Comparing Phemex and NDax for Canadian crypto traders: Ever felt like choosing a crypto exchange is like picking a flavour of ice cream with a thousand bizarre options? This deep dive into Phemex and NDax aims to simplify the decision for Canadian crypto enthusiasts, comparing fees, available cryptos, user interfaces, security, and more. Buckle up, buttercup, it’s going to be a wild ride!

We’ll dissect everything from the nitty-gritty details of trading fees (because who doesn’t love saving a few satoshis?) to the crucial matter of regulatory compliance in Canada. We’ll even explore the user experience, because let’s face it, a frustrating interface can ruin even the most lucrative trade. Prepare for a comprehensive comparison that’ll leave you feeling like a crypto trading ninja.

Fees and Pricing: Comparing Phemex And NDax For Canadian Crypto Traders

Choosing the right crypto exchange often boils down to one crucial factor: the fees. After all, nobody wants to see their hard-earned crypto evaporate into thin air before it even hits the moon! Let’s dive into the fee structures of Phemex and NDax, comparing apples to apples (or should we say, Bitcoin to Bitcoin?). We’ll dissect spot trading, margin trading (if applicable), and futures trading, then examine deposit and withdrawal fees.

Buckle up, it’s going to be a wild ride!

Spot Trading Fees

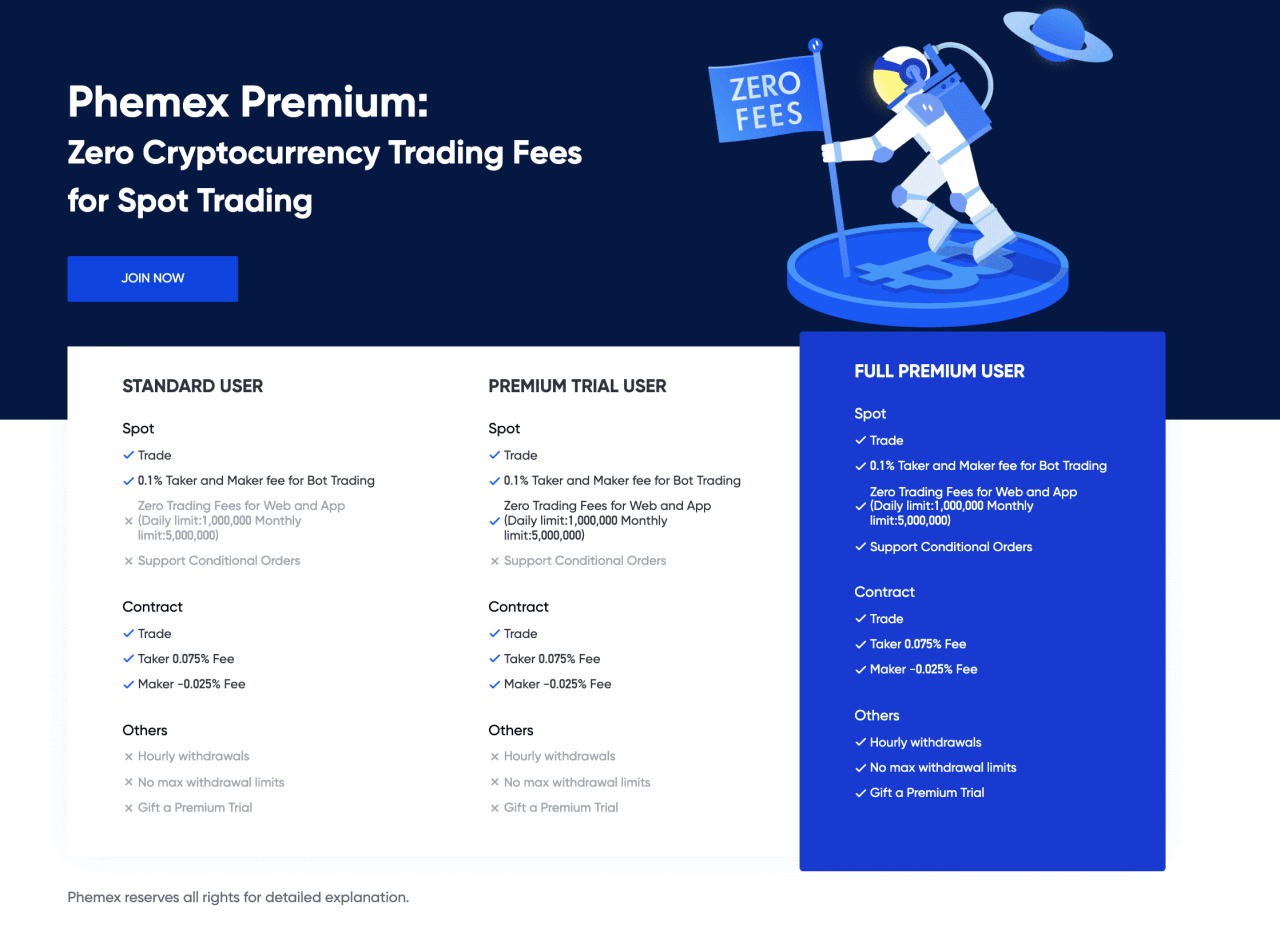

Spot trading is where you buy and sell crypto at the current market price. Both Phemex and NDax offer spot trading, but their fee structures differ. Phemex generally boasts lower maker and taker fees than NDax, especially for high-volume traders. However, the exact fees can vary based on the trading pair and your trading volume. For example, a smaller trade might incur a slightly higher percentage fee on Phemex compared to a larger trade, while NDax might have a more consistent fee structure regardless of volume.

It’s crucial to check each platform’s current fee schedule as they are subject to change.

Margin Trading Fees

Phemex offers margin trading, allowing you to borrow funds to amplify your trading positions. This comes with added risk, of course, but also the potential for greater rewards (or losses!). NDax, on the other hand, currently doesn’t offer margin trading. Phemex’s margin trading fees typically include interest charges on borrowed funds, in addition to standard trading fees.

These interest rates can fluctuate depending on market conditions and the cryptocurrency being traded. Remember, margin trading is a high-risk strategy, and only experienced traders should venture into this arena.

Futures Trading Fees

