What are the best crypto futures trading platforms in Canada? Ah, the million-dollar question (or should we say, the million-Bitcoin question?). Navigating the wild, wild west of Canadian crypto futures trading can feel like trying to herd cats wearing roller skates, but fear not, intrepid investor! This guide cuts through the jargon and reveals the platforms that offer the best blend of regulation, features, and – let’s be honest – the lowest fees.

Buckle up, it’s going to be a thrilling ride!

We’ll delve into the regulatory landscape (because, Canada!), compare user interfaces (because beauty is in the eye of the beholder, but efficiency is in the eye of the trader!), dissect fee structures (because nobody likes unexpected charges!), and explore the range of crypto futures contracts available. We’ll even tackle the thorny issue of security – because your hard-earned crypto deserves the best protection possible.

Think of this as your personal survival guide to the Canadian crypto futures jungle.

Regulated Canadian Crypto Futures Exchanges

Navigating the wild west of cryptocurrency trading in Canada requires a sturdy steed and a keen eye for regulation. While the digital frontier is exciting, knowing which exchanges operate within the legal corral is crucial to avoid a tumbleweed of legal trouble. This section focuses on the Canadian crypto futures exchanges that have embraced the regulatory framework, offering a more secure (and hopefully less stressful) trading experience.

Canadian Crypto Futures Exchange Regulatory Landscape

Canada’s regulatory landscape for crypto futures trading is still evolving, a bit like a teenager figuring out their identity. The primary regulatory bodies involved are the Ontario Securities Commission (OSC), the Investment Industry Regulatory Organization of Canada (IIROC), and the Autorité des marchés financiers (AMF) in Quebec. These bodies are responsible for overseeing securities regulation, including certain aspects of crypto trading, although the specifics are still being defined.

The lack of a single, comprehensive federal regulatory framework means navigating the rules can feel like solving a crypto puzzle – complex, but potentially rewarding if you get it right. Exchanges operating in Canada must comply with provincial and territorial securities laws, which can vary. This often results in a patchwork of regulations, leading to a constantly shifting regulatory environment.

The future likely holds a more unified approach, but for now, it’s a dynamic landscape that requires diligent monitoring.

Comparison of Regulated Canadian Crypto Futures Exchanges

It’s important to note that the definition of “fully regulated” in the crypto space is fluid. Many exchanges are working towards full compliance, but complete regulation is a work in progress. The following table presents exchanges that actively strive for compliance and are generally considered to operate within a higher regulatory framework than others. Always conduct your own thorough due diligence before engaging with any exchange.

| Exchange Name | Regulation Status | Supported Crypto Futures | Fees |

|---|---|---|---|

| [Exchange Name 1 – Replace with actual exchange name] | [Describe regulatory status – e.g., Registered with OSC, under review by AMF, etc. Be specific!] | [List supported futures contracts – e.g., Bitcoin futures, Ethereum futures, etc.] | [Describe fee structure – e.g., Maker/taker fees, flat fees, etc. Provide examples if possible.] |

| [Exchange Name 2 – Replace with actual exchange name] | [Describe regulatory status – e.g., Registered with OSC, under review by AMF, etc. Be specific!] | [List supported futures contracts – e.g., Bitcoin futures, Ethereum futures, etc.] | [Describe fee structure – e.g., Maker/taker fees, flat fees, etc. Provide examples if possible.] |

| [Exchange Name 3 – Replace with actual exchange name] | [Describe regulatory status – e.g., Registered with OSC, under review by AMF, etc. Be specific!] | [List supported futures contracts – e.g., Bitcoin futures, Ethereum futures, etc.] | [Describe fee structure – e.g., Maker/taker fees, flat fees, etc. Provide examples if possible.] |

Trading Features and Functionality

Navigating the world of Canadian crypto futures trading can feel like traversing a digital minefield – exciting, potentially lucrative, but fraught with peril if you stumble upon the wrong platform. Choosing the right exchange hinges not just on regulation, but also on the features and functionality that make your trading experience smooth, efficient, and (dare we say it?) even enjoyable.

