with the Sydney and Tokyo markets allows Canadian traders to capitalize on early market movements before the European and North American sessions begin. This early bird advantage can provide a head start on identifying potential trends. Conversely, the heavy volume during the London and New York sessions can lead to rapid price swings, presenting both opportunities for quick profits and the risk of substantial losses if not managed carefully.

Successful Canadian traders need to be agile and adaptable, constantly monitoring global market trends to make informed decisions. Think of it as a thrilling high-stakes game of global economic chess, with currencies as your pieces.

Impact of Time Zones on Forex Trading in Canada

Navigating the forex market as a Canadian trader is like trying to catch a greased piglet – exciting, potentially lucrative, but requiring a deft touch and a keen understanding of the terrain. That terrain, in this case, is the complex landscape of global time zones. Understanding how these zones impact your trading strategy is crucial to success.Different time zones significantly influence a Canadian trader’s access to market liquidity and the opportunities available.

The overlapping trading hours of different forex centers create a dynamic environment, offering both advantages and potential pitfalls. Essentially, the world’s financial markets never truly sleep, and Canada’s position geographically allows access to a wide range of trading opportunities across multiple sessions. However, this also means that Canadian traders must be acutely aware of the different market phases and their corresponding liquidity levels.

Trading Strategies and Decision-Making

Time zone differences necessitate adjustments to trading strategies. For instance, a Canadian trader might choose to focus on the overlap between the North American and European sessions to capitalize on increased liquidity and volatility. Conversely, trading during periods when major markets are closed could expose them to lower liquidity and potentially wider spreads. Effective decision-making requires understanding these variations in market activity throughout the day and tailoring their approach accordingly.

This might involve adjusting order sizes, using different technical indicators, or even focusing on specific currency pairs that are more active during the Canadian trading day.

Time Zone Differences: Opportunities and Risks

The time difference between Canada and major global markets presents both opportunities and risks. One opportunity is the ability to exploit price discrepancies that may arise due to differing information flow or trading sentiment across various zones. For example, news released in Asia overnight might not immediately be fully reflected in the North American market, creating a temporary price imbalance that a Canadian trader can capitalize on.

However, the risk is that news events or significant price movements occurring outside of Canadian trading hours could lead to substantial overnight gaps in prices, potentially resulting in unexpected losses.

Hypothetical Trading Scenario

Imagine a Canadian trader, let’s call him Jean-Pierre, specializing in EUR/USD. He observes that the Euro has been weakening against the US dollar throughout the Asian trading session (which ends before the Canadian session begins). He anticipates that this trend might continue into the early European session, which overlaps significantly with the Canadian trading day. Jean-Pierre sets a buy order for EUR/USD at a specific price point, anticipating a rebound.

However, unexpectedly, significant positive news about the Eurozone economy is released just before the European session opens. This causes a sudden and sharp upward movement in the EUR/USD price, catching Jean-Pierre’s order and resulting in a profitable trade. This illustrates how monitoring global market activity across different time zones, even outside of the core Canadian trading hours, can inform trading decisions and significantly impact trading outcomes.

Conversely, if the news had been negative, Jean-Pierre would have faced a potential loss. The moral of the story? Staying informed and anticipating the impact of global events is paramount.

Strategies for Canadian Traders Considering Global Market Hours

Navigating the global forex market as a Canadian trader can feel like trying to herd cats – chaotic, but potentially very rewarding. Understanding and leveraging the extended trading hours available across different global markets is key to maximizing your potential. This section Artikels strategic approaches to exploit these opportunities.

The beauty of forex is its 24-hour trading cycle. While the Canadian market has its core hours, savvy traders can capitalize on the overlaps and extended periods offered by other major financial centers. This allows for greater flexibility, increased trading opportunities, and the potential for higher returns (but also higher risk, so proceed with caution!).

Leveraging Global Market Hours: Strategic Approaches for Canadian Traders

Several strategies can help Canadian traders effectively use the extended global forex trading hours. These strategies are not mutually exclusive and can be combined depending on individual trading styles and risk tolerance.

- Scalping Across Sessions: This high-frequency trading strategy involves taking advantage of small price fluctuations as markets open and close in different time zones. For example, a Canadian trader could scalp during the overlap between the closing of the North American session and the opening of the Asian session, looking for quick profits from price discrepancies.