Phemex is a major player in the futures market, offering a range of contracts. NDax does not offer futures trading. Phemex’s futures trading fees are usually competitive, but again, they’re subject to change. The fees structure can vary based on the contract, leverage used, and trading volume. Similar to margin trading, futures trading carries significant risk and isn’t for the faint of heart.

You could potentially lose more than your initial investment!

Deposit and Withdrawal Fees

Deposit fees are generally low or non-existent for both Phemex and NDax, often free for deposits made via certain methods. However, withdrawal fees can vary significantly. Both platforms may charge fees for withdrawals, depending on the cryptocurrency and the network used. For example, withdrawing Bitcoin via the Lightning Network might be cheaper than using the standard Bitcoin network.

Furthermore, some fiat currency withdrawals (like CAD) might also incur fees. Always check the specific fee schedule on each platform before initiating a withdrawal to avoid unpleasant surprises.

Fee Comparison Table

| Feature | Phemex | NDax |

|---|---|---|

| Spot Trading Fees | Variable, generally lower than NDax for high volume | Variable, generally higher than Phemex for high volume |

| Margin Trading Fees | Interest charges + trading fees (available) | Not Available |

| Futures Trading Fees | Variable, competitive (available) | Not Available |

| Deposit Fees | Generally low or free | Generally low or free |

| Withdrawal Fees | Variable, depends on crypto and network | Variable, depends on crypto and network |

Available Cryptocurrencies

Choosing the right crypto exchange is like picking the perfect pizza topping – too few options and you’re bored, too many and you’re overwhelmed! Let’s dive into the crypto menus offered by Phemex and NDax to see which one best suits your Canadian palate.This section compares the cryptocurrency offerings of Phemex and NDax, highlighting the range, diversity, and any unique assets available on each platform.

Understanding these differences is crucial for Canadian traders seeking specific investment opportunities.

So, you’re wrestling with Phemex vs. NDax for your Canadian crypto needs? It’s a tough call, like choosing between a caffeinated squirrel and a sloth on a unicycle. But before you dive headfirst into digital assets, consider your overall trading style; understanding this is key, as explained in this helpful guide: Choosing the Right Forex Broker in Canada Based on Trading Style.

This will help you pick the best platform for your crypto-fueled adventures, whether it’s Phemex or NDax.