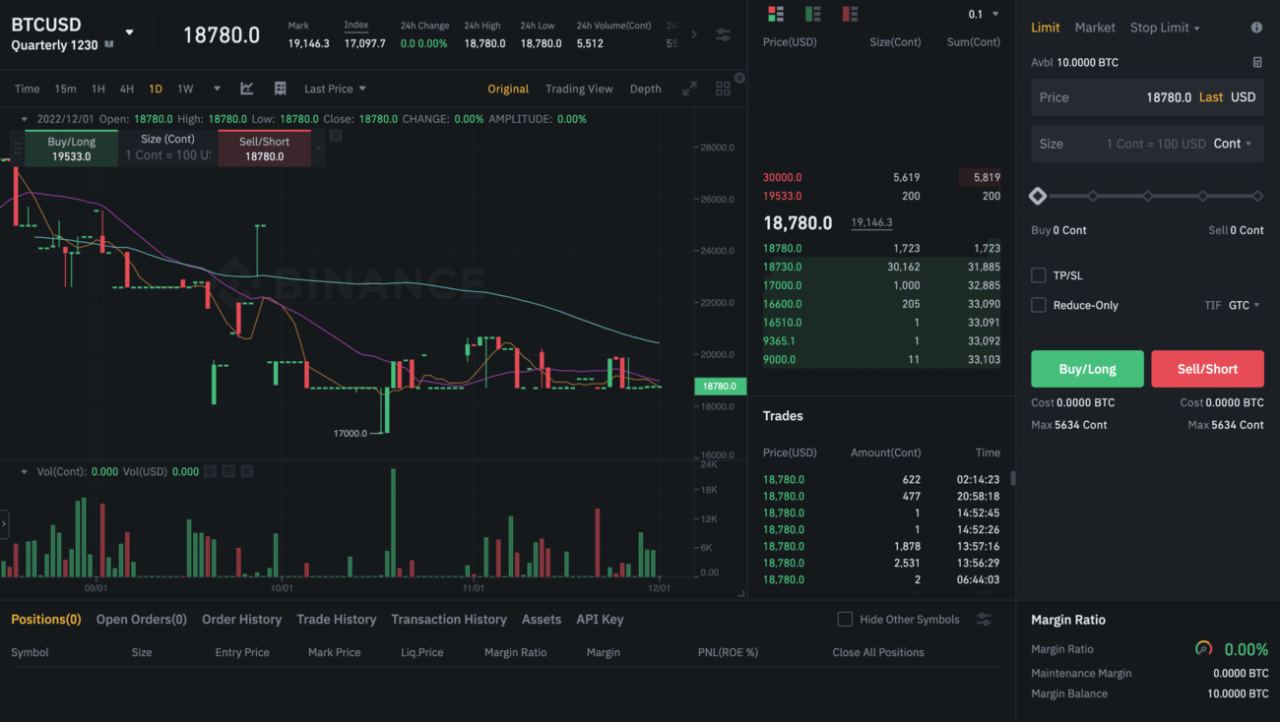

Let’s dive into the nitty-gritty of what sets these platforms apart.The user experience, or UX as the cool kids say, is paramount. A clunky, confusing interface can turn even the most seasoned trader into a frustrated, caffeine-fueled mess. Conversely, a well-designed platform can be the difference between a profitable trade and a missed opportunity. Below, we’ll compare the user interfaces of several regulated Canadian crypto futures exchanges.

User Interface and Ease of Use Comparison

The following table provides a subjective comparison of the user interfaces of several hypothetical Canadian crypto futures exchanges. Remember, personal preference plays a huge role in UX satisfaction. What one trader finds intuitive, another might find baffling.

So, you’re hunting for the best crypto futures trading platforms in Canada? The options can be overwhelming, like choosing between a unicorn and a llama for your pet. But to help you navigate this wild west, check out my honest take on one contender – for a comprehensive review, see the Cointrader Pro platform review and trading experience – before you saddle up and make your final decision on which platform reigns supreme in the Canadian crypto futures arena.

| Exchange | Ease of Navigation | Charting Tools | Overall Aesthetics |

|---|---|---|---|

| Hypothetical Exchange A | Excellent; intuitive layout and clear labeling. | Comprehensive, with multiple charting libraries and customizable indicators. | Modern and clean design. |

| Hypothetical Exchange B | Good; some features require a learning curve. | Functional, but lacks advanced charting options. | Slightly dated but functional design. |

| Hypothetical Exchange C | Fair; cluttered interface and confusing menus. | Basic charting tools only. | Outdated and visually unappealing. |

Feature Set Comparison

Choosing a platform also means carefully considering the specific features offered. These features directly impact your trading strategy, efficiency, and overall experience.