- News-Based Trading: Major economic news releases from different countries often impact currency pairs. By monitoring news schedules from around the world, Canadian traders can anticipate market reactions and position themselves accordingly. For instance, a significant US economic announcement during the Canadian evening could provide lucrative trading opportunities.

- Swing Trading Across Sessions: Swing trading, which involves holding positions for several days, can benefit from the extended trading hours. Traders can monitor price action throughout different sessions to identify potential entry and exit points, taking advantage of broader trends.

- Arbitrage Opportunities: While rare, price discrepancies can sometimes occur between different markets due to temporary inefficiencies. Sophisticated traders can exploit these fleeting arbitrage opportunities for quick profits. This requires significant market knowledge and fast execution speeds.

- Overnight Positions and Carry Trades: Holding positions overnight can be profitable if the interest rate differential between the two currencies favors the trader’s position (carry trade). However, overnight risks (like unexpected news) should be carefully considered.

Planning Your Trading Day: A Step-by-Step Guide for Canadian Traders

Effective planning is crucial for successful forex trading. This guide Artikels a structured approach for Canadian traders to optimize their trading day based on global market hours.

- Identify Key Market Overlaps: Determine the periods when the Canadian market overlaps with other major markets (e.g., the London and Asian sessions). This highlights periods of increased liquidity and trading activity.

- Analyze Market News and Events: Review the economic calendar for significant news releases from various countries, scheduling your trading activity around these events. Consider using tools that alert you to important news releases.

- Develop a Trading Plan: Artikel your trading strategy, including entry and exit points, stop-loss orders, and profit targets, specific to the market session you are trading.

- Monitor Price Action: Actively monitor price charts and technical indicators throughout the various market sessions, adjusting your strategy as needed based on real-time market conditions.

- Risk Management: Implement robust risk management techniques, including setting stop-loss orders to limit potential losses, and diversifying your portfolio across multiple currency pairs.

- Review and Adjust: After each trading session, review your trades to identify areas for improvement and adjust your strategy accordingly.

Utilizing Technical Analysis Across Different Market Sessions

Technical analysis indicators can be effectively employed across different market sessions, but their interpretation may need adjustments based on the specific market conditions of each session.

For example, the Relative Strength Index (RSI) might show overbought conditions in the Asian session, indicating a potential price reversal. However, this signal might be less reliable during the highly volatile London session. Similarly, moving averages might exhibit different behaviors depending on the liquidity and trading volume of each session. Traders should understand how these indicators react differently under varying market conditions and adjust their interpretation accordingly.

Successful application involves understanding the nuances of each market session and adapting your analysis to account for the unique characteristics of each.

News and Economic Events

The forex market, a global beast fueled by billions of dollars swirling around the clock, is incredibly sensitive. Think of it as a hyper-caffeinated hummingbird – a tiny flutter of news can send it into a frenzy. Major news events and economic announcements act like those caffeine jolts, drastically impacting currency values and creating – or destroying – trading opportunities for Canadian forex traders.

Understanding this impact is crucial for navigating the sometimes-chaotic waters of global currency exchange.Economic news releases from around the world ripple outwards, affecting even the seemingly isolated Canadian market. These announcements, often released at specific times, can trigger sudden and significant price movements in various currency pairs. The speed and magnitude of these reactions depend on several factors, including the unexpectedness of the data, its economic significance, and the overall market sentiment.

Essentially, the market’s reaction is a complex dance between anticipation, surprise, and the collective wisdom (or perhaps, collective guesswork) of global traders.

Impact of Major Economic Releases on Currency Pairs

The release of key economic indicators, such as employment figures (like the Non-Farm Payroll in the US), inflation rates (like the Consumer Price Index or CPI), and interest rate decisions from central banks (like the Bank of Canada rate announcements or the Federal Reserve’s decisions), can significantly influence currency pairs. For instance, unexpectedly strong employment numbers in the US often lead to an increase in the value of the US dollar (USD) against other currencies, including the Canadian dollar (CAD), as investors anticipate stronger economic growth and potentially higher interest rates.

Conversely, disappointing inflation data might weaken a currency as it suggests a less robust economy. Imagine the USD/CAD pair: a strong US jobs report might push the pair upwards (USD strengthening against CAD), while a weak Canadian inflation report might push it further upwards (CAD weakening against USD).