Cryptocurrency Offerings Comparison

The following table lists the cryptocurrencies offered by Phemex and NDax. Note that these offerings can change, so always check the exchange’s website for the most up-to-date information. (Please note: A completely exhaustive list for both exchanges is difficult to provide due to the dynamic nature of cryptocurrency listings. This table provides a representative sample).

| Phemex | NDax |

|---|---|

| Bitcoin (BTC) | Bitcoin (BTC) |

| Ethereum (ETH) | Ethereum (ETH) |

| Tether (USDT) | Tether (USDT) |

| USD Coin (USDC) | USD Coin (USDC) |

| Binance Coin (BNB) | — |

| Solana (SOL) | — |

| Avalanche (AVAX) | — |

| Polygon (MATIC) | — |

| — | Dogecoin (DOGE) |

| — | Litecoin (LTC) |

Range and Diversity of Cryptocurrencies

Phemex generally offers a wider selection of altcoins compared to NDax. While both platforms provide access to major cryptocurrencies like Bitcoin and Ethereum, Phemex ventures further into less mainstream options. NDax, on the other hand, focuses on a more curated selection of established cryptocurrencies, potentially prioritizing stability and regulatory compliance for its Canadian user base. This difference caters to different trader profiles; Phemex might appeal to those seeking more speculative opportunities, while NDax might attract traders prioritizing established and regulated assets.

Unique or Less-Common Cryptocurrencies

While the specific offerings change frequently, a key difference might lie in the availability of less-common cryptocurrencies. For example, Phemex might list newer projects or those with unique technological features. The significance for Canadian traders lies in access to potentially higher-growth opportunities, though with inherently higher risk. Conversely, the absence of such assets on NDax could reflect a more conservative approach, emphasizing established assets and potentially lower risk.

However, the absence of a specific cryptocurrency on one platform doesn’t necessarily mean it’s inferior; it simply reflects different business strategies.

Trading Platform and User Interface

Choosing the right crypto exchange often feels like choosing between a finely-tuned sports car and a comfortable, reliable minivan. Phemex and NDax, while both offering access to the exciting world of cryptocurrency trading, present vastly different driving experiences (or, in this case, trading experiences). One might appeal to the seasoned speed demon, while the other caters to the more cautious, yet equally determined, commuter.Let’s dive into the nitty-gritty of their respective platforms and see which one best suits your trading style.

We’ll be looking at ease of use, navigation, charting tools, and overall functionality. Prepare for a thrilling (and hopefully insightful) comparison!

Choosing between Phemex and NDax for your Canadian crypto needs? It’s a tough call, like deciding between poutine and… well, anything else. But after a long day of analyzing trading fees, maybe you deserve a reward – check out some delicious halal culinary options to fuel your crypto-trading brainpower. Then, armed with a full stomach and sharper mind, you can confidently return to comparing Phemex and NDax’s security features.