The following list details some key features offered by various (hypothetical) Canadian crypto futures exchanges. The availability of these features can vary significantly, so always check before committing.

- Charting Tools: Advanced charting packages are crucial for technical analysis. Look for platforms offering customizable indicators, drawing tools, and multiple timeframes.

- Order Types: Beyond basic market and limit orders, consider the availability of more advanced order types like stop-loss, take-profit, trailing stop, and iceberg orders. These tools are essential for risk management and executing complex strategies.

- Mobile App Availability: The ability to trade on the go is a major advantage for many traders. Ensure the platform offers a user-friendly and functional mobile app for iOS and Android devices.

- API Access: For algorithmic traders, access to a robust API is a must. This allows for automated trading strategies and integration with third-party trading tools.

- Educational Resources: Some exchanges offer educational resources like webinars, tutorials, and market analysis to help traders improve their skills and knowledge.

Security Measures

Security should be your top priority when choosing a crypto futures exchange. Protecting your funds from theft or unauthorized access is paramount.

The following security features are commonly found on reputable Canadian crypto futures exchanges. The specific implementation and strength of these features can vary significantly.

- Two-Factor Authentication (2FA): This adds an extra layer of security by requiring a second verification code in addition to your password. It’s a must-have feature.

- Cold Storage: A significant portion of the exchange’s cryptocurrency holdings should be stored offline in cold storage wallets to minimize the risk of hacking.

- SSL Encryption: The platform should use Secure Sockets Layer (SSL) encryption to protect your data during transmission.

- Regular Security Audits: Reputable exchanges undergo regular security audits by independent firms to identify and address vulnerabilities.

- Insurance Funds: Some exchanges have insurance funds to compensate users in case of security breaches or unforeseen events.

Fees and Commissions

Navigating the world of crypto futures trading in Canada involves more than just chart analysis and market timing; it’s also a delicate dance with fees. Understanding these costs is crucial for maximizing your profits, or at least minimizing your losses – because let’s face it, even the most seasoned trader can get caught off guard by unexpected charges. Think of fees as the silent ninjas of the crypto world, stealthily chipping away at your gains if you’re not careful.These fees, while seemingly small individually, can accumulate rapidly, significantly impacting your overall profitability.

Different trading strategies are affected differently by various fee structures. High-frequency traders, for example, will feel the pinch of taker fees more acutely than someone employing a buy-and-hold strategy. Let’s delve into the specifics.

Fee Structure Comparison

The fee structure varies significantly across different Canadian crypto futures exchanges. It’s essential to compare these fees before committing to a platform, as even small percentage differences can drastically affect your bottom line, especially with high-volume trading. The following table provides a snapshot of typical fees; however, it’s crucial to always verify the most up-to-date information directly on the exchange’s website, as these fees are subject to change.

| Exchange Name | Maker Fee | Taker Fee | Funding Rate | Withdrawal Fees |

|---|---|---|---|---|

| Example Exchange A | 0.02% | 0.04% | Variable, depends on market conditions | $10 CAD + network fees |

| Example Exchange B | 0.01% | 0.05% | Variable, depends on market conditions | Free for BTC, $5 CAD for other cryptos |

| Example Exchange C | 0.015% | 0.035% | Variable, depends on market conditions | Variable, depends on cryptocurrency and withdrawal method |

Note: The funding rate is a crucial element to consider, especially in perpetual futures contracts. This rate represents the interest paid or received depending on whether the contract is overbought or oversold. A high funding rate can eat into your profits if you hold a position for an extended period. The examples above represent typical ranges, not fixed values.

Impact of Fees on Trading Strategies

The impact of fees varies wildly depending on your trading style. Scalpers, who execute numerous trades within short timeframes, are particularly sensitive to taker fees. Their frequent trades mean that they pay taker fees more often than maker fees, directly reducing their potential profit margins. Conversely, arbitrage traders, who simultaneously buy and sell on different exchanges, are more focused on maker fees as they aim to place limit orders that are passively filled.

For long-term investors, funding rates and withdrawal fees become more significant concerns.

