Which platform offers the best tools for day trading stocks? This isn’t just a question; it’s the holy grail for aspiring Wall Street wizards (and those who just want to make a quick buck, let’s be honest!). Navigating the wild west of online trading platforms can feel like choosing between a rusty pickaxe and a diamond-encrusted laser shovel.

This exploration dives headfirst into the features, fees, and frankly, the sheer fun of finding the perfect platform to fuel your day-trading dreams (or nightmares, depending on how your trades go!). We’ll pit titans against each other, examining charting capabilities, order entry systems, and the all-important question of whether that extra fancy candlestick chart is

-really* worth the extra subscription fee.

Buckle up, buttercup, it’s going to be a wild ride.

From the lightning-fast execution of orders to the insightful data feeds that whisper secrets of the market, choosing the right platform is paramount. We’ll dissect the pros and cons of popular choices, comparing user interfaces, mobile app functionalities, and the often-overlooked but critically important customer support. We’ll even delve into the sometimes murky world of fees and commissions, because let’s face it, nobody likes paying more than they have to – especially when you’re trying to turn a profit.

Platform Features Comparison: Which Platform Offers The Best Tools For Day Trading Stocks?

Choosing the right platform for day trading is like choosing the right weapon for a ninja – the wrong one and you’ll be slicing air instead of profits. This comparison focuses on key features to help you find your perfect trading katana. We’ll delve into charting, order entry, and real-time data – the holy trinity of successful day trading.