User Interface and Trading Experience

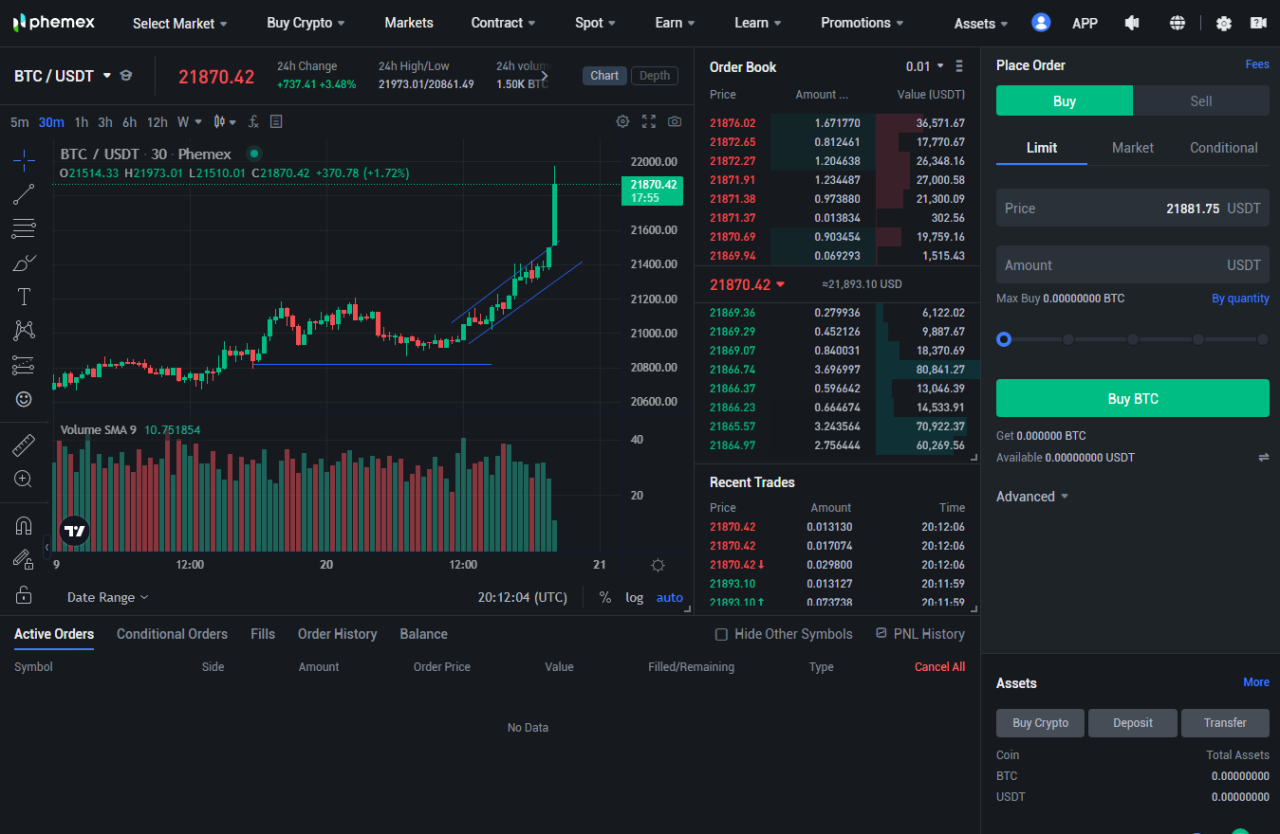

Phemex boasts a sleek, modern interface that’s generally intuitive, though it might feel a bit overwhelming for absolute beginners. Think of it as a powerful sports car – lots of features, but you need to know how to handle them. The layout is clean, prioritizing efficiency, but the sheer number of options can initially feel daunting. NDax, on the other hand, offers a more streamlined and simplified experience, perfect for those who prefer a straightforward approach.

Choosing between Phemex and NDax? It’s a Canadian crypto-conundrum! But before diving into those fee structures, remember that global markets, including crypto, don’t sleep. Understanding the ebb and flow of trading is crucial, so check out this handy guide on Understanding Forex Market Hours in Canada and Global Markets to optimize your Phemex or NDax strategy.

Knowing when the whales are awake (or asleep!) is half the battle in this wild world of digital assets.

It’s the reliable minivan – easy to navigate, comfortable, and gets the job done without unnecessary frills. Navigation on both platforms is generally smooth, with Phemex offering more advanced features hidden beneath the surface, requiring a bit more exploration to unlock their full potential.

Charting Tools and Technical Analysis Features

The charting capabilities are where the differences become more pronounced. Phemex provides a robust suite of charting tools, including a variety of indicators, drawing tools, and customizable timeframes. Imagine having access to a full toolbox of a professional trader – it’s powerful, but requires some skill to master. You can delve deep into technical analysis, creating complex strategies with ease.

So, you’re wrestling with Phemex vs. NDax for your Canadian crypto needs? It’s a tough call, like choosing between a caffeinated squirrel and a sloth on a unicycle. But before you dive headfirst into digital assets, consider your overall trading style; understanding this is key, as explained in this helpful guide: Choosing the Right Forex Broker in Canada Based on Trading Style.

This will help you pick the best platform for your crypto-fueled adventures, whether it’s Phemex or NDax.

NDax’s charting tools are more basic, focusing on the essentials. While it provides sufficient tools for fundamental analysis and simple charting needs, it lacks the advanced features found on Phemex. Think of it as a basic set of screwdrivers – enough for most jobs, but not for intricate projects.