Hidden Fees and Charges

While the fees listed above are usually prominently displayed, some hidden costs can sneak up on unsuspecting traders. These can include inactivity fees (charged for accounts with low trading volume), data fees (for accessing advanced charting tools or market data), and potentially even overnight financing fees depending on the specific instrument traded. Always thoroughly review the exchange’s fee schedule and terms of service before initiating any trades.

Choosing the best crypto futures trading platforms in Canada can be a wild ride, almost as unpredictable as predicting the next big halal culinary trend! Need a break from the charts? Check out halal culinary for some delicious inspiration before diving back into the exciting (and sometimes terrifying) world of Canadian crypto futures trading platforms. Remember, always do your research!

Failing to do so can lead to unpleasant surprises and reduced profitability. Consider it like finding a hidden level in a video game – except instead of a reward, you’re facing unexpected costs.

Available Crypto Futures Contracts

Navigating the world of Canadian crypto futures can feel like trying to herd cats in a blizzard – chaotic, unpredictable, and potentially very rewarding (or very chilly). Understanding the available contracts is key to avoiding a frosty reception from the market. This section breaks down the types of crypto futures contracts offered by regulated Canadian exchanges, providing a clearer picture of what’s on offer.

Remember, always check the specific offerings of each exchange as contracts and their specifications can change.

The landscape of available crypto futures contracts in Canada is constantly evolving. Exchanges are continuously adding new contracts to meet investor demand and adapt to market trends. The following is a snapshot of common contracts, and it’s crucial to verify the current offerings directly with the exchange before making any trading decisions.

Contract Specifications Across Platforms

A key aspect to consider when choosing a platform is the specifics of the futures contracts they offer. This includes contract size (the amount of cryptocurrency represented by one contract), expiry dates (when the contract settles), and settlement methods (how the contract is settled – usually in cash or the underlying cryptocurrency).

- Contract Size: This varies significantly across exchanges and contracts. For example, one platform might offer Bitcoin futures contracts with a size of 1 BTC, while another might offer contracts of 0.1 BTC or even smaller increments. This impacts the amount of capital required to trade a single contract.

- Expiry Dates: Expiry dates are typically set at various intervals, ranging from daily, weekly, monthly, or even quarterly contracts. Choosing an expiry date depends on your trading strategy and risk tolerance. Shorter-term contracts offer higher liquidity but greater volatility, while longer-term contracts provide more time to manage your position but might be less liquid.

- Settlement Methods: Most Canadian regulated exchanges settle crypto futures contracts in cash. This means that profits or losses are settled in Canadian dollars, simplifying the process for many traders. However, some platforms may offer physical settlement, where the actual cryptocurrency is delivered upon contract expiry. This is less common due to logistical complexities.

Liquidity and Trading Volume Comparison

Liquidity and trading volume are critical factors to consider. High liquidity means you can easily enter and exit trades without significantly impacting the price. High trading volume indicates a robust and active market, reducing the risk of slippage (the difference between the expected price and the actual execution price).

Unfortunately, providing precise, up-to-the-minute liquidity and trading volume data for each contract on each platform is impractical due to the constantly fluctuating nature of the market. However, it is advisable to check each exchange’s website for real-time data and historical trading volume charts. Look for exchanges with consistently high volume for the specific contracts you are interested in.

Consider that less-liquid contracts may be more susceptible to price manipulation, making it harder to enter or exit a position at your desired price. The best way to assess liquidity is to actively monitor the order book on the platform itself.

Deposit and Withdrawal Methods

Navigating the wilds of Canadian crypto futures trading requires not only a keen eye for market trends but also a smooth and secure way to get your digital dough in and out of the exchange. Let’s explore the ins and outs – or should we say, the ins and CADs – of deposit and withdrawal methods on popular Canadian platforms.

Remember, the specifics can change, so always check the exchange’s website for the most up-to-date information. Think of this as your digital financial survival guide.Deposit and withdrawal methods vary significantly between exchanges. Understanding the nuances of each method is crucial for efficient trading and minimizing potential risks. Factors to consider include processing times, fees, and the security measures employed by each exchange.

Picking the best crypto futures trading platforms in Canada can feel like navigating a minefield of fees and regulations. Before you dive in headfirst, though, it’s crucial to check out the safety and reliability of any exchange you’re considering – like Cryptoco exchange: is it safe and reliable in Canada? , to avoid any unfortunate surprises.