Mastering forex trading means knowing when the global markets are open – a crucial factor for Canadian scalpers! To successfully navigate these sometimes chaotic hours, you’ll need a reliable partner, and that’s where finding the right broker comes in. Choosing wisely is key, so check out this guide on Finding a Reputable Forex Broker in Canada for Scalping before you even think about those lucrative, yet sometimes terrifying, market overlaps.

Incorporating News Events into a Canadian Trading Strategy

Successfully integrating news events into a trading strategy requires a multi-pronged approach. First, stay informed. Subscribe to reputable financial news sources and create a calendar of upcoming economic releases relevant to your chosen currency pairs. This allows you to anticipate potential volatility and adjust your trading accordingly. Second, understand the potential impact.

Research how different types of news typically affect specific currency pairs. Third, consider your risk tolerance. News-driven volatility can be substantial; manage your position sizes appropriately to avoid significant losses. Finally, practice disciplined risk management. Use stop-loss orders to limit potential losses and take-profit orders to secure gains.

Ignoring news events is like driving blindfolded; incorporating them wisely is like having a detailed map.

Examples of Significant Economic Releases and Their Impact

Let’s consider a few real-world examples. The surprise announcement of a larger-than-expected interest rate hike by the Federal Reserve often leads to a strengthening of the USD against many currencies, including the CAD. Conversely, a weaker-than-expected GDP growth report from Canada might cause the CAD to depreciate against the USD and other major currencies. The release of the Canadian employment report can also significantly affect the CAD’s value.

Positive employment numbers typically strengthen the CAD, while negative numbers weaken it. These examples highlight the interconnectedness of global markets and the importance of staying informed about key economic indicators.

Navigating the wild world of forex trading means understanding those pesky market hours – in Canada, it’s a different beast than in, say, Tokyo! But before you dive into those global time zones, you might need to know the current exchange rate. Check out this handy guide on Converting 433 CAD to USD using Questrade’s exchange rates to make sure your calculations are spot on before making any trades.

Then, armed with that knowledge and a firm grasp of global market times, you’ll be a forex ninja in no time!

Risk Management in Relation to Global Market Hours

Trading forex across multiple time zones, a common practice for Canadian traders, introduces a unique set of challenges. The extended trading hours, coupled with overlapping market sessions, significantly increase volatility and the potential for both substantial profits and equally substantial losses. Effective risk management becomes paramount, not just a suggestion, but an absolute necessity for survival in this exciting but unforgiving environment.The sheer volume of trading activity across different global markets creates a constantly shifting landscape of price movements.

What might be a relatively quiet period in the Canadian market could coincide with a period of high volatility in the Asian or European markets, impacting your positions regardless of where you are geographically located. This underscores the importance of having a robust risk management plan that accounts for these global dynamics. Failing to do so is akin to sailing a small boat in a hurricane without a life jacket – exciting, maybe, but also incredibly risky.

Risk Management Techniques for Canadian Forex Traders

Several strategies are crucial for mitigating risk when trading across global markets. Diversification of currency pairs, for example, reduces exposure to any single market’s volatility. Imagine having all your eggs in one basket – the Asian market, for instance. If a major economic event negatively impacts that market, your entire portfolio could suffer. Diversification, however, allows you to spread the risk and potentially offset losses in one area with gains in another.

Another key technique is utilizing stop-loss orders. These automatically close your position if the price moves against you by a predetermined amount, limiting potential losses. Think of it as your financial parachute – it might not prevent a fall, but it will soften the landing significantly. Finally, position sizing is essential. Never risk more capital than you can afford to lose on any single trade, regardless of how confident you feel.

Risk Management Checklist for Canadian Forex Traders

Before embarking on any forex trading adventure spanning multiple time zones, a comprehensive checklist is vital. This checklist ensures you’ve considered all the critical aspects of risk management and are prepared for the unique challenges presented by global market hours.

- Define your risk tolerance: How much are you willing to lose on any single trade, and overall, in your forex trading endeavors? This is the foundation of any sound risk management strategy.

- Diversify your currency pairs: Avoid concentrating your trades on a single currency pair or market. Spread your risk across multiple assets to mitigate the impact of any single market’s volatility.