Comparative Table of Trading Platform Features

This table summarizes the key differences in the user interfaces and functionalities of Phemex and NDax:

| Feature | Phemex | NDax |

|---|---|---|

| Overall Interface | Sleek, modern, feature-rich (can feel overwhelming for beginners) | Streamlined, simple, user-friendly |

| Navigation | Generally smooth, but requires exploration to access advanced features | Intuitive and straightforward |

| Charting Tools | Advanced charting tools, wide range of indicators and drawing tools | Basic charting tools, sufficient for fundamental analysis and simple charting |

| Technical Analysis Features | Extensive, catering to sophisticated trading strategies | Limited, focusing on essential tools |

| Ease of Use | Steeper learning curve | Beginner-friendly |

Security Measures

Choosing a crypto exchange feels a bit like choosing a bank – you’re entrusting them with your hard-earned digital dough. So, let’s delve into the security features offered by Phemex and NDax, because nobody wants their crypto-fortune vanishing faster than a Bitcoin halving.Security is paramount when dealing with digital assets, and both Phemex and NDax employ various measures to safeguard user funds and data.

However, the specifics and track records differ, and understanding these differences is crucial for making an informed decision. We’ll explore their security protocols, past incidents (or lack thereof!), and what happens if –

knock on wood* – something goes wrong.

Two-Factor Authentication (2FA)

Both Phemex and NDax offer two-factor authentication, an extra layer of security that adds a significant hurdle for hackers. Think of it as a digital bouncer for your crypto account – even if someone gets your password, they’ll still need that second key to get in. Phemex and NDax typically utilize methods like Google Authenticator or similar apps to provide this second factor.

Implementing 2FA is strongly recommended for all users, regardless of the exchange used; it’s like wearing a helmet when riding a bike – a simple precaution that can save you from a world of hurt.

Cold Storage

A significant portion of both exchanges’ user funds are held in cold storage. Cold storage refers to storing cryptocurrencies offline, in wallets that are not connected to the internet. This significantly reduces the risk of hacking, as online wallets are vulnerable to cyberattacks. While neither Phemex nor NDax publicly discloses the exact percentage of funds kept in cold storage, the practice is industry standard, and the absence of a clear statement shouldn’t necessarily be cause for alarm.

Think of it like keeping your emergency cash in a safe at home, rather than leaving it lying around on your kitchen counter.

Choosing between Phemex and NDax? It’s a crypto-conundrum for Canadian traders! But before you dive headfirst into digital assets, consider broadening your financial horizons by checking out the fees and features of other options – like, say, forex – by visiting this handy guide: Compare Forex Trading Platforms in Canada: Fees and Features. Understanding the forex landscape might just give you a fresh perspective on comparing Phemex and NDax’s offerings.

Other Security Protocols

Beyond 2FA and cold storage, both platforms employ a range of other security measures, including encryption protocols to protect data transmitted between users and the exchange. They also regularly conduct security audits and implement advanced firewall systems to deter unauthorized access. Specific details on these protocols are often not publicly available for security reasons – it’s like a magician not revealing their secrets! However, the lack of publicly available detail doesn’t necessarily equate to weaker security.

The industry standard is to be opaque about the precise details of security implementations to avoid giving potential attackers any advantages.

Security Track Records and Incidents

At the time of writing, neither Phemex nor NDax has experienced any major security breaches resulting in significant user fund losses. However, it’s important to remember that the crypto landscape is constantly evolving, and new threats emerge regularly. A clean track record today doesn’t guarantee a clean track record tomorrow. Regularly monitoring security news and updates from both exchanges is crucial to staying informed.

Think of it like checking your credit report – vigilance is key.

So, you’re wrestling with Phemex vs. NDax for your Canadian crypto needs? It’s a tough call, like choosing between a caffeinated squirrel and a sloth on a unicycle. But before you dive headfirst into digital assets, consider your overall trading style; understanding this is key, as explained in this helpful guide: Choosing the Right Forex Broker in Canada Based on Trading Style.

This will help you pick the best platform for your crypto-fueled adventures, whether it’s Phemex or NDax.