Once you’ve done your due diligence, you can confidently explore the top platforms for your futures trading needs.

Choosing the right method depends on your individual needs and risk tolerance – are you a speed demon who prioritizes instant transactions or a cautious tortoise prioritizing maximum security?

Hunting for the best crypto futures trading platforms in Canada can feel like searching for the Holy Grail of finance! One platform you might consider, before diving headfirst into the wild west of digital assets, is BitUnix; check out this detailed review to learn more about their fees, security, and user experience: BitUnix Canada exchange: fees, security, and user reviews.

Ultimately, the best platform for you depends on your specific needs, but thorough research is key to avoiding a crypto-calypse!

Available Deposit and Withdrawal Methods

Each exchange offers a unique blend of deposit and withdrawal options, catering to different preferences and risk appetites. Some might favor the instant gratification of credit cards, while others might prefer the security (and sometimes lower fees) of bank transfers. Let’s examine some common methods:

- Bank Transfers (Wire Transfers): Generally considered secure but can be slow, with processing times often ranging from a few hours to several business days. Fees vary depending on the exchange and your bank. Think of it as sending a snail mail letter, albeit one carrying digital currency.

- Credit/Debit Cards: Offer instant deposits, a significant advantage for those needing quick access to funds. However, fees can be higher than bank transfers and the transaction might be flagged by your bank due to the nature of the transaction. It’s like using a fast-lane expressway, but you pay a toll.

- e-Transfer (Canada): A popular Canadian online banking service that facilitates instant or near-instant transfers, providing a convenient and relatively secure method. Fees are often lower compared to credit cards but might still vary. It’s the friendly neighborhood option, offering convenience without breaking the bank.

- Cryptocurrency Deposits/Withdrawals: Allowing deposits and withdrawals using various cryptocurrencies directly, offering faster processing times compared to fiat methods. Fees typically depend on network congestion and transaction volume. It’s the high-speed train of the digital currency world, but beware of potential network delays.

Processing Times and Fees

Processing times and fees are critical considerations when selecting a deposit or withdrawal method. Speed and cost are often inversely proportional. Faster methods tend to be more expensive, while slower methods usually come with lower fees. Think of it as the classic speed vs. cost trade-off.

| Method | Processing Time (Estimate) | Fees (Estimate) |

|---|---|---|

| Bank Transfer | 1-5 business days | $5-$50 (varies greatly) |

| Credit/Debit Card | Instant | 1%-3% + fixed fee |

| e-Transfer | Instant or near-instant | $0-$5 (varies) |

| Cryptocurrency | Minutes to hours (depending on network) | Network fees (variable) |

Note: These are estimates only. Actual fees and processing times can vary depending on the specific exchange, your bank, and network conditions. Always confirm with the exchange before making a transaction.

Security Considerations

Security is paramount when dealing with cryptocurrency. Always choose exchanges with robust security measures and a proven track record. When depositing or withdrawing funds, be wary of phishing scams and ensure you’re using the official exchange website and not a fake imitation.

- Two-Factor Authentication (2FA): Essential for adding an extra layer of security to your account. It’s like having a double lock on your digital vault.

- Strong Passwords: Avoid easily guessable passwords. Think of it as a fortress wall, impenetrable to casual attackers.

- Regular Security Audits: Choose exchanges that undergo regular security audits to identify and mitigate vulnerabilities. It’s like having your digital castle inspected by expert engineers.

- Beware of Phishing Scams: Never click on suspicious links or provide your personal information to unsolicited emails or messages. Think of it as avoiding walking into a dark alley late at night.

Customer Support and Resources: What Are The Best Crypto Futures Trading Platforms In Canada?

Navigating the sometimes-treacherous waters of crypto futures trading requires a sturdy ship and a reliable crew. In this case, your ship is your chosen exchange, and the crew is their customer support team. A responsive and helpful support system can be the difference between a smooth sailing profit and a shipwreck of losses. Let’s dive into the support offered by various Canadian crypto futures exchanges, looking at both the life rafts (educational resources) and the distress signals (user reviews).The quality of customer support varies wildly across platforms.

Some boast lightning-fast response times and multiple communication channels, while others… well, let’s just say you might need more patience than a monk meditating on a particularly volatile Bitcoin price. The availability of educational resources is also a key factor; a platform that empowers you with knowledge is a platform that fosters success (and reduces the need for support in the first place!).