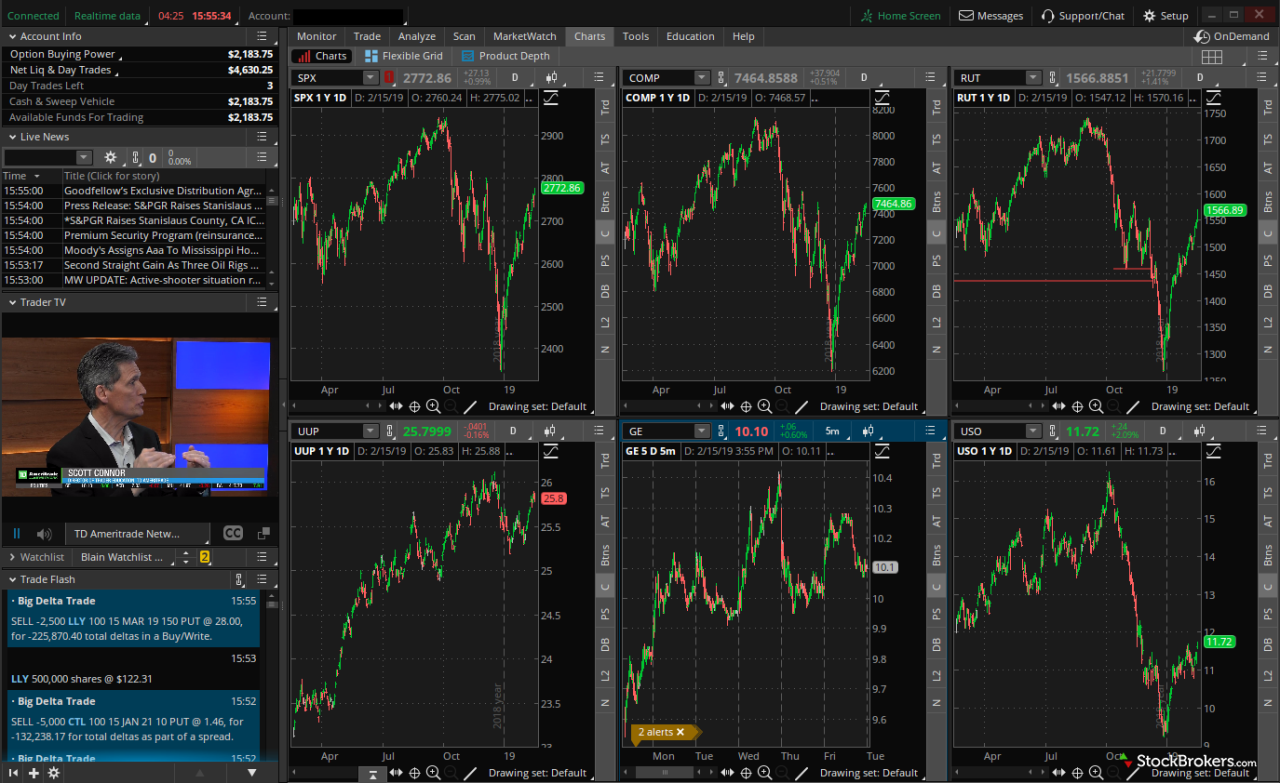

Charting Capabilities Comparison

The charts are your battlefield; the clearer the view, the better your strategy. Here’s a breakdown of three popular platforms: TradeStation, Thinkorswim, and Webull. Note that features can change, so always check the latest offerings on each platform’s website.

Picking the perfect day-trading platform feels like choosing a superhero sidekick – you need the right tools! For Canadians, the quest for the ultimate platform is simplified by checking out Expert reviews of the top day trading platforms for Canadians , which cuts through the noise. After you’ve consulted the experts, you’ll be well-equipped to conquer the stock market, one profitable trade at a time!

| Platform | Charting Features | Data Sources | Cost |

|---|---|---|---|

| TradeStation | Extensive customization options, advanced charting tools (including multiple timeframes, drawing tools, and indicators), and customizable layouts. Think of it as the Swiss Army knife of charting. | Variety of sources including real-time and historical data feeds. | Fees vary depending on the plan; generally, higher fees for more advanced features. |

| Thinkorswim | Powerful charting engine with a wide array of technical indicators and drawing tools. Known for its highly customizable layouts and ability to create complex strategies directly on the charts. It’s the Ferrari of charting platforms. | Multiple data sources, including real-time and delayed data. | Fees vary depending on the plan, with a range of options to suit different budgets. |

| Webull | User-friendly interface with a good selection of charting tools and indicators, suitable for beginners. Think of it as a sleek, efficient sports car. | Primarily relies on its own data sources; less extensive than TradeStation or Thinkorswim. | Free for most features, but some advanced features might have fees. |

Order Entry Systems

Speed and efficiency are paramount in day trading. A clunky order entry system can cost you money faster than a greased pig at a county fair.

Here’s a look at the order entry systems of three major platforms:

- Interactive Brokers: Known for its lightning-fast execution speed and a vast array of advanced order types (bracket orders, trailing stops, etc.). The interface, however, can be overwhelming for beginners. Think of it as a high-powered race car – incredibly fast, but requires skill to handle.

- TD Ameritrade: Offers a user-friendly interface with a good selection of order types. Execution speed is generally reliable, though not as blazing fast as Interactive Brokers. It’s like a well-maintained sports sedan – comfortable, reliable, and fast enough for most needs.

- Fidelity: Provides a straightforward order entry system, suitable for beginners. While not as feature-rich as others, it’s reliable and easy to navigate. Think of it as a reliable family car – dependable and easy to drive.

Real-Time Data Feeds

Real-time data is the lifeblood of day trading. Inaccurate or delayed data is like navigating a maze blindfolded – you’re bound to hit a wall.

Let’s examine the real-time data offered by Interactive Brokers, TD Ameritrade, and Fidelity:

- Interactive Brokers: Offers highly accurate and reliable real-time data from multiple exchanges. The depth and breadth of data available are unmatched. Think of it as having a crystal ball – you can see the market’s future with incredible clarity.

- TD Ameritrade: Provides generally accurate and reliable real-time data. While not as extensive as Interactive Brokers, it’s sufficient for most day traders. It’s a good balance of accuracy and ease of use.

- Fidelity: Offers real-time data, but the accuracy and reliability might not be as consistently high as the other two. It’s a more budget-friendly option, but you might sacrifice some data quality for the price.

Accessibility and User Experience

Day trading platforms are only as good as their usability. A clunky interface can turn even the most seasoned trader into a frustrated, caffeine-fueled mess. This section dives into the crucial aspects of accessibility and user experience, examining how different platforms cater (or fail to cater) to the needs of the modern day trader. We’ll explore interface design, mobile app functionality, and the overall learning curve associated with mastering these digital battlegrounds.The success of any day trading platform hinges on its ability to present complex information in a clear, concise, and easily digestible manner.

A well-designed interface should feel intuitive, even to those with limited experience. Information overload is the enemy of effective trading, and a platform’s user experience should actively mitigate this.

Picking the perfect day-trading platform feels like choosing a superhero sidekick – you need the right tools! For Canadians looking to conquer the market in 2024, finding the best platform is crucial, which is why checking out this list of Top rated day trading platforms for Canadian residents in 2024. is a smart move. Ultimately, the “best” platform depends on your individual needs, but armed with the right info, you’ll be trading like a pro in no time!

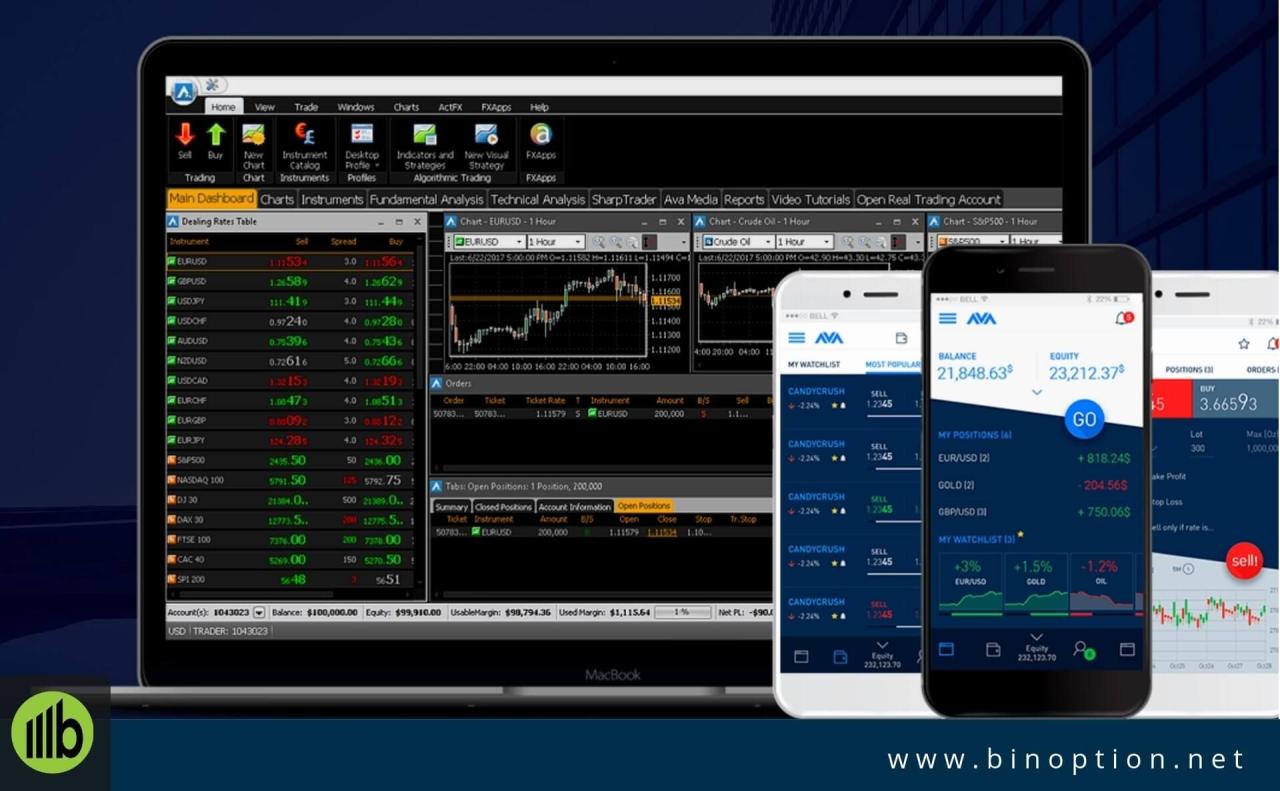

User Interface Mockup

Imagine a sleek, dark-themed interface. The central area is dominated by a customizable chart displaying real-time stock data. Multiple chart types (candlestick, line, bar) are readily selectable via clearly labeled icons. To the left, a scrollable panel lists your watchlist, neatly organized and color-coded based on pre-set criteria (e.g., gainers in green, losers in red). Below the watchlist, quick-access buttons for buying and selling stocks are prominently displayed, accompanied by order entry fields requiring minimal keystrokes.

Picking the perfect platform for day trading stocks is like choosing the right weapon for a financial ninja warrior! While some swear by Thinkorswim’s bells and whistles, others prefer the sleek simplicity of Webull. But if you’re feeling adventurous and want to venture beyond stocks, consider the volatile world of crypto; check out Best cryptocurrency exchange for day trading in Canada.

to see which platform reigns supreme there. Ultimately, the best platform for you depends on your risk tolerance and trading style – so choose wisely, grasshopper!

On the right, a panel shows your current portfolio performance, displayed in a clear, visually appealing manner with dynamic updates. At the top, a search bar allows for quick stock lookups, and a notification center keeps you informed of important market events and alerts. The overall design prioritizes visual clarity and efficient workflow, minimizing distractions and maximizing information density.

Picking the perfect platform for day trading stocks is a wild west showdown of charts and indicators! But hey, if stocks aren’t your rodeo, you could always try riding the crypto wave – check out profit from cryptocoin for some potentially wilder swings. Ultimately, though, the best stock trading platform depends on your individual needs and risk tolerance – so saddle up and choose wisely!

Mobile App Functionalities

Many popular platforms offer mobile apps that mirror – or at least attempt to mirror – the functionality of their desktop counterparts. However, the responsiveness and feature parity vary widely. Some apps offer a seamless, lag-free experience, allowing for quick trades and real-time monitoring on the go. Others, unfortunately, resemble a frantic game of digital whack-a-mole, riddled with glitches and frustrating limitations.

For example, while a desktop platform might offer advanced charting tools and complex order types, the mobile app might drastically reduce these features, focusing instead on basic buy/sell functionalities. The responsiveness of these apps is also a crucial factor; slow loading times or delayed data updates can be disastrous in the fast-paced world of day trading. Think of it like this: would you rather fight a dragon with a finely-honed broadsword (desktop platform) or a rusty spork (underpowered mobile app)?

Comparative Learning Curve Analysis

Let’s compare three hypothetical platforms: “TradeEasy,” “ChartMaster,” and “ProTrader.” TradeEasy boasts an incredibly intuitive interface and a comprehensive tutorial series, making it ideal for beginners. Its documentation is clear and concise, and its customer support is readily available via multiple channels. ChartMaster, while powerful, has a steeper learning curve. Its interface is more complex, requiring a greater investment of time to master.

Picking the perfect day-trading platform is like choosing the right weapon for a financial ninja warrior! But even the sharpest katana needs a worthy target, so before you dive into charting software, check out Top performing stocks for day trading in the Canadian market to see what juicy targets are available. Then, and only then, can you confidently select the platform with the tools to make your day-trading dreams a reality (and hopefully, a profitable one!).

However, it offers extensive charting tools and advanced order types, appealing to more experienced traders. ProTrader, on the other hand, is notorious for its challenging learning curve. It lacks robust tutorials and its documentation is often considered cryptic. Customer support is minimal, leaving users to fend for themselves in a sea of technical jargon. This platform caters to highly experienced traders willing to invest considerable time and effort in mastering its intricacies.

The choice of platform depends heavily on the user’s existing trading experience and comfort level with complex systems.

Cost and Fees

Day trading, while potentially lucrative, can quickly become a costly endeavor if you’re not mindful of the fees involved. Think of it like this: you’re trying to catch a nimble, fast-moving fish (profit), but you’re using a net (fees) with holes in it. The bigger the holes, the less fish (profit) you’ll catch. Understanding the various fee structures is crucial to maximizing your returns and avoiding unpleasant surprises.

Let’s dive into the murky waters of brokerage fees.

Different platforms employ different pricing models, impacting your bottom line. Some charge per trade, others levy data fees, and many have monthly subscription costs. The optimal platform for you will depend on your trading style and frequency. High-volume traders might find tiered pricing beneficial, while occasional traders might prefer a simpler per-trade fee structure. The following table illustrates the fee structures of three popular day-trading platforms.

Picking the perfect day-trading platform is like choosing a superhero sidekick – you need the right tools for the job! The best platform for you depends entirely on your style, so figuring out what you need is key. That’s where this handy guide comes in: How to choose the best day trading platform for your needs. After you’ve mastered the art of platform selection, you’ll be ready to conquer the stock market with your arsenal of awesome tools!

Remember, these fees are subject to change, so always check the most up-to-date information on the brokerage’s website.

Platform Fee Comparison, Which platform offers the best tools for day trading stocks?

| Platform | Per-Trade Fee | Data Fee | Monthly Subscription |

|---|---|---|---|

| Platform A (Example: Interactive Brokers) | Variable, depending on volume and plan; can be very low or even zero for high-volume traders. | Included in some plans, additional charges for others. | Variable, depending on plan; can range from free to several hundred dollars. |

| Platform B (Example: TD Ameritrade) | $0 for most trades. | Generally included in the platform fee. | $0 for most accounts. |

| Platform C (Example: Webull) | $0 for most trades. | Included in the platform fee. | $0 for most accounts. |

The impact of these fees on profitability can be significant. For instance, let’s imagine a day trader making 100 trades per month with an average profit of $10 per trade. On Platform A, with a hypothetical average per-trade fee of $1 and a $50 monthly subscription, the total fees would be $150, reducing the net profit to $850.

On Platform B, with no per-trade or monthly fees, the net profit would be $1000. This difference of $150 represents a 15% reduction in profitability, showcasing how even seemingly small fees can accumulate and significantly impact overall returns.

Tiered pricing models often offer lower per-trade fees for higher trading volumes. This incentivizes frequent trading, but it’s crucial to ensure your trading strategy can sustain this volume and that the reduced fees outweigh the increased risk associated with higher trade frequency. Subscription-based models, on the other hand, provide predictable costs regardless of trading volume, offering a degree of budgeting certainty.

The best model for you will depend on your trading style and risk tolerance.

Advanced Trading Tools

Day trading isn’t just about buying low and selling high; it’s about wielding the power of advanced tools to stay ahead of the curve. These tools can transform you from a hopeful trader into a data-driven ninja, slicing through market noise and making informed, rapid-fire decisions. Let’s explore some of the heavy hitters.

Advanced Trading Tools Overview

Several advanced tools are essential for serious day traders. These aren’t just bells and whistles; they’re the engine room of your trading strategy. Mastering them significantly improves your ability to identify opportunities and manage risk.

- Scanners: Think of these as your market’s metal detectors, sniffing out stocks meeting your pre-defined criteria. Features include customizable filters (volume, price change, moving averages, etc.), real-time alerts, and the ability to save and recall scans. The benefit? You’re not sifting through thousands of stocks manually; you’re focusing on the most promising candidates. Imagine finding that needle in a haystack—without the haystack.

- Backtesting Software: Before risking real money, you can test your strategies using historical data. Features include simulating trades with different parameters, analyzing profit/loss scenarios, and optimizing your approach. The benefit? You’re not learning from expensive mistakes; you’re refining your strategies in a risk-free environment. Think of it as a virtual trading dojo, where you hone your skills without the financial bruises.

- Options Chains: These show all available options contracts for a particular stock, including strike prices, expiration dates, and bid/ask prices. Features include visualizing option Greeks (delta, gamma, theta, vega), calculating potential profits/losses, and identifying various option strategies. The benefit? You gain a comprehensive view of the options market, allowing you to implement sophisticated strategies beyond simple stock trading.

It’s like having a crystal ball (sort of) that lets you explore different scenarios.

Algorithmic Trading Capabilities Comparison: Platform A vs. Platform B

Let’s pit two hypothetical platforms, Platform A and Platform B, against each other in the algorithmic trading arena. Platform A boasts a user-friendly drag-and-drop interface for building algorithms, making it accessible even to novice programmers. Customization is limited, however, with pre-built templates and a smaller selection of indicators. Platform B, on the other hand, offers unparalleled flexibility with its powerful scripting language, allowing for highly customized strategies.

However, this power comes at the cost of a steeper learning curve; it requires a solid understanding of programming. The choice depends on your technical skills and the complexity of your strategies. Think of it like choosing between a pre-built Lego castle (Platform A) and a limitless supply of individual Lego bricks (Platform B) – one is easier, the other is far more powerful.

Step-by-Step Guide: Using a Stock Scanner on Platform X

Let’s assume Platform X has a robust stock scanner.

- Access the Scanner: [Screenshot description: A depiction of a platform’s main menu showing a clearly labeled “Scanner” button or tab. The button is highlighted, indicating it’s the selected option.] Click the “Scanner” button, usually located on the main dashboard or under the “Tools” menu.

- Define Your Criteria: [Screenshot description: A window displaying numerous filter options, such as “Volume,” “Price Change,” “Moving Average,” and “Industry Sector.” A few filters are selected, with their values specified, such as “Volume > 100,000,” and “Price Change > 5%.” ] Select the parameters for your scan, such as minimum volume, price change percentage, and technical indicators. Platform X allows for a wide array of custom filters, ensuring a precise search.

- Run the Scan: [Screenshot description: A button labeled “Run Scan” is highlighted, and a progress bar is shown, indicating that the scan is in progress. ] Click “Run Scan” to initiate the process. Platform X’s advanced algorithms perform the search across its vast database of stocks.

- Review Results: [Screenshot description: A table displaying the results of the scan. Each row represents a stock, with columns showing the stock symbol, price, volume, and other selected parameters. Stocks meeting the specified criteria are highlighted.] Review the results. Platform X presents the data in a clear, concise table, allowing for easy comparison and selection of potential trades.

- Set Alerts (Optional): [Screenshot description: A settings menu within the scanner interface. A checkbox next to “Real-time Alerts” is checked. There are fields for entering email and/or mobile phone numbers.] Set real-time alerts to notify you when a stock meets your criteria. This allows for immediate action on promising opportunities.

Conclusion

So, which platform reigns supreme in the day-trading arena? The truth is, there’s no one-size-fits-all answer. The “best” platform depends entirely on your individual needs, trading style, and risk tolerance. A seasoned pro might gravitate towards a platform boasting advanced algorithmic trading capabilities, while a newbie might prefer one with comprehensive tutorials and readily available customer support.

Ultimately, the journey to finding your perfect platform is part of the adventure. Armed with the knowledge gleaned from this exploration, you can now embark on your quest, armed with more than just a lucky rabbit’s foot – you’ll have the knowledge to choose your trading weapons wisely!