Insurance and Compensation Mechanisms

Information regarding insurance policies or compensation mechanisms for security incidents is generally limited for both Phemex and NDax. Many exchanges operate on the principle of self-insurance, meaning they absorb losses from security breaches. However, the specifics of their risk management strategies are often kept confidential. This lack of transparency is a common characteristic of the crypto exchange industry.

It’s a bit like asking your insurance company to disclose their exact risk assessment models – it’s unlikely they’ll reveal all their cards!

Regulatory Compliance and Legal Aspects in Canada

Navigating the Canadian crypto landscape can feel like traversing a minefield of regulations. Both Phemex and NDax operate within this complex environment, but their approaches to regulatory compliance differ significantly. Understanding these differences is crucial for Canadian traders to make informed decisions and minimize potential legal risks.Phemex and NDax’s regulatory compliance in Canada presents a fascinating contrast. While both platforms aim to provide a secure trading environment, their adherence to Canadian regulations varies considerably, impacting the level of protection offered to users.

This section delves into the specifics of their compliance, highlighting key differences and potential legal ramifications for Canadian traders.

Regulatory Status of Phemex in Canada

Phemex’s regulatory standing in Canada is less defined than NDax’s. They don’t currently hold any specific Canadian licenses for operating a cryptocurrency exchange. This means they operate under a more ambiguous regulatory umbrella, relying on their international compliance efforts to mitigate potential legal issues for Canadian users. However, this lack of specific Canadian registration presents a higher level of risk for Canadian traders.

The absence of a direct regulatory body overseeing their operations in Canada means fewer consumer protections are in place compared to a registered exchange. While Phemex may adhere to international best practices, the absence of Canadian-specific oversight raises concerns regarding recourse in case of disputes or security breaches.

Regulatory Status of NDax in Canada

NDax, in contrast, holds registration as a Money Services Business (MSB) under the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) in Canada. This registration demonstrates a higher level of regulatory compliance compared to Phemex. This MSB registration signifies that NDax adheres to Canadian anti-money laundering and terrorist financing regulations. It subjects NDax to greater regulatory oversight and reporting requirements, offering Canadian users a potentially higher degree of protection.

However, MSB registration does not guarantee complete immunity from legal issues; it simply indicates a commitment to complying with specific Canadian financial regulations.

Potential Legal and Regulatory Risks for Canadian Traders

Using unregistered or less regulated platforms like Phemex carries inherent risks for Canadian traders. These risks include, but are not limited to, a lack of recourse in case of disputes, higher susceptibility to scams or security breaches, and potential difficulties in recovering funds. The absence of a Canadian regulatory body to intervene on behalf of users significantly increases the potential for financial loss.

Conversely, while NDax’s MSB registration provides a greater degree of protection, it does not eliminate all risks. Changes in Canadian cryptocurrency regulations could still impact NDax’s operations and potentially affect user accounts. Staying informed about evolving regulations is vital for all Canadian crypto traders, regardless of the platform used.

Customer Support

Choosing a crypto exchange often feels like choosing a new best friend – you’re entrusting them with your digital assets, after all. And just like a good friend, reliable customer support is crucial when things go sideways (or even when they’re just a little wobbly). Let’s dive into how Phemex and NDax stack up in the support department.Customer support is a critical aspect to consider when selecting a cryptocurrency exchange, particularly for Canadian traders who may require assistance navigating the unique regulatory landscape.

Both Phemex and NDax offer varying levels of support, each with its own strengths and weaknesses. Understanding these differences can significantly impact a trader’s overall experience.

Customer Support Channels and Responsiveness

Phemex and NDax provide different avenues for contacting their support teams. Phemex typically offers email support, a FAQ section, and potentially live chat (availability may vary). NDax, on the other hand, might prioritize email or a ticketing system, supplemented by a comprehensive knowledge base. Response times can fluctuate based on factors like ticket volume and the complexity of the issue.

While both aim for timely responses, expect potential delays during peak hours or for more intricate inquiries. Think of it like trying to get a table at a popular restaurant – sometimes you wait a bit longer.

Quality of Customer Support

The effectiveness of customer support can vary greatly. Imagine one exchange offering support that’s like receiving a personalized, hand-written letter – detailed, thoughtful, and effective. This could be indicative of a well-trained and responsive support team, equipped to handle a wide array of queries. In contrast, another exchange’s support might feel more like a generic, automated email – efficient but perhaps lacking the personal touch.