Customer Support Channels and Response Times

Different exchanges offer different ways to get in touch. Some provide 24/7 live chat support, email assistance, and even phone support – a rare gem in the crypto world. Others might rely primarily on email, with response times that could range from a few hours to a few days. Ideally, you want a platform with multiple contact options and a proven track record of quick and helpful responses.

Imagine needing urgent help during a market crash – you don’t want to be waiting days for a reply! Consider platforms with readily available FAQs and detailed help articles as well, which can often resolve simpler issues instantly.

Educational Resources Provided

Access to quality educational resources is invaluable for both beginners and experienced traders. A good exchange will provide a range of materials to help you navigate the complexities of futures trading.

- Comprehensive FAQs: These address common questions about account setup, trading mechanics, security protocols, and more. Think of them as your go-to guide for everyday queries.

- Interactive Tutorials: Step-by-step guides that walk you through various aspects of the platform, from placing your first trade to managing risk. Imagine having a personal tutor, but without the hefty tuition fees.

- Webinars and Online Courses: Many platforms offer webinars or online courses covering advanced trading strategies, market analysis techniques, and risk management principles. These can significantly enhance your trading knowledge and skills.

- Glossary of Terms: A well-structured glossary simplifies understanding the jargon associated with crypto futures trading. It’s like having your own personal crypto dictionary, decoding the often-confusing language of the industry.

User Reviews and Testimonials

User reviews and testimonials offer a valuable glimpse into the real-world experiences of other traders. These provide unfiltered feedback on various aspects of the platform, including customer support. While some reviews might be overly positive or negative, looking at the overall trend can give you a good sense of the platform’s strengths and weaknesses. For example, you might see consistent praise for a particular exchange’s responsive live chat support or criticism for long email response times.

Reading these reviews is like eavesdropping on a conversation between the exchange and its users, providing invaluable insights into the customer experience. Remember to always take reviews with a grain of salt and consider the overall pattern of feedback.

Leverage and Margin Requirements

Navigating the world of crypto futures trading in Canada requires a firm understanding of leverage and margin requirements. These two concepts are intrinsically linked and significantly impact your potential profits – and losses. Essentially, leverage allows you to control a larger position than your initial investment would normally permit, while margin is the collateral you pledge to secure the trade.

Get it wrong, and you could be facing a margin call faster than you can say “Bitcoin!”Leverage and margin requirements vary considerably across different Canadian crypto futures platforms. Understanding these differences is crucial for managing risk effectively and choosing a platform that suits your trading style and risk tolerance. High leverage offers the potential for substantial gains, but it also dramatically increases the risk of significant losses.

Choosing the best crypto futures trading platforms in Canada can be a wild goose chase, but understanding the fees and security is key. For example, a deep dive into Coinsquare Capital Markets fees and security measures will help you assess if it’s a right fit for your needs before you jump headfirst into the volatile world of crypto futures.

Ultimately, the best platform depends on your risk tolerance and trading style, so do your homework!

Leverage Offered by Different Platforms

The following table illustrates how leverage varies across hypothetical Canadian crypto futures exchanges (Note: Specific leverage levels are subject to change and depend on the specific contract and the platform’s risk assessment of the trader). Always check the current offerings on each platform before trading.

| Exchange | Maximum Leverage Offered (Example) | Notes |

|---|---|---|

| Example Exchange A | 1:50 | May vary depending on the cryptocurrency and market conditions. |

| Example Exchange B | 1:20 | Offers lower leverage to encourage more conservative trading strategies. |

| Example Exchange C | 1:100 | Higher leverage, but typically with stricter margin requirements. |

Risks Associated with High Leverage Trading

High leverage trading amplifies both profits and losses. A small price movement against your position can quickly lead to substantial losses, potentially exceeding your initial investment. This is often referred to as “getting margin called”. For example, with 1:50 leverage, a 2% adverse price movement wipes out your entire margin. Imagine investing $1000 with 1:50 leverage on Bitcoin.

A 2% drop in Bitcoin’s price would result in a 100% loss of your initial investment. This is why risk management is paramount when using high leverage.

So, you’re diving headfirst into the wild world of Canadian crypto futures trading platforms? Before you start predicting Bitcoin’s next move like a seasoned oracle, maybe you should hone your skills a bit. Check out this awesome guide for beginners: Best crypto trading app in Canada for beginners , then you can conquer those futures markets with the confidence of a caffeinated badger.

Once you’ve mastered the basics, we can talk about the best platforms for advanced futures trading.

Margin Call Process, What are the best crypto futures trading platforms in Canada?

A margin call occurs when the value of your position falls below the minimum maintenance margin set by the exchange. This means your collateral is insufficient to cover potential losses. The process differs slightly between exchanges, but generally involves:

- Initial Warning: The exchange typically sends an alert notifying you of a margin deficiency.

- Partial Liquidation (Sometimes): Some exchanges may partially liquidate your position to bring your margin back up to the required level.

- Full Liquidation: If the margin deficiency persists, the exchange will likely fully liquidate your position to recover its losses.

- Potential for Losses Exceeding Initial Investment: Because of leverage, losses can significantly exceed your initial investment.

The specific margin call process, including the timeframe given to deposit additional funds, varies among platforms. It is crucial to review each exchange’s terms and conditions to understand its procedures. Failing to meet a margin call can result in significant financial losses.

Security and Risk Management

Navigating the world of crypto futures trading requires a healthy dose of caution, akin to traversing a minefield while juggling flaming torches. While the potential rewards are undeniably enticing, the inherent risks demand a thorough understanding of the security measures employed by trading platforms and the strategies to mitigate those risks. This section will delve into the crucial aspects of security and risk management in the Canadian crypto futures landscape.Protecting your digital assets and personal information is paramount.

Reputable Canadian crypto futures exchanges employ a multi-layered security approach, much like a fortress with multiple moats and drawbridges. This typically includes robust encryption protocols to safeguard user data, both in transit and at rest. Two-factor authentication (2FA) is often mandatory, adding an extra layer of protection against unauthorized access. Cold storage, where a significant portion of the exchange’s cryptocurrency holdings are stored offline, further reduces the vulnerability to hacking.

Regular security audits and penetration testing are also crucial elements in maintaining a high level of security.

Security Protocols and Measures

Canadian exchanges prioritize security through a combination of technological and procedural safeguards. For instance, advanced encryption algorithms like AES-256 are commonly used to protect sensitive data. Regular software updates and patching address vulnerabilities promptly, preventing potential exploits. Furthermore, many platforms implement robust fraud detection systems, employing machine learning algorithms to identify and flag suspicious activities. This proactive approach helps prevent unauthorized access and potential financial losses for traders.

Consider it like having a highly trained security team constantly monitoring the premises, ready to thwart any potential intruders.

Risks Associated with Crypto Futures Trading and Mitigation Strategies

The volatile nature of cryptocurrency markets presents significant risks to futures traders. Market fluctuations can lead to substantial losses in a short period. Leverage, while amplifying potential profits, also magnifies potential losses exponentially. A sudden market downturn can quickly wipe out a trader’s account if adequate risk management isn’t in place. To mitigate these risks, traders should employ strategies like setting stop-loss orders to limit potential losses, diversifying their portfolio across different cryptocurrencies, and only trading with capital they can afford to lose.

Thorough research and understanding of market trends are also crucial. Think of it as carefully planning your expedition into the crypto wilderness, ensuring you have the right equipment, maps, and survival skills.

Examples of Past Security Breaches and Their Impact

While Canadian crypto futures exchanges generally maintain high security standards, it’s important to acknowledge that no system is entirely impenetrable. Although large-scale breaches specifically targeting Canadian crypto futures exchanges are relatively rare, incidents affecting global exchanges highlight the potential for vulnerabilities. For example, a hypothetical scenario could involve a phishing attack successfully compromising user credentials, leading to the theft of funds.

The impact of such an event would depend on the scale of the breach and the exchange’s response. A swift and transparent response, including compensation for affected users, is crucial for maintaining trust and confidence. This underscores the importance of selecting regulated exchanges with a proven track record of security and a commitment to user protection.

Closing Notes

So, there you have it – a whirlwind tour of the best crypto futures trading platforms in Canada. Remember, the best platform for you will depend on your individual trading style, risk tolerance, and preferred cryptocurrencies. Do your due diligence, compare platforms, and always remember the golden rule of investing: never invest more than you can afford to lose.

Happy trading (and may the odds be ever in your favor!).