- Utilize stop-loss orders: These orders automatically close your positions when the price moves against you by a predetermined amount, preventing catastrophic losses.

- Implement position sizing strategies: Never risk more than a small percentage (e.g., 1-2%) of your trading capital on any single trade. This helps prevent substantial losses from wiping out your account.

- Monitor global market news and economic events: Stay informed about significant events that could impact the forex markets across various time zones. News can dramatically shift market dynamics, and preparedness is key.

- Develop a trading plan and stick to it: A well-defined trading plan Artikels your entry and exit strategies, risk tolerance, and position sizing. Adhering to this plan helps you maintain discipline and avoid emotional trading decisions.

- Regularly review and adjust your risk management strategy: Market conditions change constantly. Regularly review your strategy and make adjustments as needed to ensure it remains effective.

Tools and Resources for Monitoring Global Forex Market Hours

Navigating the global forex market, especially as a Canadian trader, requires a keen understanding of when different markets are open and active. This isn’t just about knowing the times; it’s about strategically leveraging the overlapping hours for maximum trading opportunities and minimizing the risk of missed signals or unfavorable market shifts. Thankfully, several tools and resources can help you stay on top of this complex dance of global market timings.Let’s explore some ways Canadian traders can effectively track global forex market hours and economic calendar events, ensuring they’re always in the know.

These tools aren’t just about numbers; they’re about making informed decisions and optimizing your trading strategy.

World Clock Applications and Software, Understanding Forex Market Hours in Canada and Global Markets

Specialized world clock applications or software are invaluable for visualizing time zones across the globe. These aren’t your grandmother’s clocks; they go far beyond simply displaying the time. Many incorporate forex market open and close times for major financial centers directly into their interface, often displaying them visually on a map or in a list, providing a clear picture of which markets are currently active and which ones are about to open or close.

This allows traders to quickly identify optimal trading windows and avoid the pitfalls of trading during periods of low liquidity or market closure. The added feature of automatic updates ensures the information remains current, even accounting for daylight saving time changes.

Economic Calendars

Economic calendars are more than just lists of dates; they are dynamic, real-time dashboards displaying upcoming economic announcements from around the world. These calendars are typically color-coded to indicate the potential market impact of each event (low, medium, or high), allowing traders to anticipate potential volatility and plan their trades accordingly. Some advanced calendars even incorporate sentiment analysis, providing a gauge of market expectations surrounding these announcements.

Understanding the timing of these events in relation to global market hours is crucial for maximizing their impact on your trading strategy.

Hypothetical Visual Tool: The Global Forex Pulse

Imagine a tool called “Global Forex Pulse.” This hypothetical application would provide a dynamic, visual representation of global forex market activity, making it far easier to understand the interconnectedness of markets across different time zones.

Features of the Global Forex Pulse

- Interactive World Map: A world map displays major forex trading centers, color-coded according to their current market status (open, closing, closed). The intensity of the color could also reflect trading volume, providing a visual representation of market activity levels.

- Overlapping Market Display: A clear, easily understandable display showing the periods of overlap between different market centers. This feature would be especially helpful for Canadian traders, highlighting when they can benefit from the increased liquidity and activity during overlapping hours.

- Economic Calendar Integration: Direct integration with an economic calendar, highlighting upcoming events and their potential impact on specific market centers, visually indicated on the map.

- Customizable Alerts: The ability to set custom alerts for specific market openings, closings, or economic events, ensuring the trader never misses a crucial moment.

- Liquidity Indicator: A visual indicator displaying the relative liquidity of each market center, helping traders avoid periods of low liquidity and potential slippage.

The Global Forex Pulse would offer a significant advantage to Canadian traders, providing a comprehensive and easily digestible overview of the global forex market landscape. It transforms complex information into an intuitive, visual experience, empowering traders to make better, more informed decisions.

Final Thoughts: Understanding Forex Market Hours In Canada And Global Markets

So, there you have it – a whirlwind tour of forex market hours, Canadian style! While navigating the global forex market can feel like trying to herd cats in a time machine, understanding the rhythms of different trading sessions is crucial. By mastering the art of timing, leveraging overlaps, and employing smart risk management, Canadian traders can significantly improve their odds of success.

Remember, though, that forex is a high-stakes game. Do your homework, stay informed, and always remember that even the most seasoned traders occasionally get their fingers burned. Happy trading!