The overall experience might depend on the specific agent you interact with and the complexity of your problem. It’s a bit of a lottery, but a well-regarded exchange should strive for consistency.

Summary of Strengths and Weaknesses, Comparing Phemex and NDax for Canadian crypto traders

Let’s summarize the customer support strengths and weaknesses for each exchange in a concise manner. Remember, this is a generalized overview and individual experiences may vary.

- Phemex:

- Strengths: Potentially quicker response times for simpler issues via live chat (if available); often a wider array of contact methods.

- Weaknesses: Live chat availability may be inconsistent; email response times might be slower for complex problems.

- NDax:

- Strengths: May offer a more comprehensive knowledge base, potentially reducing the need to contact support directly; thorough responses for complex issues via email.

- Weaknesses: Response times for email might be longer; fewer direct contact options compared to Phemex.

Deposit and Withdrawal Methods

Getting your crypto in and out of an exchange is crucial, like successfully navigating a particularly tricky level in a video game. You wouldn’t want to get stuck, right? Let’s examine how Phemex and NDax stack up when it comes to deposit and withdrawal options for Canadian crypto traders. We’ll look at the methods, speeds, and any fees involved, so you can choose the platform that best suits your needs (and your patience!).Phemex and NDax offer a selection of deposit and withdrawal methods tailored to the Canadian market, though the specifics and their efficiency might vary.

Understanding these nuances is key to a smooth crypto trading experience. Remember, speed and fees are often inversely proportional – faster methods might charge more.

Deposit and Withdrawal Methods Comparison

The following table compares the deposit and withdrawal methods available on both platforms, focusing on options easily accessible to Canadian users. Remember to always double-check the latest information on the respective exchange websites, as these details can change.

| Feature | Phemex | NDax |

|---|---|---|

| Deposit Methods | Wire Transfer (CAD), Credit/Debit Cards (Visa, Mastercard), Cryptocurrency (BTC, ETH, etc.) | Wire Transfer (CAD), Interac e-Transfer, Cryptocurrency (BTC, ETH, etc.) |

| Withdrawal Methods | Wire Transfer (CAD), Cryptocurrency (BTC, ETH, etc.) | Wire Transfer (CAD), Interac e-Transfer, Cryptocurrency (BTC, ETH, etc.) |

| Wire Transfer Processing Time (CAD) | Typically 1-5 business days, subject to banking processing times. | Typically 1-3 business days, subject to banking processing times. |

| Interac e-Transfer Processing Time (CAD) | N/A | Usually instantaneous, but can take up to 24 hours depending on the receiving bank. |

| Cryptocurrency Processing Time | Varies depending on network congestion; generally faster than fiat withdrawals. | Varies depending on network congestion; generally faster than fiat withdrawals. |

| Fees | Fees vary depending on the method; check Phemex’s website for the most up-to-date information. Expect higher fees for faster methods. | Fees vary depending on the method; check NDax’s website for the most up-to-date information. Expect higher fees for faster methods. |

| Limitations | Minimum and maximum withdrawal limits apply; check Phemex’s website for details. | Minimum and maximum withdrawal limits apply; check NDax’s website for details. |

Processing Time Considerations

Processing times for both deposits and withdrawals are influenced by several factors, including network congestion (for crypto transactions), banking processing speeds, and the specific method chosen. For example, a wire transfer might take longer than an Interac e-Transfer, but it might also offer a higher withdrawal limit. Always factor in potential delays, especially during peak trading periods or bank holidays.

Fee Structures

Both Phemex and NDax charge fees for deposit and withdrawal services. These fees vary based on the chosen method and the amount being transferred. It’s crucial to review the fee schedule on each platform’s website before initiating a transaction to avoid unpleasant surprises. Think of it as the toll you pay to get your crypto onto or off the highway.

Sometimes, a slightly longer route with lower tolls might be the smarter choice.

Conclusive Thoughts

So, Phemex or NDax? The ultimate choice depends on your individual needs and trading style. While both offer compelling features, our comparison has hopefully illuminated the key differences, empowering you to make an informed decision. Remember, always do your own thorough research before diving headfirst into the exciting (and sometimes chaotic!) world of cryptocurrency trading. Happy